The declaration of goods* is submitted in electronic form, except for the cases specified in the Decree of the Government of the Russian Federation of December 13, 2013 No. 1154, when declaration is permitted in writing (Part 1 of Article 204 of the Federal Law of November 27, 2010 No. 311-FZ “On customs regulation in the Russian Federation”).

One goods declaration declares information about goods contained in the same consignment, which are placed under the same customs procedure.

*The following can be used as a declaration for goods: transport (shipping) documents, commercial documents, other documents containing information necessary for the release of goods placed under customs procedures: release for domestic consumption, export, when declaring goods whose total customs value is not exceeds the equivalent of 1000 euros. The rule on optional declaration does not apply to: excisable goods, goods subject to licensing or quotas, goods that are exempt from customs duties and taxes - with the exception of the provision of tariff preferences; importation of goods to diplomatic or equivalent representations of foreign states; export of goods to representatives of the Russian Federation abroad, currency, securities, precious metals and precious stones.

Box 31 of the goods declaration

From August 18, 2017, the procedure for filling out column 31 “Cargo packages and description of goods” has been adjusted. This column of the goods declaration contains information about the declared goods necessary for:

- calculation and collection of customs duties and other payments;

- monitoring compliance with prohibitions and restrictions;

- taking measures to protect rights to intellectual property, etc., as well as information about cargo packages.

Such information is indicated with their serial number. In this case, we are talking about indicating number 10 in column 31 in relation to property imported into the customs territory and included in the list of goods subject to marking with control marks.

In Russia, since 08/08/2017, number 10 is used for specified goods placed under customs procedures for export, temporary export and re-export, if control (identification) marks are applied to such goods.

Box 40 of the goods declaration

From 01/01/2017, the procedure for filling out column 40 “General declaration/Previous document” of the declaration has been clarified - when declaring goods manufactured (received) using foreign goods placed under the customs procedure of a free customs zone or free warehouse, if there is no identification for such goods.

Now, when declaring such goods, column 40 is not filled out not only in the Russian Federation, but also in the Republic of Armenia and the Republic of Belarus (subclause 4 of clause 25 of the Instruction on the procedure for filling out a declaration for goods, approved by decision of the Customs Union Commission dated May 20, 2010 No. 257, further – Instructions).

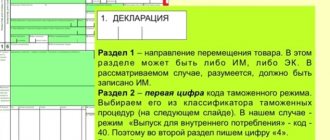

Classifier (codes) of features of the movement of goods for column 37 of the customs declaration

Column 37 consists of three codes. The first two digits are the customs procedure code. These numbers are taken from column 1 of the declaration. The choice of customs procedure was discussed here. The classification of procedure codes is here.

The second two digits are the code of the previous customs procedure. If the declared goods were previously declared under a different customs procedure (except for customs transit), then this procedure must be indicated here. Or the code of the procedure under which the goods from which the declared goods were made was previously placed (applies to processing modes) is indicated. If the goods are declared under the current procedure for the first time, then two zeros “00” are entered.

The last three-digit code indicates the peculiarity of the movement of goods. The code is taken from the classifier in the table below. Most often, three zeros “000” are chosen - i.e. when there are no features of movement.

example of filling out column 37

Classifier of features of goods movement

The data is current taking into account changes that came into force on October 16, 2021.

| Code | Name |

| 000 | The specifics of the movement of goods have not been established |

| 001 | Goods for providing free assistance and (or) for charitable purposes |

| 002 | Humanitarian aid goods |

| 003 | Technical assistance items that cannot be returned |

| 004 | Goods transported for the purpose of preventing and eliminating the consequences of natural disasters, natural and man-made emergencies, which are not subject to return |

| 005 | Monetary gold, national and foreign currencies (except those used for numismatic purposes), securities issued for circulation |

| 006 | Returnable technical assistance items |

| 007 | Goods transported for the purpose of preventing and eliminating the consequences of natural disasters, natural and man-made emergencies, subject to return |

| 008 | Goods (material and technical supplies and equipment, equipment, spare parts, fuel, food and other property) exported outside the customs territory of the Eurasian Economic Union to support the activities of vehicles and organizations of the member states of the Eurasian Economic Union or to ensure the activities of vehicles , leased (chartered) by persons of member states of the Eurasian Economic Union, with the exception of goods named in position 010 (except for the Republic of Belarus) |

| 009 | Marine products originating from member states of the Eurasian Economic Union, caught and imported by any means of transport and recognized as originating from member states of the Eurasian Economic Union |

| 010 | Goods moved as supplies |

| 011 | Goods temporarily imported into the customs territory of the Eurasian Economic Union, for which the customs procedure for temporary import (admission) is suspended |

| 013 | Goods transported as a contribution to the authorized capital (fund) |

| 018 | Incorrectly delivered goods |

| 020 | Goods intended for sports competitions and training, concerts, theatrical performances, competitions, festivals, religious, cultural and other similar events, demonstrations at exhibitions, fairs, as well as for holding and covering official and other events in the media and subject to return , with the exception of goods named in positions with codes 090 and 099 |

| 021 | Promotional materials and souvenirs that cannot be returned |

| 027 | Packaging, containers, pallets used as returnable returnable packaging |

| 031 | Goods transported for official use by diplomatic missions and consular offices of member states of the Eurasian Economic Union |

| 032 | Goods transported for official use by diplomatic missions and consular offices that are not members of the Eurasian Economic Union, located on the customs territory of the Eurasian Economic Union |

| 033 | Goods transported for official use by representative offices of states at international organizations, international organizations or their representative offices located in the customs territory of the Eurasian Economic Union |

| 034 | Goods transported for official use by organizations or their representative offices located in the customs territory of the Eurasian Economic Union specified in subparagraph 3 of paragraph 3 of Article 2 of the Customs Code of the Eurasian Economic Union |

| 042 | Goods supplied or returned for complaint |

| 044 | Goods, including vehicles, spare parts and (or) equipment, moved for implementation or returned after repair and (or) warranty maintenance, with the exception of goods specified in positions with codes 135, 136, 138 |

| 054 | Natural gas supplied to gas storage facilities or returned from such storage facilities (except for the Republic of Belarus) |

| 055 | Goods transported by pipeline transport, necessary for its commissioning work |

| 061 | Goods transported as samples (samples) for research and testing not related to the procedure for assessing compliance with the mandatory requirements of technical regulations of the Eurasian Economic Union (Customs Union) |

| 062 | Unrecoverable remains of ionizing radiation sources (except for the Republic of Belarus) |

| 063 | Goods supplied under production sharing agreements (except for the Republic of Belarus) |

| 064 | Goods transported as samples (samples) for the purpose of assessing compliance with the mandatory requirements of technical regulations of the Eurasian Economic Union (Customs Union) |

| 070 | Goods for the construction (construction) of artificial islands, structures, and other objects located outside the territories of the member states of the Eurasian Economic Union, in respect of which the member states of the Eurasian Economic Union have (will have) exclusive jurisdiction (with the exception of the Republic of Belarus) |

| 071 | Goods transported to or from artificial islands, installations, structures and other objects, over which the member states of the Eurasian Economic Union have exclusive jurisdiction, and located outside the customs territory of the Eurasian Economic Union (with the exception of The Republic of Belarus) |

| 090 | Goods transported for the preparation and/or holding of the XXII Olympic Winter Games and XI Paralympic Winter Games 2014 in Sochi (except for the Republic of Belarus) |

| 091 | Goods imported (imported) into the customs territory of the Eurasian Economic Union and intended exclusively for use in organizing and conducting official international competitive events in professional skills WorldSkills (“WorldSkills”) |

| 092 | Goods imported (imported) into the customs territory of the Eurasian Economic Union and intended exclusively for use in organizing and conducting official international events within the framework of the International Hanseatic Days of the New Age |

| 098 | Goods transported for the preparation and/or holding of the 2012 APEC summit in the city of Vladivostok (except for the Republic of Belarus) |

| 099 | Goods transported for use in the organization and conduct of the 2021 FIFA World Cup and (or) the 2021 FIFA Confederations Cup, the 2020 UEFA European Football Championship or during training activities in preparation for them.” |

| 100 | Goods transported for the construction of the Nord Stream gas pipeline (except for the Republic of Belarus) |

| 101 | Goods transported for the construction of the South Stream gas pipeline (except for the Republic of Belarus) |

| 102 | Goods manufactured (obtained) from foreign goods placed under the customs procedure of a free customs zone, and goods manufactured (obtained) from foreign goods placed under the customs procedure of a free customs zone, and goods of the Eurasian Economic Union, the status of which is determined in accordance with paragraph 8 Article 210 of the Customs Code of the Eurasian Economic Union |

| 103 | Goods located on the territory of a free (special, special) economic zone that cannot be identified by the customs authority as goods located on the territory of a free (special, special) economic zone before its creation, or as goods imported into the territory of a free (special, special) economic zone special) economic zone or manufactured (received) in the territory of a free (special, exclusive) economic zone |

| 104 | Goods manufactured (received) from foreign goods placed under the customs procedure of a free warehouse, and goods manufactured (received) from foreign goods placed under the customs procedure of a free warehouse, and goods of the Eurasian Economic Union, the status of which is determined in accordance with paragraph 8 of the article 218 of the Customs Code of the Eurasian Economic Union |

| 105 | Goods located in a free warehouse, which cannot be identified by the customs authority as goods located in the territory of a free warehouse before its creation, or as goods placed under the customs procedure of a free warehouse or manufactured (received) in a free warehouse |

| 106 | Parts, components, assemblies that can be identified by the customs authority as included (included) in the composition of goods placed under the customs procedure of a free customs zone |

| 107 | Parts, components, assemblies that can be identified by the customs authority as included (included) in the composition of goods placed under the customs procedure of a free warehouse |

| 112 | Goods manufactured (received) exclusively from goods of the Eurasian Economic Union, placed under the customs procedure of a free customs zone, including using goods of the Eurasian Economic Union, not placed under the customs procedure of a free customs zone, exported from the territory of a free (special, special) economic zone zones to the rest of the customs territory of the Eurasian Economic Union |

| 113 | Goods manufactured (received) from goods of the Eurasian Economic Union, including those not placed under the customs procedure of a free customs zone, exported from the territory of a free (special, exclusive) economic zone outside the customs territory of the Eurasian Economic Union |

| 114 | Goods manufactured (obtained) from foreign goods placed under the customs procedure of a free customs zone, and goods manufactured (obtained) from foreign goods placed under the customs procedure of a free customs zone, and goods of the Eurasian Economic Union exported from the territory of a free (special, special) economic zone outside the customs territory of the Eurasian Economic Union, if such goods are recognized as goods of the Eurasian Economic Union in accordance with Article 210 of the Customs Code of the Eurasian Economic Union |

| 115 | Goods manufactured (obtained) from foreign goods placed under the customs procedure of a free customs zone, and goods manufactured (obtained) from foreign goods placed under the customs procedure of a free customs zone, and goods of the Eurasian Economic Union exported from the territory of a free (special, special) economic zone to the rest of the customs territory of the Eurasian Economic Union, in respect of which the identification of foreign goods placed under the customs procedure of the free customs zone has been carried out |

| 116 | Goods manufactured (obtained) from foreign goods placed under the customs procedure of a free customs zone, and goods manufactured (obtained) from foreign goods placed under the customs procedure of a free customs zone, and goods of the Eurasian Economic Union exported from the territory of a free (special, special) economic zone to the rest of the customs territory of the Eurasian Economic Union, in respect of which the identification of foreign goods placed under the customs procedure of the free customs zone has not been carried out |

| 117 | Goods manufactured (obtained) from foreign goods placed under the customs procedure of a free customs zone, and goods manufactured (obtained) from foreign goods placed under the customs procedure of a free customs zone, and goods of the Eurasian Economic Union exported from the territory of a free (special, special) economic zone outside the customs territory of the Eurasian Economic Union, if such goods are not recognized as goods of the Eurasian Economic Union in accordance with Article 210 of the Customs Code of the Eurasian Economic Union |

| 118 | Equipment placed under the customs procedure of a free customs zone, put into operation and used by a resident (participant, subject) of a free (special, special) economic zone for the implementation of an agreement (agreement) on the implementation (conduct) of activities in the territory of a free (special, special) economic zone zone (agreement on the conditions of activity in a free (special, exclusive) economic zone, investment declaration, entrepreneurial program), placed under the customs procedure of release for domestic consumption, taking into account the specifics of calculating import customs duties, taxes, special, anti-dumping, countervailing duties established by paragraph second paragraph 1 of Article 209 of the Customs Code of the Eurasian Economic Union |

| 119 | Goods placed under the customs procedure of a free customs zone on the territory of a port free (special, special) economic zone or a logistics free (special, special) economic zone, placed under the customs procedure of release for domestic consumption, taking into account the specifics of calculating import customs duties, taxes, special , anti-dumping, countervailing duties established by the second paragraph of paragraph 1 of Article 209 of the Customs Code of the Eurasian Economic Union |

| 122 | Goods manufactured (received) exclusively from goods of the Eurasian Economic Union, placed under the customs procedure of a free warehouse, exported from the territory of a free warehouse to the rest of the customs territory of the Eurasian Economic Union |

| 123 | Goods manufactured (received) from goods of the Eurasian Economic Union, exported from the territory of a free warehouse outside the customs territory of the Eurasian Economic Union |

| 124 | Goods manufactured (received) from foreign goods placed under the customs procedure of a free warehouse, and goods manufactured (received) from foreign goods placed under the customs procedure of a free warehouse, and goods of the Eurasian Economic Union exported from the territory of a free warehouse outside the customs territory of the Eurasian Economic Union, recognized as goods of the Eurasian Economic Union in accordance with Article 218 of the Customs Code of the Eurasian Economic Union |

| 125 | Goods manufactured (received) from foreign goods placed under the customs procedure of a free warehouse, and goods manufactured (received) from foreign goods placed under the customs procedure of a free warehouse, and goods of the Eurasian Economic Union exported from the territory of a free warehouse to the rest of the customs territory of the Eurasian Economic Union, in respect of which the identification of foreign goods placed under the customs procedure of a free warehouse has been carried out |

| 126 | Goods manufactured (received) from foreign goods placed under the customs procedure of a free warehouse, and goods manufactured (received) from foreign goods placed under the customs procedure of a free warehouse, and goods of the Eurasian Economic Union exported from the territory of a free warehouse to the rest of the customs territories of the Eurasian Economic Union, in respect of which the identification of foreign goods placed under the customs procedure of a free warehouse has not been carried out |

| 127 | Goods manufactured (received) from foreign goods placed under the customs procedure of a free warehouse, and goods manufactured (received) from foreign goods placed under the customs procedure of a free warehouse, and goods of the Eurasian Economic Union exported from the territory of a free warehouse outside the customs territory of the Eurasian Economic Union, not recognized as goods of the Eurasian Economic Union in accordance with Article 218 of the Customs Code of the Eurasian Economic Union |

| 128 | Equipment placed under the customs procedure of a free warehouse, put into operation and used by the owner of a free warehouse to carry out operations provided for in paragraph 1 of Article 213 of the Customs Code of the Eurasian Economic Union, placed under the customs procedure of release for domestic consumption, taking into account the specifics of calculating import customs duties, taxes, special, anti-dumping, countervailing duties established by the second paragraph of paragraph 1 of Article 217 of the Customs Code of the Eurasian Economic Union |

| 129 | Goods placed under the customs procedure of re-import, in respect of which reimbursement of taxes and (or) interest on them, amounts of other taxes, subsidies and other amounts is carried out in accordance with subparagraph 3 of paragraph 2 of Article 236 of the Customs Code of the Eurasian Economic Union |

| 130 | Goods placed under the customs procedure of re-import, in respect of which no refund of taxes and (or) interest on them, amounts of other taxes, subsidies and other amounts is carried out in accordance with subparagraph 3 of paragraph 2 of Article 236 of the Customs Code of the Eurasian Economic Union |

| 131 | Waste generated as a result of processing of goods in the customs territory and processing for domestic consumption |

| 132 | Residues resulting from the processing of goods in the customs territory and processing for domestic consumption |

| 133 | Processed products obtained as a result of the processing of goods placed under the customs procedures of processing in the customs territory, processing outside the customs territory, processing for domestic consumption, with the exception of goods specified in positions with codes 044, 134 - 138 (including processed products received as a result of processing of goods placed under customs procedures for processing in the customs territory, processing outside the customs territory) |

| 134 | Processed products obtained as a result of operations for processing equivalent goods in accordance with Article 172 of the Customs Code of the Eurasian Economic Union, exported from the customs territory of the Eurasian Economic Union, with the exception of goods specified in positions with codes 136 and 138 |

| 135 | Foreign goods imported into the customs territory of the Eurasian Economic Union in exchange for processed products in accordance with Article 183 of the Customs Code of the Eurasian Economic Union, if the processing operation is the repair of goods, including warranty |

| 136 | Processed products obtained as a result of replacing foreign goods in accordance with paragraph two of paragraph 1 of Article 172 of the Customs Code of the Eurasian Economic Union, exported from the customs territory of the Eurasian Economic Union |

| 137 | Foreign goods imported into the customs territory of the Eurasian Economic Union in exchange for processed products in accordance with Article 183 of the Customs Code of the Eurasian Economic Union, if processing operations are carried out in relation to goods transported by pipeline transport |

| 138 | Processed products obtained as a result of processing operations of equivalent goods in accordance with Article 172 of the Customs Code of the Eurasian Economic Union, if the processing operation is the repair of goods, including warranty, exported from the customs territory of the Eurasian Economic Union, with the exception of the goods specified in the position with code 136 |

| 139 | Goods placed under the customs procedure of a customs warehouse, in respect of which it is expected that such a customs procedure will be completed in accordance with subparagraph 5 of paragraph 1 of Article 161 of the Customs Code of the Eurasian Economic Union |

| 15X* | Other features of the movement of goods introduced in the Republic of Belarus unilaterally |

| 150 | Goods transported under an exchange agreement (for the Republic of Belarus) |

| 151 | Goods transported under a financial lease (leasing) agreement (for the Republic of Belarus) |

| 152 | Goods transferred under a gift agreement (for the Republic of Belarus) |

| 153 | Goods exported outside the customs territory of the Eurasian Economic Union for the purpose of sale without prior conclusion of a transaction (for the Republic of Belarus) - position as amended by the Decision of the Board of the Eurasian Economic Commission No. 52 of May 12, 2015. |

| 16X* | Other features of the movement of goods introduced in the Republic of Kazakhstan unilaterally |

| 161 | Goods of group 27 of the EAEU CN FEA, produced from Kazakhstani raw materials extracted at the Karachaganak field (Republic of Kazakhstan), and exported outside the customs territory of the Eurasian Economic Union from the territory of the Russian Federation (for the Republic of Kazakhstan) |

| 17X* | Other features of the movement of goods introduced in the Russian Federation unilaterally |

| 171 | Goods placed under the customs procedure of the free customs zone in the Magadan region of the Russian Federation, intended for their own production and technological needs |

| 172 | Goods (except for excisable goods) transported for the purpose of their use in the construction, equipment and technical equipment of real estate on the territory of the innovative or necessary for the implementation of research activities and the commercialization of its results by project participants, in respect of which subsidies are provided to reimburse the costs of paying import customs duties duties and value added tax (for the Russian Federation) |

| 173 | Goods transported for the purpose of their use in the construction, equipment and technical equipment of real estate on the territory of the innovative or necessary for the implementation of research activities and the commercialization of its results by project participants, with the exception of goods indicated under code 172 (for the Russian Federation) |

| 174 | Goods necessary to support the activities of an air checkpoint or international airport (for the Russian Federation) |

| 175 | Goods intended to support the activities of sea (river) ports located at sea (river) checkpoints (for the Russian Federation) |

| 176 | Goods moved to or from the territory of the Baikonur complex (for the Russian Federation) |

| 177 | Goods (except for excisable goods) imported for the purpose of their use in the construction, equipment and technical equipment of real estate in the territories of innovative scientific and technological centers or necessary for the implementation of scientific and technological activities by project participants, in respect of which subsidies are provided to reimburse the costs of payment customs duties and value added tax (for the Russian Federation) |

| 178 | Goods imported for the purpose of their use in the construction, equipment and technical equipment of real estate in the territories of innovative scientific and technological centers or necessary for the implementation of scientific and technological activities by project participants, with the exception of goods indicated under code 177 (for the Russian Federation) |

| 18Х* | Other features of the movement of goods introduced unilaterally in the Republic of Armenia |

| 180 | Goods transported under a financial lease (leasing) agreement (for the Republic of Armenia) |

| 201 | Goods moved under an agreement on the protection and promotion of investment (for the Russian Federation) |

| 202 | Goods transported in accordance with intergovernmental agreements on production and scientific-technical cooperation of defense industry enterprises (for the Russian Federation) |

If you did not find the answer to your question in this material, then write to [email protected] and I will soon update the article.

You might be interested in the following:

1) Filling out the declaration yourself 2) We calculate customs duties 3) How and where to pay customs duties? 4) Other classifiers and other useful information on the content and completion of the declaration

If you find an error, please select a piece of text and press Ctrl+Enter.