In 2012, Russia joined the World Trade Organization (WTO). In addition, the country is a party to the agreement on a free trade zone between the CIS countries, and is a member of the Customs and Eurasian unions. Although up to this point Russia was actively engaged in foreign trade. With joining these organizations and unions, this activity only gained momentum and became more intense.

Naturally, no one doubts the relevance of this activity. After all, income received from foreign trade turnover of goods and services in Russia constitutes a significant part of the country’s budget. Therefore, in this article we will consider the foreign trade balance of the Russian Federation, what goods and services the country exports and imports, as well as the final cost for each category.

CUSTOMS CLEARANCE OF IMPORT

a specialized customs representative focused on full customs clearance of imported cargo of various types.

We will provide the necessary consulting, information support and practical assistance in passing checks and procedures related to the payment of duties, taxes and fees established by customs legislation.

The duration of customs clearance of imported cargo depends on the type of goods and the availability of documentation necessary for its clearance. As practice shows, prompt and high-quality interaction between our employees and customs services will allow us to complete the import clearance procedure within 24 hours.

With our help, the process of customs clearance of imported goods will go as quickly as possible.

Register the cargo

Russian Customs Agency "RTA" - all-Russian broker

included in the register of customs representatives of the Federal Customs Service of the Russian Federation for an indefinite period and without restrictions on the region of activity. This means that we work at all customs posts in any region of Russia.

Export to Russia

In the structure of Russian exports in 2021 (and in 2021), the main share of supplies fell on the following types of goods:

- Mineral products (HS codes 25-27) - 51.19% of the total volume of Russian exports (in 2021 - 63.33%);

- Metals and products made from them (HS codes 72-83) - 10.37% of the total volume of Russian exports (in 2021 - 8.87%);

- Precious metals and stones (HS code 71) - 9.03% of the total volume of Russian exports (in 2021 - 3.61%);

- Food products and agricultural raw materials (HS codes 01-24) - 8.80% of the total volume of Russian exports (in 2021 - 5.85%);

- Products of the chemical industry (HS codes 28-40) - 7.11% of the total volume of Russian exports (in 2021 - 6.39%);

- Machinery, equipment and vehicles (HS codes 84-90) - 5.73% of the total volume of Russian exports (in 2021 - 5.32%);

- Wood and pulp and paper products (HS codes 44-49) - 3.68% of Russia’s total exports (in 2021 - 3.02%).

The largest increase in Russian exports in 2021 compared to 2019 was recorded for the following product groups:

- Natural or cultured pearls, precious or semi-precious stones, precious metals, metals clad with precious metals, and products made from them; bijouterie; coins (HS code 71) - increase by USD 15,101 million;

- Cereals (HS code 10) – increase by USD 2,204 million.

The largest reduction in Russian exports in 2021 compared to 2021 was recorded for the following product groups:

- Mineral fuel, oil and their distillation products; bituminous substances; mineral waxes (HS code 27) - reduction by USD 95,523 million;

- Ferrous metals (HS code 72) - reduction by USD 2,134 million;

- Fertilizers (HS code 31) - reduction by USD 1,397 million;

- Ground transport vehicles, except for railway or tram rolling stock, and their parts and accessories (HS code 87) - reduction by USD 1,201 million;

- Organic chemical compounds (HS code 29) - reduction by USD 1,197 million;

- Inorganic chemical products; inorganic or organic compounds of precious metals, rare earth metals, radioactive elements or isotopes (HS code 28) - reduction by USD 1,174 million;

- Electrical machines and equipment, their parts; sound recording and sound reproducing equipment, equipment for recording and reproducing television images and sound, their parts and accessories (HS code 85) - reduction by USD 1,169 million.

Russian exports in 2021 by product groups

| HS Code | Name of product group | Exports in 2021, million US dollars | Share in total exports, % | Exports in 2021, million US dollars | Changes in 2021 relative to 2021, % |

| 01 | Live animals | 57 | 0,02 | 49 | 15,26 |

| 02 | Meat and edible meat by-products | 882 | 0,26 | 591 | 49,22 |

| 03 | Fish and crustaceans, molluscs and other aquatic invertebrates | 4 637 | 1,38 | 4 663 | -0,56 |

| 04 | Milk products; bird eggs; natural honey; edible products of animal origin, not elsewhere specified or included | 304 | 0,09 | 273 | 11,36 |

| 05 | Animal products not elsewhere specified or included | 97 | 0,03 | 117 | -17,32 |

| 06 | Living trees and other plants; bulbs, roots and other similar parts of plants; cut flowers and decorative foliage | 4 | 0,00 | 5 | -26,22 |

| 07 | Vegetables and some edible roots and tubers | 489 | 0,15 | 469 | 4,25 |

| 08 | Edible fruits and nuts; citrus fruit peel or melon rind | 137 | 0,04 | 119 | 15,56 |

| 09 | Coffee, tea, mate, or Paraguayan tea, and spices | 192 | 0,06 | 171 | 12,38 |

| 10 | Cereals | 10 126 | 3,01 | 7 921 | 27,83 |

| 11 | Products of the flour and cereal industry; malt; starches; inulin; wheat gluten | 359 | 0,11 | 328 | 9,41 |

| 12 | Oilseeds and fruits; other seeds, fruits and grains; medicinal plants and plants for technical purposes; straw and fodder | 1 735 | 0,52 | 1 011 | 71,70 |

| 13 | Natural shellac, unrefined; gums, resins and other plant juices and extracts | 10 | 0,00 | 11 | -9,82 |

| 14 | Plant materials for making wickerwork; other products of vegetable origin, not elsewhere specified or included | 18 | 0,01 | 19 | -5,40 |

| 15 | Fats and oils of animal or vegetable origin and their breakdown products; prepared edible fats; waxes of animal or vegetable origin | 4 271 | 1,27 | 3 436 | 24,28 |

| 16 | Prepared products of meat, fish or crustaceans, molluscs or other aquatic invertebrates | 232 | 0,07 | 195 | 19,06 |

| 17 | Sugar and sugar confectionery | 737 | 0,22 | 512 | 43,90 |

| 18 | Cocoa and cocoa products | 743 | 0,22 | 726 | 2,40 |

| 19 | Prepared products from cereal grains, flour, starch or milk; flour confectionery products | 756 | 0,22 | 688 | 9,85 |

| 20 | Processed products of vegetables, fruits, nuts or other plant parts | 414 | 0,12 | 341 | 21,31 |

| 21 | Various food products | 821 | 0,24 | 700 | 17,29 |

| 22 | Alcoholic and non-alcoholic drinks and vinegar | 627 | 0,19 | 615 | 1,91 |

| 23 | Residues and waste from the food industry; ready-made animal feed | 1 430 | 0,43 | 1 258 | 13,71 |

| 24 | Tobacco and industrial tobacco substitutes | 540 | 0,16 | 535 | 0,88 |

| 25 | Salt; sulfur; earth and stone; plastering materials, lime and cement | 922 | 0,27 | 1 080 | -14,66 |

| 26 | Ores, slag and ash | 4 320 | 1,28 | 4 182 | 3,28 |

| 27 | Mineral fuel, oil and their distillation products; bituminous substances; mineral waxes | 166 955 | 49,63 | 262 478 | -36,39 |

| 28 | Inorganic chemical products; compounds, inorganic or organic, of precious metals, rare earth metals, radioactive elements or isotopes | 4 058 | 1,21 | 5 232 | -22,44 |

| 29 | Organic chemical compounds | 2 478 | 0,74 | 3 675 | -32,56 |

| 30 | Pharmaceutical products | 1 053 | 0,31 | 844 | 24,76 |

| 31 | Fertilizers | 7 005 | 2,08 | 8 402 | -16,62 |

| 32 | Tanning or dyeing extracts; tannins and their derivatives; dyes, pigments and other coloring substances; paints and varnishes; putties and other mastics; printing paint, ink, ink | 340 | 0,10 | 350 | -2,82 |

| 33 | Essential oils and resinoids; perfume, cosmetic or toilet preparations | 866 | 0,26 | 772 | 12,18 |

| 34 | Soaps, organic surfactants, detergents, lubricants, artificial and prepared waxes, scouring or polishing compounds, candles and similar articles, modeling pastes, plasticine, “dental wax” and dental compositions based on plaster | 553 | 0,16 | 490 | 12,71 |

| 35 | Protein substances; modified starches; adhesives; enzymes | 59 | 0,02 | 52 | 13,24 |

| 36 | Explosives; pyrotechnic products; matches; pyrophoric alloys; some flammable substances | 139 | 0,04 | 113 | 23,49 |

| 37 | Photo and film products | 13 | 0,00 | 14 | -1,72 |

| 38 | Other chemical products | 952 | 0,28 | 996 | -4,43 |

| 39 | Plastics and products made from them | 3 776 | 1,12 | 3 026 | 24,79 |

| 40 | Rubber, rubber and products made from them | 2 624 | 0,78 | 3 032 | -13,47 |

| 41 | Unprocessed hides (except natural fur) and tanned leather | 57 | 0,02 | 88 | -35,57 |

| 42 | Leather products; saddlery and harness; travel accessories, handbags and similar products; products made from animal intestines (except silkworm fibroin fiber) | 63 | 0,02 | 55 | 15,77 |

| 43 | Natural and artificial fur; products made from it | 40 | 0,01 | 50 | -21,69 |

| 44 | Wood and products made from it; charcoal | 8 318 | 2,47 | 8 620 | -3,50 |

| 45 | Cork and products made from it | 2 | 0,00 | 2 | -7,55 |

| 46 | Products made of straw, alfa or other weaving materials; basketry and wickerwork | 1 | 0,00 | 1 | 19,87 |

| 47 | Pulp of wood or other fibrous cellulosic materials; regenerated paper or cardboard (waste paper and waste) | 1 096 | 0,33 | 1 123 | -2,43 |

| 48 | Paper and cardboard; products made from paper pulp, paper or cardboard | 2 420 | 0,72 | 2 491 | -2,85 |

| 49 | Printed books, newspapers, reproductions and other products of the printing industry; manuscripts, typescripts and plans | 547 | 0,16 | 551 | -0,73 |

| 50 | Silk | 0 | 0,00 | 0 | 11,80 |

| 51 | Wool, fine or coarse animal hair; yarn and fabric, horsehair | 13 | 0,00 | 18 | -28,34 |

| 52 | Cotton | 60 | 0,02 | 57 | 4,96 |

| 53 | Other vegetable textile fibers; paper yarn and fabrics made from paper yarn | 8 | 0,00 | 13 | -37,99 |

| 54 | Chemical threads; flat and similar yarns of chemical textile materials | 73 | 0,02 | 70 | 3,74 |

| 55 | Chemical fibers | 57 | 0,02 | 59 | -2,96 |

| 56 | Cotton wool, felt or felt and non-woven materials; special yarn; twine, ropes, ropes and cables and products made from them | 187 | 0,06 | 162 | 15,28 |

| 57 | Carpets and other textile floor coverings | 14 | 0,00 | 12 | 13,08 |

| 58 | Special fabrics; tufted textile materials; lace; tapestries; Decoration Materials; embroidery | 14 | 0,00 | 13 | 0,82 |

| 59 | Textile materials, impregnated, coated or laminated; textile products for technical purposes | 67 | 0,02 | 65 | 3,08 |

| 60 | Knitted or crocheted fabrics | 36 | 0,01 | 32 | 11,37 |

| 61 | Articles of clothing and clothing accessories, knitted or crocheted | 261 | 0,08 | 216 | 20,78 |

| 62 | Items of clothing and clothing accessories, except knitted or hand-knitted items | 269 | 0,08 | 236 | 13,79 |

| 63 | Other finished textile products; sets; used clothing and textiles; rags | 162 | 0,05 | 115 | 40,06 |

| 64 | Shoes, gaiters and similar articles; their details | 239 | 0,07 | 270 | -11,36 |

| 65 | Hats and their parts | 17 | 0,01 | 18 | -7,04 |

| 66 | Umbrellas, sun umbrellas, walking sticks, seat sticks, whips, riding crops and parts thereof | 2 | 0,00 | 2 | -24,69 |

| 67 | Processed feathers and down and articles made of feathers or down; artificial flowers; human hair products | 5 | 0,00 | 4 | 21,97 |

| 68 | Articles made of stone, plaster, cement, asbestos, mica or similar materials | 518 | 0,15 | 533 | -2,85 |

| 69 | Ceramic products | 319 | 0,09 | 323 | -1,34 |

| 70 | Glass and products made from it | 702 | 0,21 | 755 | -7,05 |

| 71 | Natural or cultured pearls, precious or semi-precious stones, precious metals, metals clad with precious metals, and products made from them; bijouterie; coins | 30 360 | 9,03 | 15 259 | 98,96 |

| 72 | Black metals | 16 007 | 4,76 | 18 141 | -11,76 |

| 73 | Ferrous metal products | 3 402 | 1,01 | 3 719 | -8,52 |

| 74 | Copper and products made from it | 5 646 | 1,68 | 5 222 | 8,11 |

| 75 | Nickel and products made from it | 3 024 | 0,90 | 2 985 | 1,28 |

| 76 | Aluminum and products made from it | 5 463 | 1,62 | 5 839 | -6,44 |

| 78 | Lead and products made from it | 174 | 0,05 | 167 | 4,59 |

| 79 | Zinc and products made from it | 39 | 0,01 | 23 | 67,62 |

| 80 | Tin and products made from it | 13 | 0,00 | 9 | 50,95 |

| 81 | Other base metals; metal ceramics; products made from them | 710 | 0,21 | 1 001 | -29,02 |

| 82 | Tools, utensils, cutlery, spoons and forks made of base metals; their parts are made of base metals | 198 | 0,06 | 197 | 0,28 |

| 83 | Other products made of base metals | 201 | 0,06 | 190 | 6,13 |

| 84 | Nuclear reactors, boilers, equipment and mechanical devices; their parts | 8 375 | 2,49 | 8 992 | -6,86 |

| 85 | Electrical machines and equipment, their parts; sound recording and reproducing equipment, equipment for recording and reproducing television images and sound, their parts and accessories | 4 391 | 1,31 | 5 560 | -21,03 |

| 86 | Railway locomotives or tram motor cars, rolling stock and parts thereof; track equipment and devices for railways or tramways and parts thereof; mechanical (including electromechanical) signaling equipment of all types | 804 | 0,24 | 911 | -11,74 |

| 87 | Ground transport vehicles, except railway or tram rolling stock, and their parts and accessories | 3 481 | 1,03 | 4 682 | -25,65 |

| 89 | Vessels, boats and floating structures | 734 | 0,22 | 520 | 41,08 |

| 90 | Optical, photographic, cinematographic, measuring, control, precision, medical or surgical instruments and apparatus; their parts and accessories | 1 479 | 0,44 | 1 814 | -18,45 |

| 91 | Watches of all types and their parts | 38 | 0,01 | 31 | 21,08 |

| 92 | Musical instruments; their parts and accessories | 13 | 0,00 | 8 | 67,03 |

| 94 | Furniture; bedding, mattresses, mattress bases, cushions and similar stuffed furnishings; lamps and lighting fixtures not elsewhere specified or included; illuminated signs, illuminated name or address plates and similar products; prefabricated building structures | 640 | 0,19 | 666 | -3,97 |

| 95 | Toys, games and sports equipment; their parts and accessories | 209 | 0,06 | 193 | 8,17 |

| 96 | Various finished products | 331 | 0,10 | 307 | 8,06 |

| 97 | Artworks, collectibles and antiques | 5 | 0,00 | 6 | -13,33 |

| SS | Secret code | 9 365 | 2,78 | 10 891 | -14,01 |

SCOPE OF WORK DURING IMPORT REGISTRATION

- Preparation of a list of necessary documents for the customs of the Russian Federation (invoice, contract, technical description, waybills, certificates)

- Determining the HS code, carrying out all calculations necessary for declaration

- Calculation and payment of customs duties (import customs duties, excise taxes, VAT and customs duties)

- Drawing up, transmitting and maintaining import declarations

- Release of goods by customs in accordance with the selected customs procedure

- Receipt of goods officially imported into the territory of the Russian Federation, and all necessary documents (issued shipping documents, confirmation of write-off of customs duties. Issued, declaration of customs value (DTV) and declaration of goods (DT).

What kind of violations will there be?

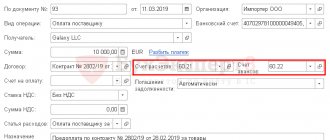

The penalties are still mild so that participants can adapt to the system. For example, if you purchased a traceable product, but the invoice does not have its identification number or it is indicated incorrectly, you retain the right to deduct VAT (clause 3 of article 2 of law No. 371-FZ).

The Federal Tax Service website states that liability measures will begin to apply from July 1, 2022. The authorities planned to supplement the Tax Code of the Russian Federation with articles 129.15-129.16 with fines for the absence of RNPT, errors in the number, lack of a report on traceable goods, but have not yet done this.

Currently, tax authorities can only request documents and explanations if they identify discrepancies between traceability system reports and other reports. For failure to provide documents upon such requests or failure to make corrections, standard fines are provided under clause 1 of Art. 126 of the Tax Code of the Russian Federation in the amount of 200 rubles for each document not provided and according to clause 1 of Article 129.1 of the Tax Code of the Russian Federation in the amount of 5,000 rubles.

Check whether you use traceable goods in your business activities. Prepare to implement a tracking system in your accounting and learn how to submit reports. And the “My Business Bureau” system will help you with this. This is a reference and legal system, consultations with lawyers, accountants and personnel officers, services for checking counterparties, assessing the likelihood of blocking a current account, a database of pre-filled forms and online calculators for calculating taxes, fees and payments to personnel.

ADVANTAGES OF WORKING WITH US

PROFESSIONALLY

Your trading operations are carried out by experienced professionals in the foreign trade industry. All specialists have certificates from the Federal Customs Service of Russia and more than 8 years of practical experience.

Comfortable

Your personal account allows you to carry out all procedures without personal presence, from uploading documents to tracking the status of customs clearance. DT is sent to customs via ED-2

Fast

Thanks to the accumulated experience of working with customs services, we have created a clear procedure that allows you to expedite customs clearance

Profitable

We will provide a declaration for Goods (DT), and all related documents at a single price, without additional payments

Dynamics and forecast

As for the further development of the situation, today it is worsening due to the unfavorable economic situation in the world, as well as due to the continued sanctions. In addition, even if export dynamics are observed, it will most likely not support the falling ruble in 2021.

The situation on the oil market indicates that Russia is currently losing oil buyers both in Europe and on the Asian market. Therefore, we should expect a decrease in export indicators on the Russian market, at least in the first half of 2020.

***

It can be assumed that in the next decade, China and Asian countries will represent the main direction of Russia's foreign trade strategy. The dependence of European countries on the EU's common foreign trade policy will hinder the expansion of Russia's trade with these countries. At the same time, the involvement of Germany, Italy and France in investment cooperation projects with Russia will contribute to bilateral trade, despite the likelihood of new sanctions. For the same reason, the United States will maintain its position in trade with Russia. The possibility of significantly expanding trade with the African and LCA regions is unlikely, since this would require significant Russian investment. Only concentrating efforts on large countries - Egypt and Algeria, Brazil and Mexico - can help promote Russian foreign trade interests in these regions. Increasing trade with partners in the EAEU seems possible within the framework of joint projects, subject to deepening integration.

. See Shkolyar N.A. Russia – Latin America: evolution of trade and the impact of the pandemic. Russian Foreign Economic Bulletin. 2021. No. 3 p.57-68.

. See Shkolyar N.A. Russia's trade with Latin American countries: guidelines for the third decade.

Africa

Yulia Belous, Miras Zhienbaev: 2021 for the EAEU: stagnation or a chance for a reboot

In recent years, there has been interest from research organizations and Russian entrepreneurs in African countries as promising partners for trade and economic cooperation. In 2019, imports from this group of countries amounted to $2.9 billion, of which 63.5% came from the top three - South Africa, Morocco and Egypt.

Africa's share of Russian exports has grown from 1.1% in 2001 to 3.3% in 2021, but of the $14 billion in Russian exports to this region, the bulk of the share came from Egypt (42%) and Algeria (24%). ,5%).