What does EXW delivery mean, what does it stand for?

Delivery conditions EXW Incoterms 2010 - decoding "Ex Works" named place - translated "Ex Works" (Ex Free Warehouse) the specified name of the place (literal translation "Pickup" ) means that the seller is considered to have fulfilled his delivery obligations when he makes the goods available the buyer at his enterprise or at another specified place (for example: at a plant, factory, warehouse, store, etc.).

The new delivery terms EXW Incoterms 2021 came into force on January 1, 2021.

What is a free factory?

The term “ex works” followed by the exact name of the place of delivery means the delivery of goods by the seller to the buyer at his premises or another place agreed upon by the other party to the contract. So, if the seller’s plant is located in a small town, in this case in the supply contract after the term EXW there should be an indication of the nearest large city where the ex-factory is located. For example, it is planned to export products from the Artyomovskaya knitting factory (Artem). In this case, it is necessary to write in the contract as follows: “EXW Vladivostok, Primorsky Territory, Russian Federation.”

Distribution of risks and responsibilities under EXW terms

Under the EXW condition, the seller is not responsible for loading the goods onto the vehicle provided by the buyer, nor for paying customs duties, nor for customs clearance of the exported goods, unless this is specifically agreed. Under the EXW delivery basis, the buyer bears all risks and all costs of moving the goods from the seller's territory to the specified destination.

Responsibilities under the basic terms of delivery EXW (EXB)

Delivery terms EXW

imposes minimal obligations on the seller, and the buyer must bear all costs and risks of transporting the goods from the seller's establishment to the destination. However, if the parties wish the seller to assume responsibility for loading the goods at the place of shipment and bear all risks and expenses for such shipment, then this should be clearly stated in the appropriate addendum to the purchase and sale agreement. The term EXW cannot be used when the buyer is unable to comply directly or indirectly with export formalities. In this case, FCA Incoterms 2010 should be used, provided that the seller agrees to bear the costs and risks of shipping the goods.

The buyer of the goods term EXW

should be used with caution as The seller has no obligation to the buyer to load the goods. If the seller actually loads the goods, this is done at the buyer's expense and risk. If the supplier of goods loads at his own risk and expense, it is advisable to use the delivery terms of FCA Incoterms 2010.

It is also necessary to take into account that the seller is only obliged to provide the buyer of goods for export on EXW terms only with assistance in export customs clearance of goods for export; the seller is not obliged to organize the implementation of customs procedures for the export of goods. Therefore, the buyer is not recommended to use the EXW delivery basis

, if he cannot ensure the completion of export customs formalities for the export of goods. While the EXW term imposes minimum obligations on the seller, the Incoterms 2010 DDP delivery basis term imposes maximum obligations on the seller.

FOB price

When calculating the final cost of the goods, it is recommended to take into account how the price works out when delivered on FOB terms, for example, when you need to transport cargo from China to Russia. So, the totals are as follows:

- Purchase price of the goods;

- Packaging, labeling;

- Obtaining licenses and permits;

- State duty and other customs duties, taxes (import and export);

- Transportation costs to the port of departure;

- Vessel charter;

- Loading and placing goods on the ship;

- Unloading at the port of arrival;

- Payment to the carrier upon transportation to a warehouse or store.

There may be other costs associated with importing. Therefore, you need to carefully calculate the budget so that, ultimately, delivery on FOB terms is beneficial and profitable for both the seller and the buyer.

EXW price, payment terms and transfer of ownership

EXW price means that the contract (invoice or customs) price for a product includes only the cost of the product itself without the cost of customs clearance and its delivery (freight).

Delivery terms EXW Incoterms

do not indicate the price for the goods and the method of payment, do not regulate the transfer of ownership of the goods or the consequences of violation of the contract. The price and transfer of ownership must be determined in the terms of the purchase and sale agreement. The trade term EXW indicates which party to the sales contract must carry out the necessary actions for transportation and customs clearance, when and where the seller transfers the goods to the buyer, as well as what costs each party bears.

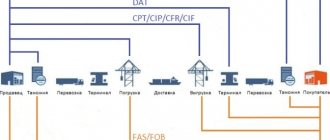

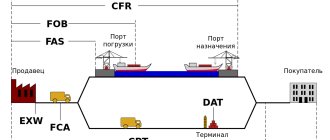

Incoterms 2010 classification

Terms of delivery of goods for any type of transport

EXW / Ex Works – Ex-factory

FCA / Free Carrier - Free carrier

CPT / Carriage Paid to - Carriage paid to

CIP / Carriage and Insurance Paid to - Transportation and insurance paid to

DAT / Delivered at Terminal

DAP / Delivered at Place

DDP / Delivered Duty Paid

Terms of delivery of goods for sea and inland water transport

FAS / Free Alongside Ship - Free along the side of the ship

FOB / Free on Board - Free on board

CFR / Cost and Freight - Cost and freight

CIF / Cost Insurance and Freight - Cost, insurance and freight

Differences between EXW and FCA delivery conditions

The difference between EXW and FCA delivery conditions is the obligation to load the goods into the vehicle and perform export customs clearance. In simple words, according to EXW delivery conditions : goods without export customs clearance and without loading are provided by the seller at the seller’s warehouse, the buyer must load the goods into the vehicle at his own expense. According to the delivery basis FCA Incoterms 2010: goods that have undergone export customs clearance at the seller by the seller into the buyer’s vehicle. Differences between EXW delivery terms and other terms are presented in the table of differences in Incoterms 2010.

Relevance of using the EXW basis

Today, the delivery conditions of EXW Incoterms as amended in 2010 are considered outdated, because On January 1, 2021, the new rules of Incoterms 2021 came into force. However, the International Chamber of Commerce only recommends, but does not oblige, the use of EXW Incoterms 2021 delivery terms, therefore, in supply contracts you can refer to the EXW Incoterms 2010 delivery basis.

>

Responsibilities of the seller under the terms of EXW (EXB) | Obligations of the buyer under the terms of EXW (EXB) |

| A.1. DELIVERY OF GOODS IN ACCORDANCE WITH THE AGREEMENT The Seller is obliged, in accordance with the purchase agreement, to provide the buyer with the goods, a commercial invoice or equivalent electronic communication, and any other evidence of compliance that may be required under the terms of the purchase agreement. | B.1. PAYMENT OF THE PRICE The buyer is obliged to pay the price of the goods stipulated in the purchase and sale agreement. |

| A.2. LICENSES, CERTIFICATES AND FORMALITIES The seller shall, at the buyer's request, expense and risk, provide the latter with full assistance, if required, in obtaining any export license or other official document necessary for the export of the goods. | B.2. LICENSES, CERTIFICATES AND FORMALITIES The Buyer shall, at his own expense and risk, obtain any export or import license or other official certificate and, if required, complete all customs formalities for the export of the goods. |

| A.3. CONTRACTS OF CARRIAGE AND INSURANCE a) Contract of carriage - no obligations. b) Insurance contract - no obligations. | B.3. CONTRACTS OF CARRIAGE AND INSURANCE a) Contract of carriage - no obligations. b) Insurance contract - no obligations. |

| A.4. DELIVERY OF GOODS The seller is obliged, on the agreed date or within the agreed period, to make the goods unloaded into any means of transport available to the buyer at the place of delivery named in the contract. In the absence of such instructions in the contract, the seller is obliged to deliver at the usual place and time for the delivery of similar goods. If the parties have not agreed on any specific point at the named place of delivery and if there are several such points, the seller may choose the most suitable point at the place of delivery. | B.4. ACCEPTANCE OF DELIVERY The Buyer is obliged to accept delivery of the goods as soon as the goods are placed at his disposal in accordance with Articles A.4 and A.7./B.7. |

| A.5. PASSION OF RISK The seller must, subject to the provisions of Article B.5, bear all risks of loss or damage to the goods until they are delivered in accordance with Article A.4. | B.5. TRANSFER OF RISK The Buyer must bear all risks of loss or damage to the goods from the time the goods are delivered to him in accordance with Article A.4., and from the agreed date or agreed period for acceptance of delivery, which arises from his failure to comply with the obligation to give notice in accordance with Article B.7. The condition, however, is that the goods comply properly with the contract. This means that the goods must be properly identified, that is, clearly separated or otherwise identified as the goods that are the subject of the contract. |

| A.6. ALLOCATION OF COSTS The Seller is obliged subject to the provisions of Article B.6. bear all costs associated with the goods until they are delivered in accordance with Article A.4. | B.6. DISTRIBUTION OF COSTS The buyer is obliged to: bear all costs associated with the goods from the moment the goods are delivered into his possession in accordance with Article A.4., and bear all additional costs arising from or failure to fulfill his obligation to accept the goods after they have been provided at his disposal, or he has not given proper notice in accordance with Article B.7. The condition, however, is that the goods comply properly with the contract. This means that the goods must be properly identified, that is, clearly separated or otherwise identified as the goods that are the subject of this contract; pay, if required, all duties, taxes and other charges, as well as the costs of completing customs formalities payable when exporting. The buyer must reimburse all costs and fees incurred by the seller in providing assistance in accordance with Article A.2. |

| A.7. NOTICE TO THE BUYER The Seller shall give the Buyer sufficient notice of the date and place when and where the goods will be made available to him. | B.7. NOTICE TO THE SELLER If the buyer has the right to determine, within the agreed period, the date and/or place of acceptance of the goods, he must give the seller the necessary notice thereof. |

| A.8. PROOF OF DELIVERY, TRANSPORT DOCUMENTS OR EQUIVALENT ELECTRONIC MESSAGES No obligation. | B.8. PROOF OF DELIVERY, TRANSPORT DOCUMENTS OR EQUIVALENT ELECTRONIC COMMUNICATIONS The Buyer must provide the Seller with appropriate evidence of acceptance of delivery. |

| A.9. CHECKING - PACKAGING - LABELING The seller is obliged to bear the costs associated with checking the goods (for example, checking quality, dimensions, weight, quantity) necessary to make the goods available to the buyer. The seller is obliged to pay at his own expense the costs of packaging necessary for the carriage of the goods (except in cases where it is customary in this branch of trade to send the contract goods without packaging). The latter is carried out to the extent that the circumstances relating to transportation (for example, methods of transportation, destination) were known to the seller before concluding the sales contract. The packaging must be properly labeled. | B.9. GOODS INSPECTION The Buyer shall bear, unless otherwise agreed, the costs of any pre-shipment inspection of the goods, including the costs of inspection required by the authorities of the country of export. |

| A.10. OTHER OBLIGATIONS The seller is obliged, at the buyer's request, to provide the latter, at his expense and risk, with full assistance in obtaining any documents or equivalent electronic messages issued or used in the country of delivery and/or in the country of origin of the goods, which the buyer may require for export and/or or import of goods or, if necessary, for their transit through third countries. The seller is obliged to provide the buyer, upon his request, with all the information necessary for the implementation of insurance. | B.10. OTHER OBLIGATIONS The Buyer must bear all costs and fees associated with the receipt of documents or equivalent electronic communications as provided in Article A.10., as well as reimburse the Seller for expenses incurred by the latter in providing assistance to the Buyer. |