HomeCustoms payments Customs excise duty

Customs excise tax is one of the types of payments paid for the import of excisable goods into the customs territory of the Russian Federation. It is also called excise duty or tax. In addition to excise duty, other customs duties and fees are paid on goods imported into the territory of the Russian Federation. The money received from the collection of excise tax goes to the budget of the Russian Federation. Customs payments include excise taxes, customs duties, import and export duties (Article 46 of the EAEU Labor Code). Excise duty is levied in addition to customs duty on excisable goods. The state has chosen for taxation highly profitable goods, the selling price of which significantly exceeds the cost of their production. The demand for excisable goods usually does not change due to an increase or decrease in their cost. They are not essential items and are not healthy. These are, for example, cigarettes, vodka, beer, etc.

Customs payments

customs duty

Customs duty

Customs VAT

Excise tax on export

When exporting, no excise tax is paid. This increases the competitiveness of excisable goods and supports domestic producers. The procedure for exemption from excise tax is regulated by Art. 184. Tax Code of the Russian Federation. According to the requirements of tax legislation, it is necessary to provide a bank guarantee to the tax service or enter into a surety agreement (letter dated June 30, 2021 N SD-4-3/12690). The bank guarantee obliges the declarant to pay excise tax if the necessary documents confirming the fact of export of the goods are not provided on time. The surety agreement exempts you from paying excise tax if the documents are provided on time, according to the agreement. If the terms of the contract are not met, the guarantor will have to pay excise tax.

What you need to know about fees

Payment of the fee is regulated by the tax obligation and is charged:

- for registration services;

- when a person applies for the service of authorized employees;

- for product support services;

- to protect rights;

- when providing legally significant services.

This obligation may be terminated upon payment of the fee. It also terminates if a fee is collected by the authorized body.

Excise duty on import (import)

Excise duty is paid when importing excisable goods into the territory of the Russian Federation, when submitting a customs declaration. In order to calculate the amount of excise tax, you need to know the excise tax rate, the tax base and the type of excise tax. The type of excise tax is determined by tax legislation. There are three types of rates: fixed, ad valorem, combined.

Firm rate

indicates how much you need to pay per unit of goods. By multiplying the fixed excise tax rate by the tax base (quantity of goods) we get the excise tax amount. A fixed rate is the cost per unit of measurement of a product. For example, it could be rub./liter or rub./gram or rub./piece. etc. The tax base for a fixed rate is determined as the number of imported goods. For example, liters, hp, pieces, grams.

Sacc

— excise tax amount

Stakts

— fixed excise tax rate

Nb

— tax base

Ad valorem rate

indicated as a percentage. The customs value of the imported goods is taken as the tax base. Not used in the current version of the Tax Code of the Russian Federation 2021.

Sacc

— excise tax amount

Advst

— ad valorem excise tax rate

Тс

— customs value

For a combined rate, two values are indicated: one for ad valorem, the other for specific. They calculate each one and choose the largest one.

Control Features

The time allocated for inspection, according to the rules for the import and export of products, is regulated by the Customs Committee of the Republic of Belarus.

Customs control is of great importance. Rules for control of products subject to import and export are also established by the Customs Code. Also, specific acts of Belarusian legislation are responsible for the control procedure at the border. Some products may be exempt from certain control operations, which are also regulated by legislation.

Customs control at the border with the Republic of Belarus

When exercising control, authorized employees do not have the right to establish additional restrictions.

All restrictions are regulated by the Labor Code, which is responsible for border control.

Customs excise tax rate

How to find out whether you need to pay excise duty on your products or not and how much? To do this, you need to correctly determine the unique digital code of the product using a special classifier of the Commodity Nomenclature of Foreign Economic Activity of the EAEU (TN FEA). Using this digital code, determine in the Unified Customs Tariff of the Eurasian Economic Union (UCT EAEU) whether excise duty needs to be paid and, if necessary, how much?

Example 1: Import of malt beer in vessels with a capacity of less than 10 liters, in bottles, with an ethyl alcohol content of less than 8.6%. We find the ten-digit product code “2203000100”; the excise tax rate for it is 21 rubles/liter. Example 2: Import from Spain of natural grape wines with the addition of plant or aromatic substances, in vessels with a capacity of 2 liters or less, with an actual alcohol concentration of less than 18%. We find the product code “2205101000”, the excise tax rate for wine is 18 rubles/liter. If a batch of imported goods includes excisable goods with different excise rates, then the excise tax is calculated for each group separately (Article 194, paragraph 6 of the Tax Code of the Russian Federation).

Imported goods placed under customs procedures are exempt from excise tax:

- Customs transit

- Processing for domestic consumption

- Free customs zone

- bonded warehouse

- Processing outside the customs territory

- Free warehouse

- Duty Free Shop

- Processing in customs territory

- Destruction

- Refusal in favor of the state

- Re-export

Features of moving goods

Every person has the right to move goods across the customs border. To move goods across the border, you need to know the provisions of the code, be aware of the international treaties of the Republic of Belarus, and also have an idea of the peculiarities of life in Belarus.

Crossing the border of Belarus

The movement of goods across the border is carried out according to the rules established by the Customs Code. This applies to both the import and export of goods across the border. The rules for moving especially valuable goods across the border, as well as national currency, are established and controlled by currency legislation.

According to the rules for moving goods across borders, a person is entitled to certain benefits. This applies to the import and export of goods across the border for personal use. If a person moves personal goods across the border, he can be completely exempt from paying duty.

Sometimes flat duty rates apply to such travelers. Taking into account the uniform duty rate, a simplified procedure for registering things can be applied to a person.

Transportation is carried out through special points. At these points, the customs service carries out inspections.

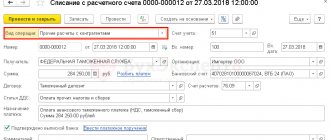

Payment of customs excise tax

The obligation to pay customs duties, including excise duty, is assigned to the declarant (Article 50 of the EAEU Labor Code). After calculating the excise tax and other customs payments, the declarant deposits funds into the account of the customs authority, which carries out customs clearance. These payments are advance payments, i.e. They must be paid in advance, before submitting the declaration. To do this, you need to transfer money to a single personal account of the ULS (payer’s personal account). The payment order indicates the Budget Classification Code (BCC), unique for each type of payment.

Attention!

When calculating customs duties, it is necessary to take into account fluctuations in exchange rates.

Individuals

can deposit funds through specialized terminals on the territory of the customs post (if available).

Legal entities

can use a customs card or a card of the Round payment system, which allows them to make customs payments without delays.

We will help you calculate and pay excise tax and other customs duties

Our company “Universal Freight Solutions” provides services for the clearance of goods, selection of HS codes, calculation of excise taxes, VAT, fees, import customs duties and other customs payments required for payment at customs. If you need to obtain a certificate, our company will help you. If necessary, we can pay customs duties for the client and carry out prompt customs clearance of cargo at customs, which will help reduce costs and time for clearing customs.

We are confident that we will become your reliable partner at customs!

general information

Belarus, being a member of the Customs Union (CU), uses fairly strict standards for the import and export of goods and crossing the border of the Republic of Belarus. These norms are regulated by the legislation of the country.

According to existing legislation, a person who has the citizenship of Belarus, which is part of the Customs Union, has the right to duty-free receipt of personal goods within 30 calendar days. In this case, the cost should not exceed 1 thousand euros. Total weight should not exceed 31 kg.

Two years ago there was information about upcoming changes in customs legislation. We were especially looking forward to changes in the article on customs payments. There were no major changes.

Moving food

In 2014, some standards for the import of certain goods and food products into the Republic of Belarus changed. Recommendations regarding new standards for food products were developed by the Customs Committee.

According to the new requirements, which apply not only to food, but also to other goods for personal use, the total cost should not exceed 1.5 thousand euros. In addition to food, this is true for alcohol. Among alcoholic beverages, beer and wine are allowed to be imported. The norms for importing alcohol into Belarus are the total volume - no more than three liters. You can import no more than 10 kilograms of food at a time.

There has been a lot of controversy regarding the issue of importing foreign currency in the past. Today, the import of European and American currency into the territory of the Republic of Belarus is not limited.

Ban on import of products

In 2014–2015 There was a serious war going on in international food markets. Then the Republic of Belarus introduced temporary restrictions on the supply of tea, fish, pork, and feed additives.

Some echoes of the “food” war can be felt in 2021.

At the very beginning of 2021, the media diligently circulated information that Belarus had banned the import of products from Russia. This turned out to be not entirely true. Temporary restrictions were introduced only in relation to the Tula and Yaroslavl regions.

Tea from Germany

Not long ago there was a ban on the import of tea. The ban affected German tea. Indian tea was also highly suspect. But the claims against Asian tea were soon dropped. In addition to tea, Belarus has banned the import of baby food from Israel.

The validity of certificates of conformity for 70 names of German tea was also canceled. According to competent employees, drinking German tea causes significant harm to health.

Some bans, on the contrary, were lifted. First of all, the removal of the taboo affected fish. This applies to both marine and freshwater fish. It can only be supplied to the domestic market. At the same time, the Republic of Belarus reserves the right to process fish.

Importers will be determined by members of a special commission. Today, about 40 companies have received the right to import fish.

Pork import taboo

The reason for temporary restrictions on the import of animal meat was the outbreak of African plague. First of all, temporary restrictions affected pork. Temporary restrictions also affected the supply of pork from the Belgorod region.

In 2021, the ban on the import of animal meat remains in relation to Poland and Ukraine. Also, at the beginning of 2021, the Republic of Belarus banned the import of animal meat from Crimea. The reason for the ban on the import of animal meat from the territory of the peninsula was the same African plague. According to some reports, Crimean pork became infected from Ukrainian animal meat.

A ban on the import of pork from the peninsula was introduced in early February. Until now, not only pork, but also meat from wild animals cannot be imported into the territory of the Republic of Belarus from the peninsula. Feed additives are also included in the list of prohibited products.

The list of prohibited products includes not only animal meat. Poultry imported from Romania and India were also affected.