Checking the customs declaration includes two stages. First, it occurs before the document is transferred to employees of the Federal Customs Service (FCS) of the Russian Federation. After the declaration has been accepted by customs, it is assigned an individual number. The authenticity of this number can be checked on government services. Through it you can find out about the number of goods exported or imported, as well as the name of the customs post.

If the seller has never had to fill out a customs declaration before and is afraid that he will enter information incorrectly into it, he can turn to lawyers for help. They are familiar with the requirements of the Federal Customs Service of the Russian Federation and will help participants in foreign economic activity (FEA) quickly understand the formalities.

Do you want to figure it out, but don’t have time to read the article? Lawyers will help

Entrust the task to professionals. Lawyers will complete the order at the cost you specify

Solve the issue >

The essence of the customs procedure for re-export

Re-export is a forced measure that involves the return transportation of previously imported foreign goods.

will be of interest to foreign trade participants who wish to export products in a simplified form, without tax burden, for which there are difficulties with registration or for the purpose of further resale outside the Russian Federation. We outsource operations to support foreign trade activities, including re-export and re-import procedures on the most favorable terms. Proper organization of trade between countries allows you to receive more profit from concluded transactions. The concept of re-export is considered a customs procedure that involves the export of goods (foreign) already imported from another country without paying customs duties or with their return. Some foreign trade participants are forced to return goods to the supplier for a number of reasons:

- due to non-compliance with the declared characteristics (detected defect);

- in order to change delivery data in accompanying documents;

- for partial processing (repackaging), but not processing;

- if a Russian company acts as an intermediary for the resale of goods in other countries.

The procedure is aimed at increasing business efficiency by optimizing trade flow patterns between foreign partners.

Sometimes it is necessary to return the goods after customs clearance and payment of all fees. In such a situation, re-export allows you to arrange the return of goods without additional payments and sanctions and receive one hundred percent compensation. Re-export for any of the parties is a profitable economic process, as it allows not only to return defective cargo, but also to correct errors in documents, and then re-import the goods to their destination through the territory of the EAEU.

The re-export registration process is regulated by Article 297 of the EAEU Labor Code.

The customs code specifies all possible situations when legitimate cargo is allowed to be placed under re-export. Unfortunately, not in every situation it is possible to notice an error in the documents and return previously imported goods. The procedure is regulated by strict rules and regulations of the law, which helps protect the country from the import of low-quality products, as well as avoid errors in the accompanying documentation.

The re-export procedure includes the following categories of goods:

- The entire range of products for domestic consumption, if they do not comply with the characteristics included in the accompanying documents (composition, physical properties, dimensions, etc.). Defective goods can be returned to be replaced with a suitable one.

- Products subject to non-tariff regulation. Essentially, these are goods for which transportation rules have been violated or they differ from their original condition.

- Products involved in tripartite transactions. If Russian entrepreneurs, at the request of foreign partners, purchase goods for their further sale outside the Russian Federation.

Examples of re-export

- Purchase of natural energy resources (oil, gas), some types of raw materials (leather, fabrics), food products.

- There is no certificate due to the product’s non-compliance with phytosanitary standards.

- The supplier shipped a batch in which each item of goods does not meet the customer’s expectations (wrong style of clothing, wrong materials, sizes, colors).

- The batch turned out to be defective.

When is the re-import procedure applied?

Re-import

— a customs procedure during which goods or consignments are imported into the territory of the Customs Union. Moreover, these goods had already undergone the procedure of export from the same territory. Goods may be subject to re-import regime if the following conditions are met:

- products were previously exported across the border of the Russian Federation subject to all rules and conditions;

- before the time of export, the products must be manufactured in Russia or, if they are of foreign origin, be in free circulation;

- no more than 10 years have passed since the export of such goods;

- basic consumer properties and characteristics must be preserved (natural wear and tear is not taken into account).

Expired products, items of historical significance not sold at international auctions, and rejected goods are subject to the re-import regime

.

However, it is worth emphasizing that goods exported from the country for interstate events

have

nothing

to

do with

such

a regime

.

If the three-year period has not expired from the date of export of the consignments, then the customs service of the Russian Federation will reimburse previously paid export payments.

Types and features of re-export

Conventionally, re-export can be divided into 2 types:

- Direct - implies passing all formalities at customs with import into the country and further export with a refund of customs duties in full.

- Indirect - the transaction is concluded with the participation of a Russian representative of foreign trade activities, but the goods do not enter the territory of the country, remaining in the customs control zone.

- The indirect type of movement is more preferable, as it allows you to bypass the tax burden and reduce transportation costs.

You can return foreign products even after they have entered free circulation. The importer can easily recall products from sale and compensate for damages if the goods are defective, expired, or obvious inconsistencies with the declared characteristics are revealed during the sales process.

There are also forced and deliberate re-exports:

- When forced to re-export products, the foreign trade participant did not assume that there would be a need to return the goods. During customs clearance, all import duties were paid, but the goods turned out to be defective. Return of goods is possible only if a number of conditions are met: mandatory inspection upon import and reverse inspection upon export. In this case, all payments, except for customs duties, will be compensated to the importer in full.

- Intentional re-export presupposes in advance that the imported goods will be exported. For example, if it is necessary to carry out warranty service for equipment or specialized equipment.

If you forced or deliberately decided to place goods under the re-export procedure, use. We competently and promptly carry out even the most complex tasks of supporting foreign trade activities.

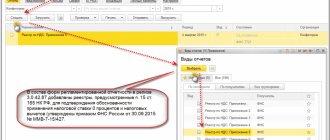

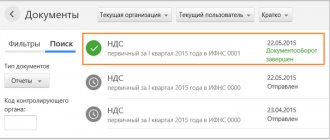

Error 2: the company confirms the zero rate with the wrong registers

There are 14 registers that can be used to confirm the zero VAT rate depending on the type of transaction (Order of the Federal Tax Service of Russia dated September 30, 2015 No. ММВ-7-15/427).

From April 2021, two more registers will appear to confirm the following transactions:

- if goods are sent by international mail;

- if the customs declaration of goods uses a goods declaration for express cargo.

The order of the Federal Tax Service, which approves the form and format of these documents, has been adopted, but has not yet been published.

It is difficult to navigate in such abundance, and taxpayers often choose a register that does not correspond to the completed transaction.

To reduce such errors, we have developed a table by which you can compare the name of the registry with the corresponding transaction codes. Let us remind you: the meanings of transaction codes are reflected in Appendix No. 4 to the Procedure for filling out a VAT return (approved by Order of the Federal Tax Service dated October 29, 2014 No. ММВ-7-3 / [email protected] ).

| No. | Registry name | KND | Regulatory document | Transaction codes used in the registry |

| 1 | Register of customs declarations (full customs declarations) provided for in subparagraphs 3 and 5 of paragraph 1, subparagraph 3 of paragraph 3.2, subparagraph 3 of paragraph 3.3, subparagraph 3 of paragraph 3.6, subparagraph 3 of paragraph 4 of Article 165 of the Tax Code of the Russian Federation | 1155110 | Form - Appendix No. 1 to the Order of the Federal Tax Service of Russia dated September 30, 2015 No. ММВ-7-15/427, format - Appendix No. 16 to the Order of the Federal Tax Service of Russia dated September 30, 2015 No. ММВ-7-15/427 | 1010410 1010428 1010429 1010431 1010434 1010439 1010452 1010453 1010456 1010457 1010458 1010459 1010460 1010470 1010471 1010472 1010473 1010474 1010475 1010476 1010477 1010478 1010479 1010480 1010481 1010485 1010486 1010487 1011410 1011412 1011422 1011424 1011425 1011426 |

| 2 | Register of documents confirming the provision of services for the transportation of oil and petroleum products by pipeline transport, provided for in subclause 3 of clause 3.2 of Article 165 of the Tax Code of the Russian Federation | 1155119 | Form - Appendix No. 2 to Order of the Federal Tax Service of Russia dated September 30, 2015 No. ММВ-7-15/427, format - Appendix No. 17 to Order of the Federal Tax Service of Russia dated September 30, 2015 No. ММВ-7-15/427 | 1010430 1010454 |

| 3 | Register of documents confirming the provision of services for organizing transportation (transportation services in the case of import into the territory of the Russian Federation) of natural gas by pipeline transport, provided for in subparagraph 3 of paragraph 3.3 of Article 165 of the Tax Code of the Russian Federation | 1155121 | Form - Appendix No. 3 to the Order of the Federal Tax Service of Russia dated September 30, 2015 No. ММВ-7-15/427, format - Appendix No. 18 to the Order of the Federal Tax Service of Russia dated September 30, 2015 No. ММВ-7-15/427 | 1010431 |

| 4 | Register of complete customs declarations or documents confirming the provision of services for the transportation of oil and petroleum products by pipeline transport, as well as transport, shipping and (or) other documents provided for in subparagraphs 3 and 4 of paragraph 3.2 of Article 165 of the Tax Code of the Russian Federation | 1155120 | Form - Appendix No. 4 to Order of the Federal Tax Service of Russia dated September 30, 2015 No. ММВ-7-15/427, format - Appendix No. 19 to Order of the Federal Tax Service of Russia dated September 30, 2015 No. ММВ-7-15/427 | 1010428 1010429 1010452 1010453 1010470 1010471 1010472 1010473 1010474 1010475 1010476 1010477 1010478 1010479 1010480 1010481 |

| 5 | Register of customs declarations (full customs declarations), as well as transport, shipping and (or) other documents provided for in subparagraphs 3 and 4 of paragraph 1 (except for the cases provided for in paragraph five of subparagraph 3, paragraph eight of subparagraph 4 of paragraph 1), subparagraphs 3 and 4 paragraphs 3.6, subparagraphs 3 and 4 paragraph 4 of Article 165 of the Tax Code of the Russian Federation | 1155111 | Form - Appendix No. 5 to the Order of the Federal Tax Service of Russia dated September 30, 2015 No. ММВ-7-15/427, format - Appendix No. 20 to the Order of the Federal Tax Service of Russia dated September 30, 2015 No. ММВ-7-15/427 | 1010410 1010434 1010439 1010456 1010457 1010458 1010459 1010460 1010485 1010486 1010487 1011410 1011412 1011422 1011424 1011425 1011426 |

| 6 | Register of customs declarations (full customs declarations), as well as transport, shipping and (or) other documents provided for in paragraph five of subparagraph 3 and paragraph eight of subparagraph 4 of paragraph 1 of Article 165 of the Tax Code of the Russian Federation | 1155117 | Form - Appendix No. 6 to the Order of the Federal Tax Service of Russia dated September 30, 2015 No. ММВ-7-15/427, format - Appendix No. 21 to the Order of the Federal Tax Service of Russia dated September 30, 2015 No. ММВ-7-15/427 | 1010442 |

| 7 | Register of transport, shipping and (or) other documents provided for in subparagraph 3 of paragraph 3.1 and subparagraph 3 of paragraph 3.7 of Article 165 of the Tax Code of the Russian Federation | 1155112 | Form - Appendix No. 7 to Order of the Federal Tax Service of Russia dated September 30, 2015 No. ММВ-7-15/427, format - Appendix No. 22 to Order of the Federal Tax Service of Russia dated September 30, 2015 No. ММВ-7-15/427 | 1010423 1010424 1010425 1010426 1010427 1010435 1010436 1010467 1010468 1010469 |

| 8 | Register of transport, shipping and (or) other documents provided for in subparagraph 3 of paragraph 3.1 of Article 165 of the Tax Code of the Russian Federation | 1155113 | Form - Appendix No. 8 to the Order of the Federal Tax Service of Russia dated September 30, 2015 No. ММВ-7-15/427, format - Appendix No. 23 to the Order of the Federal Tax Service of Russia dated September 30, 2015 No. ММВ-7-15/427 | 1010423 1010425 1010467 1010468 1010469 |

| 9 | Register of transport, shipping and (or) other documents provided for in subparagraph 3 of paragraph 3.1 of Article 165 of the Tax Code of the Russian Federation | 1155114 | Form - Appendix No. 9 to the Order of the Federal Tax Service of Russia dated September 30, 2015 No. ММВ-7-15/427, format - Appendix No. 24 to the Order of the Federal Tax Service of Russia dated September 30, 2015 No. ММВ-7-15/427 | 1010423 1010425 1010467 1010468 1010469 |

| 10 | Register of transport, shipping and (or) other documents provided for in subparagraph 3 of paragraph 3.1, subparagraph 3 of paragraph 3.5, subparagraph 3 of paragraph 3.8, subparagraph 2 of paragraph 14 of Article 165 of the Tax Code of the Russian Federation | 1155115 | Form - Appendix No. 10 to the Order of the Federal Tax Service of Russia dated September 30, 2015 No. ММВ-7-15/427, format - Appendix No. 25 to the Order of the Federal Tax Service of Russia dated September 30, 2015 No. ММВ-7-15/427 | 1010423 1010425 1010433 1010437 1010451 1010467 1010468 1010469 1010482 1010483 1010484 1011407 1011408 1011409 |

| 11 | Register of transportation documents provided for in paragraph 4.1 of Article 165 of the Tax Code of the Russian Federation | 1155122 | Form - Appendix No. 11 to the Order of the Federal Tax Service of Russia dated September 30, 2015 No. ММВ-7-15/427, format - Appendix No. 26 to the Order of the Federal Tax Service of Russia dated September 30, 2015 No. ММВ-7-15/427 | 1010440 1010441 |

| 12 | Register of transportation, shipping or other documents provided for in paragraph 3.9 of Article 165 of the Tax Code of the Russian Federation | 1155123 | Form - Appendix No. 12 to the Order of the Federal Tax Service of Russia dated September 30, 2015 No. ММВ-7-15/427, format - Appendix No. 27 to the Order of the Federal Tax Service of Russia dated September 30, 2015 No. ММВ-7-15/427 | 1011471 |

| 13 | Register of transportation documents provided for in paragraphs 5 (except for paragraph five) and 5.1 of Article 165 of the Tax Code of the Russian Federation | 1155116 | Form - Appendix No. 13 to the Order of the Federal Tax Service of Russia dated September 30, 2015 No. ММВ-7-15/427, format - Appendix No. 28 to the Order of the Federal Tax Service of Russia dated September 30, 2015 No. ММВ-7-15/427 | 1010439 1010443 1010444 1010445 |

| 14 | Register of transportation documents provided for in paragraph five of paragraph 5, paragraphs 6 and 6.1 of Article 165 of the Tax Code of the Russian Federation | 1155118 | Form - Appendix No. 14 to the Order of the Federal Tax Service of Russia dated September 30, 2015 No. ММВ-7-15/427, format - Appendix No. 29 to the Order of the Federal Tax Service of Russia dated September 30, 2015 No. ММВ-7-15/427 | 1010408 1010455 |

Fill out and send the register of customs declarations via Kontur.Extern

Re-export restrictions

Only products permitted for free circulation can be re-exported goods. Other categories of goods can be imported/exported only under the control of special departments. Restrictions directly depend on the category of goods and the purpose of its movement across the border.

What categories of goods are banned?

- valuable metals, precious and semi-precious stones, jewelry;

- nuclear segment products;

- any types of weapons, including bladed weapons;

- coding, encryption devices;

- the latest software developments;

- rocket and space technology;

- toxic, narcotic substances;

- waste hazardous to the environment (explosive, nuclear);

- some types of medications.

Re-exported goods may not comply with technical regulations, but their uncontrolled import is also prohibited by law. Cargo placed under the procedure is subject to rules and regulations. They must undergo all necessary measures: certification, quarantine supervision, expert control, etc.

Conditions for placing goods under the processing procedure in the customs territory

To be placed under the procedure you must:

- Obtain permission from customs for processing on customs territory. A permit is a document that contains all the necessary information specified by the EAEU Labor Code. It can be issued to any interested person who is a resident of the EAEU member country in which processing is intended to be carried out. If the purpose of placing goods under the customs procedure of processing in the customs territory is repair, then a declaration for goods can become the authorizing document;

- The ability to unambiguously identify imported goods in processed products, except in cases where their replacement with Union goods is provided. For this purpose, the following are used: Seals, stamps, markings, including digital ones;

- Photographs, detailed descriptions, images;

- Comparison of samples or specimens;

- Use of existing markings or applied serial numbers.

This document must indicate the period for processing the goods in the customs territory.

Conditions for re-export

One of the conditions for returning goods is the possibility of its identification by customs authorities. It is necessary to think through this issue in advance, since some categories of products cannot be identified, for example, fresh fruits, vegetables, etc.

Under what conditions can products be subject to re-export?

- The procedure is relevant only for goods of foreign origin.

- The State Customs Committee of the Russian Federation must issue a permit.

- Acceptance by the importer of regulated obligations in the form of a receipt drawn up in the presence of an official.

- Providing a full package of accompanying documents, including invoices, contracts, certificates, declarations, etc.

After completing the procedure, the cargo must leave the Russian Federation within 4 months. During this period, placement in a temporary storage warehouse or placement for transit is allowed, but no later than 3 days from the date of receipt of permits.

What is Import Mode 40?

September 24, 2019

Import regime 40 is a procedure for moving goods that are freely distributed in the countries of the customs union. Simply put, customs import regime 40 implies the import of products or technologies into the territory of Russia without the obligation of reverse re-export, so to speak, for domestic consumption. At the same time, the import of products into the territory of the Russian Federation is regulated by existing customs processes, which are prescribed in the Customs Code of the EAEU and in the legislation of the country participating in the EAEU.

The procedure for registering 40 is a rather complicated process. The main task of this operation is to clear the cargo arriving and crossing customs. As you know, customs clearance of goods is inseparable and one of the most important stages of foreign economic activity. Moreover, import regime 40 has its own characteristics when going through customs clearance, which are as follows:

- goods crossing the borders of countries included in the Customs Union are necessarily subject to one of the customs operations on the basis of the established legislation of the Customs Union and the Russian Federation;

- A prerequisite for the passage of goods is the payment of all required taxes and duties. It is also necessary to adhere to non-tariff controls, prohibitions and restrictions;

- the declarant of goods must be exclusively a representative of the Russian Federation;

- Customs clearance of cargo is permitted only if the imported cargo is in the customs zone or in a warehouse and if the customs office of receipt has closed its delivery;

- on the territory of the Russian Federation, all automobile temporary storage warehouses are commercial, so you should conclude an agreement in advance with the head of the temporary storage warehouse, which will help in the future to avoid problems associated with filing a customs declaration;

- starting from 2014, all operations carried out on the territory of the Russian Federation related to customs clearance are carried out exclusively in electronic form. Therefore, the declarant or Customs representative is required to have an electronic digital signature;

- When declaring for the first time in a new customs zone, employees of this area may require a correctly certified package of constituent documents. This package of documents must contain an original certificate from the bank, documents evidencing the lease of non-residential premises, which indicate the legal address of the declarant;

- the status of imported cargo is subject to change from foreign to Customs Union products. However, responsibility for strict adherence to all requirements for application or instruction falls entirely on the declarant.

It is also worth knowing that there are certain conditions that regulate the placement of goods under import customs operation 40. In this case, the declarant is obliged to:

- Pay all import duties and taxes.

- Comply with non-tariff controls and other existing prohibitions and restrictions related to import or export. It is also necessary to provide existing permits according to the code and import regime.

- Provide documents that confirm payment and compliance with special, protective, anti-dumping or countervailing measures.

Carrying out customs clearance of goods upon import is certainly associated with the collection of various customs duties. In order for the clearance procedure to go quickly, it must be entrusted to professional specialists who will provide a full range of services and take on all issues related to customs clearance.

Customs broker KVT Service makes the ideal accessible.

Call and see for yourself +7

Documenting

Re-export can be carried out only if you have a complete package of documents, subject to compliance with all requirements and standards.

Documents for re-export

- Application from the importer.

- A document explaining the reasons for import and return conditions.

- Complaint to the supplier and his consent to return and replace the goods.

- Checks and receipts for all necessary contributions (if the goods enter the territory of the Russian Federation).

- Documents (import/export contracts) confirming the status of re-export goods.

- Invoices of the parties.

- Declaration.

- Certificate of acceptance of goods of foreign origin.

The possibility of replacing one procedure with another cannot be ruled out.

By outsourcing foreign trade support, you will free yourself from solving complex problems. Only professionals will be able to correctly prepare customs documents and ensure safety when escorting goods to a warehouse or destination.

Error 3: the company sends registers instead of copies of primary documents

There are many registers, but still not all operations can be confirmed by a register or a list of statements. For example, registries have not yet been developed for the following operations:

- services for domestic air transportation of passengers and baggage, provided that the point of departure or destination of passengers and baggage is located in the Kaliningrad region, or provided that the point of departure and (or) destination of passengers and baggage is located in the territory of the Far Eastern Federal District (subclause 4.2 . paragraph 1 of Article 164 of the Tax Code of the Russian Federation);

- services for domestic air transportation of passengers and baggage, provided that the point of departure, the point of destination of passengers and baggage and all intermediate points of the route are located outside the territory of Moscow and the Moscow region (clause 4.3, clause 1 of Article 164 of the Tax Code of the Russian Federation).

The zero rate for such transactions can only be confirmed by copies of primary documents (Article 165 of the Tax Code of the Russian Federation).

Tatyana Panfilova, VAT expert, SKB Kontur

Terms and cost of completing the customs procedure for processing in the customs territory

The processing time in the customs territory is 1 day!

At the same time, the price or cost of clearance - placing goods under the customs procedure for processing in the customs territory in our company is the minimum in the market and depends on the place of customs clearance, the participant in foreign trade activities, the client’s tasks, the quantity and volume of goods processed and many other factors and on average can be For:

- Legal entity or individual entrepreneur – 10,000-22,500 rubles.

We are ready to become a reliable partner at customs!

Documents and information for processing the processing procedure in the customs territory

Our company’s specialists provide assistance in preparing documents and registration - placing them under the processing procedure in the customs territory. Our employees are ready to advise clients on what documents will be required in each specific case.

Documents and information for registration of goods and cargo under the processing procedure in the customs territory (IM 51)

- List of documents for registration of a Legal entity at customs (View)

- List of documents for registration of an individual entrepreneur at customs (View)

- List of documents for registration of the procedure “Processing in the customs territory” (View)

Registration of the customs procedure for processing cargo and goods in the customs territory

Ours is a customs broker and carries out prompt clearance of the customs procedure for processing in the customs territory of any cargo and goods at any customs offices of the Russian Federation:

- At airports

- In seaports

- At railway stations

- At cargo automobile terminals – temporary storage warehouse

- Express postal items

If necessary, we carry out customs clearance of goods in any other customs procedures!

We work with any participants in foreign trade activities:

- Individuals

- Legal entities

- Individual entrepreneurs

We carry out declaration of goods on the basis of a concluded brokerage agreement and a certificate of inclusion in the register of customs representatives. We bear full responsibility to the client and customs.

We will help you declare goods according to the processing procedure in the customs territory!