TMK EAEU: provision of security to customs

Lyudmila Vladimirovna Drozd, expert on ensuring the fulfillment of tax obligations

On January 1, 2018, the Customs Code of the Eurasian Economic Union (hereinafter referred to as the EAEU Customs Code) came into force. Issues of changes in customs legislation concern many business entities. What innovations does TMK EAEU offer in matters of ensuring the fulfillment of the obligation to pay payments collected by customs authorities?

The EAEU TMK uses the following concepts:

— ensuring the fulfillment of the obligation to pay customs duties and taxes;

— ensuring the fulfillment of the obligation to pay special, anti-dumping, countervailing duties;

— ensuring the fulfillment of the duties of a legal entity operating in the field of customs affairs.

The EAEU TMK determines the cases when it is necessary to ensure the fulfillment of obligations to the customs authorities, the methods and amount of security, and the persons obliged or entitled to provide it.

Let's consider each of the cases when persons carrying out foreign economic activity need to provide customs authorities with security for the fulfillment of the obligation assigned to the EAEU TMK.

Fulfillment of the obligation to pay customs duties and taxes

Clause 1 of Art. 62 TMK of the EAEU determines that fulfillment of the obligation to pay customs duties and taxes is ensured:

- when the deadlines for payment of import customs duties and taxes are changed in the form of deferment or installment plan <*>;

— release of goods before filing a declaration for them <*>;

— release of goods before completion of verification of customs, other documents and (or) information, which cannot be completed within the release time <*>;

- release of goods before receiving the results of the customs examination appointed before release <*>;

— placement of goods under the customs procedure of customs transit for transportation (transportation) through the customs territory of the EAEU <*>;

— placement of goods under the customs procedure of processing outside the customs territory <*>;

— placement of EAEU goods transported from one part of the customs territory of the EAEU to another through the territories of states that are not members of the EAEU and (or) by sea, under the customs procedure of customs transit <*>.

The payer <*> ensures the fulfillment of the obligation to pay customs duties and taxes:

1) money;

2) bank guarantee;

3) guarantee;

4) pledge of property.

The customs representative can provide security for the payer if he jointly and severally bears this responsibility with the payer. In relation to goods placed under the customs procedure of customs transit, security can be provided for the payer by the forwarder and (or) another person who has the right to own, use and (or) dispose of these goods.

The amount of security is determined based on the amounts of customs duties and taxes payable when goods are placed under the customs procedure of release for domestic consumption or the customs procedure of export. This does not take into account tariff preferences and benefits for the payment of import or export customs duties and taxes.

An exception to this rule is the customs procedure of customs transit. In this case, ensuring the fulfillment of the obligation to pay customs duties and taxes is calculated:

- in an amount not less than the amount of customs duties and taxes payable in the EAEU member states through whose territories transportation (transportation) is carried out, as if the goods were placed in these territories under the customs procedure of release for domestic consumption or under the export procedure. In such a situation, tariff preferences and benefits for the payment of import or export customs duties are also not taken into account;

- as the sum of import customs duties and taxes in a fixed amount - 4 euros per 1 kg of gross weight of international postal items when they are placed under the customs procedure of customs transit. Moreover, the gross weight does not include the weight of certain types of written correspondence (aerograms, postcards, letters and items for the blind).

Fulfillment of the obligation to pay special, anti-dumping, countervailing duties

The obligation to pay special, anti-dumping and countervailing duties is ensured in the cases specified in Art. 75 TMK EAEU, including:

- when releasing goods before filing a declaration for them <*>;

— release of goods before completion of verification of customs, other documents and (or) information, which cannot be completed within the time frame for release of goods <*>;

- release of goods before receiving the results of the customs examination appointed before release <*>;

— placement of foreign goods under the customs procedure of customs transit, if this is established by the Eurasian Economic Commission <*>.

Fulfillment of this obligation is ensured by the same methods as when fulfilling the obligation to pay import customs duties and taxes. As a method of execution, the payer can choose money, bank guarantee, surety and property pledge.

The payer of special, anti-dumping and countervailing duties ensures compliance. The customs representative has the right to do this only if he bears a joint and several obligation with the payer to pay special, anti-dumping, and countervailing duties.

The amount of security is determined based on the amounts of special, anti-dumping and countervailing duties payable when goods are placed under the customs procedure of release for domestic consumption. The exception is cases when, in accordance with Art. 75 TMK EAEU a different size is established.

For example, when releasing goods with the features provided for in Art. 121 and 122 TMK of the EAEU, the amount of security for the fulfillment of the obligation to pay special, anti-dumping and countervailing duties is determined as the amount of such duties, which may additionally be subject to payment based on the results of customs control and customs examination.

Ensuring the fulfillment of the duties of a legal entity operating in the field of customs affairs

This term appeared in customs legislation for the first time. Security is provided for the fulfillment of the duties of a legal entity carrying out activities in the field of customs affairs, when such security is a condition for inclusion in the registers of persons carrying out activities in the field of customs affairs <*>.

Ensures the fulfillment of the obligation of a legal entity operating in the field of customs to pay customs duties, taxes, special, anti-dumping, countervailing duties, penalties, interest, in the case where, in accordance with the EAEU TMK, such an obligation arises for this person or when it is his joint one obligation with the payer of customs duties, taxes, special, anti-dumping, countervailing duties.

The fulfillment of the duties of a legal entity operating in the field of customs affairs is ensured by money, a bank guarantee, a surety and a pledge of property.

To be included in the register of customs representatives, a legal entity must provide security for the performance of its duties in an amount equivalent to at least 500,000 euros <*>.

The amount of security for inclusion in the register of customs carriers is equivalent to 200,000 euros <*>.

To be included in the register of authorized economic operators with the issuance of a certificate of the first type, security is provided in an amount equivalent to at least 1 million euros <*>.

To be included in the register of authorized economic operators with the issuance of a certificate of the second type, it is necessary to provide security for the performance of duties in an amount equivalent to at least 150,000 euros, if the financial stability of a legal entity of a member state of the EAEU engaged in the production and (or) export of goods does not correspond to the value , determined on the basis of the Procedure for determining the financial stability of a legal entity applying for inclusion in the register of authorized economic operators, and the values characterizing financial stability and necessary for inclusion in this register, approved by Decision of the Council of the Eurasian Economic Commission dated September 15, 2017 N 65 <*>.

The EAEU TMK contains the following general rules regarding the provision of security for the fulfillment of the obligation to pay customs duties, taxes, special, anti-dumping, countervailing duties, as well as the obligations of a legal entity operating in the field of customs:

1) the payer has the right to choose any of the methods specified in clause 1 of Art. 63 TMK EAEU;

2) fulfillment of the obligation can be ensured in several ways at the choice of the payer;

3) the payer has the right to replace one method of securing the fulfillment of an obligation with another if the security is not foreclosed on;

4) fulfillment of the obligation to pay customs duties, taxes, special, anti-dumping, countervailing duties must be ensured continuously until its termination in accordance with the EAEU Labor Code.

The fulfillment of the duties of a legal entity carrying out activities in the field of customs affairs must be ensured continuously during the period of implementation of this activity.

5) the validity period of the security for the fulfillment of the obligation to pay customs duties, taxes, special, anti-dumping, countervailing duties in the form of a bank guarantee, surety, pledge of property, including that provided in exchange for previously accepted by the customs authority, must be sufficient for the timely sending by the customs authority to the person, who ensured the fulfillment of such an obligation, the requirements for the fulfillment of obligations accepted within the framework of these methods.

Calculation, terms, payment procedure and security for payment of customs duties

| Workshop | / For legal entities |

The calculation of customs duties and taxes is carried out by payers independently, with the exception of the amounts of those customs duties and taxes that are subject to collection. In this case, the calculation is made by the customs authority.

The calculation is made in the currency of the CU member country to whose customs authority the declaration was submitted. An exception may be cases provided for by the norms of international treaties.

The amount of customs duty is determined using the basis for calculating duties and when applying a certain type of customs duty rate (hereinafter referred to as the rate).

The basis for determining the amount of taxes that are subject to payment (collection) when goods are placed under a customs procedure or in the event of detection of illegal movement of goods on the territory of the Russian Federation is the legislation of the Russian Federation.

When goods are placed under the customs transit procedure, customs payments are calculated based on the requirements of the legislation of the CU member country whose customs authority released the goods, and if these goods are located on the territory of another member country - the legislation of that state.

But it must be taken into account that the total amount of customs duties in relation to foreign goods cannot exceed the amount of customs duties that were paid in the case of the release of these goods for domestic use without taking into account benefits. This amount can only increase as a result of a change in the customs procedure applied to goods and, as a consequence, a change in duty rates.

Import duties are calculated based on the rates that were in effect at the time of registration of the declaration by the customs authority and based on the Unified Customs Tariff (UCT). CCT is a set of duty rates that apply to goods imported into the territory of the Customs Union from third countries. An increase or decrease in rates relative to the ETT occurs based only on the decision of the Customs Union Commission. The Commission makes its decision to apply different rates based on a proposal from one of the participating countries, which must be justified. The use of higher rates may be proposed if necessary for the development of the economy of the participating country. The use of a lower one is to eliminate an acute shortage of goods if the shortage cannot be eliminated in any other way.

When calculating export rates, each participating country applies its own legislation. But, to facilitate the collection of export duties, each country has compiled a list of goods in respect of which export duties are subject to application, and the CU Commission, based on national lists, has compiled a consolidated list of such goods.

When calculating taxes, each participating country applies its own legislation. According to the legislation of the Russian Federation, the basis for calculating taxes can be: placing goods under a customs procedure or identifying the fact of illegal movement of goods on the territory, identifying transit goods that are placed under the customs transit procedure in another country - a member of the Customs Union, but are located on the territory of the Russian Federation illegally.

When calculating the amounts of customs duties, foreign currency is converted into rubles at the official exchange rate of the Central Bank of the Russian Federation, which was established at the time of registration of the customs declaration.

The obligation to pay customs duties may arise in relation to goods that:

— illegally moved across the border of the vehicle; — arrived at the customs territory of the Customs Union; — loss from the customs territory of the Customs Union (foreign goods); — are in temporary storage; — issued before filing a customs declaration; — are released or placed under the customs procedure of release for domestic consumption; — are released or placed under the customs export procedure; — are under the customs procedure of customs transit; — are under the customs procedure of a customs warehouse; — are under the customs procedure of processing within the customs territory or outside the customs territory; — are under the customs procedure of processing for domestic consumption; — are under the customs procedure of temporary import or export; — are under the customs procedure of re-export; — are under the customs procedure of duty-free trade (foreign); - imported for personal use.

Cases of termination of the obligation to pay customs duties are listed in paragraph 2 of Article 80 of the Customs Code of the Customs Union.

Customs duties are not paid:

— when placing goods under a customs procedure that does not provide for the payment of duties (if the conditions of this procedure are met); - when imported by one sender to one address of one recipient by one vehicle under one transportation document of goods, the total customs value of which does not exceed the equivalent of 200 euros. The total customs value of goods that are imported for personal use and may be exempt from duties may exceed this amount; — when moving goods for personal use in accordance with the Agreement dated June 18, 2010 “On the procedure for individuals moving goods for personal use across the customs border of the Customs Union and performing operations related to their release”; — when goods are exempt from duties in accordance with the requirements of the Labor Code of the Customs Union, the legislation of the Russian Federation or international treaties.

Also, the obligation to pay customs duties may arise and cease when a customs warehouse procedure or a special customs procedure is established in relation to the goods.

In case of illegal movement of goods, the obligation to pay customs duties arises among the persons who took part in the movement jointly and severally.

When setting payment deadlines, the following may apply:

— norms of the Customs Code of the Russian Federation; — norms of international treaties; — norms of the legislation of the Russian Federation.

In accordance with the norms of the Customs Code of the Customs Union, the deadlines for payment of customs duties are established in the following cases:

— in case of illegal movement of goods; — upon arrival of goods into the customs territory; — upon departure of goods from the customs territory; — during temporary storage of goods; — when releasing goods before submitting a customs declaration; — when placing goods under the customs procedure of release for domestic consumption; — when placing goods under the customs export procedure; — when placing goods under the customs procedure of customs transit; — when placing goods under the customs procedure of a customs warehouse; — when placing goods under the customs procedure of processing on or outside the customs territory; — when placing goods under the customs procedure of processing for domestic consumption; — when placing goods under the customs procedure of temporary import (admission) or temporary export; — when placing goods under the customs procedure of duty-free trade; — when importing goods for personal use; — for temporary import of vehicles of international transportation. — When establishing payment deadlines, international agreements come into force in the following cases: — when goods are placed under the customs procedure of a free customs zone; — when placing goods under the customs procedure of a free warehouse.

The legislation of the Russian Federation establishes deadlines for payment of customs duties in respect of goods placed under a special customs procedure.

The legislation of the Customs Union allows for changes in the deadlines for payment of customs duties . A change in payment deadlines may be provided in the form of a deferment or installment plan for goods that are placed under the customs procedure of import for internal use. Changes in the deadlines for payment of customs duties may be granted for the entire amount of customs duties, or for part of them. On the territory of the Russian Federation, the decision to change the payment deadlines is made by the Federal Customs Service of the Russian Federation within 15 days from the date the payer submits a written application. The decision on the change is provided to the applicant in writing.

For a positive result upon consideration, the application must contain the following data:

- about the payer; — about the names of goods; — about the details of a foreign trade (international) agreement; — with the grounds for granting a change in payment; — with the amount of the duty in respect of which the change is requested; — the period for which the change is requested; — about the repayment schedule (in case of installment plans); - about the existence of facts that may become grounds for refusing to grant a change.

The change in payment deadlines is regulated in more detail by the Agreement of May 21, 2010 “On the grounds, conditions and procedure for changing the deadlines for payment of customs duties . ” Art. 6 of this agreement contains a list of factors that may be the basis for granting a change in payment deadlines.

The following factors may be grounds for refusing to change the payment deadline:

— the applicant has arrears in payment of duties; — bankruptcy proceedings have been initiated against the applicant; - a criminal case has been initiated against the applicant for a crime in the customs sphere; — lack of necessary documents and data.

The maximum possible period for changing payment is 6 months, but for certain groups of goods this period cannot exceed 2 months. (subclause 3, clause 1, article 6 of the Agreement).

In accordance with the norms of the Labor Code of the Customs Union, the state has the right to charge interest for the granted change in payment deadlines.

Customs duties are paid in the country whose customs authority released the goods. The exceptions are goods that are under the customs procedure of customs transit and goods that were illegally moved across the border of the Customs Union.

The date and forms of payment of customs duties are regulated by the legislation of the Russian Federation. Payment is made to the account of the Federal Treasury (FC) of the Russian Federation in rubles. Duties or taxes on goods of individuals that are imported for personal use may be paid to the cash desk of the customs authority. To simplify the payment of customs duties, the legislation of the Russian Federation provides for a centralized procedure for the payment of duties , in which the amounts of customs duties for goods intended to be imported or exported over a certain period are deposited into the FC account. In this case, the customs authority to which the declaration will be submitted does not matter.

To carry out centralized payment, the payer is obliged to enter into an agreement on the application of a centralized procedure for the payment of customs duties with the Federal Customs Service or another customs authority, the list of which is determined by the Federal Customs Service. At the same time, the requirements for a payer entering into an agreement with the Federal Customs Service and the requirements for a payer entering into an agreement with another customs authority are different. The list of requirements that the payer must meet is specified in clause 10 and clause 11, Article 116 of the Federal Law “On Customs Regulation in the Russian Federation”. The agreement on the application of a centralized procedure for the payment of customs duties is concluded for the current calendar year.

Payment of customs duties is possible using ATMs, electronic or payment terminals.

Customs import duties and taxes are subject to distribution among the CU member countries. The procedure for the distribution of duties is regulated by the Agreement of May 20, 2010 “On the establishment and application in the Customs Union of the procedure for crediting and distribution of import customs duties (other duties, taxes and fees having an equivalent effect).”

To fulfill obligations to pay duties, the Customs Union legislation provides for ensuring the payment of customs duties . Security for payment of customs duties is required when:

— transportation of goods under the customs procedure of customs transit; — changing payment deadlines (if provided for by the legislation of the Customs Union); — placement of goods under the customs procedure of processing outside the customs territory; — release of goods before receiving customs examination (if such examination was carried out); — other cases provided for by the legislation of the Customs Union, the Russian Federation or international treaties.

Security for payment is not required if the amount of customs duties and interest does not exceed an amount equivalent to 500 euros (or other cases provided for by the legislation of the Customs Union, the Russian Federation or international treaties),

Payment is ensured by the payer, and during the customs transit procedure, by another person who has the right to own, dispose of or use the goods.

Payment security is provided in:

— the customs authority that releases the goods; — customs authority of departure or destination during the customs transit procedure; - another customs authority that has the right to accept general security for payment in the case of using this type of security.

When providing security for payment, the customs authority is obliged to issue a certificate of security for payment of customs duties and taxes.

General security is applied in the event that one person carries out several customs operations on the territory of the Russian Federation over a certain period of time. The customs authority that accepted such security is obliged to issue a confirmation of the provision of general security for payment and monitor it. The basis for issuance is a written application from the payer. General security can be provided in money, in the form of a guarantee or a bank guarantee. General security is provided for a period of at least 1 year.

Payment of customs duties can be ensured:

- money; — bank guarantee; — guarantee; - pledge of property.

If the obligation to pay is fulfilled or this obligation does not arise, the person who provided the security has the right to return this security.

A bank guarantee on the territory of the Russian Federation has the right to be provided by credit or banking organizations that are included in the Register of organizations that have the right to issue bank guarantees for the payment of customs duties and taxes. This Register is maintained by the Federal Customs Service.

The guarantee amount is determined on the basis of the amounts of customs duties that are payable when placing the goods under the customs procedure of export or release for internal use in accordance with the requirements of the legislation of the Russian Federation. Tariff preferences and benefits are not taken into account. The amounts of guarantees for goods under the customs transit procedure must be no less than the amounts that can be accrued in accordance with the requirements of the laws of other countries participating in the Customs Union.

If it is impossible to determine the exact amount of security, such amount is calculated based on the maximum rates of customs duties on value and physical characteristics.

Certain groups of goods may have fixed payment security amounts.

When releasing goods before the end of an additional customs inspection (if one is carried out), the amounts of payment guarantees are calculated taking into account all amounts of customs duties that may be additionally accrued as a result of the inspection.

The Customs Code of the Customs Union provides for the possibility of providing benefits when paying customs duties . Benefits include:

— tariff preferences; — tariff benefits (benefits for payment of duties); — tax benefits; — benefits on the payment of customs duties.

Additionally on the topic:

Basics of customs payments. Customs duties, advance payments, VAT, excise tax. Benefits when paying customs duties, tariff preferences

Refund of overpaid duties and taxes and collection of customs duties

Need some advice?

Ready-made solution for your business from CustomsExpert Consulting

When using publication materials, an active hyperlink to https://customsexpert.ru is required.

| Tweet |

Disqus commenting system

For the purposes of calculating corporate income tax, the amounts of customs duties and fees are subject to accounting as part of other expenses on the date of their accrual. This follows from subparagraph 1 of paragraph 1 of Article 264 and subparagraph 1 of paragraph 7 of Article 272 of the Tax Code.

In a published letter, the Russian Ministry of Finance explained when, using the accrual method, it is necessary to include export customs duties paid under a temporary customs declaration in expenses that reduce taxable profit.

Features of declaration

It happens that a company that exports goods of such an association of states from the customs territory of the Customs Union cannot provide accurate information about the quantity and (or) customs value in relation to these values. Then she has the right to submit a temporary customs declaration.

However, after the actual export of goods from the specified territory, it must submit one or more complete and properly completed customs declarations for all exported products. This is provided for in paragraphs 1 and 5 of Article 214 of the Federal Law of November 27, 2010 No. 311-FZ (hereinafter referred to as Law No. 311-FZ).

The emergence of an obligation to pay duties

When does the obligation to pay export customs duties arise? According to the clarifications of the Russian Ministry of Finance in a published letter, it appears to the declarant from the moment the customs authority registers both a temporary and a full declaration for goods. Moreover, in both cases, duties are paid based on the rates that were in effect on the day of registration of the temporary declaration for goods. The basis is paragraphs 8 and 12 of Article 214 of the mentioned law.

Accounting for duties paid under a temporary declaration

Expenses in the form of customs duties paid under a temporary customs declaration are taken into account when calculating the base for corporate income tax based on the date of preparation of these reports. This conclusion was made by financial department specialists in the commented letter based on the above-mentioned provisions of the Tax Code and Law No. 311-FZ.

Additional payment and refund of duties

According to paragraph 6 of Law No. 311-FZ, in a temporary declaration it is allowed to state information based on:

- intentions to export an approximate amount of goods;

- conditional customs value (assessment). It is determined according to the quantity of goods planned for movement across the customs border of the Customs Union;

- the consumer properties of goods provided for by the terms of the foreign economic transaction and the procedure for determining their price on the day of filing the temporary declaration.

Let's assume that the declaring company clarified this information. As a result, the amount of export customs duties payable has increased. Then, when submitting a full company declaration, you need to:

- make an additional payment of this amount (clause 12 of Law No. 311-FZ);

- adjust previously recorded expenses upward.

If, as a result of clarification of the information mentioned, the amount of export customs duties has decreased, then on the date of registration of the full customs declaration, the company should reduce the previously recorded expenses in the form of export customs duties.

According to the clarifications of the Ministry of Finance of Russia in letters dated 04/06/2011 No. 03-03-06/1/218, dated 04/04/2011 No. 03-03-06/1/208, income (expenses) in the form of additional charges (reductions) of customs duties are reflected in the period of their occurrence, that is, during the period of filing a full customs declaration.

The amount of additional duties charged is reflected in other expenses.

Note that the company can return amounts overpaid to the budget. To do this, she needs to submit an application to the customs authority accompanied by a number of documents. Among them:

- payment document confirming payment of customs duties subject to refund;

- documents confirming the accrual and excess payment of these mandatory payments.

Refund of overpaid export customs duties, at the request of the payer, can be made in the form of an offset against the fulfillment of obligations to pay:

- customs duties, taxes, penalties, interest;

- import customs duties.

Moreover, offset of overpaid import customs duties against the fulfillment of the obligation to pay export customs duties and taxes is not allowed (Article 147 of Law 311-FZ).

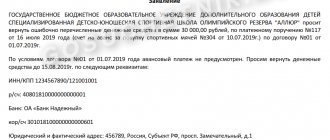

The application form for refund (offset) was approved by Order of the Federal Customs Service of Russia dated December 22, 2010 No. 2520.

Refunds are made by decision of the customs authority. It is drawn up in accordance with the form approved by Order of the Federal Customs Service of Russia dated May 3, 2011 No. 898.

Income in the form of a reduction or refund of accrued customs duties is taken into account in accordance with the provisions of Article 250 of the Tax Code of the Russian Federation as non-sales income.

Reflection on accounting accounts

To calculate export customs duties, an entry is made in accounting to the debit of account 90 subaccount “Customs duties” and the credit of account 68 subaccount “Calculations for customs duties” or 76 subaccount “Calculations for customs duties”.

Example

CJSC PrimaExpo entered into an agreement with a foreign company for the supply of chairs. The company transferred customs duties in the amount of 3,000 rubles on January 29.

The accountant of JSC PrimaExpo made the following entries:

January 29

Debit 90 subaccount “Customs duties” Credit 76 subaccount “Calculations for customs duties”

– 3000 rub. – customs duty has been charged;

Debit 76 subaccount “Calculations for customs duties” Credit 51

– 3000 rub. – customs duties have been paid.

Account 76 subaccount “Calculations for customs duties” is more convenient to use for those who first pay duties on a temporary customs declaration, then make adjustments due to clarification of information.

Eurasian Economic Commission

Article 82. Deadlines for payment of customs duties and taxes1. The deadlines for payment of customs duties and taxes are established by Articles 81, 161, 166, 172, 197, 211, 214, 227, 228, 237, 250, 261, 274, 283, 290, 300, 306, 344 and 360 of this Code.

2. Deadlines for payment of customs duties and taxes are established in accordance with:

1) international treaties of the member states of the customs union - when establishing customs procedures in accordance with paragraph 2 of Article 202 of this Code;

2) the legislation of the member states of the customs union - when establishing a customs procedure in accordance with paragraph 3 of Article 202 of this Code.

3. The deadlines for payment of customs duties and taxes in relation to goods, the specifics of customs declaration of which in accordance with Article 194 of this Code are determined by the legislation of the member states of the customs union, are established by the legislation of such a member state of the customs union.

Article 83. Changes in deadlines for payment of customs duties and taxes

1. Changes in the deadlines for payment of customs duties and taxes are made in the form of a deferment or installment plan.

2. The grounds, conditions and procedure for changing the deadlines for payment of customs duties are determined by an international agreement of the member states of the customs union.

The grounds, conditions and procedure for changing the deadlines for paying taxes are determined by the legislation of the member state of the customs union to whose budget taxes are payable.

Article 84. Procedure for payment of customs duties and taxes

1. Customs duties and taxes are paid (collected) in the member state of the customs union whose customs authority releases goods, with the exception of goods released under the customs procedure of customs transit, or on the territory of which the fact of illegal movement of goods across the customs border has been revealed.

2. In the event of an obligation to pay customs duties and taxes in relation to goods placed under the customs procedure of customs transit, customs duties and taxes are payable in the member state of the customs union whose customs authority released the goods in accordance with the customs procedure of customs transit, if otherwise is not established by part two of this paragraph.

When it is established (confirmed) in the manner determined by the international treaty of the member states of the customs union that goods placed under the customs transit procedure are located on the territory of another member state of the customs union, customs duties and taxes are payable in this member state of the customs union .

3. Customs duties and taxes are paid in the currency of the member state of the customs union in which customs duties and taxes are payable.

4. Forms of payment of customs duties and taxes and the moment of fulfillment of the obligation to pay them (date of payment) are determined by the legislation of the member states of the customs union in which customs duties and taxes are subject to payment.

5. Paid (collected) amounts of import customs duties are subject to crediting and distribution among the member states of the customs union in the manner established by the international treaty of the member states of the customs union.

6. The procedure for paying export customs duties is established by an international agreement of the member states of the customs union.

7. If there are funds (money) in the payer’s account, the bank has no right to delay the execution of the payer’s order to transfer amounts of customs duties and taxes and is obliged to execute it within one business day.

Customs payments, customs value and origin of goods

Customs payments,

special, anti-dumping, countervailing duties

Basic issues of application of customs duties, special, anti-dumping, countervailing duties when moving goods across the customs border of the Eurasian Economic Union (hereinafter referred to as the Union) are determined by the Customs Code of the Eurasian Economic Union (hereinafter referred to as the EAEU Customs Code).

Customs payments in accordance with Article 46 of the EAEU Labor Code include:

1) import customs duty;

2) export customs duty;

3) value added tax levied when importing goods into the customs territory of the Union;

4) excise taxes (excise tax or excise duty) levied when importing goods into the customs territory of the Union;

5) customs duties.

Legal regulation of the application of customs duties and taxes is carried out in accordance with Chapters 6-11 of the EAEU Labor Code, which establish:

payers of customs duties and taxes, cases and circumstances in which the obligation to pay customs duties and taxes arises and is terminated, the procedure for fulfilling such obligations, cases when customs duties and taxes are not paid, the timing and procedure for paying customs duties and taxes, including terms and grounds for granting deferment/installment plan for payment of import customs duties;

general issues of applying security for the fulfillment of the obligation to pay customs duties, taxes, collection of customs duties, taxes, cases of refund of amounts of customs duties, taxes, conditions for the return (offset) of amounts of overpaid and (or) excessively collected customs duties, taxes, etc.

The application of special, anti-dumping, and countervailing duties is regulated by Chapter 12 of the EAEU Labor Code.

Features of the application of customs duties, taxes, special, anti-dumping, countervailing duties when performing customs operations related to the arrival of goods into the customs territory of the Union, their departure from the customs territory of the Union, temporary storage of goods, their customs declaration and release, as well as the performance of other customs operations , are defined within the framework of the relevant articles of the EAEU Customs Code, which establish the procedure for performing customs operations and customs procedures.

In accordance with the EAEU Labor Code, the regulation of certain aspects of the application of customs duties, taxes, special, anti-dumping, and countervailing duties is within the competence of the Eurasian Economic Commission and the legislation of the member states of the Union (hereinafter referred to as the member states). In particular, the legislation of the member states determines the types and rates of customs duties, the procedure for refunds, collection of customs duties, special, anti-dumping, countervailing duties, the application of penalties, etc.

Import and export customs duties, taxes, customs duties, anti-dumping, countervailing, and special duties have a different nature and, as a result, significant features of legal regulation.

Import duties

Import customs duty, representing a mandatory payment levied by the customs authorities of the member states in connection with the import of goods into the customs territory of the Union (clause 2 of Article 25 of the Treaty on the Eurasian Economic Union of May 29, 2014), is an instrument of customs tariff regulation of foreign trade activities. In the context of the functioning of the Union, the Common Customs Tariff (hereinafter referred to as the EAEU CCT) and other unified measures for regulating foreign trade with third countries (Treaty on the Eurasian Economic Union of May 29, 2014) (hereinafter referred to as the Union Treaty) are established and applied.

The legal aspects of the establishment and calculation of import customs duties, as well as the determination and application of tariff benefits are regulated by the Treaty on the Union, which establishes the procedure for the formation of the EAEU CCT, the types of rates of import customs duties, the application of tariff benefits (in the form of exemption or reduction of rates), the procedure for the application of duty rates depending on the origin of the goods.

The EAEU CCT is a set of rates of customs duties applied to goods imported (imported) into the customs territory of the Union from third countries, systematized in accordance with the unified Commodity Nomenclature for Foreign Economic Activity of the Eurasian Economic Union (hereinafter -

Commodity Nomenclature of Foreign Economic Activity of the EAEU). Rates of import customs duties are established by the Commission (Decision of the Council of the Eurasian Economic Commission dated July 16, 2012 No. 54).

The EAEU CCT import customs duty rates apply to goods imported into the customs territory of the Union and originating from any country (including the origin of which has not been established), except for cases provided for in accordance with the Treaty on the Union, as well as cases when, in accordance with with international agreements within the Union or international agreements of the Union with a third party, rates different from the EAEU CCT rates are applied to calculate import customs duties.

The following types of import customs duty rates are applied in the EAEU CCT:

1) ad valorem, calculated as a percentage of the customs value of taxable goods;

2) specific, charged per unit of taxable goods;

3) combined, combining ad valorem and specific components.

The application of import customs duty rates depends on the origin of the goods.

The Union applies a unified system of tariff preferences for goods originating from developing and (or) least developed countries.

The regulations on the conditions and procedure for applying the unified system of tariff preferences of the Eurasian Economic Union were approved by Decision of the Council of the Eurasian Economic Commission dated April 6, 2016 No. 47.

The list of developing countries - users of the unified system of tariff preferences of the Union and the list of least developed countries - users of the unified system of tariff preferences of the Union are determined by the Commission (Decision of the Commission of the Customs Union of November 27, 2009 No. 130 “On the unified customs and tariff regulation of the Eurasian Economic Union”).

The list of goods originating from developing countries or from least developed countries, in respect of which tariff preferences are provided when imported into the customs territory of the Eurasian Economic Union, was approved by Decision of the Council of the Eurasian Economic Commission dated January 13, 2021 No. 8.

In relation to preferential goods imported into the customs territory of the Union, originating from developing countries - users of the unified system of tariff preferences of the Union, import customs duty rates are applied in the amount of 75 percent of the EAEU UCT import customs duty rates.

In relation to preferential goods imported into the customs territory of the Union, originating from least developed countries - users of the unified system of tariff preferences of the Union, zero rates of import customs duties of the EAEU CCT are applied.

In addition, tariff preferences are provided for goods imported from countries with which the Union (member state) applies a free trade regime in trade and economic relations (currently the Union has agreements with Vietnam and Iran, and member states also agreements within the CIS and with Serbia).

The customs duty is calculated based on the base for calculating the customs duty and the corresponding customs duty rate established for the goods (Article 53 of the EAEU Labor Code). Thus, for the correct determination of the amount of customs duty payable, the correct classification of goods, the correct determination of the origin of goods and the reliable determination of the base for calculating customs duties - the customs value and (or) other characteristics of the goods - are extremely important.

In accordance with paragraph 4 of Article 49 of the EAEU Labor Code, tariff preferences can be restored in cases and subject to the conditions determined by the Decision of the Council of the Eurasian Economic Commission dated February 22, 2021 No. 64.

Tariff benefits may be applied to goods imported (imported) into the customs territory of the Union in the form of exemption from payment of import customs duties or a reduction in the rate of import customs duties. Tariff benefits cannot be individual in nature and are applied regardless of the origin of the goods.

The provision of tariff benefits is carried out in accordance with Appendix No. 6 to the Treaty on the Union. Tariff benefits in the form of exemption from import customs duties are provided in relation to goods imported (imported) into the customs territory of the Union from third countries, listed in Section II of this Annex. Tariff benefits may be provided in other cases established by the Treaty on the Union, international treaties of the Union with third parties, and decisions of the Commission. Such tariff benefits were established by the Decision of the Customs Union Commission dated November 27, 2009 No. 130 “On unified customs and tariff regulation of the Eurasian Economic Union.” The procedure for applying exemption from customs duties when importing certain categories of goods into the customs territory of the Union is determined by Decision of the Customs Union Commission dated July 15, 2011 No. 728.

The procedure for paying import customs duties is regulated by Chapter 8 of the EAEU Labor Code, taking into account the norms established by the Protocol on the procedure for crediting and distributing amounts of import customs duties (other duties, taxes and fees having an equivalent effect), their transfer to the budgets of the member states (Appendix No. 5 to the Treaty of the Union).

Export customs duties

The establishment of export customs duty rates is at the level of national legislation of the member states. The procedure for calculating and paying export customs duties is regulated by the EAEU Customs Code, and in the part not regulated by the customs legislation of the Union - by the legislation of the Member States.

In relation to crude oil and certain categories of goods produced from oil exported from the territory of the Republic of Belarus, a special procedure for payment and crediting of export customs duties has been established (Agreement on the procedure for payment and crediting of export customs duties (other duties, taxes and charges having equivalent effect) under export from the territory of the Republic of Belarus outside the customs territory of the Customs Union of crude oil and certain categories of goods produced from oil dated December 9, 2010 (with amendments and additions).

Relevant acts of the Member States establish export customs duty rates in terms of classification of goods in accordance with the EAEU Commodity Classification for Foreign Economic Activity. For goods subject to export customs duties, ad valorem, specific and combined rates of export customs duties are applied. Accordingly, the correct determination of the amount of export customs duty payable is directly related to the correct classification of goods and a reliable determination of the basis for calculating customs duties - the customs value and (or) other characteristics of the goods.

Excise taxes, value added tax

The establishment, introduction and application of excise taxes and VAT levied when importing goods into the customs territory of the Union are regulated by the laws of the Union member states.

Acts of legislation of the Member States establish tax rates, the procedure for determining the tax base for calculating taxes, tax benefits, and the procedure for determining the amount of taxes to be paid.

At the same time, the specifics of the application of taxes in accordance with the declared customs procedure are regulated by the EAEU Customs Code.

Customs duties

Customs duties are mandatory payments levied for customs authorities performing customs operations related to the release of goods, customs escort of vehicles, as well as for performing other actions established by the EAEU Customs Code and (or) the legislation of the Member States on customs regulation.

The types and rates of customs duties are established by the legislation of the Member States.

The amount of customs duties cannot exceed the approximate cost of the customs authorities' expenses for performing actions in connection with which customs duties are established.

Payers of customs duties, objects of taxation by customs duties, the basis for calculating customs duties, the emergence and termination of the obligation to pay customs duties, deadlines for paying customs duties, the procedure for their calculation, payment, collection and return (offset), as well as cases when customs duties are not paid, established by the legislation of the Member States.

Anti-dumping, countervailing, special duties

In addition to customs payments, customs authorities collect special, anti-dumping and countervailing duties established by the Treaty on the Union (Protocol on the application of special protective, anti-dumping and countervailing measures in relation to third countries (Appendix No. 8 to the Treaty on the Union).

The application of such duties is carried out in accordance with Chapter 12 of the EAEU Labor Code. At the same time, the procedure for the crediting and distribution of special, anti-dumping and countervailing duties is established by the Regulations on the crediting and distribution of special, anti-dumping, countervailing duties (Appendix to Appendix No. 8 to the Treaty on the Union).

Customs value of goods

The customs value of imported goods is determined according to the methods for determining customs value established by Chapter 5 of the EAEU Labor Code.

The declaration of the customs value of imported goods is carried out by the declarant or a customs representative when declaring the goods to the customs authority. Cases of filling out a declaration of customs value, forms of a declaration of customs value, as well as the procedure for filling out a declaration of customs value are established by the Decision of the Board of the Eurasian Economic Commission dated October 16, 2021 No. 160 “On cases of filling out a declaration of customs value, approval of forms for a declaration of customs value and the Procedure for filling out a declaration of customs value” (came into force on 07/01/2019).

Control of the customs value of goods is carried out by the customs authority as part of the verification of customs, other documents and (or) information, begun before the release of goods in accordance with Article 325 of the EAEU Labor Code. The specifics of customs control of the customs value of goods are determined by Article 313 of the EAEU Labor Code.

Other features of control of the customs value of goods imported into the customs territory of the Union, including signs of unreliable determination of the customs value of goods, grounds for recognizing information on the customs value of goods as unreliable, are determined by the Decision of the Board of the Eurasian Economic Commission dated March 27, 2018 No. 42 “On the peculiarities of customs clearance control of the customs value of goods imported into the customs territory of the Eurasian Economic Union."

The customs value of goods exported from the customs territory of the Eurasian Economic Union is determined in accordance with the legislation of the member state of the Eurasian Economic Union, to whose customs authority the customs declaration of goods is carried out.

Origin of goods

The origin of a product is the belonging of a product to a country (a group of countries, or a customs union of countries, or a region or part of a country) in which the product was fully received or produced, or subjected to sufficient processing (in accordance with certain criteria).

The origin of goods is determined for the purposes of applying customs tariff regulation measures, measures to protect the internal market, prohibitions and restrictions, establishing requirements for marking the origin of goods, and maintaining statistics on foreign trade in goods.

The main block of rules governing the origin of goods in the EAEU Customs Code is concentrated in Chapter 4 “Origin of goods”.

In this case, Chapter 4 can be divided into two parts.

The first part is general questions of origin, regulated in Articles 28-31. These include basic provisions related to indicating by what rules it is necessary to determine the origin of goods (Article 28), in what cases it is necessary to confirm the origin of goods (Article 29), and what documents are necessary to confirm the origin of goods (Articles 30-31).

The second part of Chapter 4 deals with issues related to the use of the mechanism of preliminary decisions on the origin of goods - the procedure for their acceptance, requirements for an application for a preliminary decision, regulation of deadlines, and so on (Articles 32-36).

The form of a preliminary decision on the origin of goods imported into the customs territory of the Eurasian Economic Union, the procedure for filling it out, as well as the procedure for making changes (additions) to the preliminary decision on the origin of goods adopted by the customs authority were approved by the Decision of the Board of the Eurasian Economic Commission dated January 16, 2021 No. 7 .

Customs control of the origin of goods is carried out by customs authorities as part of the verification of customs and other documents and (or) information in accordance with Article 324 of the EAEU Customs Code. At the same time, the features of customs control of the origin of goods are determined by Article 314 of the EAEU Customs Code.

Determination of the origin of goods imported into the customs territory of the EAEU is carried out according to the rules provided for in accordance with the Treaty on the EAEU (Article 37). In this case, the choice of rules depends on the purposes for which the origin of goods is determined in a particular case.

If the origin of goods is determined for the purposes of applying measures to protect the domestic market, prohibitions and restrictions, customs tariff regulation measures (except for the purposes of providing tariff preferences), establishing requirements for marking the origin of goods, maintaining statistics on foreign trade in goods, then the Rules for Determining Origin are applied goods imported into the customs territory of the Eurasian Economic Union (non-preferential rules for determining the origin of goods), approved by Decision of the Council of the Eurasian Economic Commission dated July 13, 2021 No. 49.

If the origin of goods is determined for the purposes of providing tariff preferences for goods imported into the customs territory of the EAEU from developing or least developed countries - users of the unified system of tariff preferences of the EAEU, the Rules for determining the origin of goods from developing and least developed countries, approved by the Decision of the Council, are applied Eurasian Economic Commission dated June 14, 2021 No. 60.

If the origin of goods is determined for the purpose of providing tariff preferences for goods imported into the customs territory of the EAEU from states with which the EAEU applies a free trade regime in trade and economic relations, the rules for determining the origin of goods established by the relevant international treaty of the EAEU with a third party are applied , providing for the application of a free trade regime.

Such agreements currently include:

– Free Trade Agreement between the Eurasian Economic Union and its member states, on the one hand, and the Socialist Republic of Vietnam, on the other hand, dated May 29, 2015, containing, among other things, the rules for determining the origin of goods used for the purpose of providing tariff preferences under this agreement (Chapter 4);

– Interim agreement leading to the formation of a free trade area between the Eurasian Economic Union and its member states, on the one hand, and the Islamic Republic of Iran, on the other hand, dated May 17, 2021, containing, among other things, rules for determining the origin of goods , used for the purposes of providing tariff preferences under this agreement (Chapter 6).

In addition, in accordance with the transitional provisions established by paragraph 1 of Article 102 of the Treaty on the EAEU, EAEU member states have the right to unilaterally provide preferences in trade with a third party on the basis of an international agreement concluded before January 1, 2015 between this EAEU member state and such a third party or an international treaty to which all member states of the EAEU are parties.

Based on these transitional provisions, the EAEU member states are currently providing tariff preferences to the member states of the Commonwealth of Independent States and the Republic of Serbia within the framework of relevant international treaties.

Determination of the origin of goods exported from the customs territory of the EAEU is carried out according to the rules established by the EEC, unless other rules are established by international treaties within the EAEU, international treaties of the EAEU with a third party or international treaties of member states with a third party.