A Russian organization trades in imported goods; there are cases when the goods turn out to be defective, but this becomes clear at the stage when the item of trade has already been sold to the final buyer. The buyer, having discovered a defect, returns it to the seller, in turn, the Russian seller, who previously purchased this product from a foreign supplier, returns it to the foreign organization.

Let's figure out how such a return of imported defective goods will be reflected in tax and accounting.

Two modes

For the export of substandard goods by the importer for the purpose of returning them to a foreign supplier, only two modes are provided - export and re-export.

Their main difference is that in the export regime only those goods that are originally Russian, or previously imported goods, but which have been registered and released for free circulation (that is, have lost their foreign status) can be exported.

In the re-export mode, it is foreign goods that are exported, that is, those that have not undergone customs clearance. For example, when the recipient identifies defective goods directly at the border or at internal customs, accepting the shipment from the carrier. In this case, without starting the registration procedure, the goods are exported in the re-export mode without paying any customs duties and taxes.

What to do if a defect is detected after the goods have been registered?

Especially for such cases, the re-export regime provides an exception. According to paragraph 1 of Art. 242 of the Customs Code of the Russian Federation, goods released for free circulation, in respect of which it is established that on the day of crossing the customs border they had defects or otherwise did not comply with the terms of the foreign economic transaction in terms of quantity, quality, description or packaging and for these reasons are returned to the supplier or to another person specified by him may be placed under the customs regime of re-export.

It should be noted that courts often make the mistake of asserting that the re-export regime can only be applied to goods released for free circulation (for example, Resolution of the Federal Antimonopoly Service of the Far Eastern District dated December 17, 2008 N F03-5623/2008 in case N A51-5398/200829- 164 and the Thirteenth Arbitration Court of Appeal dated December 17, 2009 in case No. A21-2427/2009). This is wrong. Any foreign product (for example, temporarily imported) can be re-exported.

But for this it is necessary to meet a number of strict conditions, which we will consider further.

A universal method is to export goods in export mode. But everyone is trying to take advantage of re-exports.

The fact is that in accordance with paragraph 2 of Art. 242 of the Labor Code of the Russian Federation, when goods are re-exported, the amounts of customs duties and taxes paid upon import are refunded.

But the export regime does not imply a refund of customs duties and VAT paid when importing goods. In addition, such VAT cannot be deducted, since imported goods are not used in transactions recognized as subject to VAT (clause 1 of Article 39, clause 1 of clause 1 of Article 146 and clause 2 of Article 171 of the Tax Code of the Russian Federation ).

Thus, when exporting, the recipient incurs additional costs, because when importing a new product, he will again have to go through registration and pay duties and taxes at customs.

Therefore, in a foreign trade agreement, it is advisable to provide for the obligation of the foreign counterparty to reimburse such expenses upon establishing the fact of delivery of low-quality goods. It is better if such compensation occurs in direct cash, and not through a discount on the next batch. In the latter case, problems will arise with determining the customs value - customs will most likely calculate it without any discount.

You can use the re-export regime if the conditions specified in paragraph 1 of Art. 242 Labor Code of the Russian Federation:

— under the terms of a foreign trade agreement, the buyer has the right to return low-quality goods to the seller;

- defects or other non-compliance of the goods with the foreign economic transaction existed on the day of crossing the customs border;

- the product has not been used or repaired in the Russian Federation, except for cases where the use of the product was necessary to detect defects, or other circumstances that led to its return;

— the goods can be identified by customs authorities;

- the goods are exported within six months from the date of their release for free circulation.

Let's see what difficulties there may be in meeting some of these conditions.

How is the VAT refund check carried out when importing goods?

In order to verify the legality of import VAT refunds, controllers carry out the following activities:

- Analysis of documents submitted by the importer, during which the declarant, shippers, consignees, actual temporary storage warehouses are identified and the fact of vehicles crossing customs posts is determined.

- Determination of a foreign manufacturer (carried out by sending a request to the relevant control authorities of foreign states). The presence or absence of information about a foreign counterparty on the Internet can also be analyzed.

- Establishing the actual buyer of the goods based on the results of a study of the movement of goods: transport and accompanying papers are checked, the carrier, the type of transport used and its owner are determined. Also, the volume of the imported consignment is checked for compliance with the carrying capacity of the transport, the goods distribution route is established, and control measures are carried out in relation to all persons involved in the chain (carriers, forwarders, consignees and even drivers).

- Identification of the final buyer according to the above scheme.

Carrying out a detailed audit, tax authorities are trying to establish facts of illegal VAT refunds, including through the use of gray tax schemes.

Read about the procedure for such an audit in the article “Features of a desk audit for VAT refundable.”

Product identification

What can prevent customs from making sure that the goods being exported are the same ones that were imported earlier?

For example, in a case considered by the Federal Antimonopoly Service of the North Caucasus District (Resolution dated June 14, 2007 N F08-3371/2007-1369A), customs refused to place the goods under the re-export regime due to the fact that when the goods were imported, the tank had two seals from a foreign manufacturer , and when it was removed, the tank was sealed with completely different seals.

In addition, it was stated that the exported technical propylene oxide is a toxic and flammable liquid and is located in the tank under excess nitrogen pressure. Customs does not have special personal protective equipment, so there is no way to identify the goods.

The manufacturer's seals were removed to determine the quality of the tank's contents. New seals were supplied by the research center that participated in the acceptance and issued a conclusion on the non-compliance of propylene oxide with the requirements of GOST and the data stated in the quality certificate of the manufacturer. But the court supported the customs. The legality of this decision was confirmed by the Supreme Arbitration Court of the Russian Federation (Determination No. 12363/07 dated October 3, 2007), refusing to transfer the case to supervision.

How to convince customs and the court?

In the Resolution of the Federal Antimonopoly Service of the North Caucasus District dated October 19, 2005 N F08-4999/2005-1978A, customs referred to the impossibility of identifying exported defective bottoms of cans. In court, the only thing that helped the importer was proof that he did not and could not manufacture similar products.

In the Resolution of the Federal Antimonopoly Service of the North Caucasus District dated December 25, 2008 N F08-7863/2008, the court ordered the customs to allow the export of defective goods in the re-export mode, since this product was supplied for the first time, therefore, the foreign trade participant did not have the opportunity to mix the imported goods with other similar goods.

Customs clearance – what is it?

Customs clearance (also known as “customs clearance”) is actually a procedure for legalizing the movement of goods across the border. Usually it involves direct customs clearance, i.e. filing a declaration with the necessary set of documents, and paying duties, fees and taxes.

The task of customs is to distinguish things for personal use from commercial consignments of goods. In the first case, customs clearance is not required (if the norms for weight and value are not exceeded), but in the second case you will have to deal with customs clearance. You can do this on your own, or you can involve an intermediary - a customs broker.

Product defects

The presence of defects in goods at the time of crossing the customs border is proven, as a rule, by an examination, in the report of which it is desirable to indicate that the inspected products have manufacturing defects that arose as a result of a violation of the technological process during the manufacture of products, the elimination of which is either impossible or possible only in production conditions ( Resolution of the Federal Antimonopoly Service of the North Caucasus District dated December 25, 2008 N F08-7863/2008 in case N A53-7149/2008-C4-10).

But proving the presence of defects is not enough - a decision from a foreign seller is also required.

In the mentioned court decision, the examination report, together with the complaint, was sent to the foreign supplier. The goods were examined by the arriving employees of the supplier company, after which they drew up a complaint report confirming that the entire batch of goods was recognized as not meeting the terms of the contract in terms of quality, since the products had a manufacturing defect.

So, full-fledged claim work with a foreign seller is important evidence for customs.

At the same time, just a letter from a foreign counterparty with a request to return the goods does not indicate non-acceptance of the goods by the buyer (Resolution of the Federal Antimonopoly Service of the North Caucasus District dated June 14, 2007 N F08-3371/2007-1369A).

Thus, in the absence of documentary confirmation from the Russian buyer of the refusal to accept the low-quality goods, and from the foreign seller of the refusal to accept it back, re-export is impossible.

Reflection in accounting

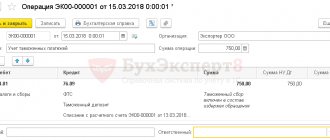

Three transactions are recorded in accounting:

- Registration of invoice for goods receipt.

- Write-off of goods from credit.

- Fixing a statement about the receipt of money from the supplier (in this case, posting DT51 KT76 is used).

This procedure is relevant when defects are discovered before the products are accounted for. In this case, you need to draw up an act. The products will be returned to the supplier.

If a defect is identified after capitalization, it is required to issue a certificate of non-compliance to the supplier. Subsequently, all transactions are reflected in subaccount 76.6 “Calculations for claims.”

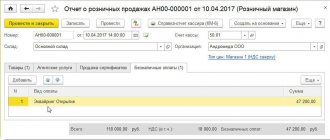

Example of using postings

The company bought nails for the amount of 25,000 rubles. Before receiving the shipment, a transfer of 50% was made to the supplier. After posting, a defect was discovered - the nails were not straight enough. When returning, the buyer uses the following transactions:

- DT60 KT51 . Explanation : prepayment. Amount : 12,500 rubles.

- DT68 KT76 . Explanation : VAT reflection. Amount : 1,906 rubles.

- DT41 KT60 . Explanation : acceptance of products for accounting. Amount : 25,000 rubles.

- DT19 KT60 . Accounting for VAT in the amount of 3,813 rubles.

- DT60 KT60 . The advance has been credited.

- DT68 KT19 . Registration of an invoice in the amount of 3,813 rubles.

- DT76 KT68 . VAT restoration.

- DT76 KT41 . Return of products to the supplier.

- DT76 KT68 . Accounting for VAT in the amount of 3,813 rubles.

- DT51 KT76 . Refund by supplier.

The supplier uses other wiring.

Starting point for the six-month export period

Customs does its best to prevent foreign trade participants from complying with this condition.

One of such cases was considered by the Federal Antimonopoly Service of the North Caucasus District in the Resolution dated November 13, 2009 in case No. A53-3735/2009.

The organization applied to the customs office with an application to offset funds against future payments deposited into the account of the customs authority upon importation of goods and subject to return in connection with the actual export of the imported goods in the re-export mode.

Customs refused. The reason is that the goods were not exported within six months from the date of their release for free circulation.

In this story, it is not clear why the goods were nevertheless placed under the re-export regime, the condition for which is compliance with the six-month deadline. And the condition for the return or offset of customs duties is the very fact of export of goods in the re-export mode.

This is far from an isolated case. For example, in the case considered by the Federal Antimonopoly Service of the North Caucasus District in Resolution No. F08-4999/2005-1978A dated October 19, 2005, customs also first allowed the export of goods under re-export mode, and then refused to refund customs duties.

The reason for the refusal is the lack of documentary evidence of the presence of defects on the goods on the day of crossing the customs border of the Russian Federation.

This refusal was challenged in court, and the court sided with the foreign trade participant and obliged the customs office to allow export in the re-export mode, which was eventually done (six months after the initial filing of the customs declaration).

After this, customs accused the organization of failure to comply with the six-month deadline for exporting goods.

But the court again supported the foreign trade participant, indicating that he applied to the customs authority with an application to place the goods under the re-export regime within the established six-month period. And the fact that the goods were placed under the re-export regime much later and after the expiration of the six-month limit is associated only with illegal actions of customs. The court demanded that customs offset previously paid payments.

So, in the dispute considered, the court actually says that within six months the goods must be placed under the re-export regime, that is, not only must a declaration be submitted and accepted, but also, in accordance with paragraph 3 of Art. 157 of the Labor Code of the Russian Federation, the goods must be released by the customs authority.

Let’s read the wording of the Labor Code of the Russian Federation: “...goods... are exported within six months from the date of their release for free circulation.” The wording is more than vague. “Exported” is a designation of the process, but not the result.

Let us turn to the concept of “export”. According to paragraphs. 9 clause 1 art. 11 of the Labor Code of the Russian Federation, the export of goods or vehicles from the customs territory of the Russian Federation means filing a customs declaration or taking actions directly aimed at the export of goods, as well as all subsequent actions with goods or vehicles provided for by the Labor Code of the Russian Federation before they actually cross the customs border.

Reference. Actions directly aimed at the export of goods include the entry (entry) of an individual leaving the Russian Federation into the customs control zone, the entry of a vehicle into a checkpoint across the State Border of the Russian Federation for the purpose of its departure from the customs territory of the Russian Federation, delivery of goods to transport organizations or postal organizations of international mail for sending outside the customs territory of the Russian Federation, actions of a person directly aimed at the actual crossing of the customs border by goods outside the places established in accordance with the legislation of the Russian Federation (clause 9, clause 1, article 11 of the Labor Code of the Russian Federation).

It can be argued that in order to be able to re-export substandard goods, it is enough to simply submit a declaration within six months from the date of release of the goods. In reality, the goods can be placed under the re-export regime later, not to mention their actual export abroad.

Availability of documents

Now let's look at these conditions in more detail. According to customs legislation, the import operation begins when the declaration and all documentation necessary for processing the imported goods are handed over to customs officers. It ends with the release of goods by a customs officer, who puts the appropriate marks on the declaration and other related documents - transport, commercial, etc.

This means that the imported goods will be considered released from customs only when the importer has in his hands a customs declaration and other necessary accompanying papers with a stamp from customs officials authorizing the release.

Forget about VAT!

According to Art. 518 of the Civil Code of the Russian Federation, the return of low-quality goods is not a separate transaction; it occurs within the framework of the original supply agreement. Therefore, this operation cannot be considered as a reverse sale of goods. In addition, Art. 38 of the Tax Code of the Russian Federation recognizes property intended for sale as goods. And low-quality goods according to Art. 469 of the Civil Code of the Russian Federation cannot be intended for implementation without special clauses in the contract. Accordingly, the return of defective goods to a seller who is located outside the Russian Federation cannot be qualified as an export operation (clause 1, clause 1, article 164 and article 165 of the Tax Code of the Russian Federation).

No operation - no subject to VAT. The buyer does not even have the obligation to collect documents confirming the zero rate (Article 165 of the Tax Code of the Russian Federation).

The tax paid when importing this product, as well as the tax deduction for this operation, does not need to be adjusted. This is due to the fact that when importing goods, VAT is imposed on the import operation itself (clause 4, clause 1, article 146 of the Tax Code of the Russian Federation) and the exact tax that was paid on this operation is taken for deduction (clause 2, article 171 of the Tax Code RF).

This position was confirmed by the Ministry of Finance of Russia in Letter No. 03-07-08/197 of 08.08.2008 and by the Presidium of the Supreme Arbitration Court of the Russian Federation in Resolution No. 2968/08 of 06.24.2008 in case No. A56-9249/2007. Judicial practice has also recently firmly adhered to this position (Resolutions of the Federal Antimonopoly Service of the North-Western District of December 16, 2008 in case No. A56-19764/2007 and of the Central District of July 23, 2009 in case No. A14-15072-2008/492/34).

Previously, courts most often proceeded from the fact that the re-export of goods is a type of export, therefore, when exporting goods in this regime, a 0% rate is applied (Resolutions of the Federal Antimonopoly Service of the Central District dated April 21, 2008 in case No. A48-2995/07-13, Moscow District dated January 21 .2008 N KA-A40/14199-07 in case N A40-18073/07-14-59 and the North-Western District of 03/19/2008 in case N A56-15912/2007).

By the way, in the aforementioned Letter from the Ministry of Finance, which confirmed the absence of a subject to VAT when returning goods in the re-export regime, the need to restore the tax is indicated. However, Art. 170 of the Tax Code of the Russian Federation does not provide for such an obligation. The courts also agree with this opinion (Resolutions of the Federal Antimonopoly Service of the Volga District dated December 11, 2008 in case N A55-3673/2008, dated October 28, 2008 in case N A55-15027/07, Ural District dated October 31, 2008 N F09-8084/08- C3 and West Siberian District dated 06.06.2007 N F04-3669/2007(35024-A45-41)).

Shortage, defects, assortment: we understand the reasons for the return

The reasons why goods may be returned from the buyer to the supplier are listed in the contract or provided for by law.

The materials on our website will help you understand how to take into account legal requirements in various business situations:

- “How many days before vacation are vacation pay paid by law?”;

- “What is the legal deadline for responding to a claim?”.

Possible reasons for returning goods are listed in the figure below:

In the following sections, we will tell you how the accounting procedure is affected by the type of returned goods (whether they are of high quality or defective), as well as the fact that the goods to be returned are reflected in the buyer’s accounting.