Improving the customs payment system

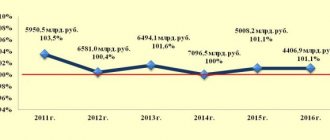

Relevance of the research topic . The Federal Customs Service of the Russian Federation is making step-by-step changes in the field of customs administration, optimizing customs operations, and introducing advanced information technologies. This work is being carried out in accordance with the Strategy for Improving Customs Authorities until 2021, taking into account the implementation of the road maps “Improving Customs Administration” [2].

In an effort to create favorable conditions for participants in foreign economic activity, the Federal Customs Service of Russia is doing a lot of work to introduce highly promising technologies for paying customs duties. According to Part 14 of Article 116 of the Federal Law of November 27, 2010 No. 311-FZ “On Customs Regulation in the Russian Federation” [1], payment of customs duties and taxes can be made through payment and electronic terminals and ATMs.

When paying customs duties, both software and hardware are used to operate the electronic terminal, determined by the customs duties operator at the payer’s workplace, as well as on the basis of personal account services.

In order to improve the customs payment system, the following technologies have been created and introduced:

1) remote payment of customs duties using an electronic signature when submitting a declaration for goods in electronic form, which has the sign of remote payment;

2) payment of customs duties by individuals through payment terminals, electronic terminals and ATMs located outside the locations of customs authorities, in cash or bank cards, the services of which are provided by customs payment operators;

3) remote payment of customs duties by individuals regarding goods for private use transported by carriers (courier delivery services and freight forwarding companies) to individuals receiving goods.

On October 5, 2015, through the Electronic Declaration Portal of the Federal Customs Service of Russia, it was possible to pay customs duties by participants in foreign economic activity, which is accessible through the official website of the Federal Customs Service.

The introduction of mandatory electronic declaration has created provisions for actively improving the technology for remote payment of customs duties.

Remote payment of customs duties is considered to be providing the payer with the opportunity to make payment of customs duties directly from his workplace using an electronic terminal with an explanation in the goods declaration submitted in electronic form of a special indicator for remote payment of customs duties.

The main thing in the technology of remote payment of customs duties is that the declarant, using a microprocessor card during the customs declaration of goods, acquires access to a special bank account of a participant in foreign economic activity, from which funds are transferred to the accounts of the Federal Treasury. A card is issued in one of the participating banks of the payment system. Operators of the Russian payment system that provide services to participants in foreign economic activity are Multiservice Payment System LLC and Customs Card LLC [4].

Payment of customs duties can be carried out remotely, through the personal account of the Internet payment operator or with the support of POS terminals at customs posts, as well as through the declarant’s software.

Significant advantages of using remote payment technology: making customs payments of all types at any customs authority on the territory of Russia; security of settlements and targeted use of transferred amounts; payment of customs duties along with filing a declaration, including additional payment of missing amounts; the ability to manage payments through online services; when issuing several cards, the admissibility of customs declaration and payment of customs duties at different customs authorities at once; no need to subsidize funds.

The Federal Customs Service of Russia has also created conditions for paying customs duties via the Internet using ROUND customs cards.

A participant in foreign economic activity with this method of paying customs duties can pay customs duties directly in the process of electronic declaration. There is no need for the physical presence of an employee at the customs post, or for installing a POS terminal in the office of a participant in foreign economic activity.

The ROUND customs card promises a significant degree of security when making online payments, due to the use of a one-time SMS password, as well as the electronic signature of the payer. The payment notification is instantly entered into the information system of the Federal Customs Service of Russia after the payment has been made.

The Federal Customs Service has created work together with the Federal Treasury aimed at speeding up the deadlines for receiving information on the transfer and payment of funds. Information is received about the payment and transfer of funds electronically to the customs authorities. The time it takes to communicate information to customs about the transfer of funds has been reduced to two hours.

Today's technologies for paying customs and other payments, managed by customs authorities, make it possible: firstly, in proportion to the amounts accrued for goods in the declaration, accept payment of customs duties, which eliminates the need for cash flow; secondly, the time for customs operations to be reduced; thirdly, to minimize errors when entering bank details and other information necessary for accurate identification of payments and the payer”; fourthly, to combine technologies for remote payment of customs duties and the possibility of electronic declaration, eliminating the need for a participant in foreign economic activity at the places where customs operations are carried out [3].

Consequently, the Federal Customs Service of Russia has done a lot of work to improve the system for ensuring the payment of customs duties, improving the methods of payment and control over the payment of customs duties. Currently, technologies such as remote payment are successfully used, which allows for real-time payment of customs duties and payment of customs duties using customs payment cards. As a result, it has become possible to carry out the release of goods before the period of actual crediting of funds to the accounts of customs authorities, as well as to significantly reduce the time for completing customs operations.

Many problems arise for customs authorities when collecting customs duties from participants in foreign trade activities. Significant difficulties are associated with falsification of documents provided during the customs declaration of vehicles and goods, as well as due to understatement of the customs value of goods, evasion of customs duties. Of no small importance when collecting and ensuring the payment of customs duties is the problem of imperfection of the regulatory framework.

The development of the customs duties payment system is carried out through the introduction of the latest information technologies, which will help improve the work of customs authorities during customs control, to solve emerging problems.

Literature:

- Federal Law “On Customs Regulation in the Russian Federation” dated November 27, 2010 N 311-FZ (as amended on August 3, 2018) // SPS Consultant-plus // https://www.consultant.ru.

- Order of the Government of the Russian Federation dated June 29, 2012 No. 1125-r On the action plan (“road map”) “Improving customs administration” // SPS Consultant-plus // https://www.consultant.ru.

- Solodukhina O.I. Features of using preliminary information technology when placing goods under the customs procedure of customs transit // In the collection: Trends in the formation of science and education / Collection of scientific papers based on the materials of the International Scientific and Practical Conference on July 31, 2015: in 3 parts. AR-Consult LLC. Moscow

- Tsukanova N. E., Solodukhina O. I. Features of customs activities in implementing customs control of goods and vehicles during customs transit // In the collection: Science, education, society: current issues and prospects for improvement. Collection of scientific papers based on the materials of the International Scientific and Practical Conference: in 4 parts. AR-Consult LLC.

Refund of customs duties: problems and solutions

Home — Articles

The topic of returning overpaid or excessively collected customs duties in the context of a more complicated economic situation in the country and the world, including as a result of the mutual imposition of sanctions, is becoming even more relevant. This is due to the fact that, firstly, in the context of a reduction in trade turnover, in order to ensure revenues to the federal budget, customs authorities are strengthening control, conducting more and more customs inspections, the quality of which begins to suffer due to the large volume, and as a result, making decisions to collect additional customs duties , which are not always legal. In the event of a successful appeal of such decisions, the declarant has the right to a refund of excessively collected payments.

In practice, situations often arise when a customs post, in the process of checking customs declarations submitted in relation to current supplies, decides to adjust the customs value (hereinafter also referred to as CTV) or to classify goods according to a different code of the Commodity Nomenclature of Foreign Economic Activity of the Customs Union than declared by the declarant , or refusal to apply VAT benefits, etc. Such decisions can be made on several customs declarations. The declarant has the right to appeal them within three months from the date of adoption of the relevant decision. Appeals against several decisions can be combined into one case, but not always. Often, the declarant does not have enough administrative or financial resources to conduct several legal proceedings at the same time. In such situations, for the purposes of procedural economy, one decision may be appealed. If such a complaint is satisfied, if the 3-month period for appealing other decisions has expired, the declarant may apply to the customs office for the return of overpaid or collected customs duties for all remaining decisions and, in case of refusal to consider the application, appeal it to the arbitration court. As a result, instead of several court cases, the organization will have to go through only two trials, which will significantly reduce legal costs not only for itself, but for the state.

In practice, there have been many cases of detection of overpayment of customs duties by clients. Errors can be either one-time (double payment, incorrect exchange rate, etc.) or systemic in nature, as a result of which the amounts of overpayments can be significant. Such errors may be due to incorrect classification of goods, incorrect interpretation of government regulations on the application of exemptions from payment or the 10 percent VAT rate, and others. In our practice, there was a case when an importer incorrectly calculated the amount of customs duty established in relation to the capacity of the goods, using the total rather than the useful volume. As a result, the total amount of overpayment, which with our help was returned to the client, amounted to more than $10 million. In order to identify such additional reserves, the organization can conduct a so-called customs diagnostics, or audit, both on its own and by external lawyers specializing in resolving such issues.

The procedure for the return of overpaid or excessively collected customs duties allows the payer to pre-trially contact the customs office in the region of operation of which the goods were declared or collection was made, which is obliged to return the overpaid or collected customs duties. By establishing this procedure, the legislator limited it to a period of 3 years from the date of excess payment or collection . However, this restriction does not deprive the payer of the right, if the specified period is missed, to file a claim in court for the return of the overpaid amount from the budget. In this case, the general rules for calculating the limitation period apply - from the day when the person learned or should have learned about the violation of his right (clause 1 of Article 200 of the Civil Code of the Russian Federation). The corresponding clarifications in relation to tax legal relations are given in the Determinations of the Constitutional Court of the Russian Federation dated June 21, 2001 N 173-O and dated December 21, 2011 N 1665-О-О. The applicability of these clarifications to customs legal relations is confirmed by wide judicial practice (see, for example, the Resolution of the Federal Arbitration Court of the Moscow District of March 18, 2013 in case No. A40-85281/12).

The application for a refund must be completed in the form established by Order of the Federal Customs Service of December 22, 2010 N 2520. To prepare a separate application for each customs declaration, significant administrative and financial costs may be required. However, as explained in the letter of the Federal Customs Service dated March 25, 2013 N 01-11/12183, the current customs legislation does not prohibit the inclusion of information on the return of customs duties on several customs declarations in one application. Thus, one application can be submitted for several declarations. At the same time, if the number of declarations is large enough, including them in one statement may complicate the preparation of such a statement. If at least one mathematical error is made when preparing calculations, the customs authority will have sufficient grounds to refuse to return the entire amount of overpaid customs duties on the remaining declarations. In such a situation, a compromise decision may be made by dividing the total number of declarations into several statements. At the same time, in order to avoid multiple lawsuits, we recommend sending such applications in one covering letter, which, in turn, may contain a justification for the occurrence of the fact of excessive payment or collection of customs duties and, accordingly, be used as a document confirming such a fact. Thus, if you receive a refusal from customs to return overpaid customs duties, this will allow you to appeal only one such refusal to the court.

What documents confirm “the fact of excessive payment or excessive collection of customs duties and taxes”? Existing legislation does not contain a list of such documents. The situation when the declarant attaches to the application a court decision that has entered into legal force is beyond doubt. But if there is no such decision yet or it concerns one declaration, and the application is submitted for other declarations in relation to the same goods, then in most cases, the customs authorities refuse to consider the application on its merits, referring to the letter of the Federal Customs Service dated April 29, 2011 N 01-11/19942 indicate that an adjustment to the goods declaration (hereinafter referred to as the CDT) should be submitted as such a document. However, if the declarant misses the 3-month period for appealing decisions on the CTS or classification, the customs authority will refuse to amend the declaration for goods, and when appealing the refusal, the court agrees with the customs authority, since such a refusal is justified.

Is it really possible that in such a situation the declarant is deprived of the right to defense? Existing legislation still makes it possible to obtain it.

Thus, the Resolution of the Federal Arbitration Court of the Volga District dated July 31, 2014 in case No. A06-3941/2013 states: “The Law on Customs Regulation does not disclose which documents confirming the fact of excessive payment or excessive collection of customs duties and taxes must be attached to the application. Documents confirming the adjustment of declarations for goods are not indicated as necessary, much less the only possible documents confirming the fact of excessive payment of customs duties.” Since the Law does not establish the need to submit the KDT as the only document that may confirm the fact of excessive payment or collection, the declarant can submit other documents to customs, including simply his written reasoned justification. Accordingly, the payer does not have to first contact the customs post with an application to adjust the declaration of goods.

At the same time, the Plenum of the Supreme Arbitration Court of the Russian Federation in its Resolution No. 79 of November 8, 2013 explained that the fact that the declarant did not appeal the decision of the customs authority on the basis of which customs payments were collected from him is not a sufficient basis for refusal to consider claims for the return of overcharged payments. This position was expressed by the Supreme Arbitration Court of the Russian Federation (hereinafter also referred to as the Supreme Arbitration Court of the Russian Federation) earlier when considering specific cases.

At the stage of discussion of the draft Resolution No. 79, representatives of the Federal Customs Service (hereinafter referred to as the FCS of Russia) asked the judges of the Supreme Arbitration Court of the Russian Federation to include in the Resolution a provision stating that an adjustment to the goods declaration must be submitted as a document confirming the fact of excessive payment. The Chairman of the Supreme Arbitration Court of the Russian Federation did not agree with this proposal, arguing that the requirement of the customs authority to present a document that is also issued by the customs authority would be a formal obstacle that would exclude access to judicial protection. As a result, Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation No. 79 does not contain such an explanation.

However, the Federal Customs Service of Russia did not agree with the position of the highest judicial body, and on its initiative, Article 255 of the draft Customs Code of the Eurasian Economic Union states that returns are made only after changes are made to the declaration of goods: “Refund (offset) of customs duties, taxes, advance payments , funds (money) contributed as security for the payment of customs duties, taxes, and other funds (money).

Clause 2. Refund (offset) of overpaid and (or) overcollected amounts of customs duties and taxes is carried out by the customs authority after making changes and additions to the declaration of goods in the prescribed manner or correcting in the prescribed manner information about calculated customs payments in the customs receipt order or in the customs document specified in paragraph 4 of Article 238 of this Code, and subject to other conditions for the return of overpaid and (or) excessively collected amounts of customs duties and taxes established by the legislation of the Member State in which the payment and (or) collection of customs duties was made duties, taxes" (see decision of the Eurasian Economic Commission dated December 18, 2014 N 233 "On the draft Agreement on the Customs Code of the Eurasian Economic Union").

So organizations need to hurry up and apply for a refund before the new Customs Code of the Eurasian Economic Union comes into force. After the above rule comes into force, in order to defend its interests, the declarant will need to have time to appeal each decision of the customs authority within three months from the date of its receipt and, in order to optimize legal costs, petition the court to consolidate similar cases. At the same time, courts in many cases, for various reasons (including to provide statistics on the number of cases considered), refuse to satisfy such requests.

For a long time, arbitration courts proceeded from the fact that if the form for adjusting the customs value of goods was filled out by the declarant independently, there were no grounds for declaring it illegal. At the same time, such an adjustment may be due to the declarant’s disagreement with the decision of the customs authority, and, for example, the task of stopping the accrual of penalties, eliminating possible delays in the release of current supplies, etc. In this regard, the Presidium of the Supreme Arbitration Court of the Russian Federation in its Resolution No. 13328/12 dated March 5, 2013 indicated: The fact that an organization independently adjusts the customs value of imported goods does not prevent the declarant from exercising the right to challenge the customs decision on adjusting the customs value and the right to demand a refund unnecessarily paid customs duties. The current legislation does not establish prohibitions and restrictions on filing claims for the return of overpaid customs duties, even if the payments were made voluntarily by the declarant.” With the adoption of the said Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation, judicial practice in such disputes began to change in favor of declarants and customs representatives. However, in case of independent adjustment of the declaration, we recommend that in the covering letter you clearly indicate your position regarding the adjustment being made by indicating that the company does not agree with the decision of the customs authority and will appeal it in accordance with the law.

Another problematic issue that arose mainly in the judicial practice of the northwestern region was the argument of the customs authorities that for VAT paid to the customs authorities when importing goods, a refund cannot be made if the payer has presented the corresponding amount of VAT for deduction. This argument has been accepted for some time by the courts in disputes related to illegal adjustment of customs value, when both customs duty and VAT were overcharged. However, when it came to disputes about the application of 10 percent or zero VAT in relation to medical goods, medicines, lenses, etc., for which the tax authorities, unlike the customs authorities, have no complaints, the absurdity of this argument became obvious. As a result, this issue is reflected in paragraph 6 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated November 8, 2013 N 79: “The customs authority does not have the right to refuse to consider on the merits an application for the return of the relevant amounts with reference to the fact that the return of overpaid tax amounts for value added or reimbursement of the said tax is made by the tax authorities on the basis of the provisions of Article 78 or Chapter 21 of the Tax Code of the Russian Federation, as well as the fact that the VAT paid (collected) upon import in full was presented for deduction in accordance with Article 171 of the Tax Code of the Russian Federation. In order to provide the tax authority with the opportunity to adjust the amount of the previously provided tax deduction, the customs authority notifies it of a decrease in the amount of value added tax payable within the framework of customs procedures.” At the same time, in the event of a refund by the customs authority of overpaid or collected VAT, the declarant, due to the requirements of tax legislation, is obliged to adjust the amount of VAT paid to the tax authorities.

Author: A.A. Kosov, partner, head of customs law and foreign trade regulation practice, candidate of legal sciences (Moscow).

Source: magazine “Customs Regulation. Customs control", No. 12

August 2015

Customs payments

Customs payments when importing fixed assets received as a contribution to the authorized capital from a foreigner

Criminal liability for evasion of customs duties

Recognition as uncollectible and write-off of customs duties, penalties, interest

Benefits for paying customs duties

Advance payments