International trade is an important component of the economy. Every year, a large number of products of different categories are supplied from other countries. Companies carrying out such transportation must take care of the necessary documents. Private individuals are also often involved in the process. They buy used cars and household appliances from neighboring countries. The article will discuss what it is - a state customs declaration (state customs declaration) for a product, the definition of the abbreviation, the rules for processing documents and why they are needed in general.

Concept

Paper is required when you need to transport valuable goods across state borders. It is worth noting that the customs declaration is currently used in a different format. At the beginning of 2011, a new name was officially adopted - “DT”. However, the former term is still in use. Therefore, in the proposed material both of them will be periodically mentioned.

What is indicated

There are strict regulations that determine the information contained in the customs declaration document. More details about this are in the table below.

| № | Information |

| 1 | Sender details |

| 2 | Recipient details |

| 3 | Name of the country where the transaction was concluded, its code |

| 4 | Place of origin |

| 5 | State of destination |

| 6 | Conditions of transportation, vehicle, in what currency payments will be made |

| 7 | Cargo characteristics |

| 8 | Border checkpoints |

| 9 | Provided quotas |

| 10 | Duties, fees |

How to fill out this type of customs documentation correctly

The main declaration sheet (Form 1) contains information about only one product in a quantity of no more than 999 units.

An additional annex (Form 2) may include information about three types of cargo.

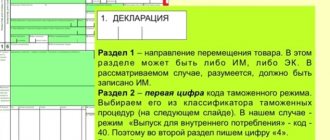

Main columns to be filled out in the declaration:

- gr. 1 – customs procedure code (import/export);

- gr. 2 – information about the sender (in accordance with the waybills);

- gr. 3 – number of declaration sheets;

- gr. 4 – number of sheets of cargo specifications submitted simultaneously with the DT (if necessary);

- gr. 5 – quantity of transported goods (units);

- gr. 6 – number of cargo items (containers, refrigerators, barrels, etc.), if the cargo is transported in bulk, enter “0” in the column;

- gr. 8 – consignee (if different types of transport are involved in the transportation process, indicate information about each intermediate consignee of the cargo marked “counterparty”);

- gr. 9 – person responsible for financial settlement;

- gr. 11 – country acting as the seller of the goods;

- gr. 12 – total customs value in the currency of the country to whose customs the declaration is submitted (for example, in rubles for the customs of the Russian Federation);

- gr. 14 – information about the person (legal or individual) drawing up and submitting the DT;

- gr. 15 – country of departure and its codes in accordance with the international classification;

- gr. 16 – country of origin (where the product was produced);

- gr. 17 – country of destination with international classification codes;

- gr. 18 – information about vehicles transporting dispatched/received cargo across the customs territory;

- gr. 19 – number “1” if the cargo is transported by container, “0” – in all other cases.

The following columns provide information about the cargo, the conditions of its transportation, taxes and fees paid.

Important! The first sheet of the DT contains 54 columns, of which 7, 43, C and D are filled out by the customs officer, the rest by the sender of the cargo.

Sample filling

The goods declaration contains either one main sheet or a main sheet with additions. There are four forms in total. This is what the first sheet of DT looks like:

You can fill out the declaration using the following links:

The first sheet of the goods declaration. Form 1

Additional sheet to DT. Form 2

Declaration of goods. Form 3

Additional sheet to DT. Form 4

Kinds

In the first section, we indicated what GTD means and how it stands for. Now it is necessary to describe the classification. The legislation of the Russian Federation provides for four types of declaration. They are applied depending on the situation that arises.

Commodity

Such paper is issued for all products intended for import into the territory of the Customs Union as part of foreign commercial activities. It includes the Russian Federation, as well as:

- Kazakhstan;

- Republic of Belarus;

- Armenia;

- Kyrgyzstan.

Transit

A cargo transport declaration of this type is required in the case when the goods are moving through a vehicle and none of the states is importing or exporting. Then the form is filled out and submitted to the appropriate authority.

Passenger

This type is used in situations where products are transported by an individual.

On the vehicle

The document is issued when a vehicle is imported into Russia from abroad.

Adjustment of customs value

If an error was made in the value of the goods in the customs declaration, then it is necessary to carry out the procedure for adjusting the customs value. Since if the customs office discovers an error in the calculations of the customs value or it raises doubts in them, then the cargo will not be allowed through and they will not process it and accept the declaration. The cost is adjusted based on the requirements and claims from the customs representative; this may be a recalculation of duties or other customs payments.

A number of companies resort to the services of experienced customs declarants who help fill out the customs declaration for goods

Recalculation is carried out taking into account the points that raised doubts among customs control, and taxes are also recalculated and the customs value of goods is adjusted based on updated data. For example, the supplier erroneously inflated the prices in the invoice compared to the contract price, which was due to an unaccounted volume discount.

The declarant is responsible for adjusting the customs value and preparing a cargo customs declaration. However, if this action does not require the provision of any documents, then sometimes the customs representative himself makes changes to the vehicle.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Which services are suitable for working with GTD?

Smthngs is a GTD manager for the browser. Can be used online and offline as an application.

Gtdagenda.com is an online service. You can manage tasks and monitor progress. There is a free and paid extended version.

Evernote is an application for creating and storing notes. Suitable for collecting all projects in one system.

Trello is a project management program. You can create different boards, make lists, attach documents.

Registration of a customs declaration at customs: why is it necessary?

The paper described in the article contains several functions. For a better understanding, it is worth examining each of them in detail. First of all, this is obtaining important information. Participants submit it to customs, thereby confirming the fact of the transaction.

The second purpose is legal. The presence of a properly drafted document is evidence that the agreement was reached taking into account applicable national laws and regulations.

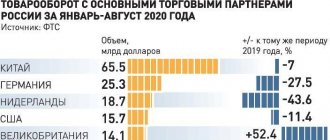

The third role is statistical. The data that was identified in the GDT declaration is used by company management to generate a report, identify strengths and weaknesses and make new large-scale decisions.

If we summarize all of the above, we can conclude that paper plays a big role at all stages of international trade. Without it, it will not be possible to draw up a schedule and certify the legality of actions.

Sections, subsections and positions of product groups

In the Commodity Nomenclature of Foreign Economic Activity, goods are systematized into categories and types, provided with a short name and description.

Product indicators are formed by:

- sections;

- groups;

- subgroups.

For those goods that are not classified in sections or groups, the following code decoding is used in the customs declaration: “other” and “other of other” items of the product nomenclature.

For example, when filling out a declaration in the product description column, you need to perform the following sequence of actions:

For example, the query “oil sensor” will find examples of declarations with several types of product descriptions of the form: “... pressure sensor...” “... pressure measuring device - special sensor...”

From the proposed options for answering the request, you must select the greatest match for keywords that relate to the target product group for the declared cargo in the declaration. For example, for the word “tractor,” the HS search engine can return codes for an agricultural tractor, as well as a toy tractor. Carefully deciding on the product group is the key to successful declaration. The more complete the request, the more accurate the codes of the cargo being processed.

And, of course, don’t forget about the “other” goods position. In customs slang, such groups are called “baskets”. Used when your cargo is not in the named product sections and positions. Then the description uses the chain “other-other-other”.

When you don't need to fill it out

Regulatory legal acts provide for several situations in which the preparation of a customs declaration for cargo transportation is not a mandatory step. First of all, these are transactions with duty-free goods that are delivered or sent. The second case is trading in very small volumes. If the cost of all products is less than 100 euros, then this paperwork is not required. It is separately indicated that the document is not needed if special products are transported that are not subject to economic policy measures. In addition, transporting cargo to the territory of another state for personal use also does not require filling out paperwork.

These rules sound simple. However, before crossing the border, you should consult with a lawyer. He will tell you what exactly needs to be presented to the border guard in a particular situation.

Taxpayer liability

Information about the registration number of the document that is the basis for the movement of goods between states is mandatory in the document that serves as the basis for VAT calculations (Article 169 of the Tax Code of the Russian Federation).

What happens if you do not indicate the number in column 11? The absence of data in column 11 of the invoice is recognized as a reason for tax inspectors not to accept such a primary document for accounting when providing a VAT deduction.

Judicial practice confirms the unequivocal position of the tax inspectorate: the taxpayer is responsible for indicating the customs declaration number (resolutions of the Federal Antimonopoly Service of the Volga Region dated May 16, 2012 No. F06-2967/12, FAS East Siberian District “F20-477/12 dated March 6, 2012, FAS North-Siberian District Western District No. F07-1879/11 dated 02/01/2112).

The Federal Tax Service Inspectorate recommends not interacting with a supplier who is unable to confirm the origin of the goods sold.

Algorithm

The first part of the article was devoted to what it is - GDT, interaction with customs, and a decoding of the abbreviation was also given. Now you need to find out exactly how the registration process occurs.

First of all, it is necessary to indicate that the declaration is filled out in the form established by the CU Commission. It is a brochure or just several A4 forms. The filling rules are regulated by a special body - the State Customs Committee. The necessary instructions are contained in the order “On approval of the Instructions on the procedure for filling out the customs declaration.”

First of all, work is carried out on the main sheet - TD 1. It is concluded for cargo with a single name and mode of movement. 4 copies are made. The first one is sent to the archive for storage. The second goes to the statistics department. The third is given to the applicant for reporting activities. The latter is attached to the goods and sent to the checkpoint. It carries out customs clearance.

Basic information must be provided by the declarant. Many people feel uncomfortable with the abundance of data and information. Especially beginners who did not know before that this is a gas turbine engine mode and what documents are needed. But if you figure it out, the procedure won’t be so complicated. When accepting papers, a special stamp is placed. The completed stages of control are noted in special columns.

In addition, there is a sheet of form TD 2. If goods are transported together, which include products with different names, then it must be filled out. One additional form can contain up to 3 articles. The maximum number of such pages is not specified in the legislation. The filling out procedure is similar to the previous form.

There is a sample attached below that you can use as a guide during the process.

How to properly space a gas turbine engine in 1C 8.3?

For example, we import products from Poland. The euro exchange rate on the day of filing the declaration is 68.2562, the customs value according to the declaration is 341281.00 rubles, and the amount of customs duty is 2000 rubles.

The customs duty amount is 10% of the customs value according to the declaration (i.e. 34,128.10 rubles), it is distributed among all items in the product range.

The VAT amount is calculated using the following formula: (product price + customs duty + excise tax) x VAT rate (10% or 18%). If the product is not subject to excise tax, it is taken equal to zero. In our case, the VAT amount will be equal to: (341281.00 + 34128.10) x 18% = = 375,409.10 x 18% = 67573.64 rubles.

To fill out a customs declaration for goods imported into the country in 1C, you will need to make some settings regarding the functionality of the program and in directories.

To work with foreign suppliers, accounts 60.21 and 60.22 are used, the amounts on which are reflected in foreign currency.

When posting receipts to account 10 (41, 15), the cost is recalculated in rubles.

In addition to total accounting, an off-balance sheet customs declaration account is used in accounting accounts for the purpose of accounting for products in the context of various declaration numbers.

Customs payments are indicated on account 76.5.

The following is an algorithm for the acquisition by a company (VAT payer) of goods with a gas turbine engine in the general mode.

To correctly convert currencies into rubles, they need to be uploaded to courses.

In the directory, by clicking on “Load exchange rates...”, a form will be displayed where you should select a time interval.

What papers are submitted along with the GDT form?

Regulatory acts provide for a list of documents submitted simultaneously with the declaration to the relevant customs authority. Below is a complete list.

A certificate that officially confirms the ability to submit a declaration of intent on one’s own behalf.

- Transport papers indicating that the cargo crossed the state border of the Russian Federation.

- A copy of the passport of the foreign economic agreement.

- Certificate of customs value.

- Product delivery control certificate.

- Receipts for payment of duties.

- Photo of the customs declaration (electronic copy on a medium).

Basic design requirements

DT is issued only on an officially approved form in block letters, without blots.

Design requirements:

- information is entered in accordance with the procedure determined by the Decision of the CU Commission No. 257 of May 20, 2010;

- corrections are certified by the seal and signature of the official and the submitter of the declaration;

- the data in the declaration must not have any discrepancies with the data in other accompanying documents.

The declaration for exported goods contains a column with customs post codes. It is not filled out if the cargo is not subject to customs duty or is outside the control post.

Sample 2021

When choosing an example, it is important to consider the date. It is possible that the information provided is no longer relevant. In the photo you can see the declaration filled out last year.

As you can see from the example, the form contains a large amount of information. First of all, the title of the document is in the upper left corner. A number is also indicated, which will be discussed below. In the window below you can see the recipient’s data, and then the declarant’s data. The names of the states are indicated on the right. Germany is the country of destination, the Russian Federation is the country of origin. Below is the payment amount and exchange rate at the time of registration. It is important to note that the data of the responsible person is also written on the sheet.

What information does it contain?

The data that must be indicated in the customs declaration is regulated by No. 181 of the Labor Code of the Customs Union. All declarations for any goods must contain the following information:

- the type of customs procedure that is carried out in a particular case;

- terms of product delivery;

- data on the transport used to transport the goods;

- information about the broker, sender and recipient of products, declarant;

- quotas (for those categories of goods for which there are certain restrictions on export or import);

- country of origin of the goods in case of import or destination in case of export;

- product data (name, code, quantity, type of packaging, cost);

- information about the point where the customs procedure is carried out;

- collection currency;

- data on amounts, types of customs duties and payments;

- date and place of document preparation;

- other data relevant for such a procedure.

Customs declarations for goods imported into Russia must be provided no later than 2 months after the cargo arrives at customs. The same document for products exported from the Russian Federation must be submitted before they move across the border. It is important that the clearance of goods should not exceed 14 days from the date of submission.

It is recommended to submit a customs declaration for perishable goods on the day the goods were delivered to customs.

How is the document number generated?

It makes sense to concentrate on this more carefully. After the declarant has filled out the forms, the papers are thoroughly checked and registered. They are then assigned an individual number. However, it does not consist of random numbers, but is formed according to clear rules.

The first block is 8 characters. This is the code of the customs organization where clearance is carried out. The second is the registration date. The number comes first, followed by the month and the last two digits of the current year. For example, April 18, 2021 will look like this: 180420.

The third part includes 7 numbers. This is a serial number assigned to the declaration by the relevant authority. The countdown starts from the beginning of the calendar year. For example, No. 0000002 is the second in a row. Elements are separated by a “/” sign; spaces or other characters cannot be inserted.

We will set up any reports, even if they are not in 1C

We will make reports in the context of any data in 1C. We will correct errors in reports so that the data is displayed correctly. Let's set up automatic sending by email.

Examples of reports:

- According to the gross profit of the enterprise with other expenses;

- Balance sheet, DDS, statement of financial results (profits and losses);

- Sales report for retail and wholesale trade;

- Analysis of inventory efficiency;

- Sales plan implementation report;

- Checking of employees not included in the time sheet;

- Inventory inventory of intangible assets INV-1A;

- SALT for account 60, 62 with grouping by counterparty - Analysis of unclosed advances.

Order report customization

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

What is a customs number?

These are eight digits indicating the code of the customs authority where the declaration is registered.

Interesting materials:

How to properly clean a Tefal frying pan? How to properly clean antique coins? How to properly clean a washing machine with citric acid? How to properly clean a washing machine? How to properly clean your phone? How to properly clean fabric sneakers? How to clean truffles correctly? How to properly clean a Philips iron? How to properly clean valui? How to properly clean a bathtub?

Registration of vehicles transported across the border

The procedure for purchasing a vehicle abroad is very common in Russia. Cars of those brands that are not officially sold on the territory of the Russian Federation are especially in great demand. For example, the famous Tesla electric car. Another reason is more attractive prices in some countries.

The algorithm for importing a car from another state is simple. It consists of 4 steps that are easy to remember and follow.

1. The first stage is the preparation of all papers necessary for the process. Data is collected about the owner, as well as about the transport itself. It is important that the model, manufacturer, identification number (VIN), year of manufacture, power and other characteristics are accurately indicated by which a specific car can be accurately identified.

2. The next step is to provide the collected certificates to the customs officer. First of all, this is a declaration of the customs declaration. In addition, the applicant is required to show the employee the technical passport of the vehicle, the delivery agreement, the invoice (invoice), and a receipt indicating the amount of transportation costs.

3. Next comes cleaning. At this stage, the exact purpose of importing the car into Russia is clarified. The moment is important, since the amount of duty charged to the new owner directly depends on the reason. Afterwards, the buyer’s benefits are checked, a detailed inspection of the car is carried out, and the actual numbers are compared with those indicated in the documents.

4. The last step is to obtain an import permit. If all bills are paid in full and the inspector has no questions about the condition of the papers, then an inscription is placed allowing you to cross the border. It gives the right to register the vehicle with the relevant authorities.

Why is a gas turbine engine needed?

Submitting a declaration to the customs authorities “speaks” of the completion of a controlled transaction; in addition, it emphasizes the fact of compliance with the laws that regulate foreign economic activity.

Important

The data reflected in the documentation must fully coincide with the real state of affairs. So, for example, if the unit numbers given in the declaration do not match the real ones, the car or spare parts will be detained - you will have to pay a fine and start processing a new customs declaration.

The document is also necessary for generating statistical information. The information provided is used in the preparation of reports and decision-making at the management level in the field of foreign trade control.

State customs declaration for cars

It is necessary if the car was purchased abroad, and then the owner plans to transport it to the Russian Federation. In this case, the processing falls on the person who made the purchase. In other words, to the new owner of the vehicle. The inspector carefully checks the papers, checking all the information specified in them. If no problems are found, an import permit is issued.

In the case when the vehicle is transported by a private person, it is mandatory to present a receipt receipt. This is a certificate stating that the duty has been paid in full. If it is absent, the employee will not allow the car to enter Russia. This can lead to the loss of not only time, but also money, since there will be costs for storing the car in a special warehouse. Therefore, it is worth checking in advance that everything you need is available.

is engaged in the creation and implementation of ready-made solutions for business. Therefore, our services will be especially useful if the client represents an organization. Using the software created by our company, you can optimize many business processes, for example, simplify inventory, labeling, etc. Thanks to optimization through the introduction of modern mobile tools, you can reduce costs, maintain a net share of profits and, if desired, reinvest it in modernization jobs, to attract more clients, as well as to hire more qualified employees who can take the organization to a new level and help develop new markets.

By contacting the company, the user saves not only time. By entrusting the procedure to professionals, you can significantly reduce the risk of complications and financial costs. The distinctive features of the organization are customer focus, prompt execution of orders, work with various tasks, as well as affordable prices. Another plus is the responsive, qualified staff.

List of documents for registration of customs declaration

Transportation of goods between different states requires a mandatory package of documents presented by the participant in foreign economic activity at customs.

To pass control and register a customs declaration you will need:

- A contract (purchase/sale agreement) concluded between individuals or legal entities. Attachments to it: specifications, bills (invoices), packing lists.

- Original contract.

- Receipts for payment of customs duties after determining the value of the goods.

- List of documents confirming data on customs assessment of cargo and financial control.

- Availability of licenses, official permits from government officials, if required by the goods being moved, availability of certificates of quality and origin from the manufacturer.

- A package of documents giving the right to the cargo manager to move it - a certificate of state registration, Taxpayer Identification Number (TIN) and certificate of foreign trade participant, registration documents of an individual entrepreneur, passport.

Body

Most car owners buy a ready-made vehicle right away. However, there are situations when a car is transported across the border in parts. In most cases, this is a way to save money by buying a used car and then restoring it.

If this is the case, and the car enters Russia in parts, then for each component, which has its own identification number, it is necessary to fill out a separate customs declaration. One such element is described in this subsection. If you do not perform all of the above steps, then after assembly the vehicle will not be able to be registered with the authorities. Accordingly, it will not be possible to drive it legally. You should consider whether the money saved is worth the time lost.

During the analysis process, an authorized inspector carefully verifies the data of the units. If a discrepancy is discovered somewhere, the declarant will be forced to spend time and money to eliminate all inaccuracies. Therefore, buying a car abroad should be taken seriously, taking into account possible pitfalls.

What to do when reselling?

A Russian importer (legal entity or individual entrepreneur) planning further resale of imported goods is obliged to enter in column 11 of his invoice the registration number of the accompanying document registered by customs (subclause 14, clause 5, article 169 of the Tax Code of the Russian Federation).

Letter of the Federal Tax Service No. AS-4-3/15798 directly indicates the seller’s obligation to write down the TD registration number for each product item in the invoice. This applies to goods imported into the Russian Federation and cleared through customs.

Goods that were produced outside the Russian Federation, passed customs registration, and then were packaged, packaged or bottled in Russia continue to have import status. When selling them, you must indicate the TD registration number in the invoice (letter of the Ministry of Finance No. 03-07-08/257 dated 08/23/12).

Based on clause 5 of Article 169, the taxpayer-seller of imported goods is responsible for the compliance of the mandatory information specified in the sales documents (Federal Law No. 150 of May 30, 2016) with the information contained in the incoming invoice (clauses 13, 14 as amended by Federal Law No. 119 of July 22, 2005).

Processing or bundling goods imported into the Russian Federation deprives them of their connection to the direct manufacturer, establishing Russia’s right to be considered a supplier. In this case, there is no need to indicate the customs declaration in the shipping document.

Important! In 2021, the basis for refusal of a deduction may be a discrepancy between the customs declaration number in the customs declaration and the contents of column 11 in the invoice.

Declaration for the motor

Some motorists buy imported engines in stores abroad. Most often they hope for a higher quality part. However, not everyone takes into account that she also has an individual number. Accordingly, it is necessary to draw up a separate declaration in this regard.

If the unit has been used, it is important to carefully inspect it before purchasing to ensure that the number is intact. This can save you a lot of trouble later.

The age, condition and technical characteristics of the motor do not matter.

The only important thing is that the equipment meets environmental standards. If no problems are found, the owner receives official permission to enter and installs the engine in his vehicle. After which changes are made to the vehicle registration certificate. Number of impressions: 9135

Secrets of the Commodity Nomenclature of Foreign Economic Activity, or how to correctly determine the product code

The cargo customs declaration indicates various indicators characteristic of each specific case of movement of goods across the customs border of the Russian Federation. The indicators must correspond to the actual cargo transported.

During customs clearance, importance is attached to the correct declaration of goods and their compliance with the commodity nomenclature of foreign economic activity - TN FEA. Customs duties, fees and payments depend on how accurately the selected code matches the product.

Commodity Nomenclature for Foreign Economic Activity are systematized cargo codes that are accepted for circulation in international trade.