Home Customs procedures

Customs procedures (formerly: customs regime, TR) are a set of rules that define, for customs purposes, the requirements and conditions for the use and (or) disposal of goods in the customs territory of the Customs Union or beyond its borders. (Article 2 of the EAEU Labor Code). Knowledge of the specifics of customs procedures is necessary to carry out any foreign trade operations with goods, be it the export of domestic products abroad (export), or, conversely, the import of foreign goods (import, customs transit). Without knowing the specifics of the chosen customs procedure, it is impossible to fill out a customs declaration and calculate the amount of customs duties. Therefore, before proceeding with a foreign trade transaction, a foreign trade participant must study the customs legislation of the country of registration and become familiar in advance with all the conditions and requirements that the selected customs procedure (CP) provides for. Otherwise, there is a high risk of the goods being delayed at customs and problems with paperwork. Therefore, it is necessary to know in advance under which customs procedure the imported or exported goods should be placed. The most popular, as a rule, are: release for domestic consumption, export, customs transit, temporary import, temporary export.

The concept of customs procedure

The customs procedure is a set of rules that determine the conditions and procedure for the use of goods within the borders of the states that are members of the Eurasian Economic Union. The rules were developed for the purpose of customs regulation of the movement of goods and vehicles and apply to each participant in foreign trade activities. Previously, instead of customs procedures, the term “customs regime” was used.

Customs procedures are regulated by the following legislative acts:

- Customs Code of the EAEU;

- Federal Law No. 289-FZ dated August 3, 2018, regulating customs clearance issues in the Russian Federation;

- Decision of the Customs Union Commission dated September 20, 2010 No. 378, which approved the classifiers of types of customs regimes;

- Other by-laws, rules, regulations.

Customs procedures are divided into four main groups:

- Basic customs procedures. These include import and export, transit transportation;

- Economic: processing of goods on the territory of the EAEU countries and beyond, for consumption on the domestic market, free and customs warehouse, temporary import, free customs territory;

- Final: re-export, re-import, refusal of goods in favor of the EAEU country, destruction;

- Temporary export: special customs regime, duty-free trade, free customs zone.

The customs procedure determines the procedure for submitting a declaration, calculating customs payments (duties, fees), deadlines for their payment, benefits, preferences, conditions for their use, and serves to control foreign trade turnover. The declarant independently, based on the goals and objectives of customs clearance, selects the appropriate mode. It must be taken into account that the customs authority has the right to make a decision that will go against the intentions of the importer or exporter.

The concept of “customs procedure” is disclosed in the Customs Code of the EAEU.

Payment of customs duties

Payment of customs duties, excise taxes, taxes and fees consists of two main parts:

- The first part is the duty or excise tax. They are calculated either as a percentage of the cost of the cargo or per unit of its accounting. Sometimes the amount of the duty is determined by expert assessments or from special catalogues. This also includes payment of VAT, if such is provided for the corresponding group of goods subject to the Commodity Classification of Foreign Economic Activity.

- The second part is additional payments, for example, for storing cargo at a temporary storage warehouse, its movement within the customs zone, payment for certification, examinations and instrumental control.

As a rule, all duties and excise taxes are paid by the cargo owner or customs broker in advance by making a deposit to the organization’s accounts (to a special treasury account). All payments are issued by invoice or bank payment order, including those in electronic form.

When importing goods, there are many nuances - a list of documents, the procedure for customs clearance and payment of duties. It can be difficult for a non-specialist to understand all this. However, knowledge of at least the general procedure for clearing imports at customs can greatly simplify the task of quickly transporting cargo in the right direction.

What applies to customs procedures

To date, 17 customs procedures are known:

- Release for domestic consumption (import). Used in relation to goods released and produced abroad that can be located and used in the territories of states; members of the Union without restrictions (free sale, exchange, etc. are allowed).

- Export. Applies to products manufactured in the EAEU countries for sale abroad.

- Customs transit. Refers to cargo that only passes along the roads, including railways, waterways, of the EAEU countries, but their final destination is outside this territory.

- Bonded warehouse. This procedure is used while imports are placed for storage in a warehouse operated by customs officials. For this period, the cargo is exempt from duties and other payments.

- Processing in customs territory. Performed in relation to imports that are subject to further processing, but in the territories of the EAEU countries in order to obtain new products from them. Subsequently, the processed product is transported outside the EAEU.

- Processing outside the customs territory. It implies the export of products manufactured within the borders of the EAEU for processing in the territories of other states and re-import into the countries of the Eurasian Union.

- Processing for domestic consumption. It involves the processing of imports for further customs clearance and sale of the final product in the EAEU countries.

- Temporary importation. The permit is issued for imports temporarily located and used in the EAEU.

- Free warehouse. Relevant for goods imported and produced in the EAEU states from a certain list, it allows you to place and use such products in a free warehouse duty-free.

- Re-export. Designed for a number of categories of imported goods that are exported from the EAEU countries, as well as those produced in the territory of the Union.

- Re-import. Indicates the import of imports that, for one reason or another, were previously exported from the countries of the Union, and are now being imported again.

- Refusal in favor of the state. Involves the transfer of imports into the ownership of the country without paying duties.

- Destruction. This operation includes imports, the import of which is prohibited or limited. No duties are paid for it.

- Free customs zone. Applies to certain goods imported and produced in the EAEU countries, which are used within the free economic zone without paying duties and other payments.

- Temporary removal. Allows duty-free export for a certain period of time of products manufactured in the countries of the Union.

- Free trade. Applies to imports and locally produced goods sold at retail in special duty-free retail outlets.

- Special customs procedure. Applies to imports and goods produced in the EAEU countries that can be cleared through customs without paying duty.

Below we will look at the main ones in more detail.

The content, application, conditions for placing products, the beginning and end of obligations to pay duties in the context of each regime are regulated by the fifth section of the EAEU Customs Code.

What is customs clearance and control of cargo and goods, what does this mean: legal regulation

The concept under consideration has a clear and unambiguous interpretation, which is used, including in the field of jurisprudence, when all sorts of problems of a judicial nature arise. Border procedures are a set of legal actions performed when transporting all kinds of things through the territory of a state. In our case, the Russian Federation is the main destination or departure point. The list of activities implemented in strict accordance with established rules includes the following series of stages:

- Provision by declarants of documents and information in full.

- Actual presentation of delivery items for inspection.

- The work of government employees: reception, inspection, collection of state duties, inspection, inspection, etc. As a result, specialists make a decision on the permissibility of passing the products in question within the stated procedure.

The main stages, technology, stages and process of customs clearance of goods and cargo are a conceptual apparatus, which, as mentioned earlier, is based on the legislative norms of the issuing country. Compliance with all legal aspects of these operations in Russia is monitored by the Federal Customs Service, a body whose competence includes submitting initiatives to change established regulations. In their activities, members of this organization use both the Constitution of the Russian Federation and a full set of various relevant legal acts. The following provisions are taken into account:

- Merchant Shipping Code;

- Government Decree dated 03/06/2012 No. 193;

- Air Code;

- Order of the Ministry of Transport dated June 28, 2007 No. 82;

- Federal Law No. 259 and No. 127 dated November 8, 2007 and July 24, 1998.

- Government Decrees No. 1272 and No. 730.

- Federal Law No. 17, dated January 10, 2003

Separate standards also exist in the area of collecting all kinds of state duties of the corresponding specifications. Federal laws No. 5003-1, No. 311, No. 754 work in this format.

The procedure for placing goods under the customs procedure

Transportation of goods across state borders is carried out by both individuals and entrepreneurs; participants in foreign trade activities: in luggage, by postal delivery, by a transport company. All of them must be cleared at customs.

To place products under the customs procedure, the applicant submits to customs officers a declaration or an application for the release of products. The beginning of the process is calculated from the day the cargo is released. When importing objects of wildlife, plants and other goods subject to sanitary, quarantine and other types of control, you must first obtain a positive conclusion from the relevant supervisory authority.

There are some differences in the import and export of goods by individuals and business entities.

For a legal entity or individual entrepreneur

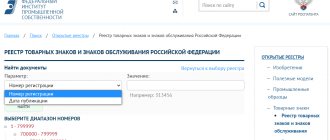

A foreign trade participant, his representative, a customs broker acting on behalf of a company or entrepreneur, submits a customs declaration electronically through an information system from the register of software testing certificates, for example, “Unified Automated System of Customs Terminal”, “GTD-PRO”, “Preliminary notification client”, “Electronic information submission monitor”, “Expert PI”, “Feanor”, “VED-Declarant”, etc. A complete list of programs acceptable for use is posted on the website of the Federal Customs Service.

When importing into Russia, you must pay customs duties and fees, VAT, and other payments depending on the product. Duty-free import; for cargo worth up to 200 euros.

For individuals

A citizen registers goods transported in accompanied or unaccompanied baggage at a checkpoint or at a customs post. The submission of a passenger customs declaration is carried out by him personally or through a customs broker with whom an agreement is concluded.

Cargo is exported without paying duty. What can be imported duty-free and for how long is determined by the decision of the EAEU Council dated December 20, 2017 No. 107, which discloses issues related to goods for personal use.

The obligation to place products under the customs procedure is determined by Art. 128 Labor Code of the EAEU.

Rules for transportation and clearance of customs cargo within the allotted time limits

Like many processes in which certain government agencies are involved, the activities in question are implemented in accordance with fairly strict and compressed time regulations. All instructions regarding the issue of urgency of certain procedures are also spelled out in the Labor Code of the Customs Union:

- If all inspection work was carried out successfully, the declarant receives about one day for physical transportation. The countdown begins from the moment of official registration of the relevant papers by FCS employees.

- If temporary storage is necessary, the owner of the parcel can leave it in the border control area for a maximum of two months. This provision is spelled out in Art. 170 Labor Code of the Russian Federation. In addition, this framework can be extended up to 180 days, by decision of the responsible persons.

- In Art. 185 of the government regulation in question states that until the end of the savings period, its owner must also start filling out and submitting new declaration forms.

Questions about how goods pass through customs (definitions and rules for processing customs documents) are established by various states based on the legal norms existing on their territory. The presented deadlines are typical for the Russian Federation in mid-2021: after some time, regulations may change due to one reason or another.

The tasks of passing border control do not appear before an entrepreneur at the very beginning of his commercial journey. Before the described procedures are completed, a huge number of, for example, local accounting events take place at the production bases of the supplier itself.

To automate many types of such work, you can use specialized software. The functionality of the Russian application “Warehouse 15” allows you to facilitate the work of stores, institutions and organizations working in the field of e-commerce.

General rules for all customs procedures

There are a number of provisions for carrying out customs procedures that are mandatory for all applicants and declarants (individuals and legal entities, entrepreneurs):

- Compliance with prohibitions and restrictions on the import and export of products;

- Permitting procedure for the release of goods in accordance with the declared customs procedure;

- Mandatory norms and rules approved for the selected customs regime;

- The right to choose a suitable customs procedure by the declarant and change it;

- The duty of the declarant to confirm his compliance with the conditions for placing the cargo under the customs regime;

- Responsibility of the declarant for violation of the conditions and requirements of the procedure.

General provisions for the legal regulation of customs procedures are given in Chapter 26 of the Federal Law “On Customs Regulation”.

The procedure for customs clearance of goods

The rules for crossing the border between states with cargo provide for the passage of 4 stages:

- Customs clearance - obtaining permission to export from the country.

- Transportation of cargo shipments across the border.

- Arrival at the customs point in the country of destination.

- Customs clearance – obtaining permission to import goods into the country.

Stage 1

To obtain permission to export cargo from the country, you must:

- fill out declaration documentation and make an oral declaration of cargo;

- go through the cargo inspection procedure;

- calculate the state duty;

- pay customs duties;

- get permission.

By declaring goods, the objects contained in the transported parcel are listed. If an incomplete set of documents is provided or if there are errors in the declaration, the cargo will not be allowed to be sent through the border checkpoint. The goods will be temporarily moved to the warehouse so that the sender has the opportunity to correct the shortcomings.

IMPORTANT! If one of the items of transported goods is not mentioned in the declaration, such goods are considered contraband and may be arrested, followed by confiscation and possible destruction. For the carrier, such a mistake can result in administrative and criminal liability.

When inspecting cargo, customs officials check the data in the declaration with the actual availability of the transported products. Opening of the packaging material can only be initiated if there is a suspicion that the transportation operation is illegal (due to the possible presence of prohibited goods in the parcel).

The next step is to calculate the duty. Its amount depends on the volume of cargo, the number of goods and the assigned classification code of the Commodity Nomenclature of Foreign Economic Activity. Customs officers check the correct classification of products and, if necessary, independently group items in the cargo according to code characteristics. After this, you can pay the duty and present supporting payment documents to the customs officers. The completion of the procedure will be the issuance of an export permit to the carrier.

NOTE! If there is a suspicion that the value of the cargo is undervalued, customs officials may request documents confirming the value of the goods in the declared amount. The submitted documentation, if necessary, can be verified for authenticity through official requests to regulatory authorities.

Stage 2

To transport goods across the border, the transported goods are packaged and sealed. The seals must bear marks from the customs authority that issued the permit.

Stage 3 and 4

Arriving at the destination country with goods requires obtaining permission to import the goods from the receiving party. The documentation procedure is similar to customs clearance: declarations are filled out, state duties are calculated and paid, and permitting documentation is obtained.

NUANCE! If additional questions arise regarding documentation or cargo when transporting animals, the animals themselves will be moved not to a temporary storage warehouse, but to a specialized nursery.

How to correctly determine the customs procedure

The procedure for moving cargo across the border, the amount of customs duties and taxes, and the need/possibility of using non-tariff regulatory measures depend on the chosen customs procedure. The regime establishes requirements for the product, variations in its use, the rights and obligations of the cargo owner, and allows saving resources for participants in foreign trade activities. Therefore, the declarant must think through everything before placing the product under the customs procedure.

To determine the appropriate mode, you need to consider the following information about the product:

- Features of movement: import or export;

- Place of production (imported or manufactured directly on the territory of one of the EAEU countries);

- Terms of purchase of goods;

- Import and export period;

- Purpose of movement (sale, rent, participation in an exhibition, etc.);

- Possibility of further use of products.

Let's say an enterprise imports expensive equipment to Russia for testing in production. To save on import duties, it is recommended to use the temporary import procedure rather than import.

Similarly, to participate in a foreign exhibition, you need to arrange for the temporary export of exhibits and equipment. If export is processed after the event, you will need to pay import duties when moving samples back across the border.

Thus, the correct choice of customs procedure saves money and time.

More information about the content of customs procedures, the procedure and conditions for their use can be found in Chapter. 19 EAEU Labor Code.

The procedure for customs control and what it is

All inspection and inspection complexes operating in the Russian Federation operate in accordance with adopted government regulations. In normative and legal acts, in addition to the conceptual apparatus defining the supervisory authorities of the executive branch, a set of clear instructions is presented, in accordance with which FCS specialists must carry out certain interventions.

Thus, the regulations of activity vary exclusively in the format of a strictly defined framework, and when implementing it, employees of the guard services are guided by previously created instructions. The technology of customs control is the stages, concepts, principles and procedure for implementing the relevant activities outlined by government documentation. Operations that typically take place on site include:

- oral survey;

- requesting paper and digital evidence;

- appointment of examination;

- accompaniment;

- establishing a specific route;

- product accounting;

- observation;

- checking the certification registration system, etc.

Of course, the issue of transporting goods across the border is an extremely important aspect that requires the most detailed consideration. However, entrepreneurs who have the status of participants in foreign economic trade activities constantly face a huge number of other tasks of varying levels of complexity.

To automate business processes in 2021, it is customary to use specialized software, for example, the Warehouse 15 service from the Russian brand Cleverence. The company, which has been developing specialized software for the last fifteen years, is a reliable supplier of solutions for organizations, institutions, transport zones, chain stores, e-commerce companies, etc.

Types of customs procedures

On the territory of the EAEU countries, it is customary to divide 17 types of customs procedures into four groups. Brokers of our company are professionals in their field and will select the most beneficial mode for the foreign trade participant for the import or export of cargo. Let's take a closer look at the types of customs procedures.

Basic customs procedures

When declaring goods within the framework of this procedure, duties and other customs payments must be paid, and prohibitions and restrictions for import and export are observed.

Release for domestic consumption

After customs clearance, such goods acquire the status of products of EAEU countries. They can be freely sold, exchanged, and used. In addition to import, the following goods can be placed under this customs procedure:

- Processed products exported under the re-export regime;

- Temporarily exported vehicles engaged in international transportation and placed under the processing regime outside the customs territory.

Products from the list must be imported back into the EAEU no later than three years after export. Her condition; unchanged except for normal wear and tear. A participant in foreign economic activity may submit information to the customs authority about the circumstances of the export accompanied by supporting documents. And the last condition; the product is subject to identification.

Export

Export is permitted after payment of export duties, taking into account benefits and preferences. After export, goods lose their status as EAEU cargo and are sold abroad.

Customs transit

The procedure is used for transporting goods across the territory of the EAEU countries, including crossing the borders of states that are not members of the Union. The cargo owner pays import customs, special, anti-dumping and countervailing duties and taxes. The goods must meet a number of conditions: be identifiable, transported by transport in a sealed form. Transit transportation of prohibited goods is not permitted.

Economic procedures

Economic customs procedures are characterized by the presence of economic significance and justification, connection with the international division of labor, attraction of investments, creation of new opportunities for the development of production capacities, targeted nature of the operation, that is, the use of goods for strictly defined purposes. The user of the customs procedure has the opportunity to take advantage of all economic preferences and benefits, including tax ones.

Processing in customs territory

Used for goods that will be processed or processed in the territory of the EAEU countries. Also processed products are products obtained as a result of installation, assembly, disassembly and adjustment work. Equipment that is imported for the purpose of restoration, replacement of parts, or modernization can be placed under this regime.

The procedure cannot be used for undenatured ethyl alcohol, acyclic alcohol, or biodiesel.

Processing outside the customs territory

The condition for placing goods under this customs operation is the possibility of their identification after processing. The period of temporary export for the manufacture of products by assembly, installation, restoration, etc. outside the territory of the Union countries should not be more than two years.

Processing for domestic consumption

The list of products that can be placed under this customs procedure is approved by Decree of the Government of the Russian Federation dated July 12, 2011 No. 565. It includes anode powder, pigments, glass mufflers, paints, electrolyte, membrane paper, synthetic rubber, brake pad linings, non-return valves for boilers, gearboxes, etc.

bonded warehouse

This customs procedure can be applied to goods whose shelf life is more than six months. The presence of cargo in a customs warehouse or other authorized place cannot exceed two years.

This mode cannot be used for compounds and products containing radioactive isotopes, explosives, ammunition, military equipment and equipment.

Temporary import (admission)

It is permissible to place cargo under this customs procedure if the goods can be identified and the conditions for the temporary location of the cargo, prohibitions and restrictions are met. In some cases, it is necessary to partially pay import duties. The period of temporary import is limited to two years.

You cannot use the temporary import regime to declare food products, drinks, consumables, or product samples. Exception; presentation at exhibitions, advertising shooting and other demonstration purposes.

Free warehouse

Goods placed under the free warehouse procedure are used in a limited range. They can be stored, unloaded, loaded, prepared for transportation and sale (packed, packaged, sorted, labeled), assembled, disassembled, assembled, repaired, maintained, taken samples. If these are machines and equipment, then they are used for goods processing operations.

By decision of the EAEU Council dated April 29, 2019 No. 45, it is prohibited to place imported white sugar under the procedure of a free warehouse and a free customs zone.

Final procedures

They assume the end of customs control under previously open procedures. They are not primary; they cannot be declared as an independent operation. Customs duties are not paid during final customs procedures.

Re-export

Used for customs clearance of imports already located on the territory of the state; member of the EAEU, including goods placed under the customs procedure. The re-export regime also applies to the following cargo:

- Processed products, generated waste and residues, if the operation was carried out in the EAEU country;

- Waste and residues after processing of goods for sale within the EAEU;

- New imported product, created in a free customs zone, free warehouse;

- EAEU products released for the domestic market, but not sold due to the counterparty’s failure to fulfill the terms of the transaction.

Products placed under the release procedure for domestic consumption can be cleared through customs under the re-export scheme no later than one year after submitting the release declaration.

Re-import

The scheme is used to complete customs clearance of goods for which the customs procedure of export, processing outside the customs territory, and temporary export was previously applied. Re-import is allowed within three years after the actual export of products from the territory of the EAEU. The goods must be in unaltered condition. If taxes were not paid upon export, they are subject to reimbursement.

Destruction

Produced in order to comply with the prohibitions and restrictions established by the customs code. Products are destroyed in whole or in part until they lose their consumer properties and cannot be restored.

Cultural and historical values, protected species of animals and plants, pledged, seized, seized goods, and material evidence cannot be placed under the customs destruction procedure. Also, the operation is not carried out in case of harm to the environment, people, or the need to allocate significant budgetary funds for the destruction of goods.

Refusal in favor of the state

Allowed for goods with an unexpired shelf life that complies with the technical regulations of the Customs Union. The permit is issued by the head of customs based on the application of the declarant.

The procedure for placing a person under the refusal procedure in favor of the state is regulated by Order of the Federal Customs Service of the Russian Federation dated February 21, 2011 No. 357.

Special customs procedures

Typical for some situations when it is possible to take advantage of preferential taxation.

Temporary removal

Can be applied to equipment, vehicles, and other cargo. Condition; temporarily exported goods must be brought back unchanged, with the possibility of identification. Repair, maintenance, and modernization of products are allowed.

You cannot use the customs procedure for temporary export in relation to food, drinks, including alcohol, cigarettes, consumables, samples, raw materials, semi-finished products and waste.

Special customs procedure

This customs regime is often used by diplomatic missions, scientific, sports, cultural, and military organizations under the jurisdiction of the Russian government. The procedure applies to goods to support the activities of diplomatic missions, consulates, as well as weapons, military equipment, and ammunition.

Vehicles for emergency prevention and response, humanitarian aid, medicines, sports nutrition, equipment, equipment, dietary supplements are not subject to duties.

Free trade

It is used in international departure areas at airports, seaports, as well as at other customs points. Buyers of such goods in duty-free stores can be all individuals leaving the EAEU country, arriving in it, or moving between the states of the Union.

Free customs zone

Goods for the free economic zone are subject to customs clearance under this scheme: those used by FEZ residents to conduct business.

Timing of the procedure

One of the main points in the entire definition of customs inspection is the time frame available to the control authorities to carry out their immediate responsibilities. This fundamental parameter is established by many regulatory documents, with confirmation provided in the Customs Code.

The size of the minute interval during which the post employees will be engaged in the implementation of the complex of the mentioned operations depends on many indicators. For example, the chosen form of control, category of products, method of transportation, type of transport used for movement, etc.

The procedures, transit times, concepts and principles of customs control of goods are briefly described in many legal regulations. Thus, Article 132 of the Labor Code establishes a standard according to which on-site processes can be organized within a maximum of two months. Paragraph 7 of Article 96 works in a similar way: according to this certificate, the maximum period of inspection in the post format should not exceed two hours.

These are the rules that entrepreneurs engaged in foreign trade activities should be guided by. However, generally accepted guidelines also contain a set of exceptions that allow for the expansion of departmental powers in terms of the time frame for inspection operations. Article 196 contains an information block that states that the shipment can be left at the surveillance point for as long as 10 days.

Time limits for placing goods under the customs procedure

The term for placing goods under the customs procedure means a limited period of time for which the declarant places the cargo under the selected regime, providing a product declaration for this.

This period depends on the type of customs procedure and can be extended by decision of the customs authority. For example, it can take up to four months to release goods for domestic consumption, the maximum period for customs transit is limited to 2 thousand kilometers per month, and for re-export the maximum period is two years.

The terms for placing goods under the customs procedure are determined in the EAEU Customs Code or by decisions of the commission, depending on the type of regime.

Rules and features of registration of foreign trade participants under the procedure of release for domestic consumption

The registration procedure for release for domestic consumption is carried out for individuals on the basis of the Decision of the EEC Council No. 107, issued on December 20, 2017.

According to this document, such persons can complete this procedure without paying taxes, duties and other fees in relation to goods intended for personal use. These can be personal items when moving internationally from abroad to permanent residence (permanent residence) or goods purchased in stores, markets, on the Internet, etc. Products can be either new or used (used). Moreover, their quantity is strictly limited depending on the type of transport and the type of product itself. When releasing for domestic consumption, some goods will require payment of customs duties. A list of them is also included in this Decision. In addition, there are rates established by law for customs duties in relation to cars and other vehicles of individuals. The amount of such fees is calculated depending on the year of manufacture and power of the vehicle. Goods not intended for personal use, recognized as a commercial consignment, cannot be placed under this procedure under any circumstances.

Issue for internal consumption for legal entities and individual entrepreneurs is carried out according to an almost identical algorithm. The main condition for performing this procedure is the payment of all necessary fees in full and the availability of all documents established by law. In addition, restrictions and prohibitions for certain goods and their groups must be observed.

Cost of customs clearance services

How much it costs to complete a customs procedure depends on the selected mode, name and characteristics of the cargo. Contact our company: we will help you choose the most advantageous customs procedure, fill out a declaration, calculate mandatory payments, and perform other actions for smooth customs control.

Reliable, competent broker; your key to successful foreign economic activity.

Customs control zones (CZZ)

This term refers to a certain, strictly delineated territory on which the inspection and inspection complex is located. The regulations for the work and presence of such structural divisions of executive authorities are prescribed in Art. 97 TK TS. All currently existing objects of this format are classified according to different criteria:

- location;

- duration of existence;

- level of authority, etc.

Such institutions are classic, standard posts, working according to well-known rules established by the state.

As mentioned earlier, customs control is not carried out by authorities in relation to persons who are heads of state of the Customs Union, as well as representatives of their families. All other citizens and foreigners at checkpoints will be subject to inspection. Number of impressions: 3781

Required documents

When obtaining permits for the export and import of goods from one country to another, you must have with you the registration and statutory documentation of the company that is the owner of the contents of the parcel (if the sender is a legal entity). Such documents may include:

- charter;

- certificate confirming state registration as a legal entity;

- a certificate with details of a current account at a banking institution.

Additionally, an agreement between the sender and the recipient regarding the cargo being processed will be required. An invoice, waybills, and specifications are attached to it. If the products included in the cargo belong to the group of goods subject to certification, you must present the appropriate certificate or license. If you have cargo insurance, customs officers will need an insurance agreement.

After paying the fee, payment receipts and checks are added to the set of documents. When entrusting the customs clearance procedure to a third party, a power of attorney must be drawn up for him. Additionally, they may request safety certificates and documents confirming the product’s compliance with hygiene standards. Individuals are required to carry personal identification documents.

Preparation for registration

It begins even before the cargo arrives at the border. In order for it to be processed as quickly as possible, it is important to prepare the documents correctly. They are checked, requested or the missing papers are filled out. For customs clearance you may need the following types of documents:

- accompanying cargo associated with it: invoice or invoice, certificate of origin, packing list and others;

- related to transportation: invoice for transportation and insurance, CMR bill of lading, customs transit document, export declaration and others;

- related to the transaction: contract with the supplier, documents on payment for goods;

- permits: certificates of conformity, licenses, phytosanitary and other certificates;

- other documents: agreement with an agent or broker, documents on the technical characteristics of imported goods, etc.

Even before the start of registration, you need to determine the HS code and the customs value of the cargo. Classification according to the Commodity Nomenclature of Foreign Economic Activity is carried out to determine duty rates, the amount of VAT, the presence of benefits or additional requirements for customs clearance of goods. When classified, it is assigned to a specific product category, and it is important to determine it as accurately and unambiguously as possible, so that customs cannot challenge it. The customs value is calculated as the transaction price summed up with transport, insurance and some other expenses that the importer incurred before the cargo arrived at customs. This cost is the basis, the base from which mandatory payments are calculated. Knowing the HS code and the customs value of the goods, you can calculate in advance the approximate amount of fees, duties and taxes.

Before the cargo arrives at the terminal, you need to check the balance of the importer’s single personal account in the FCS system. The balance is replenished in advance so that its balance is enough to make mandatory payments, taking into account possible fluctuations in exchange rates.