Bookmarked: 0

Who is a customs carrier? Description and definition of the concept.

A customs carrier is a legal entity that has a license to transport goods under

customs control. When performing work, the customs carrier is not obligated to arrange customs escort or ensure payment of customs duties. A customs carrier must be registered only with the regional customs authority of the Russian Federation in the area of which it plans to carry out its activities. The Russian customs authority is obliged to provide a list of registered customs carriers to every interested person and organization. The labor activity of customs carriers is carried out on the basis of a concluded agreement with the sender of goods. The latter, in turn. must provide all necessary documents for the goods.

Let's take a closer look at who a customs carrier is.

Types of customs carriers

There are several types of customs carriers:

- zonal customs carrier. Performs his/her work activity exclusively in the area of activity of one customs office;

- regional customs carrier. Can transport goods in the regions of operation of several customs offices at once, which are under the authority of one regional customs department;

- all-Russian customs carrier. This carrier transports goods in the area of activity of either a number of regional customs departments, or throughout the entire territory of the Russian Federation.

To obtain a license to operate as a customs carrier you must:

- have vehicles available. Their equipment or container must fully comply with the necessary rules that are put forward for the transportation of goods under customs seals in quantities determined by the customs office in whose area of activity the company is located. Some goods, for technical reasons, are allowed to be transported only on certain vehicles;

- go through the procedure of insuring your activities. The object of insurance is liability to customs authorities and persons whose goods are transported. The insured amount for liability insurance to customs authorities must be at least 1000 minimum wages in relation to each individual unit of a registered vehicle within the first ten. Within each subsequent ten units, the sum insured may gradually decrease by 10 percent;

- have in your ownership or lease for a period of at least a full 3 years the required number of equipped vehicles that could ensure the arrival of at least one unit of vehicle at the place of customs clearance within 24 hours. However, it is necessary that the rental period fully covers the license period;

- pay the mandatory fee for issuing a license;

- have fixed assets available - that is, buildings and structures, machinery and equipment, vehicles and other property that is accounted for as such a fund, in accordance with current accounting regulations.

The book value of fixed assets must be at least:

- 10,000 minimum wage, if it is intended to operate as a customs carrier in the area of activity of one customs authority;

- 50,000 minimum wage, if it is intended to operate as a customs carrier between several customs offices under the authority of one regional customs department;

- 100,000 minimum wage if it is intended to operate as a customs carrier in the area of activity, or a number of regional customs departments, or throughout the entire territory of the Russian Federation.

Authorized economic operator: benefits of status for carriers in the EAEU TMK

The status of an authorized economic operator (hereinafter referred to as AEO) has been used in world practice for more than 10 years, and since 2010 in the Republic of Belarus after the entry into force of the TMK CU. From January 1, 2018, taking into account the entry into force of the Customs Code of the Eurasian Economic Union (hereinafter referred to as the EAEU TMK), the advantages that holders of this status have have become even more attractive for various categories of organizations. In particular, a number of them are very useful for transport organizations involved in international transport. At the same time, having AEO status for a transport organization is also a plus for their clients, since this leads to a reduction in cargo delivery time and helps reduce transportation tariffs.

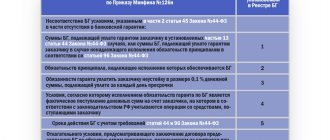

First of all, it is necessary to note that Art. 432 of the EAEU TMK establishes that the certificate of inclusion in the AEO register (certificate) can be of three types. Each of these types involves a different set of requirements and simplifications. First of all, let’s compare the simplifications for AEO according to the CU TC and EAEU TMK.

| Simplifications according to TMK TS | Simplifications according to the EAEU TMK <1> | |

| for the first type certificate | for a second type certificate | |

| temporary storage of goods in premises, open areas and other territories of the AEO | temporary storage in buildings, premises (parts of premises) and (or) in open areas (parts of open areas) AEO goods AEO | |

| release of goods before filing a customs declaration in accordance with Art. 197 TMK TS | release of goods before filing a goods declaration in accordance with Art. 120 and 441 TMK EAEU | release of goods before filing a goods declaration in accordance with Art. 120 and 441 TMK EAEU |

| carrying out customs operations related to the release of goods in premises, open areas and other territories of the AEO | carrying out customs control in buildings, premises (parts of premises) and (or) in open areas (parts of open areas) of the AEO | |

| other special simplifications provided for by the customs legislation of the Customs Union | — carrying out customs operations related to the arrival of goods into the customs territory of the EAEU, the departure of goods from the customs territory of the EAEU, customs declaration and release of goods as a matter of priority; - failure to provide, when placing goods under the customs procedure of customs transit, the declarant of which is an AEO, security for the fulfillment of the obligation to pay customs duties, taxes, special, anti-dumping, countervailing duties in cases where the provision of such security is established in accordance with Art. 143 TMK EAEU; - failure to provide security for the fulfillment of the obligation to pay customs duties, taxes, special, anti-dumping, countervailing duties upon the release of goods, the declarant of which is an authorized economic operator, with the features provided for in Art. 121 and 122 TMK EAEU; — carrying out customs control if it is assigned in the form of a customs inspection or customs inspection as a matter of priority; — recognition by customs authorities as a means of identification of seals imposed by the AEO on cargo spaces (compartments) of vehicles or parts thereof. Requirements for such seals are determined by the Eurasian Economic Commission (EEC); — failure to establish the route for the transportation of goods in relation to goods transported by the AEO; — priority participation in pilot projects and experiments conducted by customs authorities aimed at reducing time and optimizing the procedure for performing customs operations; - carrying out by a carrier who is an AEO, unloading, reloading (transshipment) and other cargo operations with goods under customs control and exported from the customs territory of the EAEU, with the exception of goods transported (transported) in accordance with the customs procedure of customs transit, as well as replacement vehicles for international transportation carrying such goods by other means of transport, including the removal of seals and seals applied, without the permission of the customs authority in the region of activity of which the corresponding operation is carried out, or without notifying it | — temporary storage in buildings, premises (parts of premises) and (or) in open areas (parts of open areas) of AEO goods of persons who are not AEO, if this is provided for by the legislation of the Member States; — delivery of goods to the customs control zone created in structures, premises (parts of premises) and (or) open areas (parts of open areas) of the AEO, their placement in such a customs control zone, carrying out customs control and performing customs operations related to the completion actions of the customs procedure for customs transit, in such structures, premises (parts of premises) and (or) in open areas (parts of open areas); - carrying out customs operations related to customs declaration and release of goods in a customs authority other than the customs authority in the region of activity of which the goods are located, if such customs authorities are located on the territory of one Member State. The legislation of the Member States on customs regulation may establish the procedure for performing these customs operations when applying this special simplification; — carrying out customs control if it is assigned in the form of a customs inspection or customs inspection as a matter of priority; — AEO use of identification means used by customs authorities in the manner determined in accordance with clause 7 of Art. 437 TMK EAEU; - failure to provide security for the fulfillment of the obligation to pay customs duties, taxes, special, anti-dumping, countervailing duties upon the release of goods, the declarant of which is an authorized economic operator, with the features provided for in Art. 121 and 122 TMK EAEU; - failure to provide security for the fulfillment of the obligation to pay import customs duties when the payment of import customs duties is deferred in accordance with clause 1 of Art. 59 TMK EAEU, if the AEO acts as a declarant of goods |

Analyzing the list of special simplifications, it should be noted that it has expanded significantly in the EAEU TMK compared to the CU TMK. And if previously special simplifications of AEO were more useful in the activities of goods manufacturers, trading companies, exporters and importers, then the opportunities provided by the EAEU TMK make this status attractive for carriers.

If we compare the special simplifications that are given within the framework of certificates of the first and second types, it becomes clear that it is more interesting for transport organizations to obtain a certificate of the first type, since it provides for a greater number of simplifications within the framework of the customs procedure for customs transit, arrival and departure of goods from customs territory, providing security for payment of customs duties and taxes.

Let's consider the conditions for inclusion in the AEO register with the issuance of a first type certificate, taking into account the specifics of transport organizations:

1) this legal entity has carried out foreign economic activities for at least three years, activities in the field of customs affairs as a customs carrier for at least two years before the date of registration by the customs authority of an application for inclusion in the register of authorized economic operators (hereinafter referred to as the application), during which:

persons carrying out foreign economic activities in the provision of services for the transportation of goods submitted at least 250 transit declarations for each year;

persons operating in the field of customs as a customs carrier submitted at least 250 transit declarations for each year.

In accordance with Art. 39 TMK TS and Art. 66 of the Law of January 10, 2014 N 129-Z “On Customs Regulation in the Republic of Belarus” (hereinafter referred to as the Law), previously AEOs were required to carry out foreign trade activities within three years before the date of application to the State Customs Committee for assignment of AEO status. Differentiation of deadlines depending on the type of activity was not established, but there was no requirement for the number of transit declarations that had to be submitted in the years preceding the application;

2) ensuring the fulfillment of the duties of an authorized economic operator, provided in accordance with Art. 436 TMK of the EAEU, namely in an amount equivalent to at least 1 million euros.

At the same time, Art. 436 TMK of the EAEU provides for the possibility of reducing this amount in the event of long-term fulfillment of obligations as an AEO without suspension:

from the 3rd year - up to 700 thousand euros;

from the 5th year - up to 500 thousand euros;

from 6 years - up to 300 thousand euros;

from 7 years - up to 150 thousand euros.

Previously, this possibility did not exist and the amount of security always had to be equivalent to 1 million euros <2>;

3) the absence in all Member States on the day of registration by the customs authority of the application of the obligation to pay customs duties, special, anti-dumping, countervailing duties, penalties, interest not fulfilled within the established period;

4) the absence in the Member State in which this legal entity is registered, on the day of registration by the customs authority, of a statement of debt (arrears) in accordance with the legislation on taxes and fees (tax legislation) of the Member States;

5) absence of facts of bringing this legal entity to administrative liability in all member states within 1 year before the date of registration by the customs authority of the application for administrative offenses, bringing to responsibility for the commission of which the legislation of the member states is defined as a basis for refusal to include in the register authorized economic operators.

The conditions specified above in paragraphs 3 - 5 were also present in the TC TC, however, with regard to conditions 3 and 5, there was no clarification that all of them must be observed in all member states of the EAEU;

6) absence of facts of involvement in all Member States of individuals of Member States who are shareholders of this legal entity, having 10 or more percent of shares of the legal entity applying for inclusion in the AEO register, its founders (participants), managers, chief accountants, criminal liability for crimes or criminal offenses, the proceedings for which are assigned to the jurisdiction of customs and other government authorities and prosecution for the commission of which is defined by the legislation of the Member States as a basis for refusal to be included in the AEO register.

Previously, there was no such requirement in the TC TC and the Law;

7) the presence of a system for accounting for goods that meets the requirements established by the legislation of the Member States on customs regulation, allowing the comparison of information submitted to customs authorities when performing customs operations with information on business transactions and providing access (including remote access) of customs authorities to such information . The EEC has the right to determine standard requirements for the goods accounting system.

A similar requirement was already contained in the TC TC and the Law. Currently, the requirements for keeping records and submitting reports to customs authorities are determined by Resolution of the State Customs Committee of April 26, 2012 No. 11 “On the procedure for keeping records and submitting reports for the purposes of customs control.”

Based on the conditions for inclusion in the AEO register, it can be noted that in some aspects they have become more complex, but significant financial concessions are provided for persons who will have this status for a long time. The scope of simplifications provided for by the EAEU TMK in relation to the transportation of goods in accordance with the customs procedure of transit, crossing the customs border, and delivery of goods will significantly simplify the work of any international carrier.

In conclusion, it can be noted that the AEO status both in world practice and in the EAEU is very popular and the number of people who work conscientiously and would like to take advantage of its benefits is constantly growing. According to information as of November 2021 contained on the official website of the State Customs Committee, there are already more than 320 such persons in the country.

What is required to obtain a customs carrier license?

To obtain the appropriate license, an enterprise must submit its application accordingly:

- to customs – if it is intended to operate as a zonal customs carrier;

- to the regional customs department - if the enterprise will operate as a regional customs carrier;

- to the State Customs Committee of the Russian Federation - if the enterprise will transport goods as an all-Russian customs carrier.

The application must contain the full and abbreviated legal name, OKPO code, actual and legal address of the company, registration number of the state registration certificate, requested status, quantity and type of available funds for transporting goods, numbers of foreign currency and ruble bank accounts, name of address and OKPO codes of the specified banks, a complete list of settlements (districts, in the case where the place of customs clearance is not located in a populated area, or urban areas) to which at least one vehicle will arrive during the day, as well as other information that can be used to make a decision on licensing enterprises.

In addition to the application, the following documents :

- a copy of the registration and constituent documents of the company (including: charter, state registration certificate, constituent agreement and others);

- a copy of the license to carry out activities as a carrier or freight forwarding activity. This does not apply to rail transport);

- a copy of the certificate of approval of vehicles for transporting goods with customs stamps and seals;

- copies of documents that confirm both ownership and the right of economic management or lease for a period of at least 3 years in relation to means for transporting goods;

- a copy of the insurance policy (certificate or certificate);

- payment receipt, which confirms the fact of payment of fees for obtaining a license to operate as a customs carrier;

- documentary evidence that the organization has fixed assets (funds) of at least the established size (purchase and sale agreement, balance sheet, extract from the balance sheet, etc.), which is officially certified in the manner prescribed by current legislation.

A company that aims to operate as a regional or all-Russian customs carrier, in

must also have a representation either in the State Customs Code of the Russian Federation or in the relevant regional customs department of the relationship of the customs company in the region of activity of which this company is located.

In this regard, the customs company confirms the data provided by the enterprise. Also in such a document, customs provides a description of the technical condition of vehicles, including a statement of the conclusion on the possibility and feasibility of granting a license to operate as an all-Russian or regional customs carrier.

The customs company provides its own attitude to the organization upon its written request. Such a petition must be considered within 30 days from the date of its receipt.

The customs company does not have the authority to refuse to provide the company with a relationship, even regardless of the conclusion set out in it.

The said conclusion must be reviewed by the customs authority within 30 days from the date of its submission.

Customs authorities have the full right to request from the relevant government agencies, banks or other organizations some additional documents confirming the information provided.

In this particular case, the period for consideration of such an application is calculated from the moment such documents are provided.

The total period for consideration of applications cannot exceed two months.

Federal Customs Service

Type:

Mandatory, Original

Number of copies:

1

Method of obtaining:

- Paper

Delivery options:

- Available without return

Description:

An application for inclusion in the Register must contain: 1) an application to the Federal Customs Service of Russia with a request for inclusion in the Register; 2) information about the name, legal form, location (mailing address and other contact details), open bank accounts of the applicant; 3) information about the period for which the applicant carries out activities related to the transportation of goods; 4) information about the means of international transportation in the possession and use of the applicant (total number, information on the approval of these vehicles for the transportation of goods under customs seals and seals), which are intended to be used by the applicant when carrying out activities as a customs carrier, including information vehicles suitable for transporting goods under customs seals and seals; 5) information on security for payment of customs duties and taxes provided in accordance with subparagraph 2 of Article 19 of the Customs Code of the Customs Union.

The application for inclusion in the Register is accompanied by permits for carrying out activities for the transportation of goods, if this type of activity, in accordance with the legislation of the Russian Federation, is carried out on the basis of appropriate permits (licenses), as well as the following documents confirming the declared information: 1) constituent documents of the applicant; 2) a document confirming the fact of making an entry about the applicant in the Unified State Register of Legal Entities; 3) certificate of registration of the applicant with the tax authority; 4) documents confirming the applicant’s right to own and use vehicles for international transportation, which are intended to be used when carrying out activities as a customs carrier; 5) certificates of approval of international transportation vehicles for the transportation of goods under customs seals and seals, if any; 6) documents confirming the provision by the Federal Customs Service of Russia of security for the payment of customs duties and taxes in an amount equivalent to at least two hundred thousand euros at the exchange rate of the Central Bank of the Russian Federation valid on the day of provision of such security; 7) confirmation from banks about the applicant’s accounts opened with them; contracts for the carriage of goods, confirming that the applicant has carried out activities for the transportation of goods for at least two years as of the date of application to the Federal Customs Service of Russia. The Federal Customs Service of Russia does not have the right to demand from the Applicant: the submission of documents and information or the implementation of actions, the presentation or implementation of which is not provided for by regulatory legal acts governing relations arising in connection with the provision of public services; submission of documents and information that, in accordance with the regulatory legal acts of the Russian Federation, are at the disposal of state bodies providing public services and other government bodies involved in the provision of public services, with the exception of documents specified in subparagraphs 1, 4, 5 of the list of documents, confirming the stated information.

2) a document confirming the fact of making an entry about the applicant in the Unified State Register of Legal Entities; 3) certificate of registration of the applicant with the tax authority; 4) documents confirming the applicant’s right to own and use vehicles for international transportation, which are intended to be used when carrying out activities as a customs carrier; 5) certificates of approval of international transportation vehicles for the transportation of goods under customs seals and seals, if any; 6) documents confirming the provision by the Federal Customs Service of Russia of security for the payment of customs duties and taxes in an amount equivalent to at least two hundred thousand euros at the exchange rate of the Central Bank of the Russian Federation valid on the day of provision of such security; 7) confirmation from banks about the applicant’s accounts opened with them; contracts for the carriage of goods, confirming that the applicant has carried out activities for the transportation of goods for at least two years as of the date of application to the Federal Customs Service of Russia. The Federal Customs Service of Russia does not have the right to demand from the Applicant: the submission of documents and information or the implementation of actions, the presentation or implementation of which is not provided for by regulatory legal acts governing relations arising in connection with the provision of public services; submission of documents and information that, in accordance with the regulatory legal acts of the Russian Federation, are at the disposal of state bodies providing public services and other government bodies involved in the provision of public services, with the exception of documents specified in subparagraphs 1, 4, 5 of the list of documents, confirming the stated information.

In the absence of documents that confirm the information specified in the application for inclusion in the Register and which are issued by government bodies, the Federal Customs Service of Russia requests confirmation of the presence and/or reliability of such documents from these government bodies in writing, or by contacting the information resources of these government agencies authorities, or through interdepartmental electronic interaction, including through the use of the information and telecommunications network Internet. In this case, the applicant may, on his own initiative, submit missing or clarifying documents certified by the relevant government authorities or in another established way.

Sample

SAMPLE.doc

Cancellation of a customs carrier's license

A license to operate as a customs carrier may be revoked or annulled , or its validity may be suspended for a certain period by the relevant customs authority that issued it, or by other higher customs authorities.

In the event that there has been a violation of established customs rules, then, as a penalty measure, the license can be revoked by absolutely any customs company or by higher customs authorities.

Cancellation of a license also occurs in the case where it could not be provided to the applicant on the basis of the procedure established by law, or when it was provided on the basis of incomplete or unreliable data that are significant when making a decision on its issuance. If a decision to revoke a license is made, it is considered to be in effect from the date the license was granted.

When it comes to license suspension, this is only possible for a period of up to three months, in cases where there are sufficient grounds to believe that a particular customs carrier is deliberately abusing its rights.

If the license has been suspended, the company does not have the right to carry out new transportation as a customs carrier, or carry out other transportation of goods that are under customs control. Also, the company does not have the right to use the name “customs carrier” in the course of conducting its commercial activities throughout the entire period of suspension of the license previously issued to it.

List of cases when a license is revoked :

- Repeated failure to fulfill duties as a customs carrier. An exception may be unjustified refusals to transport goods or documents for them. Also included as exceptions is the use of equipment for transporting goods that is not equipped in accordance with the rules, or even the requirement of payment for transportation services that is not commensurate with the average cost of the services provided;

- Repeated commission of offenses that are provided for by the current Customs Code of the Russian Federation;

- Causing damage classified as unlawful and significant in relation to the sender of the goods and documents for it. This includes damage caused due to the illegal use of data that constitutes a trade secret or confidential information. The fact of the crime must be established in court;

- Recognition of the customs carrier as either insolvent, or declaring its own insolvency.

Another reason for revocation of a license may be caused by a penalty for a specific violation of customs rules established in accordance with Section X of the Customs Code of the Russian Federation.

The revocation of a license comes into force from the date on which the decision to revoke it was made. In the event that a license is revoked as a penalty for a certain violation of established customs rules, the revocation of the license takes legal force starting from the date the decision in the case is applied for execution.

Responsibilities of the customs carrier

Among the duties of a customs carrier are the following:

carry out delivery of goods and documents on them without causing any change in their original packaging or condition. The exception is cases where changes occur due to normal wear and tear or loss under normal conditions of transportation and storage, without use for various purposes other than delivery to the location specified by the customs office of departure and storage in this place after arrival;- compliance with the periods for delivery of goods and documents for them, including traffic routes, established by the customs authority of departure. The delivery period is set in accordance with the normal delivery period. The capabilities of the vehicle, the specified route and other transportation conditions are taken into account. However, the delivery period cannot exceed the deadline, which is determined at the rate of 2 thousand kilometers per month;

- It is prohibited to transport goods that are under customs control at the same time as other goods;

- ensure the safety of transported goods;

- presentation of the goods and delivery of documents for them to the customs authority of destination. And if this customs authority requires you to actually present the goods, fulfill this requirement;

- placement of goods that arrived at their destination outside the working hours of the customs authority in the specified customs control zone;

- If the goods are delivered, then without receiving permission from the customs authority of the destination, under no circumstances leave the cargo unguarded, do not change the parking location, or unload or reload the goods. Also, without the same permission, it is not allowed to change the original location of the goods, not to open the packaging, not to pack or repack the goods, and not to make changes or destroy customs identification data. The exception is cases where there has been a real threat to the life or health of people in the vehicle, proven by the customs carrier, a threat of damage or even final loss or serious damage to the goods, as well as the vehicle itself. Each customs carrier is obliged to immediately notify the customs authority of destination about such circumstances;

- conduct training of your own personnel on the established rules for transporting goods under customs control;

- carry out full accounting of transportation under customs control and submit reports on these transportations to the customs authority under which the customs carrier is registered;

- always maintain vehicles in proper technical condition, as well as ensure constant compliance of the equipment of said vehicles with established equipment rules;

- load, unload and reload goods onto your own vehicles using your own company or on the basis of an agreement with third companies;

- in accordance with the requirements of the customs authority of destination, immediately or within the time period established by this authority, ensure a change in the parking location, reloading or unloading of goods, a change in the original location of the goods, open the packaging, pack or repackage the goods, change, remove or destroy means of identification;

- If an accident or force majeure occurs, it is necessary to take all possible measures to ensure the safety of the goods and prevent any unauthorized use. In this case, it is necessary to urgently inform the nearby customs authority about all the circumstances of the case, the location of the goods and means of transportation, ensure the transportation of the goods to the nearby customs authority, and also take all necessary measures that will be determined by this customs authority to ensure customs control.

All relationships between the sender, customs carrier, and recipient of the goods are built exclusively on a contractual basis.

Any customs carrier has the right to transport goods under customs control on the initiative of interested parties or by appropriate decision of the customs authority of departure.

The decision made by the customs authority of departure on the transportation of goods by a customs carrier is mandatory for both the sender of the goods and the customs carrier itself.

Expenses that arise for the sender, carrier or recipient in connection with the transportation of goods by a customs carrier are subject to settlement between the sender, carrier or recipient. Such expenses are not reimbursed by the customs authority.

Also, the customs authority does not reimburse expenses that arise for the customs carrier in connection with the transportation of goods under customs control. They are subject to settlement between the sender, carrier and recipient of the goods.

Customs carrier benefits from cooperation, guarantee for cargo owners.

Customs carrier benefits from cooperation, guarantee for cargo owners.

A customs carrier has a special status in the field of transport and logistics services, the benefits and responsibilities of which are enshrined in the Customs Code and controlled by the Customs Service. The activities of transport companies with a customs carrier license are carried out not only on the territory of the country of which they are a resident, but also extend to international transportation of goods under the TIR Convention (Carnet TIR). The ability to provide comprehensive transport and logistics services, as well as a simplified customs control procedure, gives customs carriers certain advantages over conventional carriers. By the way, in the international transportation market in the CIS countries there is a tendency to increase demand for the services of customs carriers, which are increasingly being used by cargo owners and their representatives.

Advantages of customs carrier status.

A customs carrier has the right to transport cargo and goods without customs escort and security for payment of customs duties and taxes in relation to foreign goods. In other words, if a common carrier, when crossing the state border, at the customs control point, is obliged to deposit goods and vehicles, enter into a surety agreement or provide a bank guarantee for some cargo transportation, then the customs carrier is exempt from these tedious procedures.

Customs carrier capabilities

allow you to significantly reduce delivery time and apply various transportation schemes, optimizing the cargo transportation process. For example, when executing an order for the delivery of cargo by air from an EU country to a distant city in Russia, there is no need to clear customs clearance of the cargo directly at the transit point - at the customs terminal at Moscow airport or another city with air traffic. Also, the personal presence of the customer’s representative during customs clearance is not required. The cargo can immediately be reloaded onto another vehicle and delivered across the country to its final destination, where customs clearance will be carried out. Thus, clients of the customs carrier save time and money by dealing with only one carrier who is able to provide a range of services; can order transportation from anywhere in the world to the most remote point, and receive uncleared cargo where they need it.

Using the services of a customs carrier is beneficial for representatives of small and medium-sized businesses when a small batch of goods belonging to them is delivered inside the country as part of a groupage cargo and unloaded at a temporary storage warehouse. No one will transport small-batch cargo on heavy-duty transport - this is not economically feasible, however, for each consignment of cargo it is necessary to open the ITT procedure - internal customs transit, i.e. transportation of cargo from the place of arrival in the country to the place of filing the customs declaration for the goods. In this case, it is possible to significantly save labor costs and money by contacting a customs carrier, who does not need to ensure payment of customs duties and taxes on the cargo.

Activities of a customs carrier

regulated by the Customs Code and controlled by customs authorities - this is a guarantee of fair and legal work in the international cargo transportation market. To obtain a license, any transport company must have at least 2 years of experience in transporting goods, and also have a sufficient number of vehicles, which confirms the solidity and reliability of the company. After registration, the transport company is entered into the register of customs carriers, and, importantly, is obliged to annually update the security for the payment of customs duties with the supervisory authority. For example, in the Federal Customs Service of Russia, customs carriers provide a bank guarantee or funds in the amount of at least 200 thousand euros, which allows them to be exempt from customs escort even for expensive cargo and carry out transportation unhindered for a whole year. In Moldova and Ukraine, the activities of customs carriers are regulated by the national legislation of these countries. For Russia, Belarus and Kazakhstan, uniform provisions of the Customs Code of the Customs Union apply, allowing them to transport goods and cargo throughout the territory without restrictions. Experts note the high potential of customs carriers and predict an increase in demand for their services due to the convenience of such cooperation. Cargo owners and their agents prefer to deal with a single carrier that provides full transport and brokerage services. Which is able to organize the delivery of cargo in various ways, including multimodal transportation and transportation of groupage cargo, using profitable and optimal transport schemes, as well as carry out all customs procedures locally and at the final point of delivery.

Termination of the company's activities as a customs carrier

Conducting activities as a customs carrier may be terminated in the following cases:

- when the license to operate as a customs carrier has been revoked or cancelled;

- at the request of the customs carrier himself;

- when the license to carry out transport activities has expired, and the company has not applied to the customs authorities with a corresponding application for a new license before the expiration of this period.

If the activity of an enterprise as a customs carrier is terminated for any of the above reasons, then this decision is formalized in the form of an order by the head of the customs authority, or by order of the deputy head of a higher customs office, which issued a license to operate as a customs carrier.

If the license has been revoked, then the company will be charged fees equal to the customs fees for customs escort of goods in relation to all shipments carried out by the specified company as a customs carrier starting from the date the license was issued.

We briefly looked at who a customs carrier is, its responsibilities, requirements for obtaining a license to operate and the reasons why this company may be closed. Leave your comments or additions to the material.