- Customs structure

- Customs legislation

- Customs clearance of goods

Customs is a government body that is responsible for the movement of any goods, be it commercial consignments, vehicles or personal items across the customs border. Each product, depending on its type or purpose, is subject to certain customs procedures: customs transit, release for domestic consumption, export, re-export and others. Currently, the legislation provides for 17 types of such procedures. All of them are listed in the Customs Code of the EAEU (Eurasian Customs Union).

The global tasks of customs are to protect the economic interests of the country and assist in ensuring state and public security measures. Within the framework of these tasks, the main functions of customs can be identified:

- Control of trade turnover across the state border and creation of optimal conditions for doing business for participants in foreign economic activity.

- Collection of legally required duties and taxes.

- Combating smuggling and illegal trafficking of weapons, drugs and other prohibited substances.

- Interaction with customs authorities of other states, maintaining statistics, informing and consulting the population on customs issues, etc.

IT IS IMPORTANT TO UNDERSTAND that no matter how customs declare their functions, the main one has always been and remains the fiscal function, in other words, the priority for customs is activities related to replenishing the Federal budget.

In addition, when we talk about customs, we mean by this term CUSTOMS AUTHORITIES, since all functions are performed by customs officials, and customs is an integral part of the structure of the customs authorities of the Russian Federation.

But for convenience, the term “customs” is used in the literature for the average user.

Purpose

Customs is a state body that carries out the procedure for moving goods, things, transport and generally any other material assets, including animals and antiquities, across the so-called customs border of the state. So now we know what customs is. The point of its control is to collect customs duties in the form of a monetary equivalent or the goods themselves (in ancient times), to monitor exactly what goods they are trying to export outside the country, and, if necessary, to stop their transportation.

Functions of the Federal Customs Service

- Carrying out customs control. This includes checking documents, examining personal belongings and other manipulations carried out by FCS employees when citizens cross the border of the Russian Federation (arrive or leave).

- Calculation and collection of customs duties and related fees. This function applies to a greater extent to manufacturers of goods who import their products into Russia and export them from Russia. For example, there are import customs duties, excise taxes, etc.

- Customs authorities are engaged in counting and statistics of foreign trade of the Russian Federation. For example, they keep statistics on trade turnover between Russia and members of the EAEU and provide data in the form of a report to the Ministry of Finance.

- Control imported and exported goods. To achieve this, checks are carried out frequently. We are talking not only about ordinary citizens who cross the border, but also about trade cargo. It is the customs services that ensure that prohibited goods, counterfeit goods, etc. are not imported into Russia. They also ensure that valuable items of historical value, raw and processed precious metals, precious stones, wild animals, etc. are not exported from Russia.

- Identification and suppression of administrative offenses/crimes. While on duty, FCS officers monitor compliance with the procedure for the movement of goods and citizens across the border, identify various offenses, for example, customs regulations, illegal drug trafficking, weapons, etc. For this purpose, on-site checks are used with special equipment and dogs.

- One of the functions of the Federal Customs Service is control over foreign exchange transactions. Department employees monitor the transportation of cash across the border and counter the laundering of illegally obtained funds. They share this function with other executive authorities, for example, with the Federal Tax Service.

- Sanitary and quarantine control. FCS employees carry out a set of various organizational measures (checking imported products according to sanitary standards, epidemiological diseases, etc.) aimed against the importation and spread of various infections. Very often, epidemics are imported into the Russian Federation along with some goods. The FCS opposes this.

Current state of affairs

Currently, in accordance with the laws of the Russian Federation, Russian customs is collecting duties. It, in turn, is formalized by filling out special forms (written, electronic, oral), if the citizen has things that are subject to mandatory declaration.

Along with taxes that come to the budget from the internal turnover of the country's economy, customs duties are one of the main types of budget income. For example, in August 2011 alone, the amount of customs duties that went to the state budget amounted to 529 billion rubles. And for the entire 2011, this amount is equal to 4329.88 billion rubles.

The customs authorities themselves are part of the Federal Customs Service of Russia, which exercises the functions of control, supervision and management of all other areas of customs affairs. But from 2021, in accordance with the decree of the President of the Russian Federation, the Federal Customs Service was transferred to the subordination of the Ministry of Economic Development.

Customs legislation

Russia is a member of the Eurasian Economic Union (EAEU), which also includes the Republics of Belarus and Kazakhstan, Kyrgyzstan and Armenia. Customs officers act in accordance with the provisions of the EAEU Customs Code, which came into force on January 1, 2021. Previously, it was replaced by the Customs Code of the Customs Union, and even earlier - by the Customs Code of the Russian Federation. Both documents have already lost force.

The EAEU Customs Code provides for a unified procedure for the movement of goods across the borders of the union member states. Its entry into force made it possible to optimize most customs procedures, taking into account the absence of customs borders between these states. However, state borders between them have not been abolished.

In particular, instead of written declaration of goods, electronic declaration is used, which significantly reduces the time for processing declarations and releasing goods for free circulation. Written declaration is relevant only for some customs procedures - for example, placing cargo under customs transit.

Certain provisions of customs legislation are regulated by the Federal Law “On Customs Regulation” No. 289-FZ, which details and explains certain provisions of the EAEU customs code in relation to the customs authorities of the Russian Federation.

These are the two main regulations in the field of customs.

What to do if your order is stuck at customs

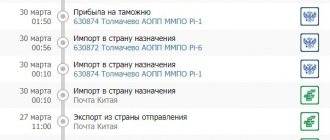

The customs clearance period is not constant. It happens that parcels “skip” the stage in just a few hours, but sometimes the procedure drags on for 3–5 days, and this is also considered normal. In any case, until this period has passed, there is no need to panic. Just check the status of your parcel periodically through the tracking system, and be patient. The delay may be due to technical problems or high customs workload, and your order will be released safely and sent to your post office shortly.

When is the time to start worrying and what can you do in this case? Go to the Russian Post website and check the status of the parcel using the ID. If your order is stuck at the “Customs clearance has started” and remains motionless for 10 days or more, it makes sense to contact customs yourself and find out what’s wrong. It is possible that customs will ask you for your passport details, TIN and other necessary information. A fee may be required.

The second status – “Customs clearance failed” means that there is a problem with the parcel and you need to contact the seller or customs. The latter option is preferable, as it will allow you to quickly find out the reason for the delay and understand what to do next.

If the problem is your fault as the buyer, for example, you ordered an item that is prohibited for import, or you do not want to pay duty, you may have difficulty getting a refund for your order. Sellers are reluctant to agree to a 100% refund because they have already incurred costs for the failed delivery. First, try to negotiate directly with the seller while order protection is in effect. And the next step is opening a dispute on Aliexpress.

- If the fault for returning goods from Aliexpress by customs lies with the seller, for example, he forgot to include accompanying documents or is selling counterfeit goods, do not rush to initiate a dispute. To prove that you are right, you will need to collect a rather impressive package of documents and present them to the Aliexpress administration within 7 days.

Be careful! When opening a dispute due to a delay in goods at customs, be prepared to prove that it is not your fault. Otherwise, there is a high risk that the decision will not be made in your favor.

Meaning of the word customs

Examples of the use of the word customs in literature.

On the territory of the bus station there is a customs office and notices are posted strongly recommending that foreigners undergo inspection.

Vasily, sparing no time, told Bremer about everything related to his work as a local representative of the company, and asked if he could carry out some delicate assignments related to customs.

Vasily successfully completed the operation at customs and transported ninety bags of coffee and the same number of boxes of cigarettes to a warehouse rented by the prudent Bremer for this purpose.

At the Belarusian customs everything went smoothly and quickly, but at the Estonian customs in Valga there was a delay.

Do I carry it through German customs in a golf club case or something?

We will meet with Demyanenko at the Izvarinskaya customs tomorrow from twelve o’clock to zero.

In all countries, among all peoples, universities were emptying, the intelligentsia - the brain of the people - was dying out, museums, paintings and book depositories were collecting dust, falling apart, scattered, the people were ruled by a soldier, wise as a barracks watch, and a gatekeeper, energetic, like a cinematograph, who believed that all industry and the economic life of peoples - there is only: the stock exchange and scams on high and low currencies: isn’t that why in England, France, Italy - blast furnaces, plants and factories did not smoke - and the coal and iron ore mines, eternally black and dusty, and alone, were filled with water after others, hundreds, thousands, burst, went bankrupt - firms, trading offices, banks, enterprises - and workers, tens, hundreds of thousands, millions - the unemployed - the lumpen proletariat walked in big cities from one professional office to another factory office, in strike-breaking, - spending the night in an unknown place, because nothing had been built in Europe for many years, and in England alone it was necessary to build a million houses - is it not because then he felt

The curtain swung, and judging by the caftan of the customs service adviser, the head of the local customs office, Matvey Korotnev, walked into the room, about whom Ivan had previously heard a lot. “Everything is clear as day,” he shrugged his dry shoulders, “take him and search him immediately.”

The Customs House also stood in the shadows, a modern aerial structure on poles draped with the national banners of Curaçao and Freakonomicist flags.

They manually moved boats and barges away from the giant fire, climbed onto the roofs, throwing off flying firebrands, and extinguished the busy customs.

Among the countless caiques standing near wooden piles darkened by water and time, I follow Gerasim out onto the Galata embankment, give my passport to the Turkish official sitting in the customs barn, and enter Galata at the hour when the calls of the muezzins fade away, a day according to Islamic law ends and the shops must be locked.

And you’ll call yourself,” answered the customs official, Ivan Nikolaevich Ponomarenko, indifferently, with a swollen pale face and small black, disobedient eyes.

Getting through customs in Nassau is much easier than getting through it in, say, Haiti or Quinson or Bogota, but they have observant guys there too.

Long Al lets me carry his weed when we go through customs, and then for days I can’t come to my senses, you’ll suffer such fear!

He had to be pretty nervous going through customs with false documents, but if he had presented his real ones, the Betan bureaucratic machine would have immediately turned on at full speed and would not have let him out soon.

Source: Maxim Moshkov library

Customs is changing the rules: what has already changed and will change by 2030?

Author : Irina Levkovskaya, head of the customs department of VED Agent JSC

In 2020-2021, customs has changed. New laws and regulations have come into force and will continue to come into force. On February 1, 2021, a dispatch system for customs declarations was launched. Reality becomes different. But the priorities remain largely the same.

Our customs clearance department employs 9 people. All professionals know how to do their work efficiently and quickly, and process a lot of information that comes from clients. They try to do this quickly. The average time for completing a declaration for imports in 2021 was one day.

The main import of VED Agent JSC (91%) was from China. This is an absolute leader. 3.4% is the Republic of Korea, 3.1% - Japan, 2% - Europe and the CIS, 0.5% - India.

In 2021, we processed mainly in the Central Customs Offices of the Far East, Vladivostok Customs (71%), 27% were the Central Customs Offices of the Baltic Customs, 2% of declarations were the center, Central Customs, Moscow Customs, and 1% were Novosibirsk (mostly what is transported by road).

As part of co-financing, we make security payments for clients. In 2021, we made more than 100 million rubles in security payments. Of these, we returned 99%.

In general, we see that our customs department copes with its tasks, ensuring the clearance of client cargo.

However, customs is changing literally before our eyes. What happened to her in 2020-2021 and what awaits us in the near future?

I remember what customs was like 18 years ago. We went to customs with a pile of papers and stood at the window waiting in line to hand them over. Among them was a customs declaration, in paper form. Then we stood in the same line at customs to pick up the customs declaration with the “Release Permitted” stamp. After which we walked on foot to the temporary storage warehouse to hand over this declaration to the warehouse specialists and receive the cargo. Now that it’s 2021, all this, fortunately, has sunk into oblivion.

What has changed in 2021?

- The main tasks that the Federal Customs Service set for itself for the period until 2020—the tasks of automation and digitalization of customs processes—were fulfilled. Now all declarations of goods are 100% done electronically in central electronic registration centers. In 2021, we had 672 customs posts. Today, all this has been restructured into 16 EDCs.

- The next task that the Federal Customs Service set for itself in the strategy until 2021 (and which was evident in all customs processes and decisions made) was to stimulate the integrity of participants in foreign trade activities. “Bring honestly, declare honestly, transparently, so that we can all see, so that your goods are risk-free!” And then customs will provide you with a “green corridor”, without inspection, without additional security deposits, with auto-registration in two minutes and auto-release in three minutes.

- By transferring customs posts to Electronic Declaration Centers, customs introduced technology for separating customs operations. If previously we had one inspector who filled out the declaration, checked all the papers, and went for inspection, now our documents are processed electronically in 16 CEDs, and physically the goods are located at customs posts of actual control (CPFC). Where the goods are located, the inspectors of this customs post, on behalf of the Central Economic Commission, carry out inspections, inspections, photography, and take samples. During the registration process, when requesting the same certificates of origin, the CED gives instructions to TPFC. And we must provide the original document to the TPFC. And already TPFC by mail, in electronic form, confirms to the CED that, yes, the original document is there, everything is fine. The CED sees all documents only in electronic form, which are submitted to it by the declarant. Operations are separated. The CED specialists do not hold papers in their hands.

- ELS and personal account on the FCS website. I would like to note the creation of unified personal accounts as an important and useful opportunity for importers. It’s really convenient: we transferred the money into one basket and don’t have to call customs 10 times: did we arrive or didn’t we arrive? To serve or not to serve? Should we release it or suddenly there won’t be enough to release it? Now we know that we transferred money, depending on the specific budget classification code (BCC) of payments: import duty - on one, VAT - on another, anti-dumping duty - on a third. Many banks are now working quickly, and often within two to three hours the money arrives in a single personal account. And all organizations conducting foreign economic activity have single personal accounts, because the Federal Customs Service automatically registered them. And about 350 thousand ELS are now registered here in Russia. If anyone has not yet registered a personal account on the FCS website, I recommend it, this is also a convenient service. I won’t say that it is directly 100% advanced, but the operations that need to be carried out daily when registering a product are there. This is also access to funds, the opportunity to find out the balance at the same fee: if you need to, you don’t have to pay extra. And given that our exchange rate is constantly fluctuating and it is impossible to predict it, it is also impossible to predict the recalculation of customs duties. Today it is one amount, but tomorrow it will be completely different. For example, I count and check payments every day. You need to check through the ELS: whether there is enough money or not. In addition, as an experiment, such an interesting function as submitting an electronic application for a refund of customs duties has appeared in your personal account. Previously, all this was done on paper: collected, signed, printed, taken to customs. Now, as promised by the Federal Customs Service, this opportunity has become available through your personal account on the website. We are already using this. We have a specialist who deals with customs payments. She probes this ground, and, of course, if clients need to check their funds or make a refund, they can always call our department, and the employee responsible for payments will help them do all this.

- Product labeling and batch traceability is a large-scale task facing customs. And they brought it to life. Mandatory labeling of goods has been introduced. This is the physical identification of goods. And there is also document identification - traceability. These are two control systems for goods and documents. Of course, this actually adds more work to us and has already led to a jump in prices. However, the tasks of these control systems are to whiten our goods as much as possible from counterfeit ones, to make sure that there are no fly-by-night companies, so that the Federal Tax Service can see the entire path of documents from the beginning of import to the sale of goods to the final buyer. It’s the same with goods: customs sees them from the moment of production, in the place where this product was produced, sees where it crossed the customs border, where it arrived - right down to who put on this boot.

What tasks does the Federal Customs Service face in its development strategy until 2030?

The main priorities are still the same: artificial intelligence, automation and digitalization. But some additional tasks are added. All work of the Federal Customs Service is carried out under the slogan “invisibly for business, as comfortable as possible, quickly and painlessly.” This is partly what happens, of course.

- Development of the institution of authorized economic operators (AEO). At the beginning, I said that customs stimulates the integrity of foreign trade participants. Just one of the tools for such incentives is the AEO status. This status means advantages, means “green corridor”. That is, goods transported by the AEO undergo customs clearance as a matter of priority. In 2030, it is expected that at the border at checkpoints AEOs will have the same advantages, being the first to cross the border. It is not yet clear what this will look like. Maybe they will allocate a separate line, a separate checkpoint for the movement of AEO vehicles? Regarding air delivery, it is even more difficult to imagine how this will be implemented. Accordingly, the AEO institution is “risk-free goods”, preferences according to the risk management system (RMS). RMS - customs risks in the form of inspection, checking customs value, assigning examination of goods, weighing goods and many other forms of customs control. But goods moved by the AEO are exempt from these customs controls and are therefore called “risk-free goods.” Accordingly, when an AEO submits a declaration, it is registered within two minutes and issued within three minutes.

- Online assessment of product lots - RMS automation. What is meant? Now the risk management system exists on paper and with the participation of inspectors and departments. The Federal Customs Service has a whole department for this. Each customs has a department that deals with analytics and a risk management system. It is expected that these processes will be automated.

- Intelligent checkpoints. It is understood that, perhaps, an electronic queue regime will operate at checkpoints, as well as automatic collection of information in the Unified Information System. That is, all information about all the results of customs control will be located at this checkpoint, all this will be automated. And vehicles will cross the customs border faster than usual.

- Single window for business requests (SIS). For veterinary, phytosanitary and other questions, you will not need to call any customs department. We called the single EIS phone number and received an answer. Of course, as long as it’s not like we now call the same clinics and hear within an hour “your call is very important for us.”

- Integration of EAEU information systems with third countries. What is meant? This is control of the movement of goods from the manufacturer to the border of the EAEU. For example, China sent information about what was leaving there, and at the border of the EAEU our customs officers already know what is coming to them.

What worries us about all this?

- Fiscal interest: simplification of controls at the import stage strengthens controls after release. That is, today we accepted the customs value for registration, declared the product code, paid a certain amount of payments, and three years later they changed the code or did not accept the customs value. And they added additional payments. And we returned to this whole story again. I'm not even talking about the fact that when the declaration of conformity goes into the archives, the product has to be withdrawn from circulation. And at all times, the “three pillars” of customs are the code, customs value and non-tariff measures. In my memory, four Customs Codes have already changed: 1993, 2004, 2011 - the Customs Code of the Customs Union, and the current Customs Code of the EAEU. And always, in all codes, both twenty years ago and now, the “three pillars” were the code, customs value and non-tariff measures. The code changed - everything fell like a snowball: the customs value went up, the payments went up, non-tariff measures went up, and, God forbid, administrative liability came up.

- Server and software malfunctions. Yes, we have automated and digitalized everything. But... What if there is a failure? Will the FCS system be ready to withstand all this?

- Interaction between CEDs and TPFCs.

- All over again. In our region of activity of the Siberian Customs Administration, the Novosibirsk Central Customs Department, Tomsk Central Customs Department, Irkutsk Central Customs Department, Omsk Central Customs Department stopped accepting customs declarations from December 15, 2020. Everything was accumulated at the Siberian Electronic Customs in Krasnoyarsk. Accordingly, if we confirmed the contracts and customs value in one customs office, then we need to reconfirm everything again at the Siberian Electronic Customs, get acquainted with its requirements and inspectors. At the same time, the lack of contacts immediately affects work. It’s no longer possible to easily call the inspector and ask: why did you charge us twice as much today as yesterday? And this is not very good, because sometimes you just need to call customs to resolve some issue.

- Labeling and traceability: foreign trade activity “under the hood”. This is additional control that covers the business. We are all under control. Products under cover. Documents under cover. This incurs additional costs for the business, additional reporting for the accounting department, and restructuring of the entire accounting system. And imagine the failures in registration due to an incorrect barcode. If we fill out a declaration for goods that are subject to mandatory labeling, such as tires, and we receive an incorrect barcode, that’s it, the declaration will stop. And, finally, the additional composition of the administrative offense under Article 16.3 of the Code of Administrative Offenses of the Russian Federation. That is, if the product is not marked, liability arises under this article. This is in addition to marking with the EAEU sign.

- The regulatory framework and automated system are not fully adapted to the transition to a paperless format. Although Vladimir Bulavin says: we are striving for paperless registration, everything will be in electronic form. But in reality everything is not so smooth.

According to Vladimir Bulavin, the customs of the future is compliance with the principle of “invisibility for business and effectiveness for the state.”

Everyone here will appreciate this slogan in their own way. For me, performance for the state will take priority. Customs clearance of goods? Easy! Apply

Modern structure of customs authorities

Prototypes of customs appeared in the 10th century.

The first duties were levied for movement across the territory and for the entry of merchants with their goods. The collection was carried out by mytniks (analogous to modern customs officers), who served at the outposts. A little later, after the introduction of the “tamga” duty by the Mongol-Tatars, outposts began to bear the name of customs, and duty collectors began to be called customs officers. The modern customs structure consists of the Central Office, which is divided into the Main Directorate and the Directorate. The regional customs department and the customs office of direct destination are subordinate to customs. The customs themselves are divided into territorial regional departments, which coincide with the federal districts:

- Central Customs,

- Far Eastern, customs,

- North Caucasus Customs,

- Volga customs,

- Ural customs,

- Southern Department,

- Siberian Department,

- North-West Customs.

Are you an expert in this subject area?

We offer to become the author of the Directory. Working conditions These departments are subordinate to the customs office, which includes posts. Customs offices are divided into:

- aviation (Vnukovo, Domodedovo, Sheremetyevo),

- specialized (Central Excise Customs, Central Energy Customs),

- territorial (Kaliningrad, Crimea, Moscow regional customs, Sevastopol),

- providing (Central Base Customs, Canine Center of the Federal Customs Service of Russia).