Export from the Russian Federation to the EAEU. Export registration procedure. A distinctive feature of exports within the EAEU is the absence of customs duties on goods transported within the borders of the EAEU.

EAEU EAEU EAEU EAEU EAEU EAEU沒有關稅。

Export from the Russian Federation to the EAEU. Export clearance procedure. A distinctive feature of exports within the EAEU is the absence of customs duties on goods moved within the EAEU borders.

This applies to the vast majority of products. However, there are separate product groups, the sale of which is accompanied by a standard declaration with payment of duties. For example, goods of group 27 according to the Commodity Nomenclature of Foreign Economic Activity.

You should carefully monitor changes in legislation within the EAEU, since EEC decisions and other legislative acts are periodically issued that restrict the movement of goods of certain groups, even within the EAEU.

Also, for some goods exported within the EAEU, a FSTEC license must be issued. This license is a permit to export goods included in the list of dual-use goods. You should carefully monitor whether your product is included in this list or not.

EAEU export support WhatsApp +79169906144

The most important document for export sales is a foreign trade contract. In addition to the standard clauses usually inherent in a standard supply agreement, an export agreement has a number of features, for example:

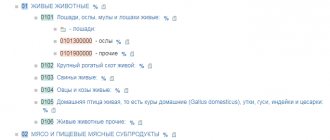

1. The export contract must contain information about the HS code. Based on this code, statistics on mutual trade within the EAEU are maintained and the registration procedure for individual groups of goods is determined.

2. It is necessary to indicate the delivery basis according to INCOTERMS 2020

3. It is important to reflect the conditions for the return of reporting documents from the buyer, confirming the fact of payment of indirect taxes in the buyer’s country.

If the amount of payments under the agreement exceeds 200,000 rubles, the bank has the right to request information about the agreement and supporting documents and only after providing the information make payments under the agreement. And if the amount of the agreement exceeds the amount of 6,000,000 rubles, such an export agreement is subject to mandatory registration with currency control.

THE MOST IMPORTANT! When concluding an international agreement, the amount of which exceeds 6,000,000 rubles, the Supplier-resident of the Russian Federation MUST (!) register the contract with currency control. From this moment on, the international contract is placed under special control. All stages of the transaction are carefully monitored by UWC of the bank, both in terms of the timing of fulfillment of obligations under the contract and in terms of amounts.

Violation of any clauses of the agreement registered with the exchange control office entails the imposition of fines on the resident. The amounts of fines can reach the full cost of the contract.

The issue of currency control is regulated by the Federal Law “On Currency Regulation and Currency Control” dated December 10, 2003 N 173-FZ

In any case, when you receive payments from non-residents, regardless of the amount of payments, the bank has the right to request (and will certainly request) the contract under which the payment is made and any other documents related to your receipt of payments from non-residents.

The declarant can return the overpaid export customs duty only after the goods are released in accordance with the customs export procedure.

This follows from the provisions of Article 141 of the EAEU Labor Code, according to which:

- the obligation to pay customs duties arises for the declarant from the moment of registration of the customs declaration at customs;

- Export customs duty must be paid before the goods are released.

To get a refund of overpaid customs duty, you need to make changes to the customs declaration. This can only be done by a customs officer (clause 19 of the Procedure approved by the decision of the EEC Board of December 10, 2013 No. 289).

The corresponding decision is made based on:

- results of customs control;

- written statement of the declarant.

This procedure is provided for in the letter of the Federal Customs Service dated April 29, 2011 No. 01-11/19942.

The customs authority is obliged to inform the declarant about overpaid customs duties no later than one month from the date of detection of the overpayment (Part 5 of Article 147 of Law No. 311-FZ of November 27, 2010).

The fact of excessive payment of customs duties can be established based on the results of customs control.

Amendments and additions to the customs declaration are permitted, in particular:

- if inaccuracies are identified during the preparation of the declaration;

- if clarifications are made on the basis of a court decision that has entered into legal force;

- if non-compliance with the declared customs procedure is detected.

A complete list of circumstances under which a customs declaration may be changed is given in paragraph 11 of the Procedure, approved by decision of the EEC Board of December 10, 2013 No. 289.

The declaration of the declarant regarding the need to make changes to the customs declaration is drawn up in any form. The application must justify the need for changes, indicate the registration number of the declaration and the list of changes made to it. The application must be accompanied by an adjustment to the goods declaration in the KDT form and an electronic copy of it.

If at the same time the customs value of goods is adjusted, please also attach to the application a value adjustment in the form DTS-3 or DTS-4, depending on which method was used to determine the customs value of goods, and an electronic copy of it (clauses 4–5 of the Procedure approved decision of the EEC board dated December 10, 2013 No. 289).

Making changes or additions to the customs declaration after the release of goods at the initiative of the customs authority is formalized by a decision in the form approved by the decision of the EEC board dated December 10, 2013 No. 289.

This follows from the provisions of paragraph 21 of the Procedure, approved by decision of the EEC Board of December 10, 2013 No. 289.

Refunds of overpaid (collected) customs duties are not made:

- if the organization has arrears in paying customs duties in an amount exceeding the amount of the overpayment. In this case, at the request of the declarant, it is possible to offset the overpayment against debt repayment. Moreover, offset of overpaid (collected) import customs duties against the fulfillment of the obligation to pay export customs duties is not allowed (Part 10, Article 147 of Law No. 311-FZ of November 27, 2010);

- if the amount of customs duties subject to refund to the organization is less than 150 rubles;

- if an application for a refund of customs duties is submitted three years after their payment (collection) (Part 1 of Article 147 of Law No. 311-FZ of November 27, 2010).

This is stated in Part 12 of Article 147 of the Law of November 27, 2010 No. 311-FZ.

Important : Article 147 of Law No. 311-FZ dated November 27, 2010 is valid until the day when the international treaty with amendments to Annexes 5 and 8 to the Treaty on the EAEU comes into force. From this date, when returning the duty, follow Articles 67 and 68 of Law No. 289-FZ dated August 3, 2018. Such rules are established by Part 5 of Article 397 and Part 8 of Article 398 of the Law of 03.08.2018 No. 289-FZ.

Export document preparation

The correctness of the documents and the completeness of the information reflected in them is extremely important when exporting to the EAEU countries. Some points have their own characteristics that distinguish a domestic sales document from a document issued for export delivery.

For example, in the UPD, in addition to standard information, it is necessary to fill in the HS code, which is reflected in the contract.

The column with information about VAT, as well as the invoice regarding VAT and all other documents where the VAT rate appears, must have the wording “VAT 0%”. Other wording is not acceptable. Except for the case if the exporter is on the simplified tax system.

It is desirable that the product name has clear wording. Those. “Machine M68-G-354-V4” must be a machine, and not just “M68-G-354-V4”. This is also optional, but it may affect the speed of the tax office making a decision on a VAT refund.

This stage has few differences from standard shipment, but they exist.

So, when exporting, the seller must issue a CMR (international transport bill of lading).

This document must contain complete information:

Essentially, it does not matter who physically fills out the CMR. It is important that the information it contains corresponds to reality. There must be 3 seals: sender, carrier and recipient.

It is interesting that on the part of the Russian Federation, no authority requires the provision of CMR when exporting to the EAEU. In Kazakhstan, the fact of crossing the border can be confirmed with a border crossing coupon, but buyers from Belarus often need it. Without this document, it is more difficult to report on imports in Belarus.

If the goods are shipped by pick-up, then CMR is not provided by the seller. If the buyer hires a transport company for transportation under a transportation contract, then the CMR is issued by the carrier, and the buyer acts as both the sender and the recipient.

Changes in the EAEU Labor Code

The EAEU Customs Code, which came into force at the beginning of 2021, adds some features regarding the payment of customs duties :

Upon application, any importer can receive (at a set interest rate) a deferment on the payment of customs duties , namely duties for up to 1 month from the date of release of goods.

In exceptional cases provided for in Art. 59 of the EAEU Labor Code, the customs authority can provide the importer with an interest-free deferment on the payment of duties for up to six months.

Owners of goods imported for the organization and implementation of industrial processing can apply to customs to obtain a six-month deferment on the payment of import duties (subject to payment of interest).

Owners of “taxable objects” are relieved of the need (and requirements) to pay customs duties when:

- the duty is not provided for by the procedure chosen for the cargo;

- the “objects” themselves (vehicles, supplies) are not subject to placement under customs procedures.

Now, at the request of the declarant or his legal representative, unused amounts of advance payments can be credited towards the payment of duties, excise taxes or other customs payments.

When importing goods, the owner also has an obligation to pay value added tax. The basis for calculating VAT is the customs value of the cargo, taking into account accrued duties and excise taxes. And the tax rate, the procedure for providing benefits and their size are established by the union state on whose territory the declaration is carried out.

Refund of customs VAT

When re-exporting - that is, exporting previously imported goods from the country - previously paid VAT can be returned. This applies to goods that are mentioned in Art. 242 of the EAEU Labor Code - that is, it is relevant when returning defective or low-quality goods that do not correspond to the quality specified in the foreign trade contract.

If the taxpayer imported goods, accepted VAT as a deduction, and then re-exported the shipment, he will have to restore the tax and then return the VAT paid upon import - this is the procedure under Art. 170 Tax Code of the Russian Federation. This position is set out in letter of the Ministry of Finance of the Russian Federation No. 03-07-08/197 dated 08.08.2008 and is due to the fact that only part of the goods could be sent for re-export.

The importer also has the right to a refund of VAT, which was paid when registering the cargo under the “release for domestic consumption” procedure (Article 242 of the EAEU Labor Code). Refund of taxes and duties occurs through adjustment of the import declaration for goods. The taxpayer must submit an adjustment declaration and confirm it with shipping documents with customs marks, payment documents with payment of duty and VAT. You will also need a certificate that import VAT was not claimed for deduction. This is a delicate point, since the law does not stipulate the procedure for issuing such a certificate and its form, so it may take more time to receive the document. Importers should consult with an expert customs broker to prepare all the necessary documents and resolve the VAT issue with customs without unnecessary hassle.

If you import goods, keep currency records in the Kontur.Accounting web service. The service will also help you pre-calculate VAT, tell you what documents are needed to reduce the amount payable and apply all deductions, and help correct possible accounting errors. Accounting includes simple accounting, payroll, reporting, financial control and other tools for accountants and directors. We give all newcomers a free 14 days of work.

Amount of customs duty payable

The amount of customs duty depends on the customs value of the imported goods. Calculate this cost yourself and indicate it in the declaration. It includes the costs of a foreign contract, insurance, cargo delivery, licensing, and so on. The customs officer will check the calculated amount, so confirm all included costs with documents.

Keep records of exports and imports using the simplified tax system in the Kontur.Accounting web service. Currency accounting and work instructions, taxes, automatic salary calculation and reporting in one service Get free access for 14 days

The amounts of customs clearance fees are presented in the table.

| Customs value | Customs duty rate |

| less than 200,000 rubles | 500 rubles |

| 200,000.01 - 450,000 rubles | 1,000 rubles |

| 450,000.01 - 1,200,000 rubles | 2,000 rubles |

| 1,200,000.01 - 2,500,000 rubles | 5,500 rubles |

| 2,500,000.01 - 5,000,000 rubles | 7,500 rubles |

| 5,000,000.01 - 10,000,000 rubles | 20,000 rubles |

| more than 10,000,000.01 rubles | 30,000 rubles |

For electronic declaration you will be given a 25% discount on customs duties (clause 7 (4) of Resolution No. 863). In Russia, customs declaration for imports is carried out only in electronic form (clause 3 of Article 104 of the EAEU Labor Code). In fact, customs duties will be as follows.

| Customs value | Customs duty rate |

| less than 200,000 rub. | 375 rub. |

| 200,000.01 - 450,000 rub. | 750 rub. |

| 450,000.01 - 1,200,000 rub. | 1,500 rub. |

| 1,200,000.01 - 2,500,000 rub. | 4,125 rub. |

| 2,500,000.01 - 5,000,000 rub. | RUR 5,625 |

| 5,000,000.01 - 10,000,000 rub. | 15,000 rub. |

| more than 10,000,000.01 rub. | 22,500 rub. |

For securities, the rate is 500 rubles per shipment, issued under one declaration. Taking into account the discount - 350 rubles.

Special conditions for air, sea and river vessels imported and exported under customs regimes of temporary import, export, processing on and outside the customs territory. The customs fee for one vessel is 10,000 rubles.

For temporary customs declaration, the customs duty rate does not depend on the customs value of the cargo and is 5,000 rubles. Upon subsequent full declaration, the rates from the table are applied.

Keep records of exports and imports using the simplified tax system in the Kontur.Accounting web service. Currency accounting and work instructions, taxes, automatic salary calculation and reporting in one service Get free access for 14 days

Important! Customs duties are included in the value added tax base. Customs duty is not included in the VAT base.

Import duties

Import customs duty represents a mandatory payment (CTT), which is levied by the customs authority for the import of goods into the customs territory of the Union. For all countries that are members of the Union, a single customs tariff applies, which is regulated by the EAEU agreement dated May 29, 2014. These legal aspects regulate the amount of calculated customs duties, which are established depending on the country of origin. The EAEU CCT is presented in the form of customs rates that apply to the list of goods imported into the territory of the Union. These rates are set by the Commission according to the Decision of the EEC Council dated July 16, 2012.

According to this Decision, the following types of rates apply:

- ad valorem - rates that are set depending on the percentage of the taxed product,

- specific rates, these rates are set based on the customs value of the goods,

- Combined bets are based on the two types of bets listed above, the bet level here is set by the larger of the two listed above.

Finished works on a similar topic

Coursework Customs duties of the EAEU 460 ₽ Abstract Customs duties of the EAEU 270 ₽ Test work Customs duties of the EAEU 190 ₽

Receive completed work or specialist advice on your educational project Find out the cost

Note 1

Rates are set depending on the country of origin of the goods. The Union has created a unified system of preferences for goods coming from developing countries.

The list of these countries is specified in the Decision of the Customs Union Commission dated November 27, 2009.

The list of developing user countries is in the Union’s unified system of tariff preferences.

In relation to preferential goods imported into the customs territory of the Union, originating from developing countries - users of the unified system of tariff preferences of the Union, import customs duty rates are applied in the amount of 75 percent of the EAEU UCT import customs duty rates. If goods are imported from countries covered by Union preferences, then zero rates are applied.

The customs duty on imported goods is calculated depending on the base for calculating the customs duty. To correctly determine the tariff, it is very important to use the correct classification of goods, correctly determine the country of origin and calculate the base.

Benefits may be applied to each product imported into the territory of the Union. However, tariff benefits are not individual in nature. The provision of benefits is regulated in Appendix No. 6 to the Treaty on the Union. These preferences are established if an Agreement is concluded with the exporting country.

The payment procedure is regulated by the EAEU Labor Code, taking into account the norms established in the Protocol.