The procedure for filling out the TTN and the rules must be followed in full, since this is an important document for accounting. It also helps to assert one’s rights when misunderstandings arise between participants in the process of moving property from one point to another. You don't have to go to court to do this. All issues can be resolved out of court. But for this you will have to document all the facts of economic life. This is a legal requirement regarding accounting, the fulfillment of which is subject to tax audit.

When to draw up a TTN

Its registration occurs during the transportation of goods and materials from one owner to another. The delivery itself is carried out independently by the sending company or with the assistance of the carrier company (third party). The one who sends the cargo also issues a waybill (its original owner for the alienation of the right or one of the divisions of the owner company to another). When using commercial transportation services, a contract for them can be drawn up by the sender or the recipient. Then the document under discussion can be signed by one or the other party.

Do I need to register it for self-export?

In a situation where the buyer independently organizes the removal of products from the seller’s warehouse, there will be two options regarding the need to draw up a consignment note.

- If you use the services of a transport company to move products, drawing up an invoice is mandatory. It will serve as a reporting document to confirm the provision of transport services by the carrier.

- If transportation is carried out by the buyer himself, an invoice is not issued, since no contract for transportation is concluded.

Read more about when and why you need to draw up a TTN here.

You can familiarize yourself with the consignment note in more detail on our website. Read the following materials:

- Features of working with waybills in EGAIS.

- TTN, delivery note and invoice: comparison of documents.

- What is a TTN number and is it a mandatory requirement?

TTN or TORG-12

The first allows you to move property from one point to another. This paper is used to write off the goods from the shipper's balance sheet to the account of the new owner. The key point is the presence of a vehicle in this scheme. This action may not take place in the form of a transaction between two parties, but as a transfer of goods and materials between branches of one organization.

TN (the second of those presented) is necessary specifically when making a sale and transferring ownership of property. It doesn’t matter whether transport is involved here or not.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

why is a cube more convenient?

Convenient online invoicing

Instantly send invoices by e-mail to your buyer

Debt control for each customer

Management reporting

Organized storage of all your documents

20% discount on accounting services from your accountant

Stop wasting time filling out templates and forms

The KUB service helps you issue invoices in 20 seconds and prepare other documents without a single error, due to the complete automation of filling out templates.

KUB is a new standard for issuing and sending invoices to customers.

Start using CUBE right now

14 days

FREE ACCESS

Do you need help filling out documents or advice?

Get help from expert accountants to prepare documents

+7

[email protected] kub-24

Procedure, rules for filling out the TTN and sample

For experienced specialists, its preparation is not difficult, since the form with the values is ready for registration. You just need to know what to enter and where.

Step-by-step instructions:

- First, we assign a number to the document and indicate it (using the internal numbering accepted at the enterprise), and enter the date.

- In the “shipper” line we write information about the company sending the goods and materials (with full name, geolocation and working phone number).

- By analogy, we write down information about the addressee in the “consignee” section.

- Where the word “payer” appears, you must enter the company paying for transportation services.

- The correct OKPO codes must be written next to all parties to the transaction.

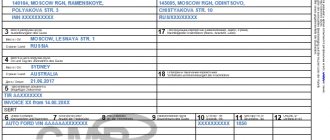

Bill of lading form

It can be unified, that is, uniform for use. You can use a format that is standard for everyone in order to certainly avoid claims from the tax authorities for arbitrariness in maintaining documentation. All information fits on one A4 sheet with compact placement of information and horizontal arrangement. The codes used here can be viewed in the all-Russian classifier.

When using a specialized program, the document is generated automatically if all the data is entered correctly. But today it is allowed to develop a convenient form yourself, shortening it, which greatly facilitates the work.

How to fill out a waybill (Bill of Lading) - rules, sample

Since this is an accounting document, the rules for its execution should be followed. It will necessarily be involved in accounting if it certifies the real fact of the economic life of the enterprise. You cannot underwrite information in the required cells, make simple blots on top of the finished version, present information here inaccurately, etc. Corrections must be certified with the date they were made. Responsible persons sign and leave their full names here. Primary documentation is allowed to be compiled on paper or stored in the form of an electronic copy. But since we are talking about an accompanying document here, it is done exclusively in paper version. It will have to be delivered to the agreed addresses and signatures collected.

Despite the permission not to use a unified format, there is definitely structure in the TT consignment note. Everything needs to be presented clearly and informatively. When starting a business, you can take common examples from the public domain. But in the future it is recommended to debug the work and use standard forms. Specialized programs will help in compilation.

How to correctly draw up a TTN according to the sample

If a standardized form is used, then its execution will not be difficult for experienced employees. However, the state at one time allowed not to use previously developed formats of primary documents. Enterprises as economic entities can develop them themselves. Transporting organizations and customers constantly deal with these invoices. This somewhat complicates the work process for subsequent participants.

The standard assumes the design of several sections. If the tax office finds fault with incorrectly completed documentation and issues a fine, its amount will vary depending on the category of the offense. In addition, the responsibility of the authorized person is assessed lower and in case of shortcomings, fines come to his name in a smaller amount than for the whole company. It is necessary to assign control functions to the chief accountant. And provide it with good software on your computer. The same goes for warehouse workers. Automation of work will simplify the process of its execution and minimize errors. Often problems arise precisely when filling out the 2nd transport section of the TTN.

TTN (1-T): sample of filling out the transport section

The transport section defines the relationship between the sender and the organization that owns the vehicle that transported the cargo. It is necessary for settlements between shippers/consignees and the carrier organization for services rendered. The section also serves to account for transport work.

The section contains information about the organization that ordered the vehicle (also known as the shipper), the carrier, the vehicle itself, the driver, cargo, loading and unloading operations, as well as additional information about transportation. If it is difficult for you to fill out this section on your own, you can use the TTN on this page and test yourself.

Please note: This section must be completed and signed by all parties. A blank TTN form (in word) can be downloaded for free here >>

More than 1,000,000 companies already print invoices, invoices and other documents in the MyWarehouse service Start using

How is it different from TN?

The concept of TORG-12 was mentioned above. This is a form of T-waybill (namely “commodity bill”). It is standardized at the state level. There are also columns and rows with values that should be filled in. Private information about participants is provided and nationwide coding is used.

A TT invoice is issued if transport is used for delivery (with its full description), but with the above one you can do without it. The first one is allowed to be used when making sales and when simply moving cargo. And the second is required exclusively in the presence of commodity-money relations. It is more extensive and includes a lot of information (including terms of the transaction, quantity of goods and materials, cost, VAT).

In addition, there is another concept of TN (“transport”). Designed for road freight transportation.

TTN-1 and TN-2 in 2021

Who is required to fill out invoices in 2021, what will be a violation when filling them out, as well as cases when TTN-1 and TN-2 need not be filled out - you will learn all this from the material.

Important in the article:

- Obligation to issue invoices

- Rules for issuing invoices

- Peculiarities of registration of invoices (shipment to a branch of the organization, shipment of goods at prices established in foreign currency, payment of wages to employees in finished products)

- Forwarding, reloading of goods in transit: entries in the invoice

Obligation to issue invoices

The list of primary accounting documents (PUD) includes, incl. consignment note (TTN-1, TTN) and consignment note (TN-2, TN). TTN and TN forms refer to document forms with a certain degree of protection.

Organizations are required to issue TN and TTN. Please note that for the purposes of filling out invoices, the concept of “organization” includes:

– legal entities of the Republic of Belarus;

– representative offices of foreign and international organizations, as well as foreign organizations operating in our country through a permanent representative office;

– individual entrepreneurs (IP) registered in Belarus.

Rules for issuing invoices

Invoices TN or TTN can be filled out manually, or using technical means. Please note that when preparing invoices, it is allowed to fill out some of the data by hand, and some to enter using technical means.

As a general rule, when transporting cargo by road, a TTN is issued. However, there are exceptions to the rule. Thus, you can transport cargo by road without issuing a TTN in the following cases:

– if goods of a non-commercial nature are transported, for which warehouse inventory records are not kept and, according to the agreement, inventory materials are not measured, weighed or geodetic measurements are not carried out;

– if the cargo is brought from abroad. In such a situation, the cargo travels without a TTN to the unloading point indicated in the shipper’s transport documents. Accompanying documents for the cargo in this case are an air waybill, a railway waybill or a CMR waybill accompanied by an invoice and other documents prepared by the shipper;

– if the cargo is transported outside the territory of Belarus, as well as in the case of transit transportation of cargo through our country. In this case, the accompanying documents for the cargo will be a CMR consignment note, as well as other documents prepared by the shipper, in particular the TN.

Important! It is not a violation to issue a consignment note or consignment note in cases where it is not necessary.

When filling out the invoice, the name of the organization may be indicated in both full and abbreviated form. The right to choose remains with the organization.

Features of invoice design

In the case where goods and materials are shipped or received by an invoice to a branch of an organization, along with the name of the organization, the name of the branch must be indicated in the invoice.

In a situation where an agreement for the supply of goods is concluded with the parent organization, and the shipment of goods and materials is made to branches allocated to a separate balance sheet, the branch must be indicated as the consignee. This is due to the fact that the execution of transport documents is tied to the actual shippers and consignees.

When shipping and paying for goods at prices set in a foreign currency, the invoice is filled out in the foreign currency in which the price was agreed upon.

Important! If, along with foreign currencies, Belarusian rubles are indicated in the contract as possible payment options, then the invoice must be issued in the national currency.

When paying for goods in Belarusian rubles is equivalent to a certain amount in foreign currency, the cost indicators in the invoice are filled in in Belarusian rubles. Please note that the cost of goods in foreign currency is reflected only in the line “Total cost including VAT”.

The issuance of wages to employees in finished products (in kind) is documented in an invoice. In the following cases, an invoice is not required for an individual:

– when selling goods through a retail network;

– in case of gratuitous transfer of goods, transfer (return) of goods under gratuitous use (loan) agreements.

Forwarding, reloading of goods in transit

When redirecting cargo, the consignee must make an entry in the consignment note about the refusal to accept the cargo. The “Readdressing” line indicates the name and address of the new consignee, the new unloading point, the surname, initials and signature of the person who made the decision on redirection. The driver can also be such a person if he is given the appropriate authority. In the case of delivery of goods with the involvement of a carrier, it is advisable to include a condition on the possibility of the driver entering information about redirection in the invoice in the contract.

In a situation where it is necessary to reload cargo from one vehicle to another along the route, a new waybill is not issued. There are two options for registering an overload:

- Changes can be made to the consignment note that comes with the cargo. To do this, information about the driver, car, trailer (if there was one), waybill is crossed out in the TTN and the surname, initials and signature of the person who made the decision on overload are indicated. The TTN provides data about the new car;

- data on transhipment to a new machine may be placed in an appendix to the invoice or transshipment report. In this case, there is no need to make changes to the TTN itself.

Note that the decision on overloading is made by an official of the organization, whose responsibilities include organizing transport work.

Along with this read:

- Samples of filling out TTN and TN

- Two options for making corrections to TTN-1

- Making changes to the electronic consignment note

- Registration of movement using a trolley

- The car was rented with fuel in the tank

- New year - new mechanism: how to work with electronic invoices

- Why do you need to indicate a wholesale markup on invoices?

- Preparation of the accompanying document

- Correction of inaccuracies in the indication of names of commodity items in TTN-1

- Invoices for shipment of goods: rules for drawing up and consequences of violations

- Sample registration of invoice TN-2 when delivering goods by courier

- Sample registration of TTN-1 when delivering goods by seller’s vehicles to a legal entity

- Sample registration form TTN-1: delivery of goods by motor transport of a third-party carrier

- Sample of filling out TTN-1: delivery of goods by the seller’s vehicles to several buyers

Who should issue a TT invoice?

Depending on the situation and stage, this is done by the recipient or the sender (and all their employees and representatives). Usually it is the sender who applies it to loading and then everyone is engaged in entering their data. The driver reports the route, and the recipient describes the acceptance procedure. A third party may be involved in the delivery (on contractual terms of cooperation). Then a transport company specializing in transportation is also related to TTN. Both parties have the right to enter into an agreement with it.

Document structure

In addition to the unified form, where the structure is clearly visible, there are special instructions on the procedure for payment for transportation from 1983 onwards. The last revision was in 1997. It accurately describes the filling instructions in a step-by-step manner. In total, there are 16 rule blocks with their own number of columns and paragraphs on the topic of correct documentation.

Since the beginning of 2011 (Federal Law 402), the format of such an accounting “primary” has been approved by the economic entity. However, it must contain all the necessary details (as specified in the same Federal Law). Therefore, now unified all-Russian forms do not need to be used, but rather develop your own with the required points. But to avoid mistakes, a ready-made basis for filling is also good. The main thing is that a single rule applies to all situations: an invoice must be drawn up when a fact of economic life is completed, and if this is not possible, immediately after its completion. In general, all participants need to understand the structural arrangement of blocks. It is also necessary to take into account how to correctly fill out and sign the TTN for the driver.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Transportation options

To transport inventory, a company can use its own vehicles, which are included in fixed assets, either its own or leased. Or he can enter into a civil contract with a third-party organization or individual entrepreneur - for the provision of transportation services (Chapter 40 of the Civil Code of the Russian Federation, Federal Law of November 8, 2007 No. 259-FZ “Charter of Automobile Transport and Urban Ground Electric Transport”) or transport expeditions (Chapter 41 of the Civil Code of the Russian Federation, Federal Law of June 30, 2003 No. 87-FZ “On transport and forwarding activities”). But when the place of loading of the goods and its place of delivery specified in the contract are located on the territory of different countries, the Convention on the Contract for the International Carriage of Goods by Road (concluded in Geneva on May 19, 1956) applies. Such transportations are not considered in our article.

Carrier

provides the service personally, directly providing the shipper with a vehicle for loading.

A freight forwarder

is a person who provides a comprehensive service for organizing transportation. The main condition of such an organization is delivery of the cargo to the addressee specified by the client. The result is the same as for the carrier. But to achieve this, the forwarder not only independently delivers the cargo or enters into contracts with other carriers. It carries out a variety of auxiliary operations that ensure cargo transportation. For example, preparing goods for transportation, transferring cargo from one carrier to another, preparing transportation documents, insurance and completing customs formalities. The carrier, in addition to transportation, only performs loading and unloading operations.

If the customer gives the carrier functions that are unusual for him, the contract of carriage will be re-qualified by the court. Of course, this is possible within the framework of a dispute, economic or tax.

A variety of intermediaries offer services in the transport market. They provide assistance in carrying out certain “related” operations, without taking on responsibilities to achieve the ultimate goal - delivery of the cargo to the consignee. Most often you have to deal with agents (Chapter 52 of the Civil Code of the Russian Federation) or dispatchers (Chapter 39 of the Civil Code of the Russian Federation).

Accountant's task

– ensure the transportation of inventory items with proper documents, on the basis of which the company can fearlessly deduct the submitted VAT and recognize income tax expenses. To do this, the accountant must understand the legal nature of transport operations.

Filling algorithm

The document must indicate the carrier, the consignee, the name of the procedure (for example, shipment of a specific product or, conversely, loading) with the date, as well as the type of product being shipped/loaded.

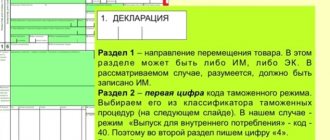

Filling out the 1st section in 1-T

Almost all of it will be filled out by the shipper. To begin with, detailed information about the property being moved, food products, etc. is entered into the table.

The first column contains the item number of the goods and materials. In the second and third - the price list number with the article (if such types of accounting are fundamentally maintained in this organization). In the fourth, with the value “Quantity”, the number of transported items, products, etc. is entered. Next comes information about the piece price, exact names, measuring units, type of packaging (cardboard, cellophane materials, etc.)

Further, in the order of registration and filling out the consignment note (Bill of Lading), different digital values are written about places, tonnage and cost. If you overpay for something (excess weight, transportation costs), this is also indicated.

The next step is to enter the generalized amount for all categories and product numbers according to the warehouse system. Then the weight of the cargo is written in words and in digital terms, the appendices (with the number of sheets) are indicated and below in words the full and final price of the released warehouse property.

Below on the left side you need to sign the responsible persons with transcripts: the shipper, the authorized person for release with shipment, as well as the chief accountant. To the right, enter the driver’s data (about his identity, existing power of attorney). A little later, the person representing the consignee will sign here to confirm that the “parcel” has been received.

Completing section 2

Here we insert transportation information.

Namely:

- when will the cargo be delivered?

- describe the carrier company;

- enter information about the car (make and state number);

- in the far right column - the numbering of the invoice and waybill.

In the “Payer” section we include information about the delivery customer and the driver. Next, you need to make it clear that this is a license card, a registration number in the TTN and what to write about the series in the transport section. You only have this information when you undergo licensing a little earlier. It is not currently being carried out, so this information may seem unclear to you. It is simply missing and missed. As for the type of transportation, it is necessary to clarify - “commercial”. As for waypoints, they can be adjusted in the future.

Below is a sign. In the column “Method of determining mass” the measurement method is indicated (what weighing devices were used: manual, automatic and other formats). To the right under the table are other accompanying documents: confirming quality, passports, acts, etc., and to the left are signatures. Next comes the table image again. Here we write information about loading/unloading.

If several sheets are expected, then additional ones must be mentioned. Moreover, on subsequent pages the number of inventory items and locations involved is duplicated. The driver also enters information: mileage, travel costs, penalties for incorrectly executed documents, downtime, etc. At the end, the carrier’s accountant writes out the calculation.

What should I write about the method of determining the weight in the TTN according to the rules for issuing a consignment note if this weighing did not take place? If there is none, we indicate “normative” or “according to the labeling”.

Who signs the document?

All actors involved in issuing from the warehouse, loading, unloading, delivery and acceptance of goods and materials. They are financially responsible to their management or customer. And they have documented authority to sign the accounting documentation. In the absence of these, the paper may be invalidated. But this will happen during trials. Otherwise, the error will go unnoticed.

Where is the stamp placed?

On all documents it is affixed in the part where there is an indication of positions. The people occupying them must sign. As for non-standard forms, the location of the desired location may move. In any case, it is located after all the information about the participants and the goods being moved. By signing, persons certify dispatch, transportation and acceptance. The location in the unified version is in the middle part of the sheet. To be sure, it’s better to see how to make and issue a consignment note according to the sample.

Applications

Additional documents can be attached to Form 1-T if they are required in a particular situation. These are passports, certificates, various certificates and contracts. Their list should be indicated in the line provided. Or they will not be taken into account. Failure to comply with formalities causes additional difficulties. You will have to deliver the papers or send them by mail. All papers are also required to be stamped and signed. The information contained in them should not contradict each other.

Rules for transporting goods by road

In the field of cargo transportation, there are two sets of rules. Let's call them “Russian” and “Soviet”. The first is a modern by-law that ensures the application of the Road Transport Charter, that is, Law No. 259-FZ. These are the Rules for the transportation of goods by road, approved by Decree of the Government of the Russian Federation dated April 15, 2011 No. 272 (hereinafter referred to as the Rules). The second ones were adopted during the USSR era. These are the General Rules for the Transportation of Goods by Road, approved by the Ministry of Automobile Transport of the RSFSR on July 30, 1971 (hereinafter referred to as the General Rules).

Law No. 259-FZ regulates legal relations arising when transporting cargo under a contract for a fee. In this area, during commercial transportation, the “Russian” Rules apply.

From paragraph 1 of Art. 1 of Law No. 259-FZ it follows that the “Soviet” General Rules do not apply to commercial transportation. After all, they are not a normative legal act of the Russian Federation. The scope of the General Rules is motor transport “self-service”, when companies use corporate transport without concluding a contract of carriage. Examples: cargo transportation between structural divisions of the company, delivery of goods to customers under supply contracts. In both examples, the company acts as the owner of the transported valuables (ownership will pass to the buyer after the goods are delivered to him).

The carrier is carrying cargo that does not belong to him. For its safety, he is responsible to the consignor and consignee. The customer under the contract of carriage is the shipper. He pays for the carrier's service. The content of the service is to transport the cargo entrusted by the consignor to the destination and hand it over to the person authorized to receive it, that is, to the consignee. Consequently, the acceptance of the carrier's service is carried out by the consignee. Therefore, it is not necessary to draw up a special act of acceptance and transfer of services between the carrier and the shipper.

Each regulation provides for its own transportation document

, the presence of which is mandatory for transportation.

According to the Rules, this is a waybill

(TN), and in accordance with the General Rules, it is

a consignment note

(BW). The TTN form was approved by Decree of the State Statistics Committee of Russia dated November 28, 1997 No. 78 (hereinafter Resolution No. 78). A direct instruction on the use of TTN when transporting goods for the needs of their production on their own and rented vehicles is contained in clause 2 of the instructions of the USSR Ministry of Finance No. 156, the USSR State Bank No. 30, the USSR Central Statistical Office No. 354/7, the RSFSR Ministry of Automobile Transport dated November 30, 1983 No. 10/ 998 “On the procedure for payment for the transportation of goods by road.” This instruction has been issued in support of the General Rules.

These are the sources of legal regulation of road transport.

It remains to add that Resolution No. 78, and with it the TTN form, are not mandatory for use. The fact is that this resolution does not have a registration number with the Ministry of Justice of Russia and has not been officially published (in violation of clause 10 of the Decree of the President of the Russian Federation of May 23, 1996 No. 763, clause 3 of Article 15 of the Constitution of the Russian Federation, clause 6 of the resolution of the Plenum Supreme Court of the Russian Federation dated October 31, 1995 No. 8). For this piquant reason, the rule on the use of TTN is in a “suspended” state. What companies successfully use in tax disputes.

The Ministry of Finance of the Russian Federation in a number of letters, the last of which is dated December 22, 2011 No. 03-03-10/123, explains the following. If the company does not enter into a transportation contract and transports the cargo in its own vehicle, then the transportation costs are confirmed by the waybill

.

The forms of waybills are also approved by Resolution No. 78. It follows from it that waybills for a truck are used in conjunction with the technical specification. The waybill indicates the TTN numbers, and the transport section of the TTN indicates the waybill number.

It is noteworthy that in the case of transportation for internal needs, we will not find a regulatory requirement on the need for a waybill. But it is generally recognized as the main primary document for recording the operation of a truck. Its form must be recognized as functional and optimal.

But for commercial cargo transportation, a waybill is required. Information about him is indicated in the TN, he acts as a power of attorney for the driver to receive cargo from the sender.

Who issues 1-T when transporting by road?

The original designer may change. This is the sending, receiving party or a third party. The latter is possible by concluding an agreement with the transporter. But a more common situation is when the goods are processed by the direct sender. He is allowed to order transportation from a third party or use his own driver.

If delivery is carried out by the supplier

This means that he gets the role of a filler. It will eventually reach all recipients, for which several copies are made at once. These are transferred to the regular driver or an employee of the transport company. Using the instructions, the correct filling of the TTN is guaranteed.

If the customer organized the removal

According to the rules, the person ordering transportation is the shipper (Government Decree 272 of April 11). This means that the functionality passes into his hands. Although it is worth clarifying what “order transportation” means. After all, it can be ordered by one or another subject of the transaction. By agreement, one or the other person also has the right to pay. Everything is negotiable.

If transporter services are ordered

He can be hired by any of the indicated persons and make payments to him in a jointly agreed upon way. That is, delivery can be made at the recipient’s expense (if agreed) or at the sender’s expense. The option of separating responsibilities is also acceptable. The amount is paid in installments from each payer or by one payer (with or without their subsequent offset). But the transporting organization most often does not issue the TTN itself. This is what the main participants do. However, redirection may occur along the route. Then the delivery person prescribes changes on the fly. The lines “Consignee” and “Unloading point” have been corrected. When an order is received by an intercity transport organization, the carrier can himself fill out form No. 2-tm in 5 copies and enter details in the header based on the application and waybill No. 4.

Do I need to return the document?

This is the same paper as the transfer acceptance certificate. They must be kept by both parties to the transaction with the signatures of their representatives. They are signed and returned as they are required for reporting and accounting purposes. And also to certify the actions taken, which will help to defend your rights if necessary. From the above it is clear that the TT invoice is formed in a large number of different variations. It is needed to describe the shipment and the persons involved. In the end, everyone gets their own copy, on which the rest of the characters had previously signed. This primary documentation goes to the archive, and until that moment remains under control in the accounting department.

We looked at what sections it consists of and how the waybill is filled out.

If the company has developed its own form, then it may be necessary to explain all its subtleties to other participants. After all, many still use the previously adopted standardized document for convenience and reliability. Software from Cleverence will help simplify all routine procedures with documents. We offer solutions of various types: both individual offers that are personalized specifically for the type of business activity and all the features of the “internal kitchen” of a legal entity, and packaged solutions for any company. Number of impressions: 87174

Documentation of cargo transportation

Decrees of the Government of the Russian Federation are an integral part of the legislation on accounting (Article 3 of the Federal Law of November 21, 1996 No. 129-FZ “On Accounting”). Therefore, the TN is the primary document for all participants in commercial transportation - the shipper, carrier and consignee.

A record number of letters from the Russian Ministry of Finance are devoted to the use of TN. True, these are answers to specific taxpayers. The questions asked are based on a misunderstanding of the difference between TN and TTN. However, officials did not delve into the difference between them. But in order to build proper document flow, you need to clearly understand the purpose of each form.

Let us explain the properties of TN using an example.

Suppose the seller hired a carrier to deliver goods to the buyer. To formalize trade transactions, he uses invoices according to the unified form No. TORG-12. And he has waybills for transportation.

Meanwhile, the carrier transports not goods, but cargo, and in batches. He does not accept goods based on quantity, assortment and quality. The goods are not visible in the container and under the packaging. “Transformation” of goods into cargo is a separate business operation of the seller-shipper.

Let's turn to TORG-12. It indicates the date of compilation and provides a list of goods in the names and units in which they are listed in the seller’s records. On this date, the listed goods, remaining in the seller’s warehouse, are considered reserved for the buyer.

In the lower left part of TORG-12, the seller’s officials (the person who authorized the release of the cargo and the chief (senior) accountant) certify the transformation of goods into cargo. The latter is characterized by mass and number of seats. This data is entered in clause 3 of the waybill.

The date in the lower left part of TORG-12 characterizes the moment the cargo is transferred to the carrier. It is confirmed by the signature of the seller’s official in the details “Cargo released”. Please note that the carrier signs acceptance of the cargo only in the TN.

The date in the lower right part of TORG-12 refers to the delivery of the cargo, not the goods. From the seller’s point of view, it makes no difference who received the cargo: the buyer-consignee himself or his representative (by proxy). One of the details must be filled in - “The cargo was accepted” (if the cargo was transferred to the representative) or “The cargo was received by the consignee” (this signature is certified by the buyer’s seal). Unused attributes are crossed out. And how the cargo is subsequently transferred from the attorney to the principal (buyer-consignee) is not the seller-shipper's concern.

The buyer formalizes the receipt of received goods by placing a stamp on TORG-12 (clause 2.1.3 of the Methodological recommendations for accounting and registration of operations for the receipt, storage and release of goods in trade organizations, approved by letter of Roskomtorg dated July 10, 1996 No. 1-794/ 32-5; clause 49 of the Methodological guidelines for accounting of inventories, approved 49 by order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n). He will return a copy of TORG-12 with an imprint of such a stamp to the seller. At the same time, this copy plays the role of an acceptance certificate for the carrier’s services, signed by an authorized person (consignee) at the other end of the route.

The header section of TORG-12 contains the requisite “Consignment note (number, date)”. And in the TN there is clause 4 “Accompanying documents for the cargo”. It indicates the number and date of compilation of TORG-12, as well as the number of its copies sent to the buyer. The seller may also include an invoice as part of the accompanying documents for the technical specification.

As you can see, TN and TORG-12 are inextricably linked. At the same time, TORG-12 specifies the object of transportation. Taken together, these two documents are equivalent to the TTN. Moreover, a separate TN does not allow us to establish what exactly the TN transports; the shipping (generalized) name of the cargo is indicated, and not the “accounting” characteristics of the goods. Therefore, TN without the TORG-12 application does not ensure compliance with the criteria of paragraph 1 of Art. 252 of the Tax Code of the Russian Federation.

The latest official clarification on transport documents is addressed to an indefinite circle of persons (clause 8 of article 75, subclause 3 of clause 1 of article 111 of the Tax Code of the Russian Federation). This is a letter from the Federal Tax Service of Russia dated March 21, 2012, No. ED-4-3/ [email protected] It says that the primary document confirming the costs of road transportation is either the TN or the TTN. There is no need to submit two forms for one trip. Officials still have not disclosed the nuances of their use. But we showed how to reason and act in practice.