Go to the list of all Incoterms terms

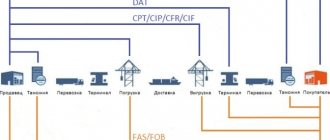

In international trade, when drawing up contracts for the supply of goods, the generally accepted rules of INCOTERMS as amended in 2010 are applied. Until January 1, 2011, the interpretations of INCOTERMS as amended in 2000 were used. Therefore, if you plan to import or export goods in 2021, you need to focus on the current International Rules for the Interpretation of Trade Terms.

One of the INCOTERMS category C terms, when the main carriage is paid by the seller, is CPT, or Carriage Paid To.

Distribution of risks and responsibilities under the CPT terms

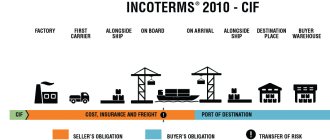

Under the CPT delivery basis, the buyer assumes all risks of loss or damage to the goods, as well as other costs, after the goods are handed over by the seller to the carrier, and not when the goods reach their destination. The term CPT contains two critical clauses, since the risk and costs pass at two different places: the risk after the goods are loaded into the vehicle, and the costs at the destination.

Responsibilities under the basic terms of delivery CPT (SPT)

The seller is obliged to pay the costs and freight necessary to deliver the goods to the specified destination, perform export customs clearance for the export of goods with payment of export duties and other fees in the country of departure, but the seller is not obliged to complete customs formalities for the import of goods, pay import customs duties or carry out other import customs procedures upon import. If the parties intend to impose on the buyer the costs of delivering the goods to the destination, it is advisable to use the FCA Incoterms 2010 rule.

Term CPT

can be used for transportation by any type of transport, including intermodal transport. The word “carrier” means any person who, on the basis of a contract of carriage, undertakes to provide or organize the transportation of goods by rail, road, air, sea and inland waterway transport or a combination of these modes of transport. In the case of transport to the agreed destination by several carriers, the transfer of risk will occur at the moment the goods are transferred to the care of the first of them.

Subtleties of work

CPT, like other foreign trade transactions, is distinguished by its subtleties. To avoid problems when concluding a contract on such terms, you need to familiarize yourself with their pitfalls in advance. There are several nuances that you should pay attention to first:

- A controversial situation between counterparties who are conducting a foreign trade transaction can be caused by an erroneous determination of the place of arrival of the cargo. For example, if the concluded contract specifies a warehouse located in the buyer’s country as the destination, then the supplier will be responsible for completing import customs formalities. But it's not right. The buyer must pay import duties and go through customs procedures related to the import of products into the country.

- Due to the similarity of terms in CPT and DAP contracts, problems periodically arise between suppliers and buyers. This happens for the reason that counterparties, when concluding a foreign economic contract, confuse the terms of the transportation agreement.

- If, according to CPT, the risks associated with the delivery of goods are assigned to the freight forwarding company or the buyer, then according to the requirements of DAP, they are fully borne by the exporter. This difference in terms, which is of particular importance due to the additional costs, may give rise to financial disputes between counterparties.

- Having concluded a transaction, the customer must remember that the seller is not obliged to ensure the unloading of the goods at the destination. This responsibility falls on the receiving party.

- If you do not pick up the cargo from the point of arrival on time, the transport company or the terminal owner may impose a fine on the customer. Therefore, the importer must ensure timely unloading.

- The sending party has the right to independently choose transport and routes for delivery. If the supplier tries to deliver cargo via a non-standard route, which may affect the customs value of the goods, the buyer has the right to demand that the sender reduce the cost of the product.

When drawing up a contract, pay attention to these nuances.

CPT price, payment terms and transfer of ownership

CPT price means that the contract (invoice or customs) price for a product includes the sum of the cost of the product itself, export customs clearance of this product with payment of export duties and other fees, and the cost of delivery (freight) to the destination.

Delivery terms CPT Incoterms

do not indicate the price for the goods and the method of payment, do not regulate the transfer of ownership of the goods or the consequences of violation of the contract. The price and transfer of ownership must be determined in the terms of the purchase and sale agreement. The trade term CPT indicates which party to the sales contract must carry out the necessary actions for transportation and customs clearance, when and where the seller transfers the goods to the buyer, as well as what costs each party bears.

What does CPT mean: decoding

In simple words, the term “Carriage Paid To” is literally translated from English as: “Carriage paid to.” Next comes the destination. This means that the seller’s responsibility for the safety of the goods extends until he fulfills his obligations to transport the goods to the place strictly defined in the contract.

Here is how, for example, the term is used in practice: CPT Novorossiysk, Russia (Incoterms 2010).

But there are some subtleties here too. Let's take a closer look at them.

Differences between CPT and DAP delivery conditions

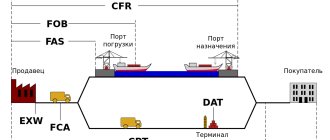

The difference between the CPT and DAP delivery conditions is the transfer of the risk of loss or damage to the goods from the seller to the buyer. In simple words, according to the terms of delivery CPT : the goods, at the expense of the seller, having passed export customs clearance, are transported to the specified destination, and the risks of loss or damage to the goods pass after the seller transfers the goods to the carrier (i.e. loading the goods onto the vehicle). According to the DAP Incoterms 2010 delivery basis: the goods, at the expense of the seller, having passed export customs clearance, are transported to the specified destination. Risk of loss or damage to the goods passes at that destination . The differences between the CPT delivery terms and other terms are presented in the table of differences in Incoterms 2010.

Features of explanations and their purpose

Any terminological abbreviation of the Incoterms 2010 delivery conditions has a detailed explanation. With their help, the main conditions for the use of terms are clearly indicated, for example: cases of need for application, situations of transfer of risk, rules for the distribution of monetary expenses between the parties to the contract. Such explanations are not included in the content of currently existing rules, but are only additional data that assist in the selection of correct international trade terminological abbreviations for concluding the necessary agreement.

Relevance of using the CPT basis

Today, the delivery conditions of CPT Incoterms as amended in 2010 are considered outdated, because On January 1, 2021, the new rules of Incoterms 2021 came into force. However, the International Chamber of Commerce only recommends, but does not oblige, the use of the CPT Incoterms 2021 delivery terms, therefore, in supply contracts you can refer to the CPT Incoterms 2010 delivery basis.

Previously, instead of the term CPT, the delivery basis DCP (Delivered Costs Paid) . The first mention of DCP delivery terms was in Incoterms 1953.

>

Responsibilities of the seller under the terms of CPT (SPT) | Obligations of the buyer under the terms of CPT (SPT) |

| A.1. DELIVERY OF GOODS IN ACCORDANCE WITH THE AGREEMENT The Seller is obliged, in accordance with the purchase agreement, to provide the buyer with the goods, a commercial invoice or equivalent electronic communication, and any other evidence of compliance that may be required under the terms of the purchase agreement. | B.1. PAYMENT OF THE PRICE The buyer is obliged to pay the price of the goods stipulated in the purchase and sale agreement. |

| A.2. LICENSES, CERTIFICATES AND FORMALITIES The Seller shall, at his own expense and risk, obtain any export license or other official certificate and, if required, complete all customs formalities for the export of the goods. | B.2. LICENSES, CERTIFICATES AND FORMALITIES The Buyer shall, at his own expense and risk, obtain any import license or other official certificate and, if required, complete all customs formalities for the import of the goods and for their transit through third countries. |

| A.3. CONTRACTS OF CARRIAGE AND INSURANCE a) Contract of carriage. The seller must contract, at his own expense and on customary terms, for the carriage of the goods to the agreed point at the named place of destination by the usual route and in the customary manner. If such a point is not agreed or determined by the practice of such deliveries, the seller may choose the most suitable point at the named place of destination. b) Insurance contract - no obligations. | B.3. CONTRACTS OF CARRIAGE AND INSURANCE a) Contract of carriage - no obligations. b) Insurance contract - no obligations. |

| A.4. DELIVERY OF GOODS The Seller is obliged to deliver the goods to the carrier with whom the contract of carriage is concluded in accordance with Article A.3., and if there are several carriers, to the first of them for transportation to the named place on the specified date or within the agreed period. | B.4. ACCEPTANCE OF DELIVERY The Buyer must accept delivery of the goods immediately upon delivery in accordance with Article A.4. and receive the goods from the carrier at the named place. |

| A.5. TRANSFER OF RISK The Seller is obliged subject to the provisions of Article B.5. bear all risks of loss or damage to the goods until they are delivered in accordance with Article A.4. | B.5. PASSION OF RISK The Buyer must bear all risks of loss or damage to the goods from the time of delivery in accordance with Article A.4. The Buyer is obliged, if he fails to comply with the obligation to give notice in accordance with Article B.7., to bear all risks of loss of or damage to the goods from the expiration of the agreed date or the end date of the fixed delivery period. The condition, however, is that the goods comply properly with the contract. This means that the goods must be properly identified, that is, clearly separated or otherwise identified as the goods that are the subject of the contract. |

| A.6. ALLOCATION OF COSTS The seller is obliged, subject to the provisions of Article B.6.: to bear all costs associated with the goods until they are delivered in accordance with Article A.4., as well as to pay freight and all costs arising from Article A.3.a) including the costs of loading the goods and unloading them at the place of destination, which, according to the contract of carriage, are borne by the seller, and pay, if required, all costs associated with the completion of customs formalities for export, as well as other duties, taxes and other charges subject to payment for the export of goods, and costs associated with its transit through third countries, in cases where these costs, according to the contract of carriage, are borne by the seller. | B.6. ALLOCATION OF COSTS The Buyer is obliged, in accordance with the provisions of Article A.3.a): to bear all costs associated with the goods from the moment of their delivery in accordance with Article A.4., and to bear all costs associated with the goods during their transit. before arrival at the agreed place of destination, except in cases where they are borne by the seller under the contract of carriage, and pay the costs of unloading the goods, except in cases where they are borne by the seller in accordance with the contract of carriage, and bear all additional costs resulting from his failure to fulfill the obligation to give due notice in accordance with Article B.7. from the date of calculation of the agreed date or from the end of the agreed period for delivery. The condition, however, is that the goods comply properly with the contract. This means that the goods must be properly identified, that is, clearly separated or otherwise identified as the goods that are the subject of this contract, and pay, if required, all duties, taxes and other charges, as well as the costs of completing customs formalities, payable upon import of goods, and, if necessary, for their transit through third countries, if they are not included in the costs of the contract of carriage. |

| A.7. NOTICE TO THE BUYER The Seller shall give the Buyer sufficient notice that the goods have been delivered in accordance with Article A.4, and shall also give the Buyer any other notice required to enable it to take such measures as are normally necessary to obtain the goods. | B.7. NOTICE TO THE SELLER If the buyer has the right to determine the time of shipment of the goods and/or destination, he must duly notify the seller about this. |

| A.8. PROOF OF DELIVERY, TRANSPORT DOCUMENTS OR EQUIVALENT ELECTRONIC COMMUNICATIONS The seller must provide the buyer at his expense with a normal transport document or documents (for example, a negotiable bill of lading, non-negotiable sea waybill, proof of inland waterway transport, air waybill, rail waybill, road waybill or mixed waybill). transportation) in accordance with Article A.3. In the event that the seller and buyer have agreed to use electronic communications, the documents mentioned above may be replaced by equivalent electronic messages (EDI). | B.8. PROOF OF DELIVERY, TRANSPORT DOCUMENTS OR EQUIVALENT ELECTRONIC MESSAGES The Buyer must accept the provisions provided in Article A.8. transport document, if it complies with the terms of the sales contract. |

| A.9. INSPECTION - PACKAGING - LABELING The seller must bear the costs associated with the inspection of the goods (e.g. quality, size, weight, quantity) necessary to deliver the goods in accordance with Article A.4. The seller is obliged, at his own expense, to provide the packaging (except in cases where it is customary in this branch of trade to send the goods stipulated by the contract without packaging) necessary for the transportation of the goods organized by him. The packaging must be properly labeled. | B.9. GOODS INSPECTION The Buyer shall bear the costs of any pre-shipment inspection of the goods unless such inspection is required by the authorities of the country of export. |

| A.10. OTHER OBLIGATIONS The Seller is obliged, at the request of the Buyer, to provide the latter, at his expense and risk, with full assistance in obtaining any documents or equivalent electronic messages (other than those mentioned in Article A.8.) issued or used in the country of dispatch and/or in the country of origin goods, and which the buyer may need to import the goods or, if necessary, for their transit through third countries. The seller is obliged to provide the buyer with all the information necessary to carry out insurance. | B.10. OTHER OBLIGATIONS The Buyer must bear all costs and fees associated with the receipt of documents or equivalent electronic communications as provided in Article A.10., as well as reimburse the Seller for expenses incurred by the latter as a result of its assistance to the Buyer. |

F-INCOTERMS 2010

FCA (AND DIFFERENCE FCA FROM EXW)

FCA (Free Carrier) incoterms are sometimes confused with EXW, but they have different responsibilities for buyers and sellers. Under the FCA, the Seller must deliver the goods, cleared for export, to the buyer's nominated carrier at the named place (example: "FCA Geodis Wholesale, Lisbon - Portugal").

The main differences between EXW and FCA can be summarized as follows:

Export customs clearance

- EXW: The exporter is not required to clear goods for export. The importer must organize and pay for export clearance operations;

- FCA: The exporter must clear the goods for export (the buyer is responsible for import transactions).

Delivery

- EXW: the exporter is not obliged to load the goods onto the buyer’s transport;

- FCA: The exporter must load the goods onto the buyer's truck(s) if the designated location matches the seller's place of business. However, if delivery must be made to another location, the seller is not responsible for unloading and loading the goods.

Application

- EXW: typical for domestic sales or sales in free trade zones (such as the European Union);

- FCA: typical for international trade transactions where export clearance is required.

FAS (free along the side of the ship)

FAS is an Incoterm used only for sea or inland waterway transport. Under FAS, the seller delivers when the goods are placed next to the ship at the named port of shipment agreed upon by the buyers and specified on time. As a consequence, the buyer must bear any costs and risks (loss or damage) associated with the goods from that point onwards.

Typically, the seller must clear goods for export in accordance with FAS agreements (this replaces the previous version of Incoterms, where such responsibility was on the buyer's side).

However, if the parties still want the buyer to be responsible for clearing the goods through customs (export), they can add clear language to that effect in the sales contract.

FOB (free on board)

Under this Incoterm, the seller is responsible (and bears the cost) of delivering the cleared goods to the ship at the named port of departure (eg Rotterdam). Any other shipping costs and risks from this point onwards must be borne by the buyer.

Under Incoterms FOB, the risk of the goods passes from the seller to the buyer as they are loaded onto the ship at the port of departure. Under FOB, the buyer is responsible, not the seller, if the item is lost, damaged or destroyed during transit. This Incoterm is very popular among Chinese pipe and fittings suppliers.