Russia's foreign trade relations with the rest of the world occupy a priority place in the country's overall economic policy, both at the state level and at the level of society, each individual family or individual. This attention is not accidental, since almost 85% of the Russian consumer market depends on imported supplies, and in the industrial sector, some industries are almost 100% dependent on the supply of imported components and materials.

ATTENTION! We work only with legal entities.

How customs clearance of imports at the border is carried out in practice, in particular the rules and procedure for customs clearance of imports, what conditions must be met for this, what documents are required, will be discussed in this article.

Customs clearance at Sheremetyevo airport

The procedures and procedures for customs clearance of imports at Russian customs posts generally have a unified format, subject to the uniform requirements of the Labor Code of the Russian Federation. However, in order to simplify the formalities, special regimes may be applied. Customs clearance in Sheremetyevo, in principle, differs little from similar events in other air transport hubs and requires the cargo owner to go through a number of successive stages.

Stages of import customs clearance

Customs clearance of goods at Sheremetyevo consists of the following stages:

- The preparatory stage involves either registering a participant in foreign trade activities with the Federal Customs Service, or concluding an agreement for transport forwarding or customs brokerage services with companies that have the appropriate licenses.

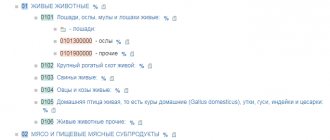

- At the second stage, customs clearance at Sheremetyevo Airport involves the preparation of documents and the selection of commodity codes according to the classification of the Commodity Nomenclature of Foreign Economic Activity, which most fully correspond to the imported goods. Moreover, the selection of HS codes includes the selection of the optimal group of goods for which the minimum possible duty is paid, or the goods are subject to a preferential tariff, for example, a complete exemption from input VAT.

- After all documents have been collected and a customs broker has been identified, the customs authority (post) is notified of the arrival of the cargo at the Sheremetyevo cargo terminal. This is done in the usual manner no later than 15 days in advance, however, for cargo traveling by air, a preferential notice period is provided, reduced to 3 days.

- Before the goods arrive at Sheremetyevo customs, a customs broker or a specially hired declarant draws up a cargo customs declaration (cargo customs declaration). Registration of a customs declaration for imports includes an indication of all the characteristics of the cargo, its destination, as well as a full calculation of the customs value. At this stage, the duty is also paid, which is carried out by making a deposit payment to the account of the Federal Customs Service (its regional division - the treasury account), or the money is transferred to the account of the customs broker.

- After the goods have arrived at the Sheremetyevo cargo customs terminal, they undergo customs clearance and customs inspection (if the inspector deems this necessary).

- If, as a result of clearance, there are no comments from customs, either on the cargo or on the amount of duty paid, then all additional fees are paid and the final release of the goods is carried out.

The procedure for customs clearance of imports includes other important points. For example, if for some reason the cargo is seized by customs or is subject to additional control, examination, or additional documents are required, it is sent to a temporary storage warehouse (customs temporary storage warehouse). He will remain there until all issues are resolved. Payment for storage will also be made at the expense of the cargo owner.

Features of goods registration

In some cases, customs clearance for imports is carried out with some specific requirements from the inspectors. In particular:

- Goods imported into the territory of the Russian Federation must not only comply with import standards, the number of cargo pieces or have maximum weight characteristics, but also meet the requirements of phytosanitary, medical-biological, veterinary and radiation safety.

- Goods imported into the territory of the Russian Federation must not be included in the group of goods prohibited for import, or have special permits from both customs and other competent authorities and services.

- For some categories of cargo imported into the Russian Federation, special insurance is provided, as well as full advance payment of all necessary duties and fees.

In addition, for those goods that are imported into the country temporarily, for example, through customs transit for subsequent shipment to third countries, a special ICT declaration (internal customs transit) must be issued for customs clearance of imports. Also, such transit cargo is subject to a special seal, and in some cases escort may be required up to the border of a third country.

Documents required for import clearance

The list of documents for customs clearance when importing goods and cargo into the Russian Federation is largely determined by whether an individual or legal entity imports (declares) such imports.

However, there is a minimum required list of documents for customs clearance of imports. This includes primarily:

- cargo customs declarations for import customs declarations;

- invoice and agreement for the purchase of goods between the seller and the buyer;

- an invoice, according to which all customs and transport costs are paid when importing into the territory of the Russian Federation;

- packing slips;

- transportation document – road waybills, sea and river bills of lading, air waybills.

In addition to these documents, customs clearance of goods and imported cargo provides options in which customs has the right to request any additional documents necessary to undergo customs clearance when imported into the territory of the Russian Federation.

Additional documents

Documents for customs clearance of imports, in addition to the mandatory list, may also include, at the request of inspectors, the following items:

- a document confirming ownership of the trademark;

- licensing documents for the right to own, use and dispose of goods;

- certificates of origin of cargo;

- quality certificates certified by internationally recognized expert organizations (for example, Chamber of Commerce and Industry);

- certificates or documents confirming the hazard class of the cargo or its absence;

- copies of transit transportation documents – bills of lading, multimodal end-to-end transportation documents.

Narrowing the topic

Let me make a reservation right away that the article will focus exclusively on batch deliveries of goods to legal entities for commercial purposes . When importing single copies for your own use, the requirements for documents will be slightly different, not to mention importing for an individual. Please pay attention to this!

It should also be borne in mind that the article discusses the minimum package of documents required for submission to customs. Depending on the delivery conditions, the characteristics of the goods and the practice of a particular customs post, it can (and most likely will be) expanded.

Payment of customs duties

Payment of customs duties, excise taxes, taxes and fees consists of two main parts:

- The first part is the duty or excise tax. They are calculated either as a percentage of the cost of the cargo or per unit of its accounting. Sometimes the amount of the duty is determined by expert assessments or from special catalogues. This also includes payment of VAT, if such is provided for the corresponding group of goods subject to the Commodity Classification of Foreign Economic Activity.

- The second part is additional payments, for example, for storing cargo at a temporary storage warehouse, its movement within the customs zone, payment for certification, examinations and instrumental control.

As a rule, all duties and excise taxes are paid by the cargo owner or customs broker in advance by making a deposit to the organization’s accounts (to a special treasury account). All payments are issued by invoice or bank payment order, including those in electronic form.

When importing goods, there are many nuances - a list of documents, the procedure for customs clearance and payment of duties. It can be difficult for a non-specialist to understand all this. However, knowledge of at least the general procedure for clearing imports at customs can greatly simplify the task of quickly transporting cargo in the right direction.

Documents for customs clearance

Before customs clearance of the cargo, the company must pay import or export customs duties and customs fees. If VAT, taxes, and excise taxes are paid on time, customs clearance of the cargo takes place without unnecessary fines or force majeure.

When declaring goods through customs, original documents or copies thereof are provided. When declaring customs under the ED-2 procedure, documents can be provided electronically. View the full package of documents required for customs clearance when declaring goods.

The customs clearance process on the territory of the Russian Federation is regulated by the Customs Code and the “Law on Customs Regulation”.

Proof of customs value. Reality

This is ideal. In reality (and in practice), there are federal and regional risks and customs value indices (by class of goods, taking into account the country of origin), statistical data from regional customs, and the personal opinion of the inspector (and the head of the post). Many participants in foreign trade activities are familiar with the problems of confirming customs value both at registration and at post-control first hand. The amount of adjustment can sometimes vary from considerable to astronomical (within a small company), making deliveries unprofitable, leading to serious problems in the business.

Partly for the above reasons, many companies, including large and reputable manufacturing and trading enterprises, use the services of customs representatives for customs clearance ( declaration and control of the customs value of goods ). Since the latter can provide preliminary consultation, timely and correct response to customs requests, personal presence at the customs post to present original documents, and communicate with management.

Our company has successful experience in defending (proofing) the declared customs value if it is lower than the ITS (risk). We provide advisory services on the preparation of commercial and accounting documents for submission to customs authorities in order to confirm the declared customs value.

If customs still does not accept the declared value of goods during the clearance process, we will help prepare applications and additional packages of documents to confirm the value at post-control and refund overpaid customs duties.

You can always get advice from our specialists on issues such as customs clearance, calculation and confirmation of the cost of goods.

Import certification - schemes and options

When importing products into the territory of the EAEU, several certification schemes for imported products into Russia are used, differing in the object, test performer, and production assessment.

These schemes apply to three main categories:

- goods certified in accordance with the technical regulations of the EAEU;

- goods certified in accordance with national requirements of GOST R;

- goods certified according to current national technical regulations.

Requirements for the type of scheme, its procedure, and the procedure for certification are described in the technical regulations for each specific procedure. TANAIS specialists guarantee competent certification of your goods during transportation and clearance by customs authorities, as well as support at all stages of the procedure.

Assistance in obtaining permits can be provided both as part of a comprehensive customs clearance service, and as a separate, independent service.

Return to list

Types of certificates for import

According to the current legislation of the Russian Federation, most imported goods must undergo a mandatory certification system, according to which all products imported into the country must meet quality and safety requirements. This compliance is confirmed by a number of permits, which include:

- Certificate of Conformity - required for importing products with mandatory compliance with the EAEU CU, issued through laboratory testing and awarding a certificate based on their results;

- Declaration of conformity - required to confirm the product’s compliance with the country’s regulatory standards, drawn up on the basis of a test report and some other documents;

- Certificate of origin of goods - required to establish the country of manufacture of products, as well as determine the amount of duties and provide benefits for imports from countries that are granted customs preferences;

- Documents of sanitary epidemiological control - hygienic, quarantine, phytosanitary and veterinary certification of imported products are required when importing goods of plant and animal origin, as well as live domestic and agricultural livestock. Verification and issuance of certificates is carried out by the relevant phytosanitary, veterinary or quarantine points;

- VNIIS waiver letter - required if the goods do not need a declaration or certification of conformity, issued by the customs or relevant certifying authority;

- License of the Ministry of Industry and Trade - required for certification of imported equipment restricted for import by the Customs Union, namely devices with the ability to transmit radio waves in order to confirm their compliance with the established standards of the SCRF;

- Certificate of State Registration - required to confirm the product’s compliance with SNiP, its inclusion in the Unified State Register and registration in accordance with the current legislation of the country.