Importing goods from foreign countries is associated not only with settlements with a foreign supplier, but also with settlements with customs. When processing import transactions, many questions may arise, for example, what is the customs declaration number in 1C?

Let's look at how in 1C 8.3 Accounting:

- import into 1C 8.3 Accounting step by step;

- capitalize imported goods;

- fill out the customs declaration for import .

For more details, see the online course: “Accounting and tax accounting in 1C: Accounting 8th ed. 3 from A to Z"

Import into 1C 8.3 Accounting step by step

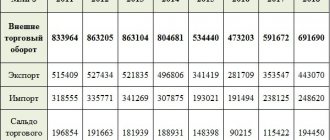

The organization entered into a contract with the supplier Galaxy LLC for the supply of goods from Germany in the amount of 20,000 EUR.

On March 11, an advance payment in the amount of 10,000 EUR was made.

On March 19, the supplier Galaxy LLC shipped the goods Lathe IM-1 (1 pc.) worth 20,000 EUR. The transfer of ownership of the goods occurs at the moment the goods are transferred by the carrier to the buyer’s warehouse. Delivery basis - DAP Moscow.

On March 27, advance customs payments were made (VAT - 315,000 rubles, duty - 75,000 rubles, fee - 750 rubles).

On March 29, customs declaration of goods was carried out. The machine was delivered to the warehouse and accepted for accounting.

Conditional courses for example design:

- March 11 — the rate of the Central Bank of the Russian Federation is 73.00 rubles/EUR;

- March 29 — the rate of the Central Bank of the Russian Federation is 75.00 rubles/EUR.

Transfer of advance payment for imported goods

Transfer the advance in 1C with the document Write-off from current account transaction type Payment to supplier in the Bank and cash desk section - Bank - Bank statements.

Please indicate:

- Bank account - foreign currency bank account in EUR;

- VAT rate - Without VAT .

Postings

Sample of a completed customs declaration form

After completing all the points, the customs declaration will be accepted for registration, then everything is recorded in a special journal and after the customs declaration becomes a document with legal force. After the full registration of the customs declaration is completed, it is strictly prohibited to issue it to the declaring party or to an outsider who is not a border service employee until the full registration is completed.

Amendments, additional notes or withdrawal of the customs declaration can be made only before the start of the inspection process of cargo and vehicles. A fully completed customs declaration along with the accompanying package of documents is transferred to the border service for control.

Transfer of payment to customs

List the customs payment in 1C with the document Write-off from the current account type of operation Other settlements with counterparties in the section Bank and cash desk - Bank - Bank statements.

The transfer of customs payments can be made in two payments: one for the payment of VAT and customs duties, the second for the payment of duties. This is due to the use of different BCCs when processing payments.

Read more Payment of VAT at customs when importing from third countries

But the overall filling will be the same:

- Agreement - basis for settlements, Type of agreement - Other ;

- Settlement account - 76.09 “Other settlements with various debtors and creditors.”

VAT and tax

Postings

Import duty when importing into 1C

Postings

Electronic exchange of invoices

The sale and purchase of traceable goods for resale must be formalized using electronic invoices and exchanged through EDI operators. This also applies to adjustment documents (clause 1 of Article 169 of the Tax Code of the Russian Federation). Exceptions are provided in the following cases:

- goods are sold to individuals for their own needs, and not for business;

- goods transferred for export or re-export;

- goods are sold and moved from the Russian Federation to the territory of a member state of the EAEU.

Exchange electronic invoices with counterparties according to new rules

Capitalization of imported goods in 1C 8.3

Receive goods from third countries in 1C using the document Receipt (act, invoice) transaction type Goods (invoice) in the section Purchases – Purchases – Receipt (acts, invoices).

Please indicate:

- Invoice No. from - data of the primary document, for example, invoice No. and date;

- from - date of transfer of ownership.

Fill out the table with the purchased goods.

- % VAT - Without VAT ;

See also How to correctly indicate the customs declaration and the country of origin of goods when importing

Postings

See also New “import” documents in the Federation Council (from the recording of the broadcast on December 21, 2021)

Customs declaration for import into 1C 8.3 Accounting

The customs declaration of goods in 1C 8.3 is reflected in the import customs declaration document in the section Purchases - Purchases - import customs declaration. Create it based on the document Receipt (act, invoice) by clicking the Create based on .

GTD in 1C Accounting 8.3

Main tab :

- The customs declaration number is the number from column A of the customs declaration (CD);

- The deposit is the basis for settlements. Type of agreement - Other ;

- Customs duty - the amount of the fee, column 47 “Calculation of payments” by type of payment 1010;

- Link Currency - rub. Settlements with customs are carried out in rubles, so select rubles. After this, the data on the Sections tab of the customs declaration in 1C will be filled in rubles;

- Calculations - the data on the link should be filled out if you need to offset the advance customs payment for specific payment orders. In our example, we do not select payments, since the payment was made according to two payment orders, and it is against them that the advance is credited automatically.

Mutual settlements with customs are carried out on account 76.09, therefore the Account for accounting of settlements with the counterparty is indicated exactly as such. The advance on it is counted in the same way as on accounts 60.02 or 62.02.

View Settlements with customs

- Reflect VAT deduction in the purchase book checkbox . If it is installed, then all payment documents against which the advance was offset will be reflected in the purchase book: payment orders for the payment of duties, fees, VAT. And it should only include the payment order that paid VAT.

BukhExpert8 recommends not checking this box, but registering a VAT deduction using the document Formation of purchase ledger entries, in which you can manually adjust the payment order data.

tab of the customs declaration in 1C based on the document Receipt (act, invoice) .

Please indicate at the top:

- Customs value : from column 12 “Total customs value” - if you fill out the entire declaration for goods;

- from column 45 “Customs value” - if you fill in according to the data in one of the sections of the declaration for goods.

In 1C, customs value is not stored or calculated.

- % duty - rate or fixed amount of duty on all goods (column 47 “Calculation of payments” of the declaration for goods, type of payment 2010). If the duty rate is not the same for goods, then the column is not filled in, and the total amount of duty is manually set in the Duty .

- % VAT - VAT rate for all goods (column 47 “Calculation of payments”, payment type 5010).

If, as a result of auto-filling the customs declaration document for imports , there are discrepancies in the amounts of duty and VAT, for example, due to rounding in 1C, then these amounts must be adjusted manually.

See also How the amount of VAT is calculated at customs when importing goods from non-CIS countries

Products by section:

- if there are several goods, then distribute the amounts of duty and VAT between the goods using the Distribute ;

- if duty is levied only on specific items, in the Duty , manually enter the amount of duty applicable to specific goods;

- Amount - the cost of goods from the document Receipt (act, invoice) , since it is this amount, together with the amounts of duty and fee, that is used to fill out column 15 of the purchase book (clause 6 of the Rules for maintaining the purchase book, approved by Decree of the Government of the Russian Federation dated December 26, 2011 N 1137).

- Accounting account, Accounting account (NU) - an accounting account in the debit of which duties and fees are reflected in the accounting system and NU;

- VAT account - account 19.05;

- Comment - BukhExpert8 advises filling out information about the payment slip for the payment of VAT offset against the customs declaration (column 47 “Calculation of payments”, type of payment 5010). This data will be needed when deducting VAT.

Postings

GDT registration services

In order to correctly carry out all the procedures, you need to know exactly the procedure for filling out the customs declaration, which goods are subject to inclusion in the document and declaration, know the legislation and all regulations regarding customs procedures. That is why the decision to use the services of customs representatives, whose roles are successfully played by specialists, will be more profitable from the point of view of finances, successful business management, and saving time.

If errors were made during the transportation of goods or the preparation of documents for them, you may face penalties, and sometimes confiscation of goods, and administrative liability. And to avoid all these problems and difficulties, cargo delays at the border, entrust customs clearance of goods to professionals.

Our center provides all types of customs services, including customs clearance of goods and cargo, filling out and submitting cargo customs declarations. We are an experienced customs declarant and can represent your interests by preparing customs documentation at any customs office of the Russian Federation.

Acceptance of VAT paid at customs for deduction

Accept VAT for deduction using the document Generating Purchase Ledger Entries in the Operations - Period Closing - Regular VAT Operations section.

Clicking the Fill will automatically display the data on accrued VAT at customs. But to correctly fill out the purchase book, make adjustments.

By default, the columns Doc. No. payment and date of doc. payments are hidden. If you are deducting VAT on imported goods, then make sure that these columns are filled out correctly: they should reflect the payment details for the payment of “import” VAT to the budget.

See also: How can an importer set up and complete this document?

VAT was paid by payment order No. 100 dated March 27, 2018 (column 47 “Calculation of payments”, payment type 5010).

This means that in order for the correct tax payment details to be indicated in the purchase book, make adjustments to the document by indicating the number and date of the payment order only for VAT - No. 100 dated 03/27/2018.

During the work process, the accountant may need to clarify and refill this document. To avoid having to repeat manual adjustments, create a separate document only to offset the VAT paid at customs. In the Comment , place a corresponding note, for example, Import .

Postings

We have successfully discussed how to reflect imports in 1C 8.3 Accounting step by step and how to fill out a customs declaration document for imports in 1C.

Common Mistakes

Keep records of exports and imports using the simplified tax system in the Kontur.Accounting web service. Currency accounting and work instructions, taxes, automatic salary calculation and reporting in one service Get free access for 14 days

Control over foreign economic activity by the state is stronger than over internal activities. Therefore, avoid mistakes when maintaining accounting records of import transactions. Check the following points:

- currency conversion - often accountants use the exchange rate on an incorrect date;

- translations of documents - import documents must be in two languages: Russian and the partner’s language, sometimes the partner sends documents only in his own language, then you need to prepare a translation;

- correspondence of accounts - an error typical for internal and external activities; it is eradicated with increasing experience of the accountant.