Eurasian Economic Commission

Article 75. Object of customs duties and taxes and the base (tax base) for calculating customs duties and taxes1. The object of customs duties and taxes are goods transported across the customs border.

2. The basis for calculating customs duties depending on the type of goods and applied types of rates is the customs value of goods and (or) their physical characteristics in kind (quantity, weight, taking into account its primary packaging, which is inseparable from the goods before its consumption and in which the product is presented for retail sale, volume or other characteristics).

3. The tax base for calculating taxes is determined in accordance with the legislation of the member states of the customs union.

Article 76. Calculation of customs duties and taxes

1. Customs duties and taxes are calculated by payers of customs duties and taxes independently, except for cases provided for by this Code and (or) international treaties of the member states of the customs union.

2. When collecting customs duties and taxes, the calculation of the amounts of customs duties and taxes payable is carried out by the customs authority of the member state of the customs union in which customs duties and taxes are payable.

3. Calculation of the amounts of customs duties and taxes payable is carried out in the currency of the member state of the customs union to whose customs authority the customs declaration was submitted, except for cases provided for by international treaties of the member states of the customs union.

4. The amount of customs duties subject to payment and (or) collection is determined by applying the base for calculating customs duties and the corresponding type of customs duty rate, unless otherwise established by this Code.

The amount of taxes to be paid and (or) collected is determined in accordance with the legislation of the member state of the customs union on the territory of which goods are placed under the customs procedure, or on the territory of which the fact of illegal movement of goods across the customs border has been revealed.,

unless otherwise provided by this article.

5. In the case established by part two of paragraph 2 of Article 84 of this Code, the amounts of customs duties and taxes are subject to calculation in accordance with the legislation of the member state of the customs union in which they are subject to payment.

6. The total amount of import customs duties and taxes in relation to foreign goods cannot exceed the amount of customs duties and taxes payable if foreign goods were released for domestic consumption, without taking into account the benefits for paying customs duties specified in subparagraphs 2) and 3) paragraph 1 of Article 74 of this Code (hereinafter referred to as benefits for the payment of customs duties, taxes), penalties and interest, except for cases when the amount of customs duties and taxes increases due to changes in the rates of customs duties and taxes, when rates are applied to foreign goods customs duties and taxes in force on the day of acceptance of the customs declaration by the customs authority when declaring another customs procedure in relation to these foreign goods.

Article 77. Application of rates of customs duties and taxes

1. For the purposes of calculating customs duties and taxes, the rates in effect on the day of registration of the customs declaration by the customs authority are applied, unless otherwise provided by this Code and (or) international treaties of the member states of the customs union.

2. For the purposes of calculating import customs duties, the rates established by the Unified Customs Tariff of the Customs Union are applied, unless otherwise provided by this Code and (or) international treaties of the member states of the Customs Union.

For the purposes of calculating export customs duties, the rates established by the legislation of the member states of the Customs Union in relation to goods included in the consolidated list of goods formed by the Commission of the Customs Union in accordance with international treaties of the member states of the Customs Union governing the application of export customs duties in relation to third parties are applied. countries

For the purposes of calculating taxes, the rates established by the legislation of the member state of the customs union are applied, on the territory of which goods are placed under the customs procedure or on the territory of which the fact of illegal movement of goods across the customs border is revealed, unless otherwise established by this paragraph.

For the purpose of calculating taxes, if it is established (confirmed) in the manner determined by the international treaty of the member states of the customs union that goods placed under the customs transit procedure are located on the territory of another member state of the customs union, the rates established by the legislation of that member states of the customs union.

Article 78. Conversion of foreign currency for the purposes of calculating customs duties and taxes

If, for the purposes of calculating customs duties and taxes, including for determining the customs value of goods, it is necessary to convert foreign currency into the currency of a member state of the customs union to the customs authority of which the customs declaration is submitted, the exchange rate established in accordance with the legislation is applied of this member state of the customs union and valid on the day of registration of the customs declaration by the customs authority, unless otherwise provided by this Code and (or) international treaties of the member states of the customs union.

Article 79. Payers of customs duties and taxes

Payers of customs duties and taxes are the declarant or other persons who, in accordance with this Code, international treaties of the member states of the customs union and (or) the legislation of the member states of the customs union, are responsible for paying customs duties and taxes.

Article 80. Origin and termination of the obligation to pay customs duties and taxes. Cases of non-payment of customs duties and taxes

1. The obligation to pay customs duties and taxes arises in accordance with Articles 81, 161, 166, 172, 197, 211, 214, 227, 228, 237, 250, 261, 274, 283, 290, 300, 306 and 360 of this Code.

2. The obligation to pay customs duties and taxes is terminated in the following cases:

1) payment or collection of customs duties and taxes in the amounts established by this Code;

2) placing goods under the customs procedure of release for domestic consumption with the provision of benefits for the payment of customs duties and taxes that are not associated with restrictions on the use and (or) disposal of these goods;

3) destruction (irretrievable loss) of foreign goods due to an accident or force majeure or as a result of natural loss under normal conditions of transportation (shipment) and (or) storage;

4) if the amount of the unpaid amount of customs duties and taxes does not exceed an amount equivalent to 5 (five) euros at the exchange rate established in accordance with the legislation of the member state of the customs union in whose territory the obligation to pay customs duties and taxes arose at the time the occurrence of an obligation to pay customs duties and taxes;

5) placing goods under the customs procedure of refusal in favor of the state, if the obligation to pay customs duties and taxes arose before the registration of the customs declaration for placing goods under this customs procedure;

6) conversion of goods into the property of a member state of the customs union in accordance with the legislation of this member state of the customs union;

7) foreclosure on goods, including at the expense of the cost of goods, in accordance with the legislation of a member state of the customs union;

refusal to release goods in accordance with the declared customs procedure, in relation to the obligation to pay customs duties and taxes that arose during the registration of a customs declaration for the placement of goods under this customs procedure;

refusal to release goods in accordance with the declared customs procedure, in relation to the obligation to pay customs duties and taxes that arose during the registration of a customs declaration for the placement of goods under this customs procedure;

9) if it is recognized as hopeless for collection and write-off in the manner determined by the legislation of the member states of the customs union;

10) the occurrence of circumstances with which this Code connects the termination of the obligation to pay customs duties and taxes.

3. Customs duties and taxes are not paid:

1) when placing goods under customs procedures that do not provide for such payment, subject to the conditions of the relevant customs procedure;

2) when importing goods, with the exception of goods for personal use, to one recipient from one sender under one transport (shipment) document, the total customs value of which does not exceed an amount equivalent to 200 (two hundred) euros at the exchange rate established in accordance with the legislation of the member state of the customs union, the customs authority of which releases such goods, in force at the time the obligation to pay customs duties and taxes arises;

3) when moving goods for personal use in cases established by international treaties of the member states of the customs union;

4) if, in accordance with this Code, legislation and (or) international treaties of the member states of the customs union, goods are exempt from customs duties and taxes (not subject to customs duties and taxes) and subject to the conditions in connection with which such exemption is granted .

4. The obligation to pay customs duties and taxes arises and terminates when customs procedures are established in accordance with:

1) paragraph 2 of Article 202 of this Code - in accordance with international treaties of the member states of the customs union;

2) paragraph 3 of Article 202 of this Code - in accordance with the legislation of the member states of the customs union.

Article 81. Origin and termination of the obligation to pay customs duties and taxes and the timing of their payment in the event of illegal movement of goods across the customs border

1. The obligation to pay import customs duties and taxes for the illegal movement of goods across the customs border arises when goods are imported into the customs territory of the Customs Union.

The obligation to pay export customs duties for the illegal movement of goods across the customs border arises when goods of the Customs Union are exported from the customs territory.

2. The obligation to pay customs duties and taxes during the illegal movement of goods across the customs border arises jointly and severally with persons illegally moving goods, persons participating in illegal movement if they knew or should have known about the illegality of such movement, and when importing goods to the customs territory of the customs union - also from persons who acquired ownership or possession of illegally imported goods, if at the time of acquisition they knew or should have known about the illegality of import.

3. The obligation to pay customs duties and taxes during the illegal movement of goods across the customs border is terminated for the persons specified in paragraph 2 of this article in the cases established by paragraph 2 of Article 80 of this Code.

4. In case of illegal movement of goods across the customs border, except for the case specified in part two of this paragraph, the deadline for payment of customs duties and taxes is considered to be the day the goods cross the customs border, and if this day is not established, the day of detection of the fact of illegal movement of goods through the customs border border.

In case of illegal movement of goods across the customs border with false declaration, the deadline for payment of customs duties and taxes is considered to be the day of registration by the customs authority of the customs declaration submitted to place the goods under the customs procedure, with the exception of the customs procedure of customs transit.

5. In case of illegal movement of goods across the customs border, customs duties and taxes are payable,

except for the case specified in part two of this paragraph:

1) when importing goods into the customs territory - in amounts corresponding to the amounts of import customs duties and taxes that would be payable when such goods were placed under the customs procedure of release for domestic consumption, without taking into account tariff preferences and benefits for the payment of customs duties and taxes calculated based on the rates of customs duties, taxes and exchange rates established in accordance with the legislation of the member state of the customs union, the customs authority of which collects customs duties, taxes, and those in force on the day the goods cross the customs border, and if this day is not established - on the day the fact of illegal movement of goods across the customs border is revealed;

2) when exporting goods of the customs union from the customs territory - in amounts corresponding to the amounts of export customs duties that would be payable when such goods were placed under the customs export procedure, without taking into account tariff preferences and benefits for the payment of customs duties and taxes, calculated on the basis of rates customs duties and exchange rates established in accordance with the legislation of the member state of the customs union, the customs authority of which collects customs duties, taxes, and those in force on the day the goods cross the customs border, and if this day is not established, on the day the fact of illegal movement is revealed goods across the customs border.

In case of illegal movement of goods across the customs border with false declaration, customs duties and taxes are subject to payment in amounts corresponding to the amounts of customs duties and taxes that would be payable on the basis of reliable information when placing such goods under the declared customs procedure on the day of registration of the customs declaration by the customs authority , submitted to place goods under a customs procedure, with the exception of the customs procedure of customs transit. In this case, the amounts of customs duties and taxes actually paid during customs declaration are not paid (collected) again, and the amounts of customs duties and taxes that were overpaid (collected) are subject to refund in accordance with this Code.

6. Customs duties and taxes for the illegal movement of goods across the customs border are calculated in accordance with this chapter.

If determining the amounts of customs duties and taxes payable is impossible due to failure to provide the customs authority with accurate information about the nature of the goods, their name, quantity, country of origin and customs value, the amounts of customs duties and taxes are determined based on the highest rates of customs duties, taxes, and also the quantity and (or) value of goods that can be determined on the basis of available information.

When accurate information about the goods is subsequently established, the overpaid or overcharged amounts of customs duties and taxes are returned, or the unpaid amounts are recovered in accordance with Chapters 13 and 14 of this Code.

What it is?

Export duties are taxes collected when goods are exported.

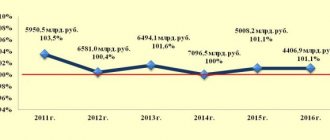

Their main task: replenishing the state treasury. Foreign products imported into the territory of the Russian Federation are not subject to these duties; they are subject to import customs duties of the Customs Union. Duty rates are set by government bodies of member countries of the Eurasian Economic Union (EAEU). And the rules for calculating duties are established by the Customs Code of the Customs Union. If a situation arises that is not described by the Code, the laws of the state gain authority.

Taxes on the export of goods are usually imposed for a certain period of time to adjust the balance of trade of the country.

Export duties are usually imposed on raw materials:

- charcoal;

- wooden products and, in fact, wood;

- crude oil and its products;

- ethyl undenatured alcohol.

The Law of the Russian Federation “On Customs Tariffs” establishes the legal basis for the imposition of customs duties. The Customs Code of the Russian Federation establishes the procedure for calculating customs duties. Changes in export duty rates are controlled by the Government of the Russian Federation.

Export duties are taxes collected when goods are exported.

Having a problem? Call our customs specialist:

Moscow and region (call is free)

Saint Petersburg

Benefits for export customs duties

Benefits in foreign trade activities are aimed at providing certain trade participants with more favorable conditions relative to others. Customs benefits may be:

- exemption from customs duties;

- a simpler process for passing goods through the customs border or complete exemption from these procedures;

- granting powers to export goods from the country, the transportation of which is prohibited by law, and others.

Tariff benefits are a type of benefits that represent:

- refund of previously paid duties,

- exemption from customs duties,

- reduction of duty rates.

Calculation and rates of export duties

The formula for calculating the export customs duty for the export of goods from Russia depends on the type of its rate. The Russian Law “On Customs Tariffs” establishes III types of rates.

- An ad valorem or value rate is added as a percentage to the customs price of exported products. The amount of customs duties is equal to the product of this rate, expressed as a percentage, and the customs value.

- The specific rate is set in monetary value for the quantity of taxed goods. The monetary unit is the euro.

- The combined rate combines both the cost and numerical values of the exported goods. The amount of the duty is established either by comparing these values or by adding them. This depends on the type of combination bet. The final amount of export tax is determined by comparison using the largest value.

Payment of export duties

Duties are paid by the seller or exporter. The following cases do not fall under this rule:

- The customs authority has established its own requirements for the payment of customs duties;

- Using the postal network to move goods.

Additional customs duties may be calculated by decision of the customs authority after checking the applicant’s data if:

- The entrepreneur provided inaccurate information about the country of manufacture;

- The rules for classifying exported goods according to the Commodity Nomenclature of Foreign Economic Activity were violated;

- The cost or quantity of goods is determined by the customs organization.