The first version of INCOTERMS trading rules was released back in 1936. Needless to say, everything in the economy has changed dramatically since then. New editions are regularly released; the current edition is 2010. It contains not only the basic conditions for the supply of goods in international trade operations, but also an explanation of basic trade concepts and terms. INCOTERMS 2010 has a more precise and unambiguous interpretation, which somewhat simplifies the conclusion of contracts. Similar terms include DAT. Let's take a closer look at it.

The emergence of the term DAT

In the 2000 version of INCOTERMS, this rule did not yet exist. It replaced the term DEQ, which was used when delivering cargo to the port and had the following features:

- The supplier was responsible for paying export duties;

- The buyer paid for the clearance of products from import duties;

- The exporter assumed the risks and costs associated with the delivery of goods to the specified port and its further unloading;

- The buyer paid for the delivery of the goods to their own warehouses.

In 2010, the International Chamber of Commerce considered that such rules were no longer relevant. They lacked specificity and delivery conditions were limited. Therefore, DEQ was replaced by the term DAT.

What does DAT mean: transcript

The term DAT stands for “Delivered at terminal”, or “delivery at the terminal”, for example, DAT Domodedovo сargo terminal, Moscow (Incoterms 2010) / DAT Domodedovo Cargo Terminal, Moscow Airport (Incoterms 2010).

If explained in simple words, it means that the seller’s obligations to the buyer are considered fulfilled after the goods are delivered to the terminal and unloaded. Customs clearance is not the exporter's responsibility.

The seller assumes responsibility for unloading. Accordingly, he bears all possible risks in case of damage and loss of the goods.

Explanation of the term

From English this term is translated as “Delivery at the terminal...”. This means that, according to the terms of the INCOTERMS DAT 2010 contract, delivery is considered completed at the moment when the sending party places the cargo at the disposal of the buyer at the agreed terminal. In this case, the supplier bears the costs associated with the delivery and unloading of the goods at the specified destination. These costs include payment for export customs procedures that are carried out when products are exported from the sender's country.

Concluding a contract on the terms of delivery of DAT INCOTERMS 2010 is beneficial for those companies whose warehouses are located near the arrival terminals. In this case, the customer’s costs associated with delivery are significantly reduced. This also reduces the final cost of purchased products.

International rules of Incoterms

Home — Articles

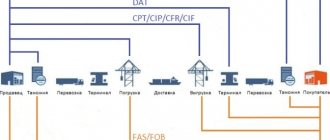

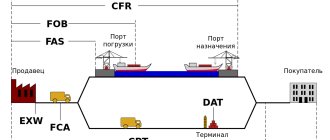

The scope of the International Incoterms Rules extends to the rights and obligations of the parties under a sales contract regarding the supply of goods. Based on clause 11 of Art. 1211 of the Civil Code of the Russian Federation, if the contract uses trade terms accepted in international circulation, then, in the absence of other instructions in the contract, it is considered that the parties have agreed on the application to their relations of business customs, denoted by the corresponding trade terms. This provision, in particular, means that the parties can, at their own discretion, determine which terms and to what extent apply to the agreement concluded by the parties. To do this, it is necessary to reflect in the contract the consent of the parties to the application of the Incoterms Rules as amended in 2000 or 2010. The Incoterms Rules mainly determine the responsibilities, costs and risks arising when delivering goods from sellers to buyers. Each term is an abbreviation of three letters, the first of which indicates the point of transition of obligations from the seller to the buyer:

E - at the place of departure (departure);

F - at the departure terminals of the main carriage, the main carriage is not paid (main carriage unpaid);

C - at the arrival terminals of the main carriage, the main carriage is paid;

D - from the buyer, full delivery (arrival).

If the Incoterms 2000 Rules contained 13 basic conditions for the supply of goods, then the Incoterms 2010 Rules, which entered into force on January 1, 2011, define 11 terms, and seven of them are applicable to any type of transport of the main carriage and regardless depending on whether one or more modes of transport are used:

1. EXW (ex works, ex-warehouse, ex-factory): the goods are picked up by the buyer from the seller’s warehouse specified in the contract, payment of export duties is the responsibility of the buyer.

2. FCA (free carrier): the goods are delivered to the customer’s main carrier at the departure terminal specified in the contract, export duties are paid by the seller.

3. CPT (carriage paid to...): the goods are delivered to the customer’s main carrier, the main transportation to the arrival terminal specified in the contract is paid by the seller, insurance costs are borne by the buyer, import customs clearance and delivery from the main carrier’s arrival terminal is carried out by the buyer.

4. CIP (carriage and insurance paid to...) - the same as CPT, but the main transportation is insured by the seller.

5. DAT (delivered at terminal): delivery to the import customs terminal specified in the contract has been paid for, that is, export payments and main transportation, including insurance, are paid by the seller, customs clearance for import is carried out by the buyer.

6. DAP (delivered at point): delivery to the destination specified in the contract, import duties and local taxes are paid by the buyer.

7. DDP (delivered duty paid): the goods are delivered to the customer at the destination specified in the contract, cleared of all duties and risks.

Incoterms 2010 also defines four terms that apply exclusively to maritime transport and transport of territorial waters. In this group of terms, both points - the point of delivery and the place to which the goods are transported by the buyer - are ports:

1. FOB (free on board): the goods are shipped to the buyer’s ship, transshipment is paid by the seller.

2. FAS (free alongside ship): the goods are delivered to the buyer’s ship, the loading port is specified in the contract, transshipment and loading are paid by the buyer.

3. CFR (cost and freight): the goods are delivered to the buyer’s destination port specified in the contract, insurance of the main transportation, unloading and transshipment is paid by the buyer.

4. CIF (Cost, Insurance and Freight) - the same as CFR, but the seller insures the main transportation.

The content of Incoterms changes in different revisions. Thus, in Incoterms 2010, in comparison with Incoterms 2000, the term DAP was introduced to replace the excluded DAF (delivered at frontier, delivery to the border), DES (delivered ex ship, delivery on board the vessel at the port of destination) and DDU (delivered , duty unpaid, delivery to a specified place without customs clearance), and instead of DEQ (delivered ex quey, delivery to a port), the more general term DAT was introduced.

Let's look at a brief description of the terms "Incoterms 2010".

1. Category "E".

EXW (EX Works)

Ex-factory (place name)

The term "ex works" (also referred to as "ex-works") means that the seller is deemed to have fulfilled his obligation to deliver when he makes the goods available to the buyer at his place of business or at another named place, such as a plant, factory, warehouse, etc. .P. The seller is not responsible for loading the goods onto the vehicle, as well as for customs clearance of the goods for export.

This term imposes minimal obligations on the seller and the buyer must bear all costs and risks of transporting the goods from the seller's premises to the destination. However, if the parties agree that the seller assumes the responsibility for loading the goods at the place of shipment and bears all risks and expenses for shipment, then this must be clearly stated in the relevant addendum to the purchase and sale agreement.

This term cannot be applied when the buyer is unable to comply directly or indirectly with export formalities. In this case, the term FCA should be used provided that the seller agrees to bear the costs and risks for shipping the goods.

2. Category "F".

FCA (Free Carrier)

Free carrier (place name)

The term "free carrier" means that the seller will deliver the goods, cleared by customs, to the carrier nominated by the buyer to the named place. It should be noted that the choice of delivery location will affect the loading and unloading obligations at that location. If delivery is made at the seller's premises, the seller is responsible for shipment. If the delivery is carried out to another place, the seller is not responsible for the shipment of the goods.

This term can be used for transportation by any type of transport, including multimodal transport.

A carrier is any person who, on the basis of a contract of carriage, undertakes to carry out or ensure the transportation of goods by rail, road, air, sea and inland waterway transport or a combination of these modes of transport.

If the buyer trusts another person, who is not a carrier, to accept the goods, then the seller is considered to have fulfilled his obligations to deliver the goods from the moment of transferring them to this person.

FAS (Free Alongside ship)

Free along the side of the vessel (name of port of shipment)

The seller is deemed to have fulfilled his obligation to deliver when the goods are placed alongside the ship at the agreed port of shipment. The point is that from this moment the buyer must bear all costs and risks of loss or damage to the goods.

If the parties want the buyer to clear customs for export, they should add clear language to the sales contract.

This term can only be used for sea transport or inland water transport.

FOB (Free On Board)

Free on board (name of port of shipment)

The term "free on board" means that the seller has delivered when the goods have passed the ship's rail at the named port of shipment and that from that time all costs and risks of loss or damage to the goods must be borne by the buyer. Under FOB terms, the seller is responsible for customs clearance of the goods for export.

This term can only be used when transporting goods by sea or inland waterway transport.

3. Category "C".

CFR (Cost and Freight)

Cost and freight (name of destination port)

The seller completes delivery when the goods pass the ship's rail at the port of shipment. He must pay the costs and freight necessary to bring the goods to the named port of destination, but the risk of loss or damage to the goods and any additional costs incurred after the goods have been shipped pass from the seller to the buyer.

Under the CFR, the seller is responsible for clearing the goods for export.

This term can only be used when transporting goods by sea or inland waterway transport.

If the parties do not intend to deliver the goods over the ship's rail, the term CPT should be used.

CPT (Carriage Paid To)

Freight/carriage paid to... (name of destination)

The seller will deliver the goods to the carrier named by him. In addition, the seller is obliged to pay the costs associated with transporting the goods to the specified destination. This means that the buyer assumes all risks of loss or damage to the goods, as well as other costs after the goods are handed over to the carrier.

A carrier is a person who, on the basis of a contract of carriage, undertakes to provide independently or organize the transportation of goods by rail, road, air, sea and inland waterway transport or a combination of these modes of transport.

In the case of transport to an agreed destination by several carriers, the transfer of risk will occur at the moment the goods are transferred to the care of the first of them.

Under CPT, the seller is responsible for clearing the goods for export.

This term can be used when transporting goods by any type of transport, including multimodal transport.

CIF (Cost, Insurance and Freight)

Cost, insurance and freight (name of destination port)

The seller completes delivery when the goods pass the ship's rail at the port of shipment.

The seller must pay the costs and freight necessary to deliver the goods to the named port of destination, but the risk of loss or damage to the goods, as well as any additional costs incurred after the goods have been shipped, passes from the seller to the buyer.

However, under the terms of CIF, the seller is also obliged to purchase marine insurance in favor of the buyer against the risk of loss and damage to the goods during transportation, therefore, the seller is obliged to enter into an insurance contract and pay insurance premiums.

The buyer should note that the CIF requires the seller to provide only minimum coverage insurance. If the buyer wants insurance with greater coverage, he must either specifically negotiate this with the seller or take steps to obtain additional insurance himself.

Under CIF, the seller is responsible for clearing the goods for export.

This term can only be used when transporting goods by sea or inland waterway transport. If the parties do not intend to deliver the goods over the ship's rail, the term CIP should be used.

CIP (Carriage and Insurance Paid)

Freight/carriage and insurance paid to... (name of destination)

The seller will deliver the goods to the carrier named by him. He is obliged to pay the costs associated with transporting the goods to the destination. This means that the buyer assumes all risks and any additional costs for shipping the goods in this manner.

Under CIP, the seller is also obligated to provide insurance against the risks of loss and damage to the goods during transit for the benefit of the buyer. Consequently, the seller enters into an insurance contract and pays the insurance premiums.

The Buyer should note that the CIP requires the Seller to provide minimum cover insurance. If the buyer wants to have insurance with greater coverage, he must either specifically agree on this with the seller, or take steps to conclude additional insurance himself.

A carrier is any person who, on the basis of a contract of carriage, undertakes to provide or organize the transportation of goods by rail, road, air, sea and inland waterway transport or a combination of these modes of transport.

In the case of transportation to a destination by several carriers, the transfer of risk will occur at the moment the goods are transferred to the care of the first carrier.

Under CIP, the seller is responsible for clearing the goods for export.

This term can be used when transporting goods by any type of transport, including multimodal transport.

4. Category "D".

DAT (Delivered At Terminal)

Delivery at terminal (name of terminal)

This is a new term “Incoterms 2010”, which can be used for deliveries by any mode of transport, including multimodal transport. It means that the seller is considered to have fulfilled his obligations when the goods, released under the customs regime of export, are unloaded from the arriving means of transport and made available to the buyer at the agreed terminal of the specified destination. Terminal means any place, including an air, auto, railway cargo terminal, pier, warehouse, etc.

The terms of delivery oblige the seller to bear all costs and risks associated with transporting the goods and unloading them at the terminal, including (where required) any duties for export from the country of origin.

A carrier is any person who, on the basis of a contract of carriage, undertakes to provide or organize the transportation of goods by rail, road, air, sea and inland waterway transport or a combination of these modes of transport.

The seller is responsible for completing export customs procedures for the export of goods.

However, the seller is not required to complete customs formalities for the import of goods, pay import customs duties or carry out other import customs procedures upon importation.

DAP (Delivered At Point)

Delivery at point (name of point)

The seller has fulfilled his obligation to deliver when he provides the buyer with the goods cleared for export and ready for unloading from the vehicle arriving at the named destination.

DAP terms of delivery oblige the seller to bear all costs and risks associated with transporting the goods to their destination, including (where required) any duties for export from the destination country.

The term can be used when transporting goods by any type of transport, including multimodal transport. A carrier is any person who, on the basis of a contract of carriage, undertakes to provide or organize the transportation of goods by rail, road, air, sea or inland waterway transport or a combination of these modes of transport.

The seller is responsible for completing export customs procedures for the export of goods. However, he is not obliged to carry out customs formalities for the import of goods, pay import customs duties or carry out other import customs procedures upon importation. If the parties intend to place on the seller all the risks and costs of completing import customs formalities for importing goods, it is advisable to use the term DDP.

DDP (Delivered Duty Paid)

Delivered Duty Paid (Name of Destination)

The seller will place the goods, cleared through customs and not unloaded from the arriving vehicle, at the disposal of the buyer at the specified destination.

The seller must bear all costs and risks associated with the transportation of the goods, including, where applicable, any duties for importation into the country of destination. Fees mean responsibility and risks for customs clearance, as well as for payment of customs formalities, duties, taxes, etc.

This term cannot be used if the seller directly or indirectly fails to obtain an import license.

If the parties have agreed to exclude from the seller's obligations some of the costs payable upon import (for example, VAT), this should be clearly defined in the sales contract.

Incoterms rules provide for the freedom of the parties to determine the terms of an agreement using Incoterms terms. Depending on the specific needs of the parties that have developed during trade relations, customs, national legislation and other circumstances, the parties may adjust the terms used.

Outside the scope of Incoterms remain the rules for the transfer of ownership from the seller to the buyer, as well as the consequences of failure by the parties to fulfill their obligations under the contract for the sale of goods, including the grounds for releasing the parties from liability, which is regulated by the applicable law or the Vienna Convention of 1980 - an international agreement, aimed at unifying the rules of international trade (we are talking about the UN Convention on Contracts for the International Sale of Goods).

Example 1. Free carrier (indicating the item) FREE CARRIER - FCA.

An English company from a warehouse in London is obliged to transfer the cargo to a Russian company. Delivery of goods to Moscow will be carried out by a carrier hired by a Russian company, who will pick up the goods from a warehouse in London. The parties agreed that the seller insures the transported cargo.

Under such conditions, it is sufficient to indicate in the contract that the contract is concluded on FCA terms in accordance with Incoterms 1990, and also that the place of delivery of the goods by the seller to the carrier is London. In addition, it is necessary to stipulate in detail the conditions of cargo insurance. This is because, according to the FCA, it is not the seller's responsibility to insure the goods. However, the parties can adjust certain terms of the FCA.

Example 2. Cost and freight (name of destination port) COST AND FREIGHT - CFR.

The Dutch company supplies its products by sea to the Russian company. In this case, the parties do not insure the cargo, and the seller’s obligations for delivery are limited to concluding an agreement with the carrier and handing over the subject of the agreement to him for transportation no later than a certain period.

In this case, it is enough for the parties to indicate that they are entering into an agreement in accordance with Incoterms 1990 on the terms “CFR St. Petersburg with shipment no later than...”.

April 2014

Customs regulations

Imposing an administrative fine for customs violations

Administrative responsibility for non-declaration of goods transported across the customs border of the Customs Union

Expertise in customs violations

Customs regulation and customs affairs

Protection of intellectual property rights by customs authorities

Terminals and transport

Unlike DEQ, the term DAT applies to all modes of transportation. In the delivery basis, “terminal” means any place, including a sea or river pier, airport, warehouse, railway station freight yard or other point. This feature of the delivery basis allows the use of multimodal delivery, during which it is possible to use several types of transport at once.

Any freight forwarding company with which the seller enters into a contract can deliver to the place specified in the contract. The sending party has the right to independently choose the carrier, since it is responsible for delivering the goods to the terminal specified in the contract.

The buyer cannot interfere in the process of concluding a contract between the seller and the freight forwarding company, since payment for delivery is at the expense of the supplier. However, if the cargo goes along a non-standard route, the customer has the right to agree on delivery details with the sending party.

If the seller has his own transport, then the delivery of the goods is carried out accompanied by a responsible person. In this case, the route along which the goods will be sent is developed by the supplier.

Delivery basis

The terms of the DAT clearly allocate responsibilities and costs between the exporter and the importer. This avoids friction between the parties to the transaction.

- The seller bears the costs associated with delivering the goods, which are previously cleared of export duties, to the destination. In addition, the supplier pays for unloading at a terminal, which can be a port, airport or warehouse.

- The sending party's obligations to deliver the goods are considered fulfilled when the cargo and accompanying documents are handed over to the customer's representative.

- The transfer of risks occurs in the terminal. The moment the carrier places the goods at the disposal of the receiving party, a transfer of risk occurs. This means that after unloading the products, the seller is no longer responsible for them.

- The buyer is obliged to pay for the goods according to the conditions specified in the contract. In addition, he bears the costs of acquiring an import license and customs clearance of the cargo.

Relevance of using the DAT basis

Today, the delivery conditions of DAT Incoterms as amended in 2010 are considered outdated, because On January 1, 2021, the new rules of Incoterms 2021 came into force. The trade term DAT was renamed to the delivery condition DPU Incoterms 2021 (Delivered Named Place Unloaded). However, the International Chamber of Commerce only recommends, but does not oblige, the use of the DPU Incoterms 2021 delivery terms, so supply contracts can refer to the DAT Incoterms 2010 delivery basis.

In Incoterms 2010, the terms DAT (Delivered at Terminal) and DAP (Delivered at Destination) replaced the following Incoterms 2000 terms: DAF (Delivered at Frontier), DES (Delivered Ex Ship), DEQ (Delivered Ex Quay) and DDU (Delivered Ex Ship). without paying duties).

>

Responsibilities of the seller under the terms of DAT (DAT) | Buyer's responsibilities under DAT |

| A.1. DELIVERY OF GOODS IN ACCORDANCE WITH THE AGREEMENT The Seller is obliged, in accordance with the purchase agreement, to provide the buyer with the goods, a commercial invoice or equivalent electronic communication, and any other evidence of compliance that may be required under the terms of the purchase agreement. | B.1. PAYMENT OF THE PRICE The buyer is obliged to pay the price of the goods stipulated in the purchase and sale agreement. |

| A.2. LICENSES, CERTIFICATES AND FORMALITIES The Seller must, at his own expense and risk, obtain any export license or other official certificate and, if required, complete all customs formalities for the export of the goods and for their transit through third countries. | B.2. LICENSES, CERTIFICATES AND FORMALITIES The Buyer shall, at his own expense and risk, obtain any import license or other official certificate and, if required, complete all customs formalities for the importation of the goods. |

| 3A.3. CONTRACTS OF CARRIAGE AND INSURANCE a) Contract of carriage. The seller is obliged to conclude, at his own expense, a contract for the carriage of goods to the designated terminal, named destination. If a specific terminal is not agreed upon, and if there are several such terminals, then the Seller can choose the most suitable terminal for him. b) Insurance contract - no obligations. | B.3. CONTRACTS OF CARRIAGE AND INSURANCE a) Contract of carriage - no obligations. b) Insurance contract - no obligations. |

| A.4. DELIVERY OF GOODS The seller is obliged to place the goods at the disposal of the buyer or other person nominated by the buyer, in shipped form, from any arriving means of transport arriving at the terminal at the named place of destination, on the agreed date or within the agreed period for delivery. | B.4. ACCEPTANCE OF DELIVERY The Buyer is obliged to accept delivery of the goods when it is made in accordance with Article A.4. |

| A.5. PASSION OF RISK The Seller is obliged to deliver the goods subject to the provisions of Article B.5. and bear all risks of loss or damage to the goods until they are delivered in accordance with Article A.4. | B.5. PASSION OF RISK The Buyer must bear all risks of loss or damage to the goods from the time of delivery in accordance with Article A.4. The Buyer shall, if he fails to comply with the obligation in accordance with Article B.2., bear all additional risks of loss and damage thereby caused to the goods. The Buyer shall, if he fails to comply with the obligation to give notice in accordance with Article B.7., bear all risks of loss of or damage to the goods from the expiration of the agreed date or the end of the agreed delivery period. The condition, however, is that the goods comply properly with the contract. This means that the goods must be properly identified, that is, clearly separated or otherwise identified as the goods that are the subject of the contract. |

| A.6. DISTRIBUTION OF COSTS The seller is obliged, subject to the provisions of Article B.6.: to bear all costs associated with the goods until they are delivered in accordance with Article A.4., as well as to pay freight and all expenses arising from Article A.3.a) including the costs of loading the goods and unloading them at the place of destination, which, according to the contract of carriage, are borne by the seller, and pay, if required, all costs associated with the completion of customs formalities for export, as well as other duties, taxes and other charges subject to payment for the export of goods, and costs associated with its transit through third countries, in cases where these costs, according to the contract of carriage, are borne by the seller. | B.6. ALLOCATION OF COSTS The Buyer is obliged, in accordance with the provisions of Article A.3.a): to bear all costs associated with the goods from the moment of delivery in accordance with Article A.4. bear all additional costs if he fails to fulfill his obligations in accordance with Article B.2. or give notice in accordance with Article B.7. The condition, however, is that the goods comply properly with the contract. This means that the goods must be properly identified, that is, clearly separated or otherwise identified as the goods that are the subject of the contract. |

| A.7. NOTICE TO THE BUYER The Seller is obliged to properly notify the buyer of the dispatch of the goods, as well as send the buyer such other notices as are required for him to take the measures usually necessary to accept delivery of the goods. | B.7. NOTICE TO THE BUYER The Buyer is obliged, if he has the right to determine the time within the agreed period and/or the point of acceptance of delivery at the named place of destination, to duly notify the seller about this. |

| A.8. PROOF OF DELIVERY, TRANSPORT DOCUMENTS OR EQUIVALENT ELECTRONIC COMMUNICATIONS The seller must provide the buyer at his expense with a delivery order and/or a regular transport document (for example, a negotiable bill of lading, non-negotiable sea waybill, proof of inland waterway transport, air waybill, rail waybill or road waybill). or a multimodal transport bill) which the buyer may require to accept delivery of the goods in accordance with Articles A.4./B.4. In the event that the seller and buyer have agreed to use electronic communications, the documents mentioned above may be replaced by equivalent electronic messages (EDI). | B.8. PROOF OF DELIVERY, TRANSPORT DOCUMENTS OR EQUIVALENT ELECTRONIC MESSAGES The Buyer must accept the required delivery order or transport document in accordance with Article A.8. |

| A.9. INSPECTION - PACKAGING - LABELING The seller is obliged to bear the costs associated with checking the goods (for example, checking quality, dimensions, weight, quantity) necessary for delivery of the goods in accordance with Article A.4. The seller is obliged to provide packaging at his own expense (except in cases , when it is customary in a given branch of trade to deliver the contracted goods without packaging) necessary for the delivery of the goods. The packaging must be properly labeled. | B.9. GOODS INSPECTION The Buyer must bear the costs of pre-shipment inspection of the goods unless such inspection is required by the authorities of the country of export. |

| A.10. OTHER OBLIGATIONS The Seller shall bear all costs and fees associated with the receipt of documents or equivalent electronic communications as provided in Article B.10., and shall reimburse all expenses incurred by the Buyer in connection with the provision of assistance. The seller is obliged to provide the buyer with all the information necessary to carry out insurance. | B.10. OTHER OBLIGATIONS The buyer shall, at the request of the seller, provide the latter, at his expense and risk, with his full cooperation in obtaining any documents or equivalent electronic communications issued or transmitted in the country of importation which the seller may require to enable the goods to be so placed at the disposal of the buyer. |

Risks of the parties

DAT terms of delivery distribute not only the responsibilities and costs between the supplier and the buyer, but also the risks of the parties.

- The supplier is responsible for the goods until he hands them over to a representative of the receiving party. Therefore, the seller insures the cargo before shipping. Thus, he relieves himself of financial risks and transfers them to the insurance company.

- After a person authorized by the buyer accepts the goods, the risks are transferred to the receiving party. If during delivery to the customer's warehouses, loss or damage to the cargo occurs, the customer or his carrier is responsible for this.

When concluding a contract on such terms, pay attention to possible nuances, since the contract has greater legal weight than the INCOTERMS rules.

How to use Incoterms rules (Incoterms 2020)

The international rules of Incoterms 2021 can be applied from January 1, 2021, but it is also possible to continue to use the rules of Incoterms 2010, or the rules of Incoterms 2000, and even earlier versions of Incoterms. Therefore, in international sales contracts, when specifying the terms of delivery, it is necessary to accurately indicate the version of Incoterms.

It is important to know that Incoterms rules do not replace the purchase and sale agreement, but only allow them to be shortened. Incoterms delivery conditions do not determine the transfer of ownership of the goods, do not indicate the price for the goods and the method of payment or the consequences of violation of the contract.

Incoterms only reflect the distribution of responsibilities and financial costs between the seller and the buyer, such as: transportation of goods, their loading and unloading from a vehicle, customs clearance, payment of taxes, duties and fees, insurance, as well as the transfer of risks of loss and damage to goods.

The ICC offers the following template for applying Incoterms rules to your contract:

“[Selected delivery term Incoterm] [name of port, place or place] Incoterm [year of publication]”

For example: “FCA Moscow Russia Incoterms 2020”

The selected Incoterms delivery condition must correspond to the product, the method of its transportation, insurance and customs clearance.

Obligations of the parties

The terms of a foreign trade transaction impose certain obligations on the supplier and the customer.

- From the buyer's side:

- The customer is obliged to pay for the goods according to the conditions specified in the contract.

- An import license is purchased at the buyer's expense.

- In a contract concluded under such conditions, an additional clause can be written down, according to which the supplier will be responsible for customs clearance of the cargo. But in this case, the transfer of risks will in any case occur after unloading at the destination.

- The buyer is obliged to accept documents from the supplier if they comply with international standards.

- If additional inspection of the goods is required to clear the cargo from import duties, it is paid for by the customer.

- The receiving party must notify the supplier that it is ready to accept the goods at the terminal.

- From the seller's side:

- The supplier is obliged to comply with the terms and conditions of delivery specified in the contract.

- The sending party pays the costs of delivering the cargo to the terminal specified in the contract. The carrier with whom the seller entered into a contract must have transport documents. We are talking about the papers that the receiving party will need to clear domestic customs and purchase an import license.

- The cargo that arrives at the agreed terminal of the designated destination must be ready for the import procedure. This means that the supplier is obliged to clear the goods from export duties.

- The seller pays for additional inspection of the goods if this procedure is necessary for export.

- The costs associated with labeling, packaging and checking the cargo are borne by the sending party.

- The supplier is obliged to provide the beneficiary with technical licenses for the supplied products:

- An export license is purchased at the sender's expense.

- The seller notifies the client that the goods are ready for unloading.

- The sending company must provide the necessary documents for the cargo.

Incoterms 2021 - safety requirements

Transport security has become the new norm (for example: mandatory inspection of containers). Article A4/B4 ("Transportation") of each Incoterms rule now requires the seller, where applicable, to comply with any transport-related safety requirements to the point of delivery and/or to provide the buyer with any information regarding transport-related safety requirements that necessary for the buyer to organize transportation.

Article A7/B7 (“Export/Import Customs Clearance”) of each Incoterms rule, where applicable, now also explicitly requires the seller to complete any security-related formalities when clearing exports and to assist the buyer in obtaining any documents or information necessary to comply with customs formalities related to import or transit.

Transport-related security costs have also become more prominent in the separate list of expenditure obligations under Articles A9/B9 of each Incoterms rule. It should be noted that references to “security” in Incoterms 2020 are general in nature, there is no specific reference to cybersecurity or other forms of security.

Features of delivery under such conditions

DAT INCOTERMS 2010 has features that set it apart from other rules of international trade.

- If the contract does not specify a specific place for the arrival of the goods, then the supplier has the right to choose the most suitable shipment terminal. Therefore, the customer should indicate in the contract the legal and physical address of the terminal at which it is convenient for him to pick up the purchased products.

- If the buyer is expecting an urgent delivery, then he needs to ask the seller for the date and time when the cargo will arrive at the terminal. It is also necessary to specify in the contract the penalties that will be imposed on the supplier in case of failure to meet deadlines.

- When concluding a contract, discuss issues related to insurance. This will reduce financial risks.

Advantages and disadvantages

DAT INCOTERMS delivery conditions have both positive and negative aspects

- Benefits for the seller:

- No need to obtain an import license.

- It is possible to independently choose transport and forwarding companies.

- Benefits for the buyer:

- The cargo is delivered to the specified terminal.

- Unloading is paid by the supplier.

- There is no need to clear products from export duties.

- Negative sides for the seller:

- Registration and payment of an export license.

- Clearing goods from export duties.

- Unloading of goods at the arrival terminal.

- Negative sides for the buyer:

- Risk transfer at the arrival terminal.

- Payment for an import license and completion of customs procedures.

The main advantage of such a transaction is that it is financially transparent. It clearly allocates the financial costs of the parties.