Pay for customs work

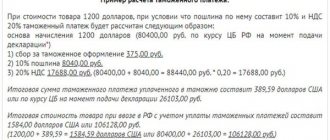

Customs duties are actually payment for the work of customs and inspectors, the amount of which is determined by the Government of the Russian Federation. The rate of customs clearance fee depends on the declared value of the cargo. When importing, the amount varies from 775 rubles. when the cost of the cargo is less than 200 thousand rubles. up to 30,000 rub. when the cost of cargo is over 10 million rubles.

In addition, you will have to pay a fee for terminal processing and storage of cargo in a customs temporary storage warehouse (TSW) . The tariffs at the terminals are different; the fee is charged according to the official price list and depends on the type and quantity of cargo and on the transport on which it arrived.

1. Concept and types of customs duties.

2. The emergence and termination of obligations to pay customs duties. The procedure for calculating and paying customs duties. General rules of forced collection.

3. Ensuring the fulfillment of the tax obligation to pay customs duties.

4. Customs benefits and preferences.

1. According to the Labor Code of the Republic of Belarus, the following types of customs payments can be distinguished:

1)import or export customs duties

2) special, anti-dumping and countervailing duties

3) VAT, which is charged when importing goods into the customs territory

4) excise taxes that are levied when importing goods into the customs territory on strictly defined goods

5)customs fees

Customs duty is a mandatory payment to the republican budget, which is levied by the customs authorities of the Republic of Belarus in connection with the movement of goods and vehicles across the customs border.

The main part of customs duties in almost all countries of the world, as in the Republic of Belarus, is precisely import customs duties (import duties). Import duties are intended for:

1) to protect national producers from the adverse effects of foreign competition on certain goods

2) for the effective structuring of imported goods in order to support the economy, etc.

Export customs duties are established on goods produced on the territory of the Republic of Belarus, and in some cases, outside its borders. Export duties are intended for:

1) restrictions on the export outside the country of those goods that are necessary for the national economy

2) curbing the export of raw materials and primary processed products

As a rule, import duties and export duties are intended to replenish the revenue side of the republican budget.

The rates of import and export duties are approved by presidential decrees. Presidential Decree No. 699; 12/31/1997 No. 700; 06/18/2009 No. 320.

Special customs duties are applied as a protective measure if goods are imported into the customs territory of the Republic of Belarus under conditions and in such quantities that may cause damage to competing domestic goods.

Anti-dumping customs duties are applied in cases of import of goods into the customs territory of the Republic of Belarus at a lower price than their normal value in the country of export.

Countervailing duties are applied in cases of import into the customs territory of the Republic of Belarus of those goods in the production of which subsidies were directly or indirectly used and if such import may cause material damage to domestic goods or interfere with the organization or expansion of production of such goods.

VAT is one of the main taxes in the Republic of Belarus, which is a form of withdrawal to the budget of a certain part of the added value created at all stages of production. The object of VAT is the import of goods into the customs territory of the Republic of Belarus and other circumstances with which the legislation of the Republic of Belarus relates the emergence of a tax obligation to pay VAT.

Excise tax is an indirect tax that is included in the price of individual goods (excise goods). Excise tax can be levied on both domestic and foreign goods.

Customs duties represent a fee for carrying out legally significant actions on the part of customs and other authorities. The customs authorities of the Republic of Belarus may charge the following customs duties:

1) for customs clearance

2) for customs escort of goods

3) for issuing a qualification certificate for a customs clearance specialist

4) for the adoption by customs authorities of a preliminary decision

5) for issuing stamps, issuing signs to designate goods, etc.

6) for inclusion in the register of banks and non-bank financial institutions recognized by customs authorities as guarantors of payment of customs duties, etc.

The types of customs duties, as well as the procedure for their collection and rates are provided for by the Presidential Decree of January 24, 2007 “On customs duties.”

According to the legislation, the following types of customs duty rates are distinguished:

1) ad valorem rate - applied when customs duty is calculated as a percentage of the customs value of goods

2) specific rate - applied when customs duty is calculated in a certain amount per unit of goods

3) combined rate - consists of 2 previous types of rates and is calculated both from the customs value of the goods and from their volume in physical terms. The greater of them or both may be paid.

Customs duty

Customs duty is the main payment that must be made by a foreign trade participant. In the case of import, an import duty is assigned, in the case of export, an export duty.

Import duty

The duty paid when importing goods is determined based on the customs value and rate, which depends on the HS code. The rate for finished goods is higher, and for raw materials – lower.

In this way, the state stimulates production within the country, as this creates jobs and added value, and therefore contributes to economic development. Depending on the country of origin of the cargo, you can expect to receive benefits.

For example, the import duty coefficient for the same product of a certain category from Germany and Azerbaijan will be different, since Azerbaijan is one of the CIS countries with which there are agreements on preferential treatment for the import of goods. An experienced broker will always advise you on such nuances and help you save money.

The amount of import duty is calculated in rubles at the Central Bank exchange rate on the day the declaration is submitted.

Export duty

Export duty is calculated on the same principle as import duty: the customs value (or unit of goods) is multiplied by the rate established by the Government of the Russian Federation.

The state, on the one hand, is interested in stimulating exports, so there are no export taxes on most goods, or they are temporary and related to a specific economic situation. On the other hand, the state needs to preserve natural resources within the country in order to process them in its own production facilities, therefore high duty rates are set for oil, timber and other raw materials.

Value added tax

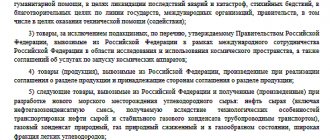

VAT is paid only when goods are imported. Some goods, according to Article 150 of the Tax Code of the Russian Federation, are classified as preferential, which reduces the tax to 0% or 10%; in other cases, VAT is 20%. Both organizations and individual entrepreneurs will have to pay, and even those who work under the simplified tax system.

Excise taxes

Excise tax is imposed on imported goods, the demand for which does not change due to a decrease or increase in their cost - alcohol, tobacco, fuel, etc. The rates are determined by the Tax Code of the Russian Federation, Part 2 of Article 193.

When importing alcoholic products, you will have to not only pay excise taxes, but also label each bottle with a brand, having previously entered the data into the Unified State Automated Information System. Duties for excise stamps are also stipulated by the Tax Code of the Russian Federation. Moreover, it will be necessary to obtain a separate license for foreign trade operations with alcohol.

To reduce costs, you can use the service of a technical importer, who will take care of the entire procedure - from concluding a contract to delivering alcohol to your warehouse in the Russian Federation.

Eurasian Economic Commission

Article 85. General conditions for ensuring payment of customs duties and taxes1. Fulfillment of the obligation to pay customs duties and taxes is ensured in the following cases:

1) transportation of goods in accordance with the customs procedure of customs transit;

2) changes in the deadlines for payment of customs duties and taxes, if this is provided for by international treaties and (or) the legislation of the member states of the Customs Union;

3) placing goods under the customs procedure for processing goods outside the customs territory;

4) when releasing goods in accordance with Article 198 of this Code;

5) other cases provided for by this Code, international treaties and (or) the legislation of the member states of the Customs Union.

2. Security for payment of customs duties and taxes is not provided:

1) if the amount of customs duties, taxes and interest payable does not exceed an amount equivalent to 500 (five hundred) euros at the exchange rate established in accordance with the legislation of the member state of the Customs Union in which customs duties and taxes are payable, effective on the day of registration customs declaration, and if a customs declaration is not submitted - on the day the decision is made not to provide security;

2) in other cases provided for by this Code and (or) the legislation of the member states of the Customs Union.

3. Security for payment of customs duties and taxes is carried out by the payer, and when transporting goods in accordance with the customs procedure of customs transit - also by another person on behalf of the payer, if this person has the right to own, use and (or) dispose of the goods in respect of which payment is secured customs duties, taxes, unless otherwise established by this Code.

4. Security for the payment of customs duties and taxes is provided to the customs authority releasing the goods, except for the cases specified in paragraph 5 of this article, part two of paragraph 1 of Article 87 and Chapter 3 of this Code.

5. When transporting goods in accordance with the customs procedure of customs transit, security for the payment of customs duties and taxes may be provided to the customs authority of departure or the customs authority of destination, unless another customs authority to which general security may be provided is not determined by the legislation of a member state of the Customs Union.

(paragraph as amended by the Protocol dated April 16, 2010)

Customs authorities mutually recognize a document issued by the customs authority that accepted the security for payment of customs duties and taxes, confirming the acceptance of such security. The procedure for providing and the form of such a document, as well as its validity period, are determined by the international treaty of the member states of the Customs Union.

6. Refund (offset) of security for payment of customs duties and taxes is carried out provided that the customs authority is satisfied that the secured obligations have been fulfilled, or in the event that the secured obligation has not arisen.

Article 86. Methods of ensuring payment of customs duties and taxes

1. Payment of customs duties and taxes is ensured in the following ways:

in cash (money);

bank guarantee;

surety;

pledge of property.

The legislation of the member states of the Customs Union may provide for other methods of ensuring the payment of customs duties and taxes.

2. The payer has the right to choose any of the methods of ensuring payment of customs duties and taxes specified in paragraph 1 of this article.

3. The payer’s fulfillment of the obligation to pay customs duties and taxes must be ensured continuously throughout the entire period of validity of the obligation. The validity period of the provided security for the payment of customs duties and taxes must be sufficient for the timely submission by the customs authority of a requirement for the fulfillment of the obligation assumed before this customs authority.

4. The procedure for applying methods of securing the payment of customs duties and taxes, as well as the currency in which the amount of such security is deposited, are determined by the legislation of the member state of the Customs Union to whose customs authority the security is provided.

Article 87. General security for payment of customs duties and taxes

1. If the same person on the territory of one of the member states of the Customs Union carries out several customs operations within a certain period of time, the customs authority of such a member state of the Customs Union may be provided with security for the payment of customs duties and taxes for the performance of all such operations (general security ).

Customs authorities accept general security for the payment of customs duties and taxes to carry out customs operations on the territory of one of the member states of the Customs Union in several customs authorities of this state, if such security can be used by any of these customs authorities in the event of a violation of the obligations secured by this general security .

2. The procedure for applying general security is determined by the legislation of the member states of the Customs Union.

Article 88. Determination of the amount of security for payment of customs duties and taxes

1. The amount of security for the payment of customs duties and taxes is determined based on the amounts of customs duties and taxes payable when goods are placed under customs procedures for release for domestic consumption or export without taking into account tariff preferences and benefits for the payment of customs duties and taxes in a member state of the Customs union, the customs authority of which releases goods, except for the cases established by part two of this paragraph and Chapter 3 of this Code.

When placing goods under the customs procedure of customs transit, the amount of security for the payment of customs duties and taxes is determined based on the amounts of customs duties and taxes payable when placing goods under the customs procedure for release for domestic consumption or export, without taking into account tariff preferences and benefits for the payment of customs duties, taxes in a member state of the Customs Union, whose customs authority releases goods, but not less than the amount of customs duties and taxes that would be payable in other member states of the Customs Union, as if the goods were placed on the territories of these member states of the Customs Union under customs procedures for release for domestic consumption or export without taking into account tariff preferences and benefits for the payment of customs duties and taxes. In this case, to determine the amount of security for the payment of customs duties and taxes, the foreign exchange rate established in accordance with the legislation of the member state of the Customs Union, whose customs authority releases goods in accordance with the customs procedure of customs transit, is used.

The legislation of the member states of the Customs Union may provide for the inclusion of customs duties and interest in the security amount.

2. If, when establishing the amount of security for payment of customs duties and taxes, it is impossible to accurately determine the amount of customs duties and taxes payable due to failure to provide the customs authority with accurate information about the nature of the goods, their name, quantity, country of origin and customs value, the amount of security is determined based on the highest rates of customs duties, taxes, the cost of goods and (or) their physical characteristics in kind (quantity, weight, volume or other characteristics), which can be determined on the basis of available information, the procedure for using which is determined by the legislation of the member states of the Customs Union .

3. When releasing goods in accordance with Articles 198 and 199 of this Code, the amount of security for payment of customs duties and taxes is determined as the amount of customs duties and taxes that may be additionally assessed as a result of verification of information that affects the amount of customs duties and taxes payable taking into account the requirements established by paragraphs 1 and 2 of this article.

4. In relation to certain types of goods, fixed amounts of security for the payment of customs duties and taxes may be established, taking into account the requirements established by paragraphs 1 and 2 of this article, if this is provided for by the legislation of the member states of the Customs Union.

5. When releasing goods in accordance with paragraph 2 of Article 69 of this Code, the amount of security for payment of customs duties and taxes is determined as the amount of customs duties and taxes that may be additionally assessed as a result of an additional inspection taking into account the provisions of paragraph 2 of this article.

What is customs security?

Verifying the documentary evidence for the value of the cargo takes a long time. Its period can last up to 30 days.

Often, during an inspection, customs services make a decision to increase the cost of imported valuables. As a result, if there is a discrepancy in the calculations for customs payments, the release of the declarant’s cargo may be suspended. The consequences can be unfavorable for entrepreneurs, since a delay in a shipment, especially when it comes to perishable goods, is fraught with losses.

Customs support covers costs such as:

- customs duties;

- tax payments;

- payment when adjusting the customs value of the vehicle.

If it is impossible to correctly calculate the amount of upcoming customs payments, exporters cover the upcoming costs through financial security. The following valuables can be provided as collateral:

- cash;

- property of a foreign trade participant;

- bank guarantees;

- guarantee of third parties.

Declarants have the right to return overpaid amounts. But the return of customs duties is not an easy procedure, which is usually accompanied by bureaucratic delays.

Legal nature of customs payments

Home — Articles

In the most general form, customs payments are funds collected by customs authorities from entities participating in the process of moving goods and vehicles across the customs border of the Russian Federation. In this case, it is necessary to take into account some factors.

Firstly, the legal basis for customs payments is the Customs Code of the Russian Federation, in Art. 318 of which an exhaustive list of them is established. As accompanying legal acts, certain issues of the institution under study are regulated by the Tax Code of the Russian Federation, the Law of the Russian Federation “On Customs Tariffs,” as well as the legislation of the Russian Federation on measures to protect the economic interests of the Russian Federation in foreign trade.

Secondly, customs payments are the federal budget’s own revenues. They are assigned to him on a permanent basis and in full (Article 51 of the Budget Code of the Russian Federation). Absolutely all customs payments are fiscal revenues of the federal budget and cannot be spent on other purposes.

Thirdly, customs duties are levied only in case of movement of goods across the customs border of the Russian Federation. In most cases, they serve as a condition for such movement. This feature expresses their transboundary nature.

Fourthly, the customs authorities are vested with the right to collect customs duties. The exception is cases of movement of goods in international mail, when, according to Part 4 of Art. 295 of the Labor Code of the Russian Federation, the subject pays the due amount to the postal service organization, which subsequently transfers it to the account of the customs authority.

Fifthly, payment of customs duties is ensured by the coercive force of the state. For non-payment, violation of payment deadlines, evasion of customs duties, the guilty person is brought to criminal, administrative, financial and legal responsibility.

It should be noted that the term “evasion” is not defined by law, but it has significant practical significance. A law enforcement officer is often faced with a situation where it is necessary to accurately qualify a particular act. It seems necessary to agree with the opinion of N.S. Gilmutdinova and V.D. Larichev, who understand evasion of customs duties as “socially dangerous, criminally punishable, intentional acts provided for and prohibited by criminal law, aimed at complete or partial failure to pay customs duties prescribed in accordance with the law on time.” Such an act is punishable in criminal proceedings.

The legislator uses various terms to refer to fiscal customs payments, the content of which does not always correspond to the term used. Sometimes this is dictated by tradition. For example, in most countries, including Russia, the monetary contribution for export and import is usually called customs duty. In any case, such a payment is levied as an imperative and constitutes nothing more than a “forced withdrawal of funds.” Inconsistent use of various terms arises, as a rule, due to the lack of a systematic approach to establishing payments, which leads to obscuring their true nature and complicates their analysis by the taxpayer.

It seems that in this regard one cannot agree with the opinion of A.N. Fomichev on the inclusion of monetary resources in the customs payment system in the form of fines, penalties, and funds received from the sale of goods converted into federal property. Of course, as measures of responsibility by their legal nature, they are fiscal revenues in the structure of the budget of the Russian Federation, but to identify them with customs payments, the list of which is established by Art. 318 of the Labor Code of the Russian Federation, illegal.

It should be noted that most countries in the world use a customs payment system, the center of which is customs duty. In addition to this, certain goods imported into EU countries are subject to customs surcharges. Thus, in the UK, an imported car is taxed at 10% of its wholesale price. In France, para-fiscal taxes are levied: on leather - 0.18% of customs value, on clothing production - 6 - 11%, on prunes - 4%. In Sweden, plant protection tax applies to bulbs, live plants, cut flowers, etc. Moreover, such additional payments are justified by the interests of the national economy and are applied to goods, the import of which can significantly affect domestic production.

Customs payments are one of the conditions for moving goods across the customs border of the Russian Federation. This institution is based on the lawful behavior of participants in foreign trade transactions. The lack of legitimacy in the actions of subjects entails bringing them to legal responsibility and imposing appropriate sanctions. This circumstance serves as a criterion for the delimitation of financial resources collected in the field of customs affairs.

So, customs payments include the following categories of mandatory contributions: duty, tax, fee. This classification of mandatory payments provided for by customs legislation is contrary to the norms of tax legislation, which operates in two categories: “tax” and “fee”.

What definitions does the legislator give to these concepts? Article 8, Part 1 of the Tax Code of the Russian Federation defines a tax as a mandatory, individually gratuitous payment levied on organizations and individuals in the form of alienation of funds belonging to them by right of ownership, economic management or operational management for the purpose of financial support for the activities of the state and (or) municipalities . The fee is a mandatory contribution levied on organizations and individuals, the payment of which is one of the conditions for state bodies, local governments, other authorized bodies and officials to carry out legally significant actions in relation to fee payers, including the granting of certain rights or the issuance of permits (licenses). ).

In the legal and economic literature, great attention has always been paid to the definition of “tax” and its difference from the concept of “fee”. However, A.V. Bryzgalin believes that the terms “tax”, “fee”, “duty” are synonymous, and their use is explained only by established practice and traditions. Meanwhile, it is taxes that manifest themselves as the main source of accumulation of state revenues. In economic theory, it is customary to define taxes as “monetary relations that develop between the state and legal entities and individuals in connection with the mobilization of financial resources into centralized monetary funds.” Lawyers believe that taxes cannot be a relationship; they act primarily as a payment, contribution, entailing certain relationships.

S.D. Tsypkin, examining the category of taxes as a special financial institution, notes that thanks to taxes, “part of the income of citizens and organizations is attracted to a centralized fund of funds to meet national needs.” N.P. adheres to a similar position. Kucheryavenko, pointing out that the main feature of the tax is the receipt of funds for the state to meet public costs and saturate the budget. This circumstance confirms the fiscal sign of the tax.

The study of the tax category allowed V.A. Solovyov to note the conceptual contradiction in his definition, expressed in the phrase “charged payment”. He believes that, “on the one hand, a tax is a payment, an active action of the payer, showing his will; on the other hand, collection is an active action of a public subject, showing his will in relation to a private subject.” However, it appears that payment may be paid or collected depending on who performs the action. The important thing is that the payment is alienated, and this can happen not only through collection, but also through voluntary payment. The Customs Code of the Russian Federation, in terms of the term “customs payments”, operates with various concepts: payment, calculation, collection, return, and such an establishment is not a legal conflict.

Noting the public nature and fundamental fiscal role, N.I. Khimicheva interprets taxes as “mandatory and, in legal form, individually gratuitous payments of organizations and individuals, established within their competence by representative bodies of state power or local self-government for inclusion in the budget system (or in cases specified by law - extra-budgetary state and municipal funds) with the definition their amounts and terms of payment." This definition reflects the characteristics of this type of payment with maximum clarity. Taxes are unthinkable without their mandatory nature, established by the administrative method.

At the same time, N.I. Khimicheva identifies a group of payments (state and customs duties, various fees), the difference from taxes is that they are of a reimbursable nature, and the obligation to pay them arises only in connection with an appeal to state or municipal bodies for a specific service. Considering the presence of common features (obligatory payment, enrollment in the budget system or extra-budgetary fund, control of payment by tax authorities), the legislation, according to N.I. Khimicheva, combines these payments with taxes into a single system, called the tax system, later - the system of taxes and fees. Thus, the Tax and Budget Codes of the Russian Federation previously classified the mentioned payments as part of the group of tax revenues of the budget. However, subsequently, thanks to amendments to them, differentiation and clarification occurred, which resulted in the fact that indirect taxes remained tax revenues of the budget, and customs duties and customs fees became non-tax revenues.

Customs duty is a fee for carrying out various activities by customs authorities. In the name of the fee, the legislator determines the content of the consideration. According to clause 31, part 1, art. 11 of the Labor Code of the Russian Federation, customs duty is understood as a payment, the payment of which is one of the conditions for the customs authorities to perform actions related to customs clearance, storage, and tracking of goods. This definition generally reflects the essence of the payment under study, but the following definition seems more preferable: customs duty is a mandatory non-tax contribution levied to cover the costs of customs authorities for carrying out actions for customs clearance, storage, and escort of goods moved across the customs border of the Russian Federation.

Thus, customs authorities perform various legally significant actions, which are paid by the subjects of export-import operations at a time. Unlike taxes, they are compensated and are levied in connection with the provision of any specific services. Customs duties according to Art. 357.1 of the Code are paid for customs clearance (when declaring goods), customs escort (when transporting goods in accordance with the internal customs transit procedure or with the customs regime of international customs transit), as well as for storing goods in customs warehouses and temporary storage warehouses.

The peculiarity of the fee is “the establishment of its size on the basis of equivalence to the costs incurred by the fiscal in the implementation of relevant actions of legal significance, or in the production of goods (work, services) transferred to the payer, subject to payment of the fee.” Naturally, in this case, not nominal compliance is assumed, but a certain comparability of the subject’s expenses and the cost of a specific service. You can find customs duties divided into one-time (payment for each operation) and lump-sum (payment for the entire range of services provided).

Before January 1, 2005, the amount of fees for customs clearance was 0.15% of the customs value of transported goods, which essentially denied the legal nature of this type of payment. The dependence of the fee on the value of the goods to a certain extent equates it to a tax, while its size should consist of the costs of the customs authorities to complete the necessary formalities. “Tying” this type of payment to the costs of regulatory authorities will undoubtedly reduce the amount of customs duty and reduce the costs of participants in foreign trade.

Currently, the rates of customs duties for customs clearance are established by the Government of the Russian Federation, and their maximum amount should not exceed 100 thousand rubles. The establishment of such a limit is at least unclear. What was the legislator guided by when determining its amount? It seems that the amount of customs fees for customs clearance should be calculated solely on the basis of the cost of services provided.

The Customs Code of the Russian Federation contains an exhaustive list of customs duties. In Art. 30 of the Federal Law of December 8, 2003 N 164-FZ “On the Fundamentals of State Regulation of Foreign Trade Activities” establishes a system of payments collected in connection with the import and export of goods. Payments apply to:

— quantitative restrictions;

— licensing;

— currency control;

— statistical services;

— confirmation of product compliance with mandatory requirements;

— examination and inspection;

— quarantine, sanitary service and fumigation.

The legislator determines that the amount of payments should not exceed the approximate cost of services provided and constitute protection of goods of Russian origin or taxation for fiscal purposes. Therefore, it seems possible to designate such payments by the term “fees”. At the same time, not all payments in this group relate to customs, since some of them are collected by specialized government bodies - for example, during certification or licensing. Consequently, their list may be open, and some of the fees may be established by other legislative acts.

It should be noted that customs duties, taxes, and customs duties have a fiscal function. They, in fact, represent mandatory contributions, are the federal budget’s own tax and non-tax revenues, and are protected by the state from the standpoint of coercion.

S.G. points out the fiscal feature of duties and fees. Pepelyaev, O. It seems that in the field of customs affairs this feature has different content for duty, tax and fee. The sizes of customs duties and customs fees are incomparable. When calculating the amount of expected customs payments, the subject first of all pays attention to the amounts of customs duties and taxes. The volume of the fee paid by him does not play a decisive role. Therefore, the payer associates duty and tax with a financial barrier, while collection is not such an obstacle. But all these payments have the attribute of fiscality, since they are recognized as revenues of the state treasury.

Thus, customs payments are an integral part of the system of taxes, fees and other obligatory payments, and their application is possible in the event of the movement of goods and vehicles across the customs border. It is the condition of movement that predetermines the special place of customs payments in the budget system of the Russian Federation.

It seems appropriate to formulate the following definition of customs duties.

Customs payments are mandatory payments that are tax and non-tax revenues of the federal budget, levied by customs authorities and paid in connection with the movement of goods and vehicles across the customs border of the Russian Federation.

The practice of customs payments allows us to come to the conclusion that at present the constituent entities of the Federation are not interested in expanding foreign economic relations in their territories. This situation is caused by the fact that there are no resources collected by customs authorities in the revenue side of regional budgets. All of them go to the federal budget. In our opinion, their part of 5 - 7% could remain in the regions, thereby significantly replenishing the treasury of the subjects of the Federation. The introduction of such a provision would create regional interest, which could be expressed in the creation of a favorable investment climate, in expanding cooperation with foreign partners, in intensifying the activities of local chambers of commerce and industry.

The lack of regional interest leads to self-removal of the authorities of the constituent entities of the Federation from solving these pressing problems. Improving the distribution of customs payments between the federal and regional budgets will contribute to Russia’s integration into the global system of economic relations.

Customs payments

Refund of customs duties: problems and solutions

Customs payments when importing fixed assets received as a contribution to the authorized capital from a foreigner

Criminal liability for evasion of customs duties

Recognition as uncollectible and write-off of customs duties, penalties, interest

Benefits for paying customs duties