Who should apply for the right to reduce personal income tax?

The direct calculation and transfer of personal income tax to the tax service is usually not carried out by the foreigner himself, but by his employer, who is the direct tax agent. He also writes an application to reduce the amount of tax paid due to the advance payments made by the foreigner as payment for the patent. In this case, not all payments are taken into account, but only those that were made in the current calendar year.

It is important to recall here that a patent can be paid either at a time or in installments, since it is issued for a period of 1 to 12 months. All receipts and checks confirming payments made must be kept.

How to receive a notification

In order to receive a notification from the tax office about the right to reduce personal income tax through advance payments, the employer of a foreign citizen needs to contact the local tax service with a corresponding request, which is also drawn up in the form of an application in the approved form.

Within 10 days after this application is received by tax specialists, they are required to send the required notification.

Moreover, before sending it, tax officials must make sure that the FMS has proof of the conclusion of an employment contract between a foreigner and a Russian enterprise, and also that a notification has not yet been sent to anyone in relation to this person.

Who should buy a work patent?

Citizens of other states arriving to work in the Russian Federation must acquire a special patent .

At the same time, the patent is not available to all foreigners, but only to immigrants from those countries with which Russia has a visa-free regime.

This document replaced the previously mandatory work permit for everyone in our country. During the validity period of the patent, its owners must make strictly fixed advance payments to the Federal Tax Service of the Russian Federation .

Those foreign citizens who came to work in Russia from visa countries are still required to obtain a work permit.

It should be noted that a patent must be acquired regardless of whether the foreigner is an entrepreneur and works for himself personally or is an employee. The organizational and legal status of his employer also does not matter: either an individual entrepreneur or a legal entity can act as such.

Neither commercial nor state enterprises have the right to hire foreign citizens without special permission or a patent.

Otherwise, they face serious administrative punishment in the form of a fairly large fine.

How to fill out an application and submit it to the tax office

The application is written strictly according to the model developed and approved by the Federal Tax Service.

The form includes information about the employer and foreign worker, as well as the tax office to which the application is submitted, but the amount of personal income tax is not indicated in it.

Once the application has been properly completed, it must be submitted to the tax office. You can do this in any convenient way:

- coming to the tax office in person,

- coming with a representative holding a power of attorney,

- through electronic means (provided that the employer has a digital signature registered in accordance with all the rules),

- by sending via Russian Post by registered mail with acknowledgment of receipt.

How to fill

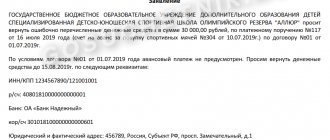

If the taxpayer decides to redistribute his own funds, then he needs to write a corresponding appeal to the tax service. The application form for offset of overpayment of taxes is presented in the order of the Federal Tax Service dated February 14, 2017 No. ММВ-7-8/ [email protected] , Appendix No. 9. You can download it at the bottom of the page.

Let's say PPT.ru LLC filed a VAT return, but when paying it made a mistake, paying 25,000 rubles more. The organization contacts the interdistrict Federal Tax Service, writes a letter asking for the overpayment to be offset against another account - for upcoming income tax payments to the federal budget. Let's take a step-by-step look at how such a document is filled out.

Step 1. Traditionally, the TIN and KPP should be indicated at the very top. The individual entrepreneur’s identification number consists of 12 digits, and there should be no free cells left. Organizations enter only 10 numbers in the appropriate fields, and put dashes in the remaining two. When filling out the line intended for the checkpoint, applicants act in the same way: if there are numbers, enter them, if not, put dashes.

Step 2. Enter the request number. Here they put down the number of times in the current year they applied for the test. Don’t forget about dashes if the number of numbers to be entered is less than the number of cells.

Step 3. Enter the code of the tax authority where the application is sent. This is an inspection of the Federal Tax Service at the place of registration of the individual entrepreneur or organization. In a consolidated group of taxpayers, the responsible participant in this group requests a credit for the overpayment of income tax.

Step 4. We write down the full name of the applicant organization - for example, limited liability company "PPT.ru". Fill in the remaining cells with dashes. None of them should be left empty. When filling out this field by an individual entrepreneur, he must indicate his last name, first name and patronymic, if any. In addition, the status of the applicant, as whom he is applying, should be indicated in accordance with the instructions:

- taxpayer - code “1”;

- fee payer - code “2”;

- payer of insurance premiums - code “3”;

- tax agent - code “4”.

Step 5. We indicate the article of the Tax Code of the Russian Federation on the basis of which the offset is made. It depends on which payment was overpaid. The Federal Tax Service left 5 cells to indicate a specific article. If some of them are not needed, then dashes must be added. Here are the options for filling out this field:

- Article 78 of the Tax Code of the Russian Federation - for offset or return of overpaid amounts of fees, insurance premiums, penalties, fines;

- Article 79 of the Tax Code of the Russian Federation - for the return of excessively collected amounts;

- Article 176 of the Tax Code of the Russian Federation - for VAT refund;

- Article 203 of the Tax Code of the Russian Federation - for the return of overpayments of excise tax;

- Article 333.40 of the Tax Code of the Russian Federation - for the return or offset of state duty.

Step 6. We write down what the overpayment was for - taxes, fees, insurance premiums, penalties, fines.

Step 7. Enter the OKTMO code. If you don’t know it or have forgotten it, then call the Federal Tax Service at the place of registration or on the website nalog.ru find out the required code by the name of the municipality.

Step 8. If you apply for a refund of state fees, fill out the fields “Payment date” and “Payment number”, where the abbreviation is payment order. Since in our example we are talking about offsetting overpaid tax, these two fields are filled in only with dashes.

Step 9. We accurately enter the BCC to pay the appropriate payment, using Order of the Ministry of Finance of Russia No. 85n dated 06/06/2019. Find out the code using the Federal Tax Service website or look at it on a previously completed payment order.

Step 10. We clarify to which Federal Tax Service the excess funds were transferred.

Step 11. On the first sheet, it remains to fill in how many sheets the application is submitted on and how many sheets of supporting documents are attached, and indicate information about the applicant himself. We recommend leaving these two small sections for later.

Let's continue filling out the sample application for offset of tax overpayment in 2021 on the second sheet. In the very first field where you need to indicate your last name, first name and patronymic, put dashes. Below we indicate what needs to be done with the overpayment - pay off the debt or leave funds for upcoming payments.

Step 12. We write down the specific amount that the applicant wants to offset. It is indicated in numbers, without text decoding.

Step 13. Write down the OKTMO code again. Usually it is duplicated.

Step 14. We specify the KBK for the transfer of funds, into which the excess amount will go. Ours is different from the previous KBK, since the taxes are different. If the overpayment goes towards future payments for the same fee, then the BCCs are the same.

Step 15. Enter the code of the Federal Tax Service, which accepts receipts. As can be seen from the sample letter to the tax office about a credit from one KBK to another, it is duplicated.

Step 16. Since there are no more overpayments, the following lines contain only spaces.

Organizations and individual entrepreneurs do not fill out the third sheet. It is intended for individuals who are not registered as individual entrepreneurs and who have not indicated their TIN.

Step 17. Return to the first sheet and enter the number of pages and attachments. Applicants indicate the relevant data in the provided fields.

Step 18. The last part of the application should not cause problems when filling out. Here you need to clarify who is submitting the appeal and when, and indicate a contact phone number. The right side remains blank: it is intended for marks from Federal Tax Service inspectors.

How to get your money back

If an entrepreneur (company) decides to return the overpayment amount, then he needs to use another form from the Federal Tax Service order No. ММВ-7-8 / [email protected] dated 02/14/2017, proposed in Appendix No. 8, to return the excess amount.

The rules for filling out this document are basically the same. We will not consider them in detail, but will give an example of a completed document. Let’s say PPT.ru LLC overpaid VAT by 10,000 rubles and now wants to return it. This is what an appeal from the head of an LLC looks like.