This customs declaration is issued in accordance with the Common Transit Convention (CTC) for goods originating from a territory outside the EU.

In particular, T1 can be issued for the following types of transportation:

- Export transportation from Russia to common transit countries (EU + EFTA)

- Transportation to Russia of goods arriving in the EU from third countries or transportation to Russia in transit through the EU.

If the goods registered with the customs status “Transit” are not delivered to the customs post for customs clearance, the guarantor, in accordance with T1, is obliged to pay all customs duties and fees to the budget of the country of origin of the transit.

To complete the T1 declaration, the following documents are required:

- Shipping documentation (for example, a CMR waybill for road transport or a bill of lading for sea transport);

- Invoices for the consignment of goods.

In fact, the T1 transit declaration is an electronic alternative to TIR Carnets, which are issued in accordance with the Carnet TIR Convention. The main difference between the T1 declaration and the TIR Carnet is the provision of information to customs authorities in digital format.

Below is an example of a completed T1 declaration for cargo transit through the EU. Transit begins in Lithuania, ends in Germany. The cargo is natural rubber in the form of sheets on 30 pallets. Total weight is 20,000 kg, data on the value of the cargo is not indicated in the declaration (7,500 euros).

The document's pre-registration number at customs LRN is indicated in the upper left corner of the declaration. Just below are the details of the shipper and consignee. Even lower we see the carrier’s data and the numbers of the tractor (A002AP77) with the semi-trailer (A003AP77).

At the bottom of the document, the details of the guarantor company (SGS division in Lithuania), the customs office of the beginning and end of transit are indicated:

The right side of the declaration contains information about the quantity and weight of the cargo, the country of origin of the cargo and the country of unloading. It also describes which countries the route will pass through (Lithuania, Poland, Germany):

The second page of the declaration contains information about the product and accompanying documents. Description, HS code, invoice numbers and CMR (consignment note):

How to close an export declaration?

The declaration is closed upon crossing the border or issuing a CARNET TIR. To close the document, you must send a copy of the declaration to the regulatory authorities (necessarily completed in accordance with all the rules, with the appropriate codes and numbers). ... The need for an export declaration arises in many cases.

Interesting materials:

What is the melting point of paraffin? What is the temperature in the desert? What is the temperature in the toaster? What tissue makes up the glands? What is the thickness of a sheet of paper? What is the thickness of chipboard? Which herb is best for the liver? What is the root system of dicotyledonous plants? What is the altitude above sea level? What is the height of Ostankinskaya?

CUSTOMS TRANSIT GUARANTEE SERVICE THROUGH THE SGS TRANSITNET PLATFORM

TransitNet is an SGS Group-owned online platform that is integrated with the NCTS customs environment and enables the submission of T1 declarations. This service also includes the guarantee required for customs clearance in the EU, Turkey, Serbia and Macedonia. In other words, SGS assumes responsibility for the risks associated with non-payment of customs duties.

When using the TransitNet system, the cargo owner can complete his T1 declarations either through the SGS office, or through a broker or forwarder, or without intermediaries directly from his office online.

The speed of processing the T1 declaration depends on the qualifications of the declarant. TransitNet allows you to do this as quickly as possible thanks to its user-friendly interface.

Video instructions for registering T1 with the start of transit in Poland and Lithuania:

Video instructions for registering T1 with the start of transit in Latvia:

FILE T1 DECLARATION in the TransitNet system

Contact us right now to clarify the conditions for issuing a T1 declaration for your cargo:

Vladislav Skarzhinets , head of sales department +7 ext. 255 Email

In what cases is refusal possible?

Authorities of the Federal Customs Service (FCS) will refuse registration in the following situations:

- The transit declaration is submitted by a person who is not the declarant (supplier) or his authorized representative.

- Significant errors were found in the document.

- The declarant applied to the customs authority, which does not have authority in a particular region.

- T1 does not provide comprehensive information about the transported products.

- The declaration does not comply with the established form.

Electronic form of TD

An international road transport booklet is used as an electronic transit declaration, to which commercial and transportation documents are attached.

If the TD is transmitted in this format, then its use is regulated by the federal executive authorities in this area.

But even if the documentation is submitted in paper form, since 2011 it has been provided for the transfer of its electronic copy.

So, the TD is presented for the purpose of maintaining statistics in the field of collection of payments, determining the main indicators of foreign economic activity, and regulating financial flows in the customs sector.

In this case, only the minimum information required from the declarant is required to carry out these actions.

What information should be displayed in the TD?

The information should be of the following nature:

- information about countries of departure and destination;

- information about the sender and recipient of transit goods;

- carrier, declarant;

- the type and characteristics of transport through which international transportation is carried out;

- the number and cost of articles, their names, codes according to the Harmonized System or the Commodity Nomenclature of Foreign Economic Activity (at least 1–6 digits of codes);

- gross weight or volume of goods, their quantity in those units of measurement provided for by the above systems and nomenclatures;

- the number of cargo units on which goods are transported;

- the exact destination of the declared goods according to the submitted transportation documents;

- documents that confirm full compliance with a number of restrictions on the movement of goods across the border of the Customs Union;

- plans for reloading (transshipment) of goods or other trade operations during transit.

This information is the minimum necessary for maintaining statistics, collecting customs duties and applying legislation on the territory of the member countries of the customs union.

Transit Declaration (T1) and Export Declaration (EX)

Transit declaration T1

T1 is a financial guarantee issued by a customs agent (the one whom the customs trusts and who, if something happens... will pay for everything) in favor of the EU customs authorities, providing a guarantee of payment to the EU budget of all customs duties and fees.

For example, if a product transported across the EU under the T1 procedure is not delivered from the border to the customs post, then the agent who issued T1 (guaranteed) will have to pay all customs duties as if the cargo had been cleared for use in the EU. T1 is used in the following cases:

- the goods arrived by sea to an EU port from another non-EU country (America, Japan...) and then by road from the seaport are transported inside the EU to a customs post for customs clearance or to a customs warehouse for storage or further transshipment;

- the goods arrived at an EU seaport from a non-EU country and are then transported by road from the seaport to an EU border, in this case T1 is issued to customs at the EU border;

- the goods are exported from a customs warehouse, for example in Germany, to a customs warehouse, for example in Lithuania;

- goods are imported from outside the EU across the land border into the EU to a customs post for clearance or to a customs warehouse for storage or transhipment;

- cargo is imported from outside the EU through the land border in transit to a seaport or to Switzerland, Norway, …. countries not yet members of the EU;

Export Declaration (EX-1)

An export declaration is a document that is issued for cargo produced or sold from a EEC country. In the EU, according to document EX-1, they control the export of goods. EX-1 can be issued either by the seller of the goods himself or by his agent, who has the appropriate license. To issue an EX-1, the agent will need a power of attorney from the sender for the person who will do the EX-1 and invoice. The EX-1 declaration must be registered at the customs office of departure. EX-1 is closed by customs at any forwarding company in the place where the cargo leaves the EU. EX-1 is always tied to the sender and along the route the cargo can be resold 100 times. It doesn’t matter who the final recipient of the cargo is, the EU tax office only cares about the fact that the cargo has been exported. Thus, it is clear that EX1 is a document that confirms the fact of export of goods outside the European Union, certified by customs authorities. Previously, customs put a stamp on the paper EX1, which confirmed the fact of export of the goods, after which it was necessary to return this stamped piece of paper to the sender, but now electronic means are used. All EX1 and marks are stored in the EU electronic database and there is no need to send anything to anyone. It is important to understand that it is not the fact of the presence of EX1 that is important, but the fact that the customs mark EX1 is important, confirming the export of goods outside the EU. It is the EX1 customs mark that gives the seller of goods in the EU the right to a refund/non-payment of intra-European VAT (VAT).

The EX1 declaration must accompany goods of European origin moving from the seller's warehouse from the EU outside the EEC countries. The EX1 declaration is drawn up by the supplier or an agent of the supplier or carrier (forwarder) who has the appropriate authority to do so. As always, everything is very strict, but options are possible: in EX1, not only goods produced in the EC can be indicated.

The purpose of each chapter of EX-1 can be found here:

| Field | Content | field type, number of characters | example |

| 1 | Last two digits of the year of acceptance of the warranty (YY) | Numeric, 2 | 87 |

| 2 | Guarantee country identifier (ISO alpha 2 country code) | Letter, 2 | LT |

| 3 | Individual identifier for acceptance of guarantee by EU/EFTA Guarantee Customs by year and country | Alphanumeric, 13 | KK20000083619 |

| 4 | Check digit | Numeric, 1 | 3 |

| MRN number format | |||

https://ec.europa.eu/ecip/model_transactions/export/export_direct/step4_en.htm

Invoice

In Russian, Invoice is an Invoice - a commercial document that reflects the transaction between the buyer and the seller. Typically, the Invoice indicates the name of the product, the quantity of each item and the price per unit and the total amount to be paid. The date, number, names and details of the buyer and seller must be indicated. This is a very important document for international transport ; especially customs wants to see it and carefully studies it. Often the speed of border customs clearance depends on the details specified in the Invoice. Therefore, the carrier first looks at how the Invoice .

Packing List

The packing list is very similar to the invoice and often a lot of information in these documents is duplicated, but the packing list, in addition to information about the sender, recipient of the cargo, and the name of the cargo, also indicates the weight characteristics of the cargo and packaging, their volumes and information about what and how the cargo is packed .

The main difference from an invoice is the lack of information about the price of each item and the cargo as a whole. But no one can prohibit you from providing this data. There is no specific form and each company comes up with its own form of packing list. The packing list is very convenient for the carrier and everyone who deals with loading, unloading, sorting and accounting for cargo; it is used to count the number of pieces and check the integrity of the cargo.

Number of seats

In freight transportation, a cargo package is usually called a unit of measurement of cargo that the carrier accepts for transportation. For example, one place is one box or one pallet or one box or package.

You must understand that the carrier is transporting exactly the items - he has loaded 18 items (boxes) for transportation, handed over 18 items and he does not know what is happening inside, the main thing is that the packaging is intact and the number of items matches. According to the CMR convention, the carrier is not responsible for internal damage (what is inside the container), i.e. If the goods inside the packaging are damaged, the carrier will not accept the claim. If the sender or customer skimps on packaging, then this is his problem.

Certificate of Origin - Certificate of origin of goods

A certificate (certificate) of origin of a product is a document printed on a special form containing a description of the product and confirmation from a government agency that the product for which the certificate (certificate) is issued was produced in this country. The form of the certificate is standard. This form is defined by the Kyoto Convention. A certificate of origin of goods is presented in cases where customs clearance of goods requires documentary confirmation of the country of origin.

Procedure for filling out TD

The transit declaration form and its completion are carried out in accordance with the decision of the Customs Union Commission dated June 18, 2010 No. 289.

Thus, the transit declaration is compiled from the main and additional sheets (if they are necessary).

The latter are attached if the declarant declares two or more names of goods.

One declaration sheet must indicate only goods from the same batch, sent to the same address.

The transit declaration is filled out in two copies on printed A4 forms , in legible handwriting and without corrections or crossing out.

Foreign persons and their addresses can be indicated in Latin letters. All necessary additions can be either added or printed.

Corrections are certified by the stamp of the LNP of the official of the customs authority on which the declaration is drawn up.

Models and articles are filled out only in the original language , as they reflect the individual characteristics of the product.

Additional sheets are drawn up in accordance with the same rules that apply to the main sheet of the transit declaration.

Since the TD is filled out in two copies at once, one of them is given to the declarant for the purpose of presenting it to the customs authority of destination for the release of goods from the territory of the Customs Union.

The second copy is stored at the customs point of departure and can be used for control and statistics.

After the transit procedure is completed, the completed TDs are kept in the files of the customs authorities.

Requirements for the declarant when filling out the declaration

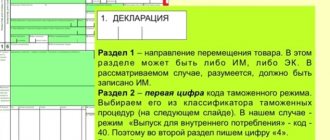

- In column 1 in the first subsection “TT” is entered, in the second – “FL”, in the third – “TR”, “IM”, “EK”, “VT” or “TS”, depending on the type of transit.

- In paragraph 2 the name and address are written (for legal entities); Full name and m/f (for individuals).

- The subsections of column 3 indicate the TD number and the total number of main and additional sheets.

- The fourth column remains blank if the declarant does not submit shipping specifications.

- Column 5 should contain information on the number of transit goods, No. 6 – the number of cargo units.

- Clause 8 contains information about the recipient (similar to clause 2).

- In columns 15 and 17 , countries are indicated according to the classifier, that is, only the abbreviated name is written.

- Point 18 is completed depending on the type of transport used. So, you should indicate the number of the car, cars or platforms, ship or flight. In the “Container” line, put “1” if any are used; "0" - if they are absent.

- Column 33 contains the product code without any characters other than numbers or spaces. Point 35 is completed in accordance with the gross weight (in the format of three numbers after the decimal point).

- 41 items contain information about additional units of measurement of goods. Paragraph 42 indicates the currency designation and the numerical value of the cost of goods. In some cases, this column is not filled in.

What is a transit declaration?

A transit declaration is a required document when going through the customs transit procedure.

Just like the export declaration, it is a guarantee for customs. As a rule, such a document is issued for goods that are not subject to customs duties. Having a problem? Call our customs specialist:

Moscow and region (call is free)

Saint Petersburg

Types of transit declaration

There are the following types of transit declaration:

- transport;

- a commercial.

If the declaration does not reflect all the necessary information, the foreign trade participant must attach additional papers to it.

Content

The transit declaration must contain the following information:

- Country of manufacture.

- Destination.

- Buyer information.

- Seller information.

- Carrier information.

- Characteristics of vehicles used for transportation.

- Number of goods, their weight, characteristics.

- Customs value of goods.

- Availability of papers confirming the legality of the transaction and its compliance with all rules, etc.

Lack of information may lead to the customs authority:

- will require additional paperwork;

- will refuse to carry out the product registration procedure.