Perfumes are compounds used to flavor something. Most often these are liquid solutions based on alcohol, a mixture of alcohol and water, dipropylene glycol and other liquids. Imported perfume products are in demand in Russia and are imported mainly from France, Germany, Spain, and other countries, for example, Poland, Korea, and Turkey. The popularity of this product does not mean at all that customs clearance is easy and simple. On the contrary, during international transport and

customs clearancePerfumery often faces difficulties. In order to competently and quickly clear perfume products through customs, you must have in-depth knowledge in the field of customs and tax legislation.

Creation of TsELT

ATTENTION!

We work only with legal entities. In accordance with the order of the Federal Customs Service of Russia dated February 7, 2021 No. 145 “On the creation of the Central Electronic Customs,” a main control center was formed - the first Central Electronic Customs. If we compare it with the EDC, this is a higher body that has higher competence and its decisions are more significant. In the CED, the customs inspector actually does not make independent decisions, because he acts in accordance with strict instructions. At CELT, employees perform more thorough control of declarations. They will also make a decision if, for any reason, problems arise with the release of cargo at the EDC.

Transportation of perfume products

International transportation of perfumes can be carried out by any means of transport: air, rail, road, sea, multimodal. During transportation, it is sometimes necessary to ensure compliance with temperature and humidity levels. Packaging must protect perfume products from damage. It is possible to seal a consignment of goods. The packaging is marked with the words “fragile cargo” and “flammable”.

Reality and risks

The creation of a new customs authority, subordinate to the Central Customs Administration, is carried out as part of the digitalization and automation of customs declarations. This is one of the areas of large-scale reform aimed at transforming customs and using artificial intelligence. The introduction of the latest technologies is necessary for fast and convenient information interaction with internal and external partners. It is believed that this transformation will create more comfortable conditions for business, ensure transparency of customs work, reduce time for the release of goods and uniformity of customs operations, and eliminate the need to transport uncleared goods deep into the country.

Thus, by creating TsELT, the leadership of the Federal Customs Service promises to optimize the work of customs, but in reality it is not clear how exactly this progress will be achieved. For now, especially at the stage of formation and transformation, there are high risks of delays and confusion in the export and import of goods. And there are reasons for this. The main one is the lack of a sufficient number of qualified personnel. While in Moscow the forecast is quite favorable, in the regions the situation on this issue is less optimistic. There are not enough personnel. The high responsibility of officials and relatively low wages do not contribute to filling vacant positions. TsELT is staffed with personnel from the customs authorities of the Central Federal District. The latter are declining.

After the transfer of CEDs to the jurisdiction of CELT, the processing of documents is expected to slow down. You will need to get used to innovations and changes in business processes, perhaps retraining local employees. It will take some time to stabilize the work. The problem will be especially acute in industry-specific EDCs and EDCs in large cities. In fairness, it must be said that on-site personnel training is already carried out using virtual simulators, which should ensure adaptation to the real operating mode and reduce the likelihood of problems arising.

Since information from EDCs will now be transferred to TsELT and additional capacities will be used for this, there is a possibility of technical and software failures at the initial stage, which will also negatively affect the speed of customs clearance.

Potential risks exist, and foreign trade participants need to be prepared for delays in customs clearance of goods. I'm glad this problem is temporary. If we are guided by the experience of launching the Aviation CED, then approximately six months after the launch, the CELT will operate at a constant pace.

Terms and cost of customs clearance of perfumes

The design of perfumes is carried out on a general basis, according to the established procedure. The period for obtaining a permit varies from 3 hours to one day. Professional support from DMlogist guarantees faster crossing of the checkpoint.

We guarantee minimal time and financial costs. For questions about the cost of services, please contact the current phone numbers. Prices are calculated based on batch size, country of origin and related operations.

Why choose us?

Cooperation with the company DMlogist is:

- 24/7 support

- Legal advice on foreign trade issues

- Personal approach

- Professional customs brokerage services

- Individual design schemes

- Customs storage services

- Integrated Logistics Operations

- Democratic pricing policy

Find out the cost of our services:

Main reform trends

Along with the formation of a new customs authority, from June 29, 2020 to March 1, 2021, in accordance with the order of the Federal Customs Service No. 228-r, an experiment is being conducted to divide competence in the field of customs operations.

Since July 31, 2021, the department has been operating the Central Customs Post Electronic Declaration Center (101 310 10), telephone number - (495) 276 36 62. It is planned to include under the jurisdiction of TsELT and some branch capital CEDs. The regions will also have their own electronic customs offices. They are expected to appear by the end of 2021. In addition to the existing Ural, Siberian, North Caucasian, and Volga regions, Southern, Northwestern, and Far Eastern customs will operate.

In general, the main reform trends are the unification of some temporary storage warehouses and central economic centers, division of powers and narrowing of competence, subordination of regional customs posts to the Main Center. This means that in the regions it will no longer be possible to independently clear customs or clear cargo. It will be necessary to send information to CELT via open communication channels. In this case, all interaction between regional customs brokers, customs posts, logistics areas and Moscow takes place via email.

If the CEDs are subordinate to the CELT, then the customs posts of actual control can no longer release cargo without the participation of the CEDs. In other words, it will soon be impossible to register regional cargo and prepare the necessary documentation on the spot. Registration will now take place using the Electronic Customs Center. Regional tampars contact the employees of this center via mail and submit appropriate requests. And the employees located at the Electronic Customs Center prepare the necessary documentation in electronic and paper form and do all the preparatory formal work. In order for imported cargo to be unloaded on the customs territory of the Russian Federation, approval must come from the Main Center. When all this is completed, you can further carry out customs clearance.

At the moment, a complete restructuring of the entire system is taking place, the destruction of old connections and the creation of new ones. All this disrupts the usual well-functioning schemes, which of course negatively affects the speed of customs clearance. If previously the number of participants in the customs clearance process was minimized, and they could all interact freely with each other, resolving certain controversial issues on their own, now this is not within their competence: all processes pass through Moscow, and interaction becomes as transparent as possible.

Perfumery certification

Perfumery certification is a set of measures aimed at confirming the quality of transported products. All goods crossing the border control point must comply with the established requirements of state standards.

Certification of perfumes and products based on them is mandatory. The changes made require additional execution of a declaration of conformity in accordance with the TR of the Russian Federation. Mandatory certification does not apply to all products. The full list of products is specified in the Technical Regulations.

The DMlogist company offers certification services for perfumes and other products. We provide advice on obtaining required documents and provide assistance in their preparation. Perfumery certification services include the development of a personal algorithm of actions and preparation for laboratory testing.

Detailed information is publicly available on the official DMlogist page.

Help SB Cargo

Our company positively assesses the changes taking place. SB Cargo provides customs clearance services in Moscow and the Moscow region, is a participant in the “Charter of Bona fide Participants in Foreign Economic Activity” and complies with the law. We are ready to help regional companies, regional businesses and industries with customs clearance of goods. We have positive experience in this, and we are aware of all the latest innovations.

A regional customs broker, through electronic interaction with the Electronic Customs Center, can process all the necessary documentation, but customs brokers in Moscow and the Moscow region are located in close proximity to the Center, so specific situations and problems in Moscow are processed much more quickly. If there is any innovation in the work of CELT, our representatives will be able to quickly change their tactics and quickly process the cargo.

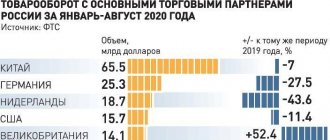

Importing countries

The main countries supplying cosmetic products are:

- Korea;

- France;

- Italy;

- USA;

- Poland.

For example, the Russian Federation imports skin care products from Korea, Japan, China, eau de toilette from Spain, perfumes and essential oils from Germany and France, powder and shampoos from Poland and the USA, lipstick from the UK and the USA. SB Cargo can deliver goods to any city in Russia: Moscow, St. Petersburg, Yekaterinburg, Irkutsk, Rostov-on-Don, Vladivostok and many others.

What does the Standard Line customs broker offer? Import of cosmetics to Russia.

By trusting our company to clear the customs declaration of cosmetics and perfumes, you can be calm and confident that the cargo will arrive at the appointed place in its original form as quickly as possible, because we have extensive experience in customs clearance of such goods, taking into account all the requirements and customs laws, as well as experience in safe cargo transportation. We will also carry out all the necessary procedures when importing hair cosmetics into Belarus.

The mission of the customs representative Standard Line is to reduce money and time costs for customs clearance of goods and eradicate possible business failures. The company continuously works to increase knowledge and improve the qualifications of its customs declarants, as well as to improve the quality of customer service.

Import and customs clearance of cosmetics

Over the past year alone, approximately three hundred thousand tons of cosmetics and perfumes were imported into the Russian Federation from other countries. The volume of imports of foreign cosmetic products is increasing every year, because the quality of goods is improving and new fashion brands and trends are appearing. Importing cosmetics from Korea is very popular. But various amendments are also periodically made to customs legislation regarding customs clearance of cosmetics imports.

This group of goods is under the diligent supervision of customs authorities, since most products contain ethyl alcohol and must have a license for storage and purchase. If you do not comply with the rules and laws of registration of cosmetics and perfumes, as well as when contacting unlicensed and inexperienced customs brokers, there is a high probability of losing time and money. For the prompt and unhindered import of imported products, it is necessary to comply with all established customs regulations, therefore most participants in foreign economic activity choose to cooperate with experienced customs representatives and carriers, such as the Standard Line company +7 (495) 788-80-56.

Due to the fact that all perfumes and some cosmetics contain ethyl alcohol, all these products belong to the category of non-food alcohol-containing goods, and therefore the products are imported into the Russian Federation under expanded customs laws. If the percentage of alcohol in cosmetics or perfumes is more than nine percent, then this product is excisable. An important factor is that excisable goods are subject to customs clearance only at competent customs posts with permission to carry out customs clearance. Each product containing ethyl alcohol must have a cosmetic product safety certificate.

We recommend that you do not waste time and money studying endlessly changing laws, and immediately contact a professional customs representative - he will take care of all customs clearance procedures for the import of cosmetics and perfumes.

What HS codes can your cosmetic products have?

The goods you import in this category may relate to HS code 33 - Essential oils and resinoids; perfumery, cosmetic or toilet preparations. This group is divided into subgroups:

| Position | Description |

| 3301 | Essential oils (whether or not containing terpenes), including concretes and absolutes; resinoids; extracted essential oils; concentrates of essential oils in fats, fixed oils, waxes or similar products obtained by enfleurage or maceration; terpene by-products of deterpenization of essential oils; aqueous distillates and aqueous solutions of essential oils |

| 3302 | Mixtures of fragrant substances and mixtures (including alcoholic solutions) based on one or more such substances, used as industrial raw materials; other preparations based on aromatic substances used for the manufacture of beverages |

| 3303 | Perfume and eau de toilette |

| 3304 | Cosmetics or make-up products and skin care products (other than medicinal products), including sunscreen or tanning products; manicure or pedicure products |

| 3305 | Hair products |

| 3306 | Oral or dental hygiene products, including fixative powders and pastes for dentures; threads used for cleaning interdental spaces (dental floss), individually packaged for retail sale |

| 3307 | Before, during or after shaving preparations, personal deodorants, bath preparations, hair removers and other perfumery, cosmetic or toilet preparations not elsewhere specified or included; room deodorants, whether or not scented or with disinfectant properties |

Also, your goods may belong to group 34 of the Commodity Code of Foreign Economic Activity - Soap, surfactants, detergents, lubricants, artificial and prepared waxes, cleaning or polishing compositions, candles and similar products, modeling pastes, plasticine, “dental wax” "and dental compositions based on gypsum.

| Position | Description |

| 3401 | Soap; organic surfactants and preparations for use as soap, in the form of bars, pieces or molded articles, whether or not containing soap; organic surfactants and skin washes, in liquid or cream form and put up for retail sale, whether or not containing soap; paper, wadding, felt or felt and non-woven materials, impregnated or coated with soap or detergent |

| 3402 | Organic surfactants (except soap); surfactants, detergents (including detergent auxiliaries) and cleaning preparations, whether or not containing soap (other than those of heading 34.01) |

| 3403 | Lubricants (including cutting emulsions for cutting tools, loosening agents for bolts or nuts, rust removers or anti-corrosion agents and release agents based on lubricants) and products used for oil or grease treatment textile materials, leather, fur or other materials, except products containing as the main components 70% by weight or more of petroleum or petroleum products derived from bituminous rocks |

| 3404 | Artificial waxes and ready-made waxes |

| 3405 | Waxes and creams for shoes, polishes and mastics for furniture, floors, car bodies, glass or metal, cleaning pastes and powders and similar products (including paper, wadding, felt or felt, non-woven materials, porous plastics or porous rubber, impregnated or coated with such preparations), other than waxes of heading 34.04 |

| 3406 | Candles, wax candles and similar products |

| 3407 | Modeling pastes, including plasticine for children's modeling; "dental wax" or dental impression compositions, put up in kits, in packages for retail sale or in the form of bars, horseshoes, bars or similar forms |

You can view the list of exceptions and other HS codes you need on the website https://www.alta.ru/.

Cosmetics wholesale

Cosmetics are the most frequently counterfeited products. When purchasing imported products in bulk, there is always a chance that you will encounter illegal use of trademarks. It often happens that the entire wholesale shipment, when checked at customs, turns out to be counterfeit and is subject to confiscation. To avoid this outcome, it is necessary to correctly complete all the necessary customs documentation, for this it is best to contact a licensed professional in the field of customs clearance. Specialists will quickly and easily cope with this difficult process for an unprepared person. Call the number +7 (495) 788-80-56 or write to us by e-mail

Delivery and customs clearance of cosmetics from China

Recently, a large number of global brands of cosmetics and perfumes have transferred their production to China, because the cost of the necessary resources there is much lower. The quality of the products has not decreased much, and the wholesale price of the goods is amazing.

The Standard Line company puts forward favorable conditions for you for the transportation of cosmetic and perfumery products from China.

Features of cosmetics delivery

Over many years of successful work in the customs and logistics market, the Standard Line company has earned a reputation as a responsible, reliable, stable and serious partner in the transportation of goods from China and other countries.

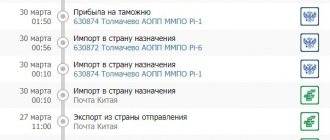

Working with us includes: -customs clearance – the goods will arrive to the customer having already completely passed all customs clearance procedures; - sophisticated logistics - there are representative offices in Hong Kong, Guangzhou, Beijing, Chuguchak, Yiwu, Moscow, which can allow issues and problems to be resolved on the spot, and this greatly reduces the time spent on transportation; -various transport services – air, road, railway, sea or multimodal transportation; -service and awareness - thanks to the presence of its own manager, the customer, if desired, can at any time clarify where his cargo is currently located.

Deadlines

The established period for filling out and submitting a declaration for cosmetics ranges from several hours to 2 working days and depends on the type of cargo, the number of items in the invoice and the number of EAEU HS codes.

The customs authority checks and releases the declaration within a few hours from the moment of its registration, if no changes are required to the declaration and all permits are provided. There are also other reasons for delay, which our company, having extensive experience, minimizes, thereby saving time and money for its clients.

Any deviation from the planned customs clearance period is fraught with downtime and additional costs for the foreign trade participant, which is why it is important to minimize all risks of increasing customs clearance time.

Customs payments

When importing cosmetics, you must pay customs duty and value added tax. Initially, the classification code of the Commodity Classification of Foreign Economic Activity is determined for each type of product in order to subsequently calculate customs duties according to the code.

Amount of duties and taxes on cosmetic products

| Code | Name according to the Commodity Nomenclature of Foreign Economic Activity | Duty | VAT |

| 3301 | Essential oils | 5 | 20 |

| 3301300000 | Resinoids | 5 | 20 |

| 3303001000, 3303009000 | Perfume and eau de toilette | 6,5 | 20 |

| 3304100000 | Lip and eye makeup products | 6,5 | 20 |

| 3304100000 | Products for manicure, pedicure | 6,5 | 20 |

| 3304910000 | Powder | 6,5 | 20 |

| 3305100000, 3305200000 | Shampoos and products for curling or straightening hair | 6,5 | 20 |

| 3305300000, 3305900001 | Hair varnishes, lotions | 6,5 | 20 |

| 3306100000 | Teeth cleaning products | 6,5 | 20 |

| 3306200000 | Dental floss | 6,5 | 20 |

| 3307100000 | Shaving products, as well as before and after shaving | 6,5 | 20 |

| 3307200000 | Deodorants and antiperspirants | 6,5 | 20 |

| 3305900001 | Bath salts | 6,5 | 20 |

| 3401110001 | Toilet soap | 4.5%+0.02 euro/kg | 20 |

| 3401300000 | Creams, shower gels | 6,5 | 20 |

In addition to import duties and VAT, some goods are subject to an excise tax, namely, alcohol-containing products classified according to the Legislation of the Russian Federation in the amount of 544 rubles/l of 100% alcohol. Excise products are cleared at specialized customs posts.

Customs duty is paid for completing the customs clearance procedure by customs authorities.

When calculating, the country of origin of the goods is also taken into account, since some countries enjoy preferences and have the right to import goods without paying customs duties on the basis of a certificate of origin.