If you have a question regarding customs payments, hurry up and contact a specialist; it is important to thoroughly understand the issue.

Customs collection authorities have the right to demand payment that was not made on time and in accordance with the law, but you need to understand whether there are any violations of your rights, whether the benefits for paying customs duties have been taken into account, whether the penalties are too high and whether they exist at all be in this situation.

ATTENTION : our customs lawyer will help you figure everything out: professionally and on time

Basic Principles for Receiving Late Payments

Collection of customs duties from individuals is governed by the following principles:

- If there is no payment for customs services, upon completion of the payment period, the regulatory authorities are obliged to receive it forcibly.

- Before forced collection of payment, it is necessary to send a notice to the payer with the stated amount of the debt.

- Forced collection cannot be carried out if it was established later than a period equal to three years from the date of the last date of payment or if the total cost does not exceed one hundred and fifty rubles.

- The deadline for fulfilling the requirement to pay customs duties should not be less than ten working days, but should not exceed twenty days from the date of receipt of the notification.

Payment calculation

The peculiarity of customs payments is the need for them to be independently calculated by the payer. To quickly release the cargo, this must be done competently and as accurately as possible. The basis for the calculation is the code of the commodity nomenclature (TN) of foreign economic activity, which allows you to find out:

- whether the product is excisable;

- whether additional certificates or permits are required to move it;

- is it subject to export duty?

Knowing the HS code, you can calculate the total customs payment.

Calculation example

Theoretically, knowing the TN code, country of origin and customs value of the goods (CTV), you can calculate payments without resorting to the online calculator option. In practice, most foreign trade participants prefer to use the services of experienced brokers who guarantee the accuracy of calculations and the success of operations at customs.

The calculation formula looks like the sum of several terms:

Customs duty + customs or seasonal (if necessary) duty + excise tax (if necessary) + VAT + special duties = total customs payment.

The Federal Customs Service draws attention to the fact that calculations should be made taking into account currency exchange rate fluctuations.

Procedure for collecting customs duties

The procedure for collecting customs duties has its own structure. Until payment is made, the payer is presented with a claim with a specified amount required for payment. This notice is sent several weeks before the debt is expected to be repaid.

Requests for payment may be made to the entity that transported the goods through customs. A sum of money can be used as payment; in the absence of such, payment can be made at the expense of the confiscated goods.

ATTENTION : Consider the customs duty refund procedure whenever possible

If the subject does not take advantage of the opportunity given to him to pay for customs services, then the responsible authority has the right to receive the necessary amount from the personal account.

The procedure for collecting customs duties from the payer’s bank accounts will come into force on an indisputable basis. This decision must be made within 60 days after the last day of expected payment.

Call our lawyer to sort everything out and not be held administratively or criminally liable for delays.

Penalties for late payment of customs duties

If customs duties are paid in violation of the deadlines, then the payer becomes obligated to pay penalties in accordance with Art. 70 of the law of August 3, 2018 No. 289-FZ.

Penalties are payable simultaneously with the payment of overdue customs duties.

Penalties are accrued from the next day on which the payment deadline has expired, and are accrued for each day of delay. The amount of the penalty is determined by applying the penalty rate and the base for their calculation, which is equal to the amount of unpaid customs duties. In any case, the amount of penalties should not exceed the amount of debt on customs duties.

The penalty rate is equal to 1/360 of the key rate of the Central Bank of the Russian Federation, which is valid on the day of its application. In some cases, a rate of 1/100 of the key rate of the Central Bank of the Russian Federation may be applied.

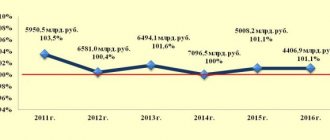

Customs duty rates for clearance

Since August 2021, new rates of fees in favor of customs have been in effect, the amounts of which still correlate with TCT. The number of bets has increased from 7 to 11, and their ranges have also changed.

Table 2. Tax rates for imports

When exporting, the only payment to customs is customs clearance (from 500 rubles), provided that the goods are not included in the list of those subject to export duty.

Methods for calculating the cost of goods

TCT is calculated from the cost of production of goods and its transportation to the border of the Customs Union. Several methods are used for calculation, based on the transaction value:

- with imported goods;

- with identical goods;

- with homogeneous (similar) goods.

And:

- by subtracting the cost of costs characteristic of the domestic market;

- by summing production costs, expenses and profits;

- a backup method, which is used if it is impossible to use other methods.

The calculation procedure begins with the main method. If its use is impossible, proceed to the following methods in the order indicated in the list.

Deadline for collecting customs duties

Collection of customs duties implies the absence of voluntary execution on the part of the payer of the relevant payments. Consequently, in order to forcefully collect customs payments, the authorized body must perform certain actions.

According to the provisions of Art. 71 of the law on customs regulation in the Russian Federation, penalties are not applied if notification of the amounts of customs duties that have not been paid is not sent within 3 years from the day when the deadline for their payment expired or from the day the fact of non-payment was discovered. Thus, within 3 years, notification of the existence of arrears in payments must be sent.

Once it has been established that the payer has not fulfilled his obligation to make payments, a corresponding notification must be sent to him within 10 days.

From the date of receipt of the notice by the payer, it must be executed within 15 working days. If the notice is not executed by the payer, then the customs authority makes a decision to recover funds from the accounts in an indisputable manner.

- Detection of the fact of non-fulfillment or improper fulfillment of the obligation to pay customs duties and notification of the payer about this

Collection of customs duties is carried out by the customs authority if, during customs control, both before and after the release of goods, a fact of non-fulfillment or improper fulfillment of the obligation to pay customs duties is discovered.

The identification of such a fact is recorded:

1) if the customs declaration of goods was carried out using a declaration for goods - by making changes to the information specified in the declaration for goods (forming an adjustment to the declaration for goods);

2) if customs declaration of goods was not carried out or was carried out using other customs documents - by filling out:

- calculation of customs duties, taxes, special, anti-dumping, countervailing duties;

- adjustments to the customs receipt order;

- adjustments to the application for transactions in relation to international transport vehicles located outside the customs territory of the Union, which are goods placed under the customs procedure of temporary import (admission);

- adjustments to the document on payment of customs duties and taxes in relation to goods for personal use, the customs declaration of which is carried out using a passenger customs declaration for express cargo;

- calculation of customs duties and taxes levied at uniform rates.

The day of registration of these documents by the customs authority is considered the day of discovery of the fact of non-fulfillment or improper fulfillment of the obligation to pay customs duties within the prescribed period.

After this, no later than ten working days, the customs authority must send the payer a notification about the amounts of customs duties and taxes not paid on time (hereinafter referred to as the notification).

If there is a subsequent change in the amount of calculated and payable customs duties specified in an already sent notification, the customs authority is obliged to send a clarification to such notification.

In the event of a joint obligation to pay customs duties, notifications (clarifications to the notification) are sent simultaneously to the payer and to persons bearing a joint obligation (hereinafter referred to as payers).

The deadline for execution of the notification is fifteen working days from the date of its receipt, clarifications to the notification - ten working days from the date of its receipt.

In case of sending a notification (clarification to the notification):

- by mail by registered letter - the day of its receipt is considered the sixth working day following the day of sending the registered letter;

- in the form of an electronic document - the day of its receipt is considered the day following the day of its sending.

The customs authority does not send a notification in the following cases:

- identification after the release of goods of the fact of non-payment of customs duties calculated in one declaration for goods in an amount not exceeding an amount equivalent to 5 euros - in this case the obligation to pay customs duties is terminated;

- identification of the fact of non-payment of customs duties calculated in one calculation of customs duties, taxes, special, anti-dumping, countervailing duties or in one application for transactions in relation to international transport vehicles located outside the customs territory of the Union, which are goods placed under the customs procedure of temporary import (admission), in an amount not exceeding an amount equivalent to 5 euros - in these cases, the obligation to pay customs duties is terminated;

- if the customs authority does not have information about the location (place of residence) of the payer or the payer is a foreign person;

- if security for the fulfillment of the obligation to pay customs duties was deposited with the customs authority in the form of a cash deposit;

- if the maximum storage period for goods in respect of which customs duties have not been paid or have not been paid in full has expired and the payer has not been identified by the customs authorities.

- Measures for collecting customs duties

If the notification was not executed within the prescribed period, as well as in cases where such a notification is not sent, the authorized customs authority collects customs and other payments.

Collection of customs duties, special, anti-dumping, countervailing duties, interest and penalties is carried out at the expense of:

- cash (precious metals) in bank accounts;

- electronic money;

- advance payments;

- customs duties, special, anti-dumping, countervailing duties, interest and penalties subject to refund;

- ensuring the fulfillment of the obligation to pay customs duties and taxes;

- ensuring the fulfillment of the obligation to pay special, anti-dumping, countervailing duties;

- ensuring the fulfillment of the duties of a legal entity operating in the field of customs;

- ensuring the fulfillment of the duties of an authorized economic operator;

- goods in respect of which customs duties have not been paid or have not been fully paid - in this case the obligation to pay customs duties and taxes in respect of such goods ceases;

- other property.

The specified measures to collect customs duties and taxes are not taken in the following cases:

- if the notification (clarification to the notification) is not sent within three years, i.e. when the collection period has expired;

- the obligation to pay customs duties and taxes has ceased due to their payment or due to other circumstances;

- the amounts of customs duties and taxes are considered uncollectible;

- for the period of suspension of the application of measures to collect export customs duties in cases established by the Government of the Russian Federation.

Collection of customs duties is carried out:

- from legal entities and individual entrepreneurs - in court, if during the application of the above measures by the customs authorities, such a recovery was not made.

- from individuals, with the exception of individual entrepreneurs - in court, except for the following cases:

a) if the customs authority does not have information about the location (place of residence) of the payer or the payer is a foreign person;

b) if security for the fulfillment of the obligation to pay customs duties was deposited with the customs authority in the form of a cash deposit.

For the amount of customs payments, the deadline for fulfilling the obligation to pay for which was violated, the customs authority charges a penalty for each calendar day of delay.

Penalties are calculated based on 1/360 of the key rate of the Central Bank of the Russian Federation, and in some cases - based on 1/100 of the key rate of the Central Bank of the Russian Federation.

- Collection of customs duties using funds (precious metals) in bank accounts and electronic funds (uncontested collection)

In case of failure to comply with the notification, and insufficient or absent advance payments, the customs authority shall foreclose on the funds (precious metals) in the payer’s bank accounts and his electronic funds.

Collection is carried out on the basis of a decision of the customs authority on indisputable collection, which is accepted no later than fifteen working days after the expiration of the period specified in the notification.

If the specified period was violated, the customs authority no later than six months after the expiration of the period specified in the notification may apply to the court with an application for the collection of customs duties.

Collection of customs duties is carried out by decision on indisputable collection by sending the customs authority to the bank, in which:

- bank accounts have been opened, bank accounts in precious metals, - orders from the customs authority for undisputed collection;

- there are electronic funds - instructions from the customs authority to transfer electronic funds to the payer’s bank account.

Customs payments are not collected from the deposit account if the deposit agreement has not expired. In this case, the customs authority may give the bank an instruction to transfer funds from the deposit account to the settlement (current) account of the payer upon expiration of the deposit agreement.

If there is a bank deposit agreement in precious metals, the customs authority has the right to give the bank an order to sell precious metals in the amount necessary to fulfill the customs authority’s order for undisputed collection upon the expiration of the specified agreement.

The bank is obliged to unconditionally fulfill the instructions of the customs authority.

If there is insufficiency or absence of funds in the payer’s accounts or balances of electronic funds, the bank executes the orders of the customs authority as such funds arrive.

- Suspension of transactions on bank accounts and electronic money transfers

To ensure the execution of the customs authority's decision on an indisputable collection, suspension of transactions on bank accounts and electronic money transfers is applied, with the exception of accounts of individuals who are not individual entrepreneurs.

The customs authority has the right to decide to suspend transactions on the payer’s bank accounts and transfers of his electronic funds in the event of:

- failure by the payer to comply with the decision of the customs authority to provide security for the fulfillment of the obligation to pay customs duties within the period established in such decision;

- failure by the person who submitted the application for the release of goods before filing a declaration for goods to fulfill, within the established period, the obligation to pay customs duties in respect of goods released before filing a declaration for goods;

- non-payment or incomplete payment of import customs duties and taxes paid by the payer periodically in relation to temporarily imported goods;

- if the amount of security for the fulfillment of the duties of an authorized economic operator is less than the amount of customs duties payable under one or more declarations for goods not submitted within the prescribed period;

- failure by the guarantor to fulfill the requirement to pay a sum of money within the prescribed period.

The bank is obliged to unconditionally execute the decision to suspend transactions on the payer’s bank accounts and transfers of his electronic funds, as well as to inform the customs authority about the balances of funds (precious metals) on the accounts on which transactions are suspended, as well as about the balances of electronic funds, whose translation has been suspended.

The decision of the customs authority to suspend operations on the payer’s bank accounts and transfers of his electronic funds is canceled by the decision of this customs authority after the reasons for its adoption have been eliminated.

If the total amount of funds in the accounts on which transactions are suspended exceeds the amount specified in the decision, the payer has the right to submit to the customs authority an application to cancel the suspension of transactions on his bank accounts, indicating the accounts on which there are sufficient funds to execute the decision of the customs authority on an indisputable collection.

- Collection of customs duties at the expense of the provided security

The customs authority may demand from the guarantor who issued the bank guarantee, the guarantor who entered into the surety agreement, to pay the amounts of customs duties or to foreclose on the collateral or cash collateral.

To do this, the customs authority, after the expiration of the notice period, as well as in the event of insufficient or absent advance payments, no later than fifteen working days, sends to the guarantor, guarantor a demand for payment of a sum of money under a bank guarantee or surety agreement.

The amount of money payable under a bank guarantee or surety agreement includes penalties.

In case of ensuring the fulfillment of the obligation to pay customs duties in several ways, the customs authority sends demands to each guarantor, surety for the full amount of customs duties, but not more than the amount specified in the bank guarantee or surety agreement.

The obligation under a bank guarantee or surety agreement is subject to fulfillment by the guarantor or surety no later than five working days from the date of receipt of the request from the customs authority.

If security for the fulfillment of the obligation to pay customs duties was provided in the form of a cash deposit, then the customs authority forecloses on the deposit without sending a notice.

If the notification is not fulfilled within the period established therein, the customs authority, no later than five working days from the date of expiration of such period, forecloses on the cash deposit posted to ensure the fulfillment of the duties of an authorized economic operator or the duties of a legal entity operating in the field of customs affairs.

Such collection is carried out on the basis of a decision of the customs authority to foreclose on the cash deposit posted to secure the duties of an authorized economic operator and (or) the duties of a legal entity operating in the field of customs affairs.

If a pledge of property has been provided to ensure the payment of customs duties, the customs authority, no later than five working days from the date of expiration of the notice for execution, forecloses on the pledged property.

Such collection is carried out on the basis of a decision of the customs authority to foreclose on the collateral.

If, in accordance with an international treaty of the Russian Federation, the fulfillment of the obligation to pay customs duties is ensured by a guaranteeing association (association), then in case of non-fulfillment or improper fulfillment of the obligation to pay customs duties, the customs authority sends to the guaranteeing association (association) a demand for payment of customs duties and penalties, taking into account provisions of such an international treaty.

In case of failure to comply with the conditions of the customs procedure for temporary import or customs transit in relation to goods imported into the customs territory of the Union under ATA carnets, the amount of funds payable by the guaranteeing association includes penalties that cannot exceed 10 percent of the amount of customs duties.

- Collection of customs duties at the expense of goods for which they have not been paid or have not been paid in full

In the event of a lack of funds (precious metals) in bank accounts, electronic funds or lack of information about the payer’s accounts, as well as about electronic funds, the customs authorities may recover the amounts of customs duties payable at the expense of goods in respect of which they have not been paid .

The decision on such collection is made no later than ten working days after the expiration of the notice period, or the expiration of the maximum storage period for goods if the payer has not been identified.

No later than ten working days after the day such a decision is made, the customs authority submits an application to the court or arbitration court to foreclose on the goods, except for cases where such goods have been transferred to the customs authorities as collateral.

Foreclosure of goods is carried out on the basis of a decision of a court or a customs authority, if such goods have been transferred to the customs authorities as collateral.

If the payer is not the owner of the goods, then the owner has the right to pay customs duties in respect of the goods belonging to him.

- Seizure of property and seizure of goods in respect of which customs duties have not been paid or have not been paid in full

To ensure the execution of the decision to foreclose on goods, the customs authority may decide to seize the goods.

Seizure is an action to restrict the rights of the owner in relation to his property, applied by the customs authority to ensure the collection of customs and other payments.

Seizure of property can be:

- complete - in which the owner does not have the right to dispose of the seized property, and the possession and use of this property is carried out with the permission and under the control of the customs authority;

- partial - in which the possession, use and disposal of this property is carried out with the permission and under the control of the customs authority.

The seizure of property is carried out with the sanction of the prosecutor on the basis of a decision of the customs authority.

The property of an individual is not seized.

Seizure of property is imposed only on property that is necessary and sufficient to fulfill the obligation to pay customs and other duties.

Seizure of goods is imposed on all goods in respect of which customs and other duties have not been paid or have not been paid in full.

In order to execute the decision of the customs authority to seize property, such a decision is sent to suspend registration actions in relation to the seized property:

- to the federal executive body authorized in the field of state registration of rights to real estate and transactions with it, state cadastral registration of real estate, maintaining the state real estate cadastre;

- to the divisions of the State Road Safety Inspectorate of the Ministry of Internal Affairs of the Russian Federation and the state supervision body over the technical condition of self-propelled vehicles and other types of equipment in the Russian Federation.

Seizure of property and seizure of goods are carried out with the participation of witnesses or using video recording.

Before arrest, a customs official presents a decision on seizure and documents certifying the authority of such an official.

When seizing property or goods, a protocol on the seizure of property or goods is drawn up.

In such a protocol or in the inventory attached to it, the property or goods subject to seizure are listed and described, with a precise indication of the name, quantity and individual characteristics of the items, and, if possible, their value.

The customs authority that made the decision to seize property or to seize goods determines the place where the property or goods to be seized should be located.

Alienation (except for those carried out under the control or with the permission of the customs authority that applied the seizure), embezzlement or concealment of property or goods subject to seizure is not permitted.

At the request of the person whose property is seized, the customs authority has the right to replace the seizure of property with a cash deposit.

The decision of the customs authority to seize property, the decision of the customs authority to seize goods are canceled if:

- termination of the obligation to pay customs and other payments;

- accepting a cash deposit as security for the fulfillment of the obligation to pay customs duties;

- seizure of property by a bailiff, in the event of execution of a judicial act on the collection of customs and other payments or a resolution of the customs authority on the collection of customs payments at the expense of the property.

- Collection of customs duties from amounts subject to return and (or) amounts of advance payments and other property of the payer

In case of failure to comply with the notification, the customs authority shall levy the amount of customs duties, taxes, special, anti-dumping, countervailing duties subject to refund, and (or) the amount of advance payments (hereinafter referred to as advance payments).

The decision of the customs authority to collect customs and other payments through advance payments is made no later than ten working days from the date of expiration of the notice.

The customs authority may also collect customs and other payments due from other property of the payer (a person bearing joint and several liability), including from cash, in the following cases:

- failure to fulfill or improper fulfillment of the obligation to pay customs duties after the expiration of the notice period;

- insufficiency or lack of funds in bank accounts and (or) electronic funds;

- lack of information about the payer’s accounts or information about the details of his corporate electronic payment instrument used for electronic money transfers.

Collection of customs and other payments at the expense of property is carried out by decision of the customs authority by sending no later than three working days from the date of such decision to the bailiff.

Such a decision is made no later than one year after the expiration of the notice period. After the expiration of such a period, the customs authority may apply to the court within six months with an application to recover from the payer the amount of customs and other payments due.

- Recognition of the amounts of customs and other payments as hopeless for collection and write-off

Debt for payment of customs and other payments, the collection of which turned out to be impossible after taking all collection measures, is recognized as uncollectible in the following cases:

- liquidation of the payer - a legal entity, an organization that is not a legal entity;

- declaring an individual entrepreneur bankrupt;

- declaring a citizen bankrupt;

- death of an individual (individual entrepreneur) or declaration of his death;

- adoption by the court of an act in accordance with which the customs authority loses the ability to collect amounts of customs and other payments due to the expiration of the established period for their collection;

- the bailiff issuing a resolution to complete enforcement proceedings and return the writ of execution to the claimant, if more than five years have passed since the date of establishment of the fact of non-fulfillment or improper fulfillment of the obligation to pay customs and other payments, and:

a) the amount of these amounts does not exceed the amount of claims against the debtor established by the legislation of the Russian Federation on insolvency (bankruptcy) for initiating bankruptcy proceedings;

b) the court returned the application to declare the debtor bankrupt or terminated the bankruptcy proceedings due to the lack of funds sufficient to reimburse legal expenses for the procedures applied in the bankruptcy case;

- the expiration of three years from the date of establishment of the fact of non-fulfillment or improper fulfillment of the obligation to pay customs and other payments by a foreign person, in the absence of information from the customs authorities about the availability of funds and (or) other property of this person on the territory of the Russian Federation, on which collection may be taken.

In order to apply the risk management system, customs authorities maintain a register of persons (founders and (or) participants) whose amounts of customs and other payments are recognized as hopeless for collection.

Additional material on the topic in the Customs payments section

Write-off of customs duties

In certain cases, amounts of customs payments may be considered uncollectible and written off.

Cases where customs payments are subject to write-off include: liquidation of the payer, recognition of an individual entrepreneur or a citizen as bankrupt, death of an individual, if the court adopted an act on the loss of the customs authority’s ability to collect payments, if the bailiff issued a resolution to complete the proceedings and return the writ of execution, etc. cases.

The write-off procedure is established by Order of the Federal Customs Service of Russia dated December 27, 2018 No. 2138. According to this procedure, the head of the customs authority makes a decision to recognize the amounts of customs duties as hopeless for collection and to write them off. Amounts based on the specified decision are written off in the UAIS TO software no later than the next day when the corresponding decision to write off was made.

Bibliography

- Annual collection “Customs Service of the Russian Federation in 2017” [Electronic resource]. — Access mode: https://www.customs.ru/index.php?option=com_content&view=article&id=7995&Itemid=1845 (access date: 05/08/2018).

- APS “Debt” and customs payments [Electronic resource]. — Access mode: https://www.logistics.ru/customs/news/aps-zadolzhennost-i-tamozhennye-platezhi (access date: 05/08/2018).

- Customs Code of the Eurasian Economic Union (Appendix No. 1 to the Treaty on the Customs Code of the Eurasian Economic Union) [Electronic resource]. — Access mode: https://www.eaeunion.org/ (access date: 05/08/2018).