Any product crossing the border of the Russian Federation is subject to “customs clearance”, and customs duty is paid for its import. This directly affects the cost of imported goods. There are duty free shops at airports and seaports. But it was not always so.

Until the mid-18th century, there were a large number of duties in Russia, even within the country. Customs law came closer to the modern one thanks to Empress Elizabeth Petrovna and Count P.I. Shuvalov, the author of the customs reform of 1753-1757. How did this process go, what were the prerequisites, difficulties and results of the changes?

Cancellation of internal customs duties

Together, transportation costs and fees accounted for more than half of the income received from the sale of goods. Since 1754, duties began to be collected only at the border . This was a progressive step. France eliminated such fees only in 1799, Germany - in the 19th century. The reform brought customs law closer to modern law.

This is interesting! At the beginning of the 18th century, a merchant paid 17 fees and small duties.

Decree of Elizabeth Petrovna on the abolition of internal customs duties

Reasons for cancellation

An urgent need for change arose in society by the mid-18th century . The following reasons led to customs reform:

- fight against corruption;

- discontent of merchants and peasants;

- the need to replenish the treasury.

Modern customs law:

What are customs duties and what are they?

What is a customs warehouse

How does customs clearance of jewelry take place?

Elimination of internal customs – Current Aspects

Reasons for cancellation.

The complex and confusing system of trade fees on the roads gave rise to corruption and abuse. The government did not have the resources necessary to eradicate these phenomena. From a practical point of view, establishing total control over customs officials was impossible.

The only way to solve this problem was to completely eliminate the ineffective system. According to the author of the project for the abolition of internal customs duties, this was supposed to contribute to the explosive growth of trade and industry. In addition, Count Shuvalov proposed an alternative source of replenishment of the treasury.

In his opinion, it was necessary to increase the fees imposed on export and import goods at the external borders of the state.

Elimination of the internal customs system

Thus, in the agreement between Prince Oleg of Kyiv and the Byzantines the word “myt” appears, which meant a fee for transporting goods through the outposts.

The collected customs payments were called “osmnic”, “mytnye” money. After the Tatar-Mongol invasion, the most commonly used customs term “tamozhit” (from the Turkic “tamga” - sign, letter, brand) took root in the Russian language. “Customs” meant stamping and collecting duties.

The manifesto recognized the burdens imposed by collectors of customs duties within the State on those subject to payment thereof.

it was pointed out that robbery and theft and other abuses in the collection of customs duties caused the merchants to become insanity in trading, interruption of goods and other losses.

Internal customs duties were declared to hinder the increase in the well-being and strength of the State and the people.

Customs reform P

Domestic policy of the second half of the 40-50s.

is largely connected with the activities of Count P.I. Shuvalov, who became the de facto head of the Elizabethan government. On his initiative, budget revenues were reoriented from direct taxation to indirect taxation.

This made it possible to increase treasury revenues.

He felt that the time had come for another customs reform. The most important event in the field of customs policy was the elimination of customs restrictions within the country.

UNION OF SOVIET SOCIALIST REPUBLICS - (USSR, Union of SSR, Soviet Union) the first socialist in history.

Presidential Library named after B

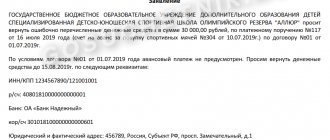

On December 20 (31), 1753, Empress Elizaveta Petrovna signed a decree

“On the abolition of internal customs and petty duties”

, which were one of the main obstacles to the development of domestic trade turnover.

Already in 1754, internal customs were eliminated in most of the country, and the collection of 17 petty taxes that burdened internal trade ceased.

The “newly established surplus” duty of 13% that replaced them was planned to be collected at port and border customs on all imported and released goods.

Procedure for refund of customs duties

If the procedure for resolving the dispute was followed, but the customs authority refused to return payments, the payer may go to court. The payer must:

- apply to the courts,

- write and present a statement containing information that he wants to return the overpaid duty.

- prove in court, if necessary, that he paid the excess amount.

According to Article 122 of the Federal Law, the following types of documents are attached to the application:

- an official document confirming that the transfer of advance transactions has been completed,

- papers that are specified in parts 4-7 of the current article (depending on the status of the person),

- other documents provided by the person to confirm the validity of the return.

Income from customs duties History of internal customs duties in Russia

Revenue from customs duties in all European countries forms a prominent part of the budget; in Russia - more than V8 (159 million).

R. according to the list for 1897), in England - 75 (21 million.

f. Art.), in Italy - about 77 (244 million.

lira), in France - 77 (460 million francs), in Austria - 188/J4 (47 million flor.) of all income.

Russia, which is still distinguished by its agricultural character, was at the beginning of its history a country devoted exclusively to agriculture and partly to cattle breeding; as a result, it could not have extensive and developed foreign trade, and the insignificant trade that existed at that time was internal.

In the 70s XVIII century Germany was economically and politically one of the most backward countries in Europe. Economically, it lagged significantly behind not only England, but also France and Holland.

If in England the industrial revolution began in the second half of the 17th century. in France - at the end of the 18th century. The emergence of large-scale industrial production in Germany, associated with the massive use of machines, occurs only in the second half of the 19th century.

Elimination of internal customs duties and borders

a ban was introduced for landowner peasants to enter military service of their own free will (under Peter I this was allowed); in 1747, nobles were allowed to sell peasants as recruits; in 1760, landowners received the right to exile peasants they disliked to Siberia.

Customs affairs during the reign of Elizabeth

Empress Elizaveta Petrovna

The Empress paid special attention to the development of industry and the domestic economy . At the beginning of her reign, she proclaimed a return to Peter’s orders, part of which was a policy of supporting production and trade within the country.

The operation of customs posts required a large staff of employees. They extorted bribes from merchants, resulting in reduced profits. Some of the money went past the treasury. Numerous litigations in court increased costs. Both merchants and the state suffered from corruption.

The customs charter of 1731 also limited the rights of peasants, who were allowed to sell products for no more than 20 kopecks. The government was unable to establish control over employees, so the only solution was to completely eliminate the system .

“Russia for Russians” - or Russia for non-Russians?

Discussion: 2 comments

- Sergey Yurievich:

05/02/2013 at 00:00Hello! I am glad to welcome you and come to your aid, because... I have enormous experience in legal and teaching activities, being a former employee of customs authorities and tax police, as well as the author of the textbook “Basic aspects of customs management and declaration of goods”; I have in-depth knowledge of • customs, tax, administrative legislation, including regulatory legal acts of the Customs Union, the Federal Customs Service (SCC) of Russia; • international private law, including contract law with a foreign element of the legislation of the Russian Federation on foreign trade activities, currency control, currency regulation; • legal basis for the organization: - work of customs and other state control bodies when moving goods and (or) vehicles across the customs border; – international sea, railway, road transportation; I have the practice of effectively participating in courts in disputes related to: • customs value of goods and vehicles; • collection and return of customs duties; • compliance with the conditions of preferential customs procedures; • origin of goods; • classification of goods according to the Commodity Nomenclature of Foreign Economic Activity; • bringing persons to administrative responsibility for violating customs rules; • etc. I PROVIDE citizens and organizations with the following SERVICES: CONSULTATIONS on customs issues (including on issues of customs value) and other legal issues, as well as preparing and filing statements of claim, complaints, etc.

REPRESENTATION in court and government. organs I provide assistance in obtaining preliminary classification decisions, certificates of conformity or declaration of conformity.

INDIVIDUAL LESSONS (including remotely) on training in filling out a cargo customs declaration using the Alta - Maximum software package. In addition, I am a part-time employee, and therefore I offer a discount of 20% on programs for declaring this company. Check out my website https://www.tamojnyasud.ru/

- MVN:

10/25/2016 at 00:00

In the Russian Federation, Customs Officer's Day is celebrated on October 25... according to the new style. This is another manifestation of the illiteracy of the authorities: “Customs Officer’s Day was established on August 4, 1995 by Yeltsin’s decree. The decision of Russian President Yeltsin on this particular day is not accidental, because it was on October 25, 1653 that the Unified Customs Charter first appeared in the Russian Kingdom” (Wikipedia). However, at that time in Rus' there was a Julian calendar, and in 2021 this day falls on 7.11.

Introduction of the bill

In 1747, a commission was established, which was tasked with studying the fees and the amount of income they generate , and drawing up a new internal tariff. In the same year, P.I. Shuvalov submitted a project to the Senate that proposed abolishing customs duties within the Empire. He described in detail the reasons and necessity of this measure.

The report applied only to peasants, did not affect merchants, and did not contain a reorganization plan . Shuvalov made adjustments to the draft and submitted the final version for consideration by the Senate in August 1753.

Note. The author of the bill was Count P.I. Shuvalov, who actually ran the government during the time of Elizabeth Petrovna.

Carrying out reforms

Count P. I. Shuvalov

In 1754, duties ceased to be collected and a border tax of 13% began to be levied on the import and export of goods. To combat smuggling, the reward method was used. Payment was made with confiscated goods. Border guards were given a quarter, and informers - half. To receive a reward, one could report the trade in goods without a special stamp.

The new Charter on customs law was adopted on December 1, 1755 . Merchants received a one-year deferment to pay the border tax. In 1757, the commission completed its work and a new customs tariff was drawn up.

The payment for the import of goods depended on the degree of development of this production in Russia . The degree of processing of raw materials also influenced the size of the rate. The tariff, like its 1731 predecessor, remained inconvenient. The main problem was that payment was made in metal and “walking” money. This made calculations difficult. In addition, the procedure for registering goods was very complicated.

The triumph of the third estate: how Elizaveta Petrovna revived trade

On February 3, 1754, representatives of the Russian merchants presented Empress Elizabeth Petrovna with a diamond weighing 56 carats

The generosity of Peter's daughter

Elizaveta Petrovna became the Russian Empress in 1741. Having carried out a palace coup with the support of guard regiments, she ruled the country for twenty years and left a good memory of herself among subjects from all classes. The ruler was loved not only for her close relationship with Peter the Great.

According to contemporaries, Elizabeth was seen by the people as the embodiment of the “Russian soul” itself: funny and unforgettable, sometimes superstitious and eccentric, generous and unhurried. The Empress knew how to enjoy life (she dressed up with pleasure, organized lavish festivities, appreciated haute cuisine, often tasting them without any measure) and showed concern for the lives of her subjects.

It is known that during all the years of her reign she did not sign a single death warrant.

Snuff box with the image of Empress Elizabeth

Source: pinterest.ru

Continuing the work of her father, Elizaveta Petrovna strove to increase the importance of the Governing Senate and further centralize government administration.

In order to prevent the country from being divided into separate “principalities,” she ordered the abolition of internal customs duties once and for all, as well as the establishment of a Commercial Bank.

As a token of gratitude for such a broad gesture, Russian merchants presented the Mother Empress with a gift of extraordinary beauty - a diamond weighing 56 carats on a gold plate. All the courtiers knew about Elizabeth Petrovna’s passion for clothes and jewelry.

In addition to a solid collection of fifteen thousand dresses and a couple of chests with other wardrobe items, the empress willingly collected brooches in the form of flower bouquets, snuff boxes, caskets and earrings. The merchant's gift also took a worthy place among this splendor.

Jewelry of Elizabeth Petrovna

Source: liveinternet.ru

Increasing wealth

What prompted the empress to such a progressive economic reform? The fact is that until the middle of the 18th century, Russian provincial authorities used internal customs to replenish the local treasury. Duties slowed down the transport of goods across provincial borders and increased final prices. Under such conditions, it was quite difficult for domestic merchants to compete with foreign ones.

The author of the project to eliminate internal fees was Count P.I. Shuvalov. In September 1752, he presented the first version of the document in the Senate, but it did not imply facilitating the activities of merchants and concerned only peasant trade.

But the second option, developed by Shuvalov a year later, concerned the merchants, peasants, and nobles involved in distilling. Only border and port duties should have been retained, and trade within the country should have become free.

To compensate for the budget shortfall after the new reform, P.I. Shuvalov proposed increasing import and export taxes by thirteen percent in addition to the existing ones.

After discussions in the Senate, on December 20, 1753, Elizaveta Petrovna signed a decree “On the abolition of internal customs and petty duties,” opening a new page in the development of Russian trade.

Medal issued in honor of the abolition of internal customs duties

Source: uploadbigspirit.ru

The promulgation of the decree took place in a solemn atmosphere during the Empress’s stay in Moscow. In honor of this event, the city was illuminated with festive illumination.

It was representatives of the Moscow merchant class who presented Elizaveta Petrovna with a luxurious gift and even added a considerable sum of money to it.

In their acceptance speech, they proudly stated that the Mother See can rightfully be considered the center of internal Russian trade.

But the reform brought benefits not only to the ancient capital. In 1754, the government abolished customs taxes on goods imported from central Russia to Siberia.

The export of goods through Siberia to China and other Asian countries was now taxed at a higher rate (18%), and Chinese merchants had to pay 23% when bringing anything to Russia. Such radical measures brought positive results in a short time.

Under Elizabeth Petrovna (before the reform), customs duties amounted to about nine hundred thousand rubles a year, and by the beginning of the reign of Catherine the Great, this figure more than doubled - in the 1760s, the treasury was replenished annually by as much as 2 million!

Russian merchant of the 18th century

Source: upload.wikimedia.org

Cover: polit.ru

Who is she - the main fashionista in Russia?

How did the empress come to power and abolish the death penalty?

Sour cabbage soup for the Empress: how Catherine II visited Lomonosov

To bestow like a king: what gifts did Russian rulers receive and give?

Favorite games of Catherine the Great

Source: https://histrf.ru/biblioteka/b/triumf-trietiegho-sosloviia-kak-ielizavieta-pietrovna-torghovliu-ozhivila

Results of liquidation

The abolition of small fees and internal payments for merchants and peasants influenced the development of the country and led to the following results :

- The situation of peasants and merchants improved. The increase in the border duty rate shifted the payment of duties to foreigners. Raw materials were exported from the Russian Empire. In this case, the declarant was a foreign consumer, so it became his responsibility to pay the duty. They brought luxury goods to Russia, which the nobles paid for.

- The treasury has replenished. In 1753, duties brought in 1.5 million rubles, and in 1761 - 5.7 million.

- The internal structure of customs has changed. 27 customs houses with outposts were created in border cities.

- Customs legislation was updated, a new Charter and tariff were adopted.