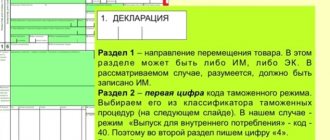

A customs declaration is a document that must be drawn up and filled out in cases where goods or cargo crosses the border of the Russian Federation, regardless of whether it is imported or exported. The document must be drawn up in accordance with the current legislation of a particular state, based on where the goods are exported or imported: products, cargo, as well as hand luggage or passenger luggage, valuables or currency, it is filled out for both legal entities and individuals when transporting certain things across the state border.

In addition, there is a specific and established form of customs declaration; information about the goods or cargo transported across the state border is entered into it. This document has a strictly established form, and therefore, to fill it out correctly, you will need experience, knowledge of all the nuances of legislation and registration requirements, as well as knowledge of all changes to the customs code.

In order not to encounter problems when filling out a Russian or international customs declaration, to save your time, nerves and finances, contact professionals. Our specialists have extensive experience in providing all types of customs services and, in particular, preparing customs declarations of all types.

Customs declaration: what is it and what is it for?

This is a document that is essentially a statement, which is drawn up in a certain form. It contains accurate information about goods or cargo, the customs procedures applied to them, the transport on which they are transported, as well as other information that is necessary for transportation across the border in accordance with Art. 4 TK TS. That is, a completed customs declaration (abbreviated as TD) for goods is evidence that the goods are permitted.

It must meet all established requirements for its form, content and reflect all information about the cargo being transported.

The very procedure of filling it out, as well as the subsequent submission of a declaration to the customs authorities for its acceptance, is called customs declaration, the procedure is carried out by the declarant: either the one who owns, transports the cargo, or a representative, whose role can be “Guarantor Documentation”. Our company provides customs declaration services to both individuals and legal entities; we will help you fill out all documents correctly and in compliance with all established standards.

Customs declaration is carried out according to the selected procedure in accordance with Art. 179 of the Customs Code of the Customs Union. The document is issued for goods that:

- transported through a customs control point;

- fall under innovations and changes in the customs regime;

- are waste due to processing;

- a number of other products.

Organizations participating in foreign economic activity must file a declaration for goods transported across the border. If this is not done, customs will not process the cargo and will not allow it through. All information in the TD must clearly reflect reality, that is, all information must be as accurate and truthful as possible, since if inconsistencies are found between what is indicated in the document and the actual situation, the paperwork will be delayed, which means the cargo will remain idle at customs. That is why it is best to entrust the entire process to an experienced customs broker.

Tax Code on customs declaration

Tax regulations related to export transactions do not contain such detailed information.

Thus, taxation on the sale of goods actually exported in the customs export procedure is carried out at a tax rate of 0% (clause 1, clause 1, article 164 of the Tax Code of the Russian Federation). To confirm the right to apply the zero VAT rate, you must submit to the inspectorate the documents listed in Art. 165 Tax Code of the Russian Federation. Among them is a customs declaration (its copy) with marks from the Russian customs authority that released the goods in the export procedure, and the Russian customs authority of the place of departure through which the goods were exported from the territory of the Russian Federation and other territories under its jurisdiction.

For your information. In order to obtain information about the quantity and date of goods actually exported during tax control activities, tax authorities have the right to request this information from the customs authorities of the Russian Federation, which carried out customs clearance of the export of goods (Letter of the Federal Tax Service of Russia dated December 10, 2012 N ED-4-3/ [email protected] , Federal Customs Service of Russia dated July 16, 2010 N 04-45/35094 (brought to the territorial tax authorities by Letter of the Federal Tax Service of Russia dated July 21, 2010 N ShS-37-3/ [email protected] ), Cooperation Agreement between the Federal Customs Service of Russia and the Federal Tax Service of Russia dated 01/21/2010 N 01-69/1/MM-27-2/1).

The Federal Tax Service of Russia in Letter dated December 19, 2011 N ED-4-3/ [email protected] states: other requirements for the customs declaration submitted to the tax authority for the specified sale of goods, the provisions of Art. 165 of the Tax Code of the Russian Federation do not contain.

In other words, the Tax Code does not specify which customs declaration must be submitted by the taxpayer as part of the documents confirming the lawful application of the 0% VAT tax rate. By the way, the tax regulations also don’t say a word about what exactly the marks on the customs declaration should be, it simply states that they should be available (we’ll talk about this in detail later).

Taking into account the uncertainty of the wording of the law, the opinions of the authorized body and arbitrators regarding whether, when filing a customs declaration - temporary or full, the taxpayer properly fulfills the requirement of the Tax Code to confirm the right to apply a 0% VAT rate in relation to the export supply of goods, were divided.

For your information. When exporting goods across the border of the Russian Federation with a member state of the Customs Union, instead of customs declarations, a register of customs declarations may be submitted containing information about the customs clearance of goods in accordance with the customs export procedure, with marks from the customs authority of the Russian Federation confirming the fact of placing the goods under the customs export procedure ( Subclause 3, Clause 1, Article 165 of the Tax Code of the Russian Federation). Registers of customs declarations are submitted in the manner determined by the Ministry of Finance in agreement with the Federal Customs Service. The Tax Code does not provide for approval by the Ministry of Finance of the form of registers or the list of information reflected in these registers (Letter of the Ministry of Finance of Russia dated October 30, 2012 N 03-07-08/308). The Federal Tax Service of Russia believes that the register of customs declarations should contain information about goods actually exported outside the territory of the Russian Federation in accordance with the customs export procedure, allowing taxpayers to justify the legality of applying a 0% VAT rate on specific supplies of goods, and tax authorities to exercise control over such operations and prevent the unlawful application of the specified tax rate (Letter dated September 13, 2012 N AS-4-2/15309).

What information is indicated in the customs declaration

Let us repeat that a customs declaration is a document of a standard form, drawn up and filled out in a certain form. It contains a number of information, namely:

- country of origin of the transported goods or cargo;

- its type, that is, the nomenclature according to the Commodity Nomenclature of Foreign Economic Activity;

- the transport on which it is transported, its number;

- weight, value of the declared cargo;

- for what purpose is the transport or export carried out;

- other information without which customs clearance cannot be carried out.

The application also indicates the date at the time of its completion. The completed declaration is used not just as a written confirmation of the data about the product, but after its acceptance, it is proof of the fact that the customs authorities have authorized its import or export. When filling out the document, no edits are allowed; all information entered in it is certified by the seal of the organization declaring the cargo, for example, a customs broker, if you use his services.

The customs declaration number is not indicated in the invoice: legal consequences

A Russian importer who has drawn up a customs declaration (cargo customs declaration, officially - DT or declaration for goods) for imported goods must, in the event of subsequent sale of the completed purchase, indicate in the invoice the number of the corresponding DT (subclause 14, clause 5, article 169 of the Tax Code of the Russian Federation) .

From 07/01/2021 a new invoice form is in effect, incl. adjustment, as amended by the Decree of the Government of the Russian Federation dated 04/02/2021 No. 534. The update of the form was caused by the introduction of a goods traceability system. All taxpayers are required to use the new form, even if the goods are not included in the traceability system. We described in more detail the changes made to the invoice here.

You can download the new invoice form by clicking on the image below:

ConsultantPlus experts have prepared step-by-step instructions for preparing each line of the updated invoice. To do everything correctly, get trial access to the system and go to the Guide. It's free.

If, during the resale of property, for some reason the customs declaration number was not indicated on the invoice, then this cannot become a basis for refusing the subsequent receipt by the importer of a VAT deduction, when other information available in the tax documentation allows the Federal Tax Service to establish information about the supplier, buyer, find out the names of goods, their price, VAT rates (Letter of the Ministry of Finance of Russia dated January 26, 2018 N 03-07-08/4259).

Please note that DT numbers are not recorded in invoices for goods imported from the EAEU, simply because customs declarations in such legal relations are generally not drawn up.

See here for details.

But how can an importer find the DT number if he decides to indicate it in tax documentation? How to record information about the customs declaration in the invoice?

Types and deadlines for filing a declaration

Customs declarations are divided into several types according to Art. 180 of the Customs Code. Based on the chosen procedures and the persons who transport the goods, they are divided into the following types:

- declarations for goods, this type was previously called cargo, it is issued to legal entities and individual entrepreneurs who cross the state border, in which case the TD is submitted exclusively in electronic format;

- transit, filled out and submitted either on paper or in electronic format, issued for goods that are in transit through the territory of the Customs Union or through it from one border to another;

- an application for a vehicle, submission of a declaration for a vehicle is carried out in TsAT in writing on a paper or electronic application, issued under the selected customs regime, that is, import export, temporary import and so on;

- passenger, submitted independently by an individual in the form of a standard application on paper or by his representative.

Cargo or customs declarations for goods are the most common documents among all types. The date of submission of the TD is recorded by a customs representative; the timing of its submission differs depending on whether the goods are exported or imported.

For example, if things are imported, then the deadline for filing a TD is 2 months, that is, the period allocated for the temporary storage of goods, which, if necessary and on the basis of an application, can be extended for another 2 months. If the goods are exported from the customs territory, no deadlines have been established; however, the document must be provided before its actual export.

The customs authority checks the correctness of execution and completion of the declaration, the compliance of the information specified in it with the actual data, and checks with other documentation that is submitted for cargo clearance. The information specified in the TD must be supported by documents; these can be either original documents or their copies certified by a notary.

The preparation of an international customs declaration requires experience, extensive knowledge of legislation, in particular the customs code, and practical experience, which is why it is best to entrust the desk to a professional customs broker for a specific task. – an experienced customs representative who will help you go through all the procedures at customs, in particular, prepare all the required documentation, quickly and professionally.

How to obtain a copy of the customs declaration

What information is contained in the customs declaration?

- country of origin of the goods;

- type of cargo of the goods according to the Unified Tax Code of Foreign Economic Activity;

- cargo mass;

- price;

- purpose of import and export of goods;

- number of the vehicle delivering the goods;

- other information without which it is impossible to clear the goods through customs;

Types of customs declarations

According to the Customs Code of the Customs Union, Article 180. Customs declaration: When customs declaring goods, depending on the declared customs procedures and persons moving the goods, the following types of customs declaration are applied:

- declaration of goods;

- transit declaration;

- passenger customs declaration;

- declaration for the vehicle.

If you are a legal entity and carrying cargo:

- across the territory or through the territory (from border to border) of the Customs Union - a Transit Declaration is required;

- for the territory of the Customs Union to foreign countries or from these countries - a Goods Declaration is required;

Below we will talk in more detail about the declaration of goods, since this is a necessary document for all companies conducting foreign trade activities.

Customs declaration for goods

A customs declaration for goods (previously called a “Cargo Customs Declaration” or “CCD”) is issued exclusively for legal entities or individual entrepreneurs when they move goods across the customs border. Important: filing a customs declaration for goods is carried out exclusively in electronic form.

Filing a customs declaration

For legal entities or individual entrepreneurs, filing a declaration for goods is carried out remotely in electronic form. A declaration can be submitted to the customs authorities as a legal entity/individual entrepreneur independently or with the help of a customs broker. If we talk about imported goods and placed in a temporary storage warehouse, the deadline for filing a declaration for goods cannot exceed 2 months. This period can be extended for another 2 months. When exporting goods across the customs border, the filing deadlines are not established.

Where can I get a customs declaration for goods?

The customs declaration begins with a form. You can pick up the form at the customs checkpoint or download the current version on the Internet. Before submitting your return, we strongly recommend that you check all the information provided in it. A small difference in the information contained in the declaration and the actual information about the product can cost you dearly. Some companies that have a declarant on their staff outsource the verification of information in declarations to customs broker companies. In the presence of large volumes of transported goods, human factors cannot be excluded and companies insure themselves against the risks of transferring this work to outsourcing organizations in the field of foreign trade. After checking the information specified in the goods declaration, you must pay all duties and fees.

Places for filing a goods declaration

The place of customs clearance (place of filing a declaration for goods) is any customs post of the Russian Federation listed in Order of the Federal Customs Service of Russia dated June 15, 2010 No. 1133.

Registration number of the customs declaration

After the declarant submits a customs declaration for the goods to customs, the inspector checks the data specified in the declaration. If no errors were made and the information in the declaration meets all the requirements, the customs inspector assigns a unique number to the document and endorses it with a stamp. Before assigning this number for DT, the declarant must provide all documents that indicate payment of all payments and fees. Only after this can customs authorize the release of goods. The issuance of a customs declaration for goods is the final stage of customs clearance of goods. After the inspector has endorsed the “Release Authorized” stamp by customs, the cargo is moved across the customs border and can be used under the selected procedure. As you can see, preparing a customs declaration is a rather labor-intensive process that requires special attention. To avoid financial risks, we recommend that you contact specialists to perform this procedure. Naturally, we offer our services in this direction. The Bereg company is a customs broker that ranks first in Russia in terms of the number of goods brought and transactions completed. Every third product lying on a store shelf is a product brought by our company. There's no need to reinvent the wheel. Take advantage of the experience of large companies that perfectly understand the financial benefits of working with our company.

Submission and Acceptance

Correctly filling out the document and submitting reliable information is an important step, without which it will be impossible to legalize the export or import of goods or cargo across the border.

The document is submitted either by the declarant himself or his representative; legal entities and individual entrepreneurs do this remotely, namely in electronic form. Declaration forms can be obtained directly from customs when crossing the border, and can also be downloaded from the website.

Immediately before submission, the application is checked again by our specialists, which allows us to avoid the slightest inaccuracies. After all documents are verified, duties and fees are paid, payment documents are also submitted to the customs authority, TD can be submitted at any customs post of the Russian Federation. After receiving the application from the declarant, the inspector checks the correctness of all the information entered; if no complaints have arisen, then the TD is assigned a number and certified with a seal that export or import is permitted, which means that the declaration has been accepted.

Functions of customs declaration.

Customs declaration is an important area of control over foreign economic activities of entities in various countries. The declaration is the main tool in the hands of customs authorities, allowing:

- exercise control over the volume and quality of import and export of goods across the state border,

- receive complete information about transported goods to collect customs statistics,

- monitor the legality of foreign economic transactions,

- guarantee the safety of customers by allowing environmentally friendly and high-quality goods to enter the country’s domestic market,

- pursue illegal trade,

- guarantee the state income from foreign trade in the form of duties paid.

At the same time, the rules for importing goods across the border require full assistance to customs authorities during inspection and declaration of cargo.

Our customs declaration services

“Garant Documentation” is an experienced and professional customs representative who provides all types of customs services to individuals and legal entities, as well as individual entrepreneurs. Our specialists will prepare all the necessary documentation for passing procedures at customs, and will also draw up and fill out declarations of the required type competently, clearly and professionally at any customs post throughout the Russian Federation.

We will save your time, money and nerves, because you do not have to waste time studying customs legislation, delving into all its nuances, we will do everything for you. And the cost of processing customs declarations for our company is the lowest on the market. At the same time, an individual approach to each client and attention to all your wishes are guaranteed.