Administration of customs payments: overview of significant changes

The Customs Code of the EAEU (TmK EAEU), compared to the current legislation, contains many innovations in matters of calculation and payment of customs duties.

Payments for temporary import

The procedure for paying import customs duties and taxes when applying the customs procedure for temporary import (admission) is regulated by Art. 223 TMK EAEU.

By analogy with the current legislation, the EAEU TMK provides that the declarant can place goods under such a procedure with partial payment or without payment of import customs duties and taxes.

The procedure for calculating payments for partial payment has not changed. For each full and partial calendar month of use of temporarily imported goods, it is necessary to pay 3% of the amount of import customs duties and taxes that would have to be paid if the goods were placed under the customs procedure of release for domestic consumption. The period is calculated from the day when goods are placed under the customs procedure of temporary importation (admission) to the day when its validity ends.

The declarant has the right to prefer periodic payment of customs duties and taxes calculated for temporary importation. This means that he will pay them monthly before the start of the period for which payment is due. The declarant determines the frequency in the goods declaration.

If the next installment of import customs duties and taxes is not paid on time, the declarant will lose the right to periodic payment for the remaining period. In this case, you will have to make all payments at once.

Payments in relation to processed products

The procedure for calculating import customs duties and taxes in relation to processed products formed outside the customs territory and placed under the customs procedure of release for domestic consumption is regulated by Art. 186 TMK EAEU.

On this issue, the general postulate has not changed: processed products are subject to customs duties and taxes based on the cost of processing operations outside the customs territory of the EAEU.

The EAEU TMK has normatively established answers to many frequently asked questions. For example, what is included in the cost of processing operations, and do they include transportation costs?

According to the TMK of the EAEU, the cost of processing operations outside the customs territory of the EAEU should be determined as the totality of actual expenses for these operations and for foreign goods used in the process of processing (repair) . Other expenses are not included in the cost of processing operations outside the customs territory of the EAEU.

Deferment and installment payment of customs duties

The procedure for granting deferment or installment payment of import customs duties was established by Art. 58 - 60 TMK EAEU.

The current procedure provides for mandatory enforcement of the obligation to pay import customs duties, payment of interest for deferment (installments), as well as a six-month period for provision. For goods subject to rapid deterioration, the period is two months.

TMK EAEU conditionally divided this order into three.

1. Deferment for one month. It can be provided to the payer regardless of the category of imported goods. There is also no requirement to provide evidence to the customs authorities that the payer has grounds for a deferment. The period is calculated from the next day after the release of goods in accordance with the customs procedure for release for domestic consumption. Mandatory conditions for granting a deferment are ensuring the fulfillment of the obligation to pay import customs duties, as well as payment of interest for the deferment.

2. Deferment or installment plan for a period of no more than six months. This procedure is more attractive for the payer, since there is no need to pay interest for the deferment or installment plan. However, in order to receive it, you need to ensure the fulfillment of the obligation to pay import customs duties. In addition, the payer must have grounds for deferment or installment plan, as defined in Art. 59 TMK EAEU. The period is calculated from the day after the release of goods in accordance with the customs procedure for release for domestic consumption.

The EEC has the right to expand the list of grounds for deferment or installment payment of import customs duties.

3. A special procedure for granting a deferment or installment plan for a period of no more than six months. It can be used by persons who import goods for industrial processing into the customs territory of the EAEU. These products include raw materials, materials, technological equipment, components and spare parts for them.

To obtain and confirm the legality of a deferment or installment plan, you must:

— provide security for the fulfillment of the obligation to pay import customs duties and pay interest for deferment or installments;

— place imported goods under the customs procedure of release for domestic consumption;

- use imported goods to obtain new goods, the codes of which, in accordance with the Commodity Nomenclature of Foreign Economic Activity of the EAEU, will differ from their codes at the level of any of the first four digits.

The period of deferment or installment plan is calculated from the next day after the goods are placed under the customs procedure of release for domestic consumption.

Origination and termination of payment obligations

The main idea implemented in the EAEU TMK is to enable declarants who violate certain legal requirements to return to the legal field and still complete the declared customs procedure in accordance with legal requirements.

In particular, the obligation to pay customs duties will cease if the declarant has not yet fulfilled it. If he did, the customs duties paid or collected will be returned.

This is more clearly seen in the example of the customs procedure for temporary importation (admission) (Articles 221 - 226 of the EAEU TMK). The validity period of this procedure has not changed. For most goods, it cannot exceed two years from the date the goods are placed under the specified customs procedure.

It must be completed before the deadline. Otherwise, the customs procedure for temporary importation (admission) is terminated. The day of expiration is considered the deadline for payment of import customs duties and taxes. If the declarant does not pay them, the customs authorities will begin the enforcement procedure.

In such a situation, the EAEU TMK provides the declarant with the opportunity to place goods in respect of which the customs procedure for temporary import (admission) has ceased, for temporary storage. Alternatively, these goods can again be placed under the customs procedure.

Import customs duties and taxes will have to be paid as if partial payment had been applied to them. Moreover, for the period from the day when the temporary import period expired to the day when the declarant placed the goods in temporary storage or under the customs procedure.

In addition to the amounts of partial payment of import customs duties and taxes, you will need to pay:

— interest as if the declarant had been granted a deferment or installment plan;

- special, anti-dumping, countervailing duties (if they are provided for these goods) in full with interest calculated on them.

The declarant may initially declare the period of validity of the temporary import shorter than the maximum possible. In such a situation, the declarant has the right to apply for an extension of the period within two years. A prerequisite is that this must be done before the expiration of the initially stated period.

At the same time, the EAEU TMK has provided for the possibility of extending the validity period of temporary import to the maximum possible even after its expiration. To do this, the declarant must submit an application within a month after the expiration of the temporary import period. Then the temporary import will be resumed from the day it ceased. The declarant will need to pay customs duties and taxes necessary for temporary import. Customs payments, special, anti-dumping and countervailing duties calculated due to the expiration of the initial period are not collected.

There is in Art. 162 TMK EAEU innovations in the customs procedure of a customs warehouse. They consist in the issues of emergence and termination of the obligation to pay import customs duties, taxes and other payments.

Thus, the owner of a customs warehouse may lose goods or release them without documents confirming the completion of the customs procedure of the customs warehouse. In this case, the due date for payment of customs duties, taxes, special duties, anti-dumping duties and countervailing duties becomes due.

These payments will be of the maximum possible size, as when releasing goods for domestic consumption. Moreover, tariff preferences and benefits will not be applied. Today, customs duties and taxes calculated based on the above circumstances are collected regardless of the further use of the goods.

In accordance with the EAEU TMK norms, the owner of a customs warehouse may cease to have the obligation to make payments, even if the goods have already been lost or were unlawfully released from the customs warehouse. It is enough just to complete the customs procedure of the customs warehouse. Payments paid or collected in this case will be returned or offset.

The above fully applies to the situation when the customs procedure for foreign goods has ceased, including due to the expiration of the deadline. In order for such goods to be located and used in the customs territory of the EAEU or exported in the future, they must be placed under the customs procedure.

Payment obligations in respect of goods released before the filing of the declaration

The declarant can declare goods for release before submitting a declaration for them in accordance with the customs procedures for release for domestic consumption, processing in the customs territory, free customs zone, free warehouse, as well as temporary import (admission) without paying customs duties and taxes.

TMK EAEU describes in more detail the production of goods for domestic consumption. The customs authority will not require the person applying for the release of goods to pay customs duties, taxes, special duties, anti-dumping duties or countervailing duties. However, you will need to ensure their payment. An exception is provided for declarants - authorized economic operators and in some other cases.

The deadline for payment of payments is limited by filing a goods declaration. It must be submitted no later than:

— the 10th day of the month following the month of release of the goods;

— the 15th day of the month following the month of release of goods, when the declarant is an authorized economic operator.

If the declarant violates the specified deadlines, the customs authority will independently calculate the payments due. It will be based on the information specified in the application for the release of goods and the documents submitted with such an application.

Published in the journal “Industrial and Trade Law”, 2021, No. 8

Temporary import of vehicles

According to paragraph 6 of Article 264 of the Labor Code of the Union, temporarily imported vehicles for personal use must be in the customs territory of the Union in the actual possession and use of the declarant, unless otherwise established by this article.Temporarily imported vehicles for personal use may be transferred by the declarant to another person, including the person to whom such a vehicle belongs by right of ownership, in the cases and on the conditions established by this article.

In accordance with clause 8 of Article 264 of the Labor Code of the Union, without the permission of the customs authority and without customs declaration, the declarant is allowed to transfer the following vehicles for personal use:

1) a temporarily imported vehicle for personal use - into the possession of another person for maintenance, repair (except for major repairs, modernization) and (or) for storage;

2) a vehicle for personal use, temporarily imported by an individual of a Member State - his parents, children, spouse in a registered marriage;

3) a vehicle for personal use, temporarily imported by a foreign individual - to other foreign individuals;

4) temporarily imported watercraft or aircraft for personal use - to the captain of the watercraft, commander of the aircraft, crew members for control and operation of this vehicle in cases where the technical design of the vessel does not imply its operation without the participation of these persons;

5) a vehicle for personal use, registered to a diplomatic mission and (or) consular office of a Member State, a representative office of a Member State with an international organization, located outside the customs territory of the Union, temporarily imported by an individual of a Member State working in such a diplomatic mission and (or) a consular office, a representative office of a Member State to an international organization - to another employee of such a diplomatic mission and (or) consular office of a Member State, a representative office of a Member State to an international organization located outside the customs territory of the Union.

The procedure for temporary import of goods (IM 53) provides for the free use and movement of goods within the territory of the EAEU countries. Under this procedure, you can import products of almost any group and category. The exceptions are food, alcohol, tobacco products, consumables, waste of any origin, and prohibited goods. Goods do not lose their foreign status throughout the entire period of stay in Russia.

The concept of temporary import procedure

The customs procedure for importing foreign goods into the territory of the Russian Federation for a certain period of time is called temporary import admission of goods or Import 53. The procedure provides for mandatory declaration and payment of customs duties and other payments. However, in most cases no fees apply. The conditions for payment of duties or exemption from them for different categories of cargo differ and are established on the basis of the Customs Code of the EAEU. The IM53 regime allows you to save money on paying duties and taxes, which are completely absent or their amount is significantly lower compared to other regimes. At the same time, it is extremely important to comply with such a condition for the temporary import of goods as the mandatory removal of cargo from the territory of the Russian Federation after the expiration of the permitted period.

According to the Customs Code IM 53 applies to the following types of products:

- exhibition exhibits,

- sports equipment,

- musical instruments,

- structures for organizing fairs and exhibitions,

- theater props,

- mobile gadgets necessary for professional activities,

- packaging and containers, containers,

- equipment for organizing concerts and competitions,

- transport necessary for the above purposes, etc.

This declaration regime also applies to foreign goods that are in transit through the territory of the Russian Federation or are in storage under customs control.

To apply the procedure, cargo identification is required. Throughout the entire period of stay in the country, imported products must remain in their original condition (natural wear and tear is allowed) and at the disposal of the declarant. Transfer of cargo to third parties is permitted only after obtaining the appropriate permit.

If the cargo was not exported within the allotted time, a release procedure for domestic consumption is formalized. Taxes and duties from which the products were exempt are paid. If payments are late, additional penalties will be assessed.

Legal regulation of temporary import and admission

Temporary import of goods is regulated by Ch. 22 of the Customs Code of the Russian Federation, Federal Law on Customs Regulation, certain legislative acts of the Customs Union, international agreements establishing rules for certain categories of products. Detailed conditions of the procedure are described in the Convention on Temporary Importation, signed in Istanbul. Separate provisions on simplification and harmonization of customs procedures are devoted to this issue.

Conditions for placing goods under the customs procedure

The declarant is obliged to collect and provide to the customs authority documents with a detailed description of the reasons for temporary import and documents that guarantee subsequent re-export. One of the main conditions for obtaining access is the identification of goods being transported. Identification means must be applied in an indelible manner. They must remain readable while the products are in use.

The means of identification may be the following:

- digital marking,

- letter marking,

- serial numbers, etc.

Identification is not required if temporarily imported goods are being replaced. Next, customs duties are calculated and their partial payment is made. The exception is cases when products temporarily located on the territory of the Russian Federation are used without paying taxes and duties.

It is important to strictly comply with non-tariff regulation measures, technical regulation, quarantine-phytosanitary and veterinary-sanitary standards, and radiation requirements.

While the cargo is in the Russian Federation, natural loss and wear are allowed. Particular attention should be paid to maintaining proper storage and use conditions for such goods that may be tested, inspected, repaired, tested, or receive maintenance. It is prohibited to carry out functional improvements to designs in comparison with the original.

After the declaration of temporary import of goods has been completed, the cargo must be at the disposal of the owner. It is possible to temporarily transfer products to another person in cases provided for by law without notifying the customs authority. For example, to perform maintenance or repair work. The transfer of products to other persons for reasons not provided for by law can only be carried out with permission from customs. The document is issued on the basis of an application from the declarant, indicating the reason for the need and providing information about the owner or user.

Important! The Import 53 procedure can only be applied to products of foreign origin.

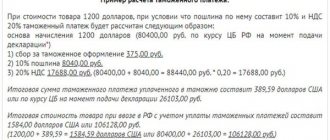

Procedure for paying customs duties for temporary import

Regime IM 53 provides for partial or complete exemption from taxes and duties.

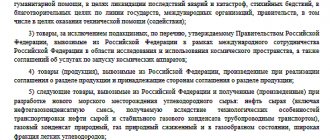

Products that are not subject to taxes include:

- goods related to science, culture, film industry, tourism;

- products imported for the purpose of improving international relations;

- international aid goods, etc.

The decision on tax exemption can only be made at the federal level. In case of violation of the terms of the procedure or import of new goods not declared in the declaration, tax payments are accrued in full.

In case of partial payment of duties and taxes, obligations arise after the opening of the regime and end at the moment of termination of the regime.

The date of payment must correspond to the date of registration of the declaration or, if the goods were released before registration, then the date of registration of the application for the release of the cargo. The final payment deadline falls on the day of expiration of the temporary import of products or takes into account its features. For example, when transferring cargo to other persons, the payment deadline falls on the date of their transfer or registration of the declaration with the customs authority. In case of loss of cargo, the payment deadline falls on the day of its loss or the day of registration of the declaration, if the day of loss cannot be determined. The exception is cases of complete destruction of cargo for objective reasons.

Taxes and duties paid are not offset against payments and are not refunded.

Terms and documents for temporary import into Russia

The maximum period for cargo registered under the IM 53 regime to remain on the territory of the Russian Federation is 2 years. The storage period in a customs warehouse may be excluded from the calculation. The period of admission is determined by the customs authority taking into account the purposes specified in the declaration. In general cases, the countdown of the period begins from the day the regime opens. For some categories of cargo, taking into account the purposes of their import into the territory of the EAEU countries, an extension of the period is possible. This condition does not apply to containers, but applies to fixed production assets, provided that they are owned by the declarant. For example, equipment may be placed under the temporary import procedure for 34 months. If registration is carried out by different declarants, the total period does not exceed 2 years. The customs authority has the right to revise the period downward based on current legislation, taking into account the characteristics of the goods.

The documents required to complete the IM 53 procedure are as follows:

- description of the cargo with a plan for the event, for example, concerts, scientific tests, etc.;

- product identification document,

- confirmation of the purpose of admission,

- certificate of temporary admission of goods not subject to taxes, with reference to a regulatory act confirming the possibility of tax abolition;

- a statement indicating the date of return export,

- documented guarantees of re-export of cargo within the established time frame.

If the goods were placed under other customs procedures before this regime, the declarant must provide evidence of compliance with all applicable requirements.

Customs import may be terminated early if it turns out that the cargo is under other customs procedures, for example, under re-export and other regimes, with the exception of transit. Termination of the IM 53 procedure is possible if violations of the obligations assumed by the declarant are identified. Early termination of the regime occurs if import conditions have been violated, for example, goods have been modernized. The procedure for suspending and resuming the procedure is determined by the FCS commission.

The standard completion of the procedure occurs after the cargo is placed under the re-export procedure.