VAT refunds for exports to Kazakhstan in connection with the creation of the EAEU have generally not changed, despite the fact that new documents have appeared regulating the procedure for refunding zero VAT. We will tell you what these documents are and how tax is returned today when exporting to Kazakhstan.

2015 brought us some changes that affected the procedure for refunding export VAT:

- The Treaty on the EAEU entered into force.

For more details, see the material “Since 2015, the Eurasian Economic Union has been in place instead of the Customs Union”

- The Tax Code of the Russian Federation has lost the provisions that provided for the need to restore the “input” VAT on exported goods (although the latest clarifications from the Ministry of Finance indicate the opposite).

Documents confirming VAT refund when exporting to Kazakhstan

Since the beginning of 2015, in connection with the signing of the Treaty on the Eurasian Economic Union of May 29, 2014, the Protocol on the procedure for collecting indirect taxes and the mechanism for monitoring their payment when exporting and importing goods, performing work, and providing services has become regulated along with the Tax Code of the Russian Federation ( Appendix 18, hereinafter referred to as the Protocol). Thus, the issue of exporting goods to Kazakhstan and documenting this transaction are regulated by the Protocol, Ch. 21 of the Tax Code of the Russian Federation and the Customs Code of the Russian Federation.

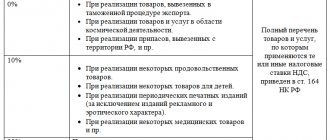

When selling goods outside the Russian Federation, the taxpayer has the opportunity to save on paying VAT due to the provisions of clause 1 of Art. 164 of the Tax Code of the Russian Federation, using a 0 percent rate. However, in order to realize this opportunity, it is necessary to collect a package of documents that will confirm the validity of this rate. Sales to the EAEU countries are carried out in a more simplified form due to the fact that the list of documents justifying the 0 percent rate is much narrower than when exporting to other countries.

Thus, in order to confirm a zero shipment to Kazakhstan, it is necessary to have the following documents for the tax department (clause 4 of p. II of the Protocol):

- contract with a Kazakh counterparty;

- shipping and transport documents (for example, CMR);

- an application for the import of goods and payment of indirect taxes or a list of applications.

Moreover, due to the abolition of the border between the countries of the EAEU, customs authority marks on shipping documents are not required. On the application for the import of goods, a mark is made by the tax authority of Kazakhstan.

Customs clearance of goods transported between members of the EAEU

Filling out declarations for goods in the usual manner for goods transported between the states of the EAEU has been abolished; accounting is carried out through the submission of a statistical declaration form (statistical form) to the customs office of the state of export. Submission of statistical forms is carried out in order to record the movement of goods during Russia’s foreign trade with member countries of the Eurasian Economic Union. The statistical form is drawn up by the person who made the transaction, or on whose instructions this transaction was made, or who is vested with the right to own and dispose of goods.

The statistical form is submitted to customs no later than the eighth working day of the month following the month in which the goods were shipped.

Important! For violation of the deadlines for submitting a statistical form for recording exports to Belarus, a fine may be imposed on officials in the amount of ten thousand to fifteen thousand rubles under Article 19.7.13 of the Code of Administrative Offenses of the Russian Federation; for legal entities - from twenty thousand to fifty thousand rubles.

The statistical accounting form in the form of a paper document can be sent through the Personal Account of a participant in foreign trade activities on the website of the Customs Service in the following order:

- It is necessary to fill out the statistical form electronically;

- Make sure that the form is filled out correctly and completely;

- Request a system number and save the form;

- Certify the received document with the signature and seal of the applicant;

- Send the received document in paper form in person or by post with acknowledgment of receipt to the customs office at the place of registration of the applicant;

- The customs inspector, having received the statistical form in paper form, will download it from the customs system using the system number, verify the information and register it, assigning an official registration number;

Procedure for VAT refund when exporting to Kazakhstan

As part of confirming the zero rate, the following procedures must be followed:

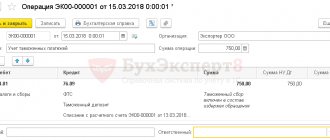

- After the goods have been shipped to the Kazakh counterparty, an invoice must be issued within 5 days (clause 1 of Article 169 of the Tax Code of the Russian Federation).

- Upon shipment, restore the VAT previously accepted for deduction on exported goods (letter of the Ministry of Finance of the Russian Federation dated February 13, 2015 No. 03-07-08/669).

- The restored VAT amounts should be reflected in line 100 of column 5 of Section 3 of the VAT Declaration for the quarter of shipment (Order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558).

- In the sales book, reflect this shipment at a rate of 0 percent in the period when the tax liability arose (clause 9 of article 167 of the Tax Code of the Russian Federation, clause 2 of the rules for maintaining the sales book), i.e. at the end of the quarter in which a complete package of documents confirming fact of export. The taxpayer has 180 days for such confirmation. Depending on whether he succeeds in collecting the package of documents or not, and on when this happens, the procedure for filling out the declaration and reflecting VAT in accounting will change.

After the taxpayer has shipped the goods, he has 180 days to confirm the possibility of applying the 0 percent rate. And depending on whether he manages to collect a package of documents or not, the procedure for filling out the declaration and reflecting VAT in accounting will change.

Cargo transportation to Azerbaijan

When delivering to Azerbaijan from Russia, you should develop the correct and competent algorithm of actions for transporting your cargo. In addition to choosing the type of transport, it is necessary to organize the loading and unloading of cargo.

To avoid worries about logistics planning, contact our specialists. In the shortest possible time, our logisticians will provide you with an individual proposal for exporting your goods with all calculations that will not change, but remain static.

If documents are not collected within 180 days

If for some reason the taxpayer suddenly did not meet the deadline for collecting supporting documents and did not submit them to the Federal Tax Service, the algorithm of actions is as follows:

- It is necessary to charge VAT on sales at the appropriate rate (10 or 18 percent), drawing up the corresponding invoice in 1 copy.

- Register this invoice in an additional sheet of the sales ledger for the shipment period, reflecting the accrued VAT.

- Accept VAT, previously restored, for deduction on the date of shipment in the amount corresponding to this shipment.

The updated declaration for the shipment period is filled out as follows:

- line 010 of section 6 indicates the operation code;

- in line 020 of section 6 - revenue from the sale of export goods;

- in line 030 of section 6 - the amount of accrued VAT at a rate of 10 or 18 percent;

- in line 040 of section 6 - the amount of “input” VAT.

It should be noted that there is a court decision that speaks of the possibility of reflecting additional VAT in the declaration for the period after 180 days, and not for the period of export shipment. This position is enshrined in the resolution of the Federal Antimonopoly Service of the Moscow District dated December 22, 2010 No. KA-A40/15981-10 in case No. A40-172099/09-20-1318.

OUR ADVANTAGES

COMFORTABLE

Your personal account allows you to carry out the vast majority of procedures electronically, from uploading documents and information to monitoring the progress of customs clearance. The declaration for goods is submitted to the customs authority through a secure channel using Electronic Declaration technology (ED-2).

FAST

Thanks to our long-term experience of working with the customs service, we have created a clear procedure for interaction, allowing us to complete the customs clearance procedure quickly enough.

PROFITABLE

Our clients receive a Declaration of Goods (DT) and a set of documents for crossing the border at a single price specified in the Agreement, without additional costs.

If documents are collected after 180 days

If documents are collected after the specified period, then during the period during which the documents are collected, the following actions must be performed:

- Previously accrued VAT at a rate of 10 or 18 percent is accepted for deduction (clause 10 of Article 171 of the Tax Code of the Russian Federation).

- The purchase ledger records the invoice generated when the 0 percent rate is not confirmed and is recorded in the sales ledger.

- VAT previously accepted for deduction is restored.

The declaration is completed as follows:

- line 010 of section 4 - “Operation code”;

- line 020 of section 4 - the amount of proceeds from export sales;

- line 030 of section 4 - the amount of deductions for the confirmed export transaction;

- line 040 of section 4 - the amount of tax accrued on export shipment due to the lack of documents;

- line 050 of section 4 - the amount of deduction for goods involved in export shipment.

If documents confirming the rate of 0 have been collected, but there is no right to deduction, then after such a right arises, it is necessary to fill out section 5.

Certificate of foreign exchange transactions

This certificate is issued:

— when crediting foreign currency to the transit currency account of an industrial enterprise. The enterprise must submit it to the authorized bank within 15 working days after the date of crediting the funds specified in the notification of the authorized bank about their crediting to the transit currency account (clause 2.3 of Bank of Russia Instruction No. 138-I);

— when crediting Russian currency to a current account in Russian currency under a contract for which a transaction passport has been issued. The deadline for submitting a certificate to the authorized bank is 15 business days after the date of crediting of funds indicated in an extract from the resident’s current account or another document transmitted by the authorized bank to the resident, which contains information about the crediting of Russian currency received from a non-resident to this resident’s current account ( clause 3.8 of Bank of Russia Instruction No. 138-I).

Along with the certificate of currency transactions, documents related to the conduct of currency transactions specified in the certificate of currency transactions are submitted to the authorized bank. Let us add: an agreement between an authorized bank and a resident may stipulate that if Russian currency is credited to a current account in Russian currency, a certificate of foreign exchange transactions is filled out by the bank independently. In this case, the resident only needs to submit to the bank within 15 days documents related to currency transactions (clause 3.9 of Bank of Russia Instruction No. 138-I).

Adoption of “input” VAT on goods exported to Kazakhstan

In order to understand how much tax in the event of an export shipment needs to be restored and deducted, it is necessary to maintain separate records. Moreover, the Tax Code of the Russian Federation does not indicate its specific methodology: the taxpayer must independently determine for himself the methods of maintaining such accounting and consolidate them in the accounting policy. This is provided for in paragraph 10 of Art. 165 of the Tax Code of the Russian Federation, clarifications of the Ministry of Finance (for example, letter dated 07/06/2012 No. 03-07-08/172) and court decisions (for example, resolution of the Federal Antimonopoly Service of the North-Western District dated 06/29/2012 No. A56-27834/2011).

Services and works: differences, examples

Keep records of exports and imports using the simplified tax system in the Kontur.Accounting web service. Currency accounting and work instructions, taxes, automatic salary calculation and reporting in one service Get free access for 14 days

The agreement provides language for services and works.

Services are activities without a tangible result that is consumed in the process of the activity itself. Services also include the transfer of patents, trademarks, licenses, and copyrights. Examples of services: rental of premises, machinery and equipment, consulting, accounting and legal services.

Work is an activity with a tangible result that can be used to meet the needs of an organization or individuals. Examples of work: installation, construction, software development.

VAT refund by tax authorities

After the taxpayer submits a VAT return with a package of documents confirming the right to apply the 0 percent rate, the tax authorities begin a desk audit of the validity of applying this rate (Article 88 of the Tax Code of the Russian Federation).

If the tax office makes a positive decision, the taxpayer reserves the right to apply a 0 percent rate. And in case of refusal, you will need to submit a “clarification” and pay an additional amount of unpaid VAT to the budget for this shipment, as well as penalties and fines for late payment of tax.

See also the material “How is VAT refunded: return (refund) scheme?”

Contractual insurance against unscrupulous buyers

In order to somehow protect yourself from careless buyers from the EAEU, provide special conditions in your contracts with them. For example:

- The buyer's obligation to pay a fine (compensating for the seller's losses from paying VAT and penalties on it) if the import application is not received from him within the agreed period (for example, no later than 160 days from the date of shipment).

- An indication of the judicial authority (Russian or Belarusian) in which the dispute will be heard if the buyer refuses to pay penalties. It is no secret that it is better to protect your interests on your own territory with the participation of competent lawyers.

The “penalty” element of the contract may look like this:

conclusions

By shipping to the EAEU countries, in particular to Kazakhstan, Russian organizations receive great economic benefits due to the fact that the exporting taxpayer, in accordance with current legislation, does not charge VAT on this sale.

However, tax authorities are very suspicious of such shipments and thoroughly study the documents justifying the application of the rate. But still, within the EAEU, export shipments raise fewer questions from regulatory authorities than when exporting to other states, and the exporter only needs to provide correctly completed:

- Contract;

- application for the import of goods and payment of indirect taxes;

- shipping documents.

If all requirements are met, the desk audit will pass with a positive result.

If for some reason the taxpayer suddenly did not meet the deadline for collecting supporting documents and did not submit them to the Federal Tax Service, the algorithm of actions is as follows:

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Difficulties that may arise for exporters:

Despite the simplified procedure for processing export-import transactions in the EAEU states, there are many peculiarities. For example:

- In the absence of confirmation of the 0% rate of Value Added Tax, within a certain period of time, the exporter may be additionally charged Tax at the internal rate on the amount of goods released for export;

- Tax inspection - you need to prepare for a serious desk audit of the exporting company and its counterparties;

- Some products are on control lists and require permits or licenses from various government agencies to export them. Only an experienced customs representative can determine whether a product belongs to the control lists;

Our company guarantees the fulfillment of its promises regarding the organization of foreign trade activities. With our help, customs clearance for the export of your products to Belarus from Russia will be easy and transparent, and will also significantly expand the number of potential partners in both countries.

Service consultation

Place of sale of services

Keep records of exports and imports using the simplified tax system in the Kontur.Accounting web service. Currency accounting and work instructions, taxes, automatic salary calculation and reporting in one service Get free access for 14 days

Then the question arises: how to determine the place of sale of services? If a Russian company provides services to a Belarusian company or entrepreneur, then Belarus is recognized as the place of provision of services in the following cases:

- services or work related to real estate on the territory of Belarus (rent);

- services or work related to transport or movable property on the territory of Belarus (maintenance, repair of equipment or vehicles);

- services in the field of education, culture and art, tourism, sports and recreation were provided on the territory of Belarus (training of employees of a Belarusian company in Minsk);

- The Belarusian taxpayer works on the territory of Belarus and purchases any advice from the Russian partner, receives the assistance of a lawyer, auditor, accountant, engineer, designer, advertiser, marketer, orders scientific research, as well as recruitment services if they work at the place of business of the Belarusian buyer.

In all these cases, services are subject to “Belarusian” VAT.

Important! If a Russian company provides several types of services, and some services are auxiliary to others, then the place of provision of auxiliary services is equal to the place of provision of main services. For example, a Russian company leases a building in Belarus and hires staff to work in this building.