The term Incoterms refers to a trademark owned by the International Chamber of Commerce.

The ICC procedure presupposes the circumstances of using terminological abbreviations in the field of purchase and sale. The Incoterms 2010 rules are recognized by international governments, legal professionals, and merchants around the world as an explanation of frequently used international trade terms. They operate with the rights and obligations of participants in the process of delivery of goods. The list of Incoterms rules is presented in the form of three-letter abbreviated trade terms that demonstrate commercial experience in the industry of international conclusion and implementation of agreements for the purchase or sale of goods.

C-INCOTERMS 2010

CFR (cost and freight)

CFR means that the seller must pay the costs and freight necessary to deliver the goods to the named destination and the risk of loss or damage to the goods, as well as any additional costs due to events occurring after the goods have been delivered on board the vessel, is transferred from seller to buyer when the goods pass the ship's rail at the shipowners' port.

The CFR term requires the seller to inspect the goods for export. This term can only be used for maritime and inland waterway transport.

CIF (cost, insurance and freight)

CIF means that the seller delivers the goods on board the ship or purchases the goods already delivered.

The risk of loss or damage to the goods passes when the goods are on board the vessel. The seller must enter into a contract and pay the costs and freight necessary to deliver the goods to the named port of destination.

The seller also contracts for insurance coverage against the risk of loss or damage to the goods during transit. The buyer should note that under CIF the seller is required to obtain insurance only for minimum coverage. If the buyer wishes to obtain additional insurance protection, he will need to either make clear arrangements with the seller or make his own additional insurance arrangements.

DIFFERENCE BETWEEN CIF AND CFR

The difference between these two Incoterms is that under CIF the seller must insure the goods, while under Incoterm CFR the buyer bears this responsibility. CFR is used when the buyer chooses to rely on their own insurance company rather than the sellers.

DIFFERENCE BETWEEN CIF, CFR AND FOB (Free to Ship)

Under CIF/CFR agreements, the seller has broader responsibilities as he must arrange and pay for the transport of the goods to a remote location; instead, under FOB, the seller is responsible for delivering the goods cleared for export to the port of departure (usually his home country).

CIP (carriage and insurance paid to)

Under CIP, "Carriage and Insurance Paid to...", the seller delivers the goods to a carrier of his choice and pays for carriage to the named destination agreed between the parties and the government in Incoterms, while the buyer bears all risks and expenses arising after delivery of the goods to the carrier.

When the CIP is an agreed Incoterm, the seller must arrange and pay insurance for transportation (loss or damage to the goods). Such insurance must cover a minimum value of the goods (unlike other arrangements, such as CIF, where the cost of insurance usually exceeds the value of the goods).

The buyer, not the seller, purchases insurance to cover the amount in excess of such minimum value.

The word "carrier" as used in these Incoterms means any company and/or person who, under a contract of carriage, undertakes to provide or purchase transport services by rail, road, air, sea, inland waterway or multimodal transport. If more than one carrier is used to transport goods to their destination, the risk passes from the seller to the buyer because the goods have been delivered to the first carrier.

CPT (carriage paid to)

Under the Incoterm CPT, "Carriage Paid To...", the seller must deliver the goods to the carrier and bears the cost and risk of delivering the goods to the named destination agreed with the buyer and mentioned in the term itself (For example: "Carriage Paid To Madrid, Spain" ).

The risk of damage or loss of goods passes from the seller to the buyer once the goods are delivered to the carrier. On the other hand, the buyer bears the shipping costs to move the goods from the agreed destination to the final destination, if any. Under CPT, the seller is responsible for clearing the goods for export.

This Incoterm can be used regardless of the mode of transport, including multimodal.

DIFFERENCE BETWEEN CIP AND CPT INCOTERMS

CIP is the same as CPT, except that the seller must also provide and pay for insurance against the risk of loss or damage to the goods by the buyer while in transit to the named destination. As for CPT, the term CIP can be used for any mode of transport.

D-INCOTERMS 2010

DAP (DELIVERY TO LOCAL)

Under the Incoterm DAP, which stands for Delivered at Place, the seller is responsible for transporting the goods from the point of origin (its location, warehouse or sub-supplier) to the designated destination ready for unloading. The destination must be defined as clearly as possible to prevent litigation upon delivery.

With DAP terms, the seller bears all risks and expenses until the goods are delivered to the specified location (and is responsible for arranging physical transportation of the goods to that point). The seller, and not the buyer, also bears the costs of unloading the goods at destination, and such costs cannot be reimbursed by the buyer.

Under the DAT, the seller also arranges and pays for export clearing, while the buyer must arrange and pay for import customs, as well as applicable taxes and duties, if applicable. The Delivery to Place incoterm can be agreed upon between the exporter and the importer for any mode of transport such as land, sea, air and rail.

Obligations of the buyer and seller under the terms of the DAP:

| Seller's obligations | Buyer's obligations |

| Provision of goods The seller must deliver the goods, provide a commercial invoice or equivalent electronic document, provide proof of conformity or proof of delivery | Payment The buyer must pay the price of the goods agreed upon in the sales contract. |

| Licenses, Permits and Formalities The Seller must provide export licenses or local permits for the export of goods. | Licenses, Permits and Formalities The Buyer must obtain an export license and an import permit to export goods. |

| Contracts of carriage and insurance Contract of carriage at the expense of the sellers along the usual route to the agreed delivery point | Contracts of carriage and contracts of insurance of carriage without obligations. Insurance contract without obligations |

| Delivery The Seller must deliver the goods unloaded at the agreed time and point. | Acceptance of delivery Accept delivery of goods at the agreed destination |

| Risk transfer. The seller is responsible for the availability of goods as agreed. | Risk transfer. The buyer must bear all risk of loss or damage from the time the goods are delivered at the agreed delivery point. |

| Costs The seller must pay: any costs of main carriage, loading at origin, export clearance at origin | Costs The buyer pays all costs associated with the availability of goods, import duties and taxes, unloading at destination. |

| Notification to the buyer The seller must notify the buyer that the goods have been delivered | Notice to Seller Buyer must indicate time of shipment and port of destination |

| Delivery confirmation, transport document or equivalent electronic message. A document allowing the buyer to pick up the goods at his own expense | Delivery confirmation, transport document or equivalent electronic message. A document allowing the buyer to pick up the goods at his own expense |

| Inspection - Packaging - Labeling The seller must bear the costs of inspection, quality control, measuring, weighing, counting, packaging and labeling of the goods. If a special package is required, the buyer must inform the seller and negotiate additional costs. | Inspection If not required at point of departure, pay for any inspection before shipment |

| Other assistance in obtaining additional information required by the seller | Other assistance in obtaining additional information required by the seller |

DAT (“DELIVERY TO TERMINAL”)

Under the Incoterm DAT, which stands for Delivered to Terminal, the seller clears the goods for export and is responsible for all logistics activities up to the designated Arrival Terminal. Such a terminal can be an embankment, a warehouse, a container yard or any railway, air or road (for example, an airport).

The seller must deliver the goods to the buyer or buyer's agent unloaded at a named terminal whose name must be properly indicated (for example, "DAT Kuwait Airport" and not "DAT Kuwait"). The DAT incoterm can be used for any type of transport, land, air, sea, rail - if a specific terminal can be specified in the contract.

Despite its wide range of potential applications, Incoterm DAT was specifically designed for delivery to airport and seaport terminals.

The seller arranges and pays for transportation of the goods from departure to the airport terminal or container yard at the port of arrival, while the buyer must pick up the goods at the named terminal, arrange and pay for customs clearance activities, applicable taxes and duties, and move the goods from the terminal to the final receiving point ( e.g. project site).

DDP (“Delivered Duty Paid”)

Under Incoterm DDU, which stands for Duty on Delivery Payment, the supplier arranges and pays for transportation, export/import customs clearance, applicable taxes, duties and charges applicable on export/import from the point of departure to the destination specified in the contract , and bears overall responsibility for making the goods available to the buyer at the named destination.

Due to the wide range of responsibilities that the DDP imposes on the seller, this Incoterm is by far the riskiest term for exporters and should be carefully reviewed before acceptance. Shipping Duty Paid Incoterms can be used for any type of transport.

In the same way as DAP, the term DDP must therefore indicate the exact location (example: "DDP Houston, Harbor Street 12 - USA").

DDU (“DELIVERY WITHOUT PAYMENT OF DUTIES”)

Back in 2010, the 8th edition of the International Chamber of Commerce introduced Incoterms DAP, which largely replaced the term Delivered Duty Free (DDU). Even if Incoterms DDU can still be found in some old contracts, buyers and sellers are encouraged to replace them with DAP in new ones. The ICC (International Chamber of Commerce) has completely abandoned DDU since 2013.

Under the Incoterms DDU, the seller was obliged to deliver the goods not cleared for import and not unloaded at the named place of destination agreed upon by the parties.

The seller had to bear the costs and risks of delivering the goods to such destination, excluding any duties and taxes applicable in the country of destination. In accordance with the delivery and unpaid duty Incoterms, the seller is not responsible for completing customs formalities.

Any costs, risks and duties associated with importing goods into the destination country must be borne by the buyer (who also bears the risk of delays in import transactions and associated costs).

DDU was used regardless of the mode of transport, but for delivery to the port of destination on board a ship or former quay, Incoterms DES or DEQ were preferred.

DAP vs DDP

If the seller must clear the goods and pay applicable import taxes and duties, the term DDP will be used instead of DAP.

DDP vs EXW

In accordance with Incoterm DDP, the seller bears all risks and costs of delivering the goods to the final destination. Instead, under EXW, such responsibilities and expenses are borne by the buyer (not the seller).

Thus, the two conditions establish completely opposite obligations for sellers (minimum for EXW, maximum for DDP).

The term DAP, which replaced the old Incoterm DDU, should generally be preferred by sellers to ensure that import risks and costs are transferred to (and managed by) the buyer.

In fact, not in all cases, sellers can easily manage the steps required to legally import goods into another country.

DDT and Value Added Tax (VAT)

If the parties wish to exclude the payment of importing country value added tax (VAT) from the seller's obligations, such an agreement must be clearly set out in the Incoterms contract statement (example: DDP Houston, 12 Harbor Street - USA, VAT not paid).

DAF (“DELIVERED TO THE BORDER”)

Delivered to Border Incoterms, "DAF", are typically used for goods transported by land (even though it could theoretically be used for any other mode of transport, such as sea, rail and air).

Under a DAF, the seller fulfills its delivery obligations when the goods are placed at the disposal of the buyer on an arriving means of transport (usually a truck), not unloaded, cleared for export, not cleared for import, at the named point and place, but before the customs border of the next country to be crossed (any border can apply, even the exporter's border).

The exact name of the border must follow the abbreviation "DAF" to make the agreement clear and valid (example: "DAF Como Brogeda Frontier, Italy").

However, if the parties wish the seller to be responsible for unloading the goods and to bear the associated costs and risks, add clear language to this effect in the sales contract (example: “DAF Como Borgheda Frontier, Italy – unloaded”).

For goods that are to be transported by sea and delivery is to be at a port of destination, on a ship or at a quay (wharf), then the Incoterm DES or DEQ should be used instead of DAF.

DES (“DELIVERY ON BOARD SHIP”)

DES (Delivered on Ship) means that the seller has fulfilled his delivery obligations when the goods are placed at the disposal of the buyer on board the ship at the port of entry not cleared for import.

The shipper must bear all costs and risks of transporting the goods to the port of destination agreed upon by the parties and is not responsible for unloading the goods from the ship.

DES is used when goods must be transported by sea or inland waterways (or in the case of multimodal transport involving navigation to a seaport).

DEQ (“DELIVERY TO WHARY”)

The DEQ incoterm is similar to the DES, but with one difference: under the DEQ, the seller (rather than the buyer) is responsible for unloading the goods from the ship at the port of arrival (and bears the costs and risks associated with such activity).

E-INCOTERMS 2010

EXEMPT FROM FACTORY (EXW)

If the purchase contract specifies ex-factory conditions, the seller must deliver the goods to the location (own or third-party warehouse) and the buyer must arrange collection and transportation to the final destination, bearing all risks and costs of logistics operations after delivery.

EXW is beneficial to the seller and less beneficial to the buyer, since the buyer assumes the burden and associated risks of delivering the goods to the final destination - and the seller is released from any liability once the goods are delivered to the buyer.

Once the item is manufactured and packaged, the seller sends a “Notice of Readiness” to the buyer. Upon receipt of such notice, the buyer must plan, organize and perform any subsequent logistics activities to deliver the goods to the destination (for example, loading on a truck or rail, transporting goods by road, rail, sea or air, clearing goods for export and import, storing goods at any intermediate point, unload goods upon arrival, etc.).

The seller can, of course, assist the buyer in loading operations, however, if the goods are damaged during these activities, the buyer, not the seller, bears any financial responsibility.

The buyer accepts EXW only when he is confident that he can manage all the activities of moving goods from the exporting country to the importing country, including the customs clearance activities for export and import (which may not be easy in some countries).

Indeed, even if the seller has a general obligation to support the buyer in such actions, the buyer has primary responsibility under this Agreement. If the buyer and seller are in the same country, then accepting EXW shipping is less risky and hassle.

DIFFERENCE BETWEEN EXW AND FOB

The term FOB is a variation of the plant agreement used for deliveries that occur at a specific point of origin rather than at the seller's premises. Under this condition, the seller bears the costs and risks associated with transferring the goods to the transport terminal and clearing the goods for export to make them readily available on board the vessel.

However, with FOB delivery, the buyer is responsible for arranging and paying for the shipment of the goods from origin to destination and for clearing the goods upon import. Under FOB, the buyer is also responsible for arranging and paying insurance costs for the goods.

Delivery terms EXW

EXW delivery basis literally means “from the factory”, that is, the cost of goods produced at the factory includes packaging, labeling and loading onto transport provided by the buyer. Costs associated with customs clearance in the country of departure, delivery and transshipment at the seaport when transporting cargo by sea are not included in this delivery condition. However, quite often suppliers from China independently handle customs clearance of cargo sold on EXW terms. Of course, for the buyer this is a definite plus in the transaction, since there is no need to contact brokers in China.

F-INCOTERMS 2010

FCA (AND DIFFERENCE FCA FROM EXW)

FCA (Free Carrier) incoterms are sometimes confused with EXW, but they have different responsibilities for buyers and sellers. Under the FCA, the Seller must deliver the goods, cleared for export, to the buyer's nominated carrier at the named place (example: "FCA Geodis Wholesale, Lisbon - Portugal").

The main differences between EXW and FCA can be summarized as follows:

Export customs clearance

- EXW: The exporter is not required to clear goods for export. The importer must organize and pay for export clearance operations;

- FCA: The exporter must clear the goods for export (the buyer is responsible for import transactions).

Delivery

- EXW: the exporter is not obliged to load the goods onto the buyer’s transport;

- FCA: The exporter must load the goods onto the buyer's truck(s) if the designated location matches the seller's place of business. However, if delivery must be made to another location, the seller is not responsible for unloading and loading the goods.

Application

- EXW: typical for domestic sales or sales in free trade zones (such as the European Union);

- FCA: typical for international trade transactions where export clearance is required.

FAS (free along the side of the ship)

FAS is an Incoterm used only for sea or inland waterway transport. Under FAS, the seller delivers when the goods are placed next to the ship at the named port of shipment agreed upon by the buyers and specified on time. As a consequence, the buyer must bear any costs and risks (loss or damage) associated with the goods from that point onwards.

Typically, the seller must clear goods for export in accordance with FAS agreements (this replaces the previous version of Incoterms, where such responsibility was on the buyer's side).

However, if the parties still want the buyer to be responsible for clearing the goods through customs (export), they can add clear language to that effect in the sales contract.

FOB (free on board)

Under this Incoterm, the seller is responsible (and bears the cost) of delivering the cleared goods to the ship at the named port of departure (eg Rotterdam). Any other shipping costs and risks from this point onwards must be borne by the buyer.

Under Incoterms FOB, the risk of the goods passes from the seller to the buyer as they are loaded onto the ship at the port of departure. Under FOB, the buyer is responsible, not the seller, if the item is lost, damaged or destroyed during transit. This Incoterm is very popular among Chinese pipe and fittings suppliers.

Basic delivery terms CIF and FOB: differences in the responsibilities of the parties

What are fob delivery terms or cif delivery terms? It would seem that clearly state in the contract who is responsible for what and until when - and there will be no problems. But no! The main problem is the completely different, sometimes even opposite, interpretation of some trade terms by the legislation of individual countries. This leads to misunderstandings, disagreements, disputes, loss of time and money, and litigation. In order for terms and conditions to be interpreted equally and problems of unambiguous interpretation to arise as rarely as possible, the International Chamber of Commerce (International Chamber of Commerce - The World Business Organization https://www.iccwbo.org) developed and published uniform standardized rules - Incoterms (international commercial terms), also called basic terms of delivery - Basis terms of delivery. They make it possible to simplify the wording as much as possible when concluding a purchase and sale agreement, clearly indicate the obligations assumed by the parties, and greatly facilitate the choice of transport conditions . If you have expensive cargo or it needs to be delivered to several customs offices, then in Russia the simplest and least expensive option is to hire a customs carrier .

The purpose of Incoterms is to clearly regulate the following issues:

- Which party is responsible for providing the means of transport to ship the goods?

- Which party bears the costs of customs clearance, certification and licensing of imported/exported goods.

- The exact place, and sometimes even the position of the goods, where the seller’s transportation costs end and the buyer’s begin.

- The point at which the risk of damage or loss of cargo passes from the seller to the buyer.

- The point in time before which the seller must fulfill his obligations and transfer the goods to the buyer (or transport company). In other words, delivery times.

In the new edition of Incoterms, the obligations of the parties are grouped into 13 sections. Below we will briefly describe each of the sections, but now let's look at these responsibilities using the example of the two most popular terms - FOB and CIF. For us, these conditions are also close in that they relate exclusively to sea cargo transportation.

RESPONSIBILITY OF THE BUYER AND SELLER ACCORDING TO INCOTERMS 2010

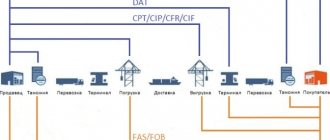

The table shows the distribution of responsibilities and costs between buyers and suppliers according to the selected Incoterm (source: Incoterms 2010).

| Incoterm type | Cargo transportation | Risks | Expenses |

| EXW | Shipping will be arranged by the buyer | Transfer of risks from the seller to the buyer when the goods are in the buyer's possession | The transfer of value from the seller to the buyer when the goods are in the buyer's possession |

| FCA | Transportation is carried out by the buyer or seller on behalf of the buyer | Transfer of risk from the seller to the buyer when the goods are delivered to the carrier at the named place | Transfer of costs from the seller to the buyer when the goods are delivered to the carrier at the named place |

| CPT | Transportation must be arranged by the seller | Transfer of risks from the seller to the buyer when the goods are delivered to the carrier | Transfer of expenses at the port of destination, the buyer pays such expenses that are not included in the seller’s account under the contract of carriage |

| C.I.P. | Shipping and insurance will be arranged by the seller | Transfer of risks from the seller to the buyer when the goods are delivered to the carrier | Transfer of expenses at the port of destination, the buyer pays such expenses that are not included in the seller’s account under the contract of carriage |

| DAT | Transportation must be arranged by the seller | Transfer of risks from the seller to the buyer upon delivery and unloading of goods at the terminal | Transfer of costs from the seller to the buyer upon delivery and unloading of goods at the terminal |

| DAP | Transportation must be arranged by the seller | Transfer of risks from the seller to the buyer upon delivery of the goods to the specified location ready for unloading | Transfer of costs from the seller to the buyer when the goods are delivered to a designated location ready for unloading |

| DDP | Transportation must be arranged by the seller | Transfer of risks from the seller to the buyer when the goods are placed at the disposal of the buyer | Transfer of costs from the seller to the buyer when the goods are placed at the buyer's disposal |

| F.A.S. | Transportation must be arranged by the seller | Transfer of risks from the seller to the buyer when the goods have been placed next to the vessel | Transfer of costs from the seller to the buyer when the goods have been placed next to the vessel |

| FOB | Transportation must be arranged by the seller | Transfer of risks from the seller to the buyer when the goods pass the ship's rail | Transfer of costs from the seller to the buyer when the goods pass the ship's rail |

| CFR | Transportation must be arranged by the seller | Transfer of risk from seller to buyer when goods pass the ship's rail | Transfer of expenses at the port of destination, the buyer pays such expenses that are not included in the seller’s account under the contract of carriage |

| CIF | Shipping and insurance must be arranged by the seller | Transfer of risk from seller to buyer when goods pass the ship's rail | Transfer of expenses at the port of destination, the buyer pays such expenses that are not included in the seller’s account under the contract of carriage |

Transport conditions and commercial risks

It should be noted that Incoterms govern the relations of the parties exclusively within the framework of the purchase and sale agreement. Therefore, the transportation contract should be concluded separately, and it should already stipulate all the transport conditions . For sea transportation, this section of the sales contract stipulates:

- port of loading and unloading of goods;

- point of transfer or transshipment of cargo;

- type of charter or bill of lading;

- the procedure for informing the parties about the vessel’s arrival at the port and its readiness for loading and unloading operations;

- procedure for determining lay time;

- loading and unloading standards;

- conditions and procedure for paying fines (demurrage and dispatch) to the carrier.

Incoterms also do not stipulate who assumes the commercial risks for possible maritime surcharges. For example, BAF (fuel surcharge), ERS (contingency transport charges) or CAF (currency surcharge). Commercial risks may also include sudden increases in port or insurance rates, increases in wages or carrier tariffs. Unfortunately, there are many such “pitfalls” hidden in Incoterms.

All these risks can be additionally reinsured. However, in this case, insurance costs will increase.

INTERNATIONAL CHAMBER OF COMMERCE (ICC)

The International Chamber of Commerce is an important institution for supporting trade operations throughout the world. It has thousands of member companies in more than 130 countries and a wide range of business interests. The ICC was founded in France in 1919, and the International Court of Arbitration was founded in 1923.

The Chamber also has a large number of committees and experts covering all sectors, and works closely with other important political and business associations such as the United Nations, the World Trade Organization (WTO) and other government bodies dealing with financial and economic issues .

ROLE OF THE ICC

The role of the ICC is to support international trade between member countries and companies and to promote open markets for goods, services and capital. The ICC is responsible for:

- Establish rules and guidelines for international trade (one example is Incoterms 2010);

- Resolve disputes between members and states;

- Advocate for trade policy;

- Fighting commercial crime and corruption to promote economic growth

Although the ICC is not a regulatory body, thousands of business transactions occur every day in accordance with the policies set by this organization.