Go to the list of all Incoterms terms

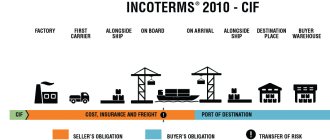

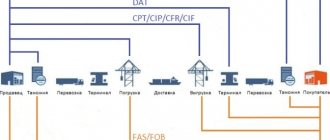

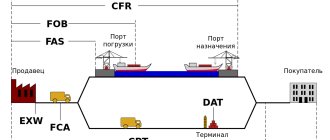

In the field of international trade, the Incoterms Rules as amended in 2010 apply - the rules for the fulfillment of obligations by the parties to the contract. Until January 1, 2011, when drawing up a purchase and sale agreement, participants in the foreign trade process were guided by the Incoterms 2000 Rules. In the new edition, two new concepts appeared: DAT and DAP, which replaced the terms DAF, DES, DEQ and DDU that were used before 2011. Consequently, Incoterms 2010 has fewer rules: 11 instead of 13. These are EXW, FCA, CPT, CIP, DAT, DAP, DDP, which apply regardless of the mode of transport for transportation, and FAS, FOB, CFR and CIF in relation to sea transport and transportation of goods by inland water transport.

In this article we will look at the term FCA - Free Carrier.

What are FCA terms of delivery (transcription, translation)?

Delivery terms FCA Incoterms 2020 is a trade term for the international rules of Incoterms 2021, stands for “Free Carrier” named place, translated “Franco Carrier” the specified name of the place means that the seller is considered to have fulfilled his delivery obligations when the goods are released under the customs regime of export , loaded onto the carrier's vehicle specified by the buyer at the specified location.

The FCA Incoterms 2020 delivery terms define the rights and obligations of the parties under an international sales contract, indicate the actions required for transportation and customs clearance, when and where the seller transfers the goods to the buyer, as well as what risks and expenses are borne by each party. Since 2021, the International Chamber of Commerce (ICC) does not oblige the use of the new rules of Incoterms 2021, but only recommends their use, so in international contracts you can refer to the rules of Incoterms 2010, as well as the rules of Incoterms 2000 or even earlier versions of Incoterms.

The delivery conditions of FCA Incoterms 2010 and FCA Incoterms 2021 are essentially identical in content. Previously, the FRC delivery basis . The term FRC replaced the basic terms of delivery FOT (Free on Truck), FOR (Free on Rail) and FOA (Free on Airport). The FRC delivery terms were introduced in 1980 and were renamed the FCA delivery basis in the 1990 edition of Incoterms. FCA terms of delivery are the most commonly used Incoterms rule in global trade, almost 40% of contracts worldwide are concluded on the basis of this rule.

INTERNATIONAL CHAMBER OF COMMERCE (ICC)

The International Chamber of Commerce is an important institution for supporting trade operations throughout the world. It has thousands of member companies in more than 130 countries and a wide range of business interests. The ICC was founded in France in 1919, and the International Court of Arbitration was founded in 1923.

The Chamber also has a large number of committees and experts covering all sectors, and works closely with other important political and business associations such as the United Nations, the World Trade Organization (WTO) and other government bodies dealing with financial and economic issues .

ROLE OF THE ICC

The role of the ICC is to support international trade between member countries and companies and to promote open markets for goods, services and capital. The ICC is responsible for:

- Establish rules and guidelines for international trade (one example is Incoterms 2010);

- Resolve disputes between members and states;

- Advocate for trade policy;

- Fighting commercial crime and corruption to promote economic growth

Although the ICC is not a regulatory body, thousands of business transactions occur every day in accordance with the policies set by this organization.

What is a Free Carrier?

The term “Free Carrier” (“Free Carrier” or literally “Free Carrier”) means the delivery by the seller of the goods at the specified place to the carrier specified by the buyer. The word “Carrier” means any person who, on the basis of a contract of carriage, undertakes to carry out or organize the transportation of goods by rail, road, air, sea and inland waterway transport or a combination of these modes of transport. If the buyer trusts another person, who is not a carrier, to accept the goods, then the seller is considered to have fulfilled his obligations to deliver the goods from the moment of transferring them to this person. Also, the buyer can independently, using his own transport, deliver the goods, without concluding a transportation contract. The FCA delivery basis can be used for transportation by any mode of transport, including intermodal transport.

Satisfaction of claims

This aspect deserves special attention. Conflict situations, as a rule, arise in the event of a discrepancy between the quantity of unloaded goods and the volume specified in the accompanying documentation. The buyer may refuse acceptance if the losses are within the limits of natural loss provided for by law.

In this case, reconciliation reports are drawn up, in which the paid quantity of goods is entered. In order not to find yourself in a similar situation and to avoid many problems, each party must maintain independent records of the shipped cargo. Documentation on the fact of the inspection is submitted within 5 days after its completion. If there are discrepancies, delivery may be discontinued. If the situation cannot be resolved peacefully, then cooperation ends.

Responsibilities under FCA terms of delivery (FSA)

Delivery terms FCA Incoterms 2020

impose on the seller the obligation to load the goods onto transport at the agreed place of shipment and to carry out export customs procedures for the export of goods with payment of export duties and other fees, but the seller is not obliged to carry out customs formalities for the import of goods, pay import customs duties or perform other import customs import procedures. If the parties intend to impose on the seller the costs of delivering the goods to the buyer, it is advisable to use the CPT Incoterms 2021 rule.

The FCA Incoterms 2021 rule has two possible shipping locations for goods. The first option is a place that belongs to the seller (for example, his warehouse, store, factory). Shipment is complete when the goods are physically loaded onto the buyer's vehicle or handed over to the courier designated by the buyer. The second option concerns a place that does not belong to the seller (for example, a railway terminal, a seaport, an airport). In such a case, shipment is deemed to have taken place after the goods have been handed over to the carrier from the seller's vehicle, delivering the goods to the place of shipment. It should be noted that unloading goods from the seller’s transport is not his responsibility.

The seller is obliged to provide the buyer with any information related to the safety requirements for transporting the goods, and the buyer must organize transportation of the goods by his own transport, or by a contract carrier at his own expense, from the specified place of shipment.

If the buyer has instructed his carrier to issue a shipping document to the seller, such as a bill of lading or air waybill, then the carrier must provide a complete set of original shipping bills to the seller.

Important aspects

This issue needs to be given special attention. There are several nuances that should be clarified in advance when concluding a supply agreement under FCA terms. This is especially true for the type of cargo being transported. Some products must be transported in special containers and under certain conditions.

These include:

- batches of farm animals;

- perishable products;

- fuels and lubricants;

- pesticide;

- explosives;

- radioactive materials;

- poisonous and toxic substances;

- compressed and liquefied gases;

- caustic and corrosive substances.

All information regarding transportation conditions must be provided to the carrier upon request. Specific terms, time and place of loading, as well as the transport route are also agreed upon in advance. If delivery is not observed under FCA terms, the contract may be terminated unilaterally.

FCA price, payment terms and transfer of ownership

FCA price means that the contract (invoice or customs) price for a product includes the sum of the cost of the product itself and export customs clearance of this product with payment of export duties and other fees, without the cost of delivery (freight) to the buyer.

Basic delivery terms FCA Incoterms 2020

do not indicate the price for the goods and the method of payment (prepayment, partial prepayment, postpayment or after submitting documents to the bank under a letter of credit), do not determine when payment should be made (before shipment, immediately after shipment, a month after shipment or something else) , do not regulate the transfer of ownership of goods or the consequences of violation of the contract. The price and transfer of ownership must be determined in the terms of the purchase and sale agreement.

Changes to FCA Incoterms 2021 delivery basis

The FCA delivery terms in the Incoterms 2010 and 2021 rules are essentially identical in content, except for one provision.

The Incoterms 2021 rules have placed a new obligation on the buyer where, if agreed upon in the contract, the buyer must instruct his carrier to issue an on-board bill of lading marked “on board” to the seller (or an air waybill for air transport) once the goods have been loaded on board the ship.

But, despite good intentions, this poorly thought-out provision will most likely not be implemented. Dispatch still occurs when the seller hands over the goods to the buyer's carrier. The seller is not required to actually load the goods on board the ship, and if anything happens to the goods between delivery to the port and loading on board, the buyer will bear all risks of loss or damage to the goods. Therefore, not only will the seller not be provided with a bill of lading, but the buyer will not receive the exported goods and, accordingly, will refuse to pay for it.

This new provision was added primarily to accommodate the seller's need to receive payment by bank letter of credit. This is the only provision in the Incoterms 2021 rules that requires one party to instruct the carrier in transmitting a transport document, but provides no guarantee or remedy to the other party if the carrier fails to do so.

Despite the fact that the ICC (ICC) for sea container transportation recommends using the FCA delivery basis instead of the FOB Incoterms 2021 term, in practice this rule is practically not used for this type of delivery. This is because in FCA deliveries the buyer does not want to take the risk of damage or loss of the goods in the exporter's country, but only take it when the goods have actually been exported, i.e. after loading the container on board the vessel.

Force majeure

Let's look at this in more detail. If FCA delivery conditions cannot be met due to unforeseen circumstances, then payment of a penalty can be avoided if this is documented. Force majeure circumstances include:

- epidemic;

- changes in the political situation;

- natural disasters;

- Act of terrorism;

- entry ban by territorial authorities;

- car crashes.

If a force majeure situation occurs, one party must notify the other of this within no more than 2 days. You also need to provide supporting documents at the nearest branch of the Chamber of Commerce and Industry of the Russian Federation. If delivery cannot be completed for three or more months, then either party may refuse to fulfill its obligations by first submitting notice and paying for the goods already delivered.

Differences between FCA and EXW delivery conditions

The difference between FCA and EXW delivery conditions is the obligation to load the goods into the vehicle and perform export customs clearance.

In simple words, according to the FCA delivery basis: goods that have undergone export customs clearance at the seller’s by the seller into the buyer’s vehicle if the shipment takes place at the seller’s premises.

According to the delivery basis EXW Incoterms 2021: goods without export customs clearance and without loading are provided by the seller at the seller’s warehouse, the buyer must load the goods into the vehicle himself and perform export customs clearance at his own expense.

The main differences between FCA delivery terms and other terms are presented in the Incoterms 2021 table.

Advantages and disadvantages of applying the FCA rule

Because According to the FCA delivery terms, the seller is required to perform export customs clearance, the buyer must provide the seller with information about the vehicle that will export the goods from the seller’s country, be it road, rail, air or sea transport. The seller must know from the buyer the name and contact details of the carrier, freight booking information, including details such as truck registration plate, wagon number, voyage number or vessel details, so that he can correctly complete the export declaration and other necessary transport documents.

After shipment of the exported goods, the seller usually refunds the VAT. To justify a VAT refund, tax authorities may require the seller to provide a document confirming the export (export) of goods abroad. For the first time in the FCA Incoterms 2021 framework, a requirement was introduced that, if requested by the seller, the buyer must instruct his carrier to issue the seller a transport document indicating that the goods have been loaded on the vehicle. This addition was introduced mainly to allow the seller to receive payment for goods through a bank letter of credit. The FCA terms of delivery refer to a transport document confirming that the goods have been loaded onto the vehicle (for example, for sea container transport - a bill of lading with o). Also, this waybill can be used by the seller for other purposes, for example, to confirm the export with the tax authorities.

There are several economic benefits to using the FCA term for the buyer. Allows the buyer to control the transport of goods, possibly combining them from multiple sellers in one vehicle (for example, a full truck load or a full container load). Negotiate rates with the chosen carrier, and therefore minimize your transport costs.

The main disadvantage of using the FCA basis for the buyer is that the risk of loss or damage to the goods begins at a very early stage in the seller's country.

What data must be provided by the customer?

So what do you need to know about this? According to the law, the buyer is obliged to provide the carrier with detailed information about the order within 10 working days.

The list should include the following data:

- type and volume of cargo;

- recipient details and codes;

- full address;

- numbers of access roads and codes of transshipment points, if access to them is expected;

- additional information that will allow delivery to be completed on time.

If the customer does not provide all the necessary information, cargo transportation is suspended. If it is impossible to deliver to the destination, all costs of returning the cargo to the warehouse are borne by the buyer.