The information is of interest to those who carry out or are just planning to engage in foreign economic activity for commercial and non-commercial purposes, as well as for those who plan to transport personal belongings, luggage, vehicles and receive international mail crossing the border of the Russian Federation. Knowledge of the specifics of customs operations in 2021 and proper execution of documents will allow you to avoid unnecessary expenses and carry out customs clearance as quickly and efficiently as possible.

What are customs duties

Customs duties include payments collected for the provision of customs services for clearance, storage and customs escort of goods, regardless of their commercial affiliation. The declarant can be the owner of the declared property himself or a third party who replaces him and is endowed with the necessary powers.

The amounts of customs duties are calculated on the basis of Decree of the Government of the Russian Federation No. 863 of December 28, 2004 “On the rates of customs duties for customs operations.” The calculation is based on the customs value of the goods in Russian rubles. The amount of customs duties is limited and cannot exceed 100,000 rubles.

Types of customs duty rates that are useful to businessmen

1) Fee for customs clearance of goods.

When goods cross the border of the Russian Federation, they are necessarily subject to customs duties. They are paid in rubles (Part 1 of Article 114 of the Labor Code). Currently, the rate is 0.1% of the total amount at which the transported property is valued.

Customs duty as a type of tax is levied on goods that do not fall under the definition of “commercial goods”. For this category an additional 0.05% of the total amount is paid. Payment is made in US dollars or euros.

Check out the current rates in 2021 that are subject to payment upon registration at the customs of the Russian Federation:

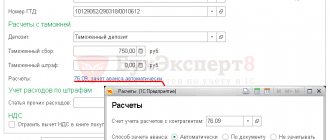

- When the cost of cargo with goods in one delivery is less than 200 thousand rubles, you need to pay 375 rubles.

- If the entire delivery is valued at more than 200,000.01 rubles, then you will be charged 750 rubles. It is important that this amount does not exceed 450 thousand rubles.

- If the amount for the entire delivery is more than 450 thousand rubles, you must pay 1,500 rubles. It is worth remembering that the total cost should not be more than 1 million 200 thousand rubles.

- If the goods in the lot are valued at an amount equal to 1.2 - 2.5 million rubles, then the fee will be 4,125 rubles.

- Further, the rates are presented in the following ratio: 5,625 rubles (2.5 - 5 million rubles); 15 thousand rubles (from 5 to 10 million rubles); delivery cost 22,500 rubles (10 - 30 million rubles).

Customs duties may vary. They depend on the properties of goods or other property that are imported into the Russian Federation from abroad:

- When property that is considered personal property (not for commercial use) is brought into the country, the fee is 250 rubles. The exception is vehicles (vehicles).

- Customs clearance of transit cargo by rail will cost you 375 rubles per shipment using one consignment note. The same amount is paid in the case of transportation of securities (in foreign currency), and if the same cargo, under the same customs regime, is declared more than once.

- When goods are transported across the border (there or back) by plane or by any of the sea or river modes of transport, the customs fee will be 7,500 rubles. It is also possible to move goods that fall under the “processing” (repair) category in accordance with the protocol for the temporary movement of goods. In addition, it is permissible if the period of temporary operations at customs has expired, or a product related to re-export or re-import for consumption within the country comes to the attention of customs.

- Filing a temporary declaration (falling under periodic temporary declaration) is estimated at 3,750 rubles.

2) Rate for customs escort.

Employees of authorized bodies can accompany the delivery along with documents when it passes through the border of the Russian Federation. Customs duty rates are described in Art. 357.10 Labor Code of the Russian Federation.

If you need vehicle escort (in the case of a railway, we are talking about one unit in a train), then you will need to pay money, the amount of which varies depending on the distance:

— Distance up to 50 km – 2,000 rubles;

— Distance from 50 to 10 km – 3,000 rubles;

— Distance from 100 to 200 km – 4,000 rubles;

— Distance over 200 km – 1,000 for every 100 km over the required distance. The minimum deposit required is 6,000 rubles.

If we are talking about an airplane or ship, then at the moment the amount of customs duty is 20 thousand rubles (the distance does not matter).

It is important to know that there are situations where fees are not paid. You can find out about them in Article 357 of the Labor Code of the Russian Federation.

3) Customs storage.

The ability to store property or goods in a customs warehouse is also subject to certain types of customs duties. We are talking about both permanent storage and temporary storage.

Currently, the following types of customs duty rates for storage are applied:

— For storing goods weighing 100 kg, 1 ruble per day is charged;

— If the goods are stored in a specially equipped warehouse, then the cost increases to 2 rubles per 100 kg of weight.

Procedure for payment of export (export) customs duties

When calculating customs duties or taxes levied when moving goods across the customs border of the Russian Federation, the general tax base is the customs value of goods moved across the customs border of the Russian Federation, which is determined in accordance with Article 323 of the Labor Code of the Russian Federation.

Customs duties are paid directly by the declarant or another person responsible for paying customs duties, in accordance with the customs legislation of the Russian Federation. At the same time, the latter admits that any interested person has the right to pay customs duties, except for cases provided for by the customs legislation of the Russian Federation.

When moving goods across the customs border of the Russian Federation, customs duties are paid before or simultaneously with the acceptance of the customs declaration. If the customs declaration was not submitted within the period established by the customs legislation of the Russian Federation, then the deadline for paying customs duties is calculated from the date of expiration of the established period for filing the customs declaration.

Customs duties are paid to the customs authority performing customs clearance of goods. In relation to goods sent by international mail, customs duty is paid to the state communications enterprise, which credits the paid amounts of customs duty to the accounts of the customs authorities of the Russian Federation. With the written permission of the State Customs Committee of Russia, customs duties may be paid to the accounts of the State Customs Committee of Russia.

At the request of the payer, customs duties can be paid both in the currency of the Russian Federation and in foreign currencies, the rates of which are quoted by the Central Bank of Russia. Payment of customs duties in various types of currencies, the rates of which are quoted by the Central Bank of Russia, is permitted with the consent of the customs authority performing customs clearance of goods.

Conversion of foreign currency into the currency of the Russian Federation when paying customs duties is carried out at the rate of the Central Bank of Russia valid on the day the customs declaration is accepted by the customs authority, and in cases provided for by the customs legislation of the Russian Federation, on the day of payment. When converting foreign currencies into the currency of the Russian Federation, as well as when converting the currency of the Russian Federation into foreign currency, the resulting amounts are rounded according to the rules for rounding to the second decimal place.

Customs duties can be paid to the customs authority either by bank transfer or in cash to the cash desk of the customs authority within the limits of the amounts established by the legislation of the Russian Federation. All bank transfers received to the accounts of the customs authority must be issued in the form of payment orders or other payment documents in accordance with the procedure established by the Central Bank of Russia and the State Customs Committee of Russia.

The amount of customs duty due is calculated and paid in accordance with the terms of the chosen customs regime provided for by the customs legislation of the Russian Federation. When individuals move goods across the customs border of the Russian Federation that are not intended for production or other commercial activities, a simplified or preferential procedure for paying customs duties may be applied in accordance with the customs legislation of the Russian Federation.

In case of illegal movement of goods and vehicles across the customs border, responsibility for payment of customs duties and taxes lies with:

- persons illegally moving goods and vehicles;

- persons participating in illegal movement, if they knew or should have known about the illegality of such movement.

These persons bear the same responsibility for the payment of customs duties and taxes as in cases where they acted as a declarant.

Thus, the same rules regarding calculation and payment apply to both export and import customs duties. There are three significant differences:

- Obligations to pay export duties arise from the moment the declaration is submitted, i.e. before the goods cross the customs border of the Russian Federation.

- Providing benefits for the payment of customs duties. Article 266. The Labor Code of the Russian Federation “Conditions for exemption from customs duties and taxes” provides for benefits on export (export) duties in the case of a regime for the movement of supplies. When exporting supplies from the customs territory of the Russian Federation on board sea (river) and aircraft, export customs duties are not paid if these supplies are exported in quantities corresponding to the number of passengers and crew members, the duration of the flight and sufficient to ensure normal operation and technical servicing the said vessels, taking into account the supplies available on board those vessels. When exporting from the customs territory of the Russian Federation supplies necessary to ensure normal operation and maintenance of trains, as well as supplies intended for consumption by train passengers and train crew employees, export customs duties are not paid if these supplies are exported in quantities sufficient to ensure normal operation and maintenance of trains and necessary for consumption by passengers and employees of train crews along the route, taking into account the supplies available on these trains. In case of import of goods in accordance with the customs regime of re-import, customs authorities will reimburse the amounts of paid export customs duties.

- The most significant difference: export duties are imposed only on a limited range of goods, the export of which in significant quantities could damage the economic interests of the Russian Federation, especially raw materials. According to Art. 3 of the Law of the Russian Federation “On Customs Tariffs”: “the rates of export customs duties and the list of goods to which they apply are established by the Government of the Russian Federation, unless otherwise established by this article. In relation to the goods specified in paragraph 4 of this article, the rates of export customs duties are established by the Government of the Russian Federation in the manner established in this paragraph.” The rates of export customs duties on goods exported from the territory of the Russian Federation outside the states party to the agreements on the Customs Union were approved by Order of the State Customs Committee of the Russian Federation dated August 6, 2003 N 865.

In case of non-payment of customs duties, including their incorrect calculation and (or) untimely payment, the person who is responsible for paying customs duties and taxes bears responsibility to the customs authorities. Forced collection of unpaid (or incompletely paid) amounts of customs duties is carried out by the customs authority in accordance with the procedure established in Chapter 32 of the Labor Code of the Russian Federation.

Excise taxes

A number of goods are excisable. When importing them into the territory of the Russian Federation, you have to pay an excise tax, which refers to indirect taxes.

Excise duty is collected on the import of tobacco products, alcoholic beverages, alcohol and alcohol-containing liquids, passenger vehicles (cars and motorcycles), fuels and lubricants (for example, motor oil and fuel).

Excise tax rates are determined by the Tax Code. To form a specific amount of excise duty, several parameters are used, as in calculating the customs duty. The importer needs to take into account that for each batch of imported products, excise tax rates may change, including due to changes in the price of the product, volume of delivery, etc. Consequently, for each delivery the amount of excise duty is calculated individually.

Deadlines for calculating duties on the export of goods from Russia

Article 329 of the Trade Code of the Russian Federation establishes the following types of deadlines:

- When exporting goods beyond the customs border of the Russian Federation, there are no time limits for the payment of customs duties. It is determined by an event that is directly related to the emergence of the obligation to pay customs duties - the submission of a declaration to the customs authorities. Certain exceptions apply to some periodically declared goods, as well as to substances transported by pipeline.

- In case of a change in the customs regime, fees must be paid within the day of expiration of the changed customs regime.

- If conditionally released cargo is used for other purposes , the deadline for payment of export fees is the day on which the violation of the restrictions on the disposal and use of the goods occurred. If it is impossible to determine such a day, the payment deadline is the day on which the customs authority accepted the declaration.

- If an entrepreneur has violated the requirements of customs operations and is obliged to pay customs duties, the deadline will be considered the day on which the violation took place (issuance without permission from the customs organization or loss of goods moved through intra-customs transit, temporarily stored or under the customs regime of a customs warehouse, duty-free site trade). If it is impossible to establish this day, payment of customs duties must be made during the day on which such operations started (the day the cargo was delivered to the customs site, the day a paper permit for intra-customs transit was received, the end day, the day the cargo was placed under the customs regime).

- The period for calculating customs duties when applying special customs operations is assigned separately for each operation. For example, individuals with hand luggage or accompanied luggage pay customs duties when crossing the Russian border.

The deadline for payment of export customs duties is the period of time for which it is necessary to pay the amounts of customs duties, or an incident due to which the Code obliges to pay customs duties.

Calculation and rates of export duties

The formula for calculating the export customs duty for the export of goods from Russia depends on the type of its rate. The Russian Law “On Customs Tariffs” establishes III types of rates.

- An ad valorem or value rate is added as a percentage to the customs price of exported products. The amount of customs duties is equal to the product of this rate, expressed as a percentage, and the customs value.

- The specific rate is set in monetary value for the quantity of taxed goods. The monetary unit is the euro.

- The combined rate combines both the cost and numerical values of the exported goods. The amount of the duty is established either by comparing these values or by adding them. This depends on the type of combination bet. The final amount of export tax is determined by comparison using the largest value.

The amount of customs duty payment is determined for registration, escort and storage of goods according to Tables 1, 2, 3, 4. Based on the available data, calculation in 2021 is also performed by summing up individual items.

Changes, installments and deferred payment

The Trade Code of the Russian Federation does not exclude changes in the deadline for payment of customs duties or the possibility of installments or deferment of payment of customs duties. They can apply to either the entire amount of fees or part of it.

Installment plans and deferments can be for a period of 1-6 months if there is at least one of the following grounds:

- The merchant transports goods under an interstate agreement;

- The entrepreneur suffered from delays in government sponsorship or payment of government orders;

- Transportation of perishable goods across the customs border;

- Damage to the payer due to the impact of natural disasters, man-made disasters, etc.

Changing the deadline for paying customs duties is accompanied by the collection of interest (added to the amount of debt).

If an entrepreneur goes bankrupt or a criminal case has been initiated against him, the customs organization:

- revokes a previously issued permit;

- invalidates a previously issued permit to defer or installment payment of customs duties.

Benefits for export customs duties

Benefits in foreign trade activities are aimed at providing certain trade participants with more favorable conditions relative to others. Customs benefits may be:

- exemption from customs duties;

- a simpler process for passing goods through the customs border or complete exemption from these procedures;

- granting powers to export goods from the country, the transportation of which is prohibited by law, and others.

Tariff benefits are a type of benefits that represent:

- refund of previously paid duties,

- exemption from customs duties,

- reduction of duty rates.

Transportation

Specify the terms of delivery of goods to our country in the contract, because this is one of the key points. If the seller takes delivery responsibilities upon himself, then you don’t have to think about how the goods will get to you. But if, according to the contract, the buyer himself is responsible for the delivery of goods, then you will need the services of logisticians. Choose the delivery methods yourself and evaluate which one will be most profitable for you:

- delivery by plane - fast, but expensive;

- By train it’s cheaper, but you’ll have to wait about a month.

Who is responsible for paying customs duties?

Duties are paid by the seller or exporter. The following cases do not fall under this rule:

- The customs authority has established its own requirements for the payment of customs duties;

- Using the postal network to move goods.

Additional customs duties may be calculated by decision of the customs authority after checking the applicant’s data if:

- The entrepreneur provided inaccurate information about the country of manufacture;

- The rules for classifying exported goods according to the Commodity Nomenclature of Foreign Economic Activity were violated;

- The cost or quantity of goods is determined by the customs organization.

According to paragraph 1 of Art. 320 of the Customs Code, the declarant or his representative (customs broker) is responsible for paying customs duties. If a fact of non-payment or incomplete payment of customs duties is discovered, collection is made either from the owner of the goods or from the customs broker.

Results

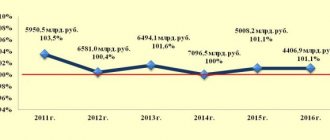

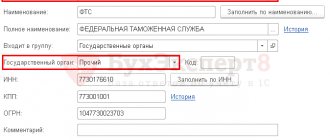

To summarize: export customs duties are taxes collected when goods are exported. Their main goal is to replenish the state budget. Foreign products are not subject to these duties. Duty rates are set by government bodies of member countries of the Eurasian Economic Union (EAEU).

The rules for collecting duties are established by the Customs Code of the Customs Union. If a situation not described by the Code arises, state legislation takes over.

The formula for calculating the export customs duty for the export of goods from Russia depends on the type of its rate. The Russian Law “On Customs Tariffs” establishes 3 types of rates:

- ad valorem rate;

- specific rate;

- combined rate.

The deadline for payment of export customs duties is the period of time for which it is necessary to pay the amounts of customs duties, or an incident due to which the Code obliges to pay customs duties. Benefits on export duties are called more favorable conditions for trade.

We determine the customs value of the goods

All customs payments must be made before the start of the customs clearance procedure for the goods.

Customs duties are calculated based on the customs value of the imported goods. Customs value can be determined by several methods. We will consider the main one - the assessment of the value of a transaction with imported goods. You can read about other methods in Chapter 5 of the Customs Code of the Eurasian Economic Union.

The customs value is equal to the contract price, i.e. the amount you pay for your order. In addition, additional costs are included in the customs value if they were not taken into account in the contract price:

- Your expenses for the broker's remuneration, the cost of containers and packaging.

- License and other payments for the use of intellectual property (trademarks, copyrights, etc.)

- The amount of the seller's profit, if under the contract part of the profit you receive is returned to the foreign seller.

- The cost of transportation to the place of arrival in the customs territory of the Russian Federation, if it was not included in the transaction price. As well as the cost of containers for transporting goods, loading and unloading, if you used several vehicles for delivery.

- Costs for insurance of delivery of goods.

Additional charges to the transaction price are calculated only on the basis of officially executed documents if they are fully paid by the buyer. Your costs for delivery of goods after import into the customs territory, costs for assembly, installation, and maintenance are not included in the customs value.

Let's look at what customs duties you have to pay when importing goods from abroad.