To submit a declaration, it is necessary to determine the code of the commodity nomenclature of foreign economic activity (TN FEA) of the product, fill out the declaration, and also provide all permitting documentation. The latter depends on what kind of goods are being cleared through customs. In most cases, a regular certificate of conformity is sufficient (if you are not carrying children's, medical, food, or “complex goods” that must undergo mandatory certification).

How to pay? First, customs duties are paid, then VAT, then customs duties. If you are an excise company, then you will have to add excise duty to all of the above.

Stage 1 - Declaration

The movement of all international trade cargo is governed by various arrangements. For example, the UN has a special protocol, according to which most countries in the world have agreed to classify goods. In Russia, this classification is called TN VED - Commodity Nomenclature of Foreign Economic Activity. In order to clear goods through customs and put them into circulation on the territory of the Customs Union (as of February 1, 2015, the Customs Union includes Russia, Belarus, Kazakhstan and Armenia), it is necessary, first of all, to determine the so-called HS code.

Its own HS code is assigned to any product, commodity or item. It is organized “from the general to the specific”: first comes the group, then the subgroups, then certain classifications, and at the end the goods themselves. Products are distributed according to the rule: the more complex the product, the higher the group it belongs to. If you import two types of goods - a pen and a pencil case, then all the goods will be imported and cleared through customs according to the classification of the pencil case, because it is a technically more complex product than a pen. Specially trained people can assign the HS. You can have such a person on staff or turn to customs brokers or transport companies that carry out international deliveries on a turnkey basis.

Some novice businessmen try to do this on their own at first. At first they manage to do this, but sooner or later they stumble upon a rake.

I would not recommend experimenting with HS codes. There are goods that are coded ambiguously, and in these cases the entrepreneur may face administrative and criminal liability.

If you code the goods incorrectly and submit such a declaration, and customs determine this after the fact (customs has the right to inspect the goods within 3 years after the declaration is issued), you may be accused of transporting undeclared goods across the border, that is, contraband. And punishment for smugglers is provided for in both the Administrative and Criminal Codes.

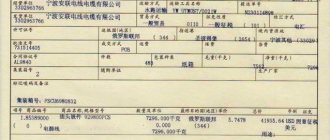

COOPERATION WITH CHINESE PARTNERS

We search and select suppliers in Russia according to specified parameters.

We provide the opportunity to purchase goods from companies not involved in international trade. We complete and ship consignments of goods from several contractors to one recipient.

The purchase and sale agreement is concluded with our exporting company, and this company will purchase the required goods on its own behalf for you on the domestic market. For clients from China, our company will become the only counterparty in the Russian Federation and we will take on all the concerns regarding the export transaction.

Therefore, our partners are freed from the need to spend time and money visiting Russia in order to control shipments on their own.

Service consultation

Stage 2 - Customs clearance

For all countries of the Customs Union, customs clearance requirements are the same. Formally, to pass through customs, it is enough to submit a correctly completed declaration, attach a certain set of documents required for the cargo, and wait for the decision of the customs authority.

The advantage of many years of experience in international trade is that you can submit declarations in advance and agree on certain controversial positions in advance. After all, sometimes customs officers themselves do not know how to correctly declare a particular product. And for this case they have their own internal system, which is called RMS - risk management system. This system ultimately decides what needs to be done with the declaration and the goods. In some cases, you can immediately release the goods into free circulation, in others you can carry out an inspection or request additional documents, check the company for offshore companies, etc. This is what customs officers do, guided by the internal regulatory rules of the customs office. In theory, these rules should also be uniform, but sometimes they differ at different customs offices. And customs sometimes treat the same goods differently because they interpret these rules differently.

There are specialized customs houses and there are general customs houses. Among the specialized ones, for example, is the excise post, where all excise goods are processed. Or customs offices that specialize in certain goods: food or flowers. Because holding flowers in customs for 2-3 days is an unforgivable luxury; they can simply wither.

“Bad” and “good” customs posts are posts with which you have a “bad” or “good” relationship.

Most customs posts are located on the borders of Russia. But there are exceptions: Ryazan customs, Moscow customs, for example. You can choose any customs office, depending on the logistics. You can choose Vladivostok customs, and then transport the goods to Moscow, you can choose customs in Bryansk, and then transport the goods to Yamal. But since different customs offices, as I already said, interpret certain standards differently, customs clearance at one customs office can cost several times more than at another. This is due to the fact that there is a concept of “risk profile”, which is different for each customs office. If the product you declare to customs is cheaper than the “risk profile” for it, then customs will ask an insane number of questions - why are you importing this product cheaper. For example, if you are carrying 3 boxes of pens worth 1 rub. 20 kopecks, then this is normal, but if you are carrying a container of pens worth 1 ruble. (below the “risk profile”), then customs may be wary.

For each product there is non-tariff regulation - the collection of documents to obtain a specific certification for each product. For example, all children's products that are imported into the Russian Federation must be certified in a special way. To do this, in most cases, it is necessary to provide samples of goods to special certification bodies in order to receive a certificate that the product is safe for use by children. However, you can often receive a certificate without providing the product, without testing the product. For example, based on photographs.

We had a case where notebooks were considered contraband. They stood at customs for four months. The reason is low cost. At that time, we had a large long-term contract with a company from China, so they gave us a big discount on these notebooks. But at customs they said that these notebooks couldn’t be that cheap. In order to rescue the shipment of goods, we had to collect a bunch of documents, raise email correspondence with representatives of the Chinese company and show letters in which it was stated that we bought these notebooks at the exact price that was stated at customs.

There was another case. We cleared customs for an industrial boiler through St. Petersburg. The cauldron was more than 7 meters high and weighed several tons. But at customs they told us: “Guys, according to our code, your boiler actually costs twice as much as you stated. Therefore, we suggest you pay twice the customs duties.” And “twice” meant hundreds of thousands of dollars. We began to find out why this happened, and found out: previously, some kind of boiler with a certain value was transported through this customs office. And based on this data, customs officers also examine the remaining boilers. We also declared our boiler as a boiler according to the HS, but that boiler weighed 5 kilograms. Accordingly, in terms of comparison, comparing the cost of a 5-kilogram boiler and ours, it turns out that ours will cost several times less. And we dealt with this for a very long time, provided a huge amount of documents and resolved this issue pre-trial in our favor.

Customs clearance of goods

Customs clearance of goods from China is carried out:

- According to the general method. The scheme is applicable if a legal entity or individual transports a variety of goods for the purpose of selling them. Such customs clearance is carried out at the place of delivery of the goods or at the border. You can carry out customs clearance remotely, then customs clearance of goods from China takes place in one place, and papers for import are submitted in another. (It is no longer possible to issue DT at the border. Declarations are issued at the EDC Electronic Declaration Center)

- Using a simplified method. The method is used when an individual imports products intended for personal needs. The scheme does not apply if you plan to sell the product.

The declarant can submit a declaration to the customs authorities independently or through a broker.

Large companies that have a lawyer, logistician and other specialists on their staff independently deliver and clear customs goods from China. The advantages of this method are that the goods are controlled at all stages of customs clearance, and there are no additional expenses. The disadvantage is the mass of risks associated with the intricacies of customs clearance.

Customs clearance of goods has nuances that are not known to a person without specialized education, which is why small companies usually resort to the services of brokers.

Stage 3 - Payment of duties

Customs fees can be divided into three large parts. If we do not pay excise duty, then on other goods we pay duty (in Russia, for 95% of goods this is from 0 to 20% of the contract value), VAT (0%, 10% or 18%) and the customs duty itself - this is a small amount, not exceeding 0.5% of the contract value.

If you take the maximum, then formally the fee should be no more than 45% of the contract value. But in reality, you will have to leave more money at customs, because there are specific duties that are paid not on the value of the contract, but on a certain unit of measurement of the goods. There are duties that are paid per engine size, and this is how all cars are cleared through customs. There are duties per kilogram, this is how textiles or furniture are cleared through customs. Therefore, often the difference between the price at the factory and the price in the countries of the Customs Union reaches at least 70%, and in some cases it can even be 200% (rattan furniture from Indonesia or an inexpensive refrigerator from China).

Konstantin Bushuev , co-founder of Xiao Long Group, expert on business with China

Types of goods for export to China

We work with cargo of various types: groupage, dangerous, bulk, refrigerated and others. We organize delivery by any means of transport from all major cities of Russia to Beijing, Shanghai, Tianjin, Guangzhou, Shenzhen or another destination country of the customer's choice.

The main differences between export supplies to China compared to supplies to other countries:

- To export food products from Russia to China, you will need to register with the special PRC authority for quality control and quarantine and receive a special certificate. Export of electronics will also require obtaining an appropriate certificate, the same applies to medicines, dietary supplements, medicinal plants and other types of products;

- There are about 150 types of goods prohibited for import into the country, and about 100 types of products for the export of which it is necessary to obtain special licenses, permits, certificates, or quotas have been established. At the same time, a large category of goods is subject to preferential taxation due to the requirements of the WTO, of which both the Russian Federation and China are members.

Snowmobile customs clearance services

It is convenient to ride a snowmobile in the cold season in areas that have absolutely any terrain. It is easy to purchase a high-quality, inexpensive model of this equipment in one of the foreign countries. Customs clearance of a snowmobile is not particularly difficult, since it can be registered in the name of any individual without restrictions. This equipment is considered not intended for road use, so there are no strict rules restricting its import.

Read more about customs clearance of a snowmobile...

Step-by-step instructions: how to calculate the amount of duty

Before you understand the calculation using specific examples, read the general recommendations.

Costing tips:

- The amount of the duty is calculated solely on the excess amount. The total cost of the product is not included in the calculations. This rule also applies to the weight of the goods.

- The last non-taxable amount is 199 €, for 200 € you already need to pay extra.

- It is not the total value of online orders placed that should be taken into account, but rather the advertised price of the product.

- The cost of delivery services is not included in the calculation of customs duties. If the order amount does not exceed 199 €, and the delivery cost is more than 1 €, the fee is not charged.

- The cost of parcels cannot be combined with each other. In theory, you can make 50 separate orders up to 200 €, but if these are 100 identical sets of cheap Chinese linen, the parcels will be transferred to the “commercial” status.

To ensure that calculating the amount of customs duty does not cause difficulties, we propose to analyze this issue using specific examples.

Excess cost

The price of the smartphone is 300 €:

- 300 € — 200 € =100 €;

- 100×0,15=15.

The tax fee is 15 €.

Excess weight

Product cost - 199 €, weight - 34 kg:

- 34-31=3;

- 3×2=6.

The tax fee is 6 €.

How to pay the fee

Information that it is necessary to pay customs duties will be sent in the form of SMS to the phone number specified during registration. It will also contain information about the amount to be paid and will provide a link to payment via Russian Post.

Information about customs duty payment should be sent via SMS

How to avoid paying duties

Despite the vigilance of customs officers, there are still several workarounds:

- Place multiple orders worth no more than 199 €. But if they arrive at customs in one shipment, there is a high probability that they will be counted as one parcel. In this case, you will have to pay tax duty.

- Try to convince the online store seller to indicate a convenient price for the product (less than 200 €). Many managers are happy to make concessions. But a number of sellers from AliExpress send information about the cost of the parcel immediately after payment is received.

- Ask a friend who lives in a country with fewer restrictions to place the order and delivery for himself and bring the parcel to the Russian Federation.

Customs clearance of construction equipment

Concrete mixers, road rollers, asphalt pavers, bulldozers, hole drills and other heavy specialized machines must be registered at customs control. An individual has no right to perform this operation, since this equipment is not intended for personal use. Therefore, customs clearance of construction equipment often occurs with significant difficulties. Our company’s specialists will help you overcome all obstacles, fill out declarations correctly, calculate the amount of duties, determine the customs value and reduce clearance costs

The customs clearance of equipment carried out by our company will always be carried out efficiently and promptly, regardless of its type.

Features of customs clearance of special equipment

Often, customs clearance of special equipment is a more complex process than customs clearance of conventional equipment. This is due to the fact that some special equipment is oversized cargo, and they require more complex registration and non-standard transportation conditions.

Customs clearance of special equipment, moreover, may imply the need to pay additional customs duties or, conversely, may allow its owner to receive a discount upon clearance. As you understand, in order for all these nuances to be taken into account and the optimal solution to be found, you need to be well versed in modern legislation and have practical experience in customs clearance of such equipment. Our company has all the necessary knowledge and rich experience. We are well versed in all the subtleties and nuances. Therefore, entrusting customs clearance of special equipment to us will be a wise and correct decision.

Customs clearance of a snowmobile, customs clearance of a tractor, customs clearance of an excavator, customs clearance of a dump truck, customs clearance of agricultural machinery and customs clearance of construction equipment - all this is a concern.

We will help with customs clearance of equipment and special equipment from manufacturers: Caterpillar, Komatsu, John Deere, Hitachi Construction Machinery, Volvo Con-struction Equipment, XCMG, Sany, Liebherr, Doosan infracore, JCB, Terex, Sandvik Mining and Rock Technology, Zoomlion, Epiroc, Metso, Oshkosh Access Equipment (JLG), Kobelco Construction Machinery, CHH Industrial, Sumitomo Heavy Indus-tries, Hyundai Construction Equipment, Liugong, Kubota, Manitou, Lonking, Wacker Neuson, Palfinger, Fayat Group, Manitowoc, Tadano, Hiab, Shantui, Astec Indus- tries, Ammann, Sunward, Kato Works, Takeuchi, Bauer, Skyjack, Furukawa, Haulotte Group, Foton Lovol, Bell Equipment, Aichi, Sennebogen, Yanmar, XGMA, Merlo, Sa-kai Heavy Industries, Boart Longyear, BEML, etc. ..