Go to the list of all Incoterms terms

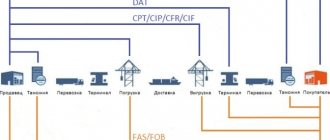

In 2021, importers and exporters, when drawing up supply contracts, are guided by the Incoterms rules as amended in 2010. They have been operating since 2011. Prior to this, participants in foreign economic activity used Incoterms terms approved in 2000.

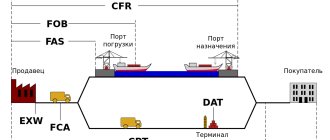

One such rule governing deliveries by river vessel or by sea is the CFR. A term from group C, which implies payment for the main transportation by the seller.

Allocation of risks and responsibilities according to CFR terms

Under the CFR delivery basis, the buyer assumes all risks of loss or damage to the goods and other costs after the goods are placed on board the vessel at the port of shipment and not when the goods reach their destination. The term CFR contains two critical points because the risk and costs are transferred in two different places: the risk at the port of shipment and the costs at the port of discharge.

What does CFR mean: decoding

The term CFR stands for Cost and Freight, which means “cost and freight” in English. To put it in simple words, the rule means that the buyer pays the cost of the goods and its freight, that is, delivery by water to the customer’s port. The importer undertakes further organizational issues. This includes unloading of goods, customs clearance, delivery to a warehouse, store or final buyer.

Unlike the FAS rules (“Free along the side of the ship”), when using the term CFR there is no imaginary perpendicular line (the side of the ship, for example), beyond which the obligations of one party end and the other begins.

Responsibilities under the basic terms of delivery CFR (SFR)

Delivery basis CFR Incoterms 2010

imposes on the seller the obligation to pay the costs and freight necessary to deliver the goods to the specified port of destination and perform export customs clearance for the export of goods with payment of export duties and other fees in the country of departure, but the seller is not obliged to carry out customs formalities for the import of goods or pay import customs duties or carry out other import customs procedures upon import.

The buyer is obliged to unload the ship at the port of arrival, complete import customs clearance with payment of import customs duties and taxes, and deliver the goods to the destination. If the parties intend to assign the buyer the obligation to deliver the goods by ship to the port of destination, it is advisable to use the FOB Incoterms 2010 rule.

CFR Incoterms 2010

can only be used when transporting goods by sea or inland waterway transport. If the parties do not intend to deliver the goods on board the vessel, CPT Incoterms 2010 should be used.

Disadvantages of CFR

Despite the fact that the buyer pays for the cargo, the price of which already includes transportation and export clearance procedures, he still has many responsibilities (for import clearance and for transporting the cargo to his warehouses/to the destination).

The recipient is at great risk with the goods from the moment they are loaded onto the ship - you can be left without goods and without money.

It is necessary to take a responsible approach to drawing up the contract and documentation for the goods so that there are no problems when passing through customs in the country of receipt.

CFR price, payment terms and transfer of ownership

CFR price means that the contract (invoice or customs) price for a product includes the sum of the cost of the product itself, export customs clearance of this product with payment of export duties and other fees, as well as the cost of delivery (freight) to the port of destination, without unloading at the port.

Delivery terms CFR Incoterms

do not indicate the price for the goods and the method of payment, do not regulate the transfer of ownership of the goods or the consequences of violation of the contract. The price and transfer of ownership must be determined in the terms of the purchase and sale agreement. The CFR trade term indicates which party to the sales contract must carry out the necessary actions for transportation and customs clearance, when and where the seller transfers the goods to the buyer, and what costs each party bears.

Differences between CFR and CIF delivery conditions

The difference between CFR and CIF delivery terms is the obligation to purchase marine insurance in favor of the buyer against the risk of loss and damage to the goods during transportation. In simple words, according to the terms of delivery CFR : the goods, at the expense of the seller, having passed export customs clearance, are transported to the port of destination. According to the delivery basis of CIF Incoterms 2010: the goods, at the expense of the seller, having undergone export customs clearance, are transported to the port of destination, and must also be insured in favor of the buyer against the risk of loss and damage to the goods during transportation to the port of unloading. The differences between the CFR delivery terms and other terms are presented in the table of differences in Incoterms 2010.

Obtaining the necessary information by the buyer and seller and the safety of the cargo

Typically, all buyers are concerned about the safety of the product, so it is natural that they may be interested in all the relevant information. Regarding these issues, some rules are also provided in INCOTERMS 2010.

- The seller must, upon request, immediately provide his counterparty with information about the safety of the goods, which he will need during the transportation of the goods.

- The seller must pay all costs associated with obtaining the necessary documents and information.

- In order for the seller to act as required by the above paragraphs, the buyer must promptly inform the seller of information and security needs.

- The buyer is obliged to provide or assist the seller in obtaining the necessary information, which may be useful when exporting goods from the country, transporting them, etc.

Relevance of using the CFR basis

Today, the delivery conditions of CFR Incoterms as amended in 2010 are considered outdated, because On January 1, 2021, the new Incoterms 2021 rules came into force. However, the International Chamber of Commerce only recommends, but does not oblige, the use of CFR Incoterms 2021 delivery conditions, therefore, in supply contracts you can refer to the CFR Incoterms 2010 delivery basis.

Previously, the C&F delivery basis (CNF) . The first mention of C&F terms of delivery (CNF) was in the 1936 Incoterms.

>

Responsibilities of the seller under the terms of the CFR (SFR) | Obligations of the buyer under the terms of the CFR (SFR) |

| A.1. DELIVERY OF GOODS IN ACCORDANCE WITH THE AGREEMENT The seller is obliged, in accordance with the contract of sale, to provide the buyer with the goods, a commercial invoice or equivalent electronic communication, and any other evidence of compliance that may be required under the terms of the contract of sale. | B.1. PAYMENT OF THE PRICE The buyer is obliged to pay the price of the goods stipulated in the purchase and sale agreement. |

| A.2. LICENSES, CERTIFICATES AND FORMALITIES The seller must, at his own expense and risk, obtain any export license or other official certificate and, if required, complete all customs formalities required for the export of the goods. | B.2. LICENSES, CERTIFICATES AND FORMALITIES The Buyer must, at his own expense and risk, obtain any import license or other official certificate and, if required, complete all customs formalities required for the import of the goods and for their transit through third countries. |

| A.3. CONTRACTS OF CARRIAGE AND INSURANCE a) Contract of carriage. The seller must contract, at his own expense and on customary terms, for the carriage of the goods to the named port of destination by the usual shipping route in a sea (or suitable inland waterway) vessel of a type customarily used for the carriage of goods similar to those specified in the purchase contract. sales. b) Insurance contract - no obligations. | B.3. CONTRACTS OF CARRIAGE AND INSURANCE a) Contract of carriage - no obligations. b) Insurance contract - no obligations. |

| A.4. DELIVERY OF GOODS The seller is obliged to load the goods on board the vessel at the port of shipment on or within the agreed date. | B.4. ACCEPTANCE OF DELIVERY The Buyer must accept delivery of the goods when made in accordance with Article A.4. and receive the goods from the carrier at the named port of destination. |

| A.5. TRANSFER OF RISK The Seller is obliged subject to the provisions of Article B.5. bear all risks of loss or damage to the goods until the goods pass the ship's rail at the port of shipment. | B.5. TRANSFER OF RISK The Buyer must bear all risks of loss or damage to the goods from the moment the goods pass the ship's rail at the port of shipment. The Buyer is obliged to give notice in accordance with Article B.7 if he fails to fulfill his obligation. bear all risks of loss or damage to the goods from the expiration of the agreed date or the end date of the fixed shipment period. The condition, however, is that the goods comply properly with the contract. This means that the goods must be properly identified, that is, clearly separated or otherwise identified as the goods that are the subject of the contract. |

| A.6. ALLOCATION OF COSTS The seller is obliged, subject to the provisions of Article B.6.: to bear all costs associated with the goods until they are delivered in accordance with Article A.4., and to pay freight and all costs arising from Article A.3.a), including the costs of loading the goods on board the vessel and any costs of unloading the goods at the agreed port of discharge, which, according to the contract of carriage, are borne by the seller, and to pay, if required, all costs associated with the completion of customs formalities for export, as well as other duties, taxes and other fees payable upon export of goods, as well as costs associated with their transit through third countries in cases where they are borne by the seller according to the contract of carriage. | B.6. ALLOCATION OF COSTS The Buyer is obliged, subject to the provisions of Article A.3.a): to bear all costs associated with the goods from the moment of their delivery in accordance with Article A.4., and to bear all costs and fees associated with the goods during their transit transportation until arrival at the port of destination, except in cases where they are borne by the seller according to the contract of carriage, and pay the costs of unloading the goods, including the costs of paying lighter and berthing charges, except in cases when they are borne by the seller according to the contract of carriage, and bear all additional costs resulting from his failure to comply with the obligation to give proper notice in accordance with Article B.7. from the expiration of the agreed date or agreed delivery period. The condition, however, is that the goods comply properly with the contract. This means that the goods must be properly identified, that is, clearly separated or otherwise identified as the goods that are the subject of this contract, and pay, if required, all duties, taxes and other charges, as well as the costs of completing customs formalities, payable upon import of goods, and, if necessary, for their transit through third countries, if they are not borne by the seller when executing the contract of carriage. |

| A.7. NOTICE TO THE BUYER The Seller shall give the Buyer sufficient notice that the goods have been delivered in accordance with Article A.4, and shall also give the Buyer any other notice required to enable it to take such measures as are normally necessary to obtain the goods. | B.7. NOTICE TO THE SELLER In the event that the buyer has the right to determine the period within which the goods must be shipped and/or the port of destination, he is obliged to duly notify the seller about this. |

| A.8. PROOF OF DELIVERY, TRANSPORT DOCUMENTS OR EQUIVALENT ELECTRONIC COMMUNICATIONS The Seller shall promptly provide to the Buyer at his own expense a normal transport document issued for the agreed port of destination. The document (e.g., negotiable bill of lading, non-negotiable sea waybill, proof of inland waterway transport) must cover the goods sold, be dated within the period agreed for shipment of the goods and enable the buyer to receive the goods from the carrier at the port of destination and, unless otherwise agreed, give the buyer the opportunity to sell the goods to a third party during transit by means of an endorsement (negotiable bill of lading) or by notifying the carrier. If several originals of a transport document are issued, the buyer must be given a complete set of originals. In the event that the seller and buyer have agreed to use electronic communications, the documents mentioned above may be replaced by equivalent electronic messages (EDI). | B.8. PROOF OF DELIVERY, TRANSPORT DOCUMENTS OR EQUIVALENT ELECTRONIC MESSAGES The Buyer must accept the provisions provided in Article A.8. transport document, if it complies with the terms of the sales contract. |

| A.9. INSPECTION - PACKAGING - LABELING The seller must bear the costs associated with the inspection of the goods (e.g. quality, size, weight, quantity) necessary to deliver the goods in accordance with Article A.4. The seller is obliged, at his own expense, to provide the packaging (except in cases where it is customary in this branch of trade to send the goods stipulated by the contract without packaging) necessary for the transportation of the goods organized by him. The packaging must be properly labeled. | B.9. GOODS INSPECTION The Buyer shall bear the costs of any pre-shipment inspection of the goods unless such inspection is required by the authorities of the country of export. |

| A.10. OTHER OBLIGATIONS The Seller is obliged, at the request of the Buyer, to provide the latter, at his expense and risk, with full assistance in obtaining any documents or equivalent electronic messages (other than those mentioned in Article A.8.) issued or used in the country of dispatch and/or in the country of origin goods that the buyer may need to import the goods or, if necessary, for their transit through third countries. The seller is obliged to provide the buyer, upon his request, with all the information necessary for the implementation of insurance. | B.10. OTHER OBLIGATIONS The Buyer must bear all costs and fees associated with the receipt of documents or equivalent electronic communications as provided in Article A.10., as well as reimburse the Seller for expenses incurred by the latter as a result of its assistance to the Buyer. |

Required documents for import according to INCOTERMS 2010 rules

As mentioned earlier, transportation requires either a river or sea waybill. They must be non-negotiable. An alternative to them is a negotiable bill of lading.

There is one more document that you need to obtain. This is an export invoice. This document confirms payment of the goods for all customs duties. If the seller does not fulfill these conditions (and it is he who must purchase the export invoice), then he undertakes to pay all costs associated with this.

You will also need an import license. This document is the responsibility of the buyer, since all responsibility for importing goods rests with the receiving party.