The Customs Code of the Eurasian Economic Union provides for 16 types of customs procedures, that is, methods for importing and exporting goods. These procedures function equally on the territory of the Russian Federation and other countries of the union, and they all require the subject of foreign economic activity to submit a cargo customs declaration (CCD). The only exception is the customs transit regime.

When transiting, a T1 form is required from the declarant. You will learn about what kind of document this is, when it is used, how it is drawn up, registered and in what cases the customs authorities have the right to refuse.

What is a transit customs declaration

The transit declaration (T1) is a document without which it will not be possible to transit goods to (through) the countries of the Eurasian Economic Union (EAEU TC). It serves as a guarantee that the declarant will pay customs duties in the event of the goods being released into circulation in the transit country.

In other words, according to paragraph one of Article 142 of the EAEU Labor Code “Content and application of the customs procedure for customs transit,” the declarant does not pay customs duties if he fulfills the transit condition, that is, he simply transports the goods through the country . But if he starts selling it there, then the amount of customs security will simply not be returned to him, since he will violate the conditions for placing the product under this procedure (Article 76 of the EAEU Labor Code “Return (offset) of the amounts of special, anti-dumping, countervailing duties...).

Note. The transit procedure is necessary in order to avoid paying duties and taxes in the country that you have to cross in order to reach the place where the products are sold in another country. It is impossible to place a product under the transit procedure without completed accompanying reporting.

How is it different from a goods declaration?

So, a transit declaration is used to place goods under the transit procedure , that is, to transport goods from one point to another through intermediate points-countries. But a goods declaration is used to place products under any procedure other than transit. And all these procedures do not imply further movement of cargo from country to country. The goods remain (sold) in a specific state, and the declarant pays taxes and duties to its budget.

Types of transit declaration

Form T1 comes in two types:

- transport;

- a commercial.

There is another option for filing a declaration , but it is used only when the reporting reflects all the necessary information to complete the procedure. This type is used extremely rarely.

If the information in the reporting is insufficient, the declarant is obliged to submit supporting papers and certificates that reflect reliable and complete information about the transit products. If this is not possible, the goods will be placed under customs regulation measures, that is, taxes and duties will have to be paid for it.

How to fill out a declaration

The answer to this question should begin with a definition. A transit declaration is a document required for the VTT procedure or, in other words, internal customs transit. It may take the form of transport, commercial or customs documentation.

The invoice or packing list is used as the basis for filling out this paper.

When filling out the form, you must adhere to the following rules:

- One declaration may contain information only about products belonging to one batch of goods.

- The filling language is Russian, the use of Latin characters is allowed when indicating the name and address of a foreign company, the text must be printed, without erasures. If necessary, changes can be made using printing equipment or handwritten, but be sure to make a certification note from a customs officer. According to the law, customs officers have the right to demand that the transit declaration be filled out again.

- Articles, trademarks and other similar information are indicated in strict accordance with the original; the use of the Latin alphabet is allowed.

- Paper preparation involves the use of a classifier, that is, legally accepted reference information.

- Only customs officers have the right to fill out certain columns of the declaration (columns A, C, D, D/J, F, I).

If it is planned to transport goods produced outside the EU through customs, then when transporting to member countries of the European Union, a T1 transit declaration must be issued, which confirms the transit regime.

The preparation of the transit declaration is carried out by the supplier's representative. When delivering cargo by land transport, clearance is carried out at the EU border, if by air or sea - at the airport or port, respectively.

When is a transit declaration completed?

A number of main cases in which a transit declaration is issued:

- Cargo enters the EU territory by sea from ports of countries outside the European Union. Delivery is carried out by road to a customs post for further reloading or clearance.

- When products arrive by sea from countries outside the EU for further transit outside the European Union. The importer draws up a transit declaration, which will accompany the cargo until it passes departure control at the border.

- Between the countries of the European Union, products are transported or exported from one warehouse to another.

- Import of goods by land into the EU from countries outside the European Union. The cargo is transported to a customs post for comprehensive clearance or to a customs warehouse for reloading for storage.

- Products are imported from countries outside the EU via land routes to EU seaports for further transportation.

What information to display

The following data must be indicated in T1:

- the country in which the product was produced;

- the point where the cargo is to be delivered;

- information about the buyer, seller and carrier;

- characteristics of the transport used to transport the cargo;

- exact description of the product: quantity, weight, etc.;

- customs value of products;

- accompanying documents confirming the legality of the transaction and its compliance with all rules.

If suddenly something is missing, prepare for the fact that you will urgently have to supplement the package of documents. Delays and errors will lead to refusal of product registration.

Procedure and rules for filling out

The first rule for filling out the declaration : the data must correspond to the main documentation and be filled out strictly according to the invoice (in international commercial practice, this is a document provided by the seller to the buyer and containing a list of goods and services, their quantity and the price at which they were delivered to the buyer, formal features of the goods, conditions delivery and information about the sender and recipient).

All information is written in Russian . It is very important to get the translation correct, as errors may be seen as attempts to conceal contraband.

Reference. Customs officers do not have the right to touch the fields to fill out.

T1 is drawn up in two copies in printed form . One remains for the participant in foreign economic activity (FEA). Additional sheets (if any) must be prepared in accordance with all established rules. They must be numbered and certified, like the main sheet.

The transit declaration can be submitted not only on paper, but also electronically . This format is fixed by the decision of the board of the Eurasian Economic Commission dated January 16, 2018 No. 2. An electronic form is a kind of personal book that records information about documents issued during the transportation of goods and cargo.

After T1 is completed, it must be submitted to the appropriate customs authority for the region.

Requirements for the declarant

The declarant (the person preparing the transit declaration) can be an authorized representative of the supplier . But in this case, he must have with him a valid power of attorney, certificate, license or other permitting document.

For reference. As a rule, the supplier is responsible for completing the documentation.

Lecture 10. Customs clearance of transit declaration

1. Basic information contained in the transit declaration.

2. Procedure for submitting and registering a transit declaration, grounds for refusal

in the registration of the transit declaration.

3. Revocation of the transit declaration

1. Basic information contained in the transit declaration. The list of information to be indicated in the transit declaration is listed in paragraph 3 of Art. 182 TK TS.

The transit declaration must contain information about:

— sender, recipient of goods (according to the transport (shipment) document);

— country of departure, country of destination of goods;

- declarant;

- carrier;

— a vehicle of international transportation on which goods are transported;

— name, quantity, cost of goods in accordance with commercial, transport (shipment) documents;

— product code in accordance with the HS or TH FEA TC at a level of at least the first six characters;

— gross weight of goods or volume, as well as the quantity of goods in additional units of measurement (if such information is available) for each TH foreign economic activity code TC or HS;

— number of cargo pieces;

— the destination of goods in accordance with transport (transportation) documents;

— documents confirming compliance with restrictions associated with the movement of goods across the customs border, if such movement is permitted in the presence of these documents;

— planned reloading of goods or cargo operations in transit.

As a rule, a transit declaration is submitted for the transportation of goods moved from one sender to one recipient under one transport (shipment) document.

2. Procedure for submitting and registering a transit declaration, grounds for refusal

in the registration of the transit declaration

The following can be submitted as a transit declaration:

— completed sheets of the transit declaration (See the decision of the Customs Union of Ukraine dated June 18, 2010 No. 289 “On the form and procedure for filling out the transit declaration”);

- TIR Carnet with transport documents attached to it

nal) and commercial documents (Invoices (invoices), specifications, shipping and packing lists.);

— ATA carnet with accompanying transport (transportation)

nal) and commercial documents;

— transport (transportation), commercial and (or) other documents (When using transport (transportation), commercial and other documents as a transit declaration, the basis of the transit declaration is the transport (transportation) document. The remaining documents are its integral part. All documents, forming a transit declaration are submitted to the customs authority in two sets with an inventory of each.)

Together with the transit declaration, submit to the customs authority

its electronic copy is submitted (According to the Procedure for customs authorities to carry out customs operations related to the submission and registration of a transit declaration (approved by the decision of the Customs Union of the Customs Union of August 17, 2010 No. 438) simultaneously with the transit declaration, the declarant submits an electronic copy of it to the customs authority of departure, unless otherwise provided by law The Customs Union and (or) a member state of the Customs Union.

“Other” is provided for in the case of using preliminary informing of customs authorities about arriving goods, when an electronic copy of the transit declaration is generated by an official of the border customs authority (located at a road or railway checkpoint across the state border of the Russian Federation). For more details, see Order of the Federal Customs Service of Russia dated October 3, 2008 No. 1230 “On approval of the Instruction on the specifics of the performance by officials of customs authorities of certain customs operations in relation to goods and vehicles moved across the customs border of the Russian Federation, using preliminary information”, decision of the Customs Union dated 09.12 .2011 No. 899 “On the introduction of mandatory preliminary notification of goods imported into the customs territory of the Customs Union by road transport.”)

and necessary documents:

— transport expedition agreement (for the forwarder);

— foreign economic agreement (for the declarant);

— transport (shipment) documents (International or domestic consignment note, bill of lading (another document confirming the existence and content of a sea (river) transportation agreement), air waybills, railway waybills, documents provided for by acts of the Universal Postal Union;)

— commercial documents;

— documents that allow the identification of transported goods (description of goods, their photographs, shipping documents, etc.).

Depending on the types of goods transported, their country of origin, mode of transport and persons declaring customs transit, other documents may be submitted, for example;

— documents confirming compliance with prohibitions and restrictions (if the presence of such documents is a condition for the movement of goods across the customs border) (For example, a phytosanitary certificate issued by the authorized body of the exporting country.);

— documents confirming the country of origin of goods (if the customs authority finds signs indicating the origin of goods from a country whose goods are prohibited for import and (or) transit through the territory of the Customs Union);

— documents confirming the security for payment of customs duties and taxes (if such security is required);

— certificate of approval of the vehicle for the transportation of goods under customs seals and seals (For one-time transportation of goods, a certificate of approval is not required to be presented.);

— documents on registration and nationality of a vehicle for international transportation (for cars);

— documents confirming the status and powers of the declarant. (For example, confirming the status of a customs carrier, an authorized economic operator and (or) the authority to carry out customs operations with goods (contract of transportation, contract for the provision of services by a customs representative).

The customs authority records the date and time of submission of the transit declaration (in a separate journal) and within no more than two hours (from the moment of submission) registers it by assigning a registration number.

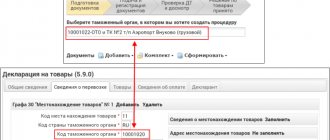

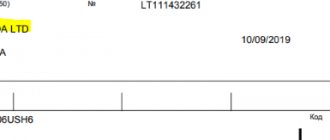

The registration number is formed according to the following scheme: ХХХХХХХХ/DDMMYY/ХХХХХХХ, where:

1 2 3

— element 1 — code of the customs authority that registered the transit declaration;

— element 2 — date of registration of the transit declaration (day, month, last two digits of the year);

- element 3 - serial number of the transit declaration, assigned according to the registration log (starts with one for each calendar year).

The registration number of the transit declaration is indicated:

— in the register of transit declarations;

- in the transit declaration (in column “A” of the main and additional sheets) (Additional sheets of the transit declaration are used in addition to the main sheet if information about two or more goods is declared in one transit declaration);

— in two copies of transport (transportation) documents;

- in two copies of the list of documents making up the transit declaration.

The customs office of departure refuses to register a transit declaration if one of the following grounds exists:

— the transit declaration was submitted to a customs authority not authorized to accept and register it;

— the transit declaration was submitted by an unauthorized person;

— the transit declaration does not contain the necessary information;

— the transit declaration is not signed or not properly certified or is not drawn up in the prescribed form;

— in relation to the declared goods, the necessary actions have not been taken (for example, permission to move certain types of goods across the customs territory of the Customs Union has not been received).

3. Revocation of the transit declaration.

Revocation of a transit declaration is possible upon a written request from the declarant (before the customs authority makes a decision on the release of goods) (See clause 11 of the Procedure for customs authorities to carry out customs operations related to the submission and registration of a transit declaration (approved by the decision of the Customs Union of the Customs Union of August 17, 2010 No. 438) ).

.

After receiving such a request, the customs official makes a “Review” entry:

— in the register of transit declarations;

- in the transit declaration (with affixing a signature and imprint of a personal numbered seal);

— makes a copy of the completed transit declaration sheet;

tions or transport (transportation) documents (if used)

use as a transit declaration);

— notifies the declarant about the acceptance of the response by delivering the transfer

national declaration (TIR Carnet or ATA Carnet) with the corresponding

with a mark.

Lecture.9 Basic information contained in the goods declaration. The procedure for submitting and registering a declaration for goods, grounds for refusing to register a declaration for goods. Revocation of goods declaration

Questions:

1. Basic information contained in the goods declaration

2. The procedure for submitting and registering a declaration for goods, grounds for refusing to register a declaration for goods.

3. Grounds for refusal to register a declaration

4. Revocation of the goods declaration

1.Basic information contained in the goods declaration.

The basic information contained in the goods declaration is listed in paragraph 2 of Art. 181 TK TS.

This information includes:

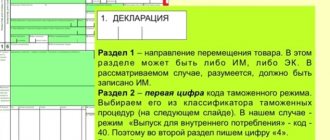

1) the declared customs procedure;

2) information about the declarant, customs representative, sender and recipient of goods;

3) information about vehicles used for the international transportation of goods and (or) their transportation through the customs territory of the Customs Union;

4) information about goods:

- Name;

- description;

— classification code of goods according to the Commodity Nomenclature of Foreign Economic Activity of the Customs Union;

— name of country of origin;

— name of the country of departure (destination);

— description of packages (quantity, type, marking and serial numbers);

— quantity in kilograms (gross weight and net weight) and in other units of measurement;

— customs value;

— statistical value;

5) information on the calculation of customs duties:

— rates of customs duties, taxes, customs duties;

— application of benefits for the payment of customs duties;

- the amount of calculated customs duties, taxes, customs fees;

— exchange rate established in accordance with the legislation of a member state of the Customs Union and used to calculate customs payments;

6) information about the foreign economic transaction and its main conditions;

7) information about compliance with restrictions;

information about the manufacturer of the goods;

information about the manufacturer of the goods;

9) information confirming compliance with the conditions for placing goods under the customs procedure;

10) information about the documents required for customs declaration;

11) information about the person who prepared the goods declaration;

12) place and date of drawing up the goods declaration.

However, in each specific case of customs declaration of goods, not all of this information must be indicated. For example, if the declarant independently submits a declaration for goods, then information about the customs representative is not indicated. When paying customs duties and taxes in full, there will be no information about benefits on customs duties.

2. The procedure for submitting and registering a declaration for goods, grounds for refusing to register a declaration for goods.

The procedure for filing and registering a declaration for goods consists of general requirements and registration actions of customs authorities.

The general requirements for filing a goods declaration include:

a) filing a customs declaration:

— an authorized person (declarant or customs representative);

- the customs authority authorized to accept, register and verify it (For example, depending on the types of goods, these may be specialized customs authorities (for example, excise customs posts) or ordinary customs posts with the competence to accept customs declarations (see, for example, Order of the Federal Customs Service of Russia dated May 21, 2012 No. 965 “On customs authorities authorized to register customs declarations”).

- in the prescribed form indicating the necessary information;

b) submission of an electronic copy of the declaration (According to Part 2 of Article 322 of the Law on Customs Regulation, before January 1, 2014, at the choice of the declarant, customs declaration is carried out in written or electronic form using a customs declaration. After the specified period, the rule of Part 1 of Art. 204 of the Law on Customs Regulation states that the declaration for goods is submitted in electronic form, with the exception of certain cases of written declaration established by the Government of the Russian Federation.

Based on the results of three quarters of 2012, more than 2.6 million declarations for goods were issued in electronic form, which amounted to about 94 percent of the total // Customs. 2012. No. 22. P. 9.)

and documents confirming the information specified in the declaration of goods;

c) performing certain actions, for example paying a fee for customs operations.

Registration actions of customs authorities include:

— recording the date and time of filing a declaration for goods (in the registration journal (Fixing the date and time of filing a declaration during an electronic declaration, as well as notifying the declarant about such recording are carried out automatically after the declaration is received in the electronic system of the customs authority.) and in the list of documents submitted with declaration for goods) (By putting the date and time on two copies of the list of documents indicating the surname and initials of the customs official.)

— assigning a registration number to the goods declaration (The registration number is formed according to the following scheme: ХХХХХХХХ/ ХХХХХХ/ ХХХХХХХ, where:

(1 2 3)

— element 1 — code of the customs authority that registered the DT;

— element 2 — date of registration of the DT (day, month, last two digits of the year);

— element 3 — the serial number of the DT, assigned according to the DT registration log by the customs authority that registered the DT (starts with one for each calendar year).

- indication of the registration number of the declaration and the time of its registration on two copies of the list of documents (with a signature and imprint of a personal numbered seal) (One copy of the list is returned to the declarant (customs representative), the second is attached to the declaration of declaration and documents.)

, as well as the registration number in the corresponding column DT (First line of column “A”.)

3. Grounds for refusal to register a declaration

Registration of a customs declaration may be refused if one of the following grounds exists:

— the customs declaration was submitted to a customs authority not authorized to register customs declarations;

— the customs declaration was submitted by an unauthorized person;

— the customs declaration does not contain the necessary information;

— the customs declaration is not signed (not certified) or is not drawn up in the prescribed form;

— in relation to the declared goods, the necessary actions have not been taken (for example, customs duties for customs operations have not been paid).

In case of refusal to register a customs declaration, an official of the customs authority draws up a sheet of refusal to register a declaration for goods (The form of a sheet of refusal to register a declaration for goods was approved by the decision of the Customs Union dated May 20, 2010 No. 262 “On the registration procedure, refusal to register a declaration for goods and registration of refusal in the release of goods." In the case of using a written form of customs declaration, the sheet of refusal to register the declaration for goods is printed in two copies. In case of electronic customs declaration, the sheet of refusal to register the declaration for goods is sent to the declarant as part of an authorized message (see the order of the Federal Customs Service of Russia dated 12/13/2011 No. 2506 “On approval of the Instructions on the actions of customs officials when performing customs operations related to the refusal to register a declaration for goods”).

4.Revocation of goods declaration

Revocation of a declaration for goods after its registration is permitted upon a written application from the declarant and on the basis of written permission from the customs authority, if the customs authority:

- did not notify the declarant about the place and time of the customs inspection (or after the customs inspection no violations of customs rules were detected);

— found no violations of customs rules.

After the revocation of the declaration for foreign goods, a new declaration is submitted within the period of temporary storage of goods indicating any customs procedure (subject to compliance with its conditions).

The declaration for goods of the Customs Union can be withdrawn both before and after the release of goods, but before their actual departure outside the customs territory (The application for withdrawal of the declaration indicates the location of the goods of the Customs Union.)

Based on clause 5 of Art. 193 of the Customs Code of the Customs Union, the declarant has the right to withdraw, including the preliminary customs declaration (if, after the import of goods, differences in cost, quantity or weight indicators from those previously declared are discovered).

Registration of transit declaration

The customs authorities decide on the registration of the declaration no later than one hour of the department’s working hours from the moment of filing the customs declaration. However, in some cases, legislation may establish a shorter period.

To register, you must contact the customs authority. itself is carried out by an authorized employee . To do this, he will need the following documents:

- A document that confirms the applicant’s right to carry out the registration procedure.

- Confirmation of the fact of the purchase and sale transaction.

- A receipt from the bank confirming the provision of taxes and duties.

- Transport and commercial papers, etc.

So, if everything is in order with the documents, the customs officer will assign an individual serial number.

The release of goods must be completed by the customs authority within 4 hours from the moment of registration of the transit declaration, and in cases where the transit declaration is registered less than 4 hours before the end of the customs office hours - within 4 hours from the start of work on the next day, for with the exception of cases of extension of the period for the release of goods provided for in paragraphs 3 and 4 of Article 119 “Time limits for the release of goods” of the EAEU Labor Code.

Application and registration process

The process of submitting a transit declaration requires the provision of an accompanying package of official papers, namely:

- A document confirming the right of an authorized person to submit a declaration to state customs authorities;

- A document confirming the fact of concluding an agreement with the transport expedition;

- Confirmation of the transaction for the right to dispose of the cargo;

- Commercial and transport documents;

- Confirmation of compliance with established prohibitions;

- Information about the state in which the transported goods were produced;

- Documents confirming the fact of payment of taxes and government duties.

Registration is carried out by customs officers. It can be carried out within 2 hours after its submission. As a result of registering a transit declaration, an individual registration number will be assigned, certified by the seal and signature of a customs officer.

However, the customs service may refuse to register the document. There may be several reasons for this:

- the paper was submitted to bodies that do not have these powers;

- submitted by a person who does not have the authority to provide it to government agencies;

- the information contained in the paper is incomplete;

- the document was drawn up in violation of the uniform rules with errors or inaccuracies;

- the form does not contain the signature of the person filling it out.

Registration of the release of goods can be made only after registering the transit declaration for the goods and demonstrating it to a customs officer.

The release is prepared by the same specialist who fills out the fields in the form and affixes the required stamps. If other documents were submitted instead, including transport documents, stamps and seals are affixed to them.

The transport declaration is an important document required for clearance of cargo at customs. It can be replaced with the documents mentioned above: commercial papers or transport papers. When filling out the form, you must follow the established rules so that the application and registration process is quick and successful.

Video

This material contains information on how to correctly fill out the goods declaration form.

rating 5.00 out of 5 (2 votes)

In what cases is refusal possible?

Authorities of the Federal Customs Service (FCS) will refuse registration in the following situations :

- The transit declaration is submitted by a person who is not the declarant (supplier) or his authorized representative.

- Significant errors were found in the document.

- The declarant applied to the customs authority, which does not have authority in a particular region.

- T1 does not provide comprehensive information about the transported products.

- The declaration does not comply with the established form.

Electronic declaration of transit

According to the order of the Ministry of Finance of the Russian Federation No. 144n “On approval of the Procedure for using the Unified Automated Information System of customs authorities for customs control, customs declaration and release (refusal to release) of goods...”, since March 2017, a transit declaration can and should be submitted electronically.

To send an electronic transit declaration to the customs authorities or to obtain information about the progress of customs transit clearance procedures as a carrier, you must:

- Purchase software for preparing documents and ETD, for example, CTM VED-Declarant or CTM Fill-Bill.

- Connect to the automated system for electronic submission of information (AS EPS) of the Federal Customs Service of the Russian Federation using the information operator “InfoDek” and receive the identifier of the participant in the information exchange.

- Purchase CIPF CryptoPro CSP.

- Get an electronic signature.

Among the required documents:

- international waybill (CRM);

- invoice;

- packing list;

- technical passports for the car and trailer;

- driver's passport;

- specification (if required) indicating HS codes and breakdown by cost and weight;

- certificate of the customs carrier (if available).

You can do the clearance either yourself or by contacting a customs broker . As a rule, brokerage organizations provide services for electronic registration of T1 around the clock.