Refund of customs duties is possible in two main cases. According to the application, the company can return the funds stored in its single personal account in the FCS system if it does not plan to use them for settlements with customs. The second case is the return of overpaid duties, taxes, and fees. It is carried out if, as a result of an adjustment or after resolving a dispute, the amount has decreased, resulting in an overpayment. The overpayment can be returned pre-trial and in court.

Pre-trial procedure for the return of customs duties

The pre-trial return procedure is determined by the Federal Law “On Customs Regulation in the Russian Federation”.

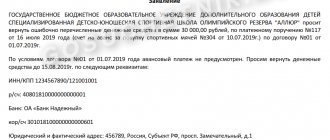

Art. 122. Describes the procedure for returning advance payments. Funds can be returned within three years upon application, to which is attached a payment document confirming their enrollment, copies of documents of the legal entity.

Art. 147. Describes the procedure for returning overpaid payments. In pre-trial procedure, it is carried out upon application after the provision of documents that confirm the fact of payment, the accrual of fees, duties, taxes, the fact of their excessive collection, as well as copies of documents of the legal entity.

Art. 148. Establishes the procedure for the return of paid taxes and duties in cases where customs refuses to release goods, a declaration is withdrawn, the customs procedure is changed, and in a number of other cases.

Art. 149. Determines the procedure for returning unused cash deposit (unused balance of funds on the company’s unified personal account). Performed within three years upon written application, provided that the applicant can provide payment documents confirming the replenishment of the account.

Cases of pre-trial refund of customs duties can be divided into two large groups.

Overpaid customs duties. Their return is carried out in several stages. Even after detecting an overpayment and notifying the importer about it, customs does not return the funds, since the payment continues to be considered customs and the funds do not belong to the payer. You need to proceed as follows:

- establish the fact of overpayment by receiving notification of this from customs or collecting documents confirming the accrual of “extra” amounts;

- fill out an application in the prescribed form;

- prepare documents confirming the execution of payments to customs and the fact of overpayment, hand them over to customs officers or send them by registered mail with notification;

- within a month, customs must submit a decision on the return (possible or not);

- in case of unlawful refusal, funds are returned in court.

Advance payments. These are funds transferred towards future payments. They remain the property of the payer, are not formally considered customs payments and are returned according to a simplified procedure. Within three years from the date of crediting funds to a single personal account, companies submit an application for a refund. Customs is obliged to review it within 1 month and return the funds, transferring them to the details specified by the applicant. Payment documents confirming the crediting of advance funds are attached to the application.

In pre-trial procedure, customs does not return funds if:

- the amount is less than 150 rubles;

- the payment was an advance payment, and more than three years have passed since enrollment;

- the applicant is in arrears on other payments. In this case, the “surplus” will be used to pay for it.

If the payer receives a refusal, the next stage of pre-trial settlement is to contact a higher customs authority. So, if a dispute arose with regional customs, the claim can be sent to the Federal Customs Service. This stage is not mandatory, and it is not always worth contacting the FCS: there is a risk that this will only strengthen the customs’ argument.

If the amount of customs payments during customs clearance has increased due to the fact that the inspector changed the customs value or the HS code, the importer has three months to challenge the adjustment (including through the court). After this period, funds can only be returned using a longer and more complex standard return procedure (up to three years). Employees of the customs representative "CTT Logistics" recommend starting processing the return immediately after detecting an overpayment. Our company also offers transportation services, delivery of groupage cargo, warehouse logistics and outsourcing of foreign economic activity.

How to return overpaid funds from customs?

An important issue that almost every participant in foreign economic activity faces is the return of overpaid customs duties that remained on the accounts after customs clearance, or if you accidentally paid more. Let me remind you that funds are stored for no more than 3 years from the date of their last use, and then are safely written off in favor of the foreign trade participant (no joke, of course) ... in favor of the state.

Getting your money back is not so quick, but it is quite possible. So here's a quick guide:

Step 1 . First, you need to decide how much you are returning and from where. To do this, the easiest way is to request the remaining funds in customs accounts from your broker. Or, if you have your own digital signature, request balances on the website edata.customs.ru in your personal account. Of course, you need to understand which customs office you are going to return the money from.

After you receive the balances, you will already know how much money is left on which payment card.

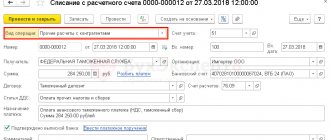

Step 2 . From the bank-client system, print out those payment orders whose balances you decide to return. Payments are certified by the General Director: the phrase “the copy is correct”, position, signature, transcript, stamp.

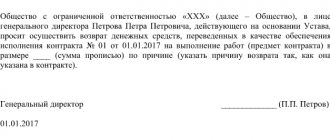

Step 3 . We fill out an application for a refund. Moreover, for duties there is a separate application, and for advance payments – one. The application is signed by the general director in the presence of a notary. In other words, the notary certifies the authenticity of the director’s signature on the application. The application form is clearly regulated by Order of the Federal Customs Service of Russia No. 2520 dated December 22, 2010.

Step 4 . We are preparing a set of constituent documents. Namely:

-a notarized copy of the tax registration certificate (TIN);

-a notarized copy of the certificate of state registration of a legal entity (OGRN);

-the original of the order (or decision of the founders) on the appointment of the State Duma;

-if the decision does not indicate the term of office of the State Duma, then we additionally make a notarized copy of the Charter.

When applying for a refund to this customs office again, it is not necessary to provide a set of constituent documents.

Step 5 . We take the application, payment slips, and constituent documents to the required customs office. We get the number of the incoming document. Or put it in the correspondence box at the entrance to customs, and the next day call the office and find out the incoming number. You can also send it by registered mail with an inventory and notification.

St. Petersburg customs:

199034, St. Petersburg, VO, 9th Line, 10

Baltic customs:

198184, St. Petersburg, Kanonersky Island, 32A

Pulkovo customs:

196210, St. Petersburg, Startovaya st., 7a

Step 6 . We are waiting for the money to arrive in our account, while simultaneously planning where to spend it.

If something was done wrong, the customs office will send you a reasoned refusal. Each customs office may have its own “local cockroach” who doesn’t like something in the documents.

For a small share I can help with returns at St. Petersburg, Baltic and Pulkovo customs.

If you did not find the answer to your question in this material, then write to [email protected] and I will soon update the article.

You may be interested in the following: 1) We do customs clearance ourselves 2) We calculate customs payments 3) How to calculate the customs value? 4) Classifiers and other useful information on the content and completion of the declaration

If you find an error, please select a piece of text and press Ctrl+Enter.

Should authorities inform the payer about an overpayment?

The occurrence of an overpayment is a fairly common phenomenon, and many payers are wondering how to determine the fact of its existence. This can be noticed either by the payer himself (whether he is an individual or a legal entity) or by the customs authority. However, should the latter notify the payer that he has overpaid?

Federal Law No. 311 clearly regulates this component of the relationship. The customs authority that discovered an overpayment is obliged to inform the payers who overpaid. The law even stipulates the reporting period - it cannot be more than a month from the moment the fact of overpayment is discovered.

The decision to return payments can be made in court - in this case, the authority is obliged to adjust the payments within ten days and send the corrected information to the payer within no more than one day.

Return of goods by the buyer

Income tax

The letter of the Federal Tax Service of Russia for Moscow dated September 21, 2012 N 16-15/ [email protected] states that in accordance with clause 2 of Art. 475 of the Civil Code of the Russian Federation, the buyer to whom goods of inadequate quality have been sold has the right to refuse to fulfill the supply contract and demand the return of the amount of money paid for the goods. The operation of returning defective products to the buyer can be reflected in tax accounting:

- recalculating the income tax base for the period in which goods were sold with significant violations of the requirements for its quality.

In accordance with paragraph 1 of Art.

81 of the Tax Code of the Russian Federation, if a taxpayer discovers in the tax return submitted by him that information is not reflected or is incompletely reflected, as well as errors leading to an underestimation of the amount of tax payable, the taxpayer is obliged to make the necessary additions and changes to the tax return. If errors (distortions) are detected in the calculation of the tax base relating to previous tax (reporting) periods in the current (reporting) tax period, recalculation of tax liabilities is carried out in the period of the error (clause 1 of Article 54 of the Tax Code of the Russian Federation).

Taking into account the above, errors (distortions) in the calculation of the tax base relating to previous tax (reporting) periods, identified in the current (reporting) tax period, lead to the need to recalculate the tax base for previous tax (reporting) periods and submit an updated declaration to the tax authorities on corporate income tax.

VAT

If the return of goods is carried out by an organization, then for returned goods previously registered by the buyer, the corresponding invoice is issued to the seller of these goods by the buyer, who is a taxpayer of value added tax. Such an invoice received by the seller of goods from the buyer is a document that serves as the basis for deducting value added tax from the seller in the manner prescribed by Art. 172 of the Tax Code of the Russian Federation.

As for the return of goods not accepted by the specified buyer for registration, in these cases the Rules do not provide for the issuance of invoices by buyers (Letter of the Ministry of Finance of Russia dated 04/07/2015 N 03-07-09/19392).

The letter of the Federal Tax Service of Russia dated May 14, 2013 N ED-4-3/ [email protected] states that there are exceptions to the general procedure for applying deductions of value added tax amounts when returning goods by persons who are not taxpayers of value added tax, the provisions of Chapter. 21 of the Tax Code of the Russian Federation is not provided for; when such persons return the entire batch of shipped goods, both accepted and not accepted for registration, one should be guided by clause 5 of Art. 171 Tax Code of the Russian Federation. In this case, the invoice registered by the seller in the sales book when shipping goods is registered by him in the purchase book as the right to tax deductions arises, taking into account the provisions of clause 4 of Art. 172 of the Tax Code of the Russian Federation.

Thus, in tax accounting for income tax purposes, the return by the buyer of low-quality goods is taken into account by the supplier as correction of an error. Income is reduced by the proceeds from the sale of low-quality goods, and expenses are reduced by its cost. To adjust the sales of past periods, it is necessary to submit an updated declaration.

When returning goods, the VAT payer buyer must issue an invoice to the supplier. The invoice received from the buyer is recorded in the purchase ledger.

If the goods are returned by a VAT non-payer, then when the goods are returned, the invoice issued upon shipment is recorded in the purchase ledger.