Read about the specifics of returning funds to the buyer’s payment card in 1C: Accounting 8, including when combining special tax regimes.

In the articles “Features of accounting for acquiring transactions under the simplified tax system” and “Accounting for acquiring transactions in 1C: Accounting 8”

1C experts talked about the concept of an acquiring agreement, how acquiring transactions are reflected in 1C: Accounting 8 (rev. 3.0) when applying the general taxation system and the simplified tax system.

If the buyer returns the goods, the acquiring bank does not write off the funds that should be transferred to the buyer’s bank card from the seller’s current account, but deducts them from the amounts of subsequent deposits in accordance with the acquiring agreement. Starting from version 3.0.49 in the 1C: Accounting 8 program version 3.0, such operations are automated.

The supplier violated the terms of the contract

Various supply discrepancies may arise:

- goods of inadequate quality;

- the scope of delivery does not correspond to that specified in the documents;

- the work has not been completed in full.

But the essence of the working situation is always the same: the buyer (customer) must pay the supplier (performer) less than what was initially established in the contract. And if the prepayment is 100%, the money should be returned.

The contract may not stipulate how to draw up documents if the terms of the transaction are violated. Then you can use the following algorithm:

- If there are discrepancies in the quantity of goods, you need to make corrections to the invoice. Draw up a report on the discrepancy in quantity and quality in any form or using the TORG-2 form. If the quality corresponds to the contract, the act is sufficient.

- Indicate in the work completion certificate the volume that was accepted and the new amount.

- Notify the seller with an official letter and attach a corrected act on materials, goods, works, services.

- Agree with the supplier to reduce the cost of the transaction, return part of the advance payment, or offset this amount for subsequent payments for goods, work, and services.

If the transaction is a one-time transaction, then the seller has no choice; he must transfer the money to the buyer. If the seller refuses to admit that he has violated the contract or does not intend to return the money, a claim is filed in his name. You should go to court only after options for pre-trial settlement have been exhausted. Otherwise, judges may refuse to consider claims. In practice, it is easier and cheaper for the debtor to agree with the claim and settle the debt than to go through the courts.

Advice!

Returning money to a current account is a simple procedure if recipients and suppliers resolve the issue pre-trial. It is recommended to keep payments under control and check your bank statement daily. When concluding contracts, fix the procedure for documenting in case of violation of the terms.

Postings when returning an erroneously transferred payment from a counterparty

For the payer, the amount transferred to the wrong counterparty or transferred in a larger volume also goes to account 76: Dt 76 Kt 51 (52) or Dt 76 Kt 60 (if it is no longer possible to correct the posting made on the payment order).

The return of incorrectly transferred funds from the counterparty in the postings will be expressed as Dt 51 (52) Kt 76. For currency payments, here you will also need to take into account the exchange rate difference, the amount of which will be charged either to the debit or credit of account 91 (Dt 91 Kt 76 or Dt 76 Kt 91).

If, in relation to an erroneous payment, a decision is made to offset it against payment for a delivery within the framework of an existing relationship with the counterparty, then the payment recorded on account 60 will simply change the analytics due to internal posting. In this case, it will be possible to take into account VAT in deductions for both advance payment and delivery.

Refund Policy

Non-cash payment for goods and services is regulated by Federal Law No. 54. How the return will be made depends on the method of payment when purchasing: if the buyer paid for the goods by bank transfer, they will return it to the card, if in cash, they will issue cash from the cash register.

Cash refunds for non-cash payments are a violation of the law. The fact is that the client paid with a card, and when returning the goods the seller decided to give cash, then the tax office identifies such an operation as money laundering and cashing out in an illegal way. If the Federal Tax Service detects this violation, it will impose a large fine on the seller.

Returning funds to the buyer’s bank card in “1C: Accounting 8” (rev. 3.0)

We remind you that the return of goods by the buyer in “1C: Accounting 8” edition 3.0 is registered by the document Return of goods from the buyer (Sales section). To reflect transactions involving payment for goods (work, services) by customers using a bank payment card, the Payment Card Transaction document is intended. To summarize information on cash flows under acquiring agreements, subaccount 57.03 “Sales by payment cards” is intended.

Starting from version 3.0.49 of the program, you can issue a refund to the buyer to his payment card using the document Transaction on a payment card with the transaction type Return to the buyer (section Bank and cash desk).

We will consider the procedure for transferring funds to the buyer’s bank card when returning goods using the following example.

Example 1

| Andromeda LLC sells goods and services at retail, applies the general taxation system, is a VAT payer, and does not apply the provisions of PBU 18/02. In accordance with the accounting policy of the organization, retail goods are accounted for at purchase prices. Goods and services are sold through an automated point of sale using cash register equipment (CCT). Andromeda LLC accepts bank cards for payment. According to the terms of the agreement concluded by the organization with the acquiring bank: the acquiring bank's remuneration is 2% of the amount of revenue received; funds for goods paid for by the buyer by bank card (minus the amount of remuneration) are credited to the organization’s bank account the next day after the day of purchase; In the case of a return of goods not made on the day of purchase, the funds for the returned goods credited to the buyer’s card are withheld by the acquiring bank from the amount due for the transfer to the organization. In this case, no bank commission is charged for transferring funds. Sequence of operations: — On April 10, 2017, the organization sold men’s suits (5 pieces) for the amount of RUB 118,000.00. (including VAT 18%), which were paid by buyers in cash (RUB 70,800.00) and payment cards (RUB 47,200.00); — on April 12, 2017, the acquiring bank transferred funds to the settlement account of Andromeda LLC, minus the amount of remuneration; — 04/13/2017 an individual buyer returned a suit (1 piece), paid for by bank card, in the amount of RUB 23,600.00; — On April 17, 2017, the organization provided services in the amount of RUB 100,000.00. (including VAT 18%), which were paid by the buyer by payment card; — On April 18, 2017, the acquiring bank credited the bank account of Romashka LLC with funds minus the amount of remuneration and the amount transferred to the buyer when returning the goods. |

Retail sales of suits are reflected in the document Retail Sales Report (Sales section) with the transaction type Retail Store. On the Products tab, the goods sold to retail customers per day are indicated: their product range, quantity, price and amount (five suits for RUB 23,600.00, including 18% VAT).

By default, all payments are considered cash. If during the day payments were made with payment cards, bank loans or gift certificates, then you must fill out the Non-cash payments tab (Fig. 1).

Rice. 1. Non-cash payments in the retail sales report

On the Non-cash payments tab, in the Payment type field, indicate the type of payment from the directory of the same name and the amount of non-cash payments per day - RUB 47,200.00. The following details must be indicated in the form of the Payment Types directory element (Fig. 2):

- payment method - Payment card;

- information about the acquiring bank: agreement, settlement account, amount of bank commission.

Rice. 2. Type of payment

If there are several payment options from customers, retail revenue is reflected in the intermediate account 62.Р “Settlements with retail customers”, after which it is distributed according to payment methods.

After posting the document Retail Sales Report dated April 10, 2017, the following accounting entries will be generated:

Debit 90.02.1 Credit 41.01 - for the cost of suits sold (RUB 80,000.00); Debit 62.R Credit 90.01.1 - for the amount of proceeds from the sale of suits (RUB 118,000.00); Debit 57.03 Credit 62.R - for the amount of payment by payment cards (RUB 47,200.00); Debit 50.01 Credit 62.R - for the amount of cash payment received (RUB 70,800.00); Debit 90.03 Credit 68.02 - for the amount of VAT (RUB 18,000.00).

For the purposes of tax accounting for income tax, the corresponding amounts are also recorded in the resources Amount NU Dt and Amount NU Kt for accounts with a tax accounting attribute (TA). Since, according to the conditions of Example 1, there are no differences between accounting and tax accounting, we will not mention these resources in the further description.

An entry is entered into the Sales VAT accumulation register reflecting the accrual of VAT payable to the budget to create a sales book for the second quarter of 2021.

We will generate a document Receipt to the current account dated 04/12/2017 with the transaction type Receipts from sales on payment cards and bank loans. Minus the amount of remuneration, the acquiring bank transfers funds to the organization in the amount of RUB 46,256.00. (47,200.00 - 2%). If the document is not downloaded from the “Client-Bank” program, but is entered manually, then in the Amount of services field you need to indicate the amount of the bank’s commission (944.00 rubles).

After posting the document, the following entries are entered into the accounting register:

Debit 51 Credit 57.03 - for the amount of funds received from the acquiring bank (RUB 46,256.00); Debit 91.02 Credit 57.03 - for the amount of remuneration withheld by the acquiring bank (944.00 rubles).

The buyer returns one suit on April 13, 2017. The document Return of goods from the buyer can be generated based on the document Retail Sales Report dated April 10, 2017.

On the Products tab, the tabular part needs to be adjusted so that only the returned suit in the amount of RUB 23,600.00 is indicated there.

Despite the fact that the sale was carried out at retail, where analytical records of counterparties are not kept, when processing a return you should pay attention to the following points:

- in the header of the document you must indicate the name of the counterparty and the agreement with the counterparty. To simplify accounting, you can specify an abstract individual and an abstract agreement with him as a counterparty (for example, Retail sales);

- on the Settlements tab, account 62.01 “Settlements with buyers and customers” and account 62.02 “Settlements for advances received” are indicated as accounts for settlements with customers (and not auxiliary account 62.R).

The fields Cash receipt order No. and from are not filled in, since the refund to the buyer will be made to his bank card, that is, by non-cash method.

After posting the document Return of goods from the buyer, the following entries are entered into the accounting register:

REVERSE Debit 90.02.1 Credit 41.01 - for the cost of the returned suit (-16,000.00 rub.); REVERSE Debit 62.02 Credit 90.01.1 - for the amount of proceeds from the sale of the returned suit (-23,600.00 rub.); REVERSE Debit 90.03 Credit 19.03 - for the amount of VAT (-3,600.00 rub.).

In the postings to accounts 62.02 and 19.03, the individual buyer is indicated as the counterparty.

In addition to the accounting register, an entry is entered into the VAT register presented with the type of movement Receipt.

To reflect the transaction of transferring funds to the buyer to the card, we will create a document Payment card transaction with the type Return to buyer (Fig. 3). It is convenient to create a document based on the document Return of goods from the buyer.

Rice. 3. Payment card transaction

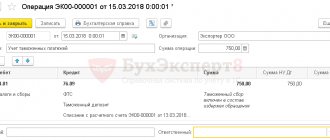

As a result of posting the Payment Card Transaction document, the following transactions will be generated:

Debit 62.02 Credit 57.03 - for the amount of return of funds to an individual (RUB 23,600.00).

Settlements with an individual can be viewed by generating the Account Card report for account 62.02 and setting the selection for the counterparty Individual. The report clearly shows that on April 13, 2017, the buyer returned goods in the amount of RUB 23,000.00. On the same day, the bank was instructed to return the money to the buyer’s card. Thus, the organization’s debt to the buyer is repaid. In other words, at the time of the chargeback operation, the organization’s debt to the retail buyer is transferred to mutual settlements with the acquiring bank.

The provision of services to individuals is also reflected in the document Report on Retail Sales dated April 17, 2017.

On bookmarks:

- Goods - indicates the cost of the service sold to a retail buyer (RUB 100,000.00);

- Non-cash payments - type of payment and amount of non-cash payments per day (RUB 100,000.00).

After posting the document Retail Sales Report dated April 17, 2017, the following transactions will be generated:

Debit 62.R Credit 90.01.1 - for the amount of revenue from the sale of services (RUB 100,000.00); Debit 57.03 Credit 62.R - for the amount of payment by payment cards (RUB 100,000.00); Debit 90.03 Credit 68.02 - for the amount of VAT (RUB 15,254.24).

An entry is entered into the Sales VAT accumulation register reflecting the accrual of VAT payable to the budget to create a sales book for the second quarter of 2021.

On April 18, 2017, the acquiring bank transfers funds to the organization minus the amount of remuneration (RUB 2,000) and minus the amount returned to the buyer (RUB 23,600.00), that is, a total of RUB 74,400.00.

We will generate a document Receipt to the current account with the transaction type Receipts from sales on payment cards and bank loans in the amount of RUB 74,400.00. In the Amount of services field, you need to indicate the amount of the bank commission (RUB 2,000.00).

After posting the document, the following entries are entered into the accounting register:

Debit 51 Credit 57.03 - for the amount of funds received from the acquiring bank (RUB 74,400.00); Debit 91.02 Credit 57.03 - for the amount of remuneration withheld by the acquiring bank (RUB 2,000.00).

Let's create a balance sheet for account 57.03. The absence of a balance on account 57.03 indicates the complete completion of settlements with the acquiring bank.

To claim input VAT on returned goods for deduction, you must create a document Creating purchase ledger entries (section Operations - Regular VAT operations).

Data for the purchase book on the amounts of tax to be deducted in the current tax period must be reflected on the Purchased assets tab.

As a result of posting the document, an accounting entry is generated:

Debit 68.02 Credit 19.03 - for the amount of VAT accepted for tax deduction (RUB 3,600.00).

An entry with the type of movement Expense is made in the VAT accumulation register presented. To create a purchase book for the second quarter of 2017, an entry is made in the Purchase VAT accumulation register.

| 1C:ITS For step-by-step instructions on recording transactions involving the transfer of funds to the buyer’s bank card when returning goods, see the “Handbook of Business Transactions. 1C: Accounting 8" in the "Accounting and Tax Accounting" section. For information on accounting for VAT in transactions for the return of goods from customers in retail trade, see the reference book “Accounting for Value Added Tax” in the “Accounting and Tax Accounting” section. |

Why is this necessary?

Planning expenses for customs payments becomes more comfortable: the transfer of funds to the Unified Personal Account is carried out much faster than it was under the old work scheme. Currently, payments are divided into advance payment and import duty, but in the future they may be consolidated into a single payment. All payments under the ULS will be deposited into the account of the customs authority using the new unified code “10000010” (field 107 p/p).

Such optimization of the customs payments system erases the boundaries between regional customs offices and makes it possible to more quickly and efficiently manage the funds of foreign trade participants. Now you do not need to receive several reconciliation reports from customs if you are processing your cargo in different cities or at different departments. Also, thanks to an electronic digital signature and registration in your personal account, you can obtain data on balances online.

By obtaining an electronic digital signature and creating a personal account, you will be able to track the status of your account and control the balance of customs payments in your personal account on the website of the Federal Customs Service of Russia online.

Responsibility for non-use of cash registers

Responsibility for violation of the law regarding the mandatory use of cash registers is established by the Code of Administrative Offenses.

The violator pays a fine. The amount depends on how much revenue the organization received that was not passed through the cash register. Both the organization itself (or individual entrepreneur) and the cashier who did not punch the check are fined.

So, the cashier will pay a fine of 25-50% of the proceeds that he did not clear through the cash register (minimum 10 thousand rubles), an organization or individual entrepreneur will pay a fine of 75-100% of the revenue (minimum 30 thousand rubles).

In the event of a repeated violation (failure to carry out transactions through a cash register) and if the revenue amounted to more than one million rubles, the company’s activities are suspended for up to three months.

The Supreme Court explained the nuances of the return of overpaid customs duties when importing imported goods

On May 13, the Supreme Court issued Ruling No. 307-ES19-18595 in the case of an organization challenging the fact of excessive payment of customs duties when importing imported goods due to an increase in its customs value by the regulatory authority.

JSC Kemira Chemical, after concluding a foreign trade contract with a Finnish company in December 2010, imported a chemical product into Russia for use in the paper industry, declaring it at the Pargolovsky customs post. When declaring the goods, its customs value was determined by the company based on the transaction value.

Further, the customs post, suspecting an unreliable determination of the customs value of the goods, in order to release the goods, requested additional documents from the JSC and security for payment of customs duties and taxes. Since the organization fulfilled the above requirement by paying the required amount, the customs post decided to release the goods.

Subsequently, the customs post increased the customs value of the imported goods, determining it using a different method. Subsequently, the St. Petersburg Customs canceled this decision on one customs declaration, and on the remaining five sent an appeal to Kemira Chemicals JSC to the North-West Customs Administration, which reported that reviewing the decisions of a lower body in the manner of departmental control is its right, and not duty.

In February and March 2021, the company twice contacted the North-Western Technical University with an application for a refund (offset) of the overpaid (collected) amounts. The customs authority twice refused to consider the application under the pretext of failure to provide payment documents confirming the fact of overpayment. Appealing decisions to adjust the customs value of goods imported under five declarations in accordance with Art. 358 of the Labor Code of the Russian Federation was also unsuccessful.

In this regard, the Kemira KHIM society attempted to oblige the St. Petersburg customs office to return 3.4 million rubles in court. The applicant justified his demands by arguing that customs duties for the import of goods were paid by him in a larger amount than provided for by customs legislation.

Arbitration courts of three instances refused to satisfy the company's demands on the pretext of their being unfounded, since it did not apply to the customs authority on the issue of changing information about the customs value of imported goods specified in the declarations. Thus, the courts indicated that there were no grounds for considering the payments made by the declarant as overpaid and for imposing on the customs authority the obligation to return them.

As a result, the company filed a cassation appeal to the Supreme Court of the Russian Federation, whose Judicial Collegium for Economic Disputes, after studying the materials of case No. A56-122276/2018, recognized it as justified.

With reference to the practice of the Constitutional Court of the Russian Federation, the highest court recalled that if a taxpayer allows an overpayment of a certain amount of tax, all constitutional guarantees of property rights apply to this amount, since its payment in this case was made in the absence of a legal basis.

In addition, the International Convention on the Simplification and Harmonization of Customs Procedures, to which the Russian Federation is a party, establishes that the refund of duties and taxes is made in cases of excessive collection as a result of an error made when calculating duties and taxes. When an overcharge is due to a customs error, refunds are given priority (standard 4.22).

The Supreme Court explained that if customs payments are made in excess in connection with the adoption of relevant illegal decisions by the customs authority, the interested person has the right to apply directly to the court with a property claim for the return by customs of the payments made in excess to the budget within three years from the day the payer learned or should have find out about a violation of your rights. At the same time, going to court with a property claim for the return of overpaid customs duties does not imply the need to comply with the administrative procedure for the return: the stated claim must be considered by the court on its merits, regardless of whether the decision of the customs authority that served as the basis for the excessive payment of customs duties was challenged in a separate court. payments to the budget.

In the case under consideration, as the Court explained, the company applied to the court with a property claim to impose on the customs authority the obligation to return customs payments, citing as its basis the non-compliance with customs legislation with decisions on adjusting the customs value taken based on the results of customs control begun before the release of goods. Thus, the lower courts should have resolved the dispute on the merits, assessing the legality of decisions to adjust the customs value, and decide on the existence of grounds for the return of overpaid payments, taking into account compliance with the deadline for filing a lawsuit and the current state of settlements on customs payments, which they did not do .

“Contrary to the conclusions of the courts, the need to apply to the customs authority in an administrative manner to change information about the customs value specified in the declaration arises in cases where, after the release of goods, the interested person has the opportunity to prove a different amount declared before release (adjusted based on the results of customs control) customs value in connection with newly received documents affecting the reliability of the determination of customs value. In these cases, the transfer of customs payments to the budget in excess is the result of an error by the declarant, which must be corrected by him, and the customs authority must be given the opportunity to carry out customs control in order to verify the existence of an error and the occurrence of an overpayment,” the Court’s ruling noted.

Use of cash register when returning

In case of return, the seller is obliged to carry out the transaction, including via cash register. The fiscal carrier's receipt reflects only the amount paid by the buyer.

List of details in the CCP strict reporting form and CCP cash receipt:

- QR code;

- Title of the document;

- time of the operation;

- the address where the payment was made;

- name of the organization or full name of the individual entrepreneur;

- TIN and taxation system, if we are talking about individual entrepreneurs.

Important! Even if at the time of sale of the goods the receipt on the cash register was not punched, in case of return it must be printed.

An important condition for issuing a check is the presence of a payment indicator. This sign indicates the type of transaction performed - purchase of goods, return of goods or adjustment. In the case when a return is made, the client is given a check with the calculation sign “return to the buyer (client) of funds received from him - return of receipt.”

Results

All actions with a payment transferred to a counterparty by mistake are carried out with a written indication of their nature on the part of the payer.

In this case, the funds can be offset against settlements on existing relationships. In the accounting of both the recipient and the payer, the amount of the erroneous payment is reflected in account 76. In correspondence with this account, both parties will show the cash flow for the return: Dt 76 Kt 51 (52) - for the returning party, Dt 51 (52) Kt 76 - at the recipient of the refunded funds. Returning an erroneous payment has no tax consequences. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Money transferred incorrectly

This can happen if the recipient's details in the payment order are filled in incorrectly. For example, one supplier is specified instead of another. A company or individual entrepreneur who received money by mistake will not be able to keep it: civil legislation equates this to illegal enrichment (Article 1102 of the Civil Code of the Russian Federation).

A counterparty who has not received payment may report that an error has occurred. Or organization accounting −

The account owner will notice this on the bank statement when they record the transactions. After the error is found, the recipient of the money must be sent a letter about the return of funds to the current account. A copy of the payment slip with the bank's note on execution should be attached to the letter.

The return letter can be written in any form, but it must contain the following components:

- data for precise identification of the transaction - date, payment order number, amount, purpose of payment;

- bank details for refund;

- warning about liability in case of non-return.

The detected error should be reflected in the accounting: the debt must be transferred to the company or individual entrepreneur to whom the money was sent by mistake. After the money is returned to the current account, the accountant will make adjustments.

Example of a refund letter:

If the recipient to whom the money was transferred by mistake does not return it, you will have to go to court. The letter will serve as proof that the account owner took the necessary measures to return the money.