From this article you will learn:

- Why indicate the country of origin of the goods according to 44-FZ

- Documents confirming the country of origin of the goods in accordance with 44-FZ

- How to draw up a declaration of the country of origin of goods

- Restrictions on the country of origin of goods

- Changes in the rules for indicating the country of origin of goods under 44-FZ from 2021

Participants in electronic auctions and open tenders should be aware of the customer’s requirement to indicate the country of origin of the goods. 44-FZ is adamant in this regard: this information is mandatory; in its absence, the application simply will not be considered.

However, this fact does not eliminate some questions, in particular, about why this data is so necessary, how to correctly indicate information, and what supporting documents are needed. Let's try to figure it out.

Why indicate the country of origin of the goods according to 44-FZ

44-FZ establishes that the contractor in the first part of the application must indicate the place of manufacture of the product he offers. The name of the country of origin of the goods according to 44-FZ consists of the name of one or more states in whose territory the production is located. The auction organizer is obliged to state in the documentation the rule according to which bidders must provide such information.

The concept of “country of origin of goods under 44-FZ” is often confused with terms that differ in meaning, such as:

- Designation of origin of products . It speaks of a specific place that is directly associated in the consumer’s mind with unique items. A striking example here is the Orenburg scarf.

- Manufacturer's location . This concept also does not correspond to the country of production. As practice shows, a company will not be selected for participation in tenders when the country is replaced by the manufacturer in the documents. The organizer will indicate non-compliance with the tender rules as the reason.

- Country of the trademark . The state in which the trademark is registered is often not identical to the place of production itself. It is no secret that you can often find products under the Apple brand registered in America, manufactured in China.

In Art. 33 Federal Law-44 establishes standards for drawing up documents. In the description of the auction item, references to trademarks, names of the place of production, and the manufacturing company are prohibited.

According to 44-FZ, the seller is deprived of the opportunity to replace the country of origin of the goods or the product itself. The contract is terminated if the customer is given products whose country of origin does not meet the pre-agreed conditions. Namely, such actions by the supplier are followed by a unilateral refusal.

Quite often, bidders cannot understand why they should indicate the country in which the product was manufactured. The text of the law provides an explanation: the fact is that for all auctions organized by state and municipal bodies, the national regime applies. That is, there are varieties of goods manufactured in our country, Belarus, and Kazakhstan, for which preferences are provided. We will talk about this in detail below.

How to determine where a product was made

The memo on the rules for determining the place of production of products when imported into the EAEU, which was approved by the board of the Eurasian Economic Commission, indicates which goods are considered produced in Russia for the purposes of government procurement. Products are recognized as originating from a specific state if the following conditions are met:

- The product is entirely obtained or manufactured in such state.

- Or sufficiently processed if foreign materials were used in the production of the product.

Here are instructions on how to determine the country of origin of a product.

If foreign materials were used in production, such products are considered to originate from such a state if one of the following conditions is met:

1. As a result of processing or production operations, the classification code of a product according to the Harmonized Commodity Description and Coding System (HS) differs at the level of any of the first four digits from the HS classification code of the materials used in the production of such products.

Example:

In state A, in the production of “furniture” (code 9401), foreign material “wooden boards” (from state B) (code 4407) was used.

As a result of production, the foreign product's classification code (4407) has changed to at least one of the first four digits relative to the manufactured product's classification code (9401) and, therefore, the state of origin of the product has changed to A.

2. The cost of foreign materials does not exceed 50% of the cost of manufactured products.

Example:

In the country of origin, Russia or the Russian Federation, foreign material (from China) was used in production. The cost of the product is $100. And the confirmed cost of the foreign materials used in the cost of the finished product is $45. Consequently, the share of foreign material is 45% and, accordingly, does not exceed 50%, the origin criterion is met and the place of production is Russia or the Russian Federation.

For products that are similar to those subject to internal market protection measures, residual criteria of origin are additionally established, which make it possible to more accurately determine where the product is made in the vast majority of cases:

1. If the production used materials originating from only one state other than the one in which the goods were made, then the resulting products are recognized as originating from the state from which all the materials used originate.

Example:

In State A, in the production of a product (cost $100), foreign material (cost $80) (from State B) is used. The criteria for sufficient processing in this case are not met, therefore, the produced product originates from State B.

2. If during production materials originating from more than one state were used, then the resulting product is recognized as originating from the state from which the largest part of the value of the materials used in the cost of the resulting product originates.

Example:

In State A, the production of a product ($100 cost) uses foreign materials ($60 cost) from State B and a $30 cost material from State B, and the overhead cost of making the mixture is $10. The criteria for sufficient processing in this case are not met, therefore, the origin of the manufactured products is determined by the country from which the largest part of the materials comes from, i.e., State B. In other cases, determination of origin (goods for which domestic protection measures have not been established) market) if the criteria for sufficient processing are not met, the origin of the goods is considered unknown.

Documents confirming the country of origin of the goods in accordance with 44-FZ

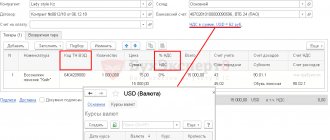

The country is indicated in the first part of the application, and in the second (at the request of the tender organizer) documents are attached that can confirm this fact.

Let us note that most often it is enough for the customer to see a statement of the fact itself. Rarely, according to the terms of bidding, it is necessary to attach a document in accordance with the type of product. The law allows the auction organizer to demand:

- declaration of country of origin - there are no clear rules for filling it out;

- certificate of examination of the Chamber of Commerce and Industry (validity of this document is 1 year);

- CT-1 certificate (when it comes to medicines), issued on the basis of the above act/application of the supplier - it can be one-time or valid for three months or a year;

- a copy of a special investment contract - let’s say a legal entity invests more than 3 billion rubles in production on the territory of the Russian Federation, then these products are purchased without tendering.

When organizing tenders for certain types of products, documents are required to confirm the country of origin of the goods in accordance with 44-FZ.

For radio electronics:

- SPIC;

- confirmation from the Ministry of Industry and Trade of the Russian Federation about the manufacture of these products within Russia;

- notification of a similar agency about confirmation of the status of telecommunications equipment of Russian origin;

- one-time/annual certificate ST-1.

For furniture or mechanical engineering products:

- SPIC;

- CCI examination report;

- certificate ST-1.

When supplying medical products, if there are access restrictions for them, it is necessary to provide a CT-1 certificate.

To supply products, a declaration about the country of origin and the manufacturer is required. There is no strict submission form for the latter document.

Last changes

As of January 12, 2021, new rules for determining the country of manufacture of certain types of products for government procurement are in effect, which were approved by the Council of the Eurasian Economic Commission in decision No. 105 of November 23, 2020.

The purpose of the rules is to resolve issues of determining the country of origin of goods for government procurement within the framework of the national regime. The document states that the country of origin for public procurement is determined according to the rules that are an integral part of the decision. The document is valid on the territory of the EAEU member states.

Use free instructions from ConsultantPlus experts to understand the rules for applying import substitution in government orders.

To read, you will need access to the system: .

The country of manufacture of products from the list attached to the decision will have to be determined according to the conditions, production and technological operations that are enshrined in this document. These conditions were prescribed in the following areas:

- railway engineering;

- refrigeration and compressor equipment;

- light industry;

- furniture and woodworking industry;

- special mechanical engineering;

- machine tool industry;

- shipbuilding;

- chemical and oil and gas industry.

If manufacturers of manufactured goods of a Member State do not ensure the fulfillment of the conditions and operations that are defined in the list, such Member State has the right to establish transition periods and their validity periods. During the transition period, suppliers of the Member State that established such a period do not participate in government procurement of other Member States for manufactured goods from the list.

How to draw up a declaration of the country of origin of goods

This declaration is required when the auction organizer has established a ban on goods produced by a foreign state or a group of them. It is worth explaining that the national regime was introduced at the legislative level to provide an advantage for manufacturers from EAEU member countries (Russia, Belarus, Armenia, Kazakhstan, Kyrgyzstan).

Preparing a declaration is not difficult. Usually it is drawn up on the performer’s letterhead; there is an indulgence for individual entrepreneurs - they can use a regular one.

The declaration includes the following mandatory blocks:

- Header or title of the document: “Declaration of the country of origin of goods offered for delivery.”

- A text block with the following content: “For the purpose of executing clause 6, part 5, art. 66, part 4 art. 14 FZ-44 dated 04/05/2013 “On the contract system in the field of procurement of goods, works, services to meet state and municipal needs”, Order of the Ministry of Economic Development of Russia dated 03/25/2014 No. 155 “On the conditions for the admission of goods originating from foreign countries” states, for the purpose of procurement of goods, works, services to meet state and municipal needs” “the name of the executing company” reports:...”.

- A table of three columns: item number, product name, country of origin of the product. Remember, NSPT must correspond to the name established by the All-Russian Classifier of Countries of the World.

- Position, full name, signature, seal (if any). According to the law, the executor is not obliged to print out the document, sign it, or put a stamp on it in order to scan it. It is allowed to be attached to the ETP as a file in *.doc format without signature or seal. But in this case, an electronic signature is required.

.

Sellers often doubt whether they need a declaration or whether they can only indicate the country of production. If a company wants to participate in procurement, it needs to submit documents confirming its compliance and GRU with all conditions established by the customer in accordance with Art. 14 of the federal law that interests us. Copies of such papers are acceptable. To participate in tenders and requests for quotations, copies must be certified.

If the required declaration is not attached to the application, the participant risks losing the preferences entitled to him.

According to the position of the Ministry of Economic Development, declaring the country in which the products were manufactured involves indicating the name of the state in the text of the application. Even if the seller has not provided separate papers, the application complies with the norms of the law, which means it is allowed for trading. But you need to understand that this is only the position of the MER. Often we have to deal with cases when the territorial bodies of the FAS think the opposite. Therefore, in order to avoid getting into an unpleasant situation, it is recommended to provide the auction organizer with a declaration.

Changes in the declaration of SPT from 07/01/2018

From July 1, 2021, amendments made in December 2021 by Federal Law No. 504-FZ come into force in 44-FZ.

According to these amendments, if a participant’s application does not contain the documents provided for by regulatory legal acts adopted in accordance with Article 14 44-FZ, then such an application will be equated to an application that contains an offer to supply goods originating from a foreign state or group foreign states, works, services, respectively, performed and provided by foreign persons. Thus, the participant will lose the corresponding preferences, but his application will not be rejected.

The application will be rejected only if an explicit prohibition is established in relation to the purchased goods, works, services, as provided for in Article 14 44-FZ.

You can read more about the amendments to 44-FZ in our article - Changes to 44-FZ - as amended from July 1, 2021.

44-FZ: restrictions on the country of origin of goods

The national regime in government procurement includes rules applicable to industrial and industrial products manufactured outside our country. The meaning of this regime consists of the following provisions:

- Ban on foreign dual-use products.

- Development of the Russian economy.

- Maintaining the country's defense capability.

- Ensuring national security.

- Support for domestic manufacturers.

The national regime has three main forms, namely prohibitions, restrictions, conditions of admission (preferences).