Definition

An import quota for a year is established only if there is a need to eliminate, through its use, damage to a certain sector of the domestic economy or to prevent the threat of such damage.

In the amount of the annual volume of the quota, which is introduced as a special protective measure, the government of the Russian Federation establishes such restrictions for a specific foreign state and only after conducting appropriate consultations with it, taking into account its interests in the supply of the product in question. If the import quota is distributed among supplying countries, then the government agrees on the distribution of such a restriction with all states that have an interest in this product.

TARIFF QUOTAS

“Treaty on the Eurasian Economic Union” (Signed in Astana on May 29, 2014)

Article 44

Tariff quotas

1. In relation to certain types of agricultural goods originating from third countries and imported into the customs territory of the Union, it is allowed to establish tariff quotas if similar goods are produced (mined, grown) in the customs territory of the Union.

2. The corresponding rates of import customs duties of the Unified Customs Tariff of the Eurasian Economic Union are applied to the goods specified in paragraph 1 of this article, imported into the customs territory of the Union within the established volume of the tariff quota.

3. The establishment of tariff quotas in relation to certain types of agricultural goods originating from third countries and imported into the customs territory of the Union, and the distribution of tariff quota volumes are carried out in the manner provided for in Appendix No. 6 to this Treaty.

Appendix No. 6

to the Treaty on the Eurasian

economic union

PROTOCOL ON COMMON CUSTOMS AND TARIFF REGULATION

I. General provisions

1. This Protocol was developed in accordance with Section IX of the Treaty on the Eurasian Economic Union and defines the principles and procedure for the application of customs tariff regulation measures in the customs territory of the Union.

2. The terms used in this Protocol mean the following:

“ similar goods ” - a product that, in its functional purpose, application, quality and technical characteristics, is completely identical to a product imported into the customs territory of the Union within the framework of a tariff quota, or (in the absence of such a completely identical product) a product that has characteristics close to characteristics of a product imported into the customs territory of the Union within the framework of a tariff quota, allowing it to be used for a functional purpose similar to the purpose of the product imported into the customs territory of the Union within the framework of a tariff quota, and can be commercially replaced by it;

“ significant suppliers from third countries ” - suppliers of goods with a share of 10 percent or more in the import of goods into the customs territory of the Union;

“ Tariff quota volume ” – the quantity of goods in physical or value terms allocated for import within the tariff quota;

“ previous period ” – the period in respect of which an analysis is carried out of the volumes of consumption of goods in the customs territory of the Union and the volumes of production of similar goods in the customs territory of the Union;

“ real volume of imports ” – the volume of imports in the absence of restrictions;

“ agricultural goods ” – goods classified in groups 1-24 of the EAEU HS, as well as goods such as mannitol, D-glucite (sorbitol), essential oils, casein, albumins, gelatin, dextrins, modified starches, sorbitol, skins, leather, fur raw materials, raw silk, silk waste, animal wool, raw cotton, cotton waste, combed cotton fiber, raw flax and raw hemp;

“ tariff quota ” is a measure for regulating the import into the customs territory of the Union of certain types of agricultural goods originating from third countries, providing for the application of differentiated rates of import customs duties of the EAEU CCT in relation to goods imported within a specified quantity (in physical or value terms) for a certain period period and beyond that amount.

III. Conditions and mechanism for applying tariff quotas

5. The volume of the tariff quota in relation to a certain type of agricultural goods originating from third countries and imported into the customs territory of the Union is established by the Commission and cannot exceed the difference between the volume of consumption of such goods in the customs territory of the Union and the volume of production of similar goods in the customs territory of the Union.

Moreover, if for one Member State the volume of production of a similar product is equal to or exceeds the volume of consumption of such a product, then such a difference may not be taken into account when calculating the volume of the tariff quota for the customs territory of the Union.

6. If the volume of production of a similar product in the customs territory of the Union is equal to or exceeds the volume of consumption of such a product in the customs territory of the Union, the establishment of a tariff quota is not allowed.

7. When making a decision to establish a tariff quota, the following conditions must be met:

1) establishment of a tariff quota for a certain period (regardless of the results of consideration of the issue of distribution of the volume of the tariff quota between third countries);

2) informing all interested third countries about the volume of the tariff quota allocated to them (if a decision is made on the distribution of the volume of the tariff quota between third countries);

3) publication of information on the establishment of a tariff quota, its duration and volume, including on the volume of the tariff quota allocated to third countries (in the event of a decision on the distribution of the volume of the tariff quota between third countries), as well as on the rates of import customs duties applied in relation to goods imported within the scope of the tariff quota.

8. The distribution of the volume of the tariff quota between participants in foreign trade activities of a Member State is based on their equality in relation to receiving a tariff quota and non-discrimination based on the form of ownership, place of registration or market position.

9. The volume of the tariff quota is distributed among the Member States within the difference between the volumes of consumption and production in each of the Member States, which was taken into account when calculating the volume of the tariff quota for the customs territory of the Union in accordance with paragraphs 5 and 6 of this Protocol.

Moreover, for a member state that is a member of the World Trade Organization, the volume of the tariff quota can be established based on the obligations of such member state to the World Trade Organization.

10. The distribution of the volume of tariff quotas between third countries is carried out by the Commission or in accordance with the decision of the Commission - a Member State based on the results of consultations with all significant suppliers from third countries, unless otherwise established by international treaties within the Union, international treaties of the Union with a third party or decisions of the Supreme Council.

If it is impossible to distribute the volume of the tariff quota based on the results of consultations with all significant suppliers from third countries, the decision on the distribution of the volume of the tariff quota between third countries is made taking into account the volume of supplies of goods from these countries during the previous period.

As a rule, any 3 previous years for which information is available reflecting actual import volumes is accepted as the previous period.

If it is impossible to select such a previous period, the volume of the tariff quota is distributed based on an assessment of the most probable distribution of the real volume of imports.

11. When supplying goods during the validity period of the tariff quota, no conditions and (or) formalities are established that would prevent any third country from fully using the volume of the tariff quota allocated to it.

12. At the request of a third country interested in supplying goods, the Commission conducts consultations on the following issues:

1) the need to redistribute the allocated volume of the tariff quota;

2) changes in the selected previous period;

3) the need to cancel the conditions, formalities or any other provisions established unilaterally in relation to the distributed volume of the tariff quota or its unlimited use.

13. In connection with the establishment of tariff quotas, the Commission:

1) at the request of a third country interested in supplying goods, provides information regarding the method and procedure for distributing the volume of the tariff quota between participants in foreign trade activities, as well as the volume of the tariff quota in respect of which licenses have been issued;

2) publishes information on the total quantity or cost of goods intended for delivery within the allocated volume of the tariff quota, on the start and end dates of the tariff quota and any changes thereto.

14. Except in cases of distribution of the volume of the tariff quota between third countries, the Commission has no right to require that licenses be used for the import of goods from any specific third country.

WE PROVIDE SERVICES TO LEGAL ENTITIES AND INDIVIDUAL ENTREPRENEURS (WE DO NOT WORK WITH INDIVIDUALS), INCLUDING: DECLARANTS (IMPORTERS and EXPORTERS), CUSTOMS REPRESENTATIVES, TSW OWNERS, AUTHORIZED ECONOMIC ENTITIES SKI OPERATORS, CUSTOMS CARRIERS. WE PROVIDE LEGAL SERVICES RELATED TO OPERATIONS PERFORMED WHEN MOVEMENT OF GOODS AROSS THE CUSTOMS BORDER OF THE EAEU IN THE RUSSIA REGION. WE ARE READY TO EXPLAIN THE MECHANISM OF REGULATORY REGULATION OF PROCESSES RELATED TO THE MOVEMENT OF GOODS ALONG THE BORDER, TO EVALUATE THE LEGALITY OF THE ACTIONS OF THE STATE CONTROL AUTHORITIES, TO APPEAL INDEPENDENTLY OR TO HELP YOURS RISTS ARE NOW TO APPEAL ILLEGAL ACTIONS TO HIGHER AUTHORITIES AND THE COURT.

First oral consultation is FREE (call or WhatsApp +7(906)4-313-865 ) Oral consultation – 1000 rubles Written consultation – 5000 rubles Subscription service for a month (written and oral consultations) – 15000 rubles Subscription service for a month (written and oral consultations, appealing illegal actions and decisions) – 30,000 rubles Departmental appeal (decisions on classification, customs value, preferences, application of forms of control) – 20,000 rubles Supporting an administrative investigation and preparing a complaint against a decision in a case of an administrative offense – 20 000 rubles Legal challenge (preparing a position on the case + travel expenses) – 40,000 rubles Support of customs inspection (preparing a response to a request, drawing up objections to the inspection report) – 40,000 rubles The list and price of services can be changed by agreement of the parties. The price of services does not include VAT, since the services are provided under an agreement with an individual entrepreneur using a simplified taxation system. Email WhatsApp +7(906)4-313-865

Tweet

Procedure for issuing import quotas

This restriction must often be supported by the issuance of appropriate licenses to a separate group of people or a certain number of business entities. For example, in the USA there is an import quota for the import of cheese, which is allowed only to a specific circle of companies. Each of them is granted such import rights for a specific number of pounds of foreign-made cheese.

The quota size for each business entity is determined based on the quantity that was imported by the company in previous periods. Sometimes the right to sell may be granted only to the governments of the exporting countries. In this case we are talking about a product such as military equipment or sugar.

Import quota and domestic price of goods

One should not think that the introduction of an import quota helps to limit the import of goods without raising their domestic prices. Due to the restrictions introduced, the price of imported goods always rises. When imports are limited, the following can be observed: the demand for a product at the original price exceeds all domestic supply with the addition of the amount of imports. Therefore, the price will increase until a new market situation is established. As a result, import duties and quotas raise domestic prices by the same amount as a tariff that restricts the import of goods to the same amount. The exception is the case of an internal monopoly, in the presence of which a quota can raise prices by an order of magnitude.

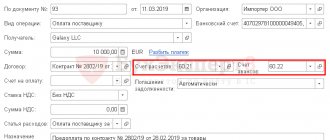

Relationship between quotas and licenses

Quotas and licenses are measures to restrict the import or export of goods. And most often, quotas work through licensing: based on quotas, companies are issued licenses to import or export goods. If you plan to import a licensed product into the country that is subject to quotas, during the process of obtaining a license, you may find that the annual quota has already been exhausted. Then you will have to give up trading in this product or wait until the beginning of next year. Sometimes product quotas are immediately supported by the issuance of licenses to a number of companies.

Quota and tariff: main differences

The main difference between the two is that with the introduction of a quota, the government does not receive any revenue.

If, when limiting imports, a quota is used instead of a duty, then the funds that could become a source of filling the budget go to the entity that acquires the appropriate licenses. Their holders purchase imported goods for their further sale on the domestic market, but at a fairly high price. The profit received by the holders of such licenses is known as “quota rent”.

Export and import operations

To achieve mutual benefit in international trade for all its participants, exports and imports for each individual state must develop in the most favorable and efficient way. In practice, this efficiency is determined by an adequate system of international payments and world prices.

International trade is characterized by export-import transactions. What imports are can be understood based on the definition of import quotas. And export is the export of various goods and services abroad for the purpose of selling them on the foreign market. In this case, technologies that are supposed to be exported outside a particular state can also be considered goods. A special form of export is re-export, which implies the export of goods previously imported without any processing in this state.

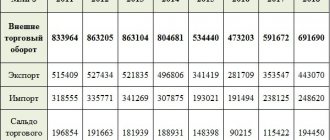

Exports and imports are recorded upon crossing the border and are reflected in foreign economic and customs statistics.

Why are quotas set?

Keep records of exports and imports using the simplified tax system in the Kontur.Accounting web service.

Currency accounting and work instructions, taxes, automatic payroll calculation and reporting in one service Get free access for 14 days A quota is a special protective measure: imports are limited if the state believes that certain goods will harm the economic situation of the country or its citizens, and also - if there are international agreements on this matter. Most often, with the help of quotas, the state tries to protect local producers of the same competing goods.

Another case of introducing quotas is in response to discriminatory measures by foreign states or foreign trading partners. Quotas also help to avoid excessive dependence on the products of one country: after all, its volume may be reduced due to unfavorable climatic conditions or the economic situation in that country. And if the state competently sets import quotas and “does not put all its eggs in one basket,” then citizens are better protected.

Types of import quotas

Considering the theoretical aspects of this concept, it is necessary to highlight the following types of quotas: group, global, individual, anti-dumping, special and compensatory.

Group quotas are restrictions on the import of goods with a clear definition of the group of states from which they are imported.

Global quotas are represented by restrictions that are set for a specific product without specifying the countries from which it is imported.

Anti-dumping quotas are characterized by restrictions on the volume of imports of goods into a particular state. In this case, we are talking about a product participating in an anti-dumping investigation, which is allowed to be imported within the approved period.

Compensatory quotas are represented by the maximum volume of imports of a specific product, which is an anti-subsidy object, which, as in the previous case, is allowed to be imported for a certain period.

For how long are quotas set?

Keep records of exports and imports using the simplified tax system in the Kontur.Accounting web service. Currency accounting and work instructions, taxes, automatic salary calculation and reporting in one service Get free access for 14 days

The quota is set for a year if there is a need. Officials set import restrictions after consultation with the specific supplying state and taking into account its and Russian interests in supplies. Often the import quota is distributed among several supplying countries. A quota is introduced regarding the quantity of a product or its cost. Before approval, quotas are carefully calculated.

Peculiarities

As mentioned above, an import quota (the formula for calculating it is shown in any economic textbook) costs a nation much more than a tariff of the same amount.

In this case, we are talking about the fact of monopolization of the domestic market due to the introduction of restrictions on the import of goods. For example, a large Russian industrial company does not gain monopoly and undivided power when using a tariff, since it is opposed by an elastic supply at a global price with the addition of a tariff. However, with the introduction of an import quota, a Russian business entity no longer fears an increase in prices, since it has confidence in the restrictions for a similar foreign-made product on its import into the territory of the Russian Federation. As a result, this constraint allows the dominant firm to make large profits through price increases.

Thus, an import quota can lead to the establishment of a very high price on the domestic market with a simultaneous decrease in the level of output.

The impact of quotas on national welfare

The impact of the restrictions on the import of goods under consideration on national welfare is manifested in the distribution of import rights by the authorities. The main ways of distributing import quotas are:

- an auction organized on a competitive basis;

- preference system;

- distribution of quotas using the cost method.

Import quotas are often sold by the state at an open auction, where the price for these licenses is set, which is equal to the difference between the cost set by the importer and the domestic price for which the imported product is sold.

Despite the cheapness of open auctions for the distribution of import quotas, in fact they are not used.

Most often, when distributing such restrictions, an auction is used on a competitive basis. In this case, underground business and the shadow economy receive an impetus for development. With this distribution, the winners are those who give the largest bribe.

Import quotas are sometimes placed on the basis of explicit and systemic preferences, in which the government assigns such restrictions to specific companies without applications, negotiations or competition.