- What is a certificate of origin

- Forms of certificates of origin

- Registration of the ST-1 certificate

- Features of the ST-1 certificate

- Certificate of Origin Form A

- List of documents for issuing a certificate form “A”

- Features of the certificate form “A”

- For which products can you obtain a certificate of origin?

- Grounds for refusal to issue certificates of origin of goods

- Receive a certificate of origin ST-1

What is a certificate of origin

Certificate of origin of goods - indicates the country of origin of the goods, and is usually required by the customs authorities of the importing country in order to implement tariff and non-tariff measures to regulate the import of goods into the customs territory of the corresponding country and the export of goods from this territory (for example, to calculate the appropriate import duty rate, in including preferential ones in case of granting preferential treatment to goods).

On January 12, 2021, new rules for determining the country of origin of goods came into effect when importing goods into the countries of the Eurasian Economic Union (EAEU). Read more about how to determine the country of origin of goods in the company news —>>>

Certificates of origin of goods of the general form are issued for Russian goods exported to all countries with the exception of the CIS countries, unless the issuance of certificates of origin of the forms “ST-1”, “ST-2”, “A” or other types of certificates is required.

How to confirm if restrictions are set

To confirm that the delivery is not subject to the restrictions established by clause 3 of Art. 14 44-FZ, include additional documents provided for in Art. 14 44-FZ, included in the application. When purchasing:

- Industrial products - information that the product is present in the register of the Ministry of Industry and Trade (Resolution No. 617 of April 30, 2020). In this case, be sure to indicate the registry number of the entry and the amount of points for completing technical specifications on the territory of the Russian Federation, if this is provided for by PP No. 719 of July 17, 2015.

- Radio-electronic products - a declaration that the product is included in the register of radio-electronic products indicating the registration number (Resolution No. 878 of July 10, 2019).

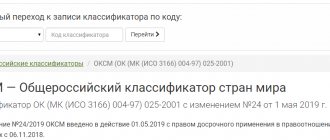

- For food products - indicate the country of origin according to OKSM (PP No. 832 of 08/22/2016).

- Medicines that are included in the list of Vital and Essential Drugs are a certificate of origin of the product or a conclusion confirming production in the Russian Federation (PP No. 1289 of November 30, 2015).

- Medical products - a certificate of origin or an examination report, which indicates the share of imported raw materials (PP No. 102 of 02/05/2015, PP No. 967 of 08/14/2017).

Forms of certificates of origin

Today, there are five forms of certificates of origin of goods:

ST-1, ST-2, form A, form EAV and general form certificate of origin:

- Certificate of origin form ST-1 for goods exported to CIS member states;

- Certificate of origin form ST-2 for goods exported to Serbia;

- Certificate of Origin Form A for goods exported to countries providing preferences under the General System of Preferences (Montenegro);

- Certificate of Origin Form EAV for goods exported to Vietnam;

- General Form Certificate of Origin for goods exported to the rest of the world.

44-FZ: restrictions on the country of origin of goods

The national regime in government procurement includes rules applicable to industrial and industrial products manufactured outside our country. The meaning of this regime consists of the following provisions:

- Ban on foreign dual-use products.

- Development of the Russian economy.

- Maintaining the country's defense capability.

- Ensuring national security.

- Support for domestic manufacturers.

The national regime has three main forms, namely prohibitions, restrictions, conditions of admission (preferences).

Registration of the ST-1 certificate

Certificate form ST-1 is a document confirming the country of origin of the goods. This document is provided when exporting products to the CIS countries, and exempts the foreign company from paying import duties. Since a simplified customs clearance system operates between Russia, Kazakhstan and Belarus, the ST-1 certificate is not required for these countries.

To obtain a certificate, you need to document the Russian origin of the product and its compliance with all parameters of origin

Depending on the product range, various documents may be required. However, there is a general list that includes:

- statement;

- foreign trade contract;

- registration documents;

- information confirming the Russian production of the product (product passport, quality certificate, instruction manual);

- composition of the product with the designation of each component and its country of origin;

- invoice (incoming and outgoing), waybill.

Documentation is provided in the form of copies with the supplier's seal.

How to confirm if restrictions are set

The contract system provides for a ban on imports (Clause 3, Article 14 44-FZ). To avoid rejection of the application, the participant confirms the fact that the products are of Russian origin or from the EAEU with documents included in the application. We tell you what documents are needed under Article 14 of 44-FZ when purchasing:

- Industrial products - an extract from the register of the Ministry of Industry and Trade or products that are manufactured in the EAEU (Resolution No. 616 of April 30, 2020). Indicate the registration number of the entry and the amount of points for completing technical specifications on the territory of the Russian Federation, if this is provided for by PP No. 719 of July 17, 2015.

- Devices for storing information - a declaration about the location of the product in the register of radio-electronic products of Russian manufacture. In this case, be sure to indicate the registration number of the entry (Decree No. 1746 of December 21, 2019).

- Software - additional documents confirming the product’s compliance with 44-FZ are not required as part of the application. It is enough to have the software in the register of programs that were released in the Russian Federation or in the register of software that was produced in the EAEU (Resolution No. 1236 of November 16, 2015).

Certificate of Origin Form A

Form “A” certificate is a document certifying that the goods were produced in Russia. The use of this certificate was introduced within the framework of the general system of preferences for the export of goods to the EU countries, the USA, Canada, Turkey and Japan. The import customs duty depends on the country of origin of the goods. However, since 2014, Russia has been recognized as a developed country and excluded from the preferential countries of the European Union. In most cases, the foreign company itself asks to provide one or another certification.

Grounds for refusal to consider a certificate of origin of goods

Sometimes customs officers may refuse to accept the certificate of origin and do not provide import duty relief.

The grounds for such refusal are:

- The certificate was issued (filled out) in violation of the requirements

- There are not enough grounds (evidence documents) for customs to recognize the certificate of origin

In such cases, customs authorities can independently contact the organization that issued the certificate of origin and request clarifying information or additional documents that will ultimately allow them to approve (or not approve) the provision of customs preferences.

Cost of certificate of origin

How much it will cost to issue a certificate of origin (ST-1, form A, general form) depends on the nature of the product, the tasks of the supplier and a number of other operational issues. Therefore, the final cost of the document is assigned individually and is called by an employee of the selected certification organization.

Accredited Certification Center Apsert LLC - urgent issuance of certificates of origin at the lowest price:

- certificate of origin ST-1 – from 7,000 rubles

- certificate form A – from 5,000 rubles

- general form certificate of origin – from 5,000 rubles

Free consultation by phone: +7 (800) 350-55-68

For which products can you obtain a certificate of origin?

Certificates of origin of goods of the form "ST-1" are issued for Russian goods exported from the Russian Federation to member states of the Commonwealth of Independent States (CIS countries), such as:

Republic of Armenia, Republic of Azerbaijan, Republic of Belarus, Republic of Kazakhstan, Republic of Kyrgyzstan, Republic of Moldova, Republic of Tajikistan, Republic of Turkmenistan, Republic of Uzbekistan, Georgia.

From January 2, 2021, general certificates are issued for goods exported to Ukraine.

The period of application of the “ST-1” certificate for the purpose of providing a free trade regime is limited to 12 months from the date of its issue.

From September 1, 2014, certificates of the ST-1 form are issued for goods exported to the Republic of South Ossetia and the Republic of Abkhazia in accordance with the Rules for determining the country of origin of goods dated November 20, 2009.

What happens if you ignore the requirements to provide supporting documents?

A supplier may miss national treatment requirements due to negligence or lack of knowledge in this area.

Further decisions are made based on the procurement rules in which the contractor participates:

- if there is a ban on foreign goods in the procurement, the application is rejected;

- If the auction gives preference to Russian-made goods, then a contract is concluded with the supplier, the amount of which is 15% less than the initial price. In other competitive procurements, the customer does not receive a reduction factor to the price when evaluating the application;

- a foreign product is considered if, in addition to it, only one application from an organization with domestic products is submitted in the auction. If a third supplier appears with Russian goods, the application with an unconfirmed country of manufacture is rejected.

Receive a certificate of origin ST-1

In order to obtain a CT-1 certificate, contact our employees by phone or email. To order a certificate, you can also fill out an application on our website. Our company provides assistance in obtaining ST-1 certificates for a wide range of products.

Certificates of origin of goods of the form “ST-1” are issued in Russian. In case of loss or damage to the certificate of form ST-1, a duplicate is issued. The duplicate certificate comes into force from the date of issue of the original. The period for applying a duplicate certificate for the purpose of granting a free trade regime cannot exceed 12 months from the date of issue of the original certificate.

How does SPT differ from similar terms?

The concept of “state of origin” should not be confused:

- with the place of production of the goods, for example, the name of a specific city or region. According to the rules of 44-FZ, the country of origin of products requires an indication of a specific state;

- manufacturer's location. Here's how the manufacturer and the country of origin differ: the place of registration of the company does not always coincide with the place of registration of the trademark or the location of production;

- the state to which the trademark belongs. What is the difference between the country of origin and the country of production: the state where the manufacturer of the product is registered is not the place of production, but the country where the trademark belongs.

If the product is only partially Russian

Sometimes it happens that part of the procurement object is of Russian origin, and part is of foreign origin. What happens if you include such a product in your application? Again, it all depends on how the national treatment for this procurement item is implemented.

If there is a complete ban on foreign goods , then such an application will be rejected.

If a price preference , then the customer’s further actions depend on the type of procedure and the share of the Russian product specified in the application:

- If this is an auction:

- the share of Russian goods is more than 50% - if the supplier wins, the contract price will not be reduced by 15%;

- the share of Russian goods is less than 50% - the entire contract price will be reduced by 15%.

- Competition, request for proposals and request for quotations. If the share of Russian products is more than 50% , the supplier is given preferences and a reduction factor is applied to the entire application.

Note! In this case, the share of Russian goods refers to their value, not volume.

Example. Product A with a price of 10 rubles per unit is 60% of the order volume, and product B with a price of 30 rubles is 40%. Despite the large share in volume, the cost part of product A is less than that of product B. Therefore, in this case, the supplier will not be given a preference.

Therefore, to calculate the share of a particular product in the cost of the entire application, it is necessary to indicate not only the origin, but also the price of each item.

What to do if the purchased goods are not produced in Russia?

Under the national regime, Russian goods are understood as products manufactured both in Russia and in the territory of other countries of the EAEU (Customs Union) .

If the goods declared for purchase are not produced in the EAEU, then customers can purchase foreign goods.

The following question arises: how to prove that a product is not produced on the territory of the Customs Union? The answer is simple - there must be a corresponding conclusion from the Ministry of Industry and Trade . Only this document is the basis for the purchase of foreign goods subject to national treatment. All other evidence will be rejected, as will the application itself.

What happens if you indicate Russia in the declaration, but deliver Chinese goods?

It is prohibited to replace a procurement item that is subject to national treatment. Moreover, you cannot replace it even with a better product. The customer will not accept such a procurement item , since these are legal requirements.

We will have to either supply Russian goods or terminate the contract. In this case, two options are possible:

- The contract will be terminated by agreement of the parties . But for this, the customer must meet the supplier halfway.

- The contract will be terminated by the customer unilaterally or by court decision . The basis will be inaccurate information about the product’s compliance with the requirements. In this case, the contractor will lose the contract security and will also be included in the register of unscrupulous suppliers.