How to submit a statistical declaration when exporting goods and products

Belarusian exporters carry out statistical declarations, as a rule, in relation to goods (products) exported to the countries of the EAEU. Therefore, the exporter (or a person authorized by him) must draw up a statistical declaration in the required format, sign it with an electronic digital signature and send it to the customs authority for registration, observing the established deadlines and procedures.

If customs operations are not carried out in relation to goods (products) and customs declarations are not made, Belarusian payers are required to carry out statistical declarations, including for shipments of goods (products) within the framework of a foreign trade agreement providing for their transfer for a fee <*>. As a general rule, goods (products) exported to the countries of the EAEU <*> are not subject to customs procedures.

For reference , a compensated agreement is an agreement under which a party must receive payment or other consideration for the performance of its obligations <*>.

Who carries out the statistical declaration

An export purchase and sale transaction (supply) with buyers from states that are members of the EAEU is subject to statistical declaration, since when it is completed, the following conditions are met in total:

— a foreign trade transaction of purchase and sale (supply) provides for the transfer of goods (products) for a fee;

— goods (products) exported to the EAEU countries are not subject to customs clearance.

Please note that the Belarusian payer will carry out statistical declaration even if the purchase and sale (supply) agreement is concluded with a resident from abroad, but goods (products) from Belarus are exported not outside the EAEU, but into the territory of the EAEU state. For more information about this, see the consultation.

When shipping goods (products) for export to the EAEU countries, the Belarusian exporter himself must carry out the statistical declaration.

reference For the purposes of statistical declaration, an exporter is a resident who has entered into a foreign trade agreement or to whom the rights and obligations under a foreign trade agreement have been transferred as a result of the assignment of the right of claim (debt transfer) between residents in accordance with the Civil Code <*>.

At the same time, on behalf of the exporter, the statistical declaration can be carried out directly by <*>:

- the person (legal entity or individual entrepreneur) who carried out the shipment on behalf of the exporter or is indicated in the contract as the shipper - we believe, with the exporter’s power of attorney;

- a customs representative on behalf of the exporter (shipper) - on the basis of an agreement concluded with him.

Under what conditions and in what time frames are statistical declarations made?

Statistical declaration is carried out for the purposes of customs authorities maintaining statistical records of exports (imports) of goods in respect of which customs operations are not carried out, as well as for the purposes of currency control of foreign trade transactions <*>.

An organization that exports goods (products) to the EAEU states for the purposes of statistical declaration is obliged to draw up and register a statistical declaration (hereinafter referred to as SD, statistical declaration) with the customs authorities if the following conditions are simultaneously met <*>:

— shipment (delivery) of goods (products) is carried out within the framework of one foreign trade agreement providing for the transfer of goods (products) for a fee;

— the cost of goods (products) shipped for export based on one or more facts of shipments (deliveries)) is the equivalent of 3,000 euros or more for the reporting calendar month.

At the discretion of the exporter (shipper), the CD may also be submitted for the shipment of goods (products) for a smaller amount <*>.

For reference If the value of exported goods (products) is expressed in other currencies, conversion into euros is made at the official exchange rate of the Belarusian ruble to foreign currency established by the National Bank on the date of conclusion of the foreign trade agreement <*>.

SD is presented from the 1st to the 10th day of the month following the reporting month <*>.

Attention! For violation of the established deadline for filing a statistical declaration or failure to submit it, administrative liability is provided - a warning or a fine in the amount of 10 BV <*>.

Example

On December 1, 2020, the exporter (seller) entered into a foreign trade agreement for the supply of goods (products) with a Russian buyer for a total amount of RUR 550,000. rub. On December 21, 2020, goods (products) worth RUR 250,000 were shipped. rub., 01/06/2021 - in the amount of RUR 200,000. rub. and 01/11/2021 - in the amount of RUR 100,000. rub.

The cost of goods (products), expressed in Russian rubles, is converted into euros at the National Bank rates established as of 12/01/2020 - the date of conclusion of the supply agreement.

The cost of goods (products) in euros is equal to:

- 2741.63 euros (250,000 Russian rubles x 3.3982 Belarusian rubles / 100 / 3.0987 Belarusian rubles) - for delivery on December 21, 2020;

- 2193.31 euros (200,000 Russian rubles x 3.3982 Belarusian rubles / 100 / 3.0987 Belarusian rubles) - for delivery on 01/06/2021;

- 1096.65 euros (100,000 Russian rubles x 3.3982 Belarusian rubles / 100 / 3.0987 Belarusian rubles) - for delivery on 01/11/2021.

For goods (products) shipped on December 21, 2020, CD is not issued, since their cost (2,741.63 euros) does not exceed 3,000 euros.

The exporter must make declarations for deliveries on 01/06/2021 and 01/11/2021. Despite the fact that neither one nor the other goes beyond the limits of 3,000 euros, a statistical declaration is submitted for goods (products) shipped as part of both deliveries, since their total value is 3,289.96 euros (2,193.31 + 1,096, 65). The CD should be submitted to the customs authority from the 1st to the 10th day of the month following the reporting month. That is, in this case - until February 10 <*>.

Attention! If shipments are carried out under different foreign trade agreements, including with the same buyer, statistical declarations are drawn up for shipments under each agreement separately according to the general rules.

As already noted, the obligation to submit a statistical declaration is assigned to a resident of Belarus, in our case, the exporter of goods (products). At the same time, the shipper or customs representative can directly draw up and submit a statistical declaration (on behalf of the exporter).

Confirmation that the obligation to submit a statistical declaration to the customs authorities has been fulfilled will be assigned to it by the information system of the customs authorities of a registration number, the structure of which contains the date of its submission <*>.

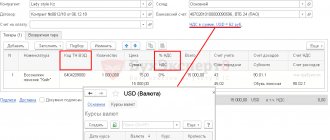

Hint The form of external presentation of the statistical declaration and instructions for filling it out are established by State Customs Committee Resolution No. 2. The structure and format of ST in the form of an electronic document are determined by State Customs Committee Resolution No. 10.

Please note that one statistical declaration can contain information about no more than 999 goods (types of products) and only under one foreign trade agreement <*>.

How to submit a statistical declaration for registration

Statistical declarations are submitted for registration only in the form of an electronic document <*>. Documents signed with the digital signature of the exporter (shipper or customs representative) (hereinafter referred to as the applicant) are sent for registration to the Minsk Central Customs (MCC) via electronic exchange using the E-Declarant checkpoint software. Moreover, this can be done around the clock <*>.

In a situation where errors are identified, the document submitted for registration will not be accepted as a statistical declaration. The applicant will be sent an email containing a list of errors. That is, the statistical declaration will not be considered submitted for registration purposes <*>.

If there are no errors, the customs authorities register the submission of the statistical declaration and indicate in column A the registration number and date of submission <*>.

If the format and procedure for filling out the statistical declaration meet the established requirements, the customs authority registers the statistical declaration itself and indicates in column B the number and date of registration of the CD. The applicant is then sent an electronic message about registration <*>.

In a situation where the format and procedure for filling out the statistical declaration are not followed, including when it does not contain the necessary information about the documents that should be available to the person submitting this declaration for registration, the customs authorities have the right to refuse registration <*>. In this case, the applicant is sent an electronic message via electronic exchange about the refusal to register the statistical declaration, indicating the grounds for the refusal <*>.

Attention! For the inclusion of false information in the statistical declaration, a fine is provided in the amount of 5 to 20 BV, and in relation to an individual entrepreneur or legal entity - up to 20% of the contract value of exported goods (products) <*>.

What documents are needed to complete statistical declarations?

Statistical declarations are filled out on the basis of certain documents. Information about the latter is reflected in column 22 “Additional information / Information on available documents” SD <*>.

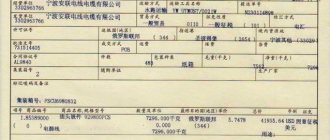

Thus, a person submitting a statistical declaration for registration when exporting goods or products must have <*>:

- foreign trade agreement. Moreover, if the transaction was subject to registration with the bank, then its registration number <*> must be indicated in the statistical declaration;

- additions (appendices) to a foreign trade agreement - if information from them is used when filling out the submitted statistical declaration;

— transport (shipping) documents. If goods (products) are transported from a warehouse by road, then reloaded and transported by other modes of transport, the statistical declaration additionally indicates information about the transport (shipment) document for the delivery of goods (products) to the airport, railway station, etc. <*>;

— an invoice (invoice) or other document provided for by law, reflecting the transfer of goods between a resident and a non-resident, if, in accordance with the law, the presence of a transport (shipment) document is not provided for when shipping goods.

Attention! The listed documents must be available to the person preparing the statistical declaration. In fact, there is no need to submit them to the customs authorities <*>.

Read this material in ilex >>* *follow the link you will be taken to the paid content of the ilex service

Who fills out the statistical form

In accordance with Article 278 of Federal Law No. 289-FZ of 03.08.2018 and with the government decree (clause 5 of the “Rules for maintaining statistics...”), a statistical declaration must be provided by a legal or individual person (or his representative acting on his behalf and on his behalf). order) located in the jurisdiction of the Russian Federation, and which:

- or entered into a transaction for the import and export of goods between the territories of the Russian Federation and the member states of the EAEU;

- or, in the absence of such a transaction, had at the time of receipt or shipment of goods the right to possess, use and dispose of them.

Additional resource services

Enterprises can take advantage of additional options that the Web collection system offers. For example:

- Learn codes and forms. Users can obtain information on statistical reporting forms, activity codes, and frequency of data submission on the site without registration.

- Offline module. Submitting reports to Rosstat is possible not only online, but also offline. In this case, the respondent downloads specialized software for automated data collection and report generation.

- Technical support forum. Respondents can receive free consultation from Rosstat employees or other structures.

The Web Collection website contains a section for frequently asked questions by users. Here you can find solutions to the most common problems faced by organizations.

It is also useful to read: Obtaining data on statistics codes by TIN

Authorised representative

Federal Customs Service: the manufacturer can perform statistical declarations on their own or by engaging experienced companies to help. When contacting organizations involved in cargo declaration, transportation or certification of goods, the customer transfers responsibility for the correct implementation of all points prescribed in the Federal Law.

In cases where an inexperienced (or unfamiliar with the new procedures) applicant may incorrectly perform one of the points and incur a fine, the performer simply cannot allow a mistake.

Regular advanced training and constant monitoring of updates in legislation eliminate the possibility of error - therefore, cargo is transferred across the border without delays or sanctions.

Customs statistics submission service

To create a statistical form by our specialists, the Client will need to provide the following package of documents on which the foreign economic activity transaction was completed:

- Agreement (Contract);

- Waybills;

- Invoices;

- Construction and installation works (consignment note);

- Unique number of the agreement or contract (submitted if the total cost of goods under one agreement for the reporting period reaches or exceeds - import 3 million rubles, export 6 million rubles).

The listed documents must necessarily contain the following information: EAEU HS codes (10 digits), country of origin of the goods, weight (net) of the goods, unit of measurement of the declared goods, date of acceptance/dispatch of the cargo, number of the goods declaration (if the goods were produced outside the territory of the countries EAEU, format TO code/date/number - 8/6/7 digits).

How we are working

- The client sends us an information card (details) of the enterprise company and the necessary documents for export-import transactions (xls file or invoices). It is convenient to do this the first time through feedback; later we will assign a specific specialist;

- We contact, clarify, inform the cost, prepare and sign the contract;

- We receive full prepayment and begin work;

- The result of the work is the transfer to the Client of the download of the statistical form in xml format and the signing of the Certificate of Services Rendered. The Client sends the statistical form through his personal account using an electronic digital signature independently.

Every month we prepare customs statistical forms for submission to companies throughout Russia that have decided to outsource this function, not to waste time and protect themselves from fines.

Service cost

The cost of the Firmmaker service for drawing up a customs statistical form is from 2000 (two thousand) rubles per report (1 agreement = 1 statistical form).

The cost of the service depends on the number of HS codes and the availability of a Goods Declaration (CDG), the availability of product labeling codes, and the format of the documents provided.

Depending on the complexity and completeness of the documents submitted, in complex cases the total cost of reports can reach up to 50,000 (fifty thousand) rubles; its preparation takes time.

Features of reporting

For data security and complete identification of enterprises, Rosstat uses a system of electronic signatures using digital keys. Electronic data processing takes place in specialized accredited centers. You can activate a digital signature as follows:

- Go to the official portal of the Web collection resource.

- Find the “Certificates” section and click on it.

- Start downloading the digital key certificate.

- Click on save information.

After this, you can start creating reports. To do this you need:

- Find the “List of Reports” section and click on it.

- Select the report creation option.

- Enter the data of the company for which reporting is being generated.

- Select the period for which statistical information is provided (month, year).

- Add fields from the directory that correspond to activity codes.

- Fill in all fields in the table that are marked as required.

- Click on save report and send the material for review.

Important! When the data is sent again, you don’t have to fill in all the fields again, but select the “Create from sample” option, which transfers data from previous reporting.

It is also useful to read: Instructions for registering in your personal account and logging into websbor.gks.ru to submit a statistical report

Checking the 1C database for errors with a 50% discount

We will provide a written report on errors. We analyze more than 30 parameters

- Incorrect indication of VAT in documents;

- Errors in mutual settlements (“red” and expanded balances according to settlement documents or agreements on accounts 60, 62, 76.);

- Lack of invoices, checking duplicates;

- Incorrect accounting of inventory items (re-grading, incorrect sequence of receipts and expenses);

- Duplication of elements (items, currencies, counterparties, contracts and accounts, etc.);

- Control of filling out details in documents (counterparties, contracts);

- Control (presence, absence) of movements in documents and others;

- Checking the correctness of contracts in transactions.

More details Order

Who submits reports to Rosstat

The following enterprises are obliged to provide statistical reporting:

- Legal entity (this also includes self-employed businesses).

- IP.

- State enterprises.

- Enterprises that are branches of foreign companies.

- Notaries, lawyers.

According to Russian Legislation, small enterprises and individual entrepreneurs can submit reports in a more simplified mode.

Reference! To understand that a legal entity belongs to a small business, it is worth familiarizing yourself with the list of defining criteria on the official portal of the Federal Tax Service.

How and in what form the completed form is submitted to the Federal Customs Service

The statistical form is the basic document for the formation of customs statistics; the personal account of a foreign trade participant on the official website of the Federal Customs Service is the only possible tool for filling it out. Next, the customs export report is submitted either electronically or in paper form. In the latter case, the statistical form filled out on the official website of the Federal Customs Service is printed and either in person or by registered mail transferred to the tax office of the region in which the applicant is registered with the tax authority.

Electronic submission is possible if the applicant has a qualified electronic signature to work with the FCS services. In this case, it is recommended to follow four steps:

- Fill in the form.

- Check.

- Certify with an electronic signature and send to TO.

- Get a registration number.

If the applicant needs to submit a statistical registration form in paper form, the FCS recommends taking seven other steps:

- Fill in the form.

- Check.

- Get the number and print it out.

- Sign and stamp.

- Send the document by mail (registered mail) or bring it in person to the TO.

- Wait for the form to be registered.

- Get a number.