Go to the list of all Incoterms terms

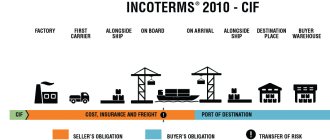

When carrying out foreign trade activities, sellers and buyers are guided by the International Rules for the Interpretation of Trade Terms Incoterms as amended in 2010. Previously, the 2000 edition was in effect. Therefore, those who intend to export or import goods in 2021 need to take into account the current rules of 2010. One of the delivery conditions is CIP from category C, when the main transportation is paid by the seller.

This Incoterm term stands for Carriage and Insurance Paid To (... named place of destination), or “freight/carriage and insurance paid to (... name of destination).” In documents this is indicated, for example, as follows: CIP Vladivostok, Russia (Incoterms 2010).

Basis and terms of delivery CIP

The basic terms of the term “freight/carriage and insurance paid to” imply that the seller will deliver the exported cargo to the place specified in the foreign trade contract and hand it over to the carrier. The exporter is responsible for paying the costs of loading the goods; transportation to the destination is also his task.

After this, responsibility for the safety of the goods shifts to the shoulders of the buyer. Delivery to the store’s warehouse or to another final point is also carried out at its expense.

According to the terms of the contract concluded taking into account CIP, the seller must insure the transported cargo against damage and loss during transportation. A corresponding agreement in favor of the importer must be concluded with the insurance company. Incoterms 2010 emphasizes that the exporter provides only minimum insurance coverage. Everything above must be discussed in advance and provided for as a separate clause in the contract. Or the importer himself can enter into an additional insurance contract with an insurance company.

An exporter can deliver cargo to its destination using several modes of transport. For example, one of the routes for transporting Toyota cars can be constructed as follows: by road from the Takaoka plant to the seaport of Toyama in Japan and then by ship to the port of Vladivostok in Russia. Already in a Russian port city, the goods are transferred to the first carrier (a logistics company that will deliver the car to a warehouse or other location by agreement with the importer). And along with it, all risks for the cargo are transferred to the buyer.

The seller transfers to the buyer the goods that have undergone export customs clearance, with accompanying documents with the stamp of the customs authority “release permitted” in the cargo customs declaration.

Please help make this article better. Answer just 3 questions.

CIP Incoterms 2010 (Carriage and Insurance Paid to)

C.I.P.

or Carriage and Insurance Paid to (from English freight/carriage and insurance paid to)

The term means that the seller will deliver the goods to a named carrier. In addition, the seller is obliged to pay the costs associated with transporting the goods to the named destination. The seller's responsibility ends when he delivers the goods to the carrier nominated by the buyer. If there are several carriers, then liability ends after delivery of the goods to the first carrier. The buyer bears all risks and any additional costs incurred after the goods have been delivered. This term is similar to CPT, except that the seller also pays for the insurance. The seller is required to provide minimum coverage insurance only. If the buyer wishes to have more protection through insurance, he must either clearly agree with the seller or obtain additional insurance at his own expense.

This term can be used regardless of the chosen mode of transport, as well as when using more than one mode of transport.

When using the terms CPT, CIP, CFR or CIF, the seller fulfills his obligation to deliver when he hands over the goods to the carrier, not when the goods reach their destination.

The term contains two critical points because the risk and costs are transferred to two different places. The parties are recommended to define, as accurately as possible, in the contract the place of delivery of the goods at which the risk passes to the buyer, as well as the named destination to which the seller is obliged to conclude a contract of carriage.

When using several carriers to transport goods to an agreed destination, and unless the parties have agreed on a specific delivery point, the disadvantage is that the risk passes when the goods are handed over to the first carrier at a point the choice of which is entirely up to the seller and which is beyond the control of the buyer. If the parties intend for the transfer of risk to take place at a later stage (i.e. at an ocean port or airport), they need to specify this in their sales agreement.

The parties are also advised to specify as precisely as possible the point at the agreed destination, since expenses up to that point are borne by the seller. The seller is advised to provide contracts of carriage that clearly reflect this choice. If the seller, under his contract of carriage, bears the costs of unloading at the agreed place of destination, the seller is not entitled to claim reimbursement of such costs from the buyer, unless otherwise agreed by the parties.

CIP requires the seller to complete customs formalities for export, if applicable. However, the seller is not required to complete import customs formalities, pay import duties or perform other import customs formalities.

| A. RESPONSIBILITIES OF THE SELLER | B. OBLIGATIONS OF THE BUYER |

| A1. General responsibilities of the seller The seller is obliged, in accordance with the purchase and sale agreement, to provide the buyer with the goods, a commercial invoice, as well as any other evidence of compliance of the goods with the terms of the purchase and sale agreement, which may be required by the terms of the agreement. Any document referred to in paragraphs A1 to A10 may be replaced by an equivalent electronic record or procedure if agreed to by the parties or customary. | B1. General responsibilities of the buyer The buyer is obliged to pay the price of the goods as provided in the sales contract. Any document referred to in paragraphs B1 to B10 may be in the form of an equivalent electronic record or other procedure if agreed upon by the parties or customary. |

| A2. Licenses, permits, security controls and other formalities If required, the seller must, at his own expense and risk, obtain an export license or other official authorization and complete all customs formalities necessary for the export of the goods and their transportation through any country. | B2. Licenses, permits, security controls and other formalities If required, the buyer must obtain, at his own expense and risk, an import license or other official authorization and complete all customs formalities necessary for the importation of the goods and their transportation through any country. |

| A3. Transportation and insurance contracts a) Contract of carriage The seller must enter into or procure a contract for the carriage of the goods from the named place of delivery, if specified, or from the place of delivery to the named place of destination or, if agreed, to any point at such place. The contract of carriage must be concluded on normal terms at the expense of the seller and provide for transportation in a usually accepted direction and in the usual way. If a specific point is not agreed upon or cannot be determined by practice, the seller may select the point of delivery or the point at the agreed place of destination that is most suitable for his purposes. b) Insurance Contract The Seller shall, at its own expense, obtain cargo insurance equivalent to at least the minimum coverage as provided in paragraph “C” of the Institute Cargo Clause (LMA/IUA) or other similar conditions. The insurance contract must be concluded with an insurer or insurance company in good standing and give the buyer or any person having an insurable interest in the goods a right of claim directly against the insurer. At the buyer's request, the seller is obliged, subject to the buyer providing the necessary information required by the seller, to carry out at the buyer's expense such additional insurance as may be obtained, for example as provided for in paragraph “A” or “B” of the Institute Cargo Insurance Conditions (LMA/IUA) or other similar conditions, and/or coverage consistent with the Institute's War Clauses and/or the Institute's Strike Clauses (LMA/IUA) or other similar conditions. Insurance must cover at least the price stipulated in the purchase and sale agreement plus 10% (i.e. 110%) and be carried out in the currency of the purchase and sale agreement. Insurance must cover the goods from the point of delivery as provided in paragraphs A4 and A5 and at least to the named place of destination. The seller must provide the buyer with an insurance policy or other evidence of insurance coverage. In addition, the seller must provide to the buyer, at the buyer's request, risk and expense, information that the buyer may require to obtain additional insurance. | B3. Transportation and insurance contracts a) Contract of carriage The buyer has no obligation to the seller to conclude a contract of carriage. b) Insurance contract The buyer has no obligation to the seller to enter into an insurance contract. However, the buyer is obliged to provide the seller, upon request, with the necessary information for the additional insurance required by the buyer as provided in paragraph A3 b). |

| A4. Supply The seller is obliged to deliver the goods by handing them over to the contracted carrier in accordance with paragraph A3 on the agreed date or within the agreed period. | B4. Acceptance of delivery The buyer must take delivery of the goods as soon as they are delivered in accordance with A4 and collect them from the carrier at the named place of destination. |

| A5. Transfer of risks The seller bears all risks of loss or damage to the goods until they are delivered in accordance with clause A4, except for the risks of loss or damage in the circumstances specified in clause B5. | B5. Transfer of risks The buyer bears all risks of loss or damage to the goods from the time they are delivered in accordance with clause A4. If the buyer fails to comply with the obligation to give notice in accordance with paragraph B7, he bears all risks of loss of or damage to the goods from the agreed date or from the date on which the agreed delivery period has expired, provided that the goods have been clearly identified as the goods being the subject agreement. |

| A6. Cost Allocation The seller must pay: a) all costs relating to the goods until they are delivered in accordance with paragraph A4, with the exception of costs paid by the buyer as provided in paragraph B6; and b) freight and other costs specified in paragraph A3 a) including the costs of loading the goods and any charges in connection with unloading the goods at the place of destination, which under the contract of carriage are borne by the seller; and c) insurance costs referred to in paragraph A3 b); d) if necessary, the costs of completing customs formalities necessary for the export of goods, as well as duties, taxes and charges payable upon export, as well as the costs of transporting them through third countries, if they are borne by the seller under the terms of the contract of carriage. | B6. Cost Allocation The buyer is obliged, subject to the provisions of paragraph A3 a), to pay: a) all costs relating to the goods from the moment of delivery in accordance with paragraph A4, excluding, if applicable, the costs of completing customs formalities for the export of the goods, as well as taxes, fees and other expenses payable upon export as provided in paragraph A6 d); b) all costs and charges relating to the goods during transit until their arrival at the agreed place of destination, unless such costs and charges are borne by the seller under the contract of carriage; c) unloading costs, unless such costs are borne by the seller under the contract of carriage; d) any additional costs incurred as a result of the seller's failure to give notice in accordance with paragraph B7, from the agreed date or from the date of expiration of the agreed period for shipment, provided that the goods have been clearly identified as goods that are the subject of the contract; e) if required, the costs of paying taxes, duties and other official charges, as well as the completion of customs formalities payable upon importation of the goods, and the costs of transporting them through any country, unless such costs and charges are allocated under the contract of carriage to seller. f) the cost of additional insurance provided at the request of the buyer, as provided in paragraphs A3 and BC. |

| A7. Notices to Buyer The seller must give notice to the buyer that the goods have been delivered in accordance with paragraph A4. The seller must give the buyer notice to enable the buyer to take such measures as are normally necessary for the buyer to receive the goods. | B7. Notice to seller If the buyer has the right to determine the time for shipment of the goods and/or the named place of destination or the point of receipt of the goods at this place, he is obliged to give the seller proper notice of this. |

| A8. Delivery document If customary or at the request of the buyer, the seller, at his own expense, must provide the buyer with the usual transport document(s) in accordance with the contract of carriage concluded under paragraph A3. The transport document must cover the goods under the contract and be dated within the agreed shipment period. If agreed or customary, the document must also enable the buyer to claim the goods from the carrier at the named place of destination and enable the buyer to sell the goods during the period of transit by delivering the document to a subsequent buyer or by notifying the carrier. If the transport document is negotiable and issued in several originals, a complete set of originals must be handed over to the buyer. | B8. Proof of Delivery The buyer is obliged to accept the transport document issued in accordance with paragraph A8 if it complies with the terms of the contract. |

| A9. Inspection, packaging, labeling The seller must bear all costs associated with the inspection of the goods (quality checks, measurements, weighing, counting) necessary for delivery of the goods in accordance with paragraph A4, as well as the costs of inspection of the goods before shipment, which is prescribed by the authorities of the country of export. The seller is obliged to provide packaging for the goods at his own expense, except in cases where it is customary in this industry of trade to ship the goods specified in the contract without packaging. The seller may pack the goods in such a manner as is necessary for their transportation, unless the buyer notifies the seller of specific packaging requirements before entering into the contract. Packaged goods must be properly labeled. | B9. Product inspection The buyer is obliged to bear the costs of mandatory inspection of the goods before shipment, except in cases where such inspection is carried out as prescribed by the authorities of the country of export. |

| A10. Assistance in obtaining information and related costs If required, the seller is obliged to promptly provide the buyer or assist him in obtaining, at the buyer's request, at his risk and expense, documents and information, including safety information, which the buyer may require for the import of the goods and/or its transportation to its final destination. destination. The seller must reimburse the buyer for all costs and fees incurred by the buyer in obtaining or assisting in obtaining documents and information as provided in paragraph B10. | B10. Assistance in obtaining information and related costs The buyer must promptly notify the seller of safety information requirements so that the seller can act in accordance with paragraph A10. The buyer must reimburse the seller for any costs and fees incurred in providing or assisting in obtaining documents and information as provided in paragraph A10. If required, the buyer is obliged to promptly provide to the seller or facilitate the receipt by the seller, at the request of the seller, at his risk and expense, of documents and information, including safety information, which the seller may require for the carriage, removal of the goods and for its transportation through any country. |

Is it worth insuring the cargo?

CIP terms imply that the seller insures the risk of loss or damage to the goods for a minimum amount, that is, 100% of the invoice value plus 10% in the currency in which the buyer pays the seller. The supporting document is handed over to the first carrier along with the cargo. But the question arises whether the buyer needs to additionally insure imported products. There are several arguments for and against.

Here are the main arguments in favor of refusing additional insurance:

- The cost of international transportation usually includes an insurance amount. For example, if transportation is to be carried out through the countries of the European Union, then CMR or TIR insurance of the road carrier is included in the invoice price of the goods (along with transportation costs, loading and unloading, payment of export duties, taxes and fees).

- Partial compensation by the insurance company for the carrier's liability will allow the damaged cargo to be repaired.

- It is possible to quickly order a new batch of goods to replace the lost one.

Additional insurance also has a number of advantages:

- A direct insurance contract is signed, which means it takes less time to compensate for damage (there is no third link in the chain - the carrier).

- Proof of the carrier's guilt in court is not required, which means the importer avoids time and financial expenses for representation expenses in court.

- The cargo owner can insure the cargo not only for the amount of the invoice value of the goods, but also taking into account the possible lost profit if it is damaged or lost.

Therefore, when it comes to additional insurance, it is recommended to consider whether standard CIP insurance will cover the losses that your organization will receive if the goods are damaged or lost completely. The company’s reputation is also at stake: will it suffer greatly in the event of untimely failure to fulfill obligations to end customers/partners?

CIP value according to INCOTERMS 2010

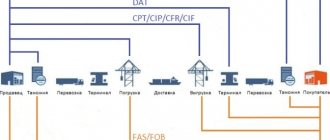

CIP belongs to category “C” in INCOTERMS 2010. This category is characterized by the fact that risks are transferred from the supplier to the buyer at the moment the goods are transferred to the carrier chosen by the seller.

When using several types of vehicles, the services of several carriers may be used. In this case, the transfer of risks occurs after the goods are transferred to the first of them. Transportation, insurance, export customs clearance and all costs associated with these operations are also borne by the seller.

CIP is an abbreviation of the English expression “Carriage and Insurance Paid to”. The literal translation into Russian is “cost and insurance paid up to.” When this expression is used in the documentation, the point of delivery of the goods is indicated.

This term is one of the most complex in INCOTERMS 2010. This is due to the fact that even after the product is transferred to the carrier, the seller pays for transportation.

These conditions are beneficial to the seller in the following cases:

- It is advantageous to conclude a transportation contract not with the buyer himself, but with an intermediary (supplier).

- Concluding a contract of carriage directly with the person purchasing the product is not feasible for technical reasons.

Having a problem? Call our customs specialist:

Moscow and region (call is free)

Saint Petersburg

Insurance - to take out or not to take out?

Additional insurance is not a mandatory procedure for the supplier to obtain. But often it allows you to reduce risks and prevent possible costs in case of cargo damage.

Often, parties to a transaction refuse additional insurance due to the insurance fee already included in the cost of transportation. But there are several disadvantages:

- In order to compensate for losses, the party to the transaction who is responsible for selling the product will have to prove in court the direct guilt of the carrier for causing damage to the cargo. This can take a lot of time and effort.

- If the cargo is lost, it will not be possible to fully compensate for losses through this type of insurance.

In what case should you refuse additional insurance? As a rule, it is more rational to resort to this procedure in cases where damage or loss of goods will cause not only direct, but also indirect costs.

But there are cases when additional insurance can be easily refused. These include the following points:

- Repairing the product will return it to its original condition and fully restore all qualities and functions.

- A secondary order of goods is possible, which will not bring additional costs to the participants in the transaction.

Responsibilities and risks of the parties

As with other Incoterms, the responsibilities and risks of the parties under CIP are clearly delineated. But in a foreign trade contract, maneuver in one direction or another is allowed by agreement of the counterparties.

Responsibilities and risks of the seller

CIP delivery conditions impose the following obligations on the seller:

- Delivery of goods at the agreed place within the period specified in the contract to the first carrier;

- Providing goods of appropriate quality and quantity/volume according to the terms of the contract;

- Providing accompanying documents for the goods, including commercial ones, certificates of conformity and safety if necessary;

- Obtaining an export license if required by law;

- Concluding a transportation contract on normal terms with delivery along the usual route, which will not lead to an increase in the price of products.

- The supplier also undertakes to insure the cargo in such a way that the buyer can directly contact the insurer for compensation for damage. The insurance contract is included in the mandatory package of accompanying documents.

These are the main points that need to be taken into account when indicating the seller’s obligations in a foreign trade contract.

Buyer's responsibilities and risks

In addition to paying the contractual amount in full and on time, the importer of the goods is obliged to fulfill the following conditions in accordance with Incoterms 2010:

- Obtain, if necessary, an import license or other certificate (at your own expense);

- Settle customs formalities related to the import of goods and transit through the territory of third countries;

- Accept delivery of products at the specified location on the agreed date or period.

Distribution of risks and responsibilities under the CIP terms

Under the CIP delivery basis, the buyer assumes all risks of loss or damage to the goods, as well as other costs, after the goods are handed over by the seller to the carrier, and not when the goods reach their destination. The term CIP contains two critical points, since the risk and costs pass at two different places: the risk after the goods are loaded into the vehicle, and the costs at the destination.

Transfer of ownership and risks

The transfer of risks under the terms of CIP from the seller to the buyer is carried out along with the transfer of cargo to the first carrier. After this, all obligations for the safety of the goods from damage and loss fall on the shoulders of the buyer.

Transfer of risks and transfer of ownership are not equivalent concepts. If the first is regulated by Incoterms 2010, then the second is regulated by the Civil Code of the Russian Federation. In accordance with paragraph 1 of Art. 223 of the Civil Code of the Russian Federation, the importer’s right of ownership arises at the moment of transfer of the thing. But a different period can be established by agreement of the parties. Therefore, it is better to highlight this point separately in a foreign trade agreement.

The transfer of risks and the transfer of ownership must be documented: the delivery note indicates the date of transfer of the goods to the first carrier.

Are you sure that the CIP condition is right for you?

Fill out the form and we will select the most favorable conditions for you

Free consultation

You can also write to us by email or call our toll-free number:

8

What is the recipient required to do under CIP technology?

According to the terms of CIP Incoterms 2010, the recipient is obliged to:

- Pay for the goods in accordance with the contract.

- Obtain the necessary licenses and documents to ensure import and, if necessary, transit.

- Accept the goods and all risks after delivery.

- If necessary, bear the costs associated with transit, as well as pay for unloading, except in cases where this responsibility is assigned to the seller.

- Pay all costs associated with importation into the recipient's country.

- Send notification of receipt of goods.

- Accept evidence (transport document) if the product meets the declared characteristics.

- Pay for pre-shipment inspection, unless required by customs inspection.

- Reimburse the seller’s expenses incurred as a result of completing additional documents at the buyer’s request.

The recipient is not required to enter into agreements with the carrier and insurance company. These delivery terms are identical to the CIF term, except for their applicability to the mode of transport. CIP is used for land transportation, CIF - 100% sea.

Price on CIP terms

The CIP contract price includes the cost of the goods and the expenses incurred by the seller in performing his duties. They are specified separately in the contract:

- Freight;

- Insurance.

This information is needed in order to calculate the customs value of goods. It is important to clearly indicate in the contract the destination under the terms of CIP: the costs of logistics and insurance to this place will be included in the customs duty.

Let's say you need to deliver cargo to Moscow from Italy (Rome). The contract specified the destination CIP Lublin, Poland (Incoterms 2010). Here the cargo is transferred to the first carrier. In this case, when calculating the customs value, the costs of transportation from Lublin to Moscow are calculated. The amount of the insurance payment will also be determined taking into account the delivery from Rome to Lublin and will be included in the calculations for payment of customs duties.

The contract can also indicate CIP Moscow, Russia (Incoterms 2010). In this case, delivery costs are divided into two amounts: to the border with the Russian Federation and further across Russian territory to Moscow. The price of logistics services in Russia can not be included in the customs value and thereby save on paying import duties.

A CIP contract of carriage is fraught with many pitfalls, as is the entire process of international trade. Therefore, it is necessary to clearly state which party bears what costs, for example, when transiting cargo through the territory of third countries, when unloading and loading at the designated place, for obtaining additional insurance, etc. Let us add that a well-executed contract under the terms of CIP is more profitable for the importer than for the exporter.

Ultimately, everything is paid by the buyer, and first of all, he should clearly monitor how the contract price is formed, how much financial costs are provided for this or that item.

Why do you need to calculate the customs value of goods?

If you import goods under the terms of CIP, then, in addition to other documents, at domestic customs you will also need an insurance policy indicating the amount of insurance coverage and the amount of the insurance payment.

The last figure will be needed to calculate the customs value of the goods being transported. The amount of the insurance payment is deducted from the invoice value specified under the CIP terms. You will also need to present a document confirming the cost of transporting the cargo to the customs border. In this case, it is necessary to note a nuance - in particular, the goods are transported from Belgium, the delivery terms are CIP Munich (Germany). Therefore, you are required to provide a contract and an invoice from the carrier with a separate indication of the cost of transportation from Munich to the customs border (namely, the state import border crossing point, and not the final destination). This amount is added to the invoice. When transporting goods from Belgium, but with delivery conditions CIP Moscow (RF), with Ryazan being the final destination, you will need to request from the seller (he is the one who pays for transportation to Moscow) a document to confirm the cost of transportation with a breakdown of Belgium - customs border RF - Moscow. In this case, when calculating customs duties, the cost of the last of these sections must be deducted from the invoice value. You can ask a customs broker for help if necessary.

Incoterms 2010 terms of delivery (ways of use)

Incorporation into an existing contract

If it is necessary to use Incoterms 2010, you should resort to clearly indicating the following information in the text of the agreement: “the required abbreviation indicating the named place, according to Incoterms 2010.”

By choosing the appropriate terminological abbreviation

The content of this designation must be consistent with the name of the product, the method of its delivery to its destination, and must also stipulate the extent of additional obligations (for example, the designation of exclusively insurance liability). The explanation of each term contains comprehensive information to help you make your choice. When defining an abbreviation, the possible influence of port customs on its interpretation should be taken into account.

The clearest possible definition of a point or port

The correct functioning of the terms defined by the parties is ensured by a clarified indication of the clause. As an example of a correct definition: “FCA 38 Cours Albert ler, Paris, France Incoterms 2010.”

According to the terminological list, the abbreviation of the delivery terms exw Incoterms 2010 stands for Ex-factory.

Terms:

- free carrier – Incoterms 2010 fca;

- terminal delivery – dat;

- making deliveries including duty fees - ddp;

- delivery at a designated place – dap;

- free along the length of the side of the marine vehicle – fas;

- availability of unoccupied space on board – fob (see delivery conditions fob).

In these cases, delivery is carried out strictly to the named point with the subsequent transfer of responsibility to the side of the company or person purchasing the goods. Terms:

- cpt – payment for transportation to a certain point;

- cip – payment of the cost of transportation and insurance services to;

- cfr – the sum of the cost of the cargo itself and the amount of payment for its delivery;

- cif - the total cost of the goods themselves, freight services and insurance coverage assume that the named point differs from the coordinates of direct delivery.

Thus, payment for transportation is carried out only to the specified point, and additional conditions for further delivery are negotiated additionally.

It is not a purchase and sale agreement in its full understanding

One should not ignore the fact that the terms of Incoterms 2010 do not act as a complete and self-sufficient agreement regulating the purchase and sale of goods. These instructions concern only part of the distribution of responsibilities of the parties to the contract regarding the provision of transportation, the provision of insurance services during the transfer of goods from the seller to the buyer, and also clearly regulate the financial costs of each party.

In no case do the requirements specify a specific price or method of payment. The rules also do not stipulate the circumstances of the transfer of property rights and the consequences of deviation from the terms of the contract. The list of such issues is often clearly defined and stipulated in the content of the contract itself. The parties entering into this agreement should remember that the terms of mandatory national legislation take precedence over the clauses of the contract, including Incoterms 2010.

The main differences between Incoterms 2020 and Incoterms 2010

- DAT has been renamed to DPU so as not to be confused with the similar DAP - delivery without unloading, and also so as not to limit the delivery location only to terminals.

- The FCA makes it possible to oblige the carrier to issue a bill of lading to the seller, which was previously poorly observed.

- CIF continues to provide for a minimum level of insurance, but provides the opportunity to increase insurance coverage.

- CIP provides a mandatory maximum level of insurance, but there is an opportunity to reduce it.

- There are situations when the cargo is transported not by a third-party carrier, but by transport owned by one of the parties.

- Section A9/B9 now contains a list of expenses.

- The points related to customs clearance of goods are indicated in more detail: export, transit, import.

- More attention is paid to security issues.

Experts hope that the new edition of the Incoterms 2021 rules will be more convenient and easier to use and will help foreign trade participants solve their problems more effectively.

We are sure that the timing, cost and quality of services will pleasantly surprise you!

Incoterms 2021: history of the new edition

Incoterms 2020 is the ninth edition of the international rules of purchase and sale, which was compiled by the International Chamber of Commerce (ICC for short) based on the text of the previous edition - Incoterms 2010, proposals from foreign trade participants, as well as experience in using earlier versions:

- Incoterms 1936;

- Incoterms 1953;

- Incoterms 1967;

- Incoterms 1976;

- Incoterms 1980;

- Incoterms 1990;

- Incoterms 2000;

- Incoterms 2010.

One revision typically lasts for one decade, which means that a revision of Incoterms is not expected until 2029, and the next revision not until 2030.