DEFINITIONS OF THE COUNTRY OF ORIGIN OF GOODS

- The terms used in these Rules mean the following:

added value - the difference between the price of a product on an ex-factory basis and the cost of imported raw materials and supplies used for its production;

consignment of goods - goods that are sent under one transport document to one consignee by one consignor, as well as goods sent under one postal invoice or transported as hand luggage by one individual crossing the customs border;

Country of origin of goods

This is the country in which the goods have been wholly produced or have undergone sufficient processing in accordance with the criteria for sufficient processing of goods established by these Regulations. In this case, the country of origin of goods can be understood as a group of countries, or customs unions of countries, or a region or part of a country, if there is a need to distinguish them for the purpose of determining the country of origin of goods;

ex-works price - the price of a product payable to its manufacturer who has carried out the last significant processing of the product, less all internal taxes that are paid or may be paid upon its export.

How to indicate the country on the electronic platform

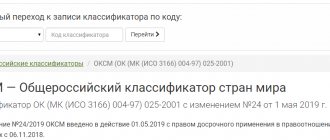

Government Decree No. 180 dated February 19, 2020 states that when filling out standard application forms for participation in an auction, competition, request for proposals, procurement participants select where the goods are made on an electronic platform from the classifier of names of the country of origin of goods according to 44-FZ (OKSM) . The same classifier also contains the digital code of the country of origin of the product (CPO). For example, Russia has 643.

IMPORTANT!

Participants indicate where each product item is made in the terms of reference, which such participants are going to supply or use when performing work or providing services. And government customers are obliged to require this information.

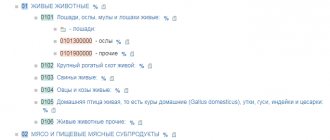

Goods that are entirely produced in a given country are considered to be:

1) minerals extracted from the bowels of the country, in its territorial sea (waters) or at the bottom of this sea;

2) products of plant origin grown or collected in a given country;

3) live animals born and raised in a given country;

4) products obtained in a given country from animals raised in it;

5) products obtained as a result of hunting and fishing in a given country;

6) products of marine fishing and other products of marine fishing received by a vessel of a given country;

7) products obtained on board a processing vessel of a given country exclusively from the products specified in subparagraph 6 of this paragraph;

products obtained from the seabed or from the subsoil of the sea outside the territorial sea (waters) of a given country, provided that the country has exclusive rights to develop the resources of that seabed or those subsoil;

products obtained from the seabed or from the subsoil of the sea outside the territorial sea (waters) of a given country, provided that the country has exclusive rights to develop the resources of that seabed or those subsoil;

9) waste and scrap (recycled raw materials) obtained as a result of production or other processing operations in a given country, as well as used products collected in a given country and suitable only for processing into raw materials;

10) high-tech products obtained in outer space at space objects, if this country is the state of registration of the corresponding space object;

Declaration (informing) about the presence of goods in the register: where to look

Declaration (informing) about the presence of goods in the register is information about the number of the register entry in free form, which is used in the procurement of industrial goods, software, and radio-electronic products.

Product information is indicated in the registers:

- Unified register of Russian radio-electronic products.

- Register of Russian software.

- Register of EAEU software.

- Register of Russian industrial products.

- Register of Eurasian industrial products.

There are two main ways to confirm the country of origin of the supplied product:

- Availability of ST-1 certificate.

- In any other form at the discretion of the supplier.

The supplier decides on the confirmation method independently, based on what goods he needs to supply. In the event that the supplied goods are included in one of the approved lists that impose restrictions on the supply of such goods, the presence of a ST-1 certificate is mandatory. For goods not included in any of the approved lists, the form of confirmation can be any and is determined by the participant independently.

How to obtain a CT-1 certificate?

The issuance of certificates in the ST-1 form is carried out by authorized bodies and organizations of the country from which the goods are exported. In order to obtain a ST-1 certificate in Russia, the participant should contact the Chamber of Commerce and Industry and provide a package of documents for the certified product.

The list of required documents includes:

- statement;

- agreement for the supply of goods;

- product registration documents;

- list of parts and components of the certified product;

- a document certifying the origin of the goods in the Russian Federation.

The certificate is issued no later than five calendar days.

- International treaties governing the procedure for determining the country of origin of goods

The importance of correctly determining the country of origin of goods has given rise to the need to agree on the general principles and rules for its determination at the international legal level.

International regulation of the origin of goods makes it possible to streamline the activities of the relevant government bodies and increases the objectivity of decisions taken on issues of determining the country of origin of goods for customs purposes. For the first time, unified rules determining the country of origin of goods from developing countries when granting tariff preferences were developed and adopted at the II and IV sessions of UNCTAD (UN Conference on Trade and Development) in 1968 and 1976. These rules were advisory in nature and were not international legal norms . However, they have become widespread and formed the basis of many international treaties concluded within various regions of the world.

The universal principles for determining the country of origin of goods are enshrined in the International Convention of May 18, 1973 “On the Simplification and Harmonization of Customs Procedures” (hereinafter referred to as the Kyoto Convention).

Special Annex K “Origin of Goods” of the Kyoto Convention provides a definition according to which: “country of origin of goods” means the country in which the goods were produced or manufactured in accordance with the criteria provided for the purposes of the application of a customs tariff, quantitative restrictions or any other measures related to trade.

Where two or more countries were involved in the production of goods, the origin of those goods must be determined in accordance with the criterion of substantial processing.

It is also established that documentary evidence of origin should be required only in cases where it is necessary for the application of preferential customs duties, economic or trade measures taken unilaterally or in accordance with bilateral or multilateral agreements, or measures taken for health purposes population or public order.

Within the framework of the WTO, the Agreement on Rules of Origin (hereinafter referred to as the Agreement) was adopted.

According to the Agreement: “rules of origin means the set of laws, regulations and administrative decisions of general application used by any member to determine the country of origin of goods.”

These rules of origin include all rules of origin used in the application of trade policy instruments that do not involve the granting of preferences, such as:

- most favored nation treatment;

- anti-dumping and countervailing duties;

- protective measures;

- labeling requirements regarding origin;

- any discriminatory quantitative restrictions or tariff quotas.

They also include rules of origin used for government procurement purposes and foreign trade statistics.

In accordance with paragraph 1 of Art. 4 of the Agreement, a Rules of Origin Committee was established, consisting of representatives of each WTO member.

In accordance with paragraph 2 of Art. 4 of the Agreement, a Technical Committee on Rules of Origin (hereinafter referred to as the “Technical Committee”) was established under the auspices of the STS/WCO.

The functions of the Technical Committee include the following:

- at the request of any member of the Technical Committee, study specific technical problems that arise in the day-to-day application of rules of origin by members and recommend appropriate solutions based on the facts presented;

- provide information and advice on any matters relating to the determination of the origin of goods that may be requested by any Member or Committee;

- prepare and distribute periodic reports on the technical aspects of the operation of this Agreement and on the progress of its implementation;

- review annually the technical aspects of the implementation and operation of parts II and III of the Agreement.

Thus, international regulation of the origin of goods includes rules of a general nature. At the same time, clearer rules for determining the origin of goods are being established at the state or regional levels.

- International treaties of the EAEU regulating the procedure for determining the country of origin of goods

For the purpose of providing tariff preferences for goods imported into the customs territory of the Union from states with which the Union applies a free trade regime in trade and economic relations, the rules for determining the origin of goods established by the relevant international treaty of the Union with a third party providing for the application of a free trade regime are applied. .

Currently, the following agreements on the creation of a free trade zone have been concluded within the EAEU:

- Free Trade Agreement between the Eurasian Economic Union and its member states, on the one hand, and the Socialist Republic of Vietnam, on the other hand (signed on May 29, 2015, entered into force on October 5, 2021) (Chapter 4 of the Agreement - Determination Rules origin);

- Temporary agreement leading to the formation of a free trade area between the Eurasian Economic Union and its member states, on the one hand, and the Islamic Republic of Iran, on the other hand (concluded on May 17, 2021, valid from October 27, 2019) (Chapter 6 of the Agreement - Rules for determining origin);

- Free Trade Agreement between the Eurasian Economic Union and its member states, on the one hand, and the Republic of Singapore, on the other hand (signed on October 1, 2019 ) (Chapter 4 of the Agreement - Rules of Origin);

- Free Trade Agreement between the Eurasian Economic Union and its member states, on the one hand, and the Republic of Serbia, on the other hand (signed on October 25, 2021) (Appendix No. 3 to the Agreement “Rules for Determining the Origin of Goods”).

At the same time, until the entry into force of the Free Trade Agreement between the Eurasian Economic Union and its member states, on the one hand, and the Republic of Singapore, non-preferential rules for determining the origin of goods, approved by the Decision of the Council of the Eurasian Economic Commission dated July 13, 2018 No. 49, apply.

Until the entry into force of the Free Trade Agreement between the Eurasian Economic Union and its member states, on the one hand, and the Republic of Serbia, the rules in force under the Free Trade Agreements with the Republic of Serbia signed bilaterally with the Russian Federation, the Republic of Kazakhstan and Republic of Kazakhstan, namely:

- Rules for determining the country of origin of goods, given in Appendix 3 to the Protocol between the Government of the Russian Federation and the Government of the Republic of Serbia on exemptions from the free trade regime and Rules for determining the country of origin of goods to the Agreement between the Government of the Russian Federation and the Federal Government of the Federal Republic of Yugoslavia on free trade between the Russian Federation and the Federal Republic of Yugoslavia on August 28, 2000;

- Protocol on determining the country of origin of goods and methods of administrative cooperation, given in Appendix 3 to the Free Trade Agreement between the Government of the Republic of Kazakhstan and the Government of the Republic of Serbia dated October 7, 2010;

- Protocol on determining the country of origin of goods and methods of administrative cooperation, given in Appendix B to the Agreement between the Government of the Republic of Belarus and the Government of the Republic of Serbia on free trade between the Republic of Belarus and the Republic of Serbia as amended by the Protocol on amendments and additions to the Agreement between the Government of the Republic of Belarus and the Government of the Republic of Serbia on free trade between the Republic of March 31, 2009.

- Contractual basis for determining the country of origin of goods in the CIS

The legal basis for the free trade zone currently operating in the CIS is the Agreement on the Establishment of a Free Trade Zone dated April 15, 1994 and the Protocol to it dated April 2, 1999.

The basic document defining the functioning of the free trade zone within the Commonwealth of Independent States should be the Free Trade Zone Agreement, signed in St. Petersburg on October 18, 2011, which is intended to replace the 1994 Agreement.

This Agreement was signed by the Republic of Armenia, the Republic of Belarus, the Republic of Kazakhstan, the Kyrgyz Republic, the Republic of Moldova, the Russian Federation ((from January 1, 2021, not valid in relation to Ukraine)), the Republic of Tajikistan and Ukraine (from January 2, 2021, not valid in relation to Russia ). On May 31, 2013, the Republic of Uzbekistan acceded to the Treaty.

The Agreement comes into force after 30 days from the date of receipt by the depositary of the third notification that the signatory Parties have completed the internal procedures necessary for its entry into force.

To date, notification has been received from the Russian Federation.

Any international free trade agreements constitute preferential trade agreements and, as such, necessarily contain rules for determining the country of origin of goods benefiting from these preferences.

Since the formation of the CIS, the Rules have been adopted three times.

The original Rules were approved by the Decision of the Council of Heads of Government of the CIS on September 24, 1993. The decision was signed by all CIS member states.

On November 30, 2000, by decision of the Council of Heads of Government of the CIS, a new edition of the Rules was approved. This Decision was not signed by Turkmenistan and the Republic of Uzbekistan. For them and in trade with other CIS member states with them, the 1993 Rules remain in force.

The 2000 Rules were supplemented by a List of special conditions and operations, under which goods, in the production of which imported materials were used, can be considered to originate from the CIS member state in which these operations were carried out (Appendix 1 to the Rules).

The 2000 Rules were amended and supplemented 15 times. Basically, these changes and additions concerned Appendix 1 to the Rules.

At the initiative of the Council of Heads of Customs Services of the CIS Member States, in 2006, preparation began for a new edition of the Rules for Determining the Country of Origin of Goods.

The result of three years of work by experts was the signing on November 20, 2009 by the heads of government of the CIS member states (with the exception of Turkmenistan and the Republic of Uzbekistan) of the Agreement on the Rules for Determining the Country of Origin of Goods in the Commonwealth of Independent States (hereinafter referred to as the Agreement), an integral part of which are the new Rules of 2009.

The agreement has been ratified and entered into force for all signatory states. When signing and ratifying the Agreement, countries made reservations regarding the application of criteria for sufficient processing of certain goods, for example, the Russian Federation included reservations regarding white sugar, vegetable oils and products made from it.

The 2009 rules contain clearer and unambiguous provisions and norms that make it possible to significantly streamline the activities of chambers of commerce and industry and organizations authorized to issue a certificate of origin of goods in the ST-1 form, customs authorities of the CIS member states, and also to minimize the number of controversial issues that were raised ambiguity in the interpretation of the provisions of the previous Rules.

Thus, within the framework of the free trade zone of the CIS countries, the origin of goods is determined in accordance with:

- Agreement on the Rules for Determining the Country of Origin of Goods in the Commonwealth of Independent States (Concluded in Yalta on November 20, 2009);

- Rules for determining the origin of goods in the CIS, 1993 (applied in mutual trade with the Republic of Uzbekistan and Turkmenistan).

This state of affairs creates additional difficulties and inconveniences during customs clearance of goods in trade with Turkmenistan and Uzbekistan.

It is obvious that for the effective functioning of the free trade regime and free movement of goods in the CIS, it is advisable to use a uniform procedure for determining the country of origin of goods.

In this regard, Article 4 of the new Free Trade Agreement of October 18, 2011, provides for the application of the 2009 Rules to determine the country of origin of goods in trade between the Parties to the Agreement.

To summarize, it can be noted that the international regulation of the origin of goods in the Russian Federation includes universal international treaties and agreements operating within the framework of the EAEU and the CIS.

Additional material on the topic in the section

Origin of goods

The practical side of the problem of confirming the origin of goods.

As is often the case in the contract system, the practice of state and municipal procurement makes its own adjustments to the interpretation of legislative provisions, letters, decrees and orders.

On the one hand, the requirement for confirmation of origin is very vague and in cases where we are not talking about the supply of goods that are subject to restrictions, it can take on an extremely formal form, when the participant almost by hand adds the name of our country to each item of the product, without anything without confirming the accuracy of this information.