Transportation

Specify the terms of delivery of goods to our country in the contract, because this is one of the key points. If the seller takes delivery responsibilities upon himself, then you don’t have to think about how the goods will get to you. But if, according to the contract, the buyer himself is responsible for the delivery of goods, then you will need the services of logisticians. Choose the delivery methods yourself and evaluate which one will be most profitable for you:

- delivery by plane - fast, but expensive;

- By train it’s cheaper, but you’ll have to wait about a month.

We determine the customs value of the goods

All customs payments must be made before the start of the customs clearance procedure for the goods.

Customs duties are calculated based on the customs value of the imported goods. Customs value can be determined by several methods. We will consider the main one - the assessment of the value of a transaction with imported goods. You can read about other methods in Chapter 5 of the Customs Code of the Eurasian Economic Union.

The customs value is equal to the contract price, i.e. the amount you pay for your order. In addition, additional costs are included in the customs value if they were not taken into account in the contract price:

- Your expenses for the broker's remuneration, the cost of containers and packaging.

- License and other payments for the use of intellectual property (trademarks, copyrights, etc.)

- The amount of the seller's profit, if under the contract part of the profit you receive is returned to the foreign seller.

- The cost of transportation to the place of arrival in the customs territory of the Russian Federation, if it was not included in the transaction price. As well as the cost of containers for transporting goods, loading and unloading, if you used several vehicles for delivery.

- Costs for insurance of delivery of goods.

Additional charges to the transaction price are calculated only on the basis of officially executed documents if they are fully paid by the buyer. Your costs for delivery of goods after import into the customs territory, costs for assembly, installation, and maintenance are not included in the customs value.

Let's look at what customs duties you have to pay when importing goods from abroad.

Import duty

The rates of customs duties on imports are determined in the Unified Customs Tariff of the Customs Union. It indicates the rates of customs duties as a percentage of the customs value of the goods or in euros per unit of imported goods. Also, the bet size can consist of two parts, then it is calculated by comparison or addition of values.

For example, you purchased school bags for your store, the import customs duty rate is 12.5% of the customs value (group 42 in the Unified Customs Tariff). If, for example, you have a furniture store and you purchased kitchen furniture, then the customs duty is calculated at a rate of 12.5%, but not less than 0.29 euros per 1 kg (group 94).

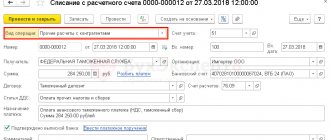

Informing about payment of customs duties

carries out customs clearance of express cargo on the basis of Order of the Federal Customs Service of Russia dated July 5, 2021 No. 1060.

In accordance with paragraph 14 of paragraph 1 of the Order of the Federal Customs Service of Russia dated January 31, 2020 No. 112 “On amendments to the Order of the Federal Customs Service of Russia dated July 5, 2018 No. 1060”, amending paragraph 38 of the Order of the Federal Customs Service of Russia dated July 5 2018 No. 1060 “Clause 38 Customs duties and taxes in relation to goods for personal use are paid by the customs representative and on behalf of the individual who purchases the goods by means of disposing of advance payments.”

Payment of customs duties was carried out by TANAIS JSC in the Personal Account of an individual on the website https://tanais.express/. Upon receiving information about an order from a foreign online store (AliExpress, Pandao, iHerb, ASOS, UsPolo and others) to carry out the customs clearance procedure, TANAIS JSC sends an SMS notification to the individual with access to the Personal Account to make customs payments.

In accordance with Art. 266 of the EAEU Labor Code, in relation to goods for personal use imported into the customs territory of the Union, customs duties and taxes levied at uniform rates, or customs duties and taxes levied in the form of an aggregate customs payment are subject to payment. Thus, the amount of customs duties issued for payment consists of the following components:

| No. | Customs payments | Size | Base |

| 1 | Customs duty | Calculated at the rate of the Central Bank of the Russian Federation on the date of payment in the Personal Account https://tanais.express/ in the amount of 15% of the excess cost of express cargo (>200 euros), but not less than 2 euros per 1 kg in terms of excess cost or weight norms. | Decision of the Council of the Eurasian Economic Commission No. 107 of December 20, 2017 “On certain issues related to goods for personal use”, in accordance with which uniform rates of customs duties and taxes are given, as well as categories of goods for personal use in respect of which payment of customs duties and taxes levied in the form of a total customs payment. |

| 2 | customs duty | 250 rubles (for goods for personal use not used for business activities). | Clause 4 of the Decree of the Government of the Russian Federation No. 863 of December 28, 2004 “On the rates of customs duties for customs operations” “When performing customs operations in relation to goods imported into the Russian Federation and exported from the Russian Federation by individuals for personal, family, household and other needs not related to entrepreneurial activity (including goods sent to an individual not traveling across the border of the Russian Federation), with the exception of passenger cars classified in heading 8703 of the unified Commodity Nomenclature for Foreign Economic Activity of the Customs Union, customs duties for customs operations are paid in the amount of 250 rubles.” |

| 3 | Service fee | Includes the commission of the payment service operator JSC TANAIS in the amount of 5% of the amount of customs duties, as well as the commission of the acquiring bank. | Based on the agreement concluded between JSC TANAIS and PJSC Promsvyazbank “On cooperation in carrying out transactions for paying for goods/works/services via the Internet using payment cards,” the bank charges JSC TANAIS a commission for conducting settlements with payment systems and cardholders for transactions of payment for goods/works/services through the online store. |

Thus, you are informed and give TANAIS JSC your consent to pay customs duties on your behalf in favor of the Federal Customs Service of Russia in case of exceeding the limits on the amount or weight of the order for the purpose of carrying out customs clearance procedures for express cargo.

Customs duties

There are three types of customs duties:

- For customs operations. This fee must be paid before customs clearance of goods. The rates are established by Decree of the Government of the Russian Federation of December 28, 2004 N 863.

- For customs escort. This fee is paid before the goods are escorted. The decision on customs escort is made by the customs authority in cases where customs duties have not been paid or the delivery of goods has certain risks. The size is given in Decree of the Government of the Russian Federation No. 1082 of November 11, 2018.

- For storage. You can place goods in a temporary storage warehouse without applying for customs treatment. There, your order will wait for customs clearance while you prepare documents for declaration. The amount of the storage fee is given in Decree of the Government of the Russian Federation No. 1082 of September 11, 2021.