HomeCustoms payments Customs duties

Customs duty is a mandatory payment levied by customs authorities in connection with the movement of goods across the customs border of the Union (Article 2 of the EAEU Customs Code) (hereinafter referred to as “duty” and “TC”).

The government of the Russian Federation, like the authorities of any other countries, strives to solve two main problems of foreign economic activity. The first is to support domestic producers, to some extent protecting them from competition from foreign producers. The second is to provide Russian citizens with access to the best imported goods. Solving these problems requires a balanced foreign economic policy of the state. The instrument is the methods of tariff and non-tariff regulation of foreign economic activity. Tariff regulation methods are various tariffs and fees levied when carrying out foreign trade transactions. Non-tariff regulatory measures include, first of all, licensing, quotas, certification of goods or services and some other methods.

Most foreign trade transactions are subject to customs duties (customs duties, taxes and fees), the purpose of which is to replenish the state budget. And since the goals of foreign economic transactions can be different (commercial, educational or charitable), the amount of duties can also be different - for some types of activities it is charged in full, and for some types the state introduces preferences in the form of preferential duties (down to 0%).

On the territory of the Customs Union, customs duty rates are determined in accordance with the unified Commodity Nomenclature for Foreign Economic Activity of the Customs Union (TN FEA) and the Unified Customs Tariff of the Customs Union (with import duties included). According to these documents, goods that are moved across the customs border are subject to duty. The duty is imposed on the customs value of the goods or on its physical characteristics (consumer unit: quantity, units, pieces, kg, liters, volume, etc.).

We will select the HS code for your product and inform you about customs payments and duties

As we have already reported, duties are far from the only type of customs payments. Also subject to payment at customs:

- Customs duties or customs clearance fees. It is calculated and paid based on the cost of the imported goods. For export/removal from 09/04/2018 this amount is not paid! Previously, the customs clearance fee was 750 rubles. “Federal Law of August 3, 2021 N 289-FZ “On customs regulation in the Russian Federation and on amendments to certain legislative acts of the Russian Federation.”

- Value added tax (VAT). It is charged only on imported goods and in the Russian Federation is: 0%, 10% or 20% (before 12/31/18 it was 18%)

- Excise taxes. Charged only on excise goods: petroleum products, cars, alcohol, tobacco, etc.

Customs payments

customs duty

Customs VAT

Customs excise duty

Types of customs duties

Import customs duty (import) is a mandatory payment collected by the customs authorities of the member states of the Eurasian Economic Union in connection with the import of goods into the customs territory of the Eurasian Economic Union (clause 2 of Article 25 of the Treaty on the Eurasian Economic Union of May 29, 2014), is an instrument of customs and tariff regulation of foreign trade activities. In the context of the functioning of the Eurasian Economic Union, a Common Customs Tariff and other uniform measures to regulate foreign trade with third countries are established and applied (Treaty on the Eurasian Economic Union of May 29, 2014) (hereinafter referred to as the Union Treaty). Read more >>>

Export customs duty (export) is a mandatory payment collected by the customs authorities of the member states of the Eurasian Economic Union when exporting goods outside the customs territory of the Eurasian Economic Union.

Special, anti-dumping and countervailing duties belong to the group of special customs tariffs, established by international treaties or legislation of the member states of the Customs Union. They are charged in the same manner as import TP (Federal Law No. 165-FZ dated December 8, 2003 (as amended on June 4, 2014) “On special protective, anti-dumping and countervailing measures for the import of goods”). Sample “Anti-dumping duty”

Another group of customs tariffs are seasonal duties . They are seasonal and apply to agricultural products. Their goal is to protect domestic producers and stimulate their own agriculture. They are applied during the harvest and sale of the harvest and replace the usual duty rates in force at other times of the year.

Deadlines for calculating duties on the export of goods from Russia

The deadline for payment of export customs duties is the period of time for which it is necessary to pay the amounts of customs duties, or an incident due to which the Code obliges to pay customs duties.

Article 329 of the Trade Code of the Russian Federation establishes the following types of deadlines:

- When exporting goods beyond the customs border of the Russian Federation, there are no time limits for the payment of customs duties. It is determined by an event that is directly related to the emergence of the obligation to pay customs duties - the submission of a declaration to the customs authorities. Certain exceptions apply to some periodically declared goods, as well as to substances transported by pipeline.

- In case of a change in the customs regime, fees must be paid within the day of expiration of the changed customs regime.

- If conditionally released cargo is used for other purposes , the deadline for payment of export fees is the day on which the violation of the restrictions on the disposal and use of the goods occurred. If it is impossible to determine such a day, the payment deadline is the day on which the customs authority accepted the declaration.

- If an entrepreneur has violated the requirements of customs operations and is obliged to pay customs duties, the deadline will be considered the day on which the violation took place (issuance without permission from the customs organization or loss of goods moved through intra-customs transit, temporarily stored or under the customs regime of a customs warehouse, duty-free site trade). If it is impossible to establish this day, payment of customs duties must be made during the day on which such operations started (the day the cargo was delivered to the customs site, the day a paper permit for intra-customs transit was received, the end day, the day the cargo was placed under the customs regime).

- The period for calculating customs duties when applying special customs operations is assigned separately for each operation. For example, individuals with hand luggage or accompanied luggage pay customs duties when crossing the Russian border.

Changes, installments and deferred payment

The Trade Code of the Russian Federation does not exclude changes in the deadline for payment of customs duties or the possibility of installments or deferment of payment of customs duties.

They can apply to either the entire amount of fees or part of it. Installment plans and deferments can be for a period of 1-6 months if there is at least one of the following grounds:

- The merchant transports goods under an interstate agreement;

- The entrepreneur suffered from delays in government sponsorship or payment of government orders;

- Transportation of perishable goods across the customs border;

- Damage to the payer due to the impact of natural disasters, man-made disasters, etc.

Changing the deadline for paying customs duties is accompanied by the collection of interest (added to the amount of debt).

If an entrepreneur goes bankrupt or a criminal case has been initiated against him, the customs organization:

- revokes a previously issued permit;

- invalidates a previously issued permit to defer or installment payment of customs duties.

Types of customs rates

The Unified Customs Tariff allows you to apply different types of customs rates to the same goods: ad valorem, specific and combined. Knowing the types of customs rates, you can calculate the customs duty rate.

Ad valorem rate

does not have a fixed amount and represents a percentage of the customs value of the goods (cost of the goods + cost of delivery of the goods to the border).

For example, when importing a consignment of clothes hangers, an amount equal to 9% of the customs value of the consignment is subject to payment at customs. Formula for calculating duty at ad valorem rate:

Sp

– amount of duty

Stov

– customs value of imported/exported goods

St(P)

– rate of import/export duty as a percentage

Specific rate

has a fixed amount that is applied to each individual unit of goods (weight, quantity, volume, etc.).

For example, when importing a batch of sneakers, a duty of 0.47 euros per pair will be charged. Formula for calculating duty at a specific rate:

Sp

– amount of duty

St(E)

– rate of import/export duty in dollars or euros per unit of goods

Ktov

– quantity of imported/exported goods in certain units of measurement

Combined rate

is a combination of ad valorem and specific rates.

The CU ETT provides two ways to calculate duties: either based on the quantitative characteristics or weight of the goods (specific rate), or based on its value (ad valorem rate). The largest amount received is subject to payment at customs. For example, a batch of fresh exotic fruits is imported: bananas (HS code 0803901000), lemons (HS code 0805501000) or pomelo (HS code 0805400000).

In relation to this commodity item, a combined rate is applied, which states that the TP should be 4% of the customs value of the consignment (ad valorem rate), but it should be less than the amount if the calculations were carried out using the formula 0.015 euros/kg (specific rate). Duty rate on imported goods

determined by the HS code in accordance with the Decision of the Customs Union Commission “On unified customs tariff regulation” dated November 27, 2009.

The amount of duty on exported goods

is determined by the HS code in accordance with Decree of the Government of the Russian Federation of August 30, 2013 No. 754.

The payers of customs duties and taxes are the declarant or other persons who have an obligation to pay customs duties and taxes (Article 50 of the EAEU Labor Code).

We will calculate customs payments and duties for you

Restrictions on the import of food products

The import of some types of agricultural products and food products is currently suspended if the country of origin of the goods is a state included in the sanctions list. It includes:

- USA;

- Ukraine;

- Canada;

- Australia;

- Republic of Albania;

- Republic of Iceland;

- Kingdom of Norway;

- Principality of Liechtenstein;

- numerous countries of the European Union.

It is prohibited to import:

- fresh, chilled, frozen cattle meat;

- pork;

- animal fats;

- meat, salted, smoked, dried or in brine;

- sausages;

- offal of various animal species;

- live fish with some exceptions;

- milk and dairy products with the exception of lactose-free milk;

- molluscs, crustaceans;

- vegetables and fruits;

- root vegetables with some exceptions;

- nuts;

- salt;

- cheese products.

Benefits for paying customs duties

Benefits for payment of TP apply to goods produced in countries with which the Russian Federation has an international agreement on the provision of mutual preferences in the field of foreign trade. The right to such a benefit can be confirmed by a foreign trade participant by submitting to the customs authority a Certificate of Origin of Goods (General Form, Form A, ST-1 or ST-2).

Benefits for paying TP are of the following types:

- Tariff preferences;

- Tariff benefits;

- Tax benefits;

- Benefits for paying customs duties.

The list of benefits valid on the territory of the Russian Federation is presented in Order of the Federal Customs Service of Russia dated May 26, 2010 No. 1022 (as amended on December 20, 2012).

Categories of food products

Food products include products in unchanged or processed form intended for human consumption. Often a basic set of products is defined, which varies depending on location and season. The components of this set are available to almost all categories of the population.

ATTENTION! We work only with legal entities.

Food products include various product groups, including:

- plant products - nuts, vegetables and fruits, mushrooms, berries, dried fruits, cereals and more;

- animal products - meat, seafood, eggs, milk. fish;

- processed products - sausage, cheese, semi-finished meat products, jams, confectionery, etc.;

- food additives - pectin, agar-agar and more.

Note! Food products can be imported fresh, chilled or frozen.

Since the range of food products is extremely wide, it is necessary to have certain knowledge in order to classify a specific product according to the foreign economic activity product nomenclature.

Customs clearance of goods without paying customs duties in 2019

Features of customs clearance when importing goods without paying customs duties in 2021 by participants in foreign trade activities:

Individual:

Cargo and goods transported for personal use are exempt from customs duties, provided that:

- Their weight does not exceed 50 kg, and the total cost does not exceed 10,000 euros (for air transport - accompanied baggage);

- Their weight does not exceed 25 kg, and the total cost does not exceed 500 euros (excluding air transport - accompanied baggage);

- Their weight does not exceed 31 kg, and the total cost does not exceed 500 euros (for postal items and goods delivered by the carrier - unaccompanied baggage).

If any of these indicators are exceeded, the citizen must pay customs duties at the rate of 30% of the amount exceeding the permissible value, or 4 euros for each kilogram of excess.

A citizen also has the right to transport across the customs border without paying duties:

- Up to 50 cigars, or 200 cigarettes, or 250 g of tobacco;

- Up to 3 liters of alcoholic beverages.

Customs clearance of individuals >>>

Legal entity or individual entrepreneur:

cargo and goods without paying customs duties and taxes can be imported with a value not exceeding 200 euros. But in this case, the customs declaration is submitted to the customs authority in any case.

Accounting

To calculate export customs duties, create the following entry:

- Calculation debit 90 “Customs duties”.

- Calculation credit 68 “Calculations for customs duties.”

In accounting, the payment of the duty must be reflected by posting:

- Calculation debit 68 “Calculations for customs duties.”

- Credit 52 (51).

In accounting, export customs duties are calculated as a debit to the subaccount “Export duties” of account 90 “Sales”. Read more about customs duty accounts here.

Procedure for paying customs duties

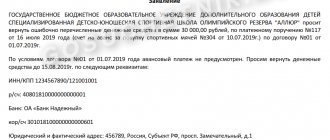

According to Art. 61 of the EAEU Labor Code, payments are made to the customs authority where the procedure for releasing the goods takes place (except for cases when the goods are placed under the customs procedure of customs transit). Methods of paying customs duties: payment can be made to the cash desk of the customs authority (the period for crediting to the account is from one to several days), or transferred electronically using the Round payment system or a customs card (the period for crediting to the account is up to several hours). Payments are paid in the currency of the state in which customs clearance of goods is carried out at the rate fixed on the day of filing the declaration. Payment, as a rule, is made in two payment orders: the first payment is sent to pay the duty, the second - VAT, excise duty (if necessary) and customs duty. The rules for filling out a payment order are defined in Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n “On approval of the rules for indicating information in the details of orders for the transfer of funds for payment of payments to the budget system of the Russian Federation.”

Shipping

Transportation of food products is carried out according to special rules, the purpose of which is to preserve the quality of the product and its presentation. Frequently, transportation is carried out using refrigeration units, which are necessary to maintain a certain level of temperature and humidity. For example, fresh products are transported at temperatures from 0 to +15°C. Frozen products must be transported at temperatures between –4°C and –20°C.

Any transport can be used to transport food products: road, air, rail, sea, multimodal.

SB Cargo services

Lack of special knowledge regarding customs clearance of food products can cause delays at customs, additional questions from the customs service, and sanctions. You can always contact a customs representative to save your time and avoid unforeseen circumstances.

Customs clearance services include numerous operations on certification, transportation, preparation of documents, obtaining permits, and insurance. A customs broker provides advice on foreign trade issues around the clock. Representatives have the appropriate license, giving the right to provide the entire necessary range of services. Products can be cleared through customs through the Sheremetyevo Central Export Center, Mega temporary storage warehouse or any other customs point. For more information, please call + 7(499)643-43-06. Send your application by email