Customs clearance of goods imported into Russia requires the execution of a certain package of documents. The type of documents varies depending on the country of departure. When importing from European countries, one of the required documents is the EX-1 export declaration. Its absence may even lead to an increase in the cost of cargo transportation.

- What is an export declaration

- Why do you need an export declaration?

- Completing the export declaration

- What must be included in the export declaration

- Cost of registration of export declaration

- Where is the export declaration completed?

What is an export declaration

An export declaration (EX-1) is a document issued for cargo produced or sold in an EU country. It eliminates the need to pay the internal tax VAT, which is mandatory for all EU countries. The document is certified by customs authorities. Previously, customs stamped the paper export declaration (EX1). The specified seal confirmed the fact of export of the goods. At the moment, the export declaration is issued electronically and the marks are stored in the EU electronic database.

The document can be completed in any European language. It is also recommended to translate some key columns into Russian for ease of customs clearance.

How to fill out the EX-1 export declaration

Let's say right away that the EX-1 export declaration indicates the commercial invoice number, and not the value of the cargo. Therefore, from the point of view of common sense, if you have the remaining shipping documents, presenting an export declaration at Russian customs is not necessary, but at our customs you need to be prepared for anything...

Export declaration EX-1 - translation into Russian

MRN - transportation identifier

In the upper right corner of the EX-1 export declaration, indicate the MRN (Movement Reference Number) and a barcode. Each customs declaration has its own 18-digit alphanumeric code (MRN).

Transport identification number (MRN)

- Year of warranty acceptance (last 2 digits);

- Letter code of the country where the guarantee is located, according to ISO 3166-1 / alpha 2;

- Alphanumeric 13-digit identifier for acceptance of guarantee by EU/EFTA customs;

- Check digit

The barcode contains information about the cargo and the customs office where the export declaration was completed. All necessary information is displayed when scanning this barcode.

Today, for all cargo exported from the European Union (place and date of opening and closing, information about delay or cancellation of the declaration), you can check the export declaration using the MRN number on the European Commission website.

The export declaration is closed the moment the cargo crosses the border. To do this, a printed copy of the export declaration is provided to customs with an individual export number and a unique barcode. The customs stamp on this form allows the supplier of the goods to be exempt from paying intra-European VAT (VAT).

Why do you need an export declaration?

As part of the delivery of goods under foreign trade contracts, this document describes the goods being exported and confirms the legality of the export of goods from the exporting country. The export declaration (EX-1) can be considered as an official statement with the submission of all information about the exported goods. It is just as necessary as a declaration of customs value, cargo declaration and other documents with information about exported goods.

EX-1 is a standard document of 40 columns, including the following information about the cargo:

- weight;

- identification numbers;

- information about fillings;

- special marks;

- customs points and goods inspection points;

- container numbers;

- stamp numbers.

Taking into account the terms of delivery, an export declaration (EX-1) is issued by the seller or buyer of the goods. Typically, the buyer delegates these responsibilities to the freight forwarder or carrier.

Opening and closing the EX1 export declaration

Export declaration EX1 is a special form of document. It is mandatory for exporting to Europe and the European Union. With its help, you can get rid of the obligation to repay the internal tax established for such states.

To open an EX1 export declaration, the following conditions must be met:

- exporter's appeal;

- undergoing inspection of the goods;

- availability of all information about the product from the invoice.

If all these conditions are met, the document can be issued. After registration, it is considered officially open. Without this procedure, the customs authority simply will not be able to accept the cargo for inspection.

You can close the EX1 declaration after the cargo has passed through the state border.

Completing the export declaration

The export declaration form (EX-1), as a rule, contains a main sheet and three additional sheets. Basically, they indicate data on one type of product, and in additional forms they enter information about other products. When filling out the declaration (EX-1), the main thing to remember is:

- An export customs declaration (EX-1) is submitted before transporting goods from the territory of the Customs Union.

- Each declaration must contain information about goods from the same consignment undergoing the same customs clearance operation. If goods from the same batch undergo different clearance procedures, then information on each procedure is indicated in a separate declaration.

- The maximum number of goods declared in each document cannot exceed 1000 items.

- Columns of the export declaration (EX-1) must be filled out without errors or corrections.

About the document

EX-1 certified by the customs authority certifies the export of goods from the EU. If products are moved across several EEC countries, the declaration is closed in the last country in the zone.

In the EU, all declarations are completed in the place where the goods are located (in the EU), electronically through a publicly accessible server. Each document is assigned a number that allows you to obtain information from the database.

Russian importers must specify in contracts the obligation of suppliers to provide a declaration.

Concept and purpose

The EX-1 declaration is used by EU exporters. For closure, a printed copy containing the export delivery number and barcode is provided to the customs authority.

Purpose of EX-1:

- certify the legality of the transaction;

- notify the customs authority about this;

- provide the data necessary for transportation across the border;

- exempt the buyer from paying VAT.

Individuals can also return the funds spent on paying taxes.

When purchasing goods during a tourist trip or online, you must prove that:

- the buyer is not a citizen of one of the EU states;

- products have crossed the EU border;

- VAT included in the price

To get a tax refund, you need to send the seller an application, a copy of your passport and a document certifying the purchase outside the EU.

European exporters do not always file the EX-1 declaration. For a Russian importer, this document is important, since it may be required by the customs authority when moving across the border.

If customs clearance involves delivery of cargo to customs, the importer must know the declaration number. The employee enters it into the server to check for restrictions and sanctions on the product, print and register the document. After entering the data onto the server, the cargo is considered to be exported from the EU. The importer can print a document with a stamp confirming the export.

Types and features

Most often, EX-1 is issued by the supplier, its carrier or forwarder (a license certifying the right to do this is required).

To obtain a document, an application from the exporter, an invoice and information about the product, and an inspection are required. The moment of opening is considered the moment of registration.

An exception is delivery under EXW Incoterms 2010, which obliges the buyer to carry out all customs clearance procedures. The seller’s duty is to cooperate, so the Russian importer can use these conditions only if he is able to control the execution of the EX-1 and transport the goods himself. It should be distinguished from EX-A and EX-Z.

When is it used?

When clearing goods delivered from the EU through customs, the importer must have this document if this is provided for in the contract. To find out whether the seller has issued it, you need to go to the European customs website and indicate the MRN (declaration number). The importer's country does not matter.

What must be included in the export declaration

Entering false data into the customs declaration (EX-1) threatens with a serious fine - 50-200% of the value of exported goods with their confiscation. The amount of penalties for officials (manager and chief accountant) is 10-20 thousand rubles. The export declaration must indicate:

- sender of the cargo;

- cargo receiver;

- country of arrival of goods;

- country of registration of the foreign counterparty;

- delivery terms according to Incoterms rules;

- vehicle moving cargo;

- customs point that processes the cargo;

- quota size (for relevant goods);

- customs value of the cargo.

Regulatory regulation

The EU's goal with regard to exports is to maximize volume and support exporters. All regulatory measures are defined in the Customs Code (Customs Code).

The requirements of other standards are also taken into account:

- Council Regulation No. 1061/2009 (export regulations);

- Art. 308 Labor Code and Regulation 376/2008 (export of agricultural products);

- EU Regulation 3911/92 (licensing of exported products);

- Incoterms 2010 (determination of those responsible for registration);

- Regulation 800/1999 (export offsets);

- Art. 5 Directive 92/12/EEC and Art. 5 Sixth Directive (VAT refund);

- Council Decision No. 70/2008/EC (development of the “e-customs decision” (electronic information exchange system)).

Individual countries may introduce restrictions on the volume of exported goods (Article 10 of the Labor Code), if:

- it is necessary to comply with safety rules;

- there is a threat to human life or health;

- the legislation on the protection of historical or artistic values is violated;

- moral considerations are violated.

Cost of registration of export declaration

The cost may vary in different countries. The price of the export declaration (EX-1) upon registration, as a rule, depends on the sending country and the nature of the cargo. In Europe its price will be about 50 €, in China - approximately 75 $, in Russia - more than 15 thousand rubles.

Let us repeat that the export declaration (EX-1) is a mandatory document for the export of products from countries that have approved the Customs Code. All three parties to a foreign trade transaction need it:

- for exporters – for export of cargo and refund of VAT paid when purchasing goods;

- carriers (forwarders) - for presentation at customs when crossing the border,

- importers - to confirm the authenticity of the customs price before calculating customs duties.

Customs clearance of goods

The concept of “customs clearance” or “customs clearance” implies, in addition to the registration and closing of the Export Declaration, a set of sequential operations carried out to legalize cargo (goods) imported into the territory of the Russian Federation after crossing the border.

Regularly fulfilling orders for the delivery of goods or technical imports from EU countries to Russia, our company combines the functions of an importer, carrier and forwarder. Our specialists will ensure competent and fast customs clearance of cargo without any problems...

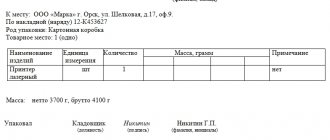

How to fill out the export declaration EX-1

EX-1 is drawn up before the export of goods. It must contain information about the products of one specific batch. If the supply is mixed (from products that require different registration), a separate document is drawn up for each type. More than a thousand units of goods cannot be included in one declaration.

Filling requirements:

- maximum number of sheets – 4 (main and 3 additional);

- errors and inaccurate data are not allowed;

- The customs authority is provided with 4 copies.

Mandatory indication:

- exporting country;

- countries of arrival;

- conditions according to Incoterms 2010;

- quota size;

- names of the sender and recipient;

- name of the customs point;

- vehicle;

- links to the invoice number, which allows you to determine the cost of the goods.

The average cost of registration is 50€. Validity period: 90 days. If the products are not exported during this time, you need to issue another document.

you can here.

Sample ED registration