“Export of services – services provided by residents of the national economy for non-residents.” This definition of export of services is given in Rosstat order No. 677 dated December 29, 2012 “On approval of Methodological provisions for organizing statistical monitoring of foreign trade in services.”

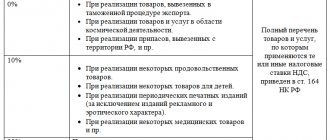

To determine whether the sale of exported work (services) will be subject to VAT, you need to find out where (according to the Tax Code) these works (services) are considered sold. If the place of sale of works (services) is the territory of the Russian Federation, then such sales are subject to VAT. If the place of sale of works (services) is not the territory of the Russian Federation, then such sales are not subject to VAT.

Read in the taker

Once it has been determined that the place of sale of works (services) is Russia, it is necessary to determine the VAT rate at which they are taxed. Don’t be mistaken when applying a zero rate - look in the berator

The place of implementation of most works (services) is determined according to special rules. Their list is given in Article 148 of the Tax Code of the Russian Federation. This:

- works (services) related to real estate;

- works (services) related to movable property;

- works (services) in the field of culture, art, education, physical culture, tourism, recreation and sports;

- works (services) provided at the place of activity of the buyer of these works (services);

- auxiliary works (services);

- transportation services (transportation) and services (work) related to transportation, transportation, chartering;

- services for organizing the transportation of natural gas by pipeline across Russia.

How to determine the place of implementation of works (services) related to real estate

If you perform work (provide services) that are related to real estate, then such work (services) are subject to VAT only if this property is located on the territory of Russia.

Such works (services), for example, include:

- construction, installation, construction and installation, repair, restoration work;

- landscaping works;

- rental services.

note

For tax purposes, real estate does not include: aircraft, sea vessels and inland navigation vessels, space objects.

As a general rule, rental services for such property are subject to VAT if the buyer of these services operates in Russia.

However, there are some exceptions. Thus, if a company leases an aircraft, sea vessel or inland navigation vessel from a Russian company for transportation, Russia is considered the place of sale only when the point of departure and (or) destination is located on the territory of the Russian Federation.

If all ports are outside Russia, then the vessel rental service is not subject to VAT.

EXAMPLE OF DETERMINING THE PLACE OF PROVIDING SERVICES WHEN RENTING AN AIRCRAFT

Exporter JSC leased an aircraft to a foreign company.

Situation 1

If, according to the contract, the aircraft operates flights from Russia to Germany, then in this case it is considered that the services are provided on the territory of Russia.

Consequently, the amount of rental payments is subject to VAT. Situation 2

If, according to the contract, the aircraft operates flights from Germany to the USA, then in this case it is considered that the services were provided abroad. Therefore, the amount of rental payments is not subject to VAT.

note

If you provide aircraft maintenance services at airports or airspace, then such services are considered to be provided in Russia.

However, there is no need to pay VAT on their cost. Such services are exempt from taxation (clause 22, clause 2, article 149 of the Tax Code of the Russian Federation). If you provide such services outside the airport and airspace, you will have to pay VAT. EXAMPLE OF DETERMINING THE PLACE OF PROVIDING SERVICES WHEN REPAIRING AN AIRCRAFT AT AN AIRPORT Situation 1

JSC Exporter is repairing an aircraft owned by the foreign airline Luftair.

Exporter carries out repair work at the Moscow airport. In this case, VAT does not need to be charged on the cost of repair work. Situation 2

Exporter JSC is repairing an aircraft that belongs to the foreign airline Luftair. Exporter carries out repair work in a specialized hangar in Moscow. In this case, VAT must be charged on the cost of the work.

A similar benefit is available for maintenance (repair) services of sea vessels and inland navigation vessels. If such services are provided during the period of stay in ports, as well as during pilotage, then VAT on sales does not need to be paid (clause 23, clause 2, article 149 of the Tax Code of the Russian Federation). And this despite the fact that the services are considered to be provided in Russia.

If you carried out repairs and maintenance of ships in other places, then you need to pay VAT on such sales of services.

EXAMPLE OF DETERMINING THE PLACE OF PROVIDING SERVICES WHEN REPAIRING AN AIRCRAFT OUTSIDE THE AIRPORT Situation 1

JSC Exporter carries out repairs and painting of a sea vessel owned by a foreign company and located in the port of St. Petersburg. In this case, the Exporter should not charge VAT on the services provided services to them.

Situation 2

JSC "Exporter" carries out repairs and painting of a sea vessel owned by a foreign company outside the port of St. Petersburg. In this case, VAT must be charged on the cost of this work.

COMMON QUESTIONS FOR EXPORTERS

How to draw up a contract correctly? Is there a specific form?

The basis of a serious commercial transaction is an agreement that allows you to legally secure the intentions, rights and obligations of the seller and buyer. Examples of standard foreign trade contracts for exports from Russia can probably be found on the Internet. We will help you draw up a basic commercial document in such a way as to not only comply with Russian and international standards, but first of all, take into account the client’s own interests as much as possible.

What documents do you really need to ship goods abroad?

The list of documents required for customs clearance can be found on our website, in the Documents section. This list may vary between brokers. We try to require a minimum package of documents from our clients in order to save time and reduce the labor costs of the exporting company’s personnel.

Where does customs clearance actually take place?

99.9% of export customs declarations are completed electronically. To work with such declarations, the customs service has organized special customs posts, Electronic Declaration Centers - EDCs. Our equipment allows you to submit a declaration to any Russian EDC from Kaliningrad to Vladivostok. The final decision on the place of registration is made jointly with the client, based on the characteristics of the cargo and the logistics scheme of delivery.

Is it possible to arrange an export delivery to a private person without concluding a contract?

Yes, in cases of a one-time delivery, when paying for the goods in cash, we can arrange the goods for export, without concluding a contract. However, the person on whose behalf we will carry out customs clearance must be an individual - a non-resident of Russia (holder of a foreign passport).

How to determine the place of implementation of works (services) related to movable property

Works (services) directly related to movable property, aircraft, sea vessels and inland navigation vessels are subject to VAT if this property is located on the territory of Russia.

In particular, such works (services) include:

- installation and assembly;

- processing and processing;

- repair and maintenance.

EXAMPLE OF DETERMINING THE PLACE OF PROVIDING SERVICES RELATED TO REPAIR OF MOVABLE PROPERTY

Exporter JSC, under an agreement with a Hungarian company, repairs machine tools. The premises where the machines are installed are located in Hungary. Consequently, such work is not subject to VAT under Russian law.

Services for leasing movable property (except for land vehicles) are subject to VAT if the lessee operates in Russia.

EXAMPLE OF DETERMINING THE PLACE OF PROVIDING SERVICES RELATED TO THE RENTAL OF MOVABLE PROPERTY

JSC Exporter leased a Ukrainian tower crane.

Situation 1

If Kievstroy is registered in Russia (or operates in Russia through a permanent representative office), then the Exporter must charge VAT on rental payments.

Situation 2

If it is not registered in Russia (and does not have a permanent representative office, place of management or location of the executive body in Russia), then it is considered that the services are provided abroad. Consequently, the Exporter does not charge VAT on rental payments.

Services for leasing land vehicles are subject to VAT if the lessor operates in Russia.

EXAMPLE OF DETERMINING THE PLACE OF PROVIDING SERVICES RELATED TO RENTAL OF MOTOR VEHICLES

Exporter JSC leased a truck to a foreign company (the lessor operates in Russia, then the service is considered to be provided in Russia. Therefore, VAT must be charged on this.

We will export products profitably and efficiently

Naturally, entering a foreign market is an important and very desirable step for any company. However, it is associated with a lot of difficulties and, accordingly, new expenses. By contacting , you will save yourself from the need to create or expand a logistics department, search for and then coordinate the work of carriers and customs brokers, understand the current legislation regarding foreign trade activities, customs clearance and constantly keep abreast of the latest changes. In addition, some issues will have to be discussed with licensing authorities, and for this you will need considerable legal training (or an employee with such training). will do all this work for you, giving you the opportunity to focus on the main thing - the further development of your own business.

How to determine the place of implementation of auxiliary works (services)

Along with the main work (services), the organization can provide auxiliary work (services).

For example, when carrying out repair work, an organization can provide an additional service for the removal of construction waste.

Clause 3 of Article 148 of the Tax Code establishes that the place of implementation of auxiliary work (services) is recognized as the place of implementation of the main work (services). At the same time, only those works and services that are closely related to the main ones can be classified as auxiliary. If there is no connection between them, then the place of implementation of work (services) is determined as provided by the Tax Code for the corresponding types of work (services).

The norm of paragraph 3 of Article 148 of the Tax Code applies only if the main and auxiliary work is performed (services are provided) by the same organization.

EXAMPLE OF DETERMINING A LOCATION FOR IMPLEMENTING AUXILIARY WORKS (SERVICES)

The German company Bauer performs construction and installation work on a building located in Russia. The work is carried out by order of Importer LLC. In addition, Bauer provides the Importer with services for developing the interior design of this building. In this case, design services will be auxiliary in relation to construction and installation works. The place of implementation of construction and installation works is Russia (subject to VAT). The place of sale of building interior design services is Russia (subject to VAT).

Government regulation: duties or taxes?

The question is highly relevant, especially for financial departments and accountants in organizations dealing with this type of service. Who should control the growing volume of international services in Russia? Customs Service? Tax Committee?

There is a regulator. This is Federal Law No. 164-FZ “On the fundamentals of state regulation of foreign trade activities” dated December 8, 2003.

Foreign trade regulators in any country face two related, but opposite in content, tasks. First of all, domestic producers must be protected from the import of competing goods or services from other countries. The second, no less important thing is to support domestic exports and expand market prospects for Russian products.

What can we say, it is easier to introduce bans, restrictions and limits than to increase the competitiveness of Russian exports. The overwhelming majority of foreign trade regulations are related to the protection of the domestic market from foreign competitors. This is a common situation in many countries, including the Russian Federation.

The Law “On the Fundamentals of State Regulation of Foreign Trade Activities” did not escape the dominance of the “import” and “commodity” chapters. The sixth chapter of the law, entitled “State regulation of foreign trade activities in the field of foreign trade in services,” is devoted to services. The three articles that make up the chapter describe the rules for the provision of services, national treatment and measures necessary to protect the interests of producers of domestic services.

Structure and dynamics of the global services market

Today, half of the world's revenues from services exports come from everything related to transport and travel. 23% of total funds come from international transportation, and 27% from international travel, including tourism and business travel.

The share of services in total world exports of goods and services is not yet the largest - only 29% (the share of imports of services is approximately the same). But foreign trade in services is growing much faster than trade in goods. So you would not be wrong if you consider these moderate percentages to be outdated. At the time of reading this article, it will happen.

The arguments for increasing the volume of services are very serious:

- geometric growth in demand for new generation banking, financial and insurance services;

- technological revolutions in almost all areas of activity;

- breakthroughs in the field of digitalization, information and Internet services.