Customs value

– the price of the goods that a participant in foreign economic activity presents to a representative of the customs authority when the cargo crosses the customs border of the Customs Union.

When filling out a cargo customs declaration (CCD) (now called a declaration of goods - DT), in one of the columns you must indicate the customs value of the goods

.

Customs value directly affects the costs of customs clearance of goods, since customs duties, fees and customs VAT are paid based on the customs value of the goods.

The customs value is determined

declarant, customs representative acting on behalf of the owner of the cargo.

Determination of the customs value of goods

is strictly controlled and verified by customs authorities, because An attempt to unreasonably independently reduce its size can lead to serious consequences. However, an assessment for customs authorities can also be carried out by an independent company, which makes it possible to determine the objective market value of goods and make correct calculations of the amount of customs duties and VAT.

The general concept of customs value is presented in the Customs Code of the Customs Union in Chapter No. 8. A foreign trade participant needs knowledge of the “Agreement taking into account the principles and provisions for the valuation of goods for customs purposes of the General Agreement on Tariffs and Trade of 1994 (GATT 1994)” and the “Agreement of January 25, 2008 “On determining the customs value of goods moved across the customs border of the Customs Union” “”, which currently standardizes the calculation of the customs value of imported goods. Determination of customs value

goods exported from the territory of the Customs Union, according to Article No. 64 of the Customs Code of the Customs Union, is carried out by the national legislation of the exporter’s country. On the territory of the Russian Federation, these legislative acts are the Federal Law of November 27, 2010 N 311-FZ “On Customs Regulation in the Russian Federation” and the Law of May 21, 1993 N 5003-1 (as amended on December 8, 2010) “On the Customs Tariff”.

Customs value of goods

and information related to its determination must be based on quantifiable and documented reliable information. The procedure for determining the customs value of goods should be generally applicable, that is, it should not differ depending on the sources of supply of goods.

Methods for determining (estimating) customs value (Customs valuation code)

Valuation method based on the transaction price of imported goods

Conditions for applying the valuation method based on the transaction price of imported goods:

- goods are imported in accordance with foreign trade sales transactions;

- the interdependence between the seller and the buyer is quantified and taken into account when calculating the vehicle;

- there are no restrictions on the rights of the buyer as the owner of the goods, with the exception of: - restrictions established by the legislation of the Russian Federation;

- — restrictions of the geographical region;

- — restrictions that do not significantly affect the price of the product;

Order No. 1 of January 5, 1994 created a set of documents for applying the 1st method:

- charter of a participant in foreign economic activity (constituent documents);

- purchase and sale contract;

- invoice (invoice) and bank payment documents or proforma invoice (for conditional value transactions);

- transport and insurance documents;

- transportation invoice or certified calculation of transportation costs;

- customs declaration of the country of departure;

- packing slips;

- license, if required;

- certificate of origin of goods, certificate of quality, conformity.

At the request of the customs authority, additional documents may be submitted, order No. 1 of 01/05/94, paragraph 2.5, order of the State Customs Committee No. 01-14/1490 of 10/31/97.

The basis for determining the customs value: the transaction price directly with the imported goods subject to assessment.

Transaction Price: Both the price actually paid and the price payable for the imported goods. It includes the following expenses if they were not previously included:

- costs of transporting imported goods to the place of their customs clearance, including: costs of loading, unloading, reloading and warehousing of goods;

- insurance costs;

- expenses for payment of commissions and other intermediary remunerations;

- the cost of containers in cases where, in accordance with the Commodity Nomenclature of Foreign Economic Activity, they are considered as a single whole with the goods being valued;

- cost of packaging, including the cost of packaging materials and packaging work;

- the corresponding part of the cost of the following goods (works, services), which were directly or indirectly provided by the importer free of charge or at a reduced price for the purpose of use for the production or sale (alienation) for export of the goods being valued;

- raw materials, materials, parts, semi-finished products and other components that are an integral part of the goods being valued;

- tools, dies, molds and other similar equipment used in the production of the goods being valued;

- auxiliary materials consumed in the production of the goods being valued (lubricants, fuel, etc.);

- engineering and development work, design, sketches and drawings made outside the territory of the Russian Federation, directly necessary for the production of the goods being valued;

- license and other payments for the use of intellectual property, which the importer must directly or indirectly make as a condition for the sale (alienation) of the goods being valued;

- part of the importer's income from any subsequent sale (alienation) or use of the goods being valued, which are subject to return to the exporter.

Features: the transaction price cannot be used to determine the customs value if:

- there are restrictions regarding the rights of the importer to the goods being valued, with the exception of: restrictions established by the legislation of the Russian Federation;

- restrictions on the geographical region in which goods can be transferred (alienated) again;

- restrictions that do not significantly affect the price of goods;

- the transaction price depends on compliance with any conditions, the impact of which cannot be taken into account;

- the data used by the declarant in determining the customs value is not supported by documents;

- The importer and exporter are interdependent persons, except in cases where their interdependence did not affect the price of the transaction, which must be proven by the declarant.

Valuation method based on transaction price for identical goods

Basis for determining customs value:

The price of a transaction with identical goods, i.e. identical in all respects with the goods being valued, including the following parameters:

- purpose and characteristics;

- quality, presence of a trademark and reputation in the market;

- country of origin;

- manufacturer.

The transaction price for identical goods is accepted as the basis for determining the customs value if these goods:

- sold (alienated) for import into the territory of the Russian Federation;

- imported at the same time or no earlier than 90 days before the import of the goods being valued;

- imported on the same commercial terms and in approximately the same quantities as the goods being valued.

Customs value

, determined by the price of a transaction with identical goods, must be adjusted taking into account the costs indicated above on the basis of reliable, documented information.

Features: if, when applying this method, more than one transaction price for identical goods is identified, then the lowest of them is used to determine the customs value of imported goods.

Valuation method based on transaction price for homogeneous goods

Basis for determining customs value: the transaction price for goods similar to those imported, which, although not identical in all respects, have similar characteristics and consist of similar components, which allows them to perform the same functions as the goods being valued and be commercially interchangeable.

When determining the homogeneity of goods, the following characteristics are taken into account:

- purpose and characteristics;

- quality, presence of a trademark and reputation in the market;

- country of origin.

The transaction price for similar goods is accepted as the basis for determining the customs value if:

- goods sold for import into the territory of the Russian Federation;

- imported at the same time or no earlier than 90 days before the import of the goods being valued;

- imported in the same quantities and on the same commercial terms as the goods being valued.

Cost subtraction method

Determination of customs value using the cost subtraction method is carried out if the valued, identical or similar goods are sold on the territory of the Russian Federation in an unchanged condition.

Base for determining the customs value: the price of a unit of goods at which the valued, identical or homogeneous goods are sold in the largest consignment on the territory of the Russian Federation at a time as close as possible to the time of import (no later than 90 days from the date of import of the goods being valued), to a buyer independent from the seller.

The following components are subtracted from the unit price of goods, if they can be separated:

- expenses for payment of commissions and expenses for transportation, insurance, loading and unloading operations on the territory of the Russian Federation after the release of goods into free circulation;

- amounts of import customs duties, taxes, fees and other payments payable in the Russian Federation in connection with the import or sale of goods. This method is rarely used, because... the amount of profit is a trade secret.

Valuation method based on cost addition

Base for determining the customs value: the price of the goods, calculated by adding:

- the cost of materials and other costs incurred by the manufacturer in connection with the production of the goods being assessed;

- total costs typical for the sale of goods of the same type to the Russian Federation from the exporting country, including the cost of transportation, loading and unloading, insurance at the place of customs clearance on the territory of the Russian Federation, etc.;

- profit usually received by the exporter as a result of the supply of such goods to the Russian Federation.

When determining the customs value using this method, all expenses included in the price of the goods must be taken into account. In the Russian Federation, this method is extremely rare, because It is difficult to obtain information about the cost of goods from a foreign manufacturer.

Backup method

If the customs value cannot be determined by the declarant as a result of the consistent application of these five methods or the customs authorities reasonably believe that these five methods for determining the customs value cannot be used, then the customs value of the goods being valued is determined and justified taking into account world customs practice.

When applying the reserve method, the customs authorities provide the declarant with the price information at their disposal.

In this case, the following can be used as a basis for customs assessment:

- customs value of identical homogeneous goods or goods of the same class and type (using the 6th method based on the 1st, 2nd, 3rd);

- the price of imported identical or similar goods or goods of the same class or type at which they are sold on the domestic market of the Russian Federation, adjusted to take into account deductions (method 6 based on method 4);

- price data from independent sources of information (Otto-type catalogs, price lists, stock exchange price quotes).

The determination of the vehicle according to method 6 should be based on real, reasonable price data. A mandatory requirement is to ensure the greatest possible similarity of goods, i.e. When considering supposed analogues, to compare the cost of goods, identical goods are first selected, then homogeneous ones, and in their absence, goods of the same class or type.

Features: the following cannot be used as a basis for determining customs value:

- price on the domestic market;

- the price of goods of domestic origin;

- the price of goods supplied from the exporting country to third countries;

- arbitrarily set or not reliably confirmed price.

In some cases, when using method No. 6, it is impossible to use the assessment bases established by methods 1-5:

- if goods are imported under a lease or rental agreement;

- if goods are re-imported after repair or modernization;

- if goods are imported temporarily as test samples or exhibition exhibits;

- if they import unique products, objects of art.

In these cases, it is allowed to use reasonable approaches to the valuation of goods, without conflicting with the principles of customs valuation established by law, coordinating them with actual commercial practice and information available in the importer’s country.

Each method is applied sequentially and only after its inconsistency is proven, calculations are started using the next method. The finally chosen methodology and the rationale for its choice must be entered in the appropriate column of the customs declaration.

In some cases, imported or exported goods are exempt from customs duties, but assessment for customs control is still mandatory:

- in case of import of goods or equipment, as free charitable assistance to legal entities from non-profit or charitable organizations;

- in case of import by foreign citizens of equipment that is a contribution to the authorized capital of a Russian company;

- in case of import of medical equipment included in a special list.

In all of the above cases, in order to receive the appropriate benefit that exempts goods from customs duties, it is necessary to provide documentary evidence.

Declaration procedure

The following must be declared (Article 260 of the EAEU Labor Code):

- Money in the amount of more than 10 thousand US dollars.

- Products that are subject to restrictions and prohibitions.

- Cargo delivered by a carrier or unaccompanied.

- Spare parts for cars.

- Vehicles for personal use or imported temporarily.

- Goods sent by international mail.

- Items in accompanied baggage for which taxes and duties for cross-border movement are paid or not.

Individuals may not declare goods:

- which are transported in transit through the EAC states in accompanied baggage or by plane;

- if the cost and weight of the cargo falls within the limits established by law.

A simplified procedure for declaring goods is applied when moving across the border:

- products intended to eliminate the consequences of a catastrophe, accident, natural disaster;

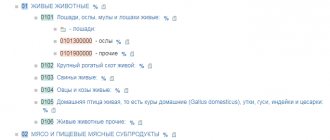

- living creatures (birds, animals);

- radioactive materials;

- messages for the media;

- products with a limited shelf life;

- goods to be used by the legislative, executive or judicial branches.

Simplified declaration involves presenting accompanying documents at customs, which indicate information about the goods being transported:

- origin;

- price;

- quantity;

- sender;

- carrier;

- recipient.

Changes in determining the customs value of goods in the Customs Union

Since July 1 (July 6), 2010, issues of determining customs value are regulated by the Agreement on determining the customs value of goods moved across the customs border of the Customs Union (hereinafter referred to as the Agreement) (Agreement dated January 25, 2008 between the Government of the Russian Federation, the Government of the Republic of Belarus and the Government of the Republic Kazakhstan “On determining the customs value of goods moved across the customs border of the Customs Union”). This Agreement establishes uniform rules for determining the customs value of goods for the purpose of applying the Customs Union Customs Union, as well as the application of other measures other than customs tariff regulation.

The system for determining the customs value (customs valuation) of goods is based on the general principles of customs valuation accepted in international practice and applies to goods imported into and exported from the customs territory (the Rules are based on the principles and provisions for the valuation of goods for customs purposes, GATT, 1994 ).

Before the date of entry into force of the commented Code on the territory of Russia, these issues were regulated by the Law of the Russian Federation of May 21, 1993 N 5003-1 “On Customs Tariffs”.

Other customs payments: VAT, excise taxes and fees

Keep records of exports and imports using the simplified tax system in the Kontur.Accounting web service. Currency accounting and work instructions, taxes, automatic salary calculation and reporting in one service Get free access for 14 days

Step 3. We charge excise taxes

When importing excisable goods, excise taxes will have to be charged. The tax rate, like the duty, can be ad valorem, specific or mixed. The calculation rules are also the same. The basis for the ad valorem rate is the sum of the cost of goods and the calculated duty.

When goods are supplied for export, no excise duty is paid. The seller will only need documents confirming the export transaction.

Step 4. We charge VAT

When exporting, the tax rate is 0%. Therefore, the amount payable does not increase. As with excise taxes, you will need a package of documents confirming export.

Import VAT is charged at a rate of 0%, 10% or 20% (from January 1, 2019) depending on the type of goods. It is multiplied by the sum of customs value, duty and excise tax.