Export - customs procedure

Export is the sale of goods and services from the territory of Russia and other EAEU countries to third countries without obligations for re-importation (Article 139 of the EAEU Labor Code).

An important condition is that goods and services must actually cross the customs border of the EAEU countries; without this, export is impossible. For example, a foreign company buys raw materials from a domestic company, which will then be used to produce goods at a factory in Russia. Such an operation is not an export, although the buyer is a foreign company, since the raw materials did not leave the borders of the Russian Federation.

Important! The Eurasian Economic Union includes: Russia, Armenia, Belarus, Kazakhstan and Kyrgyzstan. Within the framework of the union there is a single customs space.

Customs Union of Russia, Belarus and Kazakhstan

What is meant by the euphonious word “union”, which hints at good prospects, when we are talking about simplifying commodity-money relations between states? In essence, this is a single customs territory, which, on the basis of an international agreement, replaces two or more customs territories . Within officially designated areas, customs duties and other measures restricting foreign trade are abolished on almost all goods. Moreover, each party to the agreement applies common customs duties and other regulatory instruments with third countries.

The creation of a Customs Union of three states - Russia, Belarus and Kazakhstan (CU) - was an idea 15 years ago. First, on January 6, 1995, a historic Agreement between Russia and the Republic of Belarus was signed in Minsk, which, in fact, is the foundation for the creation of a modern trilateral partnership.

A new step in the formation of the Customs Union was the Agreement of October 6, 2007 “On the creation of a single customs territory and the formation of the Customs Union,” as a result of which Kazakhstan joined the existing Customs Union. In addition, it was decided to create a single customs territory and eliminate customs clearance and control procedures between the three countries.

Note. The formation of a Customs Union of three countries should eliminate customs control and administration procedures within the relevant territory, as well as establish a single customs tariff on the territory of the union.

The advantages of creating a vehicle are obvious. The restoration and strengthening of economic ties between organizations of the three countries will have a beneficial effect on the economic situation - new markets will appear for the sale of products, and the cost of goods will significantly decrease due to the simplification of border crossing conditions.

However, warm relations between states do not negate the occurrence of tax consequences for participants in foreign economic relations.

Export VAT

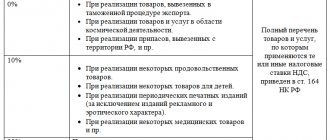

When exporting goods abroad, the exporter has the right to apply a zero VAT rate (clause 1, clause 1, article 164 of the Tax Code of the Russian Federation). The 0% rate is an exporter’s right, not an obligation. You can refuse it in favor of standard rates of 10 and 20%.

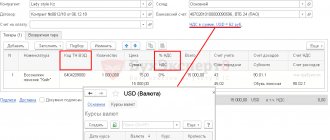

Calculate the tax base in rubles at the rate of the Central Bank of the Russian Federation on the day of shipment to the buyer (clause 3 of Article 153 of the Tax Code of the Russian Federation). This rule is relevant even if you have received 100% advance payment from the buyer.

We determine the tax base on the last day of the quarter in which we collected documents to confirm the right to apply the 0% rate (Article 165 of the Tax Code of the Russian Federation). At the same time, do not include prepayments and advances received from the buyer in calculating the tax base. Do not charge VAT on them.

The seller will not always pay you in foreign currency. Sometimes you can receive payment in rubles. This does not affect the specifics of accounting and calculation of export VAT.

SERVICES FOR PARTNERS FROM GERMANY

We provide services for searching and selecting suppliers in Russia according to established criteria.

We provide the opportunity to purchase goods from companies that are not involved in export activities. We assemble and ship consignments of goods from several contractors to one recipient.

The contract is concluded with a reliable exporting company, and this company will buy the required goods on its own behalf for you on the domestic Russian market. For buyers from Germany, our company will become a single counterparty in the Russian Federation and we will take upon ourselves all the concerns regarding the transaction.

Therefore, our customers are relieved of the need to spend time and money on visiting Russia in order to control shipments on their own.

Service consultation

VAT rate for export

The exporter has the right to apply a 0% VAT rate when exporting goods and services abroad. In addition, there are a number of works and services that accompany export operations and are also subject to VAT at a zero rate.

International transportation of goods. First of all, these are services for the transportation of goods by various modes of transport (air, railway, road, sea and river transport). But this group also includes services for the provision of railway rolling stock or containers for transportation and freight forwarding services.

Transportation of oil, petroleum products and natural gas. The services of pipeline transport organizations that transport oil and gas abroad of the Russian Federation are taxed at a zero rate.

Electricity transmission. A 0% rate can be applied by companies providing services for the transmission of electricity from domestic networks to the power grids of foreign countries.

Transshipment and storage of exported goods. The zero rate applies to the services of organizations providing transshipment and storage of goods for export in sea and river ports.

Recycling. The 0% rate applies to operations for processing goods in the customs territory, placed under the appropriate customs procedure.

Transportation by inland water transport. A 0% rate applies to services for the transportation of exported goods by inland water transport.

Cargo transportation to Tajikistan

When delivering to Tajikistan from Russia, you should develop the correct and competent algorithm of actions for transporting your cargo. In addition to choosing the type of transport, it is necessary to organize the loading and unloading of cargo.

To avoid worries about logistics planning, contact our specialists. In the shortest possible time, our logisticians will provide you with an individual proposal for exporting your goods with all calculations that will not change, but remain static.

VAT waiver 0%

You can refuse the zero rate. To do this, you need to submit a free-form application to your Federal Tax Service to waive the 0% rate. Do this before the 1st of the tax period from which you waive your right. Please note a few important points:

- waiver of the 0% rate applies to all export transactions;

- The minimum withdrawal period is 12 months, that is, within a year you will not be able to return to the 0% rate;

- the size of the rates does not depend on who your buyer is.

Important! It is impossible to refuse the 0% VAT rate when exporting to the EAEU countries, since there are no customs borders between the participating countries (Letter of the Ministry of Finance of the Russian Federation dated 01/09/2019 No. 03-07-13/1/24).

After refusing the rate, you will claim VAT deductions in the standard manner. There is no need to wait until all supporting documents are collected.

The main reason for abandoning the zero rate is the difficulty of confirming the legality of its application. However, refusal of the benefit is an additional tax burden on the company.

Export to EAEU countries

However, not all exporters can refuse the zero VAT rate. In the commented letter, the Ministry of Finance explained that if a Russian company exports goods to EAEU member states, it is obliged to apply a zero VAT rate. Refusal in this case is impossible. This is due to the effect of international treaties.

The Agreement of May 29, 2014 on the Eurasian Economic Union and Appendix No. 18 thereto does not provide for the right to refuse the zero VAT rate. The norms and rules of international treaties relating to taxation take precedence over the norms of the Tax Code (Article 7 of the Tax Code of the Russian Federation).

This means that if a company exports goods to the countries of the Eurasian Economic Union (EAEU), it is obliged to apply VAT at a rate of 0 percent.

Tax expert B.L. Swain

Confirmation of zero VAT rate

The legality of applying the zero rate needs to be confirmed. 180 days are allotted for this from the moment the goods were placed under the customs export procedure. For works and services, the period is determined depending on their nature. To confirm, perform the following steps.

We collect a package of documents

The package depends on the type of goods and services, as well as on the method of their transportation. The full package of documents is listed in Art. 165 Tax Code of the Russian Federation. The main ones are the contract and the customs declaration. However, the list can be expanded, and then they will additionally require:

- shipping documents;

- transport documents;

- waybills;

- bills of lading;

- sea waybills;

- explanations and other documents.

When exporting to the countries of the EAEU, you will be required to submit a statement from the buyer with a note from his tax authority about the import of goods and payment of all indirect taxes or that the import of goods is not subject to VAT.

Instead of statements, you can provide a list of them, but on the condition that the data from importers has already been received by the tax service. You can check the availability of the application in the Federal Tax Service database using the official service. If there is no information about the application, the list need not be compiled, as it will not be accepted.

The form of the list is enshrined in the Order of the Federal Tax Service of the Russian Federation dated 04/06/2015 No. ММВ-7-15/ [email protected]

Cargo delivery in Dushanbe

Cargo is delivered to Dushanbe in various ways; most often our clients choose the road delivery method. They most often choose delivery by car due to the economy of this type of cargo delivery in Dushanbe.

Delivery of personal belongings to Dushanbe is also possible; it is most profitable to send it as groupage cargo. Due to our experience in delivering commercial and personal cargo, you can contact our specialists for any cargo, because sending cargo to Tajikistan is not so difficult if experienced logisticians and declarants are involved in the matter.

We fill out the VAT return

Submit your VAT return along with the documents. Submit the report at the location of the organization and only in electronic format. Exporters fill out:

- title page - with information about the organization and tax period;

- section 1 - with information about the amounts of VAT to be reimbursed or paid;

- section 4 - with information on VAT amounts with a confirmed zero rate;

- section 5 - with information about tax deductions;

- section 6 - with information on VAT amounts when the zero rate is not confirmed.

Services for exporters

Those who have not previously engaged in foreign economic activity may encounter serious problems both at the stage of preparing the necessary documents and when recovering VAT. Therefore, in order not to ruin the deal and not lose profits, you can use the services of our specialists.

We are ready to both provide advisory assistance and fully take on all the difficulties associated with foreign economic activity, namely:

- preparation of all necessary documents;

- customs clearance of cargo;

- delivery of goods to the buyer in Tajikistan, including cargo escort and security;

- legal assistance in matters related to VAT refund.

Even if you decide to engage in foreign economic activity on your own, timely consultation with specialists will help you avoid the pitfalls inherent in this field of activity.

Didn't manage to report within 180 days

If you did not manage to confirm the 0% rate within 180 days, VAT on the cost of exported goods will need to be paid at the standard rate of 10 or 20% (clause 9 of Article 165 of the Tax Code of the Russian Federation). The date of determination of the tax base is generally considered to be the day of shipment of goods or performance of work.

The amount of tax paid can be deducted after you provide all documents confirming the export (Letter of the Federal Tax Service dated July 30, 2018 No. SD-4-3/14652). You retain the right to deduction for 3 years.

Tax deduction for export

Export transactions are subject to VAT at a rate of 0%. Therefore, input VAT on goods and services used for export purposes can be claimed as a deduction. To make a deduction, you need a properly executed invoice from the supplier.

The specifics of the tax deduction depend on which group the exported goods belong to: raw materials or non-raw materials.

Deduction for export of non-commodity goods

If the goods were received no later than July 1, 2021, then you can submit “input” VAT for deduction in the general manner. There is no need to wait for the shipment of goods for export or confirmation of the zero export rate (Letter of the Ministry of Finance of the Russian Federation dated July 13, 2016 No. 03-07-08/41050).

The procedure is different if the goods were received before July 1, 2021. In this case, “input” VAT on them can be deducted only in the quarter in which the company determines the tax base at a rate of 0%. The date the right to deduction arises depends on whether you have collected the documents provided for in Art. 165 of the Tax Code of the Russian Federation, or not. If yes, you have the right to deduct in the quarter when the export was confirmed. If not, the right to deduction arises only after the goods have been shipped.

Deduction for export of commodities

Commodities include the items mentioned in paragraph 10 of Art. 165 of the Tax Code and established in Decree of the Government of the Russian Federation of April 18, 2018 No. 466:

- salt, sulfur, earth and stone, plastering materials, lime;

- ores, slag and ash;

- mineral fuel, oil and petroleum products, bituminous substances, waxes;

- organic chemical compounds;

- wood and wood products, charcoal;

- pearls and precious stones;

- black metals;

- copper, nickel, aluminum, lead, zinc, tin and products made of these metals;

- other base metals and cermets.

Determine whether a product belongs to a raw material group using the HS code.

“Input” VAT when exporting raw materials is deductible in the quarter in which you confirmed your right to apply the zero rate. Other methods of deducting VAT are unacceptable.

We recommend the cloud service Kontur.Accounting. In our program you can keep track of transactions with different VAT rates. In the service you can fill out and check your VAT return. We give all newbies a free trial period of 14 days.

What about imports?

The main provisions for the payment of customs VAT when importing goods remained the same compared to the provisions of the Agreement between Russia and Belarus of September 15, 2004, with the exception of the following points:

— new rules for determining the tax base have been introduced;

— the set of documents submitted to the tax authority is supplemented with an information message;

— there are no provisions on the specifics of paying mandatory payments during the transit of goods and exemption from VAT when importing goods for processing for the purpose of subsequent export of processed products outside the Customs Union.

The general principle of VAT is the calculation and payment of tax by the buyer to the budget of the state into whose territory the goods were imported.

It is important to remember that if goods are purchased on the basis of an agreement between a resident of a member state of the Customs Union and an organization not related to the Triple Alliance, but the goods are imported from the territory of Russia, Belarus or Kazakhstan, indirect taxes are paid by the party to the transaction on whose territory goods imported.

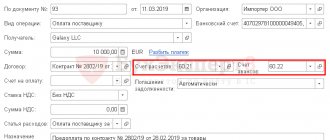

In accordance with the Protocol of December 11, 2009, the tax base for VAT is determined on the date of acceptance of imported goods for registration with the taxpayer based on the cost of purchased goods. The calculated VAT is paid no later than the 20th day of the month following the month in which imported goods were registered or the month in which the payment stipulated by the contract is due.

When importing, the Protocol of December 11, 2009 provides for the obligation to submit a set of documents along with the tax return :

— applications on paper (in four copies) and in electronic form;

— a bank statement confirming the actual payment of indirect taxes on imported goods, or another document confirming the fulfillment of tax obligations to pay indirect taxes, if provided for by the legislation of a member state of the Customs Union;

— transport documents provided for by the legislation of the CU member state, confirming the movement of goods to the territory of another CU member state. The specified documents are not submitted if for certain types of movement of goods the execution of such documents is not provided for by state legislation;

— invoices issued in accordance with the legislation of the CU member state when shipping goods, if their issuance (extract) is provided for by the legislation of the CU member state;

— contracts on the basis of which imported goods were purchased or produced;

- if the goods were shipped from the territory of one state, and the contract was concluded with a company of another state that is not part of the Triple Alliance, it is necessary to submit an information message from the supplier of the goods about the person from whom they were purchased (clause 6, clause 8, article 2 of the Protocol on the export and import of goods);

— commission agreements, orders or agency agreements in cases where they are concluded.