Foreign economic activity, one way or another, is associated with the import or export of goods. The implementation of an international trade transaction is accompanied by costs, both for advance payments to partners and for customs duties. Not all entrepreneurs, especially those who are just starting their business, are ready for long-term operations that immediately require significant investments even before making a profit. However, there are customs regimes that do not require 100% advance payment. Within the framework of many of them, there is such a term as ensuring the payment of customs duties. Let's take a closer look at it.

What is security for payment of customs duties?

Ensuring the payment of customs duties means the following: the release of cargo from the post is carried out without actual payment by the declarant.

This procedure is possible only under certain guarantees that all debts will be repaid, but with some delay. The meaning of the term is described in more detail in the official document - TC TC. Having a problem? Call our customs specialist:

Moscow and region (call is free)

Saint Petersburg

Application of the term

The term is used in many cases. They can be divided into two categories:

- Unconditional.

- Exceptional.

Unconditional cases

Unconditional cases include:

- customs transit;

- processing of cargo outside the customs territory.

Under these regimes, theoretically, customs duties should not be levied. Ensuring payment in such cases allows you to control entrepreneurs.

However, control is not always carried out properly. Some unscrupulous businessmen import and export goods without paying customs duties, under the guise of customs transit and processing outside the customs territory.

Security for payment of customs duties is provided against payment guarantees.

Exceptional cases

Exceptional cases are rare precedents. These include:

- force majeure;

- temporary regimes and agreements between the states participating in the transaction.

- various transition stages, etc.

In such situations, customs authorities cannot immediately accurately determine the amount of customs duty for a specific operation, and they do not have the right to detain the cargo. Then security for payment of duties is applied.

There is a conditional division of exceptional cases of using this term:

- Significant changes in due dates. They can be carried out within the framework of international treaties.

- Release of cargo, which is subsequently subject to various examinations. These may include quality checks and samples, procedures for obtaining permits and certificates, etc.

- Other cases. Customs clearance is a complex procedure. Each case must be considered separately, which often takes a long time. And customs officers do not have the right to detain cargo longer than the period established in the legislation of the Russian Federation.

General support

Sometimes entrepreneurs intend to adhere to a regime for a long period of time, which involves paying fees after the goods are released under the responsibility of the declarant.

Then it is most profitable to use the possibility of general security for the payment of customs duties to simplify trade procedures. The system works like this: one customs office must confirm a certificate of security for the payment of customs duties and taxes for a long period. The subscription must be recognized by other services.

The certificate contains the following information:

- The name of the government agency that confirmed the subscription.

- The person who provided the document.

- Validity.

- The entire list of procedures and operations that will be carried out within the framework of this document.

- Security amount.

Registration of general security significantly reduces costs and saves time on paperwork for a number of customs formalities.

List of banks where you can obtain a customs guarantee

To obtain a customs guarantee, you must contact one of the registered banks , VEB.RF or the Eurasian Development Bank and submit an application.

Sometimes, to obtain it, you may need to provide security, which can be a pledge of property, securities or a surety.

Our specialists will help you choose a bank with the most suitable conditions and will handle all the paperwork, so to save time you can contact our company.

© RusTender LLC

The material is the property of tender-rus.ru. Any use of an article without indicating the source - tender-rus.ru is prohibited in accordance with Article 1259 of the Civil Code of the Russian Federation

Methods and forms of ensuring payment of duties and taxes under the Labor Code of the Customs Union

Release under security of payment of customs duties is a big responsibility. The term itself implies the provision of collateral. The state needs guarantees that all duties will be paid by the pledgor in full. For this purpose, various methods and forms of ensuring payment are used, and third parties are involved.

Pledge of property

A common form of security is a property pledge. To carry out this procedure, an agreement is concluded between the customs office and the foreign trade entity itself.

But there are some exceptions here. Not all types of property can be pledged and presented as a guarantor for repayment of payments.

As security for customs payment, you cannot pledge property that:

- was mortgaged by the entrepreneur earlier;

- quickly loses useful qualities and properties;

- is not located on the territory of the Russian Federation;

- belongs to the energy industry (is its product).

Bank guarantee

A bank guarantee is a case where third parties are involved to ensure payment of payments.

They are credit organizations. These could be banks, insurance companies, etc. The main requirement for an intermediary is to belong to the register of customs guarantors. Otherwise, the state does not receive proper guarantees.

The relevant government agency may refuse to ensure payment by rejecting the bank guarantee. The main reasons for such a decision may be the following points:

- Serious errors in the preparation of the necessary accompanying documentation.

- Failure to comply with basic requirements for an intermediary.

- Exceeding the security amount.

In order to save time, you must first obtain all information about the selected credit institution from the customs authority. Only after this can you begin to prepare documents and obtain a bank guarantee.

The bank guarantee must contain the following information:

- List of obligations that must be fulfilled by the subject of foreign economic activity (entrepreneur).

- The exact time period within which the document is valid. It should not exceed 3 years.

- The right of customs to withdraw a certain amount of money from the guarantor’s account if he fails to comply with the main obligations and conditions of the security.

- The obligation of the guarantor to pay penalties and fines for late payment. The fine is 0.1% of the total fee.

- Basic terms of the deal. These include the receipt of the duty to the account of the government body, as the fulfillment of all obligations of the guarantor.

Cash deposit

Often a cash deposit is posted to ensure payment of the fees.

If the subject of foreign economic activity is a legal entity, and the trade operation involves paying large amounts of taxes, the deposit must be transferred to the account of the Federal Treasury. If the import or export of goods across the state border is carried out by an individual for personal use, then the contribution can be paid directly to the service’s cash desk.

When choosing this method of securing payment, it is very important to comply with all obligations and terms of the transaction. If they are not met, the customs authority has the right to collect payments and fines from the amount of the cash deposit.

If the foreign trade participant is conscientious and complies with all conditions and obligations, the cash deposit is subject to return. He is given a receipt, which is a document confirming compliance with the terms of the transaction. This paper cannot be transferred to another person. If it has been lost, it is possible to obtain a duplicate.

Sometimes a cash deposit can be used to pay off dues. To do this, the entrepreneur must provide a customs receipt. The following conditions must also be met:

- cargo obligations are fully fulfilled or terminated;

- the use of cash collateral will lead to the termination of obligations on the cargo.

If, after repayment of contributions and duties, the cash deposit has not been completely spent, its balance is returned to the foreign trade entity.

Surety

A guarantee is the execution of a corresponding document between customs and a third party (guarantor).

The first step when choosing this method is to find a guarantor. It is worthwhile to approach its choice as responsibly as possible in order to avoid possible risks.

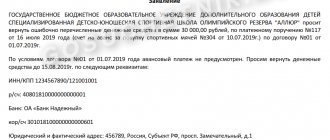

After the guarantor has been selected, he sends an application to the customs office to conclude the transaction. It can be either accepted or rejected by customs officers. The following documents are sent along with the application:

- Guarantee agreement. 2 copies are sent. They must be drawn up strictly in accordance with the rules established by the Legislation of the Russian Federation.

- A document that confirms the entrepreneur’s consent that the declared guarantor will act on his behalf as part of the transaction.

The draft agreement must contain the following provisions:

- The document must be valid for less than 24 months.

- Both the guarantor and the entrepreneur are equally responsible for fulfilling all the terms of the contract.

Refusal to accept a customs bank guarantee

A bank guarantee issued electronically may be rejected for one of the following reasons:

- Revocation of the license of the bank that issued the bank account.

- Absence from the register of the bank that issued the guarantee.

- The warranty does not include some of the information we listed above.

- The guarantee contains false information about the guarantor, beneficiary or principal.

- The size of the bank guarantee or the limit of all existing BGs has been exceeded. The amount of each and all guarantees is indicated in the register of customs bank guarantees.

- The requirements specified in the guarantee to provide the customs authority to the bank with documents not provided for in Art. 61 289-FZ

- The validity period of the BG is less than 3 months, after the completion of fulfillment of obligations to the customs authorities

If the guarantee was issued in printed form, then several more reasons are added to the above:

- Lack of information about the bank account from the executive authority, which must be provided by the bank issuing the document.

- The guarantee was signed by unauthorized persons.

- The seal impression or signature on the BG does not match the sample.

Ensuring payment during the customs transit procedure

As mentioned above, transit is an absolute case for the use of security for payment of duties. It does not provide for the repayment of fees at customs, but serves to control the activities of entrepreneurs. During this procedure, goods are transported strictly under customs control.

Customs transit is used when transporting the following types of cargo:

- foreign goods;

- goods of the customs union that are transported from the point of departure to the point of arrival across the border of a state that does not belong to the Customs Union.

Ensuring payment for temporary importation

Temporary import is an operation that involves the temporary stay of foreign goods on the territory of the Customs Union country. With such a procedure, participants in foreign trade activities may be fully or partially released from payment obligations.

After the expiration of the goods' useful life, they are included in the list of those included in the re-export procedure.

Temporary import can be used in a variety of cases:

- Organization of performances and exhibitions.

- Reception of representatives of other countries.

- Other international events.

This procedure allows you to significantly reduce the amount of payments or completely eliminate the need to pay them.

Depositing a cash deposit into the FC account

Having sent the entire amount, you must obtain a customs receipt, which must then be submitted to a specific customs authority to obtain a guarantee. Although the money is in the account of the customs office, the individual customs authority knows nothing about it. If full or partial obligations under the guarantee arise, the following options for the movement of funds are possible:

- The amount of duties and taxes is deducted from the deposit amount and is counted against the payment of future customs duties (the remaining money after the expiration of the obligation is returned to the payer or counted against future transactions);

- The amount of duties and taxes is paid separately by the payer, and the amount of the deposit is returned to him in full (or, if desired, counted against future transactions);

The guarantee must be supported by a bank guarantee.

The simplest way to obtain customs security at first glance is a cash deposit, but this is only economically beneficial if the amounts are small and ultimately the payments will actually be due.

In cases where duties and taxes will still not be withheld, it is better to refrain from interest-free freezing of large amounts in customs accounts and use one of the types of non-cash deposits.

Calculation and amount of collateral

Correct calculation of payment security amounts allows you to avoid serious losses in the form of fines and penalties.

In order to calculate the amount of security, a single formula is used. It contains the following components:

- Bid. It may vary depending on specific cases.

- Amount of cargo.

- Exchange Rates. It must be officially confirmed by the Central Bank of Russia.

For some participants in trading operations, a minimum amount of security customs payment has been established. These include:

- Customs carrier . Minimum payment amount - 20,000,000 rubles

- Customs broker . The minimum payment amount is 50,000,000 rubles.

- The owner of a customs or temporary closed warehouse . The minimum payment amount is 2,500,000 rubles.

- The owner of a customs or temporary open warehouse . The minimum payment amount is 2,500,000 rubles. But there are additional fees for this category. They may vary depending on the type of warehouse. As a rule, for open areas the fee is three hundred rubles per 1 square meter, for indoors - one thousand rubles.

German cars are invariably in demand all over the world, and Russia is no exception. Before you order a car or go abroad to buy it, you need to calculate all the costs, from accommodation to customs clearance. To help the car enthusiast, a car customs clearance calculator from Germany. Calculate your desires and capabilities. More details on how to clear a motorcycle through customs in Russia. You won't be able to save on an iron horse, although some people succeed.