Responsibilities under the basic terms of delivery DDU (DDU)

The seller bears all costs associated with the transportation and transfer of the goods at the specified destination, with the exception, if required, of any “any duty” fees (this includes responsibility for completing customs formalities, as well as payment of customs duties, taxes and other fees) levied upon importation of goods into the country of destination. The buyer is responsible for all fees and expenses associated with his failure to timely complete customs formalities required for the import of goods.

DDU term

can be used regardless of the mode of transport, however, if the transfer of the goods takes place at the port of destination on board a ship or at a quay (wharf), the terms DES or DEQ should be used.

How does the Incoterms 2000 edition differ from Incoterms 2010?

The new edition of Incoterms differs from 2000 in the following provisions:

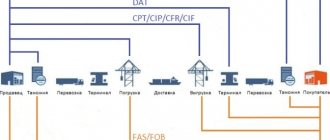

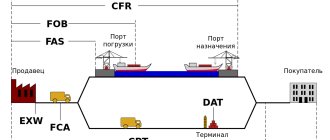

- Incoterms contains 11 terms, not 13. But 2 new provisions have been formed - DAP (delivery to point) and DAT (delivery to terminal). It is possible to use these provisions as multimodal ones.

- Removal of the 4 least used terms (DAF, DES, DEQ, and DDU).

- Using the term DAT (delivery to terminal) instead of the term DEQ: the goods are delivered to the buyer unloaded from the arriving transport.

- Using the term DAP (delivery to point) as a replacement for 3 terms at once: DAF, DES and DDU.

- The costs and risks of FOB (Free On Board), CIF (Cost, Insurance and Freight) and CFR (Cost and Freight) delivery terms have been redefined. The risk, according to Incoterms 2010, in all cases passed after delivery to the ship's side. Incoterms 2010 establishes that risks only pass after loading on board.

Get an interpretation of all Incoterms 2010 terms on our website ICC Books Russia

Differences between DDU and DAP delivery conditions

The difference between the delivery terms DDU Incoterms 2000 and DAP Incoterms 2010 is as amended by the Incoterms rules. In simple words, under the terms of DDU : the goods, at the expense of the seller, having passed export customs clearance, are transported to the specified destination . According to the DAP basis: the goods, at the expense of the seller, having undergone export customs clearance, are transported to the specified destination . The differences between the delivery terms DDU and other terms are presented in the table of differences in Incoterms 2000.

What is more important: contract terms or Incoterms 2010 rules

Incoterms are quite widely used for international sales contracts. This distribution is due to the fact that the provisions of the contracts fix important legal and commercial issues of the actual execution of a foreign trade purchase contract. Including the moment and place of performance of duties, transfer of risks, etc.

To identify and interpret the basic terms of delivery, you need to refer to the provisions of the relevant edition of Incoterms, to which reference is made in the contract. Consequently, Incoterms rules will apply if there is a corresponding clause in the contract. If the terms of the Incoterms and the contract do not match, the latter takes precedence.

Price, payment terms and transfer of ownership under DDU

DDU price means that the contract (invoice or customs) price for a product includes the sum of the cost of the product itself, export customs clearance of this product with payment of export duties and other fees and the cost of delivery (freight) to the specified destination.

Delivery terms DDU Incoterms

do not indicate the price for the goods and the method of payment, do not regulate the transfer of ownership of the goods or the consequences of violation of the contract. The price and transfer of ownership must be determined in the terms of the purchase and sale agreement. The trade term DDU indicates which party to the sales contract must carry out the necessary actions for transportation and customs clearance, when and where the seller transfers the goods to the buyer, as well as what costs each party bears.

What are the Incoterms 2010 rules?

The term Incoterms itself was first introduced in 1936. Then a set of rules of the International Chamber of Commerce was formed, which were aimed at ensuring the relationship between buyers and sellers. A dictionary was compiled at the same time, and today it unambiguously interprets all trade terms of Incoterms 2010 that are valid in foreign trade. The main attention is paid to free. This term means transition - the moment of transfer of responsibility for the goods from the seller to the buyer.

Through the use of Incoterms 2010, companies from different countries have the opportunity to significantly simplify the procedures for purchase and sale agreements. It is simply impossible to do without such rules, because each state has its own trade law, which can differ significantly in comparison with the law of another state. Through the adoption of Incoterms 2010 by the government, businesses (including consumers and sellers) are given the opportunity to avoid a number of serious difficulties.

Incoterms rules apply internationally and are accepted by law firms, businesses and governments around the world. They mean the interpretation of the terms most applicable to international trade regulations.

The key year is the Incoterms 2000 code, but in 2010 a number of changes were made to these rules. The terms of Incoterms 2000 were adopted with the participation of many countries that use this system. The latest edition is called Incoterms 2010, which came into force on January 1, 2011.

These international rules are classified into 4 categories - E, F, C, D. Incoterms 2010 terms are designated by three letters. The first letter denotes the most important thing, the point of obligation for the product from the seller to the buyer.

- E - place of departure, - F - departure terminals of the main transportation, the main transportation has not yet been paid, - C - arrival terminals of the main transportation, payment for the main transportation has already been made; — D – buyer, full delivery is implied.

Relevance of using the DDU basis

Today, the delivery conditions of DDU Incoterms 2000 are considered obsolete, because in 2010, two new terms: DAT (Delivered at Terminal) and DAP (Delivered at Destination) - replaced the following Incoterms 2000 terms: DAF (Delivered at Frontier), DES (Delivered Ex Ship), DEQ (Delivered Ex Quay) and DDU (Delivery free of duty). However, the International Chamber of Commerce only recommends, but does not oblige, the use of Incoterms 2010, so delivery contracts can refer to the DDU Incoterms 2000 delivery terms.

>

A. Responsibilities of the seller under the terms of the DDU (DDU) | B. Buyer's responsibilities under the DDU |

| A.1. DELIVERY OF GOODS IN ACCORDANCE WITH THE AGREEMENT The Seller is obliged, in accordance with the purchase agreement, to provide the buyer with the goods and a commercial invoice or equivalent electronic message, as well as any other evidence of compliance that may be required under the terms of the purchase agreement. | B.1. PAYMENT OF THE PRICE The buyer is obliged to pay the price of the goods stipulated in the purchase and sale agreement. |

| A.2. LICENSES, CERTIFICATES AND FORMALITIES The Seller shall, at his own expense and risk, obtain any export license or other official certificate or other documents and, if required, carry out all customs formalities for the export of the goods and for their transit through third countries. | B.2. LICENSES, CERTIFICATES AND FORMALITIES The Buyer must obtain, at his own risk and expense, an import license, other official permit or document for the importation of goods, and, if required, complete all customs formalities necessary for the importation of the goods and their subsequent transportation. |

| A.3. CONTRACTS OF CARRIAGE AND INSURANCE a) Contract of carriage: The seller is obliged to conclude at his own expense a contract for the carriage of goods to the named place of destination. If a special point is not agreed or determined by the practice of this type of delivery, the seller may choose the most suitable point for him at the named place of destination. b) Insurance contract - no obligations. | B.3. CONTRACTS OF CARRIAGE AND INSURANCE a) Contract of carriage - no obligations. b) Insurance contract - no obligations. |

| A.4. DELIVERY OF GOODS The seller is obliged to place the goods at the disposal of the buyer or another person nominated by the buyer, unshipped, on any arriving means of transport at the named place of destination on the agreed date or within the agreed period for delivery. | B.4. ACCEPTANCE OF DELIVERY The Buyer is obliged to accept delivery of the goods when it is made in accordance with Article A.4. |

| A.5. TRANSFER OF RISK The Seller is obliged to deliver the goods subject to the provisions of Article B.5. and bear all risks of loss or damage to the goods until they are delivered in accordance with Article A.4. | B.5. PASSION OF RISK The Buyer must bear all risks of loss or damage to the goods from the time of delivery in accordance with Article A.4. The buyer is obliged – if he fails to fulfill his obligation in accordance with Article B.2. – bear all additional risks of loss and damage thereby caused to the goods. The Buyer is obliged - if he fails to fulfill his obligation, to give notice in accordance with Article B.7. – bear all risks of loss or damage to the goods from the expiration of the agreed date or the end of the agreed delivery period. The condition, however, is that the goods comply properly with the contract. This means that the goods must be properly identified, that is, clearly separated or otherwise identified as the goods that are the subject of the contract. |

| A.6. DISTRIBUTION OF COSTS The seller is obliged, subject to the provisions of Article B.6.: – in addition to the costs arising from Article A.3 a), bear all costs associated with the goods until they are delivered in accordance with Article A.4. , and - if required - pay all costs associated with the completion of customs formalities for export, as well as other duties, taxes and other charges payable upon export of the goods and their transit through third countries prior to delivery in accordance with Article A. 4. | B.6. ALLOCATION OF COSTS The Buyer is obliged to: – bear all costs associated with the goods from the moment of delivery in accordance with Article A.4. – bear all additional costs if he fails to fulfill his obligation in accordance with Article B.2. or if he fails to comply with the obligation to give notice in accordance with Article B.7. The condition, however, is that the goods comply properly with the contract. This means that the goods must be properly identified, that is, clearly separated or otherwise identified as the goods that are the subject of this contract, and - pay, if required, all duties, taxes and other costs, as well as the costs of completing customs formalities to be paid upon import of goods. |

| A.7. NOTICE TO THE BUYER The Seller shall give the Buyer sufficient notice that the goods have been dispatched and shall also provide the Buyer with such other notices as are required for the Buyer to take such steps as are normally necessary to accept delivery of the goods. | B.7. NOTICE TO THE BUYER The Buyer is obliged, if he has the right to determine the time within the agreed period and/or the point of acceptance of delivery at the named place of destination, to duly notify the Seller about this. |

| A.8. PROOF OF DELIVERY, TRANSPORT DOCUMENTS OR EQUIVALENT ELECTRONIC COMMUNICATIONS The seller must provide the buyer at his expense with a transport document (for example, a negotiable bill of lading, a non-negotiable sea waybill, proof of inland waterway transport, an air waybill, a railway or road waybill, or a multimodal transport bill), which the buyer may require to take delivery of the goods in accordance with clauses A.4. / B.4. In the event that the seller and buyer have agreed to use electronic communications, the documents mentioned above may be replaced by equivalent electronic messages (EDI). | B.8. PROOF OF DELIVERY, TRANSPORT DOCUMENTS OR EQUIVALENT ELECTRONIC MESSAGES The Buyer must accept the transport document and/or other documents provided for in paragraph A.8 as evidence of delivery of the goods. |

| A.9. INSPECTION - PACKAGING - LABELING The seller must bear the costs associated with the inspection of the goods (e.g. quality, size, weight, quantity) necessary to deliver the goods in accordance with Article A.4. The seller is obliged to provide, at his own expense, the packaging (except in cases where it is customary in the trade to deliver the contracted goods without packaging) necessary for delivery of the goods. The packaging must be properly labeled. | B.9. INSPECTION OF GOODS The Buyer must bear all costs associated with inspection of the goods before shipment, unless such inspection is carried out by order of the authorities of the country of export. |

| A.10. OTHER OBLIGATIONS The Seller is obliged, at the request of the Buyer, to provide the latter, at his expense and risk, with full assistance in obtaining any documents or equivalent electronic messages (other than those mentioned in Article A.8.) issued or used in the country of dispatch and/or in the country origin of the goods, which the buyer may require to import the goods. The seller is obliged to provide the buyer with all the information necessary to carry out insurance. | B.10. OTHER OBLIGATIONS The Buyer must pay all costs and fees associated with receiving the documents or equivalent notices specified in paragraph A.10 by electronic communication, as well as reimburse the seller for any expenses incurred in providing the assistance provided for in paragraph A.10. |

How the concepts used in Incoterms 2010 are deciphered

“Shipper” (SHIPPER) is both the person who transfers the goods for transportation and the person who enters into an agreement with the carrier. But these can be different people.

“Delivery” is used in Incoterms in 2 different senses:

— This term is used to determine the moment the seller fulfills its delivery obligations.

— This term is applied to the seller’s obligation to receive or accept delivery of the goods. The word “delivery” in this case implies that the seller fulfills the responsibilities of shipping the goods, the buyer must accept the goods.

This last duty is important to avoid unnecessary charges for storing goods until the buyer picks up the goods. If this obligation is not observed by the buyer, the seller may be required to pay damages or pay for demurrage in order for the carrier to release the goods to him.

"Normal" - appears in several terms:

— Regarding the documents required from the seller.

— Regarding delivery time.

— Regarding the contract of carriage, which must be secured by the seller.

The word “ordinary” is evaluated from the perspective of world practice.

“Charges” payable refer to charges that are a mandatory consequence of importation as such and are payable under applicable import regulations. Storage fees that are not related to the obligation to clear goods are not included in these fee provisions. But these fees may include certain expenses of freight forwarders and customs brokers if the party bearing these obligations does not perform this work itself.

“Ports”, “Locations”, “Points” and “Premises” - places to which delivery of goods is required. In terms that are intended for use only in maritime transport, including FAS, FOB, CFR, CIF, DES and DEQ, the expressions “Port of Destination” and “Port of Shipping” are used. For all other cases the word “Place” is used. It is required in certain cases to indicate “Point” within a place or port. Where the seller's "Place" is the delivery point, the expression "Seller's Premises" applies.

“Vessel” and “Ship” are used in terms that are intended for use in maritime transport; the expressions “Ship” and “Vessel” are used as synonyms.

“Inspection” and “Checking”. The word "Check" applies to the seller's obligation to deliver. The word "Inspection" applies to the specific case where a pre-shipment inspection is performed to ensure that the goods comply with the provisions of the contract, or official conditions, before the goods are shipped.